Latin America Mattress Market Size, Share, Trends & Growth Forecast Report By Type (Innerspring, Memory Foam, Latex, Other Types), Application (Residential, Commercial), Distribution Channel (Online, Offline), and Country (Brazil, Mexico, Argentina, Chile, Rest of Latin America) – Industry Analysis From 2025 to 2033.

Latin America Mattress Market Size

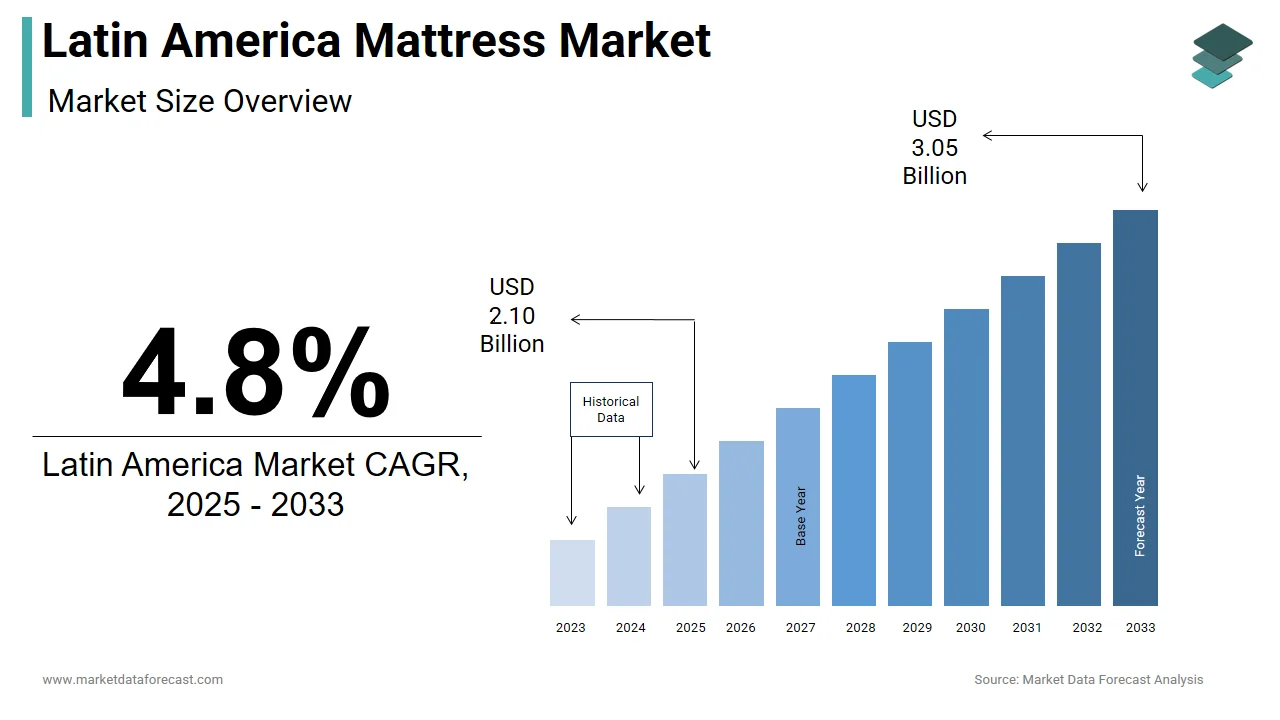

The size of the Latin America mattress market was valued at USD 2 billion in 2024. This market is expected to grow at a CAGR of 4.8% from 2025 to 2033 and be worth USD 3.05 billion by 2033 from USD 2.10 billion in 2025.

The Latin America mattress market covers a wide range of products designed for residential, commercial, and institutional use, including innerspring, memory foam, latex, hybrid, and airbed mattresses. The industry is shaped by shifting consumer preferences toward comfort, health-conscious sleeping solutions, and rising awareness about ergonomic sleep practices. Countries such as Brazil, Mexico, Colombia, and Argentina form the core of the regional market due to their relatively developed retail ecosystems and growing urban populations.

