Material Testing Market Size, Share, Trends & Growth Forecast Report – Segmented By Type (Universal Testing Machines, Servo-hydraulic Testing Machines, Hardness Test Equipment and Others), End-Use Industry, Material, Region, and Industry Analysis (2025 to 2033)

Material Testing Market Size

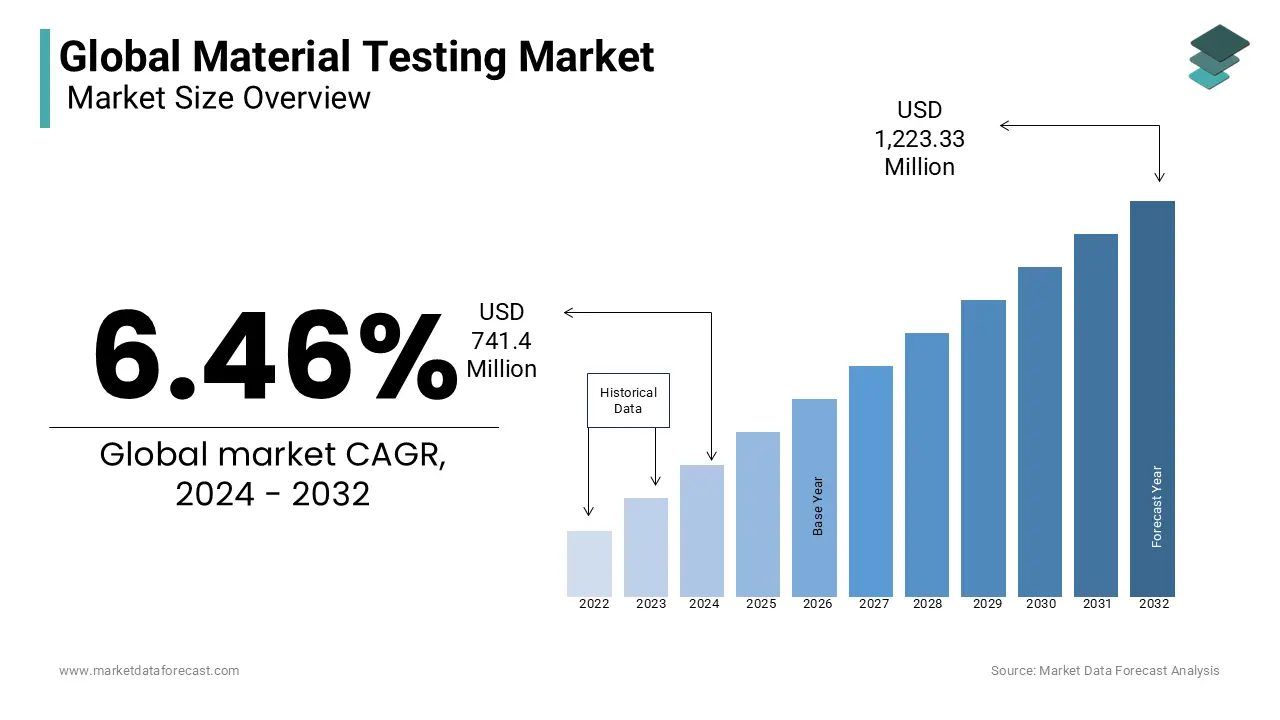

The size of the global material testing market size was valued at USD 741.39 million in 2024, and the market size is expected to reach USD 1,302.34 million by 2033 from USD 789.28 million in 2025. The market is growing at a CAGR of 6.46%.

In today’s time, the material testing market is experiencing a technological evolution and sustainability trends. Automation in this sphere is progressively spreading, particularly because even a minor disruption can affect measured values. Also, monotonous and time-consuming tasks are commonly executed by robots. There is an upward trend in automating testing processes for materials to improve productivity and decrease the possibility of human error. Another change the market witnesses is driverless transport using AGVs, taking the trays or platters to the examination equipment or system. They have a unified laser navigation system for making the layout of their setting or environment and individually identifying the appropriate route to their end location.

