Latin America Pasta Sauce Market Research Report – Segmented By Product Type ( tomato-based sauces , pesto-based sauces )Packaging Type,, Distribution Channel & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of EU) - Industry Analysis (2025 to 2033)

Latin America Pasta Sauce Market Size

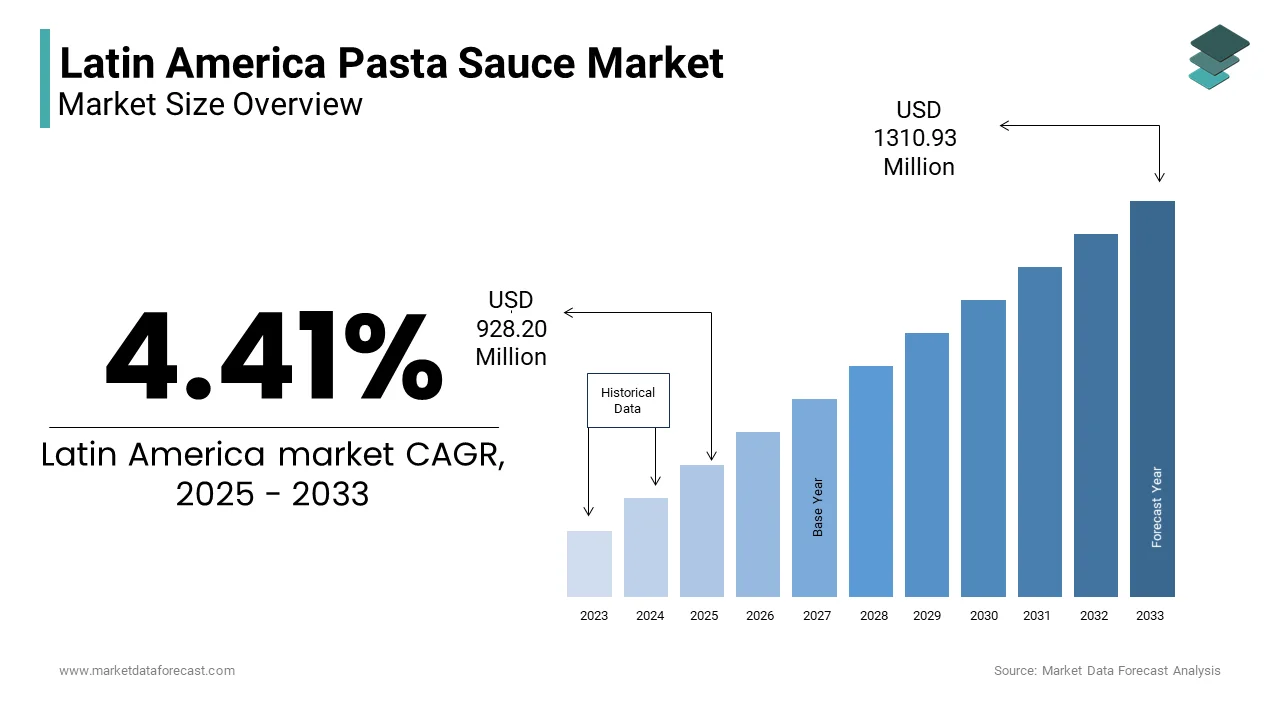

The Latin America Pasta Sauce Market Size was valued at USD 889 million in 2024. The Latin America Pasta Sauce Market size is expected to have 4.41 % CAGR from 2025 to 2033 and be worth USD 1310.93 million by 2033 from USD 928.20 million in 2025.

MARKET DRIVERS

Changing Lifestyles and Demand for Convenience Foods

A key driver of the Latin America pasta sauce market is the shift toward fast-paced urban lifestyles and an increasing preference for convenience foods. Consumers are increasingly seeking time-saving meal solutions that do not compromise on taste or quality with rising employment rates, particularly among women, and longer working hours in metropolitan areas. In countries like Colombia and Peru, where traditional home-cooked meals remain culturally significant but time constraints are growing, pasta sauces offer an accessible alternative. A 2023 survey by Ipsos MORI found that 57% of middle-class families in Lima and Bogotá regularly use store-bought pasta sauces to prepare weekday dinners, appreciating the ease of use and variety of flavors available. Additionally, frozen and chilled meal kits containing pre-mixed pasta and sauce combinations have gained traction, especially among young professionals and single-person households. Retailers and manufacturers are capitalizing on this trend by introducing portion-controlled packs and microwaveable options, further reinforcing the appeal of pasta sauces as convenient yet flavorful meal enhancers across Latin America.

