Latin America Sports and Energy Drinks Market Size, Share, Trends and Growth Analysis Report, Segmented By Product Type, Packaging, Distribution Channel, And By Country (Brazil, Mexico, Argentina, Chile & Rest of Latin America), Industry Analysis From (2025 to 2033)

Latin America Sports And Energy Drinks Market Size

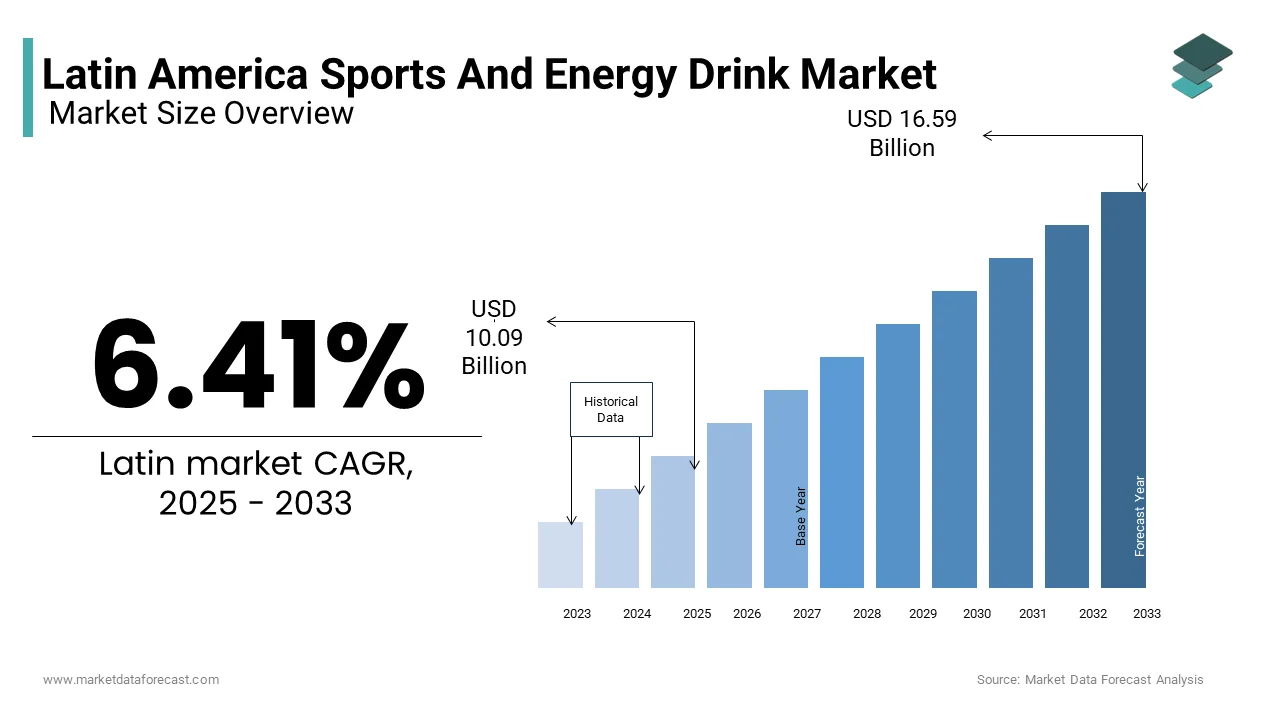

The Latin America Sports and energy drinks market size was valued at USD 9.49 billion in 2024 and is anticipated to reach USD 10.09 billion in 2025 from USD 16.59 billion by 2033, growing at a CAGR of 6.41% during the forecast period from 2025 to 2033.

Sports drinks typically contain electrolytes and carbohydrates aimed at rehydration and muscle recovery, while energy drinks are formulated with stimulants such as caffeine, taurine, and B-vitamins to increase mental focus and energy levels. These products are consumed across various settings, ranging from athletic training and gym sessions to daily work routines and social events. Latin America has seen a growing interest in health and fitness, especially among urban youth, which has directly influenced the consumption patterns of these beverages. According to Euromonitor International, increased participation in recreational sports, rising disposable incomes, and exposure to global lifestyle trends have contributed to the expansion of this market. Countries like Brazil, Mexico, and Colombia have witnessed strong brand penetration by both multinational corporations and local manufacturers seeking to capitalize on evolving consumer preferences. Moreover, digital marketing and sponsorship of sporting events have played a crucial role in boosting awareness and demand. As per NielsenIQ, social media campaigns featuring athletes and influencers have significantly impacted purchasing decisions among younger demographics.

