Latin America Payments Market Size, Share, Trends, Forecast, Research Report - Segmented By Mode of Payment (Point-Of-Sale [Card Payments, Digital Wallet, Cash, and Others] and Online Sale [Card Payments, Digital Wallet, and Others]) and End-User Industry, and Region (Brazil, Mexico, Argentina, Chile & Rest of Latin America) – Regional Industry 2025 to 2033

Latin America Payments Market Size

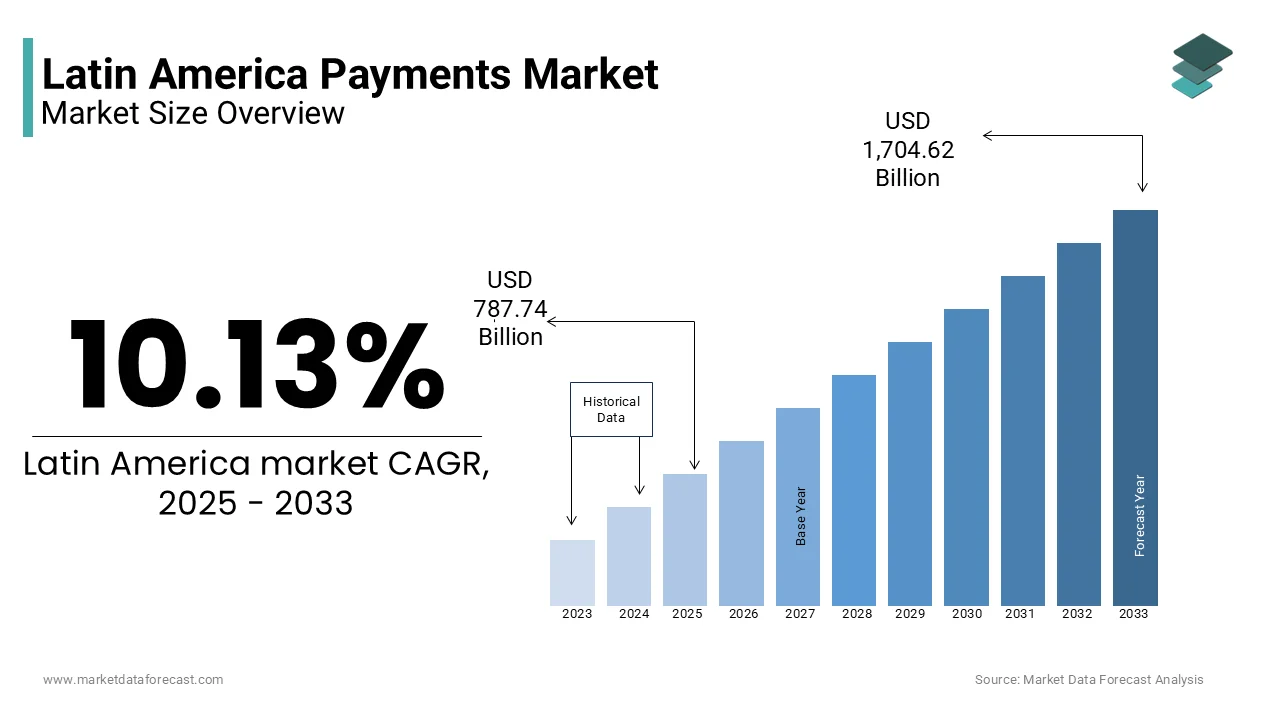

The Latin American payments market size was valued at USD 715.28 billion in 2024. The global market size is expected to reach USD 787.74 billion in 2025 and USD 1,704.62 billion by 2033, with a CAGR of 10.13% during the forecast period.

The Latin America payments market incorporates a broad spectrum of financial transactions conducted through digital, electronic, and traditional payment mechanisms. It includes point-of-sale (POS) transactions, mobile and online payments, card-based transfers, digital wallets, and real-time payment systems. Over the past few years, the region has witnessed a significant transformation in its financial ecosystem, driven by increasing smartphone penetration, expanding internet access, and growing consumer preference for cashless transactions.

