Middle East And Africa Oilseed Processing Market Research Report - Segmented By Type, Process, Application, And Region( KSA, UAE, Israel, Rest Of GCC Countries, South Africa, Ethiopia, Kenya, Egypt, Sudan And Rest Of MEA) - Size, Share, Trends, Growth, Forecast (2025 To 2033)

Middle East and Africa Oilseed Processing Market Size

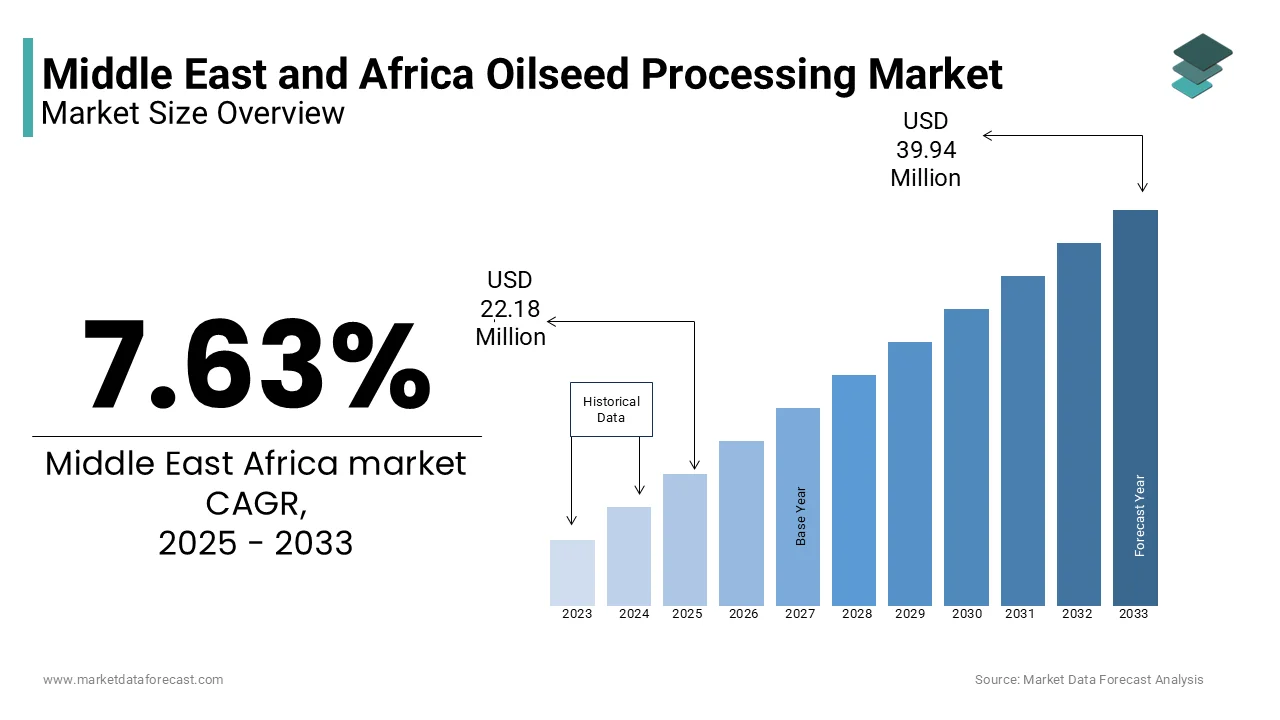

The Middle East and Africa oilseed processing market size was valued at USD 20.61 million in 2024, and the market size is expected to reach USD 39.94 million by 2033 from USD 22.18 million in 2025. The market is growing at a CAGR of 7.63% during the forecast period.

The Middle East and Africa Oilseed Processing Market involves the industrial transformation of oil-bearing seeds such as soybeans, sunflower seeds, rapeseed (canola), cottonseed, sesame, groundnut, and palm kernels into edible oils, protein-rich meals, and biofuel feedstocks. This market plays a crucial role in supporting regional food security, livestock nutrition, and renewable energy initiatives. Moreover, the sector includes mechanical pressing, solvent extraction, refining, and value addition processes that ensure quality and efficiency in oil production.

