Global Meat Substitutes Market Size, Share, Trends & Growth Forecast Report - Segmented By Product Type (Tofu-Based, Seitan-Based, Tvp-Based, Quorn-Based, Tempeh-Based, And Others), Source (Wheat, Soy, And Mycoprotein), Category (Refrigerated, Frozen, And Shelf-Stable) Regional Analysis (North America, Europe, Asia Pacific, Latin America, And Middle East & Africa) - Industry Analysis From 2024 To 2032.

Global Meat Substitutes Market Size (2024 to 2032)

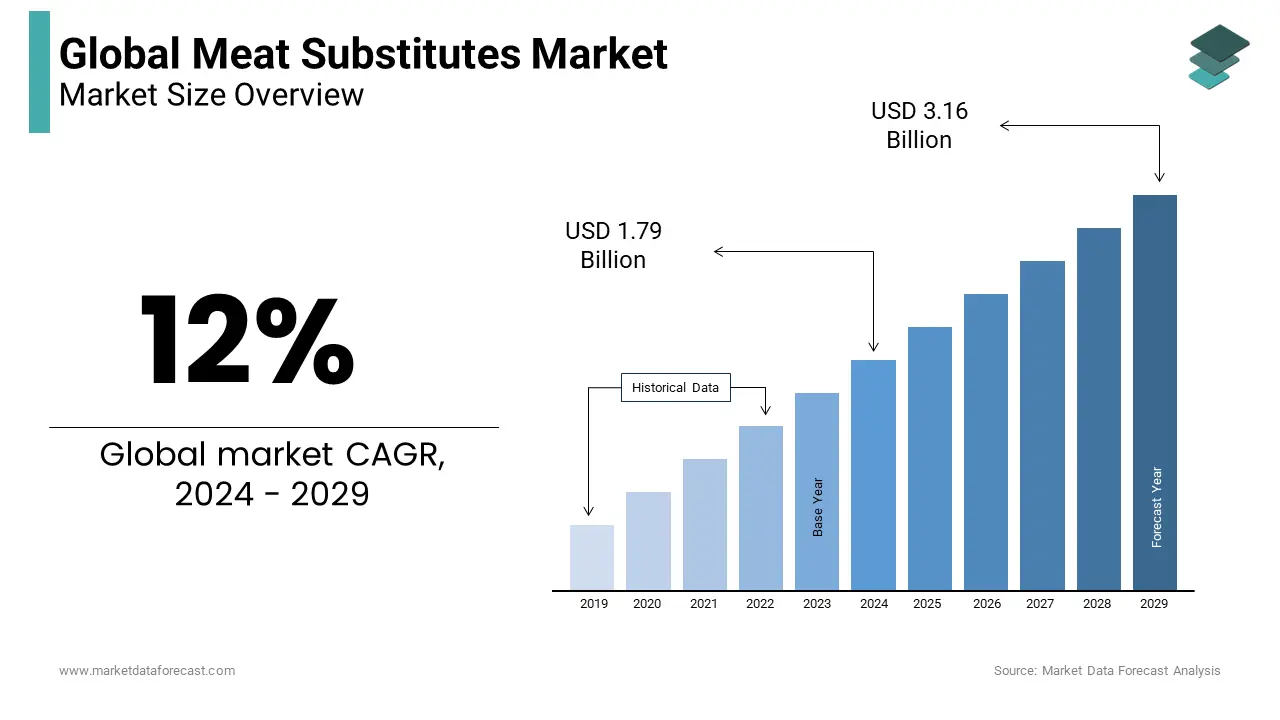

The Global Meat Substitutes market size was worth USD 1.79 billion in 2024, and it is estimated to reach USD 4.43 billion by the end of 2032 with a CAGR of 12.0%.

MARKET OVERVIEW

A meat substitute (also known as a meat analog) is a product with the flavor, texture, and look of specific types of meat, such as hog, beef, and chicken. These meat substitutes are manufactured from various plant proteins, including soy, wheat, and pea. As a result, the health benefits of these substances have been a major reason driving the increasing demand for meat replacements. Meat substitutes are less likely to cause food illness or contamination than meat products. However, livestock production is sometimes seen as a complex enterprise, including animal waste control and killing. Furthermore, the risk of food contamination is considerable throughout the supply chain, particularly in the event of expensive refrigeration and unpredictable power supplies.

