Global Medical Robots Market Size, Share, Trends & Growth Forecast Report By Product (Surgical Robots, Rehabilitation Robotic Systems, Non-Invasive Radiosurgery Robotic Systems & Hospital And Pharmacy Robotic Systems), Application and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Medical Robots Market Size

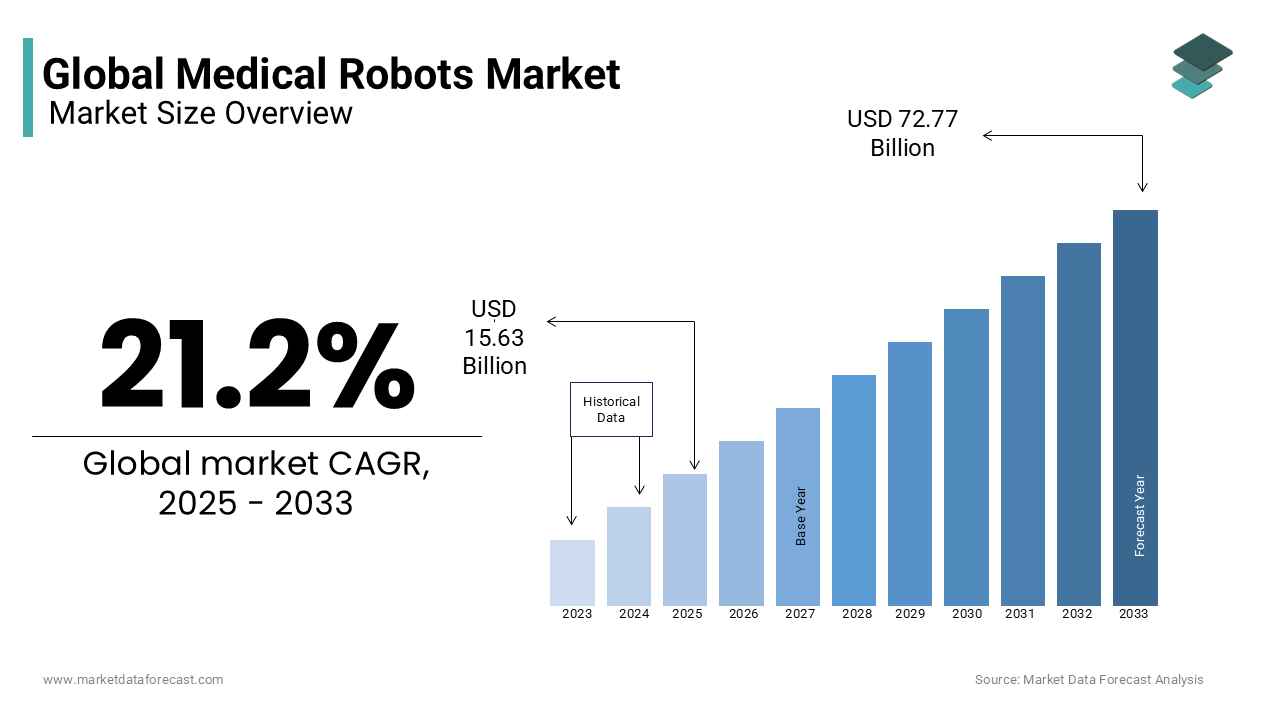

The medical robots market size was valued at USD 12.90 billion in 2024. The global medical robots market size is estimated to grow to USD 72.77 billion by 2033 from USD 15.63 billion in 2025, growing at a CAGR of 21.2% during the forecast period.

The FDA approval of Vinci X robots developed by Intuitive Surgical was a sensation in the global medical robots market and developed intense competition.