Africa is home to some of the world’s most significant producers of oilseeds, particularly Nigeria, Ethiopia, Sudan, and South Africa, where groundnut and sesame have been traditionally cultivated.

In the Middle East, countries like Egypt, Turkey, and Saudi Arabia rely heavily on imported oilseeds but are expanding local refining capacities to reduce dependency on foreign edible oils.

MARKET DRIVERS

Increasing Urbanization and Demand for Processed Foods

Among the major drivers of the Middle East and Africa Oilseed Processing Market is the rapid pace of urbanization and the corresponding shift in dietary preferences toward processed and packaged foods. As populations migrate to cities and middle-class incomes rise, there is a growing reliance on convenience-based diets that require substantial quantities of refined vegetable oils.

According to the United Nations Department of Economic and Social Affairs (UN DESA), the urban population in Sub-Saharan Africa alone is projected to increase significantly between 2020 and 2030. Similarly, in North Africa and the Gulf Cooperation Council (GCC) nations, urban centers are witnessing a surge in fast-food chains, bakeries, and ready-to-eat meal providers that depend heavily on vegetable oils.

As per the African Development Bank (AfDB), processed food sales in major African economies increased by an average of 6% annually between 2020 and 2023. In response, oilseed processors have expanded their capacities to meet this rising demand, particularly in Nigeria, Kenya, and Egypt, where domestic refining industries are gaining traction.

Apart from these, government policies aimed at reducing edible oil import bills are encouraging investment in local crushing and refining units.

Expansion of Biofuel Programs and Renewable Energy Initiatives

Another critical driver shaping the Middle East and Africa Oilseed Processing Market is the increasing adoption of biofuel mandates and renewable energy policies aimed at reducing carbon emissions and dependence on fossil fuels. Governments across the region are promoting biodiesel blending programs that utilize locally produced or imported vegetable oils derived from oilseeds such as sunflower, jatropha, and palm kernel.

In 2023, Kenya mandated a 5% biodiesel blend in diesel fuel, encouraging local processors to explore non-edible oilseed sources for methyl ester production.

Similarly, in the Middle East, the United Arab Emirates launched its Integrated Biofuel Strategy in 2023, aiming to integrate plant-based feedstocks into aviation and marine fuel alternatives. As per the UAE Ministry of Energy and Infrastructure, the initiative includes partnerships with agricultural firms to cultivate high-yield oilseeds suitable for industrial-scale refining.

Egypt has also intensified its push toward green energy, allocating funds under the Sustainable Energy Fund for Africa (SEFA) to support pilot projects converting cottonseed and sunflower oil into biodiesel.

These regulatory initiatives are encouraging investment in oilseed crushing facilities, especially those capable of producing high-quality methyl esters suitable for biofuel applications, thereby reinforcing the sector’s long-term growth trajectory.

MARKET RESTRAINTS

Limited Domestic Oilseed Production and Reliance on Imports

A significant restraint affecting the Middle East and Africa Oilseed Processing Market is the limited domestic production of oilseeds and heavy reliance on imports to meet industrial and consumer demand. Despite the presence of key oilseed-producing nations such as Nigeria, Sudan, and Ethiopia, overall yields remain low due to outdated farming practices, poor seed varieties, and inadequate irrigation systems.

According to the Food and Agriculture Organization (FAO), Sub-Saharan Africa accounts for less than 5% of global soybean production, despite having vast arable land resources. Nigeria, which once had a thriving groundnut industry, now produces only a fraction of its historical output due to declining soil fertility and pest infestations.

In the Middle East, countries like Saudi Arabia and the UAE depend almost entirely on imported soybean and palm oil to supply their refining sectors. As per the study, over 85% of vegetable oil consumed in Egypt is sourced through imports, making the country vulnerable to global price fluctuations and supply chain disruptions.

