Latin America Multiple Myeloma Therapeutics Market Size, Share, Trends & Growth Forecast Report By Treatment Type (Chemotherapy, Targeted Therapy), Drug Type & Country (Mexico, Brazil, Argentina, Chile & Rest of Latin America), Industry Analysis From 2025 to 2033

Latin America Multiple Myeloma Therapeutics Market Size

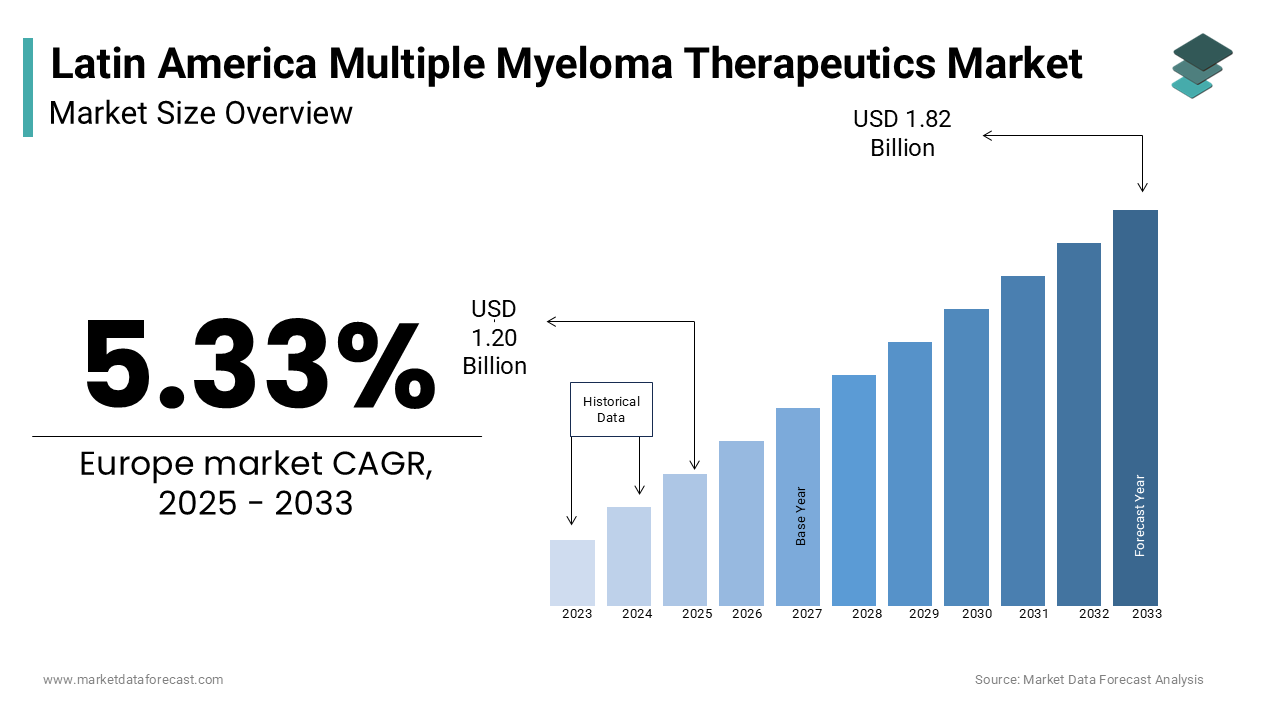

The multiple myeloma therapeutics market in Latin America was worth USD 1.14 billion in 2024 and is estimated to be growing at a CAGR of 5.33% from 2025 to 2033 and worth USD 1.82 billion by 2032 from USD 1.20 billion in 2025.

Multiple myeloma therapeutics focuses on treatments for multiple myeloma, which is a type of blood cancer that affects plasma cells in the bone marrow. Latin America has experienced a rise in multiple myeloma diagnoses, attributed to aging populations and increasing awareness of hematological disorders. According to the Global Cancer Observatory, Latin America reported over 5,000 new multiple myeloma cases in 2020, with Brazil, Mexico, and Argentina accounting for the highest numbers.

