Latin America Mining Market Size, Share, Trends and Growth Analysis Report, Segmented By Type, Technology, And By Country (Brazil, Mexico, Argentina, Chile & Rest of Latin America), Industry Analysis From (2025 to 2033)

Latin America Mining Market Size

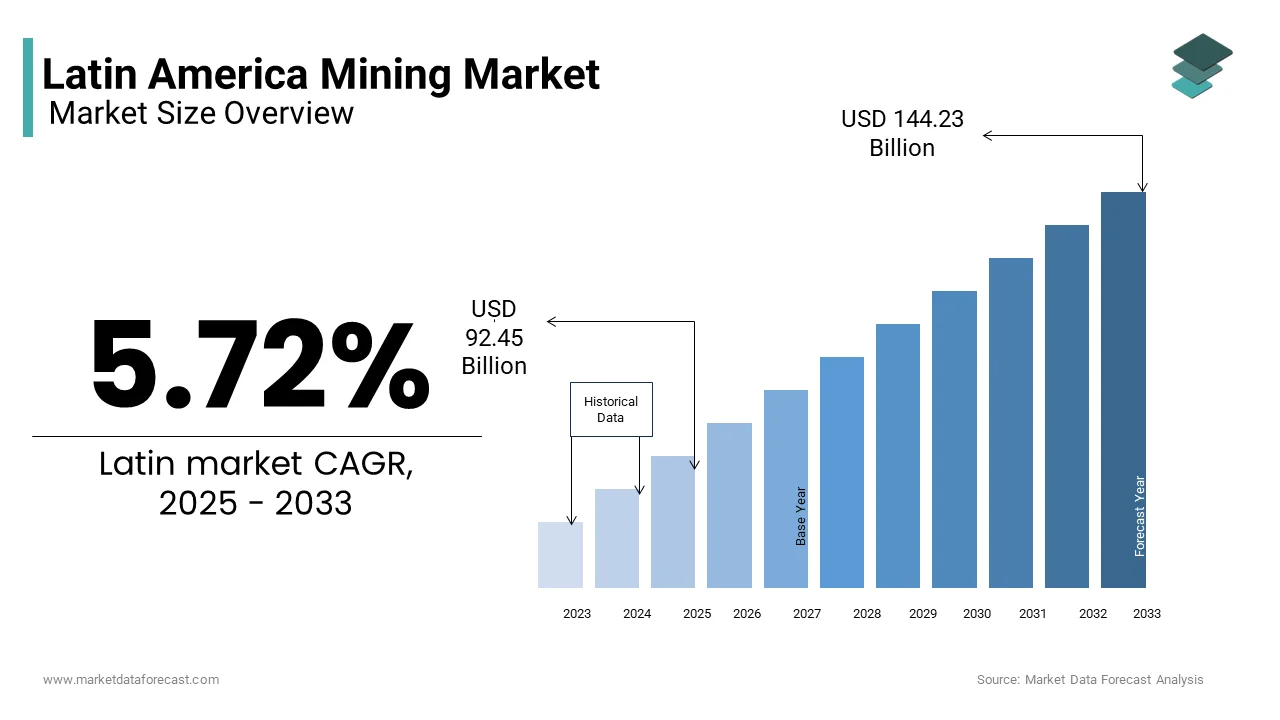

The Latin America mining market size was valued at USD 87.45 billion in 2024 and is anticipated to reach USD 92.45 billion in 2025 from USD 144.23 billion by 2033, growing at a CAGR of 5.72% during the forecast period from 2025 to 2033.

Mining involves the exploration, extraction, processing, and export of a wide range of minerals, including copper, gold, silver, lithium, iron ore, and bauxite. The region is rich in mineral resources, with countries such as Chile, Peru, Brazil, and Mexico playing prominent roles in global commodity supply chains. As per the Economic Commission for Latin America and the Caribbean (ECLAC), mining contributes significantly to national GDPs and export revenues across several countries, making it a strategic sector for economic development.

Chile remains the world’s leading producer of copper, while Argentina and Bolivia are part of the “Lithium Triangle,” a globally significant lithium-rich region. According to the Inter-American Development Bank (IDB), mining investments in Latin America surpassed USD 18 billion in 2023, driven by rising demand for metals essential to clean energy technologies, electric vehicles, and digital infrastructure.