Extrusion and processing are crucial in the meat replacement market. The extraction of pea protein, soy protein, and wheat protein is part of the processing. Traditional dry extraction procedures yield protein flour with just 20% to 40% protein and concentrate with46% to 60% protein. However, new extrudable fat technology - purchased from Coasun - duplicates animal fat, enabling more genuine fat textures, such as marbling, in plant-based meats. In addition, the method enables fat to be extruded and combined with protein to provide a superior ingredient in which the fat and protein are physically bonded together. Another technique utilized in plant-based meat is Prolamin technology, which uses plant-based components to improve the texture of plant-based cheese, and bubble, allowing it to melt and stretch like animal-derived dairy - licensed from the University of Guelph.

MARKET DRIVERS

The global market for meat-based proteins has seen a boom in demand over the last decade, with most people in Europe and North America relying on meat products for their daily protein needs. While meat proteins provide the body with the amino acids it requires, they are also high in cholesterol, which has been related to a number of serious health issues. This became the primary driver of the rising demand for plant-based protein foods, especially in developed countries like the United States, Germany, France, and the United Kingdom. Vegan population growth has been observed in several regions, including the United States and the United Kingdom. According to a 2018 article by the Food Revolution Organization, the number of vegans in the United States has surged by 600% in the last three years. This rising demand for plant-based protein is projected to drive the industry forward.

MARKET RESTRAINTS

Food allergies and intolerances have been studied for hundreds of years. However, the prevalence of food allergies has increased in recent years, raising great anxiety among consumers and food manufacturers. According to the Food Allergy Research & Education Organization (US), soy and wheat are two of the top eight food allergens responsible for the most serious food allergy reactions in the United States. Soybeans, for example, are high in nutrients such as vitamins, minerals, isoflavones, and proteins; however, anti-nutritional components in soy may cause health concerns such as soy allergy. In addition, soy allergies can cause itching and hives. Other symptoms include gas, bloating, and mild intestinal tissue irritation.

Producing pea protein is costly. Moreover, due to climatic changes, there are pea shortages, which is driving up pea prices. As a result, its manufacturers are attempting to boost manufacturing capacity by utilizing sophisticated pea protein extraction and processing technology. However, the scarcity of pea protein forces food manufacturers to import it, raising the price of raw materials and, as a result, raising the prices of finished meat substitute goods. As a result, pea protein-based meat substitute is regarded as a luxury product in a number of nations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

12.0% |

|

Segments Covered |

By Product, Source, Types, Forms, Category And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Amy’s Kitchen, Beyond Meat, Impossible Foods Inc, Quorn Foods, The Kellogg Company, Unilever, Meatless B.V, VBites Foods Ltd, Sunfed, Tyson Foods, Inc |

DETAILED SEGMENTATION OF THE GLOBAL MEAT SUBSTITUTES MARKET INCLUDED IN THIS REPORT

This research report on the Global Meat Substitutes Market has been segmented and sub-segmented based on product, source, types, forms, category, and region.

Global Meat Substitutes Market By Product

- Tofu

- Tempeh

- Seitan

- Textured Vegetable Protein

- Quorn

Tofu, manufactured from curdled soy milk, is also known as soybean curd or bean curd. Curdled soy milk is a beverage that contains iron and is made from cooked soybeans. For millennia, tofu has been a staple meal in Asian cuisines. Tofu has a great nutritional value; it provides a substantial quantity of iron, potassium, protein, calcium, and vitamin 12, all of which are essential for a healthy vegan diet. Consumers are becoming more aware of vegan food because of health benefits, environmental sustainability, and the fact that living a vegetarian lifestyle or consuming fewer animal products has become a way of life. In addition, consumers are becoming more cautious about their fat intake. They believe that red meat is rich in fat. However, sources of vegetable protein used as the base for burger patties are fat-free, according to research published in the International Congress of Meat Science and Technology in 2018. As a result, the market for meat alternatives will grow due to the rise of plant-based burgers.

