Middle East and Africa Industrial Lubricants Market Size, Share, Trends & Growth Forecast Report - Segmented By Base Oil (Mineral Oil, Synthetic Oil, Bio-Oil), Product, End-User, and Country (KSA, UAE, Israel, rest of GCC countries, South Africa, Ethiopia, Kenya, Egypt, Sudan and Rest of MEA), Industry Analysis from 2025 to 2033

Middle East and Africa Industrial Lubricants Market Size

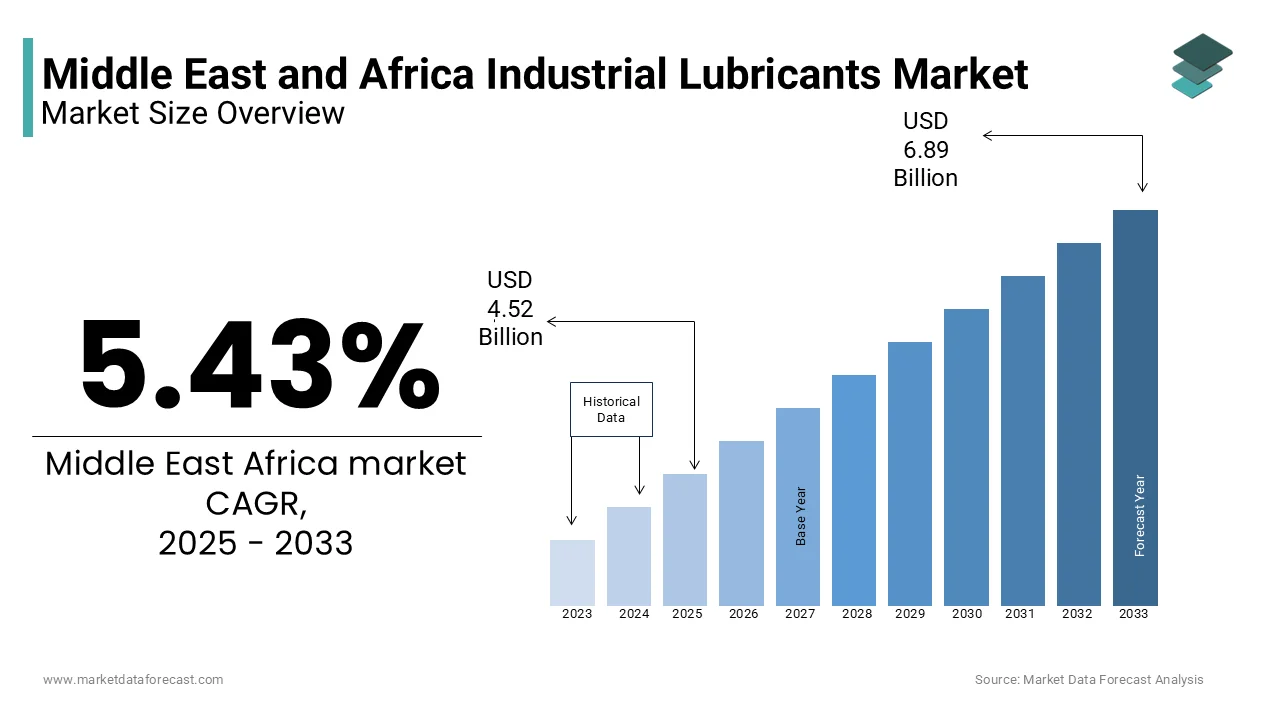

The Middle East and Africa Industrial Lubricants market was valued at USD 4.28 billion in 2024 and is anticipated to reach USD 6.89 billion by 2033 from USD 4.52 billion in 2025, with a CAGR of 5.43% during the forecast period.

Industrial lubricants in the Middle East and Africa are specialized substances vital for reducing friction and wear between moving parts in diverse industries. These oils, greases, and fluids enhance machinery performance, durability, and efficiency in manufacturing, automotive, energy, and construction sectors. By preventing corrosion and improving reliability, they support smoother operations in heavy machinery. Tailored for specific applications and environmental conditions, these lubricants are crucial for reducing maintenance costs and ensuring top-notch performance across industries in the region.

MARKET DRIVERS

The robust market growth is mostly propelled by the ongoing industrialization and economic development across the region. As countries invest in expanding their industrial sectors, the demand for industrial lubricants has surged. The escalating levels of production and the proliferation of manufacturing activities necessitate reliable lubricants to ensure seamless machinery operation. This burgeoning market is fuelled by the critical role lubricants play in enhancing the efficiency and durability of industrial machinery. The Middle East and Africa's industrial landscape, marked by increased infrastructure projects, a growing automotive sector, and advancements in mining and energy exploration, further amplifies the demand for high-performance lubricants. Additionally, evolving regulatory standards and a focus on environmentally sustainable lubricant solutions contribute to the dynamic growth of the industrial lubricants market in the Middle East and Africa.