Despite its economic importance, the sector faces increasing scrutiny over environmental and social impacts. Governments and industry players are under pressure to adopt sustainable practices and engage more effectively with local communities. Moreover, advancements in automation, digital monitoring, and green mining technologies are shaping the future of the industry.

MARKET DRIVERS

Rising Global Demand for Critical Minerals

One of the primary drivers of the Latin American mining market is the escalating global demand for critical minerals such as lithium, cobalt, and copper, which are essential for renewable energy systems, battery storage, and electric vehicle production. According to the International Energy Agency (IEA), the transition to clean energy could increase global demand for lithium and copper by over 40 times and six times, respectively, by 2040.

Latin America is uniquely positioned to capitalize on this shift due to its vast reserves of these commodities. Argentina, Bolivia, and Chile—collectively known as the Lithium Triangle—hold a substantial share of the world’s lithium resources. Similarly, Peru and Brazil have seen renewed investment in copper and nickel projects aimed at supplying the EV battery supply chain. Hence, as global industries pivot toward electrification, Latin America's abundant mineral endowment positions the region as a crucial player in the future of sustainable resource extraction.

Government Support and Policy Reforms Attracting Foreign Investment

Another key driver of the Latin American mining market is the implementation of supportive policies and regulatory reforms aimed at attracting foreign direct investment (FDI) into the sector. Several governments have recognized mining as a strategic industry and introduced measures to streamline permitting processes, offer tax incentives, and enhance legal certainty for investors. Like, Brazil enacted a revised mining code designed to accelerate licensing approvals and encourage private participation in underutilized mineral reserves. This reform has led to an uptick in interest from international mining firms seeking opportunities in iron ore, niobium, and rare earth elements. Similarly, Colombia introduced a new mining royalty framework intended to balance revenue generation with investor confidence. These developments reflect a broader trend of Latin American governments leveraging policy tools to strengthen their position in the global mining landscape and ensure sustained capital inflows into the sector.

MARKET RESTRAINTS

Social Opposition and Community Conflicts Over Mining Projects

One of the most pressing restraints affecting the Latin American mining market is the persistent social opposition and community conflicts surrounding mining operations. Many large-scale mining projects face delays or cancellations due to protests, legal challenges, and concerns over land rights, water usage, and environmental degradation. In Peru, the Ombudsman’s Office recorded more than 200 active socio-environmental conflicts in 2023, with nearly half involving mining activities. These tensions often result in project suspensions, legal battles, and reputational risks for companies operating in the region. The Panamanian Supreme Court’s decision in late 2023 to revoke the license of a major copper mine due to environmental concerns highlights how legal and social pressures can disrupt long-term mining investments.

Regulatory Uncertainty and Policy Volatility

Another significant restraint influencing the Latin American mining market is the inconsistent and frequently shifting regulatory environment across key jurisdictions. Political changes, ideological shifts, and public sentiment often lead to abrupt alterations in mining laws, taxation regimes, and ownership structures, creating uncertainty for both domestic and international investors. In 2023, Mexico’s government reaffirmed its intention to nationalize lithium production, raising concerns among foreign investors about potential implications for other mineral sectors. According to the Mexican Institute of Competitiveness (IMCO), this policy shift has already deterred several multinational companies from pursuing new exploration projects in the country. Similarly, in Argentina, frequent modifications to export duties and currency controls have made it difficult for mining firms to maintain stable financial planning. This regulatory unpredictability contrasts sharply with more stable mining jurisdictions in North America and Australia, making Latin America a riskier destination for capital-intensive projects.

MARKET OPPORTUNITY

Expansion of Green and Sustainable Mining Practices

A major opportunity emerging in the Latin American mining market is the growing adoption of green and sustainable mining practices that align with global decarbonization goals. As environmental, social, and governance (ESG) considerations gain prominence, miners are increasingly investing in cleaner extraction technologies, renewable-powered operations, and responsible sourcing initiatives. Chile, the world’s largest copper producer, has been at the forefront of this transformation. According to the Chilean Copper Commission (COCHILCO), over 70% of new mining projects launched in 2023 included commitments to reduce carbon emissions and integrate solar or wind energy into operations. Companies like Antofagasta Minerals have pledged to achieve net-zero emissions by 2050, reflecting a broader industry shift. Brazil is also advancing in sustainable mineral extraction, particularly in the Amazon region, where deforestation-linked scrutiny has intensified. The Brazilian Geological Survey (CPRM) reported in 2023 that pilot projects using low-impact exploration techniques were being tested in the Carajás mineral province to minimize environmental disruption.

