Middle East And Africa Buckwheat Products Market Size, Share, Growth, Trends, And Forecast Report - Segmented By Application, Form, Distribution Channel And Region(UAE, Israel, Other GCC Countries And Egypt, Sudan And Remaining Middle East Countries) - Industry Analysis, 2025 to 2033

Middle East and Africa Buckwheat Products Market Size

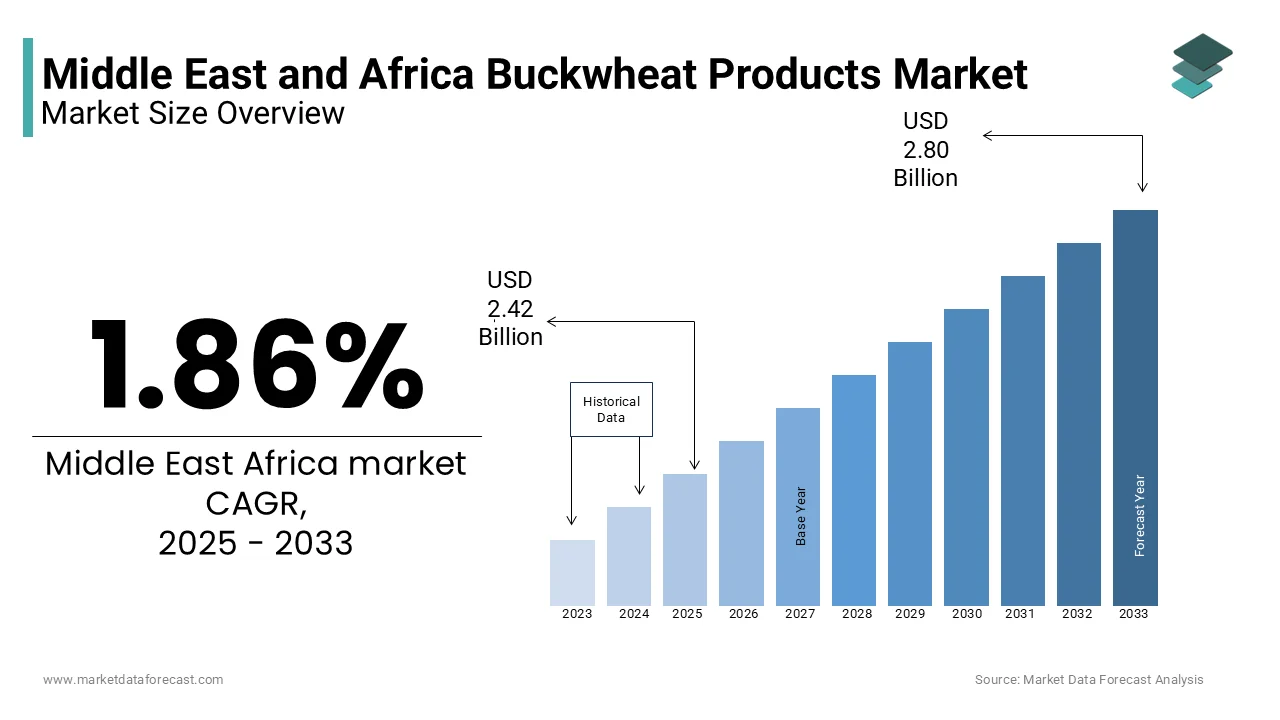

The Middle East and Africa buckwheat products market size was valued at USD 2.38 billion in 2024, and the market size is expected to reach USD 2.80 billion by 2033 from USD 2.42 billion in 2025. The market is growing at a CAGR of 1.86% during the forecast period.

Buckwheat is valued for its nutrient-rich seeds and gluten-free properties, making it an attractive alternative for health-conscious consumers. The Middle East and Africa Buckwheat Products Market encompasses a range of food items derived from buckwheat, including flour, groats, noodles, and ready-to-eat snacks. These products are increasingly being integrated into diets that seek functional benefits such as improved digestion, better glycemic control, and enhanced cardiovascular health.

