Latin America Salmon Market Size, Share, Trends, Forecast, Research Report - Segmented By Species Type (Atlantic Salmon, Coho Salmon, Masu Salmon, Chinook Salmon, and Other Species Types), Farming Type, and Region (Brazil, Mexico, Argentina, Chile & Rest of Latin America) – Regional Industry 2025 to 2033

Latin America Salmon Market Size

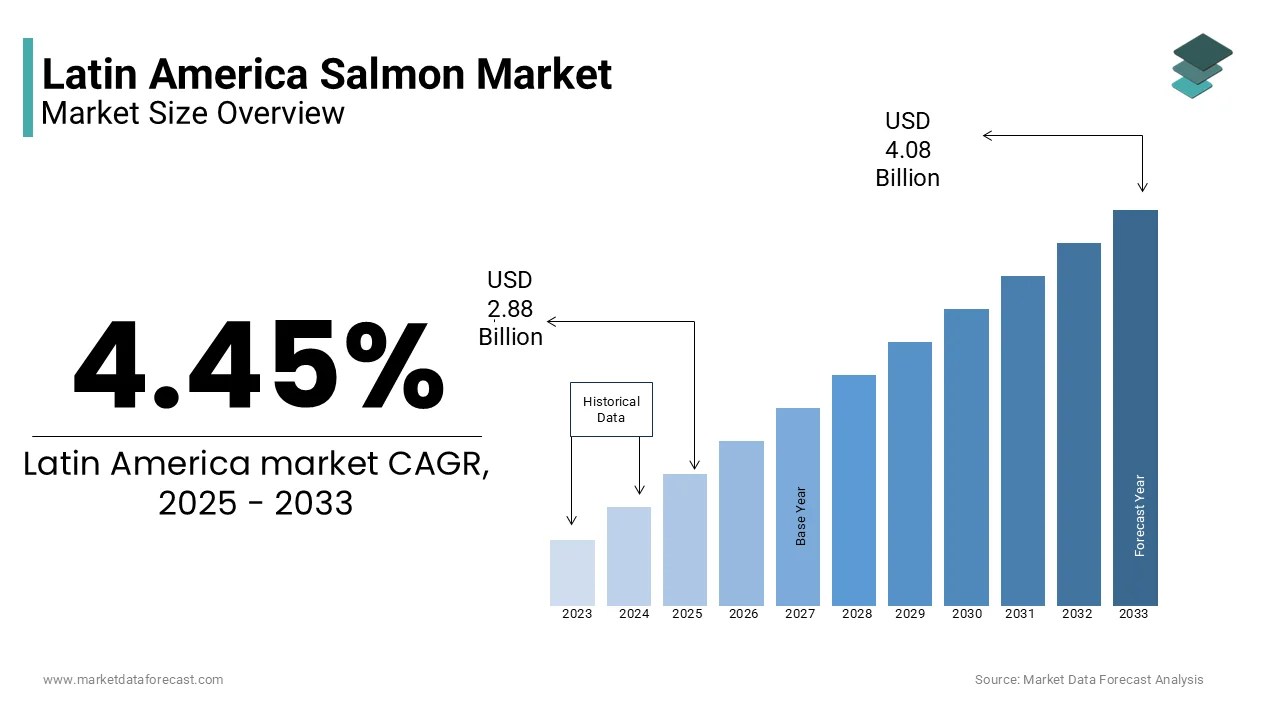

The Latin American salmon market size was valued at USD 2.76 billion in 2024. The global market size is expected to reach USD 2.88 billion in 2025 and USD 4.08 billion by 2033, with a CAGR of 4.45% during the forecast period.

The Latin America salmon market refers to the production, distribution, and consumption of farmed and wild-caught salmon within the region. Primarily centered in Chile, which is one of the world’s leading producers of farmed salmon, the market also includes emerging aquaculture activities in Argentina and Brazil, as well as increasing importation and consumption trends across other Latin American countries. Salmon has gained popularity due to its high nutritional value, particularly for being rich in omega-3 fatty acids, protein, and essential vitamins, making it a preferred choice among health-conscious consumers.