According to the Economic Commission for Latin America and the Caribbean (ECLAC), urbanization rates across the region have steadily increased over the past decade, with over 80% of the population now residing in cities. This shift has driven demand for modern bedroom furniture, including high-quality mattresses tailored to different lifestyles and budget segments.

In addition, the rise in disposable incomes, particularly in middle-class households, has supported greater spending on home furnishings.

Moreover, the post-pandemic focus on health and wellness has heightened consumer interest in sleep quality, prompting more frequent mattress replacements.

MARKET DRIVERS

Rising Urbanization and Housing Demand

One of the primary drivers of the Latin America mattress market is the rapid pace of urbanization, which has significantly expanded the demand for residential housing and associated furnishings. According to the Economic Commission for Latin America and the Caribbean (ECLAC), over 80% of the region’s population now resides in urban areas, with this figure expected to grow further in the coming years.

Urban migration has led to increased construction activity, particularly in low- and mid-income housing sectors. This growth is not limited to new homes; it also includes apartment rentals, student accommodations, and short-term lodging facilities, all of which contribute to mattress purchases. Additionally, government-backed housing programs in countries like Colombia and Peru are improving access to affordable homes, indirectly boosting mattress consumption.

As urban centers continue to expand and younger generations move into independent living arrangements, the mattress market benefits from a sustained influx of first-time buyers seeking comfort and durability in their sleep environments.

Increasing Health Awareness and Focus on Sleep Quality

A significant driver shaping the Latin America mattress market is the growing consumer awareness around health and the importance of quality sleep. Over the past few years, public discourse on wellness, ergonomics, and lifestyle diseases has intensified, influencing purchasing decisions toward supportive and orthopedic mattress designs.

In Brazil, the Brazilian Association of Orthopedic Mattress Manufacturers (ABRAMO) reported an increase in sales of medium-to-high-end orthopedic mattresses in 2023, reflecting a shift in preference toward health-focused bedding.

Similarly, in Argentina, healthcare professionals and physical therapy associations have begun recommending specific mattress types based on individual body weight and sleeping posture, further reinforcing consumer trust in premium options.

Furthermore, digital media and influencer marketing campaigns have played a crucial role in educating the public about sleep hygiene. Platforms such as YouTube and Instagram have hosted numerous collaborations between mattress brands and wellness experts, amplifying awareness and driving demand for scientifically backed sleep solutions.

MARKET RESTRAINTS

Economic Instability and Currency Fluctuations

Economic instability remains a key restraint on the Latin America mattress market, as several countries face persistent inflationary pressures, currency devaluations, and fluctuating consumer confidence. These macroeconomic challenges limit discretionary spending and delay household purchases, including essential items like mattresses.

According to the International Monetary Fund, Argentina recorded an annual inflation rate of over 211% in 2023, severely eroding real purchasing power and forcing many consumers to prioritize necessities over home furnishings.

In Brazil, despite a relatively stable economic environment compared to its neighbors, the cost of imported components such as foam and synthetic fibers.

These economic fluctuations create uncertainty for both domestic manufacturers and international brands operating in the region, making long-term planning and investment strategies more challenging. Until financial conditions stabilize, economic volatility will remain a key barrier to consistent expansion in the Latin America mattress market.

High Competition from Informal and Unbranded Segments

Another major constraint affecting the Latin America mattress market is the prevalence of informal and unbranded mattress producers, which undercut pricing and complicate market regulation. These informal players often operate outside tax systems and lack standardized manufacturing practices, offering cheaper alternatives that attract budget-conscious consumers.

In Colombia, small-scale workshops produce thousands of mattresses annually without official certifications, selling them through local markets or online classified platforms at significantly lower prices than branded counterparts.

This informal sector creates pricing pressure on legitimate manufacturers, who must compete with lower-cost offerings while maintaining compliance with quality regulations. It also hampers consumer trust, as inconsistent product performance from unverified sellers can lead to negative perceptions of the broader mattress category.

Until governments implement stronger regulatory frameworks and support formal industry growth, the dominance of informal mattress production will continue to hinder structured market development across Latin America.