Moreover, the robotization of small series tests has also been happening in the market. This can be attributed to the expense and time taking nature of stationary robotic testing systems. It further needs a broad variety of protective measures to prevent accidents and injuries. For instance, RoboTest N by ZwickRoell. In addition, market players have started to use flexible testing robots which significantly augments their application options. These intelligent machines can be moved to the suitable checking equipment and linked to the systems. It not only enables for straightforward processing of substituting small series but also mechanises the performance of a range of examinations.

Apart from these, end-user companies are taking steps and developing new sustainable solutions for the current product line. So, with emerging materials and compounds, the testing is also required to be modified accordingly.

MARKET DRIVERS

The rising focus on the quality of the goods and complying with ASTM International standards are driving the growth of the worldwide material testing market. Material testing equipment calls are escalating in several industries involved with utilizing a range of raw materials and testing their mechanical strength to improve and continue to maintain quality. Moreover, continuous advancement and changes in the composites like the fashion of utilizing advanced materials are furthermore affecting the development of the industry.

The implementation of material testing devices highly is in the automotive and construction businesses. The material testing software is also a major part of the system, where its implementation is advancing with the escalation of IoT, cloud, and big data analytics technologies. As these technologies have important implementation across businesses, so there is a requirement for advanced material testing software.

Worldwide testing machines are predicted to be one of the significant contributors to the global material testing market growth during the forecast period. The low-cost availability of the worldwide testing device and its high use in various industries to perform tensile, compression, and bend tests are driving the expansion of the global market. The precondition of advanced composites is to meet the standards with regards to the multiple industry verticals and have been escalating the test techniques on different composites thereby elevating the choosing of material testing kinds & devices across the businesses.

MARKET RESTRAINTS

The major factors restraining the global material testing market include high initial investments, which restrict access to small enterprises, high costs associated with the equipment, and expensive maintenance, which hamper market growth. The need for skilled staff, the technological complexity, and high competition among the market players, which affect the price ranges, are expected to hinder the market expansion. The presence of stringent regulatory requirements and guidelines raises the operational complexity and costs, limiting the market growth. The variations in the regulations and standards across different regions are challenging for the market players in enhancing the market revenue worldwide.

The limited awareness regarding the benefits of material testing, the scope of testing services, and environmental issues due to the usage of various harmful chemicals during testing will impede the adoption of material testing, restricting the market size expansion. The wastage of material resources due to lengthy processes and failure cases leads to a waste of money and hampers the market growth.

MARKET CHALLENGES

Mechanical examination of composite matter challenges the expansion of the material testing market. There are various problems affiliated with examining these anisotropic and heterogeneous matter. Composite materials show natural variance because of the causes, including resin-starved or -rich regions, voids, and fibre misalignment. This lack of consistency can result in a major scatter in the mechanical qualities, making it difficult to establish dependable design allowables.

Specimen preparation is another issue in this challenge for the market players. Setting up superior-quality composite test specimens is important for getting repeatable and precise outcomes. Considerations like fibre waviness, machining-induced defects, and sample geometry can affect the examination results, compelling strict compliance to the procedures of specimen formation.

In contrast to metals, mixtures or combinations generally have opposing qualities in various directions, turning the test more complicated. Resolving these issues demands a combination of stringent examination processes, modern instrumentation, methods of statistical analysis, and a thorough knowledge of the behaviour of composite materials.

Additionally, the market growth trajectory is derailed by the supply chain disruptions. Multiple factors can cause disturbances in the logistic chains that impede the productivity of the materials management process. Like, as of now, several wars or armed conflicts in the world have hampered the supply of critical elements, leading to economic fluctuations, ultimately impacting the market.