Chile dominates the regional market, with the industry contributing significantly to national exports. The cold, pristine waters of southern Chile provide an ideal environment for raising Atlantic and Coho salmon, supporting large-scale aquaculture operations. Domestically, rising disposable incomes, urbanization, and shifting dietary preferences are driving increased local consumption. In addition, the expansion of modern retail channels and foodservice sectors has enhanced accessibility.

MARKET DRIVERS

Increasing Domestic Consumption Due to Health Awareness

One of the primary drivers of the Latin America salmon market is the rising domestic consumption fueled by heightened consumer awareness regarding the health benefits associated with salmon intake. Rich in omega-3 fatty acids, high-quality proteins, and essential micronutrients, salmon is increasingly viewed as a functional food that supports cardiovascular health, brain development, and immune function. Like, cardiovascular diseases remain the leading cause of mortality in Latin America, prompting public health initiatives that promote fish consumption as part of a balanced diet. In major cities such as Santiago, Buenos Aires, and São Paulo, there has been a noticeable shift toward premium protein sources, with salmon appearing more frequently in supermarket shelves, gourmet restaurants, and home meal replacement kits. The per capita fish consumption in Chile rose between 2020 and 2023, largely driven by salmon-based products. Moreover, wellness-oriented consumers are seeking out sustainably sourced and certified salmon, encouraging retailers to highlight traceability and responsible aquaculture practices. This evolving consumer mindset is reinforcing the role of salmon not only as a luxury item but also as a staple protein in everyday nutrition, thus strengthening market growth from the demand side.

Expansion of Aquaculture Infrastructure in Chile

Expansion of Aquaculture Infrastructure in Chile

Another significant driver of the Latin America salmon market is the continuous expansion and modernization of aquaculture infrastructure in Chile, the region's largest producer. Over the past decade, the Chilean salmon industry has recovered from disease outbreaks and regulatory challenges, investing heavily in biosecurity measures, environmental compliance, and technological upgrades. Modernization efforts include the adoption of closed-containment systems, real-time water quality monitoring, and improved feed formulations that reduce reliance on marine ingredients. These advancements have led to higher survival rates and better product consistency, enabling Chilean producers to meet both export and domestic demand more efficiently. In addition, strategic partnerships between private firms and research institutions have accelerated innovation. For instance, collaborations with the University of Valparaíso have resulted in the development of vaccines and probiotics tailored for Chilean salmon strains. These improvements have not only stabilized production cycles but also enhanced the reputation of Chilean salmon in international markets.

MARKET RESTRAINTS

Environmental and Regulatory Challenges in Salmon Farming

A major restraint affecting the Latin America salmon market is the persistent environmental and regulatory scrutiny surrounding salmon farming, particularly in Chile. Salmon aquaculture has faced criticism over issues such as water pollution, antibiotic use, and ecosystem disruption, prompting stricter governmental oversight and public backlash. Regulatory agencies have implemented tighter controls on farm locations, fallowing periods, and chemical treatments, aiming to mitigate ecological impact. However, these restrictions often lead to increased operational costs and production delays. Moreover, opposition from environmental groups and coastal communities has delayed the approval of new farm sites. Also, concerns over the potential depletion of native species and contamination risks associated with intensive salmon farming. These pressures have prompted some investors to reconsider long-term commitments to the sector, creating uncertainty in the market.

Disease Outbreaks and Pathogen Management Issues

Disease outbreaks continue to pose a significant challenge to the Latin America salmon market, particularly in Chile, where infectious agents like Piscirickettsia salmonis and Infectious Salmon Anemia (ISA) have historically disrupted production cycles. Despite improvements in biosecurity, recurrent pathogenic threats contribute to financial losses, reduced harvest volumes, and fluctuating supply chains. The economic burden of managing these diseases extends beyond direct losses. Companies must invest in costly vaccines, diagnostics, and treatment protocols to contain outbreaks. In addition, prolonged fallowing periods—required to disinfect affected sites—have limited farm turnover and constrained production capacity. These challenges affect not only domestic supply but also export reliability. International buyers, particularly in the United States and Japan, have become more selective about sourcing salmon from regions with consistent health certifications. As a result, periodic disease-related disruptions can weaken market confidence and delay contract renewals.