MARKET DRIVERS

Expansion of Digital Financial Infrastructure

One of the key drivers fueling the growth of the Latin America payments market is the rapid expansion of digital financial infrastructure, particularly in countries like Brazil, Mexico, and Colombia. Governments and private institutions have been investing heavily in building robust digital payment ecosystems that support seamless, secure, and instantaneous fund transfers. According to the Central Bank of Brazil, the number of Pix transactions exceeded 18 billion in 2023 , marking a year-over-year increase of more than 45%. This real-time payment system has not only replaced a large portion of cash and card-based transactions but also encouraged small businesses to adopt digital payment methods. In Mexico, the National Banking and Securities Commission (CNBV) reported that electronic wallet usage grew by 38% in 2023 , largely driven by platforms like CoDi and open-loop digital payment apps. Furthermore, central banks across the region are actively promoting interoperability between different payment networks to ensure smoother cross-institutional transactions. The development of national switch infrastructures in Argentina and Chile has enabled faster processing and settlement of domestic payments, contributing to an environment where digital transactions are becoming the norm rather than the exception.

Rising Adoption of E-commerce and Mobile Payment Platforms

Rising Adoption of E-commerce and Mobile Payment Platforms

Another major driver of the Latin America payments market is the exponential growth of e-commerce and the widespread adoption of mobile payment platforms. With increasing internet penetration and smartphone usage, consumers are shifting away from traditional shopping models toward online retail, necessitating efficient and secure digital payment mechanisms. To support this boom, companies like Mercado Pago, Nubank, and PagSeguro have expanded their digital payment offerings, integrating features such as QR code-based payments, one-click checkouts, and BNPL (buy now, pay later) options. In Brazil, Mercado Pago reported that digital payment acceptance among SMEs increased by 42% in 2023, indicating a structural shift in business transaction behavior. Moreover, mobile money accounts have gained traction in underbanked regions, allowing users without traditional bank accounts to participate in the digital economy.

MARKET RESTRAINTS

Persistent Cash Dependency and Informal Economy

A significant restraint impeding the full potential of the Latin America payments market is the persistent dependency on cash and the prevalence of the informal economy. Despite efforts to promote digital financial inclusion, a substantial portion of daily transactions still occur in cash, especially in rural and low-income urban areas. In countries like Peru and Bolivia, informal economic activities account for a major share of GDP, limiting the scope for traceable and regulated digital transactions. Even in relatively developed markets such as Mexico, cash remains the preferred mode of payment for a large portion of small retail purchases. The lack of trust in digital systems, limited access to smartphones in certain demographics, and the absence of reliable internet connectivity in remote regions contribute to this cash-centric behavior.

Regulatory Fragmentation and Compliance Challenges

Regulatory Fragmentation and Compliance Challenges

Regulatory fragmentation across Latin American countries presents another major challenge for the payments market. Each country has distinct legal frameworks governing digital transactions, data privacy, anti-money laundering (AML) compliance, and financial institution licensing. This inconsistency increases the complexity and cost of cross-border operations for fintech firms and international payment providers. The Inter-American Development Bank highlighted that compliance costs for payment service providers in Latin America are approximately 20% higher than in North America , primarily due to overlapping regulatory requirements. Also, differences in tax treatment for digital transactions create confusion for merchants and consumers alike.

MARKET OPPORTUNITIES

Growth of Open Banking and API-Driven Financial Services

One of the most promising opportunities shaping the future of the Latin America payments market is the emergence of open banking and API-driven financial services. Open banking frameworks enable third-party developers and fintech firms to securely access banking data and offer innovative financial products, including customized payment solutions. According to the Organization for Economic Co-operation and Development (OECD), Brazil and Mexico were among the first Latin American countries to implement formal open banking regulations , with Brazil’s Phase 3 rollout completed in early 2023. Under this framework, many fintech firms integrated into the Brazilian banking ecosystem , enhancing competition and expanding consumer choice. Colombia and Chile have since followed suit, introducing phased implementation plans to foster greater financial transparency and efficiency. By leveraging APIs, new entrants can develop tailored payment gateways, credit scoring tools, and cross-border remittance platforms that cater to underserved populations.

Rise of Embedded Finance and Decentralized Payment Solutions

Another transformative opportunity in the Latin America payments market is the rise of embedded finance and decentralized payment solutions. Embedded finance allows non-financial companies—such as e-commerce platforms, ride-hailing services, and utility providers—to integrate financial services directly into their customer experience. This model has gained momentum in Latin America, where tech-savvy consumers expect seamless and contextualized financial interactions. In Brazil, companies like Nubank and Neon have partnered with food delivery apps and marketplace sellers to offer in-app lending, installment plans, and instant payments. Meanwhile, decentralized finance (DeFi) and blockchain-based payment systems are gaining traction, particularly among unbanked populations seeking alternatives to traditional banking.