Moreover, geopolitical tensions and trade barriers can significantly impact availability. For instance, in 2022, the Russian-Ukrainian conflict disrupted sunflower oil exports to Egypt and other African nations, leading to shortages and price surges.

Without significant investment in agricultural modernization and local seed production, many Middle Eastern and African oilseed processors will continue to face raw material constraints that hinder market expansion.

Inadequate Infrastructure and Post-Harvest Losses

Another major constraint facing the Middle East and Africa Oilseed Processing Market is the lack of modern agricultural and processing infrastructure, which leads to significant post-harvest losses and inefficiencies in supply chain operations. Unlike developed regions, where mechanized harvesting, cold storage, and efficient logistics ensure minimal waste, many parts of Africa and the Middle East suffer from outdated handling systems and poor transportation networks.

According to the United Nations World Food Programme (WFP), post-harvest losses in African oilseed crops range between 15% and 30%, primarily due to poor storage conditions, insect infestation, and moisture damage. In Nigeria, as per the Federal Ministry of Agriculture, over 20% of harvested groundnuts were lost before reaching processing units in 2023, impacting both smallholder farmers and industrial refiners.

In the Middle East, logistical bottlenecks and inconsistent electricity supply hinder large-scale refining operations. Furthermore, the absence of standardized quality control measures affects oil purity and marketability. Many local processors struggle to meet international certification requirements, limiting export opportunities.

These infrastructural deficiencies not only raise production costs but also deter foreign investment, making it difficult for the Middle East and Africa to compete in the global oilseed processing landscape.

MARKET OPPORTUNITIES

MARKET OPPORTUNITIES

Integration with Circular Economy and By-Product Valorization Initiatives

An emerging opportunity in the Middle East and Africa Oilseed Processing Market lies in the integration of circular economy principles and the valorization of co-products generated during oil extraction. Traditionally considered waste materials, by-products such as oilseed meal, husks, and glycerin are now being repurposed into high-value inputs for industries including livestock feed, organic fertilizers, biochemicals, and biogas.

In addition, palm oil processors in Nigeria have adopted similar strategies, extracting residual fibers and empty fruit bunches for bioenergy generation. Companies like Presco Plc and Golden Penny Group have invested in biogas plants that utilize oil mill effluent to generate renewable electricity, reducing operational costs and carbon footprints.

With increasing corporate ESG commitments and regulatory incentives favoring sustainable practices, oilseed processors embracing circular economy models are well-positioned to capture long-term value in a rapidly evolving market landscape across the Middle East and Africa.

Expansion of Plant-Based Protein Demand and Alternative Feed Ingredients

Another promising opportunity in the Middle East and Africa Oilseed Processing Market is the growing demand for plant-based proteins and alternative feed ingredients, driven by health consciousness, ethical consumption trends, and the need for sustainable livestock nutrition. Soybean meal, sunflower cake, cottonseed meal, and sesame cake are increasingly being used not only in traditional animal feed but also in novel plant-based protein formulations for human consumption.

Companies such as Nutripro and EatGreen have launched plant-based meat and dairy substitutes using soy and pea protein blends, expanding their market reach and aligning with global sustainability goals.

In Kenya, the Kenya Agricultural and Livestock Research Organization (KALRO) funded research into new protein extraction methods using sunflower biomass, aiming to develop cost-effective alternatives to soy-based proteins.

Oilseed processors that integrate downstream protein separation technologies stand to benefit from this growing market.

MARKET CHALLENGES

Fragmented Supply Chains and Logistics Bottlenecks

Among the foremost challenges confronting the Middle East and Africa Oilseed Processing Market is the fragmentation of supply chains and persistent logistical bottlenecks that hinder the efficient movement of raw materials and finished products. Unlike more developed markets, where integrated agricultural networks support streamlined procurement and distribution, many countries in the region suffer from inadequate transportation infrastructure, outdated storage facilities, and bureaucratic inefficiencies.