Digital Transformation and Automation in Mining Operations

The integration of digital technologies and automation is opening new avenues for growth in the Latin American mining market. From autonomous haulage systems to AI-driven mineral exploration tools, digital transformation is enhancing efficiency, safety, and productivity across mining operations. Additionally, digital platforms are facilitating better communication between mining firms and regulatory bodies, streamlining permitting and environmental impact assessments. As connectivity improves and technology adoption accelerates, Latin America’s mining sector is poised to benefit from enhanced operational efficiency and reduced environmental footprints.

MARKET CHALLENGES

Infrastructure Deficits Hindering Mine Development and Logistics

One of the foremost challenges facing the Latin American mining market is the persistent lack of adequate infrastructure necessary for efficient mine development, transportation, and logistics. Many mineral-rich regions are located in remote areas with limited access to roads, railways, ports, and reliable energy supplies, significantly increasing operational costs and timelines. According to the Inter-American Development Bank (IDB), infrastructure gaps in the mining sector contribute to an average 15–20% increase in project development costs compared to similar ventures in developed economies. In Peru, the Ministry of Transport and Communications highlighted in 2023 that only 40% of planned mining-related road and rail upgrades had been completed, causing bottlenecks in mineral exports. Moreover, energy shortages pose a significant constraint, particularly in Andean countries where mines require consistent power for deep underground operations. The Chilean Energy Ministry reported that several copper projects faced delays due to insufficient grid capacity in northern mining zones.

Environmental Compliance and Water Resource Management

A significant challenge impeding the Latin American mining market is the increasing complexity of environmental compliance, particularly concerning water usage and contamination risks. Mining operations typically require vast quantities of water for processing ores, a factor that becomes contentious in arid regions where water scarcity is already a critical issue. According to the United Nations Economic Commission for Latin America and the Caribbean (ECLAC), several mining projects in Chile and Argentina have faced regulatory pushback due to concerns over groundwater depletion and ecosystem disruption. In 2023, the Chilean Superintendence of the Environment issued fines against multiple companies for exceeding permitted water extraction limits in the Atacama Desert, one of the driest regions on Earth. Additionally, acid mine drainage and tailings dam failures have raised alarms among regulators and civil society groups. The Panamanian Ministry of Environment noted in 2023 that stricter waste management protocols were being enforced following a series of environmental incidents linked to metal leaching and river contamination. Mining firms are now required to invest heavily in water recycling systems, closed-loop processing, and advanced tailings management solutions to meet evolving standards.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.72% |

|

Segments Covered |

By Type, Technology, And Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Vale S.A., CODELCO (Corporación Nacional del Cobre de Chile), Glencore plc, Antofagasta Minerals S.A., BHP Group Limited, Rio Tinto Group, Jiangxi Copper, Vale SA, Yanzhou Coal Mining Co. Ltd., Anglo American, Aluminum Corporation of China, Zijin Mining Group Co. Ltd, and China Shenhua among others. |

SEGMENTAL ANALYSIS

By Type Insights

Metal mining is the biggest segment in the Latin American mining market by contributing 58% of total revenue in 2024. This dominance is attributed to the region’s vast reserves of copper, gold, silver, lithium, and iron ore, which are critical for global industrial and technological applications. According to the Economic Commission for Latin America and the Caribbean (ECLAC), metal mining accounted for over USD 70 billion in export value in 2023, with Chile alone producing nearly one-third of the world’s copper. The Chilean Copper Commission (COCHILCO) reported that copper exports reached USD 34 billion in 2023, reinforcing its position as a cornerstone of the regional economy. Brazil also plays a pivotal role, particularly in iron ore production. Vale, the country’s largest miner, produced over 300 million metric tons of iron ore in 2023, making Brazil the second-largest exporter globally. Additionally, Argentina and Bolivia have intensified exploration efforts in the Lithium Triangle, where lithium demand is surging due to its use in electric vehicle batteries.