Global Meat Substitutes Market By Source

- Soy Protein

- Pea Protein

- Wheat Protein

- Other Sources

On a global level, wheat is one of the most widely consumed cereal grains. In response to the growing popularity of low-fat diets, makers of low-fat and high-protein foods choose the low-fat protein found in wheat. It also serves as a binder for meatballs, meatloaf, and veggie burgers.

Wheat proteins can be flavored with ginger, soy sauce, garlic, paprika, and fennel and are relatively affordable. They can be used in a wide range of food products, including nuggets, burger patties, and sausages. Several plant-based protein producers are now working on different plant proteins for use in food and beverage applications. Wheat is a source of fiber, antioxidants, vitamins, and minerals for people who are not allergic to it. Leading suppliers of wheat-based protein are Archer Daniels Midland Company (US) and Cargill (US).

Global Meat Substitutes Market By Types

- Isolates

- Concentrates

- Textured

Due to the protein content, meat substitutes are available in isolates or pure forms, which are well-liked and favored by producers of protein-based foods and beverages. Soy, pea, rice, and canola are a few different protein isolate sources. Because of the health and environmental advantages linked to protein-rich foods and meat alternatives, knowledge of them has recently increased. As a great source of protein, this is an increasing demand for protein isolates. The most popular isolate protein is soy protein isolate (SPI), which is made from soybean beans and contains between 93% and 97% protein.The Soyfoods Association of North America states that soy protein isolate is a dry powder-based ingredient that has been "separated or isolated from the other components of soybean, making it 90%–95% protein and almost fat- and carbohydrate-free." In addition to increasing the protein content, moisture retention, and emulsification of meat products, soy protein isolates are also used to improve the texture of meat products. Soy protein isolates are also used because of their high protein content and nutty flavor. Additionally, because of bacterial fermentation, they have low fat, oligosaccharides, and fiber levels and don't produce as much gas.

Global Meat Substitutes Market By Form

- Solid

- Liquid

Global Meat Substitutes Market By Category

- ·Frozen

- Refrigerated

- ·Shelf Table

Global Meat Substitutes Market By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

KEY MARKET PLAYERS

Amy’s Kitchen, Beyond Meat, Impossible Foods Inc, Quorn Foods, The Kellogg Company, Unilever, Meatless B.V, VBites Foods Ltd, Sunfed, Tyson Foods, Inc.

RECENT HAPPENINGS IN THE MARKET

- ADM announced the opening a state-of-the-art plant-based innovation lab in Singapore's Biopolis research hub in April 2021. With the help of the new lab, the business could create cutting-edge, fashionable, and wholesome products to meet the demands of the Asia Pacific market.

- In November 2020, Ingredion Incorporated and its joint venture partners signed a contract to buy outright Verdient Foods (Canada), a plant-based protein producer. With this acquisition, Ingredion Incorporated should be able to meet the growing demand from consumers for plant-based foods.

- The biggest distributor in the US and the Americas, Polypro International (US), was purchased by Batory Foods in December 2019. After this acquisition, Batory Foods should become the biggest distributor of clean-label restaurants in the US.

Frequently Asked Questions

1.What are the main types of meat substitutes?

The main types of meat substitutes include:

- Soy-based products: such as tofu, tempeh, and soy protein-based meat alternatives.

- Wheat-based products: such as seitan (wheat gluten) and wheat protein-based meat substitutes.

- Legume-based products: such as products made from peas, lentils, or beans.

- Mycoprotein-based products: such as meat substitutes made from fungi-derived protein.

- Other plant-based ingredients: such as jackfruit, mushrooms, or coconut.

2.What are the benefits of meat substitutes?

Health benefits: They are often lower in saturated fat, cholesterol, and calories compared to conventional meat.

Environmental benefits: They typically have a lower carbon footprint and require fewer natural resources (such as land and water) to produce.

3.Are meat substitutes nutritionally equivalent to meat?

Meat substitutes can be nutritionally similar to meat in terms of protein content and may also contain added vitamins, minerals, and nutrients to enhance their nutritional profile. However, the nutritional composition can vary depending on the ingredients used and the specific product.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]