According to the World Bank’s Logistics Performance Index (LPI) 2023, several African nations, including Nigeria, Ethiopia, and Sudan, ranked below global averages in terms of customs efficiency, infrastructure quality, and shipment reliability. This inconsistency affects oilseed processors reliant on timely deliveries of raw materials, particularly in remote farming regions where road connectivity is poor.

Apart from these, the lack of standardized storage and handling protocols across rural collection centers leads to post-harvest losses and quality degradation of oilseeds before reaching processing units. In Kenya, the Kenya National Bureau of Statistics estimated that over 18% of domestically harvested sesame seeds were lost due to poor logistics and inadequate cold storage facilities in 2023.

To mitigate these issues, processors must invest in digital supply chain solutions, warehouse modernization, and last-mile connectivity improvements. However, such investments require substantial capital, posing a challenge for smaller players operating on tight margins and limited access to financing.

Technological Disparity and Lack of Skilled Workforce

Another critical challenge impeding the growth of the Middle East and Africa Oilseed Processing Market is the technological disparity between multinational corporations and local enterprises, compounded by a shortage of skilled labor in the sector. While large players such as Cargill, Bunge, and ADM operate highly automated, energy-efficient refineries equipped with AI-driven process optimization tools, many regional and independent processors continue to rely on outdated machinery and manual operations. The situation is exacerbated by insufficient vocational training programs focused on modern oilseed processing techniques, leaving a skills gap that limits productivity and innovation.

Without targeted interventions in workforce development and technology transfer, many Middle Eastern and African oilseed processors risk falling behind in competitiveness, efficiency, and compliance with global quality standards.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.63% |

|

Segments Covered |

By Type, Process, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UAE, Israel, KSA, South Africa, Egypt |

|

Market Leaders Profiled |

Archer Daniels Midland Company, Bunge Limited, Cargill, Wilmar International Ltd, Richardson International Limited, Louis Dreyfus Company B.V., CHS Inc, Ag Processing Inc, ITOCHU Corporation, and EFKO GROUP, and others. |

SEGMENTAL ANALYSIS

By Type Insights

Soybean continued to led the segment in the Middle East and Africa Oilseed Processing Market, accounting for 39.2% of total processed oilseeds by volume in 2024. While not as dominant as in other global markets, soybean remains a key contributor due to its versatility and growing demand across food, feed, and industrial applications.

According to the Food and Agriculture Organization (FAO), Nigeria and South Africa are the primary soybean-producing countries in the region, with combined output exceeding 1.8 million metric tons in 2023. These nations also serve as regional hubs for crushing and refining operations, supplying both domestic and cross-border markets.

One of the leading drivers of soybean’s dominance is the rising demand for animal feed, particularly in poultry and dairy farming. As per the African Development Bank (AfDB), livestock production in Sub-Saharan Africa grew by 4.5% in 2023, driven by increasing protein consumption and urbanization. Soybean meal, being a rich source of plant-based protein, plays a crucial role in this expansion.

Additionally, governments in Egypt and Kenya have been promoting local soybean cultivation and processing to reduce reliance on imported edible oils. The expansion of biofuel programs further reinforces soybean’s market position. In South Africa, the Department of Forestry, Fisheries, and the Environment included soybean oil as a preferred feedstock under its national biodiesel blending strategy, ensuring continued investment in processing infrastructure.

Sunflower seed is emerging as the fastest-growing oilseed segment in the Middle East and Africa, projected to expand at a compound annual growth rate (CAGR) of 6.1%. Sudan, Ethiopia, and Egypt are leading this growth trajectory due to favorable climatic conditions and expanding agricultural investments.

According to the Ethiopian Institute of Agricultural Research (EIAR), sunflower cultivation in Ethiopia expanded by 10% in 2023 compared to the previous year, driven by improved hybrid varieties and irrigation techniques. This has led to increased investment in small-scale and commercial crushing facilities, particularly in rural areas.