MARKET OPPORTUNITIES

Expansion of E-commerce and Digital Retail Channels

A major opportunity shaping the Latin America mattress market is the expansion of e-commerce and digital retail channels, which are transforming how consumers discover, compare, and purchase mattresses. As internet penetration improves and mobile shopping becomes more prevalent, online mattress sales are gaining traction across the region.

According to GSMA Intelligence, mobile internet adoption in Latin America surpassed 72% in 2023, enabling broader access to online shopping platforms.

Mexico has also witnessed a surge in digital mattress transactions, particularly among younger demographics who prefer researching product features and reading customer reviews before making purchases.

Additionally, direct-to-consumer mattress brands have emerged in several Latin American markets, leveraging social media marketing and influencer partnerships to build brand awareness and drive engagement. Companies like Ortobom in Brazil and Colchones Flex in Mexico have launched dedicated online stores with virtual fitting tools and chat-based consultations to enhance user experience.

With continued investment in logistics, digital payments, and customer service infrastructure, e-commerce is positioned to unlock a new wave of growth across the Latin America mattress market.

Growing Demand for Premium and Customizable Mattresses

The Latin America mattress market is witnessing a rising demand for premium and customizable mattress solutions, presenting a significant opportunity for manufacturers aiming to differentiate themselves in a competitive landscape. Consumers are increasingly prioritizing personalized comfort, durability, and advanced sleep technology, leading to a shift away from generic, mass-produced models.

This trend reflects a growing segment of middle- and upper-income households willing to invest in superior sleep quality and long-term health benefits.

In Chile, mattress retailers such as CompraDirecta and Easy Home have introduced modular and adjustable mattress systems that allow users to customize firmness levels and support zones according to individual preferences.

Similarly, in Colombia, companies like Spring and Almaware have launched smart mattresses equipped with sensors that track sleep patterns and provide personalized recommendations via smartphone apps. With rising disposable incomes and increased awareness of sleep health, the demand for premium and customizable mattresses is expected to gain further momentum, offering substantial growth potential for forward-thinking manufacturers.

MARKET CHALLENGES

Supply Chain Disruptions and Raw Material Shortages

Supply chain disruptions and raw material shortages pose a significant challenge to the Latin America mattress market, affecting production timelines, pricing stability, and product availability. The region relies heavily on imports for critical components such as polyurethane foam, latex, steel coils, and synthetic fibers, many of which are sourced from Asia and Europe.

According to the United Nations Conference on Trade and Development (UNCTAD), global shipping delays persisted into 2023, with container freight rates remaining elevated due to ongoing logistical bottlenecks.

In Mexico, manufacturers faced supply constraints for spring steel coils due to export restrictions imposed by certain Asian suppliers, forcing some companies to adjust product designs or raise prices to offset increased input costs.

Moreover, environmental regulations and sustainability concerns have led to tighter controls on raw material sourcing, adding complexity to procurement strategies.

Until supply chains stabilize and regional manufacturing capabilities expand, Latin American mattress producers will continue to face operational hurdles that affect market dynamics and pricing competitiveness.

Regulatory Fragmentation and Product Certification Requirements

Regulatory fragmentation and varying product certification requirements present a persistent challenge for mattress manufacturers operating across multiple Latin American countries. Each nation maintains distinct safety, fire resistance, labeling, and environmental compliance standards, complicating cross-border trade and distribution efforts.

According to the Pan American Standards Commission (COPANT), there is no unified certification framework for mattresses across Latin America, resulting in manufacturers needing to comply with separate testing protocols in each country.

Similarly, in Argentina, the National Institute of Industrial Technology (INTI) enforces strict flammability and durability standards that differ from those in neighboring countries, creating additional compliance costs for multinational manufacturers.

