Global Life Science Instrumentation Market Size, Share, Trends & Growth Forecast Report By Technology, Application, End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Life Science Instrumentation Market Size

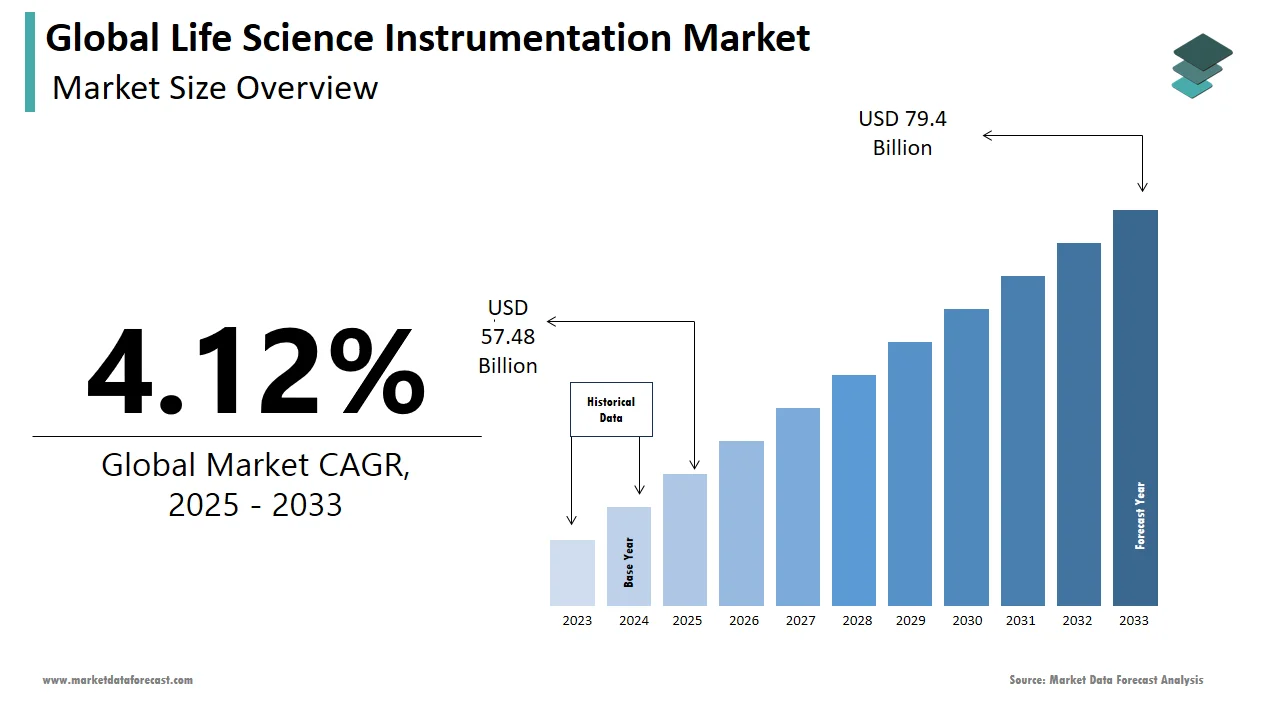

The global life science instrumentation market was valued at USD 55.21 billion in 2024. The global market is projected to grow from USD 57.48 billion in 2025 to reach USD 79.4 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 4.12% from 2025-2033.

MARKET DRIVERS

Growing developments in the healthcare infrastructure and increasing investments in life science research are primarily accelerating the growth of the life science instrumentation market.

The increasing investment in life science research is one of the significant factors for market growth; by 2025, Boston is to finish the construction of 21 million square feet of life science space. According to estimates provided by Newmark in January 2021, more than 36 million square feet of the new building had been delivered in the top 14 life science markets in the United States as life science investments. In addition, from 17 million square feet in 2010 to 27 million square feet in 2020, the greater Boston area's life sciences space increased. As a result, growing investments in life science research are expected to drive market growth during the forecast period.

Growing R&D activities in the biotechnology and pharmaceutical Industries are also anticipated to boost the growth of the life science instrumentation market.

This is due to increased demand for rapid drug development and the launching of advanced drug molecules to treat rare diseases. The pharmaceutical industry spends nearly USD 150 billion annually on R&D, per the International Federation of Pharmaceutical Manufacturers and Association. Increasing drug development for conditions such as cancer, cardiovascular disease, neurological, and infectious diseases across the globe. This demands efficient and quick life science instrumentation systems to speed the process.

