Global Medical Device Connectivity Market Size, Share, Trends & Growth Forecast Report By Products and Services, Technology, End-user, and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Medical Device Connectivity Market Size

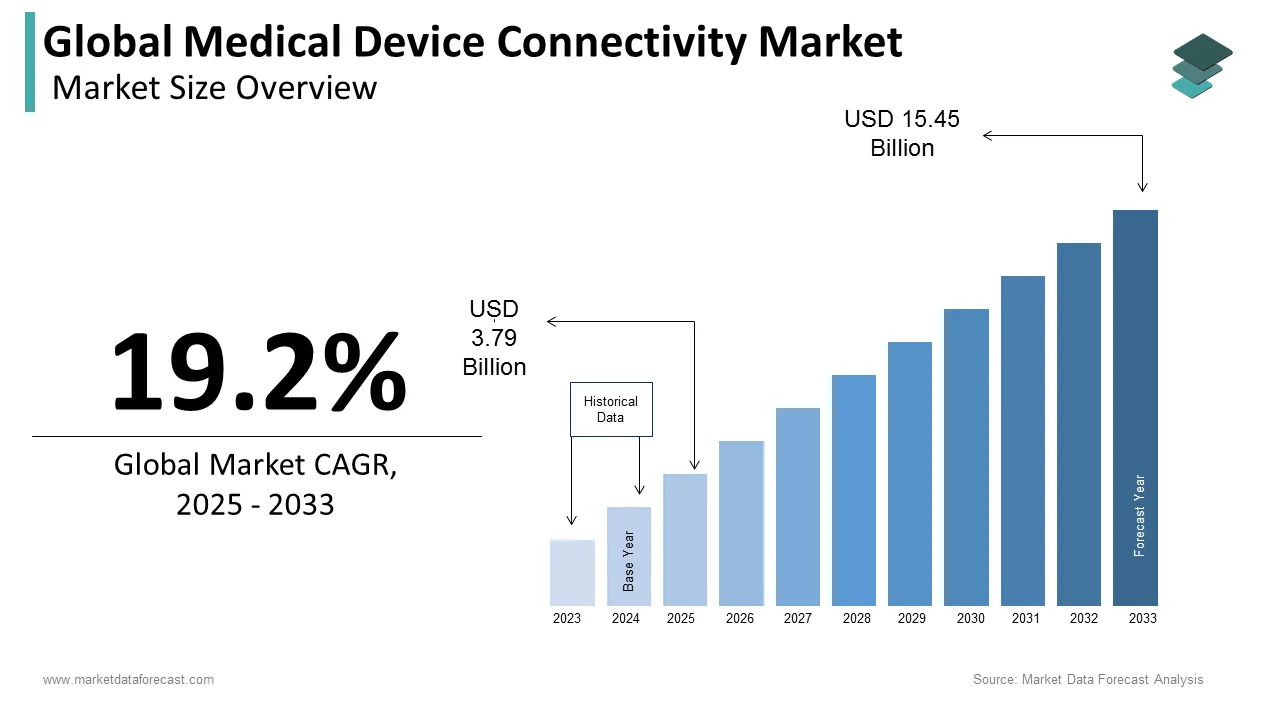

The size of the global medical device connectivity market was worth USD 3.18 billion in 2024. The global market is anticipated to grow at a CAGR of 19.2% from 2025 to 2033 and be worth USD 15.45 billion by 2033 from USD 3.79 billion in 2025.

Given the boom in remote healthcare and expanded IoMT devices, almost all healthcare organizations have seen a significant rise in network traffic in the last year. Despite this, medical device connectivity (MDC) is a tried-and-true technology that can save nurses time, increase documentation quality and timeliness, and improve patient care and safety. The vulnerable technologies include everything from conventional medical devices to tools for preventing the virus from spreading inside the hospital. A healthcare organization should take a step-by-step approach to integrate ALL of their medical equipment, both legacy and new, into their EHR and EMR solutions, keeping in mind potential integration issues upfront. The medical device manufacturer should ideally develop and build interoperable devices or provide an alternative connectivity solution.