These inconsistencies hinder economies of scale and discourage foreign investment, making it difficult for companies to develop standardized product lines suitable for broad regional distribution. Without greater harmonization of regulations, manufacturers will continue to face barriers that slow market expansion and limit consumer access to diverse mattress options.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Application, Distribution Channel, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

Brazil, Mexico, Argentina, Chile, Rest of Latin America |

|

Market Leaders Profiled |

Colchao Inteligente, Tempur Sealy International, Inc., Dunlopillo, Paramount Bed Holdings Co. Ltd, Casper Sleep, Inc., and others. |

SEGMENTAL ANALYSIS

By Type Insights

The innerspring mattresses segment dominates the Latin America mattress market, accounting for 46.4% of total revenue in 2024. This segment has maintained its prowess due to long-standing consumer familiarity, affordability, and widespread availability across both urban and rural markets.

These mattresses remain popular in traditional retail outlets and furniture stores where consumers prefer physical testing before purchase.

In Mexico, innerspring mattresses continue to be a staple in home furnishing chains such as Sodimac and Liverpool. Moreover, manufacturers have continuously improved innerspring technology by incorporating foam layers and pocketed coils to enhance comfort and durability, helping retain customer loyalty. With strong brand presence, manufacturing infrastructure, and price accessibility, innerspring mattresses remain the most dominant segment in Latin America.

Memory foam mattresses are emerging as the fastest-growing segment in the Latin America mattress market, projected to expand at a CAGR of 9.1%. This growth is driven by rising consumer awareness about sleep health, increased demand for pressure-relieving solutions, and the influence of digital marketing and e-commerce.

The increasing prevalence of musculoskeletal disorders and chronic back pain has prompted more consumers to seek orthopedic-grade sleeping surfaces, which memory foam mattresses are often marketed to address.

In Chile, government-backed initiatives promoting healthy aging have contributed to higher adoption of supportive bedding products.

Additionally, direct-to-consumer brands leveraging online platforms have played a crucial role in expanding memory foam’s reach. In Colombia, companies like Almaware and Spring launched roll-packed memory foam models designed for easy delivery and setup, capturing younger, tech-savvy buyers who prioritize convenience and value.

With continued product innovation and growing health consciousness, memory foam mattresses are positioned for sustained high growth across Latin America.

By Application Insights

The residential application segment had the largest share of the Latin America mattress market in 2024. This dominance is primarily attributed to ongoing household formation, urbanization trends, and increased spending on home furnishings among growing middle-class populations.

Mexico also witnessed a surge in residential mattress purchases due to government-backed housing programs aimed at improving living conditions for low-income families.

Moreover, changing lifestyles and increased remote work have led to greater investment in home comfort. As economic stability improves and disposable incomes rise, the residential mattress segment continues to benefit from consistent household expansion and evolving consumer expectations around sleep quality.

The commercial application segment of the Latin America mattress market is experiencing notable growth, projected to expand at a CAGR of 7.6% through 2033. This growth is being fueled by expansion in hospitality, healthcare, and student accommodation sectors, which require large-scale procurement of durable and hygienic bedding solutions.

According to the World Travel & Tourism Council, Latin America saw a rebound in tourism activity in 2023 compared to the previous year, prompting hoteliers to upgrade guest rooms and invest in premium bedding to enhance guest experience.

Hospitals and rehabilitation centers are also increasing investments in medical-grade mattresses to improve patient care and reduce pressure ulcers.

Student housing developments in countries like Colombia and Chile have further boosted commercial mattress demand. With institutional infrastructure development accelerating across Latin America, the commercial mattress segment is set for sustained growth.

By Distribution Channel Insights

Offline distribution remained the dominant channel in the Latin America mattress market, accounting for 68.4% of total sales in 2024. This preference is due to consumer habits that favor physical interaction with products before making high-value purchases, especially for items like mattresses that significantly impact comfort and well-being.

In Brazil, large furniture retailers such as Ortobom, Tok&Stok, and Magazine Luiza maintain extensive store networks where customers can test different mattress firmness levels and materials firsthand.

Similarly, in Mexico, traditional home furnishing chains like Sears, Sodimac, and Liverpool continue to play a central role in mattress sales.

Street markets and independent furniture shops also contribute significantly, particularly in smaller towns and rural areas where internet penetration and payment security concerns limit online adoption.