One key driver of this growth is the rising consumer preference for healthier oils with lower saturated fat content. Moreover, the renewable energy sector is leveraging sunflower oil for biodiesel applications. In Egypt, state-backed biofuel programs incorporated sunflower-based methyl esters into blending mandates, enhancing feedstock diversification efforts. With continued emphasis on health benefits, sustainability, and import diversification, the sunflower oil segment is poised for sustained growth across the Middle East and Africa.

By Process Insights

By Process Insights

Chemical processing had the largest share of the Middle East and Africa Oilseed Processing Market, capturing 57.3% of total processing volume in 2024. This method involves solvent extraction using hexane to maximize oil yield, followed by refining, bleaching, and deodorization steps to produce high-purity oils suitable for commercial food and industrial applications.

A primary factor behind its dominance is efficiency gains in high-volume production environments. Moreover, advancements in solvent recovery systems and environmental controls have mitigated earlier concerns about emissions.

Mechanical processing is the fastest-growing segment in the Middle East and Africa Oilseed Processing Market, expanding at a CAGR of 5.3% through 2033. This method, which includes expeller pressing and cold-pressing techniques, is increasingly favored in niche markets that prioritize natural, unrefined, and organic oils.

Countries like Ethiopia and Kenya have also witnessed a surge in demand for cold-pressed sesame and groundnut oils, which are marketed for their purported health benefits and minimal processing.

A primary factor behind its rapid growth is the rising popularity of organic and specialty oils among health-conscious consumers. According to the Organic Trade Association (OTA), organic oil sales in the Middle East and Africa grew by 9% in 2023, with mechanical extraction being the preferred method for certification compliance.

Moreover, small-scale rural enterprises are adopting decentralized mechanical oil mills to enhance local value addition and reduce dependency on large refineries. With increasing awareness around food traceability and natural ingredients, mechanical processing is gaining momentum as a viable alternative to conventional refining, especially among premium and regional oil producers.

By Application Insights

By Application Insights

Food application was the largest segment in the Middle East and Africa Oilseed Processing Market, accounting for 54.4% of total processed output in 2024. The demand for edible oils derived from soybean, sunflower, cottonseed, and sesame remains robust across both household and commercial cooking sectors.

In Egypt alone, as per the Ministry of Supply and Internal Trade, edible oil consumption reached 2.2 million metric tons in 2023, driven by population growth, urbanization, and changing dietary habits.

One key driver of this dominance is the widespread reliance on refined vegetable oils for frying, baking, and food preparation. Moreover, the expansion of the packaged food and restaurant industries has further intensified demand. Government policies also play a role. In Kenya, mandatory fortification programs have increased the adoption of fortified sunflower oil in mass-produced foods, reinforcing its position in the food application segment. These combined factors ensure the continued supremacy of food-grade oilseed derivatives in the regional market.

Industrial applications are the fastest-growing segment in the Middle East and Africa Oilseed Processing Market, expanding at a CAGR of 6.8%. This category encompasses uses such as bio-lubricants, surfactants, coatings, and biodegradable polymers derived from oilseed-based triglycerides and fatty acids.

Companies like BASF, Croda International, and Oleon are increasingly incorporating oilseed derivatives into green chemistry solutions to replace petroleum-based compounds.

A key driver of this growth is the tightening of environmental regulations aimed at reducing carbon footprints and hazardous waste. In Saudi Arabia, the Ministry of Environment mandated in 2023 that federal agencies prioritize the procurement of biobased lubricants and hydraulic fluids, directly boosting demand for industrial-grade vegetable oils.

In addition, the rise of sustainable aviation fuels (SAFs) and renewable diesel has spurred interest in oilseed-derived feedstocks. According to the International Energy Agency (IEA), many new SAF and renewable diesel projects were launched in the Middle East and Africa in recent years, many of which incorporate oilseed esters in their feedstock mix, ensuring sustained demand from the industrial sector.