The advancement in healthcare is making records with innovative launches, which are helpful in improving treatment procedures. There are various robots that work with the specific requirements in healthcare. The penetration of robotic systems in healthcare is transforming more complex surgeries into minimally invasive procedures, which is a special achievement in today’s world. The future of the healthcare industry will completely depend on the robotic systems. Scientists are looking for many possibilities to launch a robot that can efficiently deliver targeted medication to the patient, simply acting as a healthcare provider for minor issues. Already, these are enabled to perform lab tests where there is no human intervention in the laboratories. The future of the healthcare industry will change in a more effective way with the launch of these robots with more innovative techniques. According to the National Institute of Health, robotic surgeries stood as the third revolution in China, quickly launching innovative features to make the surgeries easier and more effective. The Da Vinci Surgical System was the first introduction of medical robotics in the Chinese People’s Liberation Army General Hospital in 2006. By the end of 2022, a total of 314 were installed in 257 institutions that performed more than 378,000 procedures.

MARKET DRIVERS

The increasing R&D activities by the market participants, the availability of advanced healthcare infrastructure and the rapid adoption of the latest technological advancements are propelling the global medical robots market growth. Medical robots are specialized robots used for various tasks in the healthcare industry, including the treatment of neurological and orthopedic diseases. Medical robots such as robotic-assisted surgical systems, exoskeleton devices and rehabilitation robots are used in surgical procedures and aid humans suffering from neurological and orthopedic conditions. Rising preference for minimally invasive surgeries, growing adoption of the latest advanced medical technologies and robotics, growing decrepit population, an increase of funding for medical robot research, acceptance of laparoscopic robotics procedures, and development of technologies in medical robotics are further contributing to the growth of the medical robots market. In addition, growing incidences of chronic diseases worldwide and a growing aging population are promoting the need for medical robots.

The growing prevalence of neurological and orthopedic diseases is accelerating the growth rate of the medical robots market. The population suffering from neurological diseases such as Alzheimer's disease, Parkinson's disease, and epilepsy is growing rapidly worldwide. WHO says an estimated 50 million people worldwide are suffering from dementia and approximately 10 million new cases are being added. As per the data published by the Parkinson’s Foundation, an estimated 1 million people in the U.S. are suffering from Parkinson’s disease and this number is predicted to hit 1.2 million by 2030. As per the same source, an estimated 10 million people are suffering from Parkinson’s disease. On the other hand, the patient population suffering from orthopedic diseases such as arthritis, osteoporosis, and spinal disorders is growing continuously. As per the information by the Arthritis Foundation, an estimated 78.4 million adults in the United States are predicted to suffer from doctor-diagnosed arthritis. In recent years, the usage of medical robots in the surgical procedures of neurological and orthopedic diseases has increased tremendously. For instance, medical robots such as the Mazor X robotic surgical system are used for spinal surgery, and the ROSA robot is used for brain surgery.

In addition, the growing number of healthcare centers and increasing patient flow to the hospitals, as well as the government's increasing investments in the pharmaceutical sector to provide effective treatment procedures, are further anticipated to project a favorable impact on the market growth. Furthermore, the increasing adoption of medical robots, growing per capita healthcare expenditure in developing emerging countries, and technological advancements in medical robots integrated with surgeon/patient approval for laparoscopic and robotic assistance are promoting the market’s growth rate. Furthermore, with the rise in rehabilitation centers with the help of robot assistance, technological advancements associated with medical robot systems are projected to fuel the medical robots market growth.

The increasing potential for the use of medical robots to address unmet needs in the healthcare industry, such as enhancing patients’ safety and satisfaction with the treatment process, is solely to pose new opportunities for the market in the coming years. Though healthcare providers have been using robots for the past three decades, newer technologies are transforming the shape of the industry to an extent. Scientists believe that with the help of incredible innovations, there is a huge possibility of launching life-saving techniques and improving the patient’s experience. The focus on leveraging specialized treatment procedures, even in remote areas, with the help of telemedicine and other interventions, is likely to propel the growth rate of the medical robots market. In addition to this, the rising prominence for decision-making ability, especially in the emergency rooms, so that the medical staff can prioritize the best treatment procedure to save a life is attributed to enhancing the growth rate of the market. Adopting artificial intelligence and robot technologies in medicine ultimately reduces the patient waiting time for diagnosis and treatment. Collecting patients' past medical history and checking vital signs in little time contributes to giving the proper time for the patient in the emergency room.