Despite rising digitalization, the tactile nature of mattress buying ensures that offline distribution remains the preferred mode of sale across much of Latin America.

The online distribution channel is the fastest-growing segment in the Latin America mattress market, projected to expand at a CAGR of 11.3%. This rapid growth is driven by increasing internet penetration, mobile commerce adoption, and the proliferation of direct-to-consumer mattress brands offering innovative delivery formats such as compressed roll-pack mattresses.

In Mexico, Amazon Mexico and Linio saw a significant uptick in mattress purchases, particularly among millennials and Gen Z consumers who prefer researching product features, comparing prices, and reading customer reviews before committing to a purchase.

Also, social media-driven marketing campaigns have played a pivotal role in building brand awareness and driving conversions. Companies like Colchón Express in Colombia and Dormilife in Chile leveraged influencer partnerships and targeted ads to attract first-time buyers seeking affordable yet high-quality sleep solutions.

With continued improvements in logistics, payment security, and last-mile delivery, the online mattress market is poised for sustained high growth across Latin America.

COUNTRY-LEVEL ANALYSIS

Brazil Mattress Market Insights

Brazil had the largest share of the Latin America mattress market, accounting for approximately 39% in 2024. As the region’s most populous country and economic leader, Brazil drives substantial demand across both mass-market and premium segments.

Urbanization and rising disposable incomes have supported increased spending on home furnishings, particularly among middle-class households.

The country benefits from a mature retail ecosystem, with national chains like Magazine Luiza, Tok&Stok, and Ortobom offering a wide range of mattress types at varying price points. Moreover, e-commerce platforms such as MercadoLibre and Amazon Brazil have expanded digital mattress sales, particularly for direct-to-consumer brands that offer compressed roll-pack delivery.

Government-backed housing programs, including Minha Casa Minha Vida, have also contributed to mattress consumption by facilitating homeownership for lower-income families. With a combination of strong domestic production, diversified distribution channels, and growing health-conscious consumerism, Brazil remains the cornerstone of the Latin American mattress industry.

Mexico Mattress Market Insights

Mexico benefits from a large and growing population, rising urbanization rates, and a robust furniture retail sector that supports diverse mattress purchasing options.

Traditional retailers such as Sodimac, Liverpool, and Sears continue to dominate offline sales, while e-commerce platforms like Amazon Mexico and Walmart.com have gained traction among younger consumers.

The Mexican government’s focus on housing development has also bolstered mattress demand.

Additionally, rising awareness about sleep health has led to increased interest in orthopedic and memory foam mattresses. With a well-established manufacturing base and growing consumer interest in premium sleep solutions, Mexico remains a critical market in the regional mattress landscape.

Argentina Mattress Market Insights

Argentina is emerging as a strategically important player due to its relatively high urbanization rate and growing consumer awareness about sleep health.

Despite economic volatility, mattress sales remained resilient, with domestic manufacturers adapting to inflationary pressures by introducing modular and segmented pricing models.

The country has seen a shift toward higher-value mattresses, particularly among middle- and upper-income households.

Retailers such as Restonic and Colchones Flex have capitalized on this trend by launching hybrid and adjustable mattresses tailored for individuals with posture-related discomfort. Additionally, digital mattress brands have entered the market with roll-packed options that offer convenience and competitive pricing.

Although currency fluctuations and import restrictions pose challenges, Argentina’s evolving consumer preferences and expanding home improvement culture position it for gradual but steady growth in the mattress sector.

Chile Mattress Market Insights

Chile is serving as a strategic growth hub due to its stable economy, advanced retail infrastructure, and early adoption of premium sleep products.

The country’s relatively high per capita income allows for greater investment in premium bedding solutions, particularly in Santiago and other metropolitan centers.

E-commerce is playing a growing role in mattress distribution. CompraDirecta and Easy Home have expanded their online offerings, including smart mattresses equipped with sleep-tracking sensors.

Additionally, public health initiatives promoting better sleep hygiene have reinforced demand for supportive and ergonomic mattresses.