In the Middle East, growing awareness around dietary wellness and chronic disease management has spurred interest in alternative grains, particularly among urban populations. Countries like the United Arab Emirates and Israel have witnessed a rise in demand for imported buckwheat-based products, driven by expatriate communities and evolving food trends. According to the Food and Agriculture Organization (FAO) , several pilot programs have been initiated in Egypt and Morocco to assess buckwheat's adaptability to semi-arid conditions, given its low water requirements and high nutritional value.

MARKET DRIVERS

Increasing Demand for Gluten-Free and Functional Foods

A major driver of the Middle East and Africa Buckwheat Products Market is the rising consumer preference for gluten-free and functional foods, particularly in urban centers across the Gulf Cooperation Council (GCC) countries and North Africa. With celiac disease and non-celiac gluten sensitivity becoming more widely recognized, there is a growing shift toward naturally gluten-free grains like buckwheat.

According to the World Gastroenterology Organisation , the prevalence of celiac disease in the Middle East ranges between 1% and 3% , with higher rates observed in genetically predisposed populations. In response, major supermarkets such as Carrefour UAE and Pick n Pay South Africa have expanded their gluten-free product lines, incorporating buckwheat-based options into mainstream shelves.

Apart from these, academic institutions like the American University of Beirut have conducted studies highlighting the role of buckwheat in managing diabetes and cholesterol levels, reinforcing its appeal among health-conscious consumers. Companies like Al Safi Danone in Saudi Arabia have introduced buckwheat-enriched dairy alternatives, aligning with broader dietary shifts toward plant-based nutrition.

Expansion of Organic and Sustainable Agriculture Initiatives

Another significant driver influencing the Middle East and Africa Buckwheat Products Market is the expansion of organic and sustainable agriculture initiatives, particularly in countries seeking climate-resilient crops. Buckwheat’s ability to thrive in poor soils with minimal irrigation makes it an attractive option for dryland farming and regenerative agriculture practices.

According to the Organic Agriculture Centre of Kenya , buckwheat exhibits strong allelopathic properties that suppress weeds and reduce the need for chemical herbicides, aligning with organic certification standards. Several pilot projects supported by the South African Agricultural Research Council have explored buckwheat’s viability as a rotational crop in maize and wheat systems, aiming to improve soil fertility and biodiversity.

Furthermore, international aid organizations such as the United Nations Development Programme (UNDP) have promoted buckwheat cultivation in drought-prone areas of Ethiopia and Sudan as part of climate adaptation strategies. These efforts aim to provide smallholder farmers with alternative income sources while enhancing food security through nutrient-dense grains.

MARKET RESTRAINTS

Limited Domestic Cultivation and Production Infrastructure

A major restraint facing the Middle East and Africa Buckwheat Products Market is the limited domestic cultivation and lack of specialized production infrastructure necessary for large-scale commercialization. Unlike traditional cereals such as wheat, millet, and sorghum, buckwheat remains a niche crop with minimal presence in national agricultural policies or subsidy frameworks. This scarcity of domestic production results in heavy reliance on imports, primarily from Europe and North America, which increases costs and limits accessibility for local consumers.

Moreover, the absence of dedicated harvesting, cleaning, and milling facilities tailored for buckwheat hampers post-harvest efficiency and product quality. Until investment flows into agronomic research, seed development, and processing infrastructure, the market will remain constrained by supply-side limitations, hindering broader adoption across the region.

High Cost and Limited Consumer Awareness

Another key restraint impacting the Middle East and Africa Buckwheat Products Market is the relatively high cost of buckwheat-based products combined with limited consumer awareness regarding their nutritional benefits. Due to small-scale importation and minimal domestic production, buckwheat often carries a premium price compared to staple grains, making it less accessible to budget-conscious households. This pricing disparity is even more pronounced in lower-income economies such as Nigeria and Yemen, where traditional grains dominate daily consumption.