REGIONAL ANALYSIS

Egypt

Egypt led the Middle East and Africa Oilseed Processing Market with a dominant share of 18.2% in 2024. As one of the largest importers of edible oils in the region, Egypt has been actively investing in domestic crushing and refining capacities to reduce dependency on foreign supplies.

Government-backed initiatives, including tax exemptions for local oilseed processors and subsidies for farmers cultivating sunflower and soybeans, have strengthened domestic capacity.

A key trend driving the market is the push toward self-sufficiency in edible oils. Furthermore, Egypt’s renewable energy strategy includes limited biodiesel production using locally processed sunflower oil. With growing consumer demand for healthy oils and strategic alignment under regional trade agreements, Egypt continues to solidify its leadership in the MEA oilseed processing landscape.

South Africa

South Africa is playing a pivotal role in Southern Africa’s agri-processing ecosystem. The country processes significant volumes of soybean, sunflower, and cottonseed oil, catering to both domestic and regional markets.

According to the National Development Agency (NDA), domestic edible oil consumption increased by 5% in 2023, driven by urbanization and rising middle-class incomes.

A major driver of growth is the expansion of the livestock industry, which relies heavily on soybean meal for animal feed. Additionally, South Africa’s renewable energy policy includes a national biodiesel blending mandate, encouraging processors to explore oilseed-based feedstocks. With ongoing investments in refining infrastructure and sustainability programs, South Africa remains a key player in the regional oilseed processing sector.

Saudi Arabia

Saudi Arabia remains a key player in the Middle East and Africa Oilseed Processing Market, driven by strong government backing for food security and import substitution strategies. Although the country does not cultivate large volumes of oilseeds due to arid conditions, it imports substantial quantities of soybean and palm oil for refining and packaging.

Jeddah and Jubail host several large-scale oilseed processing units, supported by logistics connectivity and proximity to international shipping routes.

A key development is Vision 2030, which includes provisions for enhancing local food production capabilities. Moreover, the country is exploring non-edible oilseed sources for biofuels. With increasing focus on economic diversification and food independence, Saudi Arabia continues to strengthen its presence in the MEA oilseed processing market.

UAE

The United Arab Emirates held a notable share of the Middle East and Africa Oilseed Processing Market, primarily driven by Dubai and Abu Dhabi’s strategic positioning as regional trade and refining hubs. While the UAE does not cultivate significant volumes of oilseeds, it imports large quantities of crude soybean and palm oil for refining and re-export to African and Asian markets.

A notable trend is the government’s push toward sustainable and halal-certified oils. Moreover, the UAE’s renewable energy strategy includes biodiesel development using non-food oilseeds. The Masdar Institute conducted trials using camelina and jatropha oils for transport fuel blends, supporting long-term energy diversification. With advanced logistics infrastructure and strategic investments in food security, the UAE continues to play a vital role in shaping the regional oilseed processing landscape.

Nigeria

Nigeria is distinguished by its focus on indigenous oilseeds such as soybean, sesame, and groundnut. Unlike other major players in the region, Nigeria does not heavily rely on imported oilseeds but instead promotes local cultivation and decentralized processing.

Local refiners, including Golden Penny Group and Presco Plc, are expanding their footprint to meet rising domestic demand.

A key trend is the government’s push toward import substitution, particularly in edible oils. Additionally, Nigeria is emerging as a regional exporter of mechanically pressed oils, particularly to neighboring West African states. With policy support and rising local demand, Nigeria is strengthening its position in the MEA oilseed processing sector.

Rest of MEA (Market Share: ~37%)

The Rest of the Middle East and Africa, comprising Sudan, Ethiopia, Kenya, Tanzania, Morocco, Algeria, and other territories, collectively holds a considerable share of the regional oilseed processing market. This diverse group of countries contributes through localized production, niche oilseed crops, and emerging refining capabilities. A significant portion undergoes local mechanical pressing before export to Middle Eastern and European markets.