In addition, rising focus on sequencing technology to understand the root cause of a disease, an increase in the research spending by governments across the world, user-friendly and advanced bioinformatics instruments, an increasing prevalence of genetic disorders and infectious diseases, and an increasing need for analytical instruments is further anticipated to favor the growth of the life science instrumentation market. Furthermore, growing expenditure on research & development by pharmaceutical & biotechnology companies, growing public & private funding for life science research, increasing life science R&D expenditure, progressing drug discovery and clinical diagnostics field, rising public health awareness technological advancements, emerging applications, growing aging population are expected to boost the growth rate of the market. Furthermore, declining costs of genome sequencing, rising use of capillary electrophoresis with mass spectroscopy, increasing incidence of hospital-acquired infections, and rapid advancements in NGS platforms are also contributing to the market's growth in the future years.

MARKET RESTRAINTS

On the other hand, high costs, lack of skilled professionals, technical limitations related to qPCR and PCR techniques, and less investment are the primary restraint to market growth. In addition, the presence of alternative technologies, low awareness among healthcare professionals regarding life science, and lack of advanced technologies and devices are significant challenges to the life science instrumentation market.

Impact Of Covid-19 On The Life Science Instrumentation Market

The COVID-19 pandemic has positively impacted life science instrumentation for rapid diagnosis. To stop the spread of the virus, automation and robotic technologies play an essential role in accelerating manual and redundant tasks in pharmaceutical companies and laboratories. Drug developers are continuously working on developing vaccines and other treatment options to prevent the virus. Robotic companies are active in this field and provide drug developers with automated solutions for quick labor-intensive steps. Biopharma businesses have launched several initiatives. For example, there are several projects in COVID-19 cell therapy. The players are using a variety of market entry approaches, including contract manufacturing organizations development, cooperation with other important stakeholders, and the expansion of biopharma facilities.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.12% |

|

Segments Covered |

By Technology, Application, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Philips, Siemens, Positron Corporation, Agfa-Gevaert N.V., CardiArc Ltd., Digirad Corporation, Gamma Medica Inc., GE Healthcare, Hologic Inc., Leica Microsystems GmbH, Nikon Corporation, Visiopharm, 3Dhistech, Hamamatsu Photonics KK, Indica Labs., and Others. |

SEGMENTAL ANALYSIS

By Technology Insights

Based on technology, the PCR segment had the largest share in the global life science instrumentation market in 2024, owing to continuous technological advancements and high utilization in COVID-19 diagnosis. PCR is adopted widely across government bodies, such as the CDC, commercial laboratories, hospitals, and public health laboratories, and has made significant contributions to the revenue generated by this product.

By Application Insights

Based on the application, the research segment led the market in 2024 owing to the increasing global regulatory scenarios for research data publication in analytical instruments-based research, increasing laboratory automation & integration of robotics, and an expanding number of research studies coupled with growing public-private funding in the field of genomic research.

By End-user Insights

Based on the end-user, the hospitals and diagnostic laboratories segment was the global life science instrumentation market leader in 2024. Increasing adoption of genomic and proteomic workflows in hospitals to diagnose and treat several clinical abnormalities enhances the growth of life science tools and the growing adoption of NGS and tissue diagnostic services in hospitals. In addition, the U.S. FDA approved a diagnostic, under which test manufacturer Roche acquired an Emergency Use Authorization. This action followed an increased demand for diagnostic tests for Covid-19, a WHO-declared pandemic disease. These measures should encourage the use of life science tools in the diagnostics industry.