Without targeted education campaigns and promotional activities, consumer adoption will remain restricted to expatriate communities and specialty health stores. Addressing this challenge requires coordinated efforts from industry players, government agencies, and academic institutions to raise awareness and make buckwheat products more economically viable for the broader population.

MARKET OPPORTUNITIES

Integration into School Feeding and Nutritional Programs

One of the most promising opportunities for the Middle East and Africa Buckwheat Products Market lies in its integration into school feeding and public health nutrition programs. Given buckwheat’s high protein content, rich mineral profile, and gluten-free nature, it presents a compelling option for improving dietary diversity and addressing micronutrient deficiencies among children.

In response, several governments are exploring the inclusion of alternative grains in school meal programs to enhance nutritional intake. Pilot trials in Egypt and Morocco have already demonstrated the feasibility of incorporating buckwheat porridge into midday meals, providing essential amino acids and fiber.

In the Middle East, refugee camps and humanitarian aid programs have also experimented with fortified buckwheat blends as part of emergency food assistance. As per the United Nations Children's Fund (UNICEF), these interventions have shown positive impacts on child growth indicators, encouraging wider adoption across regional food security initiatives. With continued support from policymakers and development agencies, buckwheat can play a vital role in public health strategies aimed at combating malnutrition and promoting sustainable food systems in the region.

Growing Popularity of Fermented and Gut-Health-Oriented Buckwheat Products

Another emerging opportunity for the Middle East and Africa Buckwheat Products Market is the growing popularity of fermented and gut-health-oriented food products. As global awareness around digestive wellness expands, there is increasing recognition of the role of probiotics and prebiotics in supporting immune function and metabolic health.

Buckwheat serves as an excellent substrate for fermentation due to its high polyphenol and fiber content, which promote the growth of beneficial gut bacteria. Researchers at the University of Cape Town have explored the use of fermented buckwheat in developing probiotic beverages and cultured breakfast bowls tailored to local tastes and dietary preferences.

In the United Arab Emirates and Saudi Arabia, health-focused startups are experimenting with enzyme-treated buckwheat powders for incorporation into functional drinks and dietary supplements. Meanwhile, artisanal bakeries in Nairobi and Johannesburg are introducing sourdough breads made with sprouted buckwheat, capitalizing on the clean-label movement and demand for natural ingredients.

MARKET CHALLENGES

Lack of Standardized Certification and Regulatory Frameworks

A major challenge confronting the Middle East and Africa Buckwheat Products Market is the absence of standardized certification and regulatory frameworks governing the production, labeling, and trade of buckwheat-based goods. Unlike well-established grains such as wheat and rice, buckwheat lacks clear classification and quality benchmarks across the region, creating inconsistencies in product offerings and consumer trust.

Similarly, in sub-Saharan Africa, the Southern African Development Community (SADC) has not yet issued formal guidelines for the inclusion of buckwheat in processed foods or infant nutrition products.

This regulatory ambiguity hinders market expansion, as food manufacturers face uncertainty regarding compliance requirements and export eligibility. Additionally, without official endorsement from national food safety authorities, consumer confidence in buckwheat’s authenticity and benefits remains limited.

Competition from Traditional Staple Grains and Imported Alternatives

Another critical challenge for the Middle East and Africa Buckwheat Products Market is intense competition from traditional staple grains and imported alternatives that dominate daily consumption patterns. Wheat, maize, sorghum, and millet remain deeply embedded in regional diets, supported by extensive government subsidies and entrenched supply chains.

In the Middle East, subsidized wheat flour and rice imports ensure affordability and availability, further limiting consumer switching to alternative grains.