MARKET DRIVERS

Y-O-Y growth in the healthcare technologies such as remote patient monitoring, EHR, EMR solutions, and telehealth/telemedicine is anticipated to accelerate the growth rate of the global medical device connectivity market. In addition, wearable healthcare monitoring devices are betting all the time, which is expected to fuel the global medical device connectivity market growth.

Wearable devices are also at the forefront of medical IoT. Aside from consumer fitness devices like the Fitbit or the Apple Watch, FDA-approved wearables designed to track patient conditions in real-time are becoming less expensive and more advanced. Healthcare professionals can get a real-time image of a patient's health using these low-cost, high-performance wearable devices. Doctors can monitor their patients' blood pressure, blood chemistry, pain levels, glucose levels, brain function, and other body parameters. Dedicated IoT networks will use wearable sensor data to detect the presence of conditions such as diabetes or atrial fibrillation, alerting the patient and the doctor to schedule an in-person checkup as soon as possible.

Telehealth systems help the healthcare sector cope with the aging population suffering from chronic diseases, which is expected to expand the global medical device connectivity market.

The world's population is aging, which is a reality of society. Baby boomers are now becoming senior citizens, fueling the aging population's growth. These advancements now include new therapies and early diagnostic methods based on advanced sensor and microcontroller (MCU) technologies available to the general public. As a result, according to the World Health Organization, people are living longer worldwide. Between 2015 and 2050, the proportion of the global population over 60 will nearly double, from 12% to 22%. According to the WHO report, noncommunicable diseases account for nearly half of the global disease burden (WHO). The most common are chronic degenerative diseases, such as cardiovascular disease, in which hypertension plays a significant role (600 million people worldwide), and metabolic diseases, such as diabetes (90 million people).

The Internet of Things (IoT) is becoming more widely used in healthcare, and this factor is estimated to act favorably in the global medical device connectivity market.

The healthcare industry has long been regarded as one of the most important Internet of Things (IoT) sectors. The Internet of Things (IoT) in healthcare applies networking technology to link medical devices and applications, allowing machine-to-machine communication and cloud connectivity. It can incorporate and merge customer and clinical data to create better and more effective linked consumer and treatment solutions by adopting IoT in healthcare and providing consistent patient care. When doctors and nurses have access to more data, the quality and efficacy of treatment improve exponentially. Diagnoses are more precise, therapies are more tailored, and severe symptoms are identified earlier. Experience developing emerging technology for healthcare institutions to provide end-to-end integrated solutions for medical devices for the Internet of Things. Not only for Philips but also for other businesses. It delivers value where it matters most by collaborating with the company.

Technological advancements in this area are among the primary factors driving the global medical device connectivity market growth.

In the coming years, advancements in medical device connectivity are planned as industry experts prepare to release new standards that they claim will reshape technical interoperability. According to Tobias Klotz, Drägerwerk AG, and Co. KGaA's device architect, as medical technology has progressed, interoperability capabilities between devices such as ventilators and fusion pumps have lagged. The Office of the National Coordinator for Health Information Technology of the Centers for Medicare and Medicaid Services and the US Department of Health and Human Services will finalize and authorize the standards.

Additionally, the shift of the point of care (POC) from the hospital to the patient's home allows for more reliable and timely contact between the patient and the doctor, making cloud and mobility-driven medical devices a huge trend. The introduction of ACOs, and other recent developments in federal healthcare legislation and regulations, such as Medicare and Medicaid financial benefits and penalties. Along with the aforementioned factors, the rising use of mHealth or digital apps is expected to support the medical device connectivity market.

MARKET RESTRAINTS

The growing adoption of IoT medical devices and stringent regulation scenarios hamper the medical device connectivity market growth. In addition, the high costs associated with and reluctance from medical professionals to habituate to healthcare IT are inhibiting the market's growth rate.