The “Other Types” segment of the Latin America mining market, which includes industrial minerals such as phosphate, potash, borates, and rare earth elements, is emerging as the fastest-growing category, expanding at a CAGR of 6.9% between 2025 and 2033. This progress is driven by rising demand for specialty minerals used in agriculture, electronics, and clean energy technologies. According to the Inter-American Development Bank (IDB), Latin America holds substantial untapped reserves of rare earth elements, particularly in Brazil and Peru, which are essential for manufacturing wind turbines, electric vehicles, and advanced electronics. In 2023, Brazil’s Geological Survey (CPRM) identified several new rare earth deposits in the Amazon basin, prompting increased interest from international investors seeking alternative sources outside China. Besides, agricultural expansion in countries like Argentina and Paraguay has boosted demand for phosphate and potash-based fertilizers.

By Technology Insights

Surface mining dominated the Latin American mining market by capturing 64.8% of total operations in 2024. This method, which includes open-pit and strip mining, is widely employed for extracting copper, gold, and iron ore due to its cost-efficiency and scalability compared to underground mining. Chile serves as a prime example of surface mining’s significance, where massive copper pits such as Escondida and Collahuasi account for a substantial portion of national production. According to the Chilean Copper Commission (COCHILCO), over 80% of copper extraction in the country occurs via open-pit methods, benefiting from favorable geology and economies of scale. In Brazil, Vale’s Carajás mine—one of the world’s largest open-pit iron ore complexes—produced more than 100 million metric tons of ore in 2023. The Brazilian Geological Survey (CPRM) highlighted that surface mining accounts for over 70% of the country’s metallic mineral output due to the accessibility of large-scale deposits. Moreover, advancements in autonomous haulage systems and GPS-guided drilling have enhanced productivity and safety in surface mines across the region.

In-situ mining is the fastest-growing segment in the Latin American mining market, projected to expand at a CAGR of approximately 8.2%. This method involves injecting solutions into underground ore bodies to dissolve valuable minerals before pumping them to the surface for processing, offering lower environmental impact and reduced operational costs compared to traditional techniques. One key driver behind this growth is the increasing adoption of in-situ leaching (ISL) for uranium and lithium extraction. According to the International Atomic Energy Agency (IAEA), Argentina and Brazil have initiated pilot ISL projects for uranium recovery, aiming to support future nuclear energy programs. Similarly, in the Lithium Triangle, Argentina and Bolivia are exploring brine-based in-situ extraction to produce lithium carbonate with minimal land disturbance. Also, regulatory agencies in Latin America are encouraging less invasive mining practices to address community concerns over deforestation and water usage. The Panamanian Ministry of Environment reported in 2023 that new lithium and copper exploration licenses were being granted preferentially to companies proposing low-impact extraction methods.

COUNTRY-LEVEL ANALYSIS

Brazil accounted for 32.5% of the Latin American mining market in 2024 by positioning it as the largest contributor in the region. The country’s progress is underpinned by its vast reserves of iron ore, bauxite, niobium, and rare earth elements, along with a well-established mining industry supported by major players such as Vale and Anglo American. Besides, Brazil is emerging as a key player in the critical minerals space. The Brazilian Geological Survey (CPRM) identified extensive rare earth element deposits in the Amazon region, attracting interest from foreign investors seeking alternatives to Chinese supply chains. The government has also encouraged sustainable mining initiatives through regulatory reforms aimed at improving licensing efficiency and environmental oversight.

Mexico is a leading global supplier of silver and ranks among the top ten producers of zinc, fluorite, and bismuth. Silver remains Mexico’s flagship commodity, with Fresnillo PLC and Peñoles operating some of the most productive silver mines worldwide. The National Institute of Statistics and Geography (INEGI) reported that silver production exceeded 6,000 metric tons in 2023, reinforcing Mexico’s position as the world’s top silver producer for over two decades. However, recent policy changes, including restrictions on foreign ownership of lithium resources and increased state control over strategic minerals, have created uncertainty for international investors. Despite these challenges, Mexico continues to attract capital inflows due to its geological richness and proximity to North American markets.