Moreover, the influx of imported quinoa, amaranth, and chia seeds—often marketed as “superfoods” with strong branding—poses additional competition for buckwheat in health-conscious segments. Unless buckwheat producers and distributors develop targeted marketing strategies and secure policy support, the market risks remaining a niche product rather than achieving widespread adoption in the region.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

1.86% |

|

Segments Covered |

By Form, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UAE, Israel, KSA, South Africa, Egypt |

|

Market Leaders Profiled |

Homestead Organics, Birkett Mills, Galinta IR Partneriai, Wels Ltd, Krishna India, Ningxia Newfield Foods Co. Ltd, Ladoga LLC, UA Global Inc, Sichuan Huantai Industrial Co., Ltd, Jinan Jinnuoankang Biotech Co., Ltd, and others. |

SEGMENTAL ANALYSIS

By Form Insights

The raw & roasted buckwheat segment held the largest share of 54.5% in the Middle East and Africa Buckwheat Products Market in 2024, driven primarily by its widespread use in food processing, traditional cooking methods, and direct consumer consumption. This form is highly preferred for making porridge, baked goods, and gluten-free meals across both urban and semi-urban areas.

One key driver behind this dominance is the increasing incorporation of raw and roasted buckwheat into ready-to-cook and ready-to-eat products that cater to time-constrained consumers.

Besides, health-conscious consumers prefer raw and roasted forms due to their minimal processing, aligning with the clean-label movement in food retail. With rising awareness of functional foods and digestive wellness, this segment continues to maintain a strong foothold in the regional market.

The unhulled buckwheat segment is projected to grow at the fastest CAGR of 10.3% during the forecast period, fueled by increasing interest in sprouting and fermenting whole grains for enhanced nutritional benefits. Unlike hulled varieties, unhulled buckwheat retains its outer husk, allowing for germination and improved bioavailability of nutrients such as polyphenols and minerals.

A major growth factor is the expanding adoption of fermented and gut-friendly food trends across the region. Researchers at the University of Cape Town found that sprouted unhulled buckwheat exhibited higher antioxidant activity compared to processed forms , making it a favored ingredient in functional food development.

Moreover, organic farmers in Egypt and Kenya are increasingly cultivating unhulled buckwheat due to its resilience against pests and minimal need for chemical inputs. These factors collectively contribute to the rapid expansion of this segment in the Middle East and Africa market.

By Application Insights

The food industry accounted for a 76.5% of the Middle East and Africa Buckwheat Products Market in 2024, serving as the primary application area due to the crop’s versatility and nutritional value. Buckwheat is widely used in baking, porridges, pancakes, cereals, and meat substitutes, particularly within gluten-free and plant-based dietary segments.

One of the major drivers of this segment is the rising prevalence of celiac disease and non-celiac gluten sensitivity, which has led to increased demand for wheat-free alternatives. Buckwheat flour, being naturally gluten-free and rich in protein, has become a staple in alternative baking and pasta production.

Another key factor is the integration of buckwheat into mainstream food formulations by leading manufacturers. Companies such as Al Safi Danone in Saudi Arabia and Purity Foods in South Africa have expanded their buckwheat-based offerings, capitalizing on its clean-label appeal and high fiber content.

The cosmetics industry is anticipated to exhibit the highest CAGR of 11.2% in the Middle East and Africa Buckwheat Products Market, driven by growing incorporation of buckwheat extracts in skincare and personal care formulations. Known for its antioxidant-rich properties, buckwheat is increasingly used in facial creams, serums, body lotions, and hair care products targeting anti-aging and skin protection benefits.

According to the Journal of Cosmetic Dermatology indicate that buckwheat-derived flavonoids such as rutin help strengthen capillaries, reduce inflammation, and improve skin elasticity. In response to these findings, beauty brands including Burt’s Bees MENA and Alba Botanica Middle East have introduced buckwheat-infused product lines emphasizing natural ingredients and dermatological benefits.

Moreover, the rise of clean beauty movements has encouraged cosmetic companies to seek plant-based, hypoallergenic ingredients. With continued innovation and consumer preference shifts toward botanical skincare, this segment is poised for robust growth.