MARKET CHALLENGES

Cybersecurity Threats and Fraud Risks

One of the foremost challenges facing the Latin America payments market is the rising incidence of cybersecurity threats and fraud risks associated with digital transactions. As payment systems become increasingly digitized and interconnected, they also become more vulnerable to cyberattacks, phishing schemes, and data breaches. According to Kaspersky Lab, Latin America experienced a notable increase in financial malware attacks, with Brazil and Mexico being the most targeted countries. Additionally, the proliferation of mobile payment apps has led to an uptick in fraudulent chargebacks and identity theft cases. In response, regulators such as Mexico’s CNBV and Brazil’s Central Bank have mandated stronger authentication protocols, including biometric verification and two-factor authentication. However, enforcement remains inconsistent, and many smaller financial institutions lack the resources to invest in advanced security infrastructure.

Limited Rural and Low-Income Access to Digital Payment Systems

Limited Rural and Low-Income Access to Digital Payment Systems

Despite progress in urban centers, a major challenge in the Latin America payments market is the limited access to digital payment systems among rural and low-income populations. A significant portion of the region’s population resides in remote areas where internet connectivity, smartphone ownership, and banking infrastructure remain inadequate. In countries like Honduras and Guatemala, less share of the rural population had access to formal banking services, making it difficult to onboard them onto digital payment platforms. While some governments have initiated programs to expand digital access, such as Colombia’s “Conexión Rural” initiative, coverage gaps persist. Moreover, many low-income individuals prefer cash transactions due to distrust in digital systems and concerns about hidden fees.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.13% |

|

Segments Covered |

By Mode of Payment, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Latin America include Brazil, Argentina, Mexico, and the Rest of Latin America |

|

Market Leaders Profiled |

Mercado Pago, Nubank, PagSeguro, StoneCo, Cielo, EBANX, Ualá, PicPay, RecargaPay, AstroPay, and others. |

SEGMENTAL ANALYSIS

By Mode of Payment Insights

The Point-Of-Sale (POS) segment had the largest share of the Latin America payments market by accounting for 62.2% in 2024. Within this segment, cash remains a dominant mode, especially in rural and informal economic settings, although its dominance is gradually declining due to increased digital adoption. The expansion of contactless payment infrastructure and government-backed financial inclusion programs have significantly boosted POS-based electronic transactions. Additionally, small merchants are increasingly adopting mobile POS systems enabled through smartphones, which has broadened access to formal payment mechanisms across underbanked regions.

The Online Sales segment is the fastest-growing component of the Latin America payments market, projected to expand at a CAGR of 19.4%. This growth is primarily fueled by the rapid expansion of e-commerce, increasing internet penetration, and the rise of fintech-driven payment gateways. Moreover, cross-border e-commerce is gaining traction, with consumers increasingly purchasing from international platforms, further driving demand for secure and seamless online payment processing. As more SMEs adopt digital storefronts and digital wallets become mainstream, the online payments segment is poised for sustained high growth across the region.

By End-User Industry Insights

The retail sector commanded the Latin America payments market by holding an estimated market share of 48.7% in 2024. This is caused by the sheer volume of daily consumer transactions, both in physical stores and online platforms. Traditional retailers are also modernizing their checkout systems, with a large number of retail outlets now accepting contactless card and QR code payments. Additionally, the proliferation of buy-now-pay-later (BNPL) services is reshaping consumer purchasing behavior, particularly among younger demographics. Governments are supporting these trends through initiatives like Brazil’s Pix instant payment system, which has streamlined point-of-sale and online retail transactions, reinforcing the sector’s leading role in shaping the regional payments landscape.

The entertainment industry is the quickest rising end-user segment in the Latin America payments market, projected to grow at a CAGR of 21.3%. This surge is largely attributed to the booming digital entertainment sector, including streaming services, gaming, and live event ticketing. Brazil saw an increase in online concert and sports event ticket sales , facilitated by digital payment integrations on platforms like Sympla and Ingresso Rápido. Fintech companies are capitalizing on this trend by offering embedded payment options within apps and websites, enhancing user experience and reducing friction. With rising smartphone ownership and improved mobile connectivity, the entertainment sector continues to drive innovation and adoption in digital payments across Latin America.