Argentina is emerging as a notable but developing participant in the region. The country is best known for its lithium potential within the Lithium Triangle, which it shares with Bolivia and Chile. Beyond lithium, Argentina also produces significant quantities of silver, gold, and copper. The San Juan and Catamarca provinces host several active mining projects, including those operated by Canadian firms such as Lithium Americas and SSR Mining. Despite progress, Argentina faces challenges related to bureaucratic delays, currency volatility, and regional opposition to large-scale mining projects. However, the government has prioritized expanding mineral exports as part of its broader economic diversification strategy.

Chile is a fast-moving innovator and is distinguished by its status as the world’s leading copper producer. The country’s mining industry is highly developed, with a strong emphasis on technological advancement, sustainability, and long-term resource planning. According to the Chilean Copper Commission (COCHILCO), copper production reached over 5 million metric tons in 2023, generating a substantial amount in export revenues. Companies such as CODELCO and Antofagasta Minerals continue to invest in automation, digital monitoring, and renewable-powered operations to enhance efficiency and reduce carbon footprints. Additionally, Chile is advancing in lithium production, leveraging its Atacama Salt Flat, one of the richest lithium brine resources globally. SQM and Albemarle have expanded their lithium extraction capacities, aligning with global EV battery demand projections.

The Rest of Latin America (RoLA) has a diversified growth potential. While individual countries in this segment may not match the scale of Brazil, Mexico, Argentina, or Chile, they present diverse opportunities for mineral exploration and production. Peru stands out as a key player, ranking third in global copper production and fourth in silver. Major projects such as Las Bambas and Antamina continue to drive investment despite social conflicts and permitting delays. Colombia is gaining attention for its coal and gold reserves, with the government promoting sustainable mining practices to attract responsible investors. The Colombian National Planning Department (DNP) reported in 2023 that new environmental regulations had been introduced to balance economic growth with conservation goals. Meanwhile, Bolivia is focusing on lithium development in the Uyuni Salt Flat, though progress has been slow due to technical and political hurdles.

KEY MARKET PLAYERS

Vale S.A., CODELCO (Corporación Nacional del Cobre de Chile), Glencore plc, Antofagasta Minerals S.A., BHP Group Limited, Rio Tinto Group, Jiangxi Copper, Vale SA, Yanzhou Coal Mining Co. Ltd., Anglo American, Aluminum Corporation of China, Zijin Mining Group Co. Lt, and China Shenhua among othersThese. Are the market players that are dominating the Latin American mining market?

Top Players in the Market

Vale S.A.

Vale is a Brazilian multinational corporation and one of the largest mining companies in the world, with a dominant presence in Latin America. The company is best known for its vast iron ore reserves and production capabilities, particularly in Brazil’s Carajás region. In addition to iron ore, Vale operates in nickel, copper, manganese, and other industrial minerals, playing a critical role in global commodity supply chains. Its operations significantly contribute to Brazil’s economy and export revenues. Vale has also been investing in sustainable mining technologies and digital transformation initiatives to improve efficiency and reduce environmental impact.

CODELCO (Corporación Nacional del Cobre de Chile)

CODELCO is a state-owned copper mining company and the largest producer of copper in the world. Based in Chile, it plays a central role in shaping Latin America’s mining landscape by supplying a significant portion of global copper demand. As a government-backed entity, CODELCO influences national economic policies and long-term mineral strategies. The company is actively modernizing its operations and expanding into cleaner extraction methods to align with global sustainability goals. Its leadership in copper production makes it indispensable to the global energy transition and electrification efforts.

Antofagasta Minerals S.A.

Antofagasta Minerals is a leading Chilean mining company focused on copper production, with a strong presence in Latin America and international markets. The company operates several large-scale mines in Chile and is recognized for its commitment to responsible mining practices, innovation, and environmental stewardship. Antofagasta has invested heavily in water management systems and renewable energy integration to ensure operational sustainability. Its strategic focus on copper aligns with global demand trends driven by electric vehicles and green infrastructure, positioning it as a key player in the future of the mining industry.

Top Strategies Used by Key Market Participants

One of the primary strategies employed by key players in the Latin American mining market is investing in technological innovation and automation to enhance productivity and safety. Leading companies are adopting autonomous haulage systems, AI-driven exploration tools, and real-time monitoring solutions to optimize operations and reduce human risk in challenging environments. These advancements not only improve efficiency but also support compliance with evolving regulatory standards.