By Distribution Channel Insights

Supermarkets and hypermarkets accounted for 58.5% of total distribution channel revenue in the Middle East and Africa Buckwheat Products Market in 2024, owing to their broad consumer reach and extensive shelf presence. Major chains such as Carrefour UAE, Spinneys, and Shoprite South Africa have significantly expanded their offering of buckwheat-based products, ranging from flour and groats to ready-to-eat snacks.

One key reason for this segment’s dominance is the increasing availability of private label and branded buckwheat products in mainstream retail outlets.

Furthermore, promotional activities such as endcap displays, in-store tastings, and digital campaigns have boosted consumer awareness and trial rates. Retailers have also leveraged data analytics to identify regional demand patterns, enabling them to tailor product assortments accordingly.

Retail stores, particularly independent health food shops and specialty grocers, are expected to grow at the fastest CAGR of 9.8% in the Middle East and Africa Buckwheat Products Market, driven by rising consumer engagement with niche wellness products and locally sourced ingredients.

Unlike mass-market supermarkets, independent retail stores often emphasize organic, ethically sourced, and artisanal food items, aligning closely with the values of health-conscious shoppers.

These stores frequently offer educational resources, recipe ideas, and personalized customer service, fostering stronger brand loyalty among buckwheat consumers. Additionally, partnerships between local producers and small retailers have facilitated direct-to-consumer sales models, reducing reliance on centralized supply chains.

REGIONAL ANALYSIS

Kingdom of Saudi Arabia –

Saudi Arabia held the largest share of the Middle East and Africa Buckwheat Products Market, accounting for 24.3% of total regional consumption in 2024, driven by strong institutional support and growing health awareness among consumers. The country’s Vision 2030 initiative has emphasized nutrition security and food diversification, encouraging the inclusion of alternative grains like buckwheat in national dietary guidelines.

According to the Saudi Ministry of Health, rising cases of diabetes and cardiovascular diseases have prompted dietary recommendations that favor low-glycemic-index foods such as buckwheat.

Major food processors like Al Safi Danone and Savola Group have introduced buckwheat-enriched dairy and bakery products, aligning with broader health trends.

United Arab Emirates

The United Arab Emirates contributes significantly to the Middle East and Africa Buckwheat Products Market, distinguished by its rapidly growing urban demand and premium product positioning. Dubai and Abu Dhabi serve as key hubs for international food imports, attracting expatriate communities familiar with buckwheat and driving localized consumption.

Supermarkets such as Waitrose and Choithrams have expanded their buckwheat selections, catering to affluent consumers seeking clean-label and functional foods.

Moreover, the UAE government has supported pilot farming projects to test buckwheat’s viability under controlled irrigation systems, aiming to reduce import dependency. With continued investment in food innovation and sustainable agriculture, the UAE is emerging as a pivotal market for buckwheat products in the Middle East.

Israel

Israel is recognized for its early adoption of buckwheat in functional and organic food sectors. The country's advanced food science infrastructure and strong emphasis on dietary wellness have positioned buckwheat as a key ingredient in health-focused formulations.

Academic institutions such as Tel Aviv University have conducted clinical studies demonstrating buckwheat’s role in improving lipid profiles and insulin sensitivity, reinforcing its acceptance among medical professionals.

Local startups and food tech firms have capitalized on this momentum, introducing buckwheat-based protein bars, cereal blends, and infant nutrition products tailored to modern consumer preferences. This combination of scientific validation, culinary innovation, and export-oriented production is strengthening Israel’s position in the regional buckwheat landscape.

South Africa

South Africa emerging as a key player due to its focus on sustainable agriculture and public health initiatives. Universities and agricultural research bodies have been exploring buckwheat’s potential in climate-resilient farming and school feeding programs aimed at addressing malnutrition.

According to the South African Agricultural Research Council (ARC) , experimental trials in KwaZulu-Natal and Western Cape provinces have demonstrated buckwheat’s adaptability to cooler, higher-altitude regions. The ARC also reported that buckwheat porridge could be successfully incorporated into midday meal programs without requiring significant changes to existing food preparation infrastructure.