Impact of COVID-19 on the Global Medical Device Connectivity Market

Before COVID-19, healthcare was already overburdened in terms of security. Rapid system adoption has increased the need to protect patients from security issues. In addition, because of the pandemic, there was an unexpectedly high demand for some medical devices. The emergence of SARS-CoV-2, the virus that causes COVID-19, has altered nearly every aspect of modern society, including how healthcare is provided, changing medical needs, and patient and provider acceptance of connected devices. In response, the USFDA and other regulatory bodies have updated guidelines on using telehealth and connected devices, at least for the time being. Due to the increasing availability of vaccinations, leading economists believe that other COVID-19 preventive strategies, such as social distancing and mask wear, would remain in use for a long time, ensuring that telehealth and medical device access would become permanent fixtures in the way we provide and receive healthcare.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

19.2% |

|

Segments Covered |

By Products and Services, Technology, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cerner Corporation, Philips Healthcare, Honeywell International Inc., Capsule Technologies Inc., Medtronic, Infosys Limited, Bridge-Tech Medical Inc., Digi International Inc., Cisco Systems, iHealth Labs, TE Connectivity, Lantronix, Spectrum Medical Ltd., S3 Connected Health, Silex Technology Inc., Hill-Rom Inc., and MediCollector LLC., and Others. |

SEGMENTAL ANALYSIS

By Products & Services Insights

Based on the product & service, the medical device connectivity solutions segment is expected to develop faster during the forecast period. This segment's rapid expansion can be attributable to the growing demand to integrate healthcare systems and rising healthcare costs.

By Technology Insights

Based on the technology, the medical device connectivity market was dominated by the Wireless technologies segment. Wireless technologies improve healthcare quality by allowing doctors to obtain real-time updates about their patients, allowing for faster treatment. These technologies also allow for shorter hospital stays and lower healthcare costs by enabling remote patient monitoring without compromising treatment efficiency.

These advantages aid the expansion of the wired technologies industry. Wi-Fi hardware, Bluetooth hardware, and wireless web map tile services are all included in the wireless hardware segment (WMTS). Traditional wired hardware is still in demand in many sectors due to its simplicity and product knowledge. Furthermore, the wireless hardware market is expected to expand rapidly. Wi-Fi is preferred mainly due to its flexibility.

By End-User Insights

Based on the end-user, in 2020, the Hospitals segment led the market, with the largest market share. In addition to the other segments, hospitals have a wide range of medical device connectivity applications. Furthermore, increased investments in the healthcare system have increased the demand for advanced medical items in the market.