With a favorable regulatory environment and strong consumer receptivity to innovation, Chile is positioned to play a pivotal role in shaping the future of the Latin American mattress market.

Rest of Latin America

The Rest of Latin America, including Colombia, Peru, Ecuador, Central America, and the Caribbean, collectively account for a notable share of the regional mattress market in 2024. These markets exhibit varied growth patterns influenced by economic conditions, urbanization rates, and cultural preferences.

Brands like Spring and Almaware have capitalized on this growth by introducing locally manufactured memory foam models tailored to regional climates and body types.

Peru is focusing on expanding its commercial mattress segment, particularly in the hospitality and healthcare industries.

Meanwhile, Central American nations like Costa Rica and Panama are leveraging bilingual education and outsourcing opportunities to attract international mattress retailers and logistics partners.

Collectively, these countries present significant untapped potential for future expansion in the Latin American mattress sector, particularly in budget-friendly and digitally accessible product lines.

KEY MARKET PLAYERS

Noteworthy Companies dominating the Latin America Mattress market profiled in the report are Colchao Inteligente, Tempur Sealy International, Inc., Dunlopillo, Paramount Bed Holdings Co. Ltd, Casper Sleep, Inc., and others.

TOP LEADING PLAYERS IN THE MARKET

Simmons Global (Latin America Operations)

Simmons, a globally recognized mattress brand, maintains a strong presence in the Latin America mattress market through its regional partnerships and localized manufacturing initiatives. Known for its innovation in comfort technology, Simmons has successfully positioned itself in both mid-range and premium segments across Brazil, Mexico, and Colombia. The company emphasizes product differentiation through patented foam and spring technologies tailored to local sleeping preferences. Its strategic collaborations with furniture retailers and hotel chains have strengthened its brand recognition and distribution footprint, contributing to broader global brand expansion through regional success.

Spring S.A. (Colombia and Regional Expansion)

Spring S.A., one of the leading mattress manufacturers in Colombia, plays a pivotal role in shaping the Latin American mattress landscape. With a focus on ergonomics and sustainability, spring has expanded its influence beyond Colombia into Ecuador, Peru, and Central America. The company invests heavily in research and development to introduce locally relevant products that address sleep health concerns. By leveraging digital marketing and e-commerce platforms, spring has built a modern brand identity that appeals to younger consumers, reinforcing its position as a key regional player with growing international visibility.

Ortobom (Brazil)

As one of Brazil’s largest mattress producers, Ortobom dominates the domestic market with a comprehensive product portfolio spanning budget-friendly to premium categories. The company's strength lies in its vertically integrated operations and extensive retail network, which ensure affordability and accessibility across diverse consumer segments. Ortobom also engages in social responsibility initiatives, including community-based sleep awareness campaigns, enhancing its brand loyalty. Its success in Brazil provides a solid foundation for potential regional expansion, positioning it as a major contributor to the evolution of sleep solutions in Latin America.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One of the primary strategies employed by key players in the Latin America mattress market is localized product development, where companies tailor mattress designs, materials, and features to suit regional climate conditions, body types, and cultural preferences. This approach ensures better consumer engagement and enhances perceived value among end users.

Another crucial strategy is expanding omnichannel distribution networks, integrating offline retail with robust online platforms. Companies are investing in digital storefronts, mobile-optimized shopping experiences, and direct-to-consumer models that offer compressed roll-pack delivery, making mattresses more accessible to tech-savvy urban buyers while maintaining physical store presence in rural areas.

Lastly, brand differentiation through wellness-focused marketing has become central to competitive advantage. Leading firms are emphasizing sleep health, ergonomic benefits, and long-term durability in their messaging, often collaborating with health professionals and influencers to build trust and encourage informed purchasing decisions across different demographic groups.

COMPETITION OVERVIEW

The Latin America mattress market is highly fragmented, characterized by intense competition between established multinational brands, well-rooted regional manufacturers, and a large number of informal or unbranded producers. While global players like Simmons and Tempur Sealy bring technological expertise and brand equity, regional champions such as Ortobom and Spring S.A. leverage deep market knowledge and cost-effective production capabilities to maintain dominance in their home markets. At the same time, a vast informal sector continues to exert pricing pressure, particularly in lower-income segments where branded alternatives may be seen as too expensive.