In Ethiopia, government-led agricultural reforms have boosted sunflower and cottonseed cultivation. The country is expanding small-scale refining units to support rural economies and reduce edible oil imports.

Kenya has also seen growth in the sector, with private companies investing in soybean crushing and refining. These developments indicate that while individually smaller in scale, the Rest of MEA remains a dynamic and evolving component of the broader oilseed processing landscape.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Key Market Players in the Middle East and Africa Oilseed Processing market are Archer Daniels Midland Company, Bunge Limited, Cargill, Wilmar International Ltd, Richardson International Limited, Louis Dreyfus Company B.V., CHS Inc, Ag Processing Inc, ITOCHU Corporation, and EFKO GROUP.

The competition in the Middle East and Africa Oilseed Processing Market is shaped by a mix of multinational agribusiness giants, regional conglomerates, and numerous independent processors vying for market share in a rapidly evolving industry. Multinational corporations such as Cargill, ADM, and Bunge dominate large-scale refining and export operations, leveraging their global networks, financial strength, and technological expertise to maintain operational efficiency and cost leadership. These firms benefit from strong supply chain linkages, access to capital, and experience in navigating complex regulatory environments.

However, regional players and local enterprises play an equally important role, particularly in niche segments such as organic oils, cold-pressed varieties, and decentralized processing units that serve rural populations. These smaller firms often capitalize on community ties, cultural familiarity, and lower overhead costs to compete against larger entities.

Strategic acquisitions, joint ventures, and investments in digital transformation are frequently used tools to expand capabilities and geographic reach. Additionally, companies are aligning their operations with environmental, social, and governance (ESG) goals to appeal to conscious consumers and institutional investors alike. The interplay between these factors creates a dynamic yet fiercely competitive environment, where adaptability, sustainability, and supply chain resilience are key differentiators among market participants.

TOP PLAYERS IN THE MARKET

Cargill Incorporated

Cargill is a dominant force in the Middle East and Africa Oilseed Processing Market, with a strong presence across key processing hubs such as Egypt, Nigeria, and South Africa. The company plays a critical role in sourcing, crushing, refining, and distributing vegetable oils that cater to both local consumption and international export markets. Cargill's operations support regional food security initiatives while also contributing to global supply chains through strategic trade linkages. The firm leverages its global expertise in sustainable agriculture and digital supply chain management to enhance efficiency and reduce environmental impact. By investing in localized infrastructure and collaborating with governments on rural development programs, Cargill strengthens its foothold in the region and reinforces its position as a key player in the global oilseed industry.

Bunge Limited

Bunge has established a growing presence in the Middle East and Africa by expanding its oilseed processing capabilities in countries such as Egypt and South Africa. The company processes soybean, sunflower, and cottonseed into high-quality edible oils and protein-rich animal feed, serving both domestic and regional markets. Bunge’s integration across the value chain enables it to manage raw material procurement, logistics, and end-user distribution effectively. The company actively engages in sustainability initiatives, aiming to source responsibly and minimize carbon emissions from processing activities. Through continuous investment in technology upgrades and partnerships with local farming cooperatives, Bunge enhances productivity and traceability in the regional oilseed sector. Its strategic alignment with global ESG goals further strengthens its reputation and market competitiveness in emerging agri-processing economies.

Archer Daniels Midland Company (ADM)

ADM plays a pivotal role in shaping the Middle East and Africa Oilseed Processing Market through its investments in sustainable sourcing, advanced refining technologies, and regional trade facilitation. The company operates in key markets such as Egypt and South Africa, where it supports the transformation of locally sourced and imported oilseeds into essential food and industrial products. ADM contributes to global market stability by linking African and Middle Eastern producers with international buyers through efficient supply chain networks. The company emphasizes innovation, particularly in clean-label oils and plant-based proteins, aligning with evolving consumer preferences in both developed and emerging markets. By promoting agricultural modernization and supporting smallholder farmers, ADM enhances raw material availability and quality, reinforcing its influence in the broader global agri-commodity landscape.