MARKET OPPORTUNITIES

Growth of Value-Added Salmon Products

An emerging opportunity in the Latin America salmon market lies in the development and commercialization of value-added salmon products. Consumers are increasingly seeking convenient, ready-to-eat, and pre-prepared seafood options, driving demand for processed forms such as marinated fillets, smoked salmon, portion-controlled cuts, and frozen meal kits. This trend is being supported by improvements in cold-chain logistics and packaging technologies, which allow for extended shelf life and enhanced product presentation. In Brazil and Argentina, supermarkets and online grocery platforms are expanding their premium seafood sections, catering to urban professionals and health-conscious households. Furthermore, foodservice operators are incorporating pre-portioned and pre-seasoned salmon into restaurant menus, reducing preparation time while maintaining quality. By capitalizing on this shift toward convenience and premiumization, the Latin America salmon market can unlock new revenue streams and expand its reach beyond traditional raw or whole-fish formats.

Expansion of Sustainable and Organic Salmon Farming

The growing emphasis on sustainability and ethical sourcing presents a significant opportunity for the Latin America salmon market, particularly in Chile, where organic and eco-certified salmon production is gaining momentum. Consumers worldwide are increasingly prioritizing environmentally responsible food choices, prompting retailers and foodservice providers to seek out certified sustainable seafood. Chilean producers are responding by adopting integrated multi-trophic aquaculture (IMTA), alternative feeds with lower fishmeal content, and renewable energy-powered processing facilities. Additionally, several companies have begun marketing organic salmon lines that adhere to European Union and U.S. Department of Agriculture (USDA) organic standards. This shift is attracting investment from international stakeholders who prioritize ESG (Environmental, Social, and Governance) criteria. As global demand for clean-label seafood rises, Latin America is well-positioned to leverage its natural resources and progressive policies to strengthen its presence in premium salmon markets.

MARKET CHALLENGES

Supply Chain Disruptions and Logistics Constraints

A critical challenge facing the Latin America salmon market is the vulnerability of its supply chain to logistical bottlenecks and transportation inefficiencies. Given that Chile is the primary exporter of salmon in the region, the movement of fresh and frozen products to international and domestic markets depends heavily on reliable cold storage, air freight, and port infrastructure. However, recurring disruptions in transportation networks have hindered timely deliveries and increased spoilage risks. The geographical remoteness of many salmon farms in southern Chile further complicates logistics. Limited road connectivity and dependence on sea routes expose the supply chain to weather-related disruptions. Moreover, extreme weather events in Patagonia caused a 12-day average delay in salmon exports during the first quarter of 2023. In addition, fluctuations in fuel prices and labor shortages at key transport hubs have added unpredictability to delivery schedules. Domestically, insufficient cold-chain infrastructure in smaller cities and rural areas restricts broader market penetration. Addressing these logistical constraints requires substantial investment in infrastructure and coordination between public and private stakeholders to ensure a stable and efficient salmon distribution network.

Rising Competition from Alternative Seafood Proteins

Rising Competition from Alternative Seafood Proteins

The Latin America salmon market faces intensifying competition from alternative seafood proteins, including plant-based substitutes, lab-grown fish, and other whitefish varieties. As consumer preferences shift toward affordable, sustainable, and ethically produced proteins, traditional salmon producers must contend with an expanding array of substitutes that offer similar nutritional benefits at lower price points. Companies producing algae-based omega-3 supplements, mycoprotein-based fish analogs, and cell-cultured seafood are gaining traction, particularly among younger and environmentally conscious consumers. Similarly, tilapia, pangasius, and trout have emerged as cheaper yet protein-rich seafood options, capturing market share in budget-conscious segments. Moreover, international seafood exporters are diversifying their offerings to Latin American importers, providing competitive pricing on frozen fish fillets that challenge salmon’s dominance. As alternative proteins gain visibility and acceptance, salmon producers must innovate in branding, pricing, and sustainability messaging to maintain their position in a rapidly evolving market landscape.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.45% |

|

Segments Covered |

By Species Type, Farming Type, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Latin America include Brazil, Argentina, Mexico, and the Rest of Latin America |

|

Market Leaders Profiled |

Cermaq Group AS (Mitsubishi Corporation), AquaChile S.A., Blumar Seafoods, Salmones Multiexport S.A., Marine Harvest ASA (Mowi ASA), Australis Seafoods S.A., Ventisqueros S.A., Salmones Camanchaca S.A., Los Fiordos S.A., and Nova Austral S.A., and others. |