MARKET DRIVERS

Rising Health and Fitness Awareness Among Urban Consumers

One of the primary drivers of the Latin American sports and energy drinks market is the increasing emphasis on health, fitness, and active lifestyles, particularly in urban centers. Consumers are actively seeking ways to maintain physical well-being, which is leading to a surge in gym memberships, fitness classes, and outdoor activities. According to the Pan American Health Organization (PAHO), over 45% of urban dwellers in Latin America now engage in regular exercise by creating a direct link between physical activity and the consumption of performance-enhancing beverages.

Brazil and Mexico have experienced a boom in fitness culture, with young professionals integrating workout routines into their daily schedules. A 2023 survey by Ipsos MORI found that nearly 60% of respondents in São Paulo and Mexico City consume sports or energy drinks before or after workouts to replenish energy and stay hydrated. Additionally, boutique gyms and CrossFit centers have become common, often promoting branded hydration and energy products on-site. This shift toward an active lifestyle has prompted beverage companies to launch targeted marketing campaigns highlighting benefits such as endurance support, muscle recovery, and mental alertness.

Increasing Demand for Functional Beverages with Natural Ingredients

A significant driver shaping the Latin American sports and energy drinks market is the growing consumer preference for functional beverages made with natural ingredients, herbal extracts, and clean-label formulations. Excessive sugar content and synthetic stimulants are commonly found in traditional energy drinks. According to Euromonitor International, demand for plant-based and organic variants has surged, prompting major brands to reformulate existing products and introduce new offerings tailored to health-conscious buyers. In countries like Chile and Argentina, where dietary trends align closely with global wellness movements, sales of low-sugar, vitamin-enriched, and botanical-infused sports and energy drinks have risen sharply. A 2023 report by NielsenIQ noted that nearly 55% of surveyed consumers in Santiago and Buenos Aires preferred drinks containing natural caffeine sources such as yerba mate, guarana, and green tea over conventional synthetic formulas.

Additionally, retailers and online platforms have expanded their range of natural and organic beverage options, making them more accessible to a broader audience. Manufacturers are also leveraging certifications such as non-GMO, gluten-free, and vegan labeling to build trust and differentiate their products in a competitive marketplace.

MARKET RESTRAINTS

Growing Concerns Over Health Risks Associated with High Sugar and Caffeine Content

One of the primary restraints affecting the Latin American sports and energy drinks market is the increasing scrutiny surrounding the health risks linked to high sugar and caffeine intake. Public health authorities across the region have raised concerns about the adverse effects of excessive consumption, including obesity, cardiovascular issues, insomnia, and nervous system stimulation. According to the Pan American Health Organization (PAHO), several Latin American countries have reported a rise in emergency room visits related to energy drink consumption among adolescents and young adults.

In response, governments have implemented stricter regulations on advertising, packaging, and ingredient disclosures. For example, Mexico introduced front-of-package warning labels in 2020 for foods and beverages high in sugar, sodium, and saturated fats—a move that significantly impacted consumer perception and purchasing behavior. Similarly, Chile banned the sale of energy drinks in schools and imposed restrictions on marketing to minors.

As a result, some consumers have shifted away from traditional high-caffeine energy drinks in favor of lower-stimulant or herbal alternatives. A 2023 Latinobarómetro survey found that over 50% of respondents in Ecuador and Peru were actively avoiding energy drinks due to health concerns. This trend presents a challenge for manufacturers seeking to balance taste appeal with regulatory compliance and public health expectations.

Regulatory Restrictions and Taxation Policies

Another significant constraint on the growth of the Latin American sports and energy drinks market is the imposition of regulatory restrictions and taxation policies aimed at curbing excessive consumption of sugary and stimulant-based beverages. Governments across the region have increasingly adopted measures to promote healthier diets and reduce the burden of lifestyle-related diseases. According to the World Bank, several Latin American countries have introduced excise taxes on sugar-sweetened beverages, including certain categories of sports and energy drinks.

In Brazil, for instance, federal and state-level tax incentives encourage the production of low-sugar alternatives, indirectly pressuring traditional beverage manufacturers to reformulate their products. Similarly, Argentina implemented a national tax on energy drinks in 2022, citing concerns over youth consumption and long-term health implications. These fiscal policies have led to price hikes, reducing affordability and discouraging repeat purchases among budget-conscious consumers.