MARKET DRIVERS

Rising Prevalence of Multiple Myeloma in Latin America

The increasing incidence of multiple myeloma is a major driver of the Latin American market growth. According to the Global Cancer Observatory, the region reported over 5,000 new cases of multiple myeloma in 2020, with Brazil and Mexico leading the numbers. Aging populations across Latin America are a significant contributor, as the median diagnosis age for multiple myeloma is around 70 years. The United Nations Economic Commission for Latin America and the Caribbean notes that the population aged 65 and older is expected to double by 2050, fueling the demand for advanced treatments. This rising prevalence underscores the need for effective therapeutic options to address the growing patient population.

Advancements in Therapeutic Approaches

Innovations in multiple myeloma treatment are significantly driving market growth in Latin America. Targeted therapies, such as proteasome inhibitors and immunomodulatory drugs, have improved survival rates and quality of life for patients. According to the Pan American Health Organization, the integration of therapies like bortezomib and lenalidomide into public healthcare systems in countries like Brazil has expanded access to advanced treatments. Furthermore, ongoing clinical trials in Mexico and Argentina are contributing to the development of novel therapies, such as CAR-T cell therapy, which offers promising results. These advancements are transforming the treatment landscape, making cutting-edge options more accessible across the region.

MARKET RESTRAINTS

Limited Access to Advanced Therapies

Restricted access to advanced multiple myeloma therapies is a significant restraint in the Latin American market. High treatment costs and uneven healthcare coverage limit the availability of novel drugs such as proteasome inhibitors and monoclonal antibodies. The Pan American Health Organization highlights that public healthcare systems in many Latin American countries allocate only 4-6% of GDP to healthcare, compared to the global average of 10%. As a result, patients in low-income regions often face delays in receiving effective treatment. For instance, in countries like Bolivia and Honduras, access to drugs such as bortezomib is limited, exacerbating health disparities and curbing market growth potential.

Insufficient Diagnostic Capabilities

The lack of robust diagnostic infrastructure is another major challenge in the Latin American multiple myeloma therapeutics market. Early detection of multiple myeloma requires specialized testing, including bone marrow biopsies and advanced imaging, which are often unavailable in under-resourced regions. According to the World Health Organization, only 30% of rural healthcare facilities in Latin America are equipped to perform comprehensive diagnostic evaluations for hematological malignancies. This insufficiency delays diagnosis and treatment initiation, resulting in poorer patient outcomes and limiting the effectiveness of advanced therapies. The absence of widespread diagnostic capabilities hinders market penetration and highlights the need for improved healthcare investments in the region.

MARKET OPPORTUNITIES

Expansion of Public Healthcare Programs

The expansion of public healthcare programs in Latin America presents a significant opportunity for the multiple myeloma therapeutics market. Governments in countries like Brazil and Argentina are increasing investments to improve access to cancer treatments through universal healthcare systems. The Brazilian Unified Health System (SUS), for instance, has incorporated key drugs like lenalidomide and bortezomib into its formulary, providing subsidized or free access to eligible patients. The Pan American Health Organization reports that healthcare expenditure in Brazil reached 9.2% of GDP in 2021, reflecting ongoing efforts to enhance cancer care infrastructure. Such initiatives improve accessibility to advanced therapies, broadening the patient base and driving market growth.

Growth in Clinical Research and Trials

The growing emphasis on clinical research and trials in Latin America offers promising opportunities for the multiple myeloma therapeutics market. Countries such as Mexico and Colombia are emerging as hubs for clinical trials due to lower operational costs and a diverse patient population. According to ClinicalTrials.gov, over 300 oncology-related trials were conducted in Latin America in 2022, with multiple studies focused on hematological malignancies like multiple myeloma. The support of regulatory agencies, such as Mexico’s Federal Commission for the Protection against Sanitary Risk, is further fostering trial activities. This trend not only accelerates the development of innovative treatments but also improves access to cutting-edge therapies for local populations.

MARKET CHALLENGES

High Cost of Multiple Myeloma Treatments

The high cost of multiple myeloma therapies is a significant challenge in Latin America, limiting access for many patients. Advanced treatments, including proteasome inhibitors and monoclonal antibodies, often exceed the financial capacity of public healthcare systems and uninsured individuals. According to the Pan American Health Organization, the annual cost of bortezomib therapy can range from $30,000 to $50,000, a prohibitive expense in countries where average per capita income is significantly lower. This financial barrier disproportionately affects low-income populations, particularly in nations like Honduras and Guatemala, where healthcare budgets are constrained. The lack of affordability hinders the widespread adoption of innovative therapies, curbing market growth.