MARKET RESTRAINTS

Though there are huge advantages to using medical robots, sometimes there is a chance for malfunctions to happen. Even a minor malfunction of the robot may lead to a fatality, which is highly a risk factor. The healthcare provider should have high concentration with the surgical robots in real-time to avoid risks. It is so true that the robot performs surgeries more effectively and precisely, but during delicate procedures, it is one of the major concerns to avoid malfunction. According to the National Institute of Health (NIH), out of 205,000 procedures, 1914 cases report any malfunction where the damage of the patient ranges between 0.5% - 5.4%. Installation of medical robots costs very high, which small and medium-scale institutes cannot afford, and is also one of the factors that is hindering the growth rate of the medical robots market. The systems, due to the high maintenance cost, and the treatment procedures using medical robots also cost high that is not common to adopt by the middle-class economy people. This factor is hugely hindering the growth rate of the market.

Lack of complete knowledge over the use of medical robots due to fewer training sessions is solely to hinder the growth rate of the market. The robots should be operated by highly experienced healthcare providers due to their complications. Increasing privacy-related concerns among patients due to the rising number of data breach incidents in the medical sector is accounted to pose great challenges for the top companies to adopt newer technologies and safety measures to reduce these risks.

Stringent rules and regulations by government authorities in approving new techniques in favor of public safety are also delaying the launch of innovative products, which may act as a barrier for companies to invest huge amounts. In remote areas, reluctance to accept new technologies due to a lack of awareness and confidence in medical robots may also impede the growth rate of the market. These challenges can only be addressed by raising awareness of the efficiency and benefits of adopting newer technologies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By product, application, and region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Intuitive Surgical Inc., Stryker Corporation, Hocoma AG, Mazor Robotics Ltd, Hansen Medical Inc., Accuray Incorporated, Omnicell Inc., Arxium, EKSO Bionics Holdings Inc., and Kirby Lester LLC. |

SEGMENTAL ANALYSIS

By Product Insights

The surgical robots segment topped the market and held the largest share of the global medical robots market in 2023 by product type. Compared to human surgeons, the success rate of surgical robots is high, and they can also perform precise surgery in tiny places. It helps disabled patients to improve their mobility and communication. It performs repetitive tasks at high speed and reliably with the help of telemanipulation without fatigue. Very few hospitals can invest in advanced technology instruments, and the hospitals with these medical robots are forced to provide the services at higher rates. The emergence of cloud-based deployment mode in every application is surging the market's growth. The growing acquisition rate of robotic systems in hospitals and the stipulation for minimally invasive surgeries are propelling segmental growth.

The rehabilitation robotic systems segment is another segment that is expected to grow at a significant CAGR during the forecast period. Rehabilitation robotic systems are used for physiotherapy in treating stroke and neurological disorders related to movement disability, which is expected to result in the growth of the segment.

By Application Insights

Based on application, the neurological segment had the largest share of the global market in 2024 and is expected to showcase a healthy CAGR during the forecast period. The growth of the segment is primarily driven by the growing neurological disorders such as depression and Alzheimer’s and technological developments for the NeuroMate system hardware and software in the field of robotic systems, with improvements made in the scope of ergonomics.

The orthopedics robotics segment held a noteworthy share of the global market in 2024 and is estimated to register a promising growth rate during the forecast period. The growing number of musculoskeletal conditions, such as rheumatoid arthritis, low back pain, osteoarthritis, and osteoporosis, are propelling segmental growth.

The laparoscopy segment is expected to do well over the forecast period due to the ease of handling the devices; these are mainly designed to meet the surgeons' requirements.