Furthermore, labeling requirements mandating clear disclosure of caffeine levels and caloric content have altered consumer perceptions. As per a 2023 study by the Latin American Food Industry Association (IALA), nearly 40% of surveyed consumers in Bolivia and Guatemala indicated they had reduced their energy drink intake following the introduction of mandatory warning labels. These regulatory pressures pose a substantial challenge for market participants navigating an increasingly complex policy landscape.

MARKET OPPORTUNITIES

Expansion of Premium and Organic Sports and Energy Drink Variants

An emerging opportunity for the Latin American sports and energy drinks market lies in the rising demand for premium and organic beverage variants that cater to health-conscious consumers. As awareness around nutrition and wellness increases, consumers are actively seeking out drinks that offer functional benefits without compromising on quality or natural ingredients. According to Euromonitor International, demand for clean-label sports and energy drinks has surged across urban centers, particularly in Brazil and Chile, where affluent millennials and Gen Z consumers form a substantial portion of the market. Supermarkets and specialty stores in São Paulo and Santiago have expanded their selection of premium-priced energy drinks infused with botanical extracts, adaptogens, and nootropics, appealing to consumers looking for cognitive enhancement alongside physical performance. A 2023 report by NielsenIQ indicated that sales of organic and zero-sugar energy drinks in these regions increased by 16% compared to the previous year, driven by partnerships with wellness influencers and targeted digital campaigns. Additionally, government-backed food certification programs in Argentina and Mexico are encouraging manufacturers to adopt healthier formulations, thereby enhancing product credibility.

Growth of E-commerce and Direct-to-Consumer Sales Channels

The rapid development of e-commerce and digital retail platforms presents a significant opportunity for the Latin American sports and energy drinks market. As internet penetration and smartphone usage rise, online grocery and beverage shopping have become increasingly popular, especially among younger and tech-savvy consumers who prefer the convenience of home delivery. According to eMarketer, online food and beverage sales in Latin America are projected to grow by 21% annually through 2026, with sports and energy drinks benefiting from improved accessibility and targeted digital promotions. Platforms such as MercadoLibre, Amazon Fresh, and regional health-focused e-retailers have expanded their offerings, allowing consumers to explore niche and imported beverage brands beyond what is available in traditional retail outlets. In a 2023 survey by Ipsos MORI, 58% of Brazilian and Colombian shoppers stated they had purchased energy drinks online in the past year, appreciating the ease of comparing ingredients, reading reviews, and accessing exclusive deals. Moreover, direct-to-consumer models allow manufacturers to engage with customers through personalized marketing campaigns, loyalty programs, and subscription-based services. As logistics infrastructure improves and last-mile delivery becomes more efficient, the online channel is expected to play a pivotal role in shaping the future of the Latin American sports and energy drinks market.

MARKET CHALLENGES

Intense Competition Between Global Brands and Local Players

One of the most pressing challenges facing the Latin American sports and energy drinks market is the intense competition between multinational corporations and well-established regional brands. The market is highly fragmented, with dominant players such as Red Bull, PepsiCo, and Coca-Cola competing against local manufacturers like Monster Beverage, AmBev, and Grupo Nutresa. According to Euromonitor International, over 200 brands were active in the Latin American sports and energy drinks sector in 2023, each vying for market share through aggressive pricing strategies and extensive marketing efforts. Brand loyalty remains relatively low, with 63% of surveyed consumers in a 2023 NielsenIQ study indicating they frequently switch between energy drink brands based on promotions or store recommendations. This behavior makes it difficult for companies to establish long-term brand equity. Additionally, private-label and store-brand energy drinks have gained ground by offering similar taste profiles at lower price points, further eroding market share from established names.

