Global Locomotive Market Size, Share, Trends & Growth Forecast Report, Segmented By Motive Power (Steam, Diesel, Gasoline, Electric, Hybrid, Steam Diesel Hybrid, Fuel Cell Electric, Atomic Electric, and Gas Turbine Electric), Power Conversion Component (Rectifier, Traction, Inverter, Alternator, and Auxiliary Power Conversion Unit), Technology (GTO Thyristor Module, IGBT Power Module, and SiC Power Module), End-Users (Passenger, Freight, and Shunting Or Switcher Locomotives), Operational Engine (Train Engine, Banking Engine, Pilot Engine, Station Pilot, and Light Engine), Wheel Arrangement (AAR, Whyte Notation Systems, and UIC Classification) And By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Industry Analysis From 2025 to 2033

Global Locomotive Market Size

The global locomotive market was valued at USD 19.09 billion in 2024 and is anticipated to reach USD 20.64 billion in 2025 from USD 38.48 billion by 2033, growing at a CAGR of 8.10 % during the forecast period from 2025 to 2033.

Locomotives are powered rail transport vehicles that deliver motive power to trains with no payload capacity, and their only purpose is to pull the trains on tracks. Nonetheless, presently, push-pull operations have become popular, in which the trains have locomotives at the back, front, or both ends. Electric locomotives are preferred since they provide high performance, lower maintenance costs, lower energy costs, and reduce pollution levels.

The increasing rate of urbanization, expansion of rail networks in most developed and developing nations, and the growing concern among individuals regarding environmental sustainability drive the global market.

MARKET DRIVERS

Key factors driving the global locomotives market growth are the rise in demand for rolling stock that is energy efficient, augmenting urbanization, and expanding rail network infrastructure. A broad spectrum of awaiting rail projects and environmental sustainability will boost the market growth in the coming years. Widespread rail networks support the locomotive market to meet the growing demand for public transport. The development of advanced technology like auxiliary power units, SiC modules, and IGBT modules adds to the largest market share in the global locomotive market. These technologies assist in escalating fuel efficiency, reducing emission levels, and lowering the overall weight, which may reduce power loss when switching the current state.

The capital intensiveness of rolling stock, high maintenance cost, and overhaul cost are the key restraining factors hampering the global locomotive market's growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.10% |

|

Segments Covered |

By Motive Power, Power Conversion Component, Technology, End-Users, Operational Engine, Wheel Arrangement, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Hitachi Ltd. (Japan), CRRC Corporation Limited (China), Bombardier Inc. (Canada), Alstom S.A. (France), ABB (Switzerland), and Others. |

SEGMENT ANALYSIS

By Motive Power Insights

Motive power is a fundamental agent such as water, steam, electricity, and wind, which imparts motion to its engine. The diesel locomotives are further segmented into early oil locomotive engines, first true diesel engines, modern diesel engines, and slugs or drones.

By Power Conversion Component Insights

Some of the power conversion components' applications include converting electric energy from one form of energy, adjusting voltage frequency, and converting alternate current to direct current.

By Technology Insights

The Gate Turn-Off Thyristor module is a high-powered semiconductor device, while IGBT power modules are found in traction inverters. SiC modules or silicon carbide modules are used as oil additives to reduce friction and emissions.

By Wheel Arrangement Insights

A wheel arrangement is a system for naming the distribution of wheels of a locomotive. Since the wheels of a locomotive are optimized for different use, they form an integral part of the locomotive system's functioning.