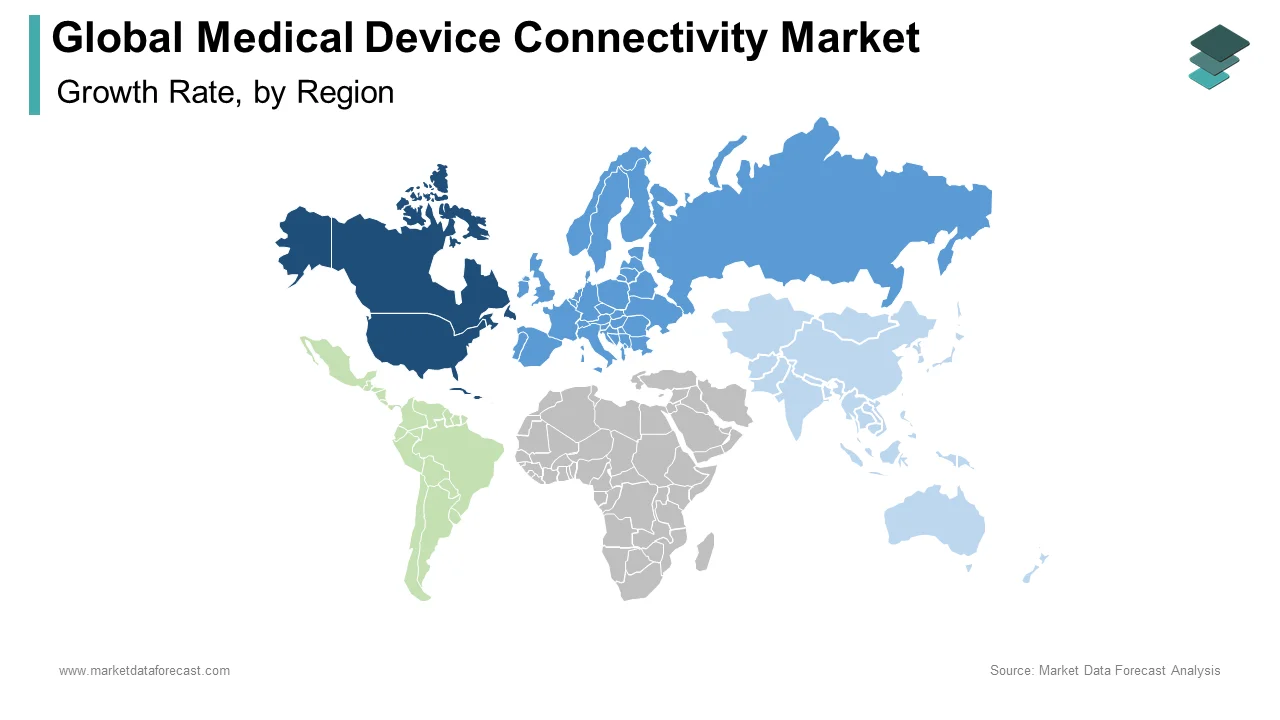

REGIONAL ANALYSIS

Based on the region, the North American medical device connectivity market held the largest share of the global market in the past and is predicted to continue the dominating momentum throughout the forecast period. The medical device connectivity market in North America is growing due to factors such as increasing consolidation among healthcare providers, widespread adoption of clinical device connectivity and interoperability solutions to curtail the rising healthcare costs, an increase in the number of coronavirus patients in the United States, and stringent regulations and guidelines imposed by various government and non-government organizations.

Because of rising disposable income and healthcare costs, Europe is expected to grow significantly in the medical device connection industry. Furthermore, prominent major players with innovative healthcare goods are expected to drive the medical device connectivity market in the region to greater heights in the coming years.

The Asia-Pacific medical device connectivity market is expected to develop fastest. Increasing demand for automation in the healthcare industry and government initiatives to encourage its implementation will pave the way for market development in the Asia-Pacific region.

KEY MARKET PARTICIPANTS

A few of the noteworthy companies operating in the global medical device connectivity market profiled in this report are Cerner Corporation, Philips Healthcare, Honeywell International Inc., Capsule Technologies Inc., Medtronic, Infosys Limited, Bridge-Tech Medical Inc., Digi International Inc., Cisco Systems, iHealth Labs, TE Connectivity, Lantronix, Spectrum Medical Ltd., S3 Connected Health, Silex Technology Inc., Hill-Rom Inc., and MediCollector LLC.

RECENT MARKET DEVELOPMENTS

- Masimo Corporation (US) and Imprivata (US) announced a partnership in 2020 to incorporate Imprivata's medical device access technology into Masimo's root patient monitoring and connection platform and Iris Gateway.

- Masimo Corporation (US) signed an agreement to acquire NantHealth's connected care business in January 2020. According to company management, Masimo's attempts to assist hospitals in enhancing their connected care through hospital automation and monitoring technology would be aided by the purchase.

- The first 60 operational satellites of SpaceX's Starlink network, which provides satellite Internet access, were launched in May 2019. Starlink is the name of a satellite network developed by SpaceX, a private spaceflight company, to provide low-cost internet to remote locations.

MARKET SEGMENTATION

This research report on the global medical device connectivity market has been segmented and sub-segmented based on the products & services, technology, end-user, and region.

By Products & Services

- Medical Device Connectivity Solutions

- Medical Device Connectivity Services

By Technology

- Wired Technologies

- Wireless Technologies

- Hybrid Technologies

By End-User

- Hospitals

- Ambulatory Care Centers

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What was the size of the medical device connectivity market worldwide in 2023?

The global medical device connectivity market size was valued at USD 3.18 billion in 2024.

Does this report include the impact of COVID-19 on the medical device connectivity market?

Yes, we have studied and included the COVID-19 impact on the global medical device connectivity market in this report.

Which region led the medical device connectivity market worldwide in 2023?

Geographically, the North American region accounted for the largest share of the global medical device connectivity market in 2023.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]