Competition extends beyond product design to include pricing strategies, distribution reach, and after-sales services, with many companies investing in logistics and customer education to differentiate themselves. E-commerce is reshaping traditional sales channels, enabling new entrants to challenge legacy brands with innovative business models. As consumer awareness around sleep quality increases, the battle for market share is shifting toward product performance, health benefits, and personalized experiences. In this evolving landscape, companies must balance affordability with innovation to succeed in a diverse and dynamic region.

RECENT MARKET DEVELOPMENTS

- In February 2024, Simmons Global launched a localized line of climate-adaptive mattresses in Brazil designed to enhance breathability in tropical conditions, aiming to improve consumer satisfaction and expand its foothold in the South American market.

- In May 2024, Spring S.A. opened a new automated foam production facility in Bogotá, Colombia, allowing the company to reduce manufacturing costs, improve supply chain efficiency, and meet rising domestic demand for memory foam and hybrid mattress models.

- In July 2024, Ortobom partnered with a Brazilian fintech firm to introduce flexible installment payment options for mattresses sold through independent retailers, increasing accessibility for middle- and low-income households across the country.

- In September 2024, Colchones Flex entered into a strategic alliance with a Mexican real estate developer to supply premium mattresses for newly constructed residential complexes, tapping into the housing boom and strengthening brand visibility among high-end consumers.

- In November 2024, Dormilife, a Chilean direct-to-consumer mattress brand, launched a nationwide influencer campaign focused on sleep health and mattress ergonomics, significantly boosting online engagement and driving higher conversion rates across digital platforms.

MARKET SEGMENTATION

This Latin America mattress market research report is segmented and sub-segmented into the following categories.

By Type

- Innerspring

- Memory Foam

- Latex

- Other Types

By Application

- Residential

- Commercial

By Distribution Channel

- Online

- Offline

By Country

- Brazil

- Mexico

- Argentina

- Chile

- Rest of Latin America

Frequently Asked Questions

1. What are the main factors driving growth in the Latin America Mattress Market?

Growth is fueled by urbanization, rising disposable incomes, expanding middle class, increased real estate and hotel construction, and greater awareness of sleep health

2. Which mattress materials are most popular in the Latin America Mattress Market?

Innerspring mattresses dominate, but memory foam, latex, gel, and hybrid mattresses are gaining traction due to comfort, durability, and innovation

3. What role does e-commerce play in the Latin America Mattress Market?

E-commerce is rapidly expanding, offering consumers easy access to a wide range of mattresses, competitive pricing, and convenient delivery across the region

4. How are consumer preferences changing in the Latin America Mattress Market?

There’s a shift toward premium, eco-friendly, and customized mattresses, with growing demand for organic materials and advanced features like cooling and sleep tracking

5. Which distribution channels are most important in the Latin America Mattress Market?

Retail (B2C) and online platforms lead, but B2B channels are vital for hotels, hospitals, and institutions needing bulk, customized solutions

6. What impact does rising disposable income have on the Latin America Mattress Market?

Higher incomes, especially in Brazil and Mexico, drive demand for luxury and technologically advanced mattresses, boosting premium segment growth

7. How is the mattress market evolving in countries like Colombia, Peru, and Chile?

These markets are seeing rapid growth, innovation, and competition from international brands, with increasing focus on quality and sleep health

8. How are sleeping disorders affecting the Latin America Mattress Market?

Rising sleep disorder prevalence is increasing demand for customized and ergonomic mattresses to improve sleep quality and health outcomes

9. What are the main challenges facing the Latin America Mattress Market?

Challenges include economic fluctuations, import competition, supply chain issues, and the need for ongoing product innovation to meet changing consumer demands

10. How do hospitality trends and tourism impact mattress market growth in Latin America?

Growth in hotels and tourism hotspots fuels demand for premium mattresses, with hotels prioritizing guest comfort and frequent bedding upgrades

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com