Influence of Global Cuisine and Restaurant Trends

Another significant driver of the Latin America pasta sauce market is the growing influence of global cuisine and the proliferation of international dining concepts, Italian and Mediterranean restaurants. As exposure to diverse food cultures increases through travel, media, and digital content, consumers are developing a more adventurous palate, driving demand for authentic and gourmet-style pasta sauces. In Mexico City and São Paulo, upscale casual dining spots and fast-casual Italian chains have introduced artisanal pasta sauces using imported or locally adapted ingredients, setting new benchmarks for flavor expectations. This trend has spilled over into retail markets, where consumers seek similar experiences at home. Moreover, social media influencers and celebrity chefs have played a role in popularizing homemade pasta dishes using store-bought sauces by making them a regular feature in household pantries and reinforcing their position in the evolving Latin American food landscape.

MARKET RESTRAINTS

Preference for Homemade Sauces Over Commercial Products

One of the primary restraints affecting the Latin America pasta sauce market is the strong cultural inclination towards homemade sauces, particularly in rural and traditional households. Across many Latin American countries, preparing meals from scratch remains a deeply ingrained practice, especially among older generations who view store-bought pasta sauces as less authentic or inferior in taste. This preference is reinforced by the region’s abundant availability of fresh produce and a general skepticism toward processed foods. In Argentina, despite the presence of international brands, local consumers often opt for freshly blended chimichurri or tomato-based salsas instead of packaged pasta sauces.

Price Sensitivity and Economic Volatility

Another significant constraint on the growth of the Latin America pasta sauce market is price sensitivity, exacerbated by economic instability and fluctuating purchasing power across several key countries. Many consumers in lower-income segments, remain cautious about spending on non-essential food items, opting instead for staple ingredients that offer higher perceived value. Even in relatively stable economies like Mexico and Colombia, budget-conscious shoppers tend to favor cheaper alternatives such as canned tomato puree or basic seasoning packets rather than premium pasta sauces. Furthermore, currency devaluations and import restrictions in certain countries have made it difficult for multinational brands to maintain competitive pricing, limiting their reach in mass-market retail channels.

MARKET OPPORTUNITIES

Rising Demand for Organic and Health-Conscious Pasta Sauces

An emerging opportunity for the Latin America pasta sauce market lies in the growing consumer preference for organic, natural, and health-focused food products. Consumers are actively seeking out pasta sauces that are free from artificial preservatives, added sugars, and synthetic additives as awareness around nutrition and wellness increases. According to Euromonitor International, demand for clean-label sauces has surged across urban centers, particularly in Brazil and Chile, where health-conscious millennials and Gen Z consumers form a substantial portion of the market. Supermarkets and specialty stores in São Paulo and Santiago have expanded their organic pasta sauce offerings, responding to heightened demand for plant-based and gluten-free alternatives. Additionally, government-backed food certification programs in Argentina and Mexico are encouraging manufacturers to adopt healthier formulations, thereby enhancing product credibility.

Expansion of E-commerce and Direct-to-Consumer Sales Channels

The rapid development of e-commerce and digital retail platforms presents a significant opportunity for the Latin America pasta sauce market. As internet penetration and smartphone usage rise, online grocery shopping has become increasingly popular, especially among younger and tech-savvy consumers who prefer the convenience of home delivery. Platforms such as MercadoLibre, Amazon Fresh, and Carrefour’s online store have expanded their pasta sauce assortments, offering consumers a wider selection of international and artisanal brands. Moreover, direct-to-consumer models allow manufacturers to engage with customers through personalized marketing campaigns, loyalty programs, and subscription-based services.

MARKET CHALLENGES

Fragmented Regulatory Environment Across Countries

One of the most pressing challenges facing the Latin America pasta sauce market is the fragmented regulatory landscape that varies significantly across countries. Each nation enforces its own set of food safety standards, labeling requirements, and ingredient regulations, complicating compliance for both multinational and regional manufacturers. According to the Pan American Health Organization (PAHO), discrepancies in permissible preservative levels and nutritional claims create operational complexities that increase costs and slow down product launches.

For example, Brazil mandates strict guidelines on sugar and sodium content disclosures, while Argentina requires detailed allergen information in both Spanish and Portuguese. In contrast, Mexico follows a more flexible framework influenced by U.S. food policies, leading to inconsistencies in how products are formulated and marketed across borders. These regulatory hurdles pose particular difficulties for small and medium-sized enterprises that lack the resources to navigate multiple legal frameworks.

