Latin America Soundbar Market Research Report – Segmented By Technology ( condensing boilers, electric boilers ) Fuel ( natural gas boilers, electric boilers) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of EU) - Industry Analysis on Size, Share, Trends & Growth Forecast (2025 to 2033)

Latin America Soundbar Market Size

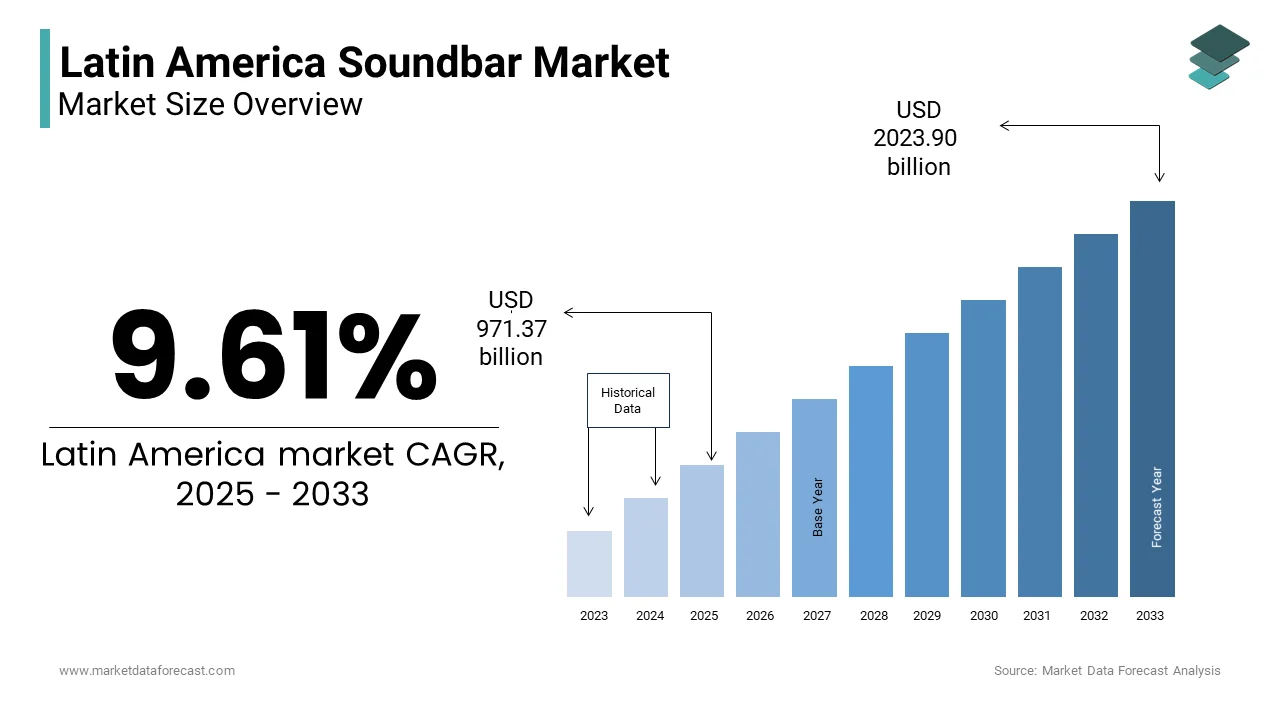

The Latin America soundbar market Size was valued at USD 886.21 billion in 2024. The Latin America soundbar market size is expected to have 9.61 % CAGR from 2025 to 2033 and be worth USD 2023.90 billion by 2033 from USD 971.37 billion in 2025.

The Latin America soundbar market involves a growing section of home audio technology designed to enhance television and multimedia experiences with compact, high-quality surround sound solutions. A soundbar is a single elongated speaker unit that delivers superior audio performance compared to built-in TV speakers, making it an attractive alternative for consumers seeking improved entertainment experiences without the complexity of multi-speaker setups. The market includes both entry-level models and premium variants equipped with wireless subwoofers, Dolby Atmos support, and smart connectivity features.

As consumer demand for immersive home entertainment continues to rise across Latin America, so does the adoption of soundbars. This trend has been further accelerated by the increasing penetration of smart TVs, streaming services, and online gaming platforms.