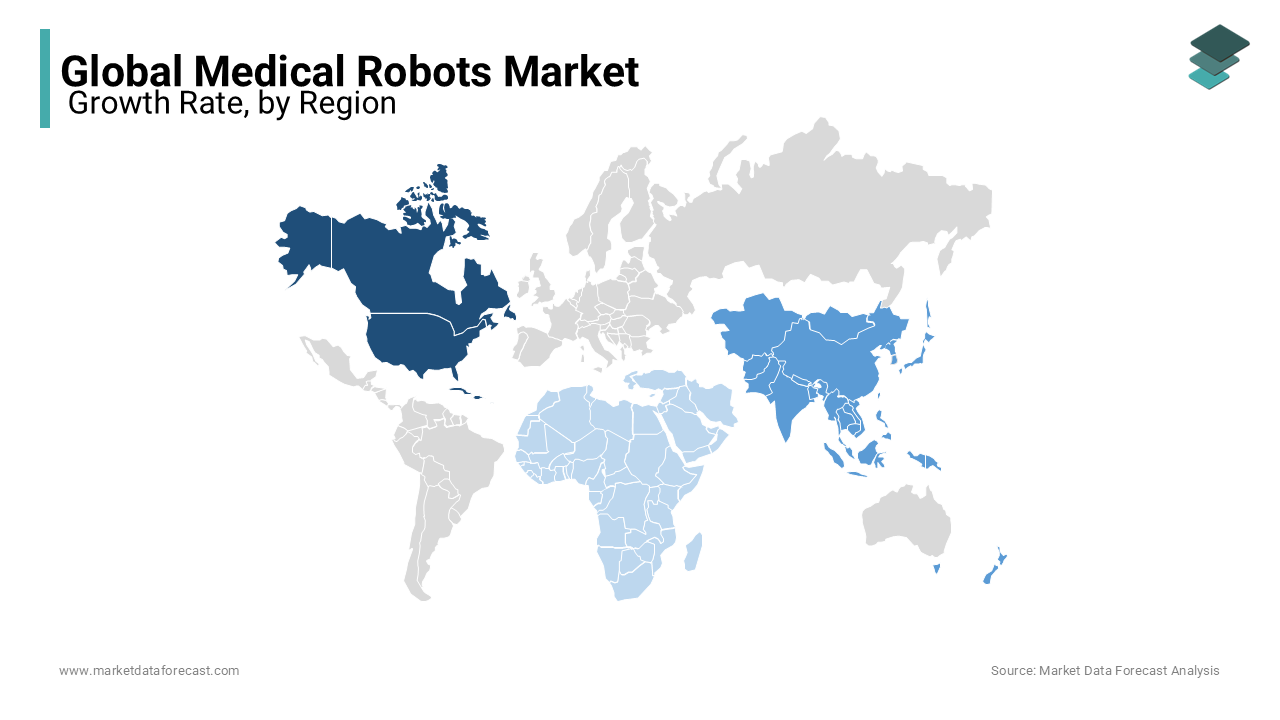

REGIONAL ANALYSIS

North America has been the most promising regional market globally for the past decade due to the rapid adoption of the latest technologies. In addition, increasing the hospital's construction activities with modern equipment is likely to leverage the demand for medical robots. Also, the growing prevalence of promoting effective treatment concerning the patient’s health prompts the market's need in this region.

The market in the Asia Pacific is a prominent regional market for medical robots and is estimated to project the fastest CAGR among all the regions. The region’s dominance is majorly driven by the rise in the number of healthcare centers and increasing funds from public and private organizations. The growing adoption of medical robots in Asia-Pacific is further propelling regional market growth. Japan, India, and China are expected to have a healthy growth rate in this region. The growing population, rising awareness, growing R&D efforts to enhance the medical robot capabilities and increasing medical robot research funds are further favoring the Asia-Pacific market growth.