REGIONAL ANALYSIS

Brazil occupied the top position in the Latin America payments market by commanding an estimated 38% market share in 2024. The country's growth is attributed to its robust digital infrastructure, high smartphone penetration, and early adoption of real-time payment systems. The widespread use of mobile wallets like Nubank Pay, PicPay, and Mercado Pago has further accelerated digital payment adoption, especially among unbanked and underbanked populations. These developments, combined with a thriving fintech ecosystem, position Brazil as the undisputed leader in the Latin American payments space.

Mexico is a key player in the Latin America payments market in 2024. The country’s strong financial inclusion policies and growing fintech sector have been instrumental in shaping its payments landscape. Platforms like CoDi, launched by Banxico, have expanded instant payment capabilities across millions of merchants. Furthermore, remittance inflows have spurred demand for efficient digital transfer mechanisms. The rise of e-commerce and BNPL services, coupled with regulatory support, positions Mexico as a key growth driver in the Latin American payments ecosystem.

Argentina is an emerging market player. The country’s payments sector is evolving rapidly, driven by high inflation and currency instability, which have pushed consumers toward alternative payment methods. Additionally, the government introduced new fintech regulations aimed at encouraging innovation while ensuring compliance with financial oversight. Despite macroeconomic challenges, Argentina is emerging as a dynamic player in the regional payments landscape.

Chile is described by its technologically advanced financial infrastructure and high levels of digital adoption. The government-backed “Digital Chile” initiative has played a crucial role in expanding financial access, particularly in underserved areas. The country’s progressive regulatory environment and strong cybersecurity framework make it an attractive destination for global payment providers seeking long-term expansion opportunities in Latin America.

The “Rest of Latin America” category, comprising countries such as Colombia, Peru, Ecuador, and Central American nations, collectively contributed notably to the regional market in 2024. While individual economies may not match the scale of Brazil or Mexico, the collective growth potential is significant. Meanwhile, Honduras and Guatemala saw a rise in telemedicine-based diagnostics , creating demand for centralized automated labs capable of processing remote samples. This diversified yet rapidly evolving market presents unique opportunities for automation vendors aiming to expand beyond traditional hubs.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Key players in the Latin America payments market are Mercado Pago, Nubank, PagSeguro, StoneCo, Cielo, EBANX, Ualá, PicPay, RecargaPay, AstroPay.

The competition in the Latin America payments market is highly dynamic, shaped by a mix of global payment giants, homegrown fintech disruptors, and traditional financial institutions adapting to digital transformation. Established players like Visa, Mastercard, and PayPal maintain a strong presence through established networks and cross-border transaction capabilities, while local fintech firms such as Mercado Pago, Nubank, and PagSeguro are reshaping consumer expectations with innovative, mobile-first payment solutions. The rise of digital wallets, instant payment systems, and embedded finance models has intensified rivalry, pushing companies to differentiate through superior user experience, enhanced security, and seamless integration with e-commerce platforms. At the same time, regulatory developments such as open banking frameworks and real-time payment infrastructures are redefining the competitive landscape, encouraging collaboration between banks and fintech startups. While urban centers are witnessing rapid digitization, rural and low-income regions present untapped potential, prompting firms to invest in financial education and affordable payment technologies. As digital adoption accelerates, the battle for market share is increasingly centered on scalability, adaptability, and the ability to deliver inclusive, secure, and efficient payment experiences tailored to the diverse needs of Latin American consumers and businesses.

TOP PLAYERS IN THE MARKET

Mercado Pago (MercadoLibre)

Mercado Pago, the fintech arm of MercadoLibre, is a dominant force in the Latin America payments market. As one of the region’s most widely used digital payment platforms, it offers a comprehensive ecosystem including online and mobile payments, point-of-sale solutions, digital wallets, and credit services. Its deep integration with MercadoLibre's e-commerce platform has allowed it to scale rapidly across multiple countries, particularly in Brazil, Argentina, and Mexico. The company continues to expand beyond marketplace payments by offering financial services such as business loans and prepaid cards, making it a key driver of financial inclusion and digital transformation in the region.