MARKET OPPORTUNITIES

Innovations and trends are presenting potential opportunities for the expansion of the material testing market. Break-throughs in consumables such as diamond suspensions, polishing pads, and abrasives are propelling improved results. These matters are engineered to reduce deformation, enhance surface quality, and increase the service life of equipment. Emerging patterns in advanced consumables for uniform outcomes include environment-friendly consumables with lower ecological impact, supplies abrasives for certain materials and alloys, and multipurpose items that join polishing, grinding, and cutting properties.

Micro-sample preparation and miniaturization provide key prospects for market expansion. Formulation techniques for a very tiny sample are gaining prominence due to escalating demand for testing for compact elements in several industries, comprising nanotechnology, electronics, and aerospace. The techniques in focus are precision ion milling for ultra-thin specimens, Fine sectioning for complicated parts, and high definition surface smoothing for nano-scale analysis.

Besides these, the application of digital tools is believed to significantly elevate market performance. Virtual developments are simplifying the quality control and documentation procedures in metallurgical testing. Integrated software platforms today enable effortless reporting, analysis, and recording of examination outcomes.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.46% |

|

Segments Covered |

By Type, End-use, Material and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Instron (US), Zwick Roell (Germany), MTS Systems (US), Shimadzu (Japan), Tinius Olsen (US), Ametek (US), Aimil Ltd., Humboldt Mfg. Co., CMT Equipment, Qualitest International Inc., Canopus Instruments, ELE International Controls S.p.A. and OLSON INSTRUMENTS INC. |

SEGMENTAL ANALYSIS

By Type Insights

The universal test equipment market dominated the global material testing market revenue due to its versatility. This equipment is highly adopted due to its ability to perform tensile, compression, and bend tests for various materials, which drives segment growth. The availability of universal test equipment at cost-effective properties and its wide adoption among various industries are majorly fueling the segment's growth, leading to market expansion.

Hardness testing equipment is estimated to grow prominently in the forecast period due to its wide adoption in the construction, manufacturing, and metalworking industries. This equipment measures a material's resistance to permanent indentation, which fuels the segment's growth. The servo-hydraulic testing machines segment will grow steadily in the coming years, as they are commonly used in the aerospace and automotive industries to test materials' fatigue strength.

By End-use Insights

The construction segment dominates the global market revenue with a significant share as the industry depends on a wide range of materials to ensure structural integrity and compliance with safety standards and longevity. The dependence on various materials is majorly driving the segment market revenue expansion. Material testing helps construction professionals predict the long-term performance of materials and identify potential weaknesses and other factors fueling the broad adoption of material testing in the construction industry.

The educational institutions segment is projected to grow significantly in the coming years due to rising research activities by research scholars. The growing government support by funding research projects to develop and analyze material quality for sustainability in specific applications is driving the segment growth opportunities.

By Material Insights

The metals segment dominated the global market revenue with a significant share as metals exhibit exceptional versatility, making them suitable for various applications across industries. The increased usage of metals in various industries, like aerospace and electronics, fuels the segment's growth.

The ceramics and composites segment is expected to grow the fastest in the material testing market. The high demand for ceramics and composites in the aerospace, defense, automotive, and construction industries will drive segment growth in the coming years.