The European market for medical robots is estimated to grow at a notable CAGR during the forecast period owing to the growing number of R&D institutes in the medical sector to spread these applications in various parts. In addition, the growing aging population, increasing demand for minimally invasive surgeries, and advancements in robotics technology are propelling the growth of the medical robots market in the European region. The UK accounted for the major share of the European market in 2023, followed by Germany.

The Latin American medical robots market is expected to see a healthy CAGR in the foreseen years due to the rising incidences of multiple health disorders the increasing need for surgical procedures, and growing economies.

The medical robots market in the Middle East and Africa is predicted to have a slight inclination in the growth rate during the forecast period. The increasing geriatric population is a significant factor influencing the growth of this market. In addition, the rise in awareness of artificial intelligence applications and their implementation at a high success rate broadens the market demand. In the Middle East and Africa, the medical robotics market is in the transition phase and is experiencing quick shifts toward growth due to factors like the governments' massive capital investments to develop healthcare infrastructure, offering advanced healthcare facilities, and implying attractive health insurance schemes.

KEY MARKET PLAYERS

Some of the notable companies in the global medical robots market profiled in the report are Intuitive Surgical Inc., Stryker Corporation, Hocoma AG, Mazor Robotics Ltd, Hansen Medical Inc., Accuray Incorporated, Omnicell Inc., Arxium, EKSO Bionics Holdings Inc., and Kirby Lester LLC.

RECENT HAPPENINGS IN THE MARKET

- In February 2020, Omnicell, Inc. announced the essential improvements in clinical trials in ROBOTIC IV insourcing offerings and leveled up Automation Technology investments.

- In November 2019, Medtronic launched the Mazor X Stealth Edition, bringing procedural solutions for surgery plans, implementation, and workflow. Professional surgeons have successfully performed their first spine surgery by using this edition.

- In August 2019, Capsa Healthcare released Kirby Lester, which is meant to provide excellent benefits for hospital patient pharmacies as it does not require technician calibration. Also, this robotic dispenser is to reduce errors while changing medications.

- In September 2019, Stryker Corporation, a leading robotics company, made a public statement that it agreed to acquire Mobius Imaging and Cardan Robotics to expand the business portfolio.

- In June 2018, FDA approval was received from the Japanese technology company Cyberdyne, which started contributing its HAL (hybrid assistive limb) exoskeleton to legal medical facilities in the US. To detect electrical signals, movement in a node in the patient’s body was caught by the sensors that are used by the exoskeleton. As a result, physical rehabilitation (lower limb disorders) were provided.

MARKET SEGMENTATION

This research report on the global medical robots market has been segmented & sub-segmented based on product, application, and region.

By Product

- Surgical Robots

- Laparoscopy Robotic Systems

- Orthopedic Robotic Systems

- Neurosurgical Robotic Systems

- Steerable Robotic Systems

- Rehabilitation Robotic Systems

- Therapeutic Robotic Systems

- Assistive Robotic Systems

- Prosthetic Robotic Systems

- Orthotic Robotic Systems

- Exoskeleton Robotic Systems

- Non-Invasive Radiosurgery Robotic Systems

- Hospital And Pharmacy Robotic Systems

- Pharmacy Robotic Systems

- Iv Robotic Systems

- Telemedicine Robots

By Application

- Laparoscopy

- Orthopedics

- Neurology

- Special Education

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How big is the global medical robots market size?

As per our research report, the global medical robots market size is forecasted to be worth USD 72.77 billion by 2033.

Does this report include the impact of COVID-19 on the medical robots market?

Yes, we have studied and included the COVID-19 impact on the global medical robots market in this report.

Which segment by product accounted for the major share in the medical robots market in 2024?

Based on product, the surgical robots segment led the medical robots market in 2024.

Which are the major players operating in the medical robots market?

Intuitive Surgical Inc., Stryker Corporation, Hocoma AG, Mazor Robotics Ltd, Hansen Medical Inc., Accuray Incorporated, Omnicell Inc., Arxium, EKSO Bionics Holdings Inc., and Kirby Lester LLC. are a few of the notable players in the global medical robots market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com