SEGMENTAL ANALYSIS

By Species Type Insights

Atlantic salmon dominated the Latin America salmon market by holding a commanding 62.4% of total market share in 2024. This species is the most widely farmed and consumed type across the region, particularly in Chile, which is one of the top global producers of Atlantic salmon. The dominance of Atlantic salmon is primarily driven by its adaptability to aquaculture systems and high consumer preference for its rich flavor and firm texture. The species’ compatibility with large-scale farming operations has made it the preferred choice for export-oriented producers. Moreover, international demand from markets such as the United States, Japan, and China continues to bolster production levels. Domestically, increasing awareness of omega-3 benefits and rising disposable incomes have also contributed to higher consumption rates. Supermarkets and premium restaurants across major cities like Santiago, Buenos Aires, and São Paulo increasingly feature Atlantic salmon in their offerings, further strengthening its market leadership.

Chinook salmon, though less prevalent than Atlantic and Coho varieties, is emerging as the swiftest advancing segment in the Latin America salmon market, expanding at a CAGR of 8.1%. This growth is largely attributed to its premium status, superior taste profile, and growing recognition among gourmet chefs and upscale foodservice providers. In Chile, where most Chinook salmon farming occurs, efforts to enhance breeding techniques and disease resistance have led to improved survival rates and higher yields. Another key driver is the rise in specialty seafood retailing and direct-to-consumer distribution channels. High-end grocery stores and online seafood platforms in Brazil and Argentina are increasingly offering fresh and frozen Chinook fillets to cater to affluent consumers seeking premium dining experiences at home. Moreover, the species’ larger size and higher oil content make it ideal for smoking and curing, aligning with the growing trend of artisanal and value-added seafood products.

By Farming Type Insights

The farmed salmon constituted the largest segment in the Latin America salmon market in 2024. This overwhelming dominance is primarily due to Chile's extensive aquaculture infrastructure, which makes it one of the world’s leading producers of farmed salmon. The controlled environment of fish farms allows for consistent supply, predictable quality, and efficient harvesting—factors that are crucial for both domestic consumption and international exports. Additionally, advancements in aquaculture technology, including improved feed formulations, biosecurity measures, and environmental monitoring systems, have enhanced productivity while reducing disease outbreaks. Domestic demand for farmed salmon has also grown significantly, driven by urbanization, health consciousness, and the expansion of modern retail formats.

Wild-captured salmon is coming up as the quickest rising segment in the Latin America salmon market, expanding at a CAGR of 5.7% through 2033. Although smaller in volume compared to farmed salmon, wild-caught species such as Coho and Chinook are gaining traction due to their perceived naturalness, sustainability, and premium positioning. In southern Chile and Argentina, small-scale fisheries targeting wild salmon populations have seen renewed interest, particularly from eco-conscious consumers and high-end culinary establishments. One of the key drivers behind this growth is the rising demand for sustainably sourced seafood. Organizations such as the Marine Stewardship Council (MSC) have certified several wild salmon fisheries in the region, enhancing their appeal to environmentally aware buyers. MSC-certified wild salmon exports grew, indicating strong market acceptance. Furthermore, local gastronomy movements promoting native ingredients have boosted the visibility of wild salmon in fine dining and farm-to-table concepts. Restaurants in Santiago, Mendoza, and Valdivia are increasingly featuring wild-caught salmon on menus, contributing to its growing prominence despite limited volumes.

REGIONAL ANALYSIS

Chile held the dominant position in the Latin America salmon market by accounting for a 76.9% of total regional production in 2024. As one of the world’s top three salmon producers, trailing only Norway and Scotland, Chile benefits from favorable oceanic conditions, advanced aquaculture infrastructure, and a well-established export network. The industry is concentrated in the southern regions of Los Lagos and Aysén, where cold, clean waters provide an ideal environment for salmon farming. Domestically, rising health awareness and shifting dietary preferences have expanded salmon consumption beyond traditional luxury segments. Additionally, government-backed initiatives aimed at improving sustainability and traceability have strengthened the country’s reputation as a reliable supplier in global seafood markets.