In addition, health-conscious consumers in urban centers such as Cape Town and Johannesburg are driving demand for buckwheat-based bakery products and breakfast cereals. Retailers like Woolworths and Pick n Pay have expanded their organic and gluten-free sections to include buckwheat flour and ready-to-eat options, reflecting growing consumer interest.

Egypt

Egypt is playing a crucial role in testing the feasibility of buckwheat cultivation under semi-arid conditions. The Egyptian Ministry of Agriculture, in collaboration with international organizations such as the FAO, has launched several pilot projects to assess buckwheat’s performance in saline soils and water-scarce environments. Additionally, Cairo-based health food brands have started incorporating imported buckwheat into gluten-free breads and pastries, catering to a growing base of diet-conscious consumers. These efforts suggest that Egypt may play a strategic role in expanding buckwheat’s footprint across North Africa in the coming years.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

key market payers of are Homestead Organics, Birkett Mills, Galinta IR Partneriai, Wels Ltd, Krishna India, Ningxia Newfield Foods Co. Ltd, Ladoga LLC, UA Global Inc, Sichuan Huantai Industrial Co., Ltd, Jinan Jinnuoankang Biotech Co., Ltd

The competition in the Middle East and Africa Buckwheat Products Market is characterized by a mix of multinational food corporations, regional producers, and emerging specialty brands vying to capture a share of a rapidly evolving niche sector. While global players bring scale, established distribution networks, and strong branding, regional and local firms are leveraging proximity, cultural understanding, and agility to carve out unique positions. The market remains relatively fragmented, allowing new entrants to gain traction by focusing on specific consumer segments such as gluten-free, plant-based, or organic diets.

Competitive differentiation increasingly hinges on transparency in sourcing, product functionality, and alignment with broader wellness trends. With rising disposable incomes, urbanization, and digital connectivity, consumers across the region are becoming more informed and selective, driving demand for high-quality, health-focused food choices. As a result, companies are intensifying efforts in marketing, product development, and supply chain optimization to differentiate themselves in an increasingly crowded space. Additionally, the growing influence of e-commerce and direct-to-consumer models is reshaping how buckwheat products reach end users, further intensifying the competitive landscape. Success in this market will depend not only on product quality but also on the ability to resonate with evolving consumer values and dietary priorities.

TOP PLAYERS IN THE MIDDLE EAST AND AFRICA BUCKWHEAT PRODUCTS MARKET

Al Safi Danone (Saudi Arabia)

Al Safi Danone plays a pivotal role in integrating buckwheat into functional food products across the Middle East, particularly in Saudi Arabia. Known for its dairy and plant-based nutrition offerings, the company has introduced buckwheat-enriched yogurts and breakfast blends aimed at health-conscious consumers. By leveraging its extensive distribution network and commitment to innovation, Al Safi Danone contributes significantly to raising awareness and acceptance of buckwheat as a valuable dietary component.

Purity Foods (South Africa)

Purity Foods is a leading natural foods brand that has incorporated buckwheat into various product lines, including gluten-free flours, porridge mixes, and baked goods. The company supports organic farming practices and promotes sustainable sourcing, aligning with growing consumer demand for clean-label and ethically produced food items. Through strategic retail partnerships and educational campaigns, Purity Foods is expanding buckwheat’s presence beyond niche markets in South Africa.

Carrefour Middle East (UAE)

Carrefour Middle East serves as a key retail gateway for buckwheat products in the region, offering a wide selection of imported and locally sourced buckwheat-based goods. As part of its broader health and wellness initiative, the company curates premium and specialty grain products, making them accessible to a diverse customer base. Its influence extends beyond retail by shaping consumer trends and encouraging regional suppliers to develop buckwheat-based options.

TOP STRATEGIES USED BY KEY MARKET PLAYERS

One major strategy employed by key players in the Middle East and Africa Buckwheat Products Market is product diversification and formulation innovation. Companies are continuously expanding their portfolios to include ready-to-eat snacks, baked goods, and plant-based alternatives that feature buckwheat as a core ingredient. This approach allows them to cater to evolving dietary preferences while enhancing the versatility and appeal of buckwheat in mainstream cuisine.