Intense Competition from Alternative Condiments and Seasonings

The Latin America pasta sauce market faces stiff competition from a wide array of traditional condiments and seasonings that dominate local cuisines. Consumers in the region have long-standing preferences for native sauces such as mole, chimichurri, adobo, and aji-based pastes, which often take precedence over commercially produced pasta sauces. According to Euromonitor International, these indigenous condiments continue to hold a larger share of pantry space, especially in countries like Mexico, Peru, and Colombia, where they are integral to daily meals. Furthermore, the versatility of staple ingredients like tomato paste, crushed garlic, and dried herbs allows consumers to customize flavors without relying on pre-made pasta sauces. This entrenched preference for alternative seasonings poses a challenge for pasta sauce brands seeking to expand beyond urban centers. Companies must invest in product localization, recipe integration, and promotional campaigns that position pasta sauces as complementary rather than competing options within the broader Latin American culinary landscape.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.41 % |

|

Segments Covered |

By Product Type, Packaging Type and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

Mexico, Brazil, Argentina, Chile, Peru and Rest of Latin America. |

|

Market Leaders Profiled |

Barilla Group, Nestlé S.A., The Kraft Heinz Company, Mizkan America Inc., Bertolli (Deoleo S.A.) |

SEGMENT ANALYSIS

By Product Type Insights

The tomato-based sauces segment dominated the Latin America pasta sauce market share in 2024. Latin American cuisines have long relied on tomatoes as a foundational ingredient in cooking, making tomato-based pasta sauces a natural extension of local flavor profiles. In countries like Mexico and Peru, where fresh tomato salsas are integral to daily meals, consumers easily transition to ready-made versions that offer convenience without compromising familiarity. According to NielsenIQ, over 70% of surveyed households in these countries regularly use tomato-based pasta sauces due to their versatility in preparing dishes ranging from spaghetti to stuffed pastas. Moreover, multinational brands such as Barilla and Nestlé have localized formulations to match regional taste preferences, incorporating mild spices and reduced acidity levels suited for Latin palates. Additionally, foodservice operators widely prefer this category for consistency in taste and ease of preparation, further reinforcing its dominance in both retail and commercial channels.

![]()

The pesto-based sauces segment is emerging with a CAGR of 11.4% during the forecast period. Pesto, traditionally made with basil, olive oil, pine nuts, and Parmesan cheese, has gained popularity as a premium alternative to conventional sauces. In Brazil and Chile, specialty grocery stores and online retailers have seen rising demand for artisanal pesto variants, including kale-based and vegan options. Additionally, food influencers and digital content creators have played a pivotal role in promoting pesto-based recipes through social media platforms, enhancing brand visibility and trial rates.

By Packaging Type Insights

The glass bottles segment was accounted in holding 38.5% of the Latin America pasta sauce market share in 2024. In countries like Argentina and Chile, where quality-conscious consumers prioritize product freshness, glass-packaged pasta sauces are commonly found in supermarkets, gourmet shops, and independent grocers. Additionally, manufacturers benefit from glass’s ability to withstand heat treatments and maintain color stability, ensuring consistent product appearance and texture. In Brazil, several local brands have leveraged this preference by introducing reusable glass jars by encouraging eco-friendly disposal habits while reinforcing brand loyalty.

The flexible pouches segment is likely to grow with a CAGR of 12.7% from 2025 to 2033. This rapid adoption is fueled by changing consumer lifestyles, increasing demand for convenience, and improved sustainability attributes compared to rigid containers. Pouches offer significant advantages such as lightweight design, easy storage, and mess-free dispensing, making them ideal for single-serve portions and on-the-go consumption.

Furthermore, manufacturers are leveraging flexible packaging innovations to enhance product differentiation. Brands in Mexico have introduced microwaveable and tearable pouches that allow direct heating and serving, aligning with modern cooking trends. Environmental benefits also contribute to their appeal many pouches now use recyclable materials, reducing carbon footprints and attracting eco-aware consumers.

By Distribution Channel Insights

The indirect distribution channel dominated the Latin America pasta sauce market with dominant share in 2024. Supermarkets and hypermarkets form the backbone of indirect distribution, offering extensive product variety and accessibility to a broad consumer base. In Brazil and Mexico, major chains like Carrefour, Walmart, and Grupo Bimbo operate thousands of outlets, ensuring widespread availability of branded and private-label pasta sauces. According to NielsenIQ, over 68% of pasta sauce purchases occur through these organized retail formats, driven by promotional campaigns and strategic shelf placements.