Brazil is a rapidly growing consumer market driven by increasing disposable incomes, urbanization, and exposure to global food trends. Also, salmon imports into Brazil surged in 2023, with frozen fillets and portion-controlled cuts gaining popularity among middle-class households and premium restaurants. The expansion of modern retail chains and e-commerce platforms has improved product availability, making salmon more accessible beyond major metropolitan areas. Additionally, public health campaigns promoting heart-healthy diets have contributed to greater awareness of seafood benefits. Despite challenges related to logistics and pricing, Brazil’s evolving food culture and investment in cold-chain infrastructure suggest a promising outlook for salmon demand.

Mexico does not engage in significant salmon farming but serves as a growing import-driven consumer market fueled by rising demand from the foodservice sector and health-conscious urban populations. The expansion of sushi and fusion cuisine restaurants, along with increasing adoption of protein-rich diets, has contributed to this upward trend. Additionally, the presence of multinational fast-food chains incorporating salmon into premium sandwiches and salads has broadened consumer exposure. With ongoing investments in cold storage infrastructure and rising disposable incomes, Mexico is expected to maintain steady growth in salmon consumption, supported by both imported raw materials and pre-processed seafood products.

Argentina plays a dual role as a minor exporter of wild-caught salmon and a growing domestic consumer market. The Marine Stewardship Council (MSC) certified several fisheries in the region, enhancing the appeal of Argentine-sourced salmon among sustainability-focused buyers. On the domestic front, salmon consumption has been steadily rising, particularly in urban centers such as Buenos Aires and Mendoza. Furthermore, Argentina’s burgeoning fine dining scene has embraced locally caught Chinook and Coho salmon, integrating them into gourmet dishes and farm-to-table concepts. Despite logistical constraints and relatively high prices, Argentina’s unique positioning as both a niche producer and an emerging consumer market contributes to its distinct footprint in the Latin America salmon landscape.

While individually smaller in scale, these countries exhibit growing interest in salmon consumption, primarily through imported products catering to urban and upscale dining sectors. Colombia stands out as a key player, with Bogotá and Medellín witnessing a surge in salmon imports for use in gourmet restaurants and health-focused meal delivery services. Peru, known for its thriving seafood industry, has also incorporated salmon into fusion cuisine and sushi offerings. Meanwhile, Costa Rica and Panama are leveraging their tourism industries to introduce salmon into hotel buffets and international restaurant chains.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Cermaq Group AS (Mitsubishi Corporation), AquaChile S.A., Blumar Seafoods, Salmones Multiexport S.A., Marine Harvest ASA (Mowi ASA), Australis Seafoods S.A., Ventisqueros S.A., Salmones Camanchaca S.A., Los Fiordos S.A., and Nova Austral S.A. are the key players in the Latin America salmon market.

The competition in the Latin America salmon market is shaped by a mix of large-scale aquaculture enterprises, government-regulated frameworks, and growing consumer awareness around sustainability and food safety. Chile dominates the market, hosting several globally recognized salmon producers that compete not only regionally but also on the international stage. These companies engage in continuous innovation, striving to enhance production efficiency, reduce environmental impact, and meet evolving consumer preferences. While multinational corporations lead the way, smaller local operators are increasingly adopting niche strategies, such as organic certification and direct-to-consumer models, to carve out their own market space.

Competition extends beyond production, influencing branding, marketing, and distribution channels. Domestic consumption is rising, prompting companies to invest in retail partnerships and premium seafood positioning. At the same time, international buyers remain highly selective, pushing Latin American exporters to maintain high quality and traceability standards. As alternative seafood proteins gain traction, traditional salmon producers must also differentiate themselves through sustainability claims, nutritional messaging, and superior product offerings. The convergence of regulatory pressures, supply chain challenges, and shifting dietary trends further intensifies the competitive environment, making adaptability a key success factor in this dynamic market.

TOP PLAYERS IN THE MARKET

Camanchaca (Pesquera Camanchaca S.A.)