MARKET DRIVERS

Rise in Smart Home and Connected Entertainment Ecosystems

One of the key drivers fueling the Latin America soundbar market is the rapid expansion of smart home technologies and integrated entertainment ecosystems. Consumers are increasingly investing in interconnected devices such as smart TVs, voice assistants, and streaming media players, creating a conducive environment for advanced audio peripherals like soundbars. According to the Inter-American Development Bank, smart home device shipments in Latin America grew significantly in 2023, with Brazil and Mexico leading the adoption curve. Soundbars, especially those compatible with voice control systems like Google Assistant and Amazon Alexa, have become integral components of modern home entertainment setups. As more consumers replace older televisions with smart models that lack robust built-in speakers, the demand for complementary audio enhancement solutions has surged. Besides, streaming platforms such as Netflix, Disney+, and Amazon Prime Video have driven higher expectations for audio-visual quality.

Increasing Disposable Incomes and Urbanization Rates

Another significant driver behind the growth of the Latin America soundbar market is the steady increase in disposable incomes and urbanization rates, particularly in major economies such as Brazil, Mexico, and Colombia. As economic conditions improve, consumers are allocating more funds toward discretionary purchases, including home entertainment upgrades. Like, Latin America’s average GDP per capita increased considerably in 2023, reflecting stronger purchasing power among the region’s expanding middle class. This financial uplift has enabled households to invest in premium electronics beyond basic necessities, with audio equipment becoming a priority for many. Furthermore, urbanization has played a crucial role in reshaping consumer preferences. These demographic and economic shifts are reinforcing the demand for soundbars as consumers seek to enhance their home entertainment environments.

MARKET RESTRAINTS

High Cost of Premium Soundbar Models

A primary restraint affecting the Latin America soundbar market is the relatively high cost of premium soundbar models, which limits accessibility for price-sensitive consumers. While entry-level options are available, high-end models featuring advanced technologies such as Dolby Atmos, DTS:X, and AI-enhanced sound processing remain prohibitively expensive for a large portion of the population. This pricing gap is especially pronounced in countries with lower average incomes, such as Bolivia, Ecuador, and parts of Central America, where even modestly priced electronics represent a significant financial commitment. Also, fluctuations in foreign exchange rates and import duties on electronic goods further inflate costs. These economic barriers hinder widespread adoption and slow down market expansion, particularly in emerging segments where affordability remains a critical concern for consumers.

Limited Awareness and Technical Understanding

Another significant challenge impeding the growth of the Latin America soundbar market is the limited awareness and technical understanding of soundbar functionalities among potential consumers. Many buyers remain unfamiliar with the benefits of upgrading from built-in TV speakers or stereo systems to a dedicated soundbar, resulting in slower adoption rates, particularly in rural and semi-urban regions. According to a consumer survey conducted by the Mexican Institute of Audiovisual Technologies, a notable portion of respondents were unaware of how soundbars could enhance their home entertainment experience. Also, confusion between soundbars, home theater systems, and Bluetooth speakers leads to misinformed purchasing decisions, reducing confidence in product value. In response, manufacturers and retailers have launched localized marketing campaigns to educate consumers about soundbar advantages. However, these efforts face challenges due to fragmented media reach and varying levels of digital literacy across different demographic groups.

MARKET OPPORTUNITIES

Expansion of Streaming and Gaming Industries

One of the most promising opportunities for the Latin America soundbar market lies in the rapid expansion of the streaming and gaming industries, both of which drive demand for high-quality audio equipment. With the proliferation of online content platforms and interactive entertainment, consumers are increasingly prioritizing immersive audio experiences at home. According to the Latin American Internet Association, streaming service subscriptions in the region surpassed 150 million in 2023, with platforms like Netflix, Amazon Prime Video, and Disney+ gaining traction across all age groups. As viewers consume more high-definition content, there is a growing recognition of the need for better audio fidelity, prompting interest in soundbar upgrades. Simultaneously, the gaming sector is experiencing substantial growth. The Latin American Gaming Report revealed that video game revenues in the region increased significantly in 2023, fueled by mobile and console gaming trends. Gamers, in particular, seek enhanced audio immersion to complement visual realism, making soundbars a preferred choice over conventional TV speakers.