REGIONAL ANALYSIS

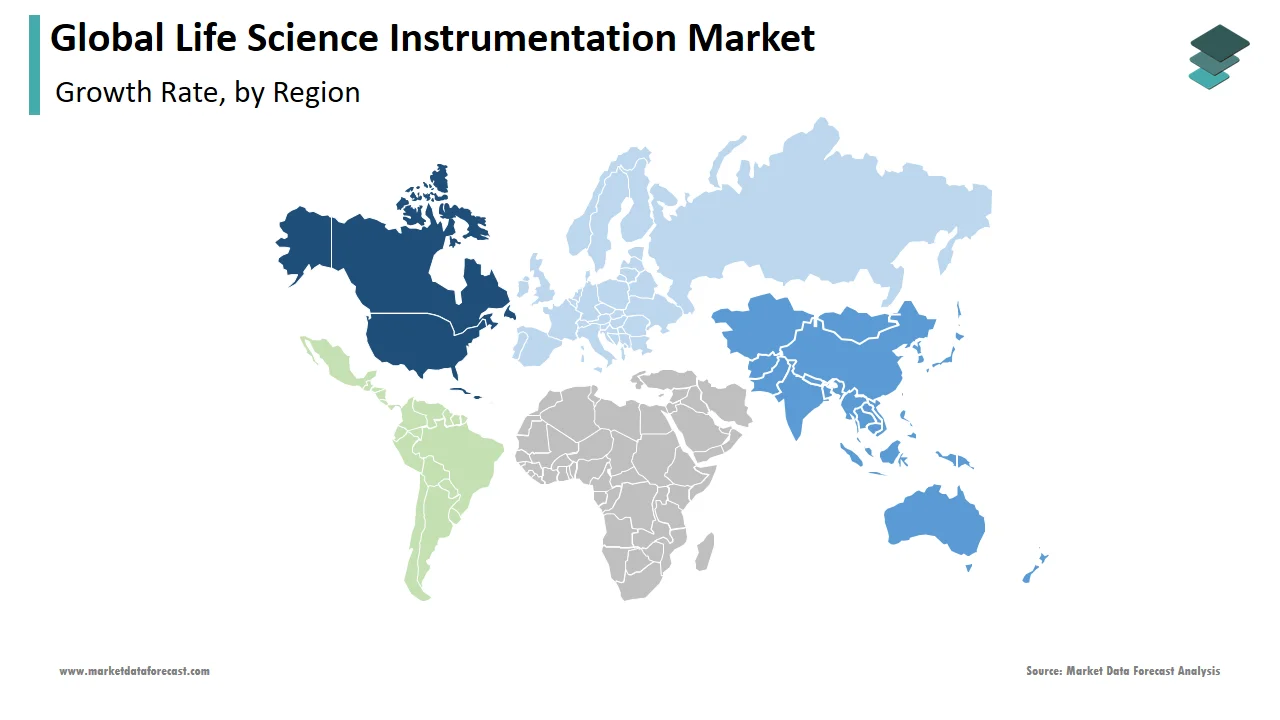

Geographically, North America led the market for life science instrumentation worldwide in 2024 owing to the factors such as Increasing research in the field of proteomics and increasing government support for investments in biotechnology, local presence of leading market players such as Thermo Fisher Scientific, a reputable informatics network, and a well-regulated framework for usage and approval of genomic tests in the region, a rise in the number of genomic procedures for academic research and clinical research in the U.S. In addition, the U.S. accounted for the largest share due to operating performance within an evolving regulatory and risk environment, ongoing pricing and cost pressures, and the adoption of new business models enabled by scientific and technological advances in this country.

The Asia Pacific is expected to have the highest CAGR during the forecast period among all the regions due to poised to the rising prevalence of chronic disease and huge government expenditure to execute research activities about drug discovery and development, growing penetration of leading players in emerging Asian countries, and investments in the design of advanced diagnostic methods. Emerging countries such as China and India have the highest share due to the presence of pharmaceutical and biotech companies.

Europe held the second largest share in the global life science instrumentation market in 2024, owing to significant players such as Merck KGaA, Agilent Technologies, Inc., Illumina, Inc., etc., in the western European region. Other factors such as ongoing research and development activities in the pharmaceutical and biotechnology industries and technological advancements in life science instrumentation are the factors that influence the growth of this market in coming years. Germany accounted for the most significant European life science instrumentation market in 2024.

KEY MARKET PLAYERS

Danaher, Thermo Fisher Scientific, Inc., Merck KGaA, Bio-Rad Laboratories, Inc., Agilent Technologies, Illumina, Inc., PerkinElmer, Inc., BD, Bruker, and Hitachi High-Technologies Corporation are some of the noteworthy players in the global life science instrumentation market.

RECENT HAPPENINGS IN THE MARKET

-

In 2019, Danaher Corporation and General Electric Company agreed to acquire GE Life Sciences' Biopharma division.

MARKET SEGMENTATION

This research report on the global life science instrumentation market has been segmented and sub-segmented into the product, procedure, end-user, and region.

By Technology

- PCR

- Spectroscopy

- Microscopy

- Chromatography

- Electrophoresis

- Next-generation sequencing (NGS)

- Flow Cytometry

- Centrifuges

- Others

By Application

- Clinical and Diagnostic

- Research

- Others

By End-user

- Hospitals and diagnostic laboratories

- Pharmaceutical and biotechnology companies

- Academic & Research institutions

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Does this report include the impact of COVID-19 on the life science instrumentation market?

The global life science instrumentation market size was valued at USD 55.32 billion in 2024.

Who are the key players in the life science instrumentation market?

The North American life science instrumentation market size is predicted to grow by USD 76.4 billion by 2033.

What was the size of the life science instrumentation market worldwide in 2023?

Companies playing a key role in the life science instrumentation market are Danaher, Thermo Fisher Scientific, Inc., Merck KGaA, Bio-Rad Laboratories, Inc., Agilent Technologies, Illumina, Inc., PerkinElmer, Inc., BD, Bruker, and Hitachi High-Technologies Corporation.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]