REGIONAL ANALYSIS

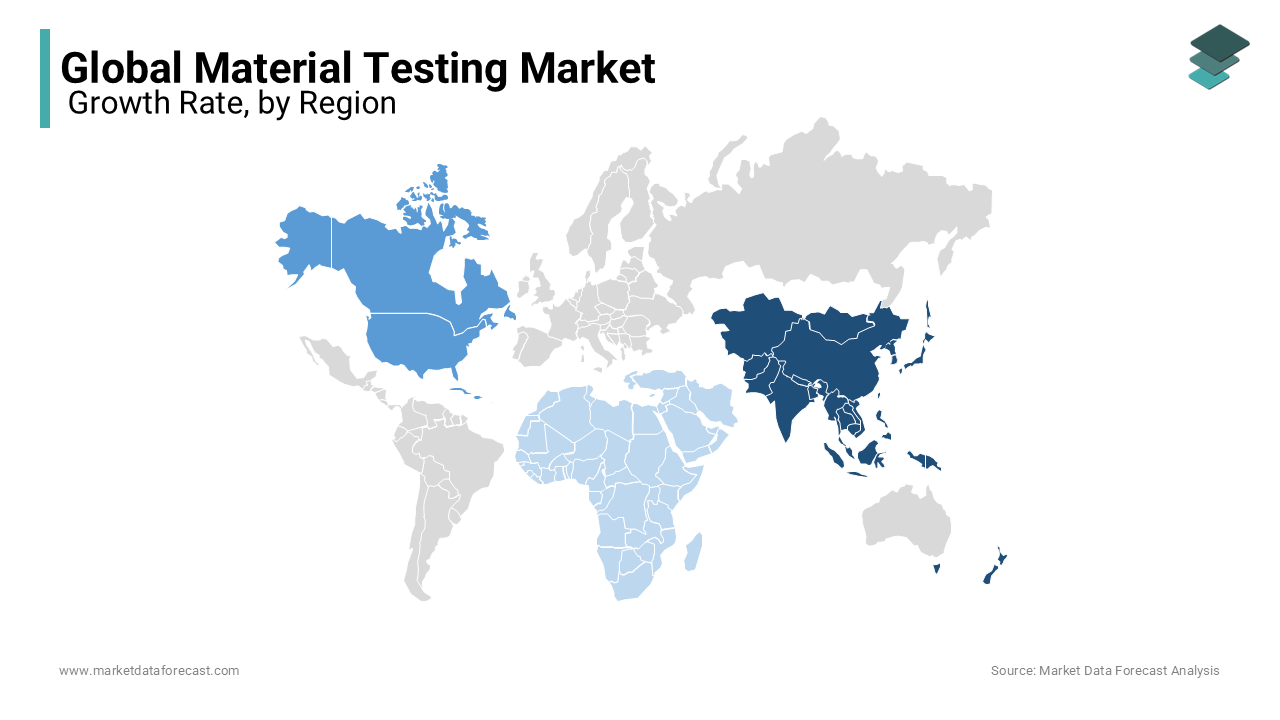

Europe holds a key position in the material testing market and is expected to grow at a decent rate during the forecast period. In the last few years, there is a trend of a rising quantity of examinations needed in all domains of materials testing. A massive amount of components to be tested and an increase in number of tests, demand quicker specimen over times. In addition, ranging from AI-enhanced imaging to automated testing of materials, these developments are propelling demand for technical sales and engineers professionals with proficiency in AI algorithms, robotics, and automation.

Moreover, in the United Kingdom and Europe, the field of AI in scientific imaging and data analytics is estimated to advance by more than 20 per cent yearly. Companies require candidates with a blend of practical technical skills, optical engineering, and software development to maintain this progress.

The Asia Pacific is predicted to be the leading region of the material testing market owing to quick industrialization and expansion of building and manufacturing businesses in the region. North America and Europe accounted for a significant share of the market share in terms of value in 2019. Hence, these are significant regions of the material testing industry. The material testing industry in the Asia Pacific is the biggest and quickest developing industry due to the rising industrialization and escalating educational research work in this region.

North America had the second-highest worldwide material testing industry size in 2020 which is being followed up by the region Europe. The industry in both these regions is good and is estimated to have average expansion in the coming years, unlike the Asia Pacific region. The Middle East, Africa, and Latin America regions, being in the low-growing nations owing to the contribution of low GDP nations, have lesser chances for market expansion. Therefore, the material testing industry in these regions is slowly developing by their nature.