Volatility in Raw Material Prices and Supply Chain Disruptions

A significant challenge confronting the American sports and energy drinks market is the volatility in raw material prices and frequent supply chain disruptions. Key ingredients such as caffeine, taurine, B-vitamins, and flavoring agents are subject to fluctuations driven by geopolitical instability, climate conditions, and transportation bottlenecks. According to the Food and Agriculture Organization (FAO), global commodity prices for essential beverage inputs rose by an average of 17% in 2023, impacting production costs across the industry. In Brazil, for instance, inflationary pressures and currency devaluation have increased import costs for key raw materials used in energy drink formulations. These supply-side challenges not only elevate manufacturing expenses but also lead to fluctuating retail prices, which can deter regular consumer purchases.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

% |

|

Segments Covered |

By Product Type, Packaging, Distribution Channel, And Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

Brazil, Argentina, Chile, Mexico, Rest of Latin America |

|

Market Leaders Profiled |

Abbott Nutrition Co., AJE Group, Britvic PLC, Extreme Drinks Co., Fraser & Neave Holdings BHD, GlaxoSmithKline Plc, Red Bull, Rockstar, Inc., Coca-cola, PepsiCo, Arizona Beverage Company, National Beverage Corp, Keurig Dr Pepper Inc., Living Essentials, Cloud 9 Beverages Private Limited, Vitale Beverages Pvt Ltd. |

SEGMENTAL ANALYSIS

By Product Type Insights

The isotonic drinks segment held 58.6% of the Latin America sports and energy drinks market share in 2024 due to its widespread use in hydration and electrolyte replenishment during physical activity, making it a preferred choice among athletes, fitness enthusiasts, and general consumers seeking post-exercise recovery. The popularity of isotonic beverages stems from their balanced formulation containing carbohydrates and electrolytes that help maintain fluid balance and enhance endurance. In countries like Brazil and Argentina, where participation in recreational sports and gym culture has grown significantly, isotonic drinks have become a staple in both urban and rural households. Additionally, multinational brands such as Gatorade (PepsiCo) and Powerade (Coca-Cola) have heavily invested in marketing campaigns aligned with sports events and athlete endorsements, reinforcing consumer trust and brand loyalty. The combination of functional benefits, strong branding, and broad retail availability ensures isotonic drinks remain the most dominant category in the region.

The hypotonic drinks segment is swiftly emerging with a CAGR of 9.4% during the forecast period. Unlike isotonic or hypertonic variants, hypotonic drinks contain lower concentrations of carbohydrates and higher electrolyte content, enabling faster absorption and improved rehydration effi, particularly appealing to endurance athletes and individuals engaging in prolonged physical activity. A 2023 survey by Ipsos MORI found that 51% of surveyed athletes in Chile and Colombia prefer hypotonic drinks for extended training sessions due to perceived health benefits and lighter formulations. Moreover, rising concerns about sugar intake and obesity have prompted manufacturers to introduce hypotonic options with zero added sugars and natural sweeteners. In Brazil, several local brands launched coconut water-based hypotonic drinks, witnessing a 25% sales increase within six months of release, as noted by Kantar Worldpanel.

By Packaging Type Insights

The cans segment was the largest and held 44.3% of the Latin America sports and energy drinks market share in 2024. In countries like Mexico and Brazil, where outdoor activities, festivals, and sporting events are integral to social life, cans offer an ideal format for easy distribution and consumption. According to NielsenIQ, nearly 60% of surveyed consumers in these markets prefer canned energy drinks due to their lightweight design and compatibility with vending machines and coolers.

Additionally, manufacturers benefit from cans’ ability to preserve flavor integrity and extend shelf life without refrigeration, ensuring consistent quality across supply chains.

The PET and glass bottles segment is likely to experience a CAGR of 7.8% during the forecast period. Bottles, especially those made from PET, offer significant advantages such as clear labeling space, stackable storage, and suitability for multi-serve portions by making them popular among families and home users. Furthermore, manufacturers are leveraging bottle formats to introduce premium and organic beverage lines. Brands in Peru have introduced glass-packaged energy drinks with natural ingredients, targeting upscale retailers and specialty stores. Environmental benefits also contribute to their appeal many PET bottles now use recycled materials, reducing carbon footprints and attracting eco-aware consumers.

By Distribution Channel Insights

The supermarkets and hypermarkets dominated the Latin American sports and energy drinks market with 48.3% of the market in 2024. In Brazil and Mexico, major retailers such as Carrefour, Walmart, and Grupo Bimbo operate thousands of outlets, offering a wide range of domestic and international sports and energy drink brands under one roof. Additionally, promotional activities such as multi-buy offers, endcap displays, and seasonal discounts significantly influence purchase decisions.