TOP STRATEGIES USED BY KEY MARKET PLAYERS

One of the primary strategies adopted by key players in the Middle East and Africa Oilseed Processing Market is vertical integration, allowing companies to control multiple stages of the supply chain—from raw material sourcing and processing to logistics and end-user distribution. This approach enhances cost efficiency, ensures consistent supply, and mitigates risks associated with fluctuating commodity prices.

Another critical strategy is investment in sustainable and traceable sourcing practices , as companies aim to meet growing consumer and regulatory demands for environmentally responsible production. Leading firms are increasingly adopting certified sustainable oilseed programs and investing in regenerative agriculture to secure long-term market access and enhance brand reputation.

Lastly, expansion into high-growth regional markets and downstream diversification is a key focus area. Companies are forming strategic alliances, acquiring local processors, and launching specialty oil and protein-based products tailored to emerging dietary trends, thereby reinforcing their competitive edge in the dynamic Middle East and Africa landscape.

RECENT HAPPENINGS IN THE MARKET

RECENT HAPPENINGS IN THE MARKET

- In February 2023, Cargill announced the expansion of its soybean crushing facility in Alexandria, Egypt, aiming to increase capacity and meet rising demand for refined oils and biodiesel feedstock in North Africa.

- In May 2023, Bunge launched a new line of sustainably sourced sunflower oil in Sudan, emphasizing improved environmental credentials and non-GMO certification to appeal to health-conscious consumers and international buyers.

- In September 2023, ADM partnered with an Ethiopian agri-tech startup to develop enzymatic oil refining processes that reduce chemical usage and improve sustainability in small-to-medium processing plants.

- In March 2024, Cargill acquired a stake in a UAE-based logistics platform specializing in agri-commodity transport, enhancing its regional supply chain optimization and delivery efficiency.

- In August 2024, Bunge entered into a joint venture with a Nigerian biofuel producer to co-develop advanced biodiesel blends using locally processed soybean oil, strengthening its position in the renewable fuels sector.

MARKET SEGMENTATION

This research report on the Middle East and Africa oil seed processing market has been segmented and sub-segmented based on the following categories.

By Type

- Soybeans

- Rapeseed

- Sunflower

- Cotton

By Process

- Mechanical

- Chemical

By Application

- Food

- Feed

- Industrial

By Region

-

UAE

-

Israel

-

KSA

-

South Africa

-

Egypt

Frequently Asked Questions

1. What is the market size and growth rate of the MEA oilseed processing market?

The market is expected to grow from USD 22.18 million in 2025 to USD 39.94 million by 2033, at a CAGR of 7.63%.

2. What factors are driving the growth of the oilseed processing market in MEA?

Increasing demand for edible oils, expanding food industries, and rising health consciousness are major growth drivers.

3. Which countries are leading the oilseed processing market in the MEA region?

Saudi Arabia, UAE, South Africa, Egypt, and Israel are key markets contributing to regional growth.

4. What are the commonly processed oilseeds in this region?

Soybean, sunflower, cottonseed, and rapeseed are widely processed across MEA.

5. What are the main applications of processed oilseeds in MEA?

They are used in cooking oils, margarine, animal feed, biofuels, and cosmetics.

6. What market trends are emerging in MEA oilseed processing?

Organic and non-GMO oils, cold-press technology, and sustainable sourcing are rising trends.

7. What challenges are affecting the market’s expansion in MEA?

Limited processing infrastructure, raw material price volatility, and trade regulations pose challenges.

8. How is technology improving oilseed processing in MEA?

Advanced pressing and refining techniques are boosting efficiency and product quality.

9. What opportunities are available for new entrants in MEA?

Rising urbanization, dietary shifts, and demand for healthy oils present strong market entry points.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com