Regional Disparities in Healthcare Infrastructure

Regional disparities in healthcare infrastructure across Latin America pose a considerable challenge to the multiple myeloma therapeutics market. While countries like Brazil and Argentina boast advanced oncology centers, rural and underdeveloped areas lack adequate diagnostic and treatment facilities. The World Health Organization notes that only 40% of rural hospitals in the region are equipped for cancer care, leading to delayed diagnosis and limited access to therapies. For example, rural areas in countries such as Bolivia and Paraguay have minimal oncology resources, forcing patients to travel long distances for treatment. These disparities create unequal healthcare access, impeding timely intervention and reducing the effectiveness of therapeutic advancements in the region.

REGIONAL ANALYSIS

Brazil accounted for the major share of the Latin American multiple myeloma therapeutics in 2023. The growth of the Latin American market is majorly driven by its extensive public healthcare system, SUS (Unified Health System), which provides free access to cancer treatments. The Pan American Health Organization highlights that Brazil accounts for over 40% of Latin America’s healthcare expenditure. With approximately 2,500 new multiple myeloma cases annually, according to the Global Cancer Observatory, Brazil has integrated advanced therapies like lenalidomide and bortezomib into its treatment protocols. The government’s investment in healthcare infrastructure and access to clinical trials further solidifies Brazil’s position as a leader in the regional market for multiple myeloma therapeutics.

Mexico is anticipated to witness a healthy CAGR over the forecast period in this regional market. The strong position of Mexico in the multiple myeloma therapeutics market in this region is attributed to its expanding healthcare programs and clinical research initiatives. The Mexican Social Security Institute (IMSS) plays a pivotal role in providing subsidized treatments for hematological cancers and improving patient access to advanced therapies. The Global Cancer Observatory reports that Mexico has around 1,200 new multiple myeloma cases annually, underscoring the need for effective treatment options. Additionally, Mexico’s strategic focus on clinical trials, supported by regulatory frameworks from COFEPRIS, has enhanced the availability of innovative therapeutics, contributing to its leadership in the Latin American market.

Argentina is estimated to progress well during the forecast period in this region owing to its advanced healthcare infrastructure and government initiatives. The National Cancer Institute of Argentina provides funding for cancer treatment programs, ensuring access to essential therapies for a significant portion of the population. The Global Cancer Observatory estimates that Argentina records approximately 1,000 new multiple myeloma cases annually. The country’s participation in global clinical trials and adoption of novel therapies like monoclonal antibodies have bolstered its market position. Argentina’s focus on reducing cancer mortality rates makes it a vital contributor to the region’s healthcare advancements.

KEY MARKET PLAYERS

Companies playing a significant role in the Latin America multiple myeloma therapeutics market profiled in this report are AB Science SA, AbbVie Inc., Ablynx NV, Acceleron Pharma Inc., IGF Oncology LLC., ImmunGene Inc., Millennium Pharmaceuticals Inc., MimiVax LLC, Mirna Therapeutics, RedHill Biopharma Ltd., Rhizen Pharmaceuticals S.A., Terpenoid Therapeutics Inc., Teva Pharmaceutical Industries Ltd., TG Therapeutics Inc., and Johnson and Johnson.

MARKET SEGMENTATION

This research report on the Latin America multiple myeloma therapeutics market has been segmented and sub-segmented into the following categories

By Treatment Type

- Chemotherapy

- Anthracycline antibiotic

- Alkylating agent

- Targeted Therapy

- Proteasome inhibitor

By Drug Type

- Corticosteroids

- Dexamethasone (Decadron)

- Prednisone (Deltasone/Orasone)

- Immunomodulatory agents

- Thalidomide (Thalomid)

- Lenalidomide (Revlimid)

- Arsenic trioxide (Trisenox)

- Plerixafor (Mozobil)

By Country

- Brazil

- Mexico

- Argentina

- Chile

- Rest of Latin America

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com