The online retail segment is expected to grow with a CAGR of 15.2% in the coming years. The growth of the segment is fueled by increasing internet penetration, mobile commerce adoption, and changing consumer behavior toward digital shopping. Platforms such as MercadoLibre, Amazon Fresh, and Rappi have expanded their beverage delivery services, which are allowing consumers to purchase both mainstream and niche brands with just a few clicks. Moreover, younger demographics are driving this shift. In a survey conducted by NielsenIQ in late 2023, 58% of consumers aged 18–34 in Colombia and Chile stated they now prefer buying sports and energy drinks online due to convenience and exclusive deals.

KEY MARKET PLAYERS

Abbott Nutrition Co., AJE Group, Britvic PLC, Extreme Drinks Co., Fraser & Neave Holdings BHD, GlaxoSmithKline Plc, Red Bull, Rockstar, Inc., Coca-cola, PepsiCo, Arizona Beverage Company, National Beverage Corp, Keurig Dr Pepper Inc., Living Essentials, Cloud 9 Beverages Private Limited, Vitale Beverages Pvt Ltd. Are the market players Latin American sports and energy drinks market?

COUNTRY-LEVEL ANALYSIS

Brazil held 32.1% of the Latin American sports and energy drinks market share in 2024. With over 215 million people, Brazil has a vast consumer base that includes a growing number of gym-goers, athletes, and office workers seeking energy boosters. Major cities like São Paulo and Rio de Janeiro serve as hubs for multinational beverage companies such as PepsiCo, Coca-Cola, and AmBev, which leverage local manufacturing capabilities and distribution networks to maximize reach. Additionally, digital marketing and sponsorship of football leagues and marathons have strengthened brand visibility.

Mexico was positioned second in the Latin American sports and energy drinks market with a 26.3% share in 2024. The country’s strong youth demographic profile, coupled with rising participation in fitness and outdoor activities, makes it a key contributor to market growth. Mexican consumers exhibit high per capita consumption of energy drinks, with Red Bull, Monster, and local brand Big Cola dominating both retail and foodservice channels. Urbanization and disposable income growth have also played a role in expanding household-level consumption. With rising refrigerator ownership and increased availability through supermarkets and convenience stores, sports and energy drinks have become a regular part of Mexican lifestyle habits. Additionally, aggressive advertising and point-of-sale promotions have reinforced brand presence in schools, gyms, and entertainment venues.

Argentina's sports and energy drinks market is likely to grow as the country maintains a stable demand for sports and energy drinks, supported by strong urban consumption patterns and a deep-rooted fitness culture. Buenos Aires and Córdoba serve as primary consumption hubs, where sports drinks are frequently purchased for both personal use and commercial applications such as gyms and sports clubs. Supermarkets such as Carrefour and Jumbo have played a crucial role in boosting retail sales, offering branded and private-label sports and energy drink options that cater to diverse budget segments. Additionally, local food processors have introduced innovative variants, including plant-based and low-sugar formulas, to meet changing dietary preferences.

Chile's energy drinks market is lucratively to grow with a developed retail landscape and high per capita income,suppor supportingstent demand for packaged beverages, despite regulatory efforts aimed at curbing excessive consumption of sugary and stimulant-based products. Santiago and Valparaíso remain the main centers of sports and energy drink consumption, where working professionals and students frequently opt for quick energy boosters. However, Chile’s stringent front-of-package labeling laws, implemented in 2016, have forced manufacturers to reformulate products to reduce sugar and caffeine content.

Top Players in the Market

Red Bull GmbH

Red Bull is a dominant force in the Latin American sports and energy drinks market, known for its strong brand identity and deep-rooted presence in youth and extreme sports culture. The company has successfully positioned itself as a lifestyle brand rather than just a beverage provider, leveraging event sponsorships, digital marketing, and strategic retail placements to maintain relevance across diverse consumer segments. Red Bull’s influence extends beyond Latin America, which is shaping global trends in the energy drink industry through product innovation and immersive brand engagement.

PepsiCo Inc. (Gatorade)

PepsiCo, through its flagship brand Gatorade, holds a leading position in the Latin American sports drink segment. With a focus on hydration science and athlete endorsements, PepsiCo has established Gatorade as a trusted name among fitness enthusiasts and professional athletes. Its distribution strength and investment in localized marketing campaigns have ensured widespread availability and brand loyalty. Globally, Gatorade remains the benchmark for sports drinks by reinforcing PepsiCo's dominance in functional beverages.

The Coca-Cola Company (Powerade, Burn)

Coca-Cola plays a crucial role in the Latin American sports and energy drinks market through brands like Powerade and Burn. The company leverages its extensive distribution network and marketing expertise to compete directly with Gatorade and independent energy drink brands. By aligning with local sports leagues and fitness influencers, Coca-Cola maintains strong visibility and relevance in both traditional and emerging market segments, which is contributing to its global portfolio of performance-focused beverages.