Integration with Smart Home Assistants and Voice Control

The integration of soundbars with smart home assistants and voice-controlled ecosystems presents a significant growth opportunity for the Latin America soundbar market. As smart home adoption rises, consumers increasingly expect seamless compatibility between audio devices and other connected gadgets, enhancing convenience and user experience. Also, smart speaker and smart home device shipments in Latin America expanded considerably in recent years, signaling a shift toward interconnected living environments. Soundbars equipped with built-in voice assistants such as Amazon Alexa, Google Assistant, and Apple Siri offer multifunctional capabilities beyond audio playback, allowing users to control lighting, security systems, and climate settings through a central hub. This convergence of audio and smart home functionality is particularly appealing to tech-savvy younger consumers who prioritize intuitive, hands-free interactions. Manufacturers are responding by launching affordable yet feature-rich soundbars with embedded smart assistant support, positioning them as essential components of next-generation home entertainment and automation systems.

MARKET CHALLENGES

Intense Competition from Alternative Audio Solutions

One of the foremost challenges facing the Latin America soundbar market is the intense competition from alternative audio solutions such as headphones, portable Bluetooth speakers, and traditional home theater systems. Each of these categories offers distinct advantages that appeal to different consumer segments, limiting the dominance of soundbars in the home audio landscape.

Headphones, for instance, provide personal, high-fidelity listening experiences ideal for individual use, particularly among students and professionals. Also, headphone sales grew in 2023, driven by demand for noise-canceling and wireless models. Similarly, portable Bluetooth speakers remain popular for outdoor and social settings, offering flexibility and portability that soundbars cannot match. Traditional home theater systems also continue to hold a niche market share, particularly among audiophiles and enthusiasts seeking full surround sound setups. Although they require more space and installation effort, these systems are perceived as delivering superior audio depth and customization.

Supply Chain Disruptions and Import Dependency

Another pressing challenge impacting the Latin America soundbar market is the region’s heavy reliance on imported components and finished products, which exposes it to supply chain disruptions and currency volatility. Most soundbars sold in Latin America are manufactured in Asia, primarily China, South Korea, and Japan, with local assembly operations remaining limited. According to the Economic Commission for Latin America and the Caribbean (ECLAC), global semiconductor shortages and logistical bottlenecks in 2023 delayed product deliveries across several consumer electronics sectors, including audio equipment. These delays affected inventory availability, leading to stock shortages in key markets like Brazil and Mexico. Besides, fluctuating exchange rates have contributed to price instability. Similar inflationary pressures were observed in Argentina and Peru, where import duties and trade restrictions further inflated retail prices.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.61 % |

|

Segments Covered |

By Equipment Type and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

Mexico, Brazil, Argentina, Chile, Peru and Rest of Latin America. |

|

Market Leaders Profiled |

DEI Holdings, Samsung Electronics Co Ltd, Bose Corporation, LG Electronics Inc ADR |

SEGMENT ANALYSIS

By Equipment Type Insights

The 2-channel soundbar segment had the largest share of the Latin America soundbar market of 40.3% of total sales in 2024. This dominance is primarily attributed to the affordability and simplicity of these models, making them accessible to a broader consumer base across the region. One key driver behind this segment’s leadership is the preference for budget-friendly home audio solutions among first-time buyers and mid-income households. According to the Latin American Consumer Electronics Association, a significant portion of surveyed consumers in Brazil and Mexico considered price as the most important factor when purchasing a soundbar in 2023. Two-channel models typically retail between USD 100 and USD 200, positioning them as an attractive upgrade from built-in TV speakers without requiring significant investment. Besides, these soundbars are well-suited for compact living spaces, which are increasingly common in urban areas. The United Nations Department of Economic and Social Affairs reported that a notable percentage of Latin Americans now live in cities, where space optimization influences electronics purchases.

On the contrary, 5-channel soundbars are projected to grow at the fastest CAGR of a 9.6% through 2033. This rapid expansion is driven by increasing consumer demand for immersive, cinema-like audio experiences within home environments. A primary contributing factor is the rising popularity of high-definition content consumption via streaming platforms such as Netflix, Disney+, and Amazon Prime Video. Five-channel systems, which include front, center, rear, and subwoofer components, offer a full surround sound experience that aligns with this trend. Moreover, gaming has become a major catalyst for advanced audio adoption. The Latin American Gaming Report noted that video game revenues increased in 2023, with console and PC gamers particularly interested in spatial audio for enhanced immersion. As a result, manufacturers are introducing affordable 5-channel packages bundled with wireless connectivity and voice assistant support, further boosting their appeal.