REGIONAL ANALYSIS

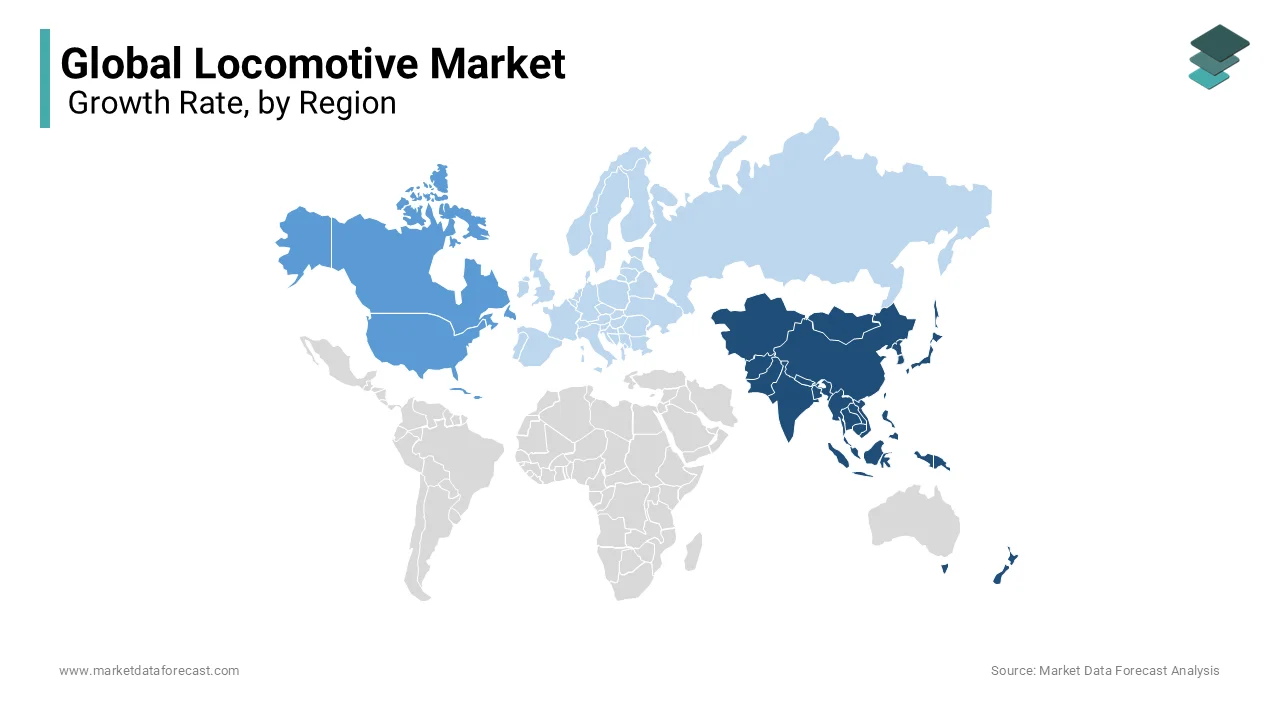

Geographically, the global locomotive market has been divided into four major regions: North America, Europe, Asia-Pacific, and the rest of the world. In 2018, the global market was dominated by Asia-Pacific, followed by Europe and North America. Asia-Pacific is predicted to hold the largest market share during the forecast timeframe due to its enormous potential consumer base and improving socio-economic conditions in countries such as China, India, and Japan. North America is expanding at a substantial rate over the outlook period. The factors adding to the market's growth in this region are the development of advanced technology, a stable economy, heavy industrialization, and key market players such as G.E. Transportation and the EMD Caterpillar region. Europe is estimated to keep the second position by market share in the global market throughout the forecast timeframe as it is one of the biggest markets for rail products.

KEY MARKET PLAYERS

Some of the significant players functioning in the global Locomotive Market are, Hitachi Ltd. (Japan), CRRC Corporation Limited (China), Bombardier Inc. (Canada), Alstom S.A. (France), ABB (Switzerland). These are the market players that are dominating the global locomotive market.

For instance, Hitachi Ltd. has a strong product offering, and it has invested heavily in R&D to retain its market position. They have embraced new product development and supply contracts as their primary strategy. In contrast, CRRC Corporation Limited has recently surfaced by collaborating with the subsidiaries and adopting new product development and mergers as their primary strategy to appear as the market's leading player.

RECENT HAPPENINGS IN THIS MARKET

- In 2020, Alstom signed an MoU with Bombardier Inc. and Caisse de dépôt et placement du Québec ("CDPQ") to procure Bombardier Transportation. The cost of the acquisition of all the Bombardier Transportation shares will be around €6 billion.

- In March 2020, C.Z. Loko launched three new hybrid locomotives concepts named DualShunter 2000, EffiLiner 2000, and DualLiner 2000 at a Future of Shunting Locomotives conference. These models were planned to hit the track by 2023.

- In 2020, Deutsche Bahn has awarded 50 hybrid locomotives orders to Toshiba Corporation. The estimated series assembly of the locomotives will start by 2021. This hybrid locomotive can provide annual energy savings of 30% and diesel fuel savings of 1 million liters per year.

- In March 2020, Alstom S.A. rolled out its first all-electric locomotive; it is a part of a USD 3.5 billion order of 800 electric double-section locomotives signed back in 2015 with the Indian Ministry of Railways public-private partnership.

MARKET SEGMENTATION

This research report on the global locomotive market is segmented and sub-segmented into the following categories.

By Motive Power

- Steam

- Diesel

- Gasoline

- Electric

- Hybrid

- Steam Diesel Hybrid

- Fuel Cell Electric

- Atomic Electric

- Gas Turbine Electric

By Power Conversion Component

- Rectifier

- Traction

- Inverter

- Alternator

By Technology

- GTO Thyristor Module

- IGBT Power Module

- SiC Power Module

By End-User

- Passenger

- Freight

- Shunting or Switcher Locomotives

By Operational Engine

- Train Engine

- Banking Engine

- Pilot Engine

- Station Pilot

- Light Engine

By Wheel Arrangement

- AAR

- Whyte Notation Systems

- UIC Classification

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the key factors driving the growth of the global locomotive market?

Rising demand for freight transportation, electrification trends, urbanization, and government investments in railway infrastructure.

Which regions dominate the global locomotive market?

North America, Europe, and Asia-Pacific, with China and India leading in railway expansion and electrification.

What are the major challenges in the locomotive industry?

High initial costs, maintenance expenses, and transition to sustainable and emission-free technologies.

How is technology impacting the locomotive market?

Advancements in hybrid and electric locomotives, automation, and digital monitoring systems enhance efficiency and sustainability.

Who are the key players in the global locomotive industry?

Companies like Siemens, Alstom, GE Transportation (Wabtec), CRRC Corporation, and Bombardier play a significant role.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com