Top Strategies Used by Key Market Participants

One of the primary strategies employed by key players in the Latin American sports and energy drinks market is strategic brand positioning through sports and lifestyle ssponsorship where companies align their products with high-profile athletes, teams, and sporting events to enhance credibility and emotional connection with consumers. This approach helps reinforce product association with performance, endurance, and vitality.

Another major tactic involves product diversification and formulation innovation, including the introduction of low-sugar, plant-based, and functional variants tailored to health-conscious consumers. Companies are investing in research and development to meet evolving dietary preferences while maintaining taste appeal and energy-boosting properties.

Digital engagement and influencer-driven marketing have become essential tools for building brand awareness and driving trial usage. Brands are leveraging social media platforms, creating interactive content, and collaborating with fitness influencers to reach younger audiences and strengthen market penetration across urban and semi-urban regions.

COMPETITIVE OVERVIEW

The Latin American sports and energy drinks market is highly competitive, characterized by the presence of global giants and well-established regional players vying for market share. Multinational corporations such as Red Bull, PepsiCo, and The Coca-Cola Company leverage their financial strength, global supply chains, and extensive branding expertise to maintain dominance, while local manufacturers capitalize on cultural insights and consumer familiarity to retain relevance in niche markets.

Competition extends beyond pricing, with companies differentiating themselves through product quality, packaging innovation, and alignment with contemporary wellness trends. The market also experiences frequent product launches and reformulations designed to meet shifting consumer expectations around nutrition, sustainability, and ingredient transparency. Additionally, the rise of e-commerce and direct-to-consumer models has intensified the need for brands to establish a strong digital presence and ensure seamless accessibility across multiple sales channels.

With increasing participation in fitness activities and rising disposable incomes, demand for sports and energy drinks continues to grow, prompting companies to invest in capacity expansion, supply chain optimization, and localized marketing efforts. In this dynamic environment, adaptability and responsiveness to consumer behavior remain critical success factors.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Red Bull launched a new line of zero-sugar energy drinks in Brazil, targeting health-conscious consumers and expanding its portfolio beyond conventional offerings.

- In May 2024, PepsiCo introduced an exclusive digital platform in Mexico that connects directly with retailers to streamline sports drink distribution and improve inventory efficiency across urban and rural locations.

- In August 2024, Coca-Cola expanded its production facility in Argentina to increase the output of locally adapted energy drinks by aiming to meet rising demand and reduce lead times in distribution.

- In October 2024, Monster Beverage entered into a strategic partnership with a leading supermarket chain in Chile to introduce private-label energy drinks, which is enhancing retail presence and improving affordability for budget-conscious shoppers.

- In December 2024, AmBev rolled out a nationwide campaign in Colombia promoting limited-edition isotonic drinks infused with natural electrolytes by leveraging social media influencers to boost engagement and trial rates.

MARKET SEGMENTATION

This research report on the Latin American sports and energy drinks market is segmented and sub-segmented into the following categories.

By Product Type

- Isotonic

- Hypertonic

- Hypotonic

By Packaging Type

- Bottle (Pet/Glass)

- Can

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

By Country

- Brazil

- Argentina

- Chile

- Mexico

- Colombia

Frequently Asked Questions

What’s driving the growth of energy and sports drinks in Latin America?

Rapid urbanization, a rise in fitness culture, and growing demand for functional beverages among young consumers—especially in Brazil, Mexico, and Colombia—are key growth drivers.

. How are consumer preferences shifting in the region?

There’s a rising demand for low-sugar, organic, and natural ingredient-based drinks, particularly among health-conscious millennials and Gen Z, pushing brands toward cleaner formulations.

Which distribution channels are gaining popularity for these beverages?

While traditional retail remains strong, e-commerce and convenience stores are growing rapidly, driven by impulse purchases and increased online promotions in urban markets.

What role do local and international brands play in the market?

Global brands dominate energy drinks, but local and regional players are gaining share in sports drinks by offering affordable, localized flavors and functional variants.

What regulatory trends are affecting product development?

Nutritional labeling laws and sugar taxes in countries like Mexico, Chile, and Peru are pushing companies to reformulate and innovate with reduced-calorie and fortified options.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com