COUNTRY LEVEL ANALYSIS

Brazil had the largest share of the Latin America soundbar market by capturing a 37.7% of total regional revenue in 2024. The country’s position in the market is primarily attributed to its large consumer base, growing middle-class population, and expanding digital entertainment ecosystem. A key driver behind Brazil’s dominant position is the increasing penetration of smart TVs and online streaming services. Like, internet usage in Brazil reached significant share of the population in 2023, supporting higher engagement with digital media. This shift has led to greater demand for complementary audio devices like soundbars to enhance the home viewing experience. Apart from these, the country benefits from a robust electronics retail sector, with both domestic and international brands actively competing in the market.

Mexico is a key player in the Latin America soundbar market. The country’s strong consumer electronics sector and rising disposable incomes have contributed significantly to its market position. A major growth catalyst is the expansion of e-commerce and digital lifestyles. Also, online electronics sales in Mexico grew in recent years, providing consumers with greater access to a wide range of soundbar models from global brands. Besides, the rise of smart home ecosystems has encouraged integration of audio devices into connected living setups. Another key factor is the increasing influence of North American entertainment trends, including a strong presence of streaming services and gaming culture.

Argentina is reflecting moderate but steady growth driven by evolving consumer preferences and improving economic conditions. Despite past financial volatility, Argentina remains a relevant market due to its tech-savvy urban population and expanding digital infrastructure. A significant factor influencing market growth is the increasing adoption of streaming services and smart TVs. According to the National Communications Entity (ENACOM), a significant portion of Argentine households had access to broadband internet in 2023, enabling higher engagement with online content. This digital shift has prompted many consumers to invest in soundbars to enhance their home entertainment experience. Also, local electronics retailers have introduced financing programs that allow customers to purchase soundbars in installments, reducing upfront costs.

Chile captures a considerable portion of the Latin America soundbar market which is supported by a relatively high standard of living, strong digital infrastructure, and early adoption of consumer electronics. Although smaller in scale compared to Brazil and Mexico, Chile remains a key market due to its affluent urban population and progressive technology adoption. A primary driver is the country’s widespread use of high-speed internet and digital entertainment platforms. According to the Subsecretaría de Telecomunicaciones (SUBTEL), Chile achieved a significant internet penetration in 2023, one of the highest rates in Latin America. This high connectivity level supports greater consumption of streaming content, reinforcing demand for enhanced audio solutions. Furthermore, Chilean consumers exhibit a strong preference for premium electronics, often opting for soundbars with advanced features such as Dolby Atmos and Bluetooth connectivity.

The remaining Latin American countries collectively account for descent portion of the regional soundbar market. This group includes nations such as Colombia, Peru, Ecuador, Bolivia, and Central American states, where market development varies based on economic stability, digital infrastructure, and consumer awareness. A key driver in this segment is the gradual improvement in internet penetration and digital content consumption. Like, consumer electronics companies are increasing their presence in secondary markets through localized marketing campaigns and partnerships with regional distributors.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Latin America Soundbar Market are DEI Holdings, Samsung Electronics Co Ltd, Bose Corporation, LG Electronics Inc ADR, Sony Group Corp, VOXX International Corp Class A, Koninklijke Philips NV, Panasonic Holdings Corp

The Latin America soundbar market is characterized by a blend of global electronics giants and regional brands competing on product innovation, pricing, and consumer engagement. While multinational corporations like Samsung, Sony, and LG dominate due to their established brand equity and technological advancements, local and emerging players are gaining traction by offering cost-effective alternatives tailored to budget-conscious consumers. The competition is intensifying as companies strive to differentiate themselves through enhanced features such as voice assistant integration, wireless connectivity, and sleek, space-saving designs.

Market participants are also focusing on strategic collaborations with streaming platforms and smart TV manufacturers to create integrated entertainment ecosystems that appeal to digitally oriented users. Additionally, there is an increasing emphasis on localized marketing and customer support services to strengthen brand presence in diverse linguistic and cultural environments. As disposable incomes rise and digital lifestyles evolve, companies are investing in expanding their distribution networks and launching region-specific product lines to capture a larger share of this growing market. The result is a dynamic and increasingly fragmented industry landscape driven by both innovation and affordability.