Another critical strategy involves consumer education and brand storytelling . Leading brands are investing in digital marketing, recipe development, and social media engagement to raise awareness about buckwheat’s nutritional benefits and culinary applications. By highlighting its gluten-free nature, protein content, and sustainability profile, companies aim to build stronger emotional connections with health-oriented shoppers.

Lastly, strategic partnerships with organic farmers and regional suppliers are helping key players secure reliable raw material sources while supporting local agricultural ecosystems. These collaborations not only ensure product quality but also reinforce corporate commitments to ethical sourcing and environmental stewardship, strengthening market credibility and long-term growth potential.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Al Safi Danone launched a dedicated line of buckwheat-infused dairy alternatives in Saudi Arabia, targeting health-conscious consumers seeking plant-based nutrition with added fiber and protein, reinforcing the company’s commitment to functional food innovation.

- In April 2024, Purity Foods expanded its distribution network in Southern Africa, partnering with independent health stores and online retailers to increase accessibility of buckwheat-based products, particularly among urban professionals and fitness enthusiasts seeking gluten-free meal options.

- In July 2024, Carrefour Middle East introduced exclusive shelf spaces for buckwheat products in select hypermarkets across Dubai and Abu Dhabi, accompanied by in-store tastings and digital promotions to educate consumers on preparation methods and health benefits.

- In September 2024, the Egyptian Ministry of Agriculture collaborated with private agri-food startups to conduct pilot-scale buckwheat processing trials, aiming to develop locally sourced flour for inclusion in school feeding programs and public health initiatives.

- In November 2024, a consortium of UAE-based food tech firms partnered with Israeli research institutions to explore enzyme-treated buckwheat powders for use in functional beverages and dietary supplements, signaling deeper cross-border collaboration in alternative grain innovation.

MARKET SEGMENTATION

This Research Report on Middle East and Africa Buckwheat Products Market is segmented and sub segmented into following categories:

By Application

-

Food industry

-

Beverage industry

-

Cosmetics industry

-

Textile industry

By Form

-

Unhulled

-

Raw

-

Roasted

By Distribution Channel

-

Retail stores

-

Supermarkets

-

Hypermarkets

-

E-retailers

By Region

-

UAE

-

Israel

-

KSA

-

South Africa

-

Egypt

Frequently Asked Questions

1. What is the market size and CAGR of the Middle East and Africa buckwheat products market?

The market size is expected to reach USD 2.80 billion by 2033, growing at a CAGR of 1.86% from 2025 to 2033.

2.What are the nutritional benefits of buckwheat products?

Buckwheat products are rich in nutrients such as protein, fiber, vitamins, minerals, and antioxidants. They offer various health benefits, including improved heart health, digestion, and blood sugar control.

3.How are buckwheat products incorporated into MEA cuisine?

Buckwheat products are used in a variety of MEA dishes, including traditional recipes like kasha, soba noodles, and porridges. They are also utilized in modern dishes as gluten-free alternatives to wheat-based products.

4.What types of buckwheat products are commonly consumed in the MEA region?

Common buckwheat products in the MEA region include buckwheat flour used in baking, buckwheat groats in savory dishes and salads, buckwheat noodles in soups and stir-fries, and buckwheat snacks such as crackers and granola bars.

5. Which countries are major contributors to market growth in this region?

UAE, Israel, KSA, South Africa, and Egypt are among the leading contributors to market expansion.

6. What are the major applications of buckwheat products in MEA?

Buckwheat is widely used in food products like noodles, flour, snacks, and cereals for both retail and foodservice sectors.

7. What challenges are limiting faster market growth?

Limited consumer awareness and relatively high prices compared to conventional grains are key restraints.

8. What is driving demand for gluten-free grains like buckwheat in the region?

The increase in gluten intolerance, along with a growing wellness movement, is driving demand for gluten-free options.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com