The direct distribution segment is likely to gain huge traction with a CAGR of 9.8% during the forecast period. One of the key drivers behind this trend is the rise of digital commerce and direct-to-consumer (DTC) strategies. Platforms such as MercadoLibre, Amazon Fresh, and regional specialty food websites have enabled pasta sauce producers to engage directly with consumers, collect feedback, and tailor offerings based on real-time data. According to Ipsos MORI, 53% of surveyed consumers in Chile and Colombia purchased pasta sauces directly from brand websites in 2023, citing exclusive deals and faster delivery as primary motivators. Moreover, food startups and artisanal producers are leveraging direct distribution to differentiate themselves in a competitive landscape. Subscription-based models offering curated sauce bundles have gained traction among gourmet and health-focused consumers, particularly in urban centers like Buenos Aires and São Paulo.

COUNTRY LEVEL ANALYSIS

Brazil was the largest in the Latin America pasta sauce market with 27.3% of share in 2024. Brazil has witnessed steady growth in pasta and pasta sauce consumption with a population exceeding 215 million and a strong cultural affinity for Italian cuisine. Supermarkets and online grocery platforms have significantly enhanced product availability, making pasta sauces a regular household item. Additionally, Brazilian manufacturers have adapted international formulations to suit local tastes, often incorporating ingredients such as palm oil and chili-infused variations.

Mexico pasta sauce market held 23.3% of Latin America pasta sauce market share in 2024. The country’s growing appetite for international flavors, coupled with the expansion of quick-service restaurant (QSR) chains, has significantly boosted pasta sauce consumption. Mexican consumers have embraced pasta as a versatile meal option, integrating it into both home-cooked and restaurant settings. According to the National Institute of Public Health of Mexico (INSP), pasta-based meals account for over 10% of all prepared dinners in urban households, with pasta sauces playing a central role in enhancing flavor profiles. Traditional Mexican condiments such as mole and chipotle are increasingly blended with classic pasta sauces, creating unique fusion offerings that cater to evolving tastes. Additionally, QSRs and casual dining establishments have incorporated pasta-based menu items, driving commercial demand for bulk pasta sauce suppliers.

Argentina pasta sauce market growth is likely to grow with prominent growth opportunities in the next coming years. Buenos Aires and Córdoba serve as primary consumption hubs, where pasta sauces are frequently used in both household and restaurant settings. According to the Argentine Chamber of Food Industries (COPAL), pasta sauce sales grew by 4.6% in 2023 with promotional campaigns and expanded distribution networks. Supermarkets such as Carrefour and Jumbo have played a crucial role in boosting retail sales, offering branded and private-label pasta sauce options that cater to diverse budget segments. Moreover, local food processors have introduced innovative variants, including low-sodium and organic formulations, to meet changing dietary preferences.

Chile’s developed retail landscape and high per capita income support consistent demand for packaged sauces are prompting the growth of the Latin America pasta sauce market. Santiago and Valparaíso remain the main centers of pasta sauce consumption, where working professionals and students frequently opt for convenient meal solutions. According to the National Institute of Statistics (INE), pasta sauce sales in Chile increased by 3.4% in 2023, benefiting from aggressive marketing and seasonal promotions.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Latin America Pasta Sauce Market are Barilla Group, Nestlé S.A., The Kraft Heinz Company, Mizkan America Inc., Bertolli (Deoleo S.A.), Prego (Campbell Soup Company), La Moderna, El Club del Gourmet, Lucchetti, M. Dias Branco, Grupo Nutresa, BRF S.A., Alicorp S.A.A., Grupo Arcor, Molinos Río de la Plata, Empresas Carozzi S.A., Grupo Herdez, General Mills Inc., Conagra Brands Inc.

The Latin America pasta sauce market is highly competitive, shaped by the presence of both multinational corporations and well-established regional producers. This dynamic environment fosters continuous innovation, aggressive branding, and strategic expansion initiatives aimed at capturing a larger consumer base. Global players leverage economies of scale, advanced production technologies, and extensive distribution networks to maintain dominance, while local manufacturers capitalize on cultural insights and proximity to raw materials to offer cost-effective solutions.