KEY MARKET PLAYERS

Instron (US), Zwick Roell (Germany), MTS Systems (US), Shimadzu (Japan), Tinius Olsen (US), Ametek (US), Aimil Ltd., Humboldt Mfg. Co., CMT Equipment, Qualitest International Inc., Canopus Instruments, and ELE International are some of the major players in the global material testing market.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, SOCOTEC, a prominent provider of advisory, consulting, and TIC (Testing, Inspection, and Certification) services with a tactical focus on building infrastructure and construction, reported the successful conclusion of 4 strategic acquisitions. This includes the two New York-based companies in the field of special inspection and testing Future Tech Consultants (FTC) and DnA Controlled Inspection, Gorman Jr. Fire Alarm Consulting Services, FDNY, and ANDT which is a non-destructive testing and investigation firm. Moreover, these targeted buyouts having a combined workforce of around 125 professionals will considerably strengthen the service portfolio of SOCOTEC USA and reinforce its abilities in the domain of testing and inspection services.

- In March 2024, Intertek Group plc, a worldwide provider of Total Quality Assurance to an array of industries, announced through a press release that it has approved the purchase of Base Met Labs US Ltd. (“Base Met Labs”) and Base Metallurgical Laboratories Ltd. The Base Met Labs is a premier vendor of metallurgical testing services in North America’s Minerals sector and its capabilities supplement the current strengths of Intertek in building appealing commercial synergies, inspection of trade of and laboratories at mine site, and geochemistry within the superior-quality service portfolio. In addition, the purchase widens the distinguished ATIC offering by the Group in the sphere of minerals, broadening its reach in the entire American continent to tap into the biggest and rapidly growing global market for mining, including the United States, Canada, and Central and South America.

- In January 2024, VCS Engineering, Inc., a foremost expert in providing state-of-the-art sturdy engineering solutions for increasing the shelf life of structures, formally declared the amalgamation of its NDT Corporation subsidiary through a corporate merger which came into effect on 1st January 2024. The newly unified group presents the concrete durability and corrosion proficiency of VCS, as well as the concrete and geophysical testing skills of NDT.

MARKET SEGMENTATION

This research report on the global material testing market has been segmented and sub-segmented based on type, end-use, material, and region.

By Type

- Hardness Test Equipment

- Universal Testing Machines

- Servo hydraulic Testing Machines

By End-use

- Construction

- Automotive

- Educational Institutions

By Material

- Metal

- Plastics

- Rubber

- Elastomer

- Ceramics and Composites

By Region

- North America

- The United States

- Canada

- Rest of North America

- Europe

- The United Kingdom

- Spain

- Germany

- Italy

- France

- Rest of Europe

- The Asia Pacific

- India

- Japan

- China

- Australia

- Singapore

- Malaysia

- South Korea

- New Zealand

- Southeast Asia

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of LATAM

- The Middle East and Africa

- Saudi Arabia

- UAE

- Lebanon

- Jordan

- Cyprus

Frequently Asked Questions

1. What is the projected size of the global material testing market by 2033?

The global material testing market is expected to reach USD 1,302.34 million by 2033.

2. What trends are currently shaping the global material testing market?

Key trends include increased adoption of automated testing systems, non-destructive testing methods, and digital data integration.

3. What factors are driving growth in the global material testing market?

Growth is driven by rising demand for quality assurance, stricter regulatory standards, and expanding manufacturing sectors.

4. How is the construction industry influencing the global material testing market?

The need for reliable and durable building materials is boosting demand for testing services in infrastructure projects.

5. How does innovation impact the global material testing market?

Advancements in testing equipment, such as AI-powered analysis and robotic testing systems, are enhancing accuracy and efficiency.

6. What challenges are faced by the global material testing market?

Challenges include high equipment costs, skilled labor shortages, and complexity in testing composite or advanced materials.

7. How are end-use industries affecting the global material testing market?

Aerospace, automotive, and medical device industries are significantly increasing demand for precise and standards-compliant testing.

8. How is the global shift toward sustainability affecting the material testing market?

Sustainable material development requires rigorous testing, driving growth in eco-friendly and recyclable material evaluations.

9. Which regions are leading the global material testing market growth?

Asia-Pacific leads due to rapid industrialization, while North America and Europe remain strong in innovation and compliance testing.

10. What is the competitive outlook for the global material testing market?

The market is competitive, with key players investing in R&D, equipment upgrades, and global service expansion.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com