Nubank

Nubank is one of the fastest-growing fintech companies in Latin America, known for revolutionizing digital banking through its no-fee credit card model and mobile-first approach. Beyond issuing credit cards, Nubank has expanded into digital payments, bill payments, peer-to-peer transfers, and business banking services. Its user-centric design and agile technology infrastructure have attracted millions of customers, especially in Brazil and Mexico, where traditional banking systems have historically been cumbersome and exclusionary. By embedding payments within a seamless digital experience, Nubank plays a critical role in shifting consumer behavior toward cashless transactions and enhancing financial accessibility across the region.

PagSeguro (PagSeguro Digital Ltd.)

PagSeguro is a leading Brazilian digital payments platform that has significantly influenced the evolution of electronic transactions in Latin America. It provides a wide range of payment solutions, including online payment gateways, mobile point-of-sale devices, and integrated financial tools for small and medium-sized businesses. Its early adoption of mobile-based payment technologies enabled rapid penetration into underbanked markets, helping merchants transition from cash-based operations to digital commerce. With a strong focus on innovation and merchant enablement, PagSeguro continues to drive digital payment adoption, particularly among SMEs, reinforcing its position as a key player in the regional payments landscape.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Key players in the Latin America payments market are leveraging strategic initiatives to solidify their competitive edge. One major strategy is expanding product ecosystems to include not only payments but also lending, insurance, and personal finance management, enabling deeper customer engagement and retention. Another prevalent approach is strategic acquisitions and partnerships , allowing companies to integrate complementary technologies, access new customer segments, and enhance operational capabilities. This includes acquiring neobanks, digital wallet providers, and cybersecurity firms to build robust, end-to-end financial service offerings. Additionally, players are focusing on localized innovation , adapting their products to meet specific regulatory environments, consumer preferences, and infrastructure limitations in different countries. These strategies collectively help firms strengthen their presence, improve service delivery, and respond effectively to the dynamic demands of the Latin American payments landscape.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Mercado Pago launched a new digital credit program in Brazil aimed at small businesses, expanding its financial services portfolio beyond payments to offer working capital solutions directly through its app.

- In March 2024, Nubank introduced a localized version of its digital wallet in Mexico, incorporating features tailored to local spending habits and merchant acceptance, aiming to accelerate digital payment adoption in the country.

- In May 2024, PagSeguro announced a strategic partnership with a major Brazilian retail chain to deploy an integrated payments and loyalty system, enhancing customer engagement and strengthening its presence in the brick-and-mortar retail sector.

- In July 2024, StoneCo merged select operations with a leading Chilean payments provider to create a more unified regional platform, improving cross-border capabilities and expanding its merchant network in South America.

- In September 2024, Bradesco, one of Brazil’s largest banks, rolled out a new contactless payment initiative in collaboration with international payment processors to support faster and more secure transactions across both online and physical channels.

MARKET SEGMENTATION

This research report on the Latin America payments market is segmented and sub-segmented into the following categories.

By Mode of Payment

- Point of Sale

- Card Payments (Includes Debit Cards, Credit Cards, Bank Financing, Prepaid Cards)

- Digital Wallet (Includes Mobile Wallets)

- Cash

- Other Modes of Payment

- Online Sale

- Card Payments (Includes Debit Cards, Credit Cards, Bank Financing, Prepaid Cards)

- Digital Wallet (Includes Mobile Wallets)

- Others (Includes Cash on Delivery, Bank Transfer, and Buy Now, Pay Later)

By End-User Industry

- Retail

- Entertainment

- Healthcare

- Hospitality

- Other End-user Industries

By Country

- Brazil

- Argentina

- Mexico

- Rest of Latin America

Frequently Asked Questions

1. What are the key trends shaping the Latin American payments market?

Major trends include the rapid adoption of digital wallets, the expansion of real-time payment systems, the rise of fintech startups, and increasing use of mobile and contactless payment methods.

2. What is driving the growth of the payments market in Latin America?

The market is growing due to rising internet and smartphone penetration, growing e-commerce activity, financial inclusion initiatives, and increasing consumer preference for digital transactions.

3. What are the main challenges facing the Latin American payments market?

Key challenges include cybersecurity threats, fragmented regulatory frameworks, limited access to digital infrastructure in rural areas, and consumer trust issues in digital platforms.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com