Competition extends beyond pricing, with companies differentiating themselves through product quality, packaging convenience, and alignment with health-conscious trends. The market also experiences frequent product launches and reformulations designed to meet shifting consumer expectations around nutrition and sustainability. Additionally, the rise of e-commerce and home meal solutions has intensified the need for brands to establish a strong digital presence and ensure seamless accessibility across multiple sales channels.

Top Players in the Market

Nestlé S.A.

Nestlé plays a significant role in the Latin America pasta sauce market through its extensive product portfolio that includes ready-to-use and shelf-stable sauces tailored for local tastes. The company leverages its global expertise in food innovation to introduce flavors that align with regional culinary preferences, making it a household name across multiple countries. Nestlé’s commitment to quality, sustainability, and brand trust enhances its influence not only in Latin America but also globally, reinforcing its dominance in the packaged food sector.

Unilever PLC

Unilever contributes to the Latin America pasta sauce market through its diversified food brands that cater to convenience-driven consumers. Unilever has successfully positioned its pasta sauces as everyday meal enhancers with a strong distribution network and a focus on flavor customization. Its ability to blend international formulations with local ingredients ensures relevance across different markets. As a global leader in consumer goods, Unilever brings strategic marketing capabilities and supply chain efficiency, strengthening its footprint in the region's evolving pasta sauce landscape.

Barilla Group

Barilla is an Italian-based global leader in pasta and pasta-related products, has made substantial inroads into the Latin American market by offering premium-quality pasta sauces that reflect authenticity and tradition. Known for its heritage and brand equity, Barilla has established itself as a preferred choice among discerning consumers who seek gourmet experiences at home. In Latin America, the company collaborates with retailers and foodservice providers to enhance visibility and availability, thereby contributing to both regional and global market growth.

Top strategies used by the key market participants

One of the primary strategies employed by key players in the Latin America pasta sauce market is product localization, where companies tailor their offerings to match regional taste preferences and culinary traditions. This includes adjusting spice levels, incorporating native ingredients, and introducing culturally relevant flavor profiles to enhance consumer acceptance.

Another crucial approach is expanding digital engagement and e-commerce presence by allowing brands to reach younger, tech-savvy consumers who prefer online shopping. Companies are investing in direct-to-consumer platforms, social media campaigns, and influencer collaborations to build brand awareness and drive trial usage among urban demographics.

Sustainability-focused branding and packaging innovations have become essential tools for differentiation. Leading manufacturers are adopting eco-friendly packaging materials, promoting recyclability, and increasing responsible sourcing practices to appeal to environmentally conscious consumers while maintaining product quality and convenience.

RECENT HAPPENINGS IN THE MARKET

In January 2024, Nestlé launched a new line of organic pasta sauces in Brazil, targeting health-conscious consumers and expanding its portfolio beyond conventional offerings.

In March 2024, Unilever introduced an exclusive digital platform in Mexico that connects directly with retailers to streamline pasta sauce distribution and improve inventory efficiency across urban and rural locations.

In June 2024, Barilla expanded its production facility in Argentina to increase output of locally adapted pasta sauces, aiming to meet rising demand and reduce lead times in distribution.

In September 2024, Knorr (a Unilever brand) partnered with a leading supermarket chain in Peru to introduce private-label pasta sauces, enhancing retail presence and improving affordability for budget-conscious shoppers.

In November 2024, La Costeña, a prominent Mexican food brand, rolled out a nationwide campaign promoting limited-edition chili-infused pasta sauces, leveraging social media influencers to boost engagement and trial rates.

MARKET SEGMENTATION

This research report on the latin america pasta sauce market has been segmented and sub-segmented into the following categories.

By Product Type

- tomato-based sauces

- pesto-based sauces

By Packaging Type

- glass bottles

- flexible pouches

By Distribution Channel

- indirect distribution

- direct distribution

By Country

- Mexico

- Brazil

- Argentina

- Chile

- Rest of Latin America

Frequently Asked Questions

Which countries in Latin America have the largest market share for pasta sauce?

Brazil and Mexico are the largest markets, followed by Argentina, Chile, and Colombia. Brazil leads due to its large population and growing middle class.

Who are the leading players in the Latin America pasta sauce market?

Some of the key players include Unilever (Knorr, Ragú) Barilla Nestlé (Maggi) Kraft Heinz Local brands and private labels

How has e-commerce impacted the pasta sauce market in Latin America?

E-commerce has expanded consumer access to a wider range of products, boosted brand visibility, and encouraged small and gourmet producers to enter the market directly.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com