Camanchaca is a leading Chilean seafood company with a strong presence in both wild-caught and farmed salmon production. The company plays a vital role in supplying high-quality salmon to international markets while also catering to domestic demand. Camanchaca focuses on sustainable fishing practices and has invested heavily in improving traceability and environmental responsibility across its operations. Its commitment to responsible aquaculture has positioned it as a key player in shaping industry standards within Latin America.

Salmones Caman SA (Part of BluPac Group)

Salmones Caman, operating under the BluPac Group, is a major force in Chile’s salmon farming sector. The company specializes in producing Atlantic and Coho salmon using advanced aquaculture technologies that emphasize efficiency and product quality. With a strong export orientation, Salmones Caman supplies premium salmon to North America, Asia, and Europe. Its focus on innovation and vertical integration allows it to maintain competitive edge and contribute significantly to Chile's global standing in salmon exports.

Australis Seafoods S.A.

Australis Seafoods is one of the largest salmon producers in Chile, known for its leadership in sustainable aquaculture and premium product offerings. The company emphasizes eco-friendly farming methods and has been proactive in adopting technology-driven solutions to enhance farm management and fish health. Australis plays a crucial role in positioning Chile as a reliable supplier of responsibly farmed salmon, contributing to both regional market growth and global seafood sustainability efforts.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

One of the primary strategies employed by leading players in the Latin America salmon market is investing in sustainable aquaculture practices . Companies are prioritizing environmental stewardship through improved feed formulations, reduced antibiotic use, and better waste management systems. These initiatives not only help comply with stringent regulations but also appeal to global buyers who value eco-certified seafood.

Another key approach is expanding value-added product lines , such as pre-portioned fillets, smoked salmon, and ready-to-cook meals. By offering processed products tailored to consumer convenience, companies can capture higher margins and meet evolving retail and foodservice demands. This strategy also helps differentiate brands in an increasingly competitive landscape.

Lastly, strengthening supply chain resilience through technological integration is gaining traction among major players. From real-time monitoring of sea cages to enhanced cold-chain logistics, these advancements ensure product quality and consistency. By leveraging digital tools and automation, companies aim to optimize production cycles and improve distribution efficiency across domestic and international markets.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Camanchaca launched a new line of sustainably sourced frozen salmon products aimed at expanding its reach in urban supermarkets across Chile and Argentina. This move was designed to strengthen its position in the domestic market by catering to health-conscious consumers seeking convenient seafood options.

- In July 2024, Salmones Caman announced the expansion of its processing facility in southern Chile to accommodate increased demand for portion-controlled and vacuum-packed salmon. The upgrade was intended to improve efficiency and support export commitments to North American and Asian markets.

- In October 2024, Australis Seafoods introduced a blockchain-based traceability system to provide full transparency from farm to table. This initiative aimed to reinforce consumer trust and meet the growing demand for certified sustainable seafood in premium retail and restaurant sectors.

- In January 2025, Blumar, a leading Chilean seafood firm, entered into a strategic partnership with a European distributor to streamline its logistics network and enhance cold-chain reliability for salmon exports. The collaboration was expected to reduce delivery times and improve product freshness in key international markets.

- In May 2025, AquaChile initiated a pilot program to test closed-containment aquaculture systems in Patagonia, aiming to mitigate environmental concerns and disease risks associated with open-net pen farming. This innovation-focused effort was part of broader industry efforts to align with global sustainability benchmarks.

MARKET SEGMENTATION

This research report on the Latin America salmon market is segmented and sub-segmented into the following categories.

By Species Type

- Atlantic

- Pink

- Chum/Dog

- Coho

- Sockeye

- Others

By Farming Type

- Farmed

- Wild Captured

By Country

- Brazil

- Argentina

- Mexico

- Rest of Latin America

Frequently Asked Questions

1. What are the key growth opportunities in the Latin America salmon market?

Rising consumer demand for high-protein diets, increasing seafood exports, and expanding aquaculture operations are major growth drivers in the Latin America salmon market.

2. What trends are influencing the Latin America salmon market?

Key trends include the adoption of sustainable farming practices, the rise of organic and antibiotic-free salmon, and growing investment in cold chain logistics.

3. What challenges does the Latin America salmon market face?

The market faces challenges such as environmental concerns related to aquaculture, disease outbreaks in fish farms, and fluctuating export regulations.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com