Another crucial approach involves prioritizing environmental, social, and governance (ESG) initiatives to secure long-term project viability. Companies are integrating sustainable practices such as water recycling, reduced carbon emissions, and community engagement programs to mitigate opposition and align with global decarbonization goals. This shift is essential for maintaining investor confidence and securing financing from ESG-focused funds.

Lastly, firms are increasingly pursuing strategic partnerships and joint ventures, particularly with local stakeholders and governments, to navigate complex regulatory landscapes and gain access to new mineral reserves. These collaborations help in building trust, sharing risks, and ensuring smoother project execution across diverse jurisdictions in Latin America.

COMPETITION OVERVIEW

The Latin American mining market is characterized by intense competition among global giants, state-owned enterprises, and regional operators vying for access to some of the world’s richest mineral resources. Countries like Chile, Peru, Brazil, and Argentina host a mix of multinational corporations and domestic firms, all competing to extract and export critical metals such as copper, lithium, gold, and iron ore. While global players bring advanced technology, capital, and expertise, local and state-owned companies often benefit from political support, deep-rooted relationships, and a better understanding of regional dynamics.

Competition extends beyond resource extraction to include control over processing facilities, transportation infrastructure, and access to international markets. As demand for clean energy minerals rises, companies are increasingly differentiating themselves through sustainability credentials, digital innovation, and community engagement strategies. However, geopolitical factors, regulatory instability, and social conflicts add complexity to the competitive environment, making adaptability a key success factor.

Moreover, the entry of new investors—particularly from Asia and Europe—has intensified competition for high-potential projects. With shifting policy frameworks and growing emphasis on ethical sourcing, the Latin American mining sector remains both highly attractive and strategically challenging for market participants.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Vale announced a major investment in an automated drilling and blasting system at its Carajás mine in Brazil, aimed at improving operational efficiency and reducing environmental impact. This move reflects Vale’s broader strategy to integrate digital technologies into its Latin American operations.

- In April 2024, CODELCO signed a strategic agreement with Chile’s Ministry of Energy to expand solar-powered operations at its Chuquicamata mine. This initiative supports the company’s goal of achieving net-zero emissions by 2050 while reinforcing its position as a leader in sustainable copper production.

- In June 2024, Antofagasta Minerals launched a new community development fund in northern Chile, designed to foster positive relations with local populations and address concerns around water usage and land rights. This effort underscores the company’s commitment to responsible mining practices.

- In August 2024, BHP expanded its exploration activities in Argentina’s lithium-rich Salta province, signaling increased interest in the Lithium Triangle and a strategic move to diversify its portfolio toward critical minerals used in electric vehicle batteries.

- In October 2024, Glencore initiated discussions with Peruvian authorities to restart the stalled expansion of its Las Bambas copper mine, aiming to resolve longstanding community disputes and reassert its influence in one of Latin America’s most important copper-producing regions.

MARKET SEGMENTATION

This research report on the Latin American mining market is segmented and sub-segmented into the following categories.

By Type

- Coal Mining

- Metal Mining

- Mineral Mining

By Technology

- Surface Mining

- Precision Surface Mining

By Country

- Brazil

- Argentina

- Chile

- Mexico

- Colombia

Frequently Asked Questions

What’s driving the growth of the mining sector in Latin America?

High global demand for copper, lithium, and rare earths—especially for EVs and renewable energy tech—is boosting exploration and investment in resource-rich countries like Chile, Peru, and Argentina.

Which countries are leading mineral production in the region?

Chile leads in copper, Peru in silver and zinc, Brazil in iron ore, and Argentina is rapidly growing in lithium production from the Lithium Triangle (shared with Bolivia and Chile).

How are environmental regulations shaping mining practices in the region?

Stricter environmental standards, water usage limits, and community consent laws—especially in Chile and Colombia—are pushing companies to adopt sustainable mining practices and ESG compliance.

What challenges are affecting mining operations in Latin America?

Key issues include political instability, social license conflicts with Indigenous communities, logistics limitations, and regulatory unpredictability, particularly in countries like Bolivia and Venezuela.

How is technology transforming the Latin American mining industry?

Automation, drone mapping, real-time ore analytics, and IoT-enabled equipment are increasingly used to improve efficiency, reduce environmental impact, and increase worker safety.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com