Top Players in the Market

Samsung Electronics Co., Ltd.

Samsung is a dominant force in the Latin America soundbar market, offering a diverse range of models that cater to various consumer segments from entry-level to premium. Known for its innovation and integration with smart TVs, Samsung has successfully positioned itself as a preferred choice among tech-savvy consumers in the region. The company’s emphasis on design, immersive audio technologies, and compatibility with other smart home devices has strengthened its foothold. Samsung's global R&D capabilities enable it to introduce region-specific features that align with local entertainment preferences, reinforcing its leadership position.

Sony Corporation

Sony plays a crucial role in shaping the Latin American soundbar landscape through its high-performance audio solutions that emphasize cinematic quality and seamless connectivity. With a strong brand reputation for superior sound engineering, Sony appeals to audiophiles and home theater enthusiasts across the region. The company integrates advanced technologies such as Dolby Atmos and wireless subwoofers into its soundbars, enhancing the overall user experience. Its partnerships with content providers and focus on ecosystem synergy further differentiate its offerings, making Sony a key player in the Latin America market.

LG Electronics Inc.

LG contributes significantly to the Latin America soundbar market by delivering competitively priced yet feature-rich products tailored to evolving consumer demands. The company leverages its expertise in home entertainment systems to offer soundbars that seamlessly integrate with LG smart TVs and voice assistants. LG focuses on energy efficiency, compact designs, and AI-enhanced audio processing to attract urban households seeking convenience without compromising on quality. Its aggressive marketing strategies and after-sales service network help reinforce its presence in major Latin American markets.

Top strategies used by the key market participants

One of the primary strategies adopted by leading companies in the Latin America soundbar market is product differentiation through advanced audio technologies . Manufacturers are integrating immersive sound formats such as Dolby Atmos, DTS:X, and AI-based audio enhancement to create a compelling value proposition for consumers seeking premium home entertainment experiences.

Another key strategy is expanding distribution networks through e-commerce platforms and regional retail partnerships . Companies are leveraging online sales channels to reach a broader customer base, particularly in emerging markets where traditional electronics retailers may have limited coverage. This approach allows them to bypass logistical constraints and offer competitive pricing.

Lastly, firms are focusing on localized marketing campaigns and after-sales service improvements to build consumer trust and brand loyalty.

RECENT HAPPENINGS IN THE MARKET

In March 2024, Samsung launched a new line of mid-range soundbars in Brazil featuring built-in Google Assistant and Amazon Alexa support, aiming to enhance smart home integration and expand its reach among urban consumers.

In July 2023, Sony partnered with a leading Mexican electronics retailer to establish exclusive display zones in over 50 stores nationwide, allowing customers to experience soundbar performance firsthand before making purchasing decisions.

In November 2024, LG introduced a financing program in Argentina that enables consumers to purchase soundbars in interest-free installments, making premium audio equipment more accessible despite economic challenges.

In February 2023, a Chilean startup specializing in eco-friendly audio products secured investment from a European venture capital firm to scale up production of sustainable soundbar enclosures made from recycled materials.

In September 2024, Sony collaborated with a popular Latin American streaming platform to bundle select soundbar models with extended subscription offers, reinforcing the link between premium audio and high-quality content consumption.

MARKET SEGMENTATION

This research report on the latin america soundbar market has been segmented and sub-segmented into the following categories.

By Equipment Type

- 2-Channel Soundbars

- 5-Channel Soundbars

By Country

- Mexico

- Brazil

- Argentina

- Chile

- Rest of Latin America

Frequently Asked Questions

What is the current size of the Latin America soundbar market?

The Latin America soundbar market has been growing steadily, driven by rising home entertainment demand, but the exact market size can vary annually based on sales and technological advancements.

What factors are driving the growth of the soundbar market in Latin America?

Key growth drivers include increasing disposable incomes, rising demand for immersive home entertainment, the popularity of smart TVs, and technological advancements like Dolby Atmos and smart assistants.

Which countries are the largest markets for soundbars in Latin America?

Brazil and Mexico are the largest soundbar markets in Latin America, followed by Argentina, Colombia, and Chile, due to their larger populations and expanding middle classes.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com