The Middle East and Africa Industrial Lubricants Market is also experiencing another driver, which is technological advancements in lubricant technology. The development of high-performance and specialty lubricants stands out as a key driver, fuelling market growth. These advanced lubricants have become instrumental in enhancing industrial operations by delivering improved efficiency, prolonging equipment life, and mitigating maintenance costs. Industries across the region are increasingly adopting these cutting-edge lubricants to optimize machinery performance and ensure reliability. As a result, the market is witnessing a shift towards lubricants that not only meet basic requirements but also offer added benefits, aligning with the growing needs of diverse sectors. The adoption of such innovative lubricant solutions underscores the commitment to efficiency and sustainability in industrial practices, positioning the Middle East and Africa as a dynamic hub for the evolution of industrial lubricant technologies.

MARKET RESTRAINTS

The market demand grapples with a significant restraint stemming from the Price Volatility of Raw Materials. The inherent fluctuations in the prices of essential components like base oils and additives, critical to formulating industrial lubricants, exert a substantial impact on the overall cost of production. Economic and geopolitical factors further exacerbate this volatility, creating an environment where sudden shifts in prices can ripple through the industry, affecting the profit margins of lubricant manufacturers. This challenge necessitates a strategic approach to risk management and pricing strategies within the market. Manufacturers must navigate this dynamic landscape, balancing the need for cost-effective production with the imperative of maintaining product quality and competitiveness in the face of unpredictable raw material pricing, ensuring resilience and sustainability in the Middle East and Africa’s industrial lubricants sector.

However, the Middle East and Africa Industrial Lubricants Market also confronts another challenge in the form of Market Competition which cause market downfall. The landscape is marked by intense rivalry among lubricant manufacturers, with numerous players vying for market share. This heightened competition exerts pressure on pricing structures, potentially leading to reduced profit margins for individual companies. The quest for market dominance propels a constant drive for innovation and cost efficiency, but it also demands strategic differentiation to withstand pricing pressures. Manufacturers must navigate this competitive milieu by focusing on product differentiation, superior quality, and innovative solutions to not only retain profitability but also to meet the evolving needs of industries. The ability to adapt to changing market dynamics and customer preferences becomes pivotal in ensuring sustained success within the fiercely competitive industrial lubricants sector in the Middle East and Africa.

SEGMENTAL ANALYSIS

By Base Oil Insights

In the Middle East and Africa Industrial Lubricants Market growth, mineral oil serves as the dominant base oil due to its widespread use and cost-effectiveness. Also its lubricants are derived from crude oil and offer good lubrication properties at a relatively lower cost, making them a popular choice for various industrial applications.

Synthetic oils, although gaining traction, constitute a smaller market share due to their higher production costs. However, the demand for synthetic oils is rising, driven by their superior performance in extreme conditions, including temperature and pressure variations.

By Product Insights

Engine oil holds the largest CAGR in market share by owing to the region's extensive focus on various industrial activities, including manufacturing, transportation, and energy production. Engine oil is crucial for the smooth operation and maintenance of engines, making it a high-demand lubricant. Metalworking fluid is another significant product, driven by the growth in manufacturing and construction activities.

By End-User Insights

The automotive sector emerges as a leading end-user, fuelled by the region's burgeoning population, urbanization, and increasing vehicle ownership. The automotive industry's reliance on lubricants for engines and machinery maintenance significantly contributes to the dominance of this sector. Following closely is the construction industry, driven by robust infrastructure development projects and urban expansion initiatives. Power generation is another substantial end-user, particularly in regions emphasizing energy infrastructure growth.

REGIONAL ANALYSIS

KSA stands out as a dominant and most important player, driven by its thriving oil and petrochemical industries. The abundance of crude oil resources contributes to a robust demand for industrial lubricants, particularly in the oil and gas sector.

UAE (United Arab Emirates) with its diverse economy, is a second key player in the industrial lubricants market. The country's emphasis on infrastructure development, manufacturing, and transportation fuels the demand for lubricants across various sectors.

KEY MARKET PLAYERS

The major key players in the Middle East and Africa Industrial Lubricants Market are ExxonMobil, Corporation, Royal Dutch Shell plc, BP plc, Chevron Corporation, TotalEnergies SE, LUKOIL Oil Company, PETRONAS Lubricants International, FUCHS Petrolub SE, Idemitsu Kosan Co., Ltd. M, Sinopec Limited, ENOC Group, Gulf Oil Middle East Ltd., Qalaa Holdings (ASCOM), ORYX Energies, Addinol Lube Oil GmbH, Oman Oil Marketing Company, ENGIE Africa, Oryx Oil Company Limited, Master Lubricants Company (MLC), and others.

MARKET SEGMENTATION

This research report on the Middle East and Africa Industrial Lubricants Market has been segmented and sub-segmented based on the following categories.

By Base Oil

- Mineral oil

- Synthetic oil

- Bio-oil

By Product

- Engine oil

- Metalworking fluid

- Hydraulic fluid

- Turbine oil

- Grease

- Gear

- Compressor

By End-User

- Automotive

- Construction

- Power generation

- Metal

- cement

- manufacturing

- food

By Country

- KSA

- UAE

- Isarel

- South Africa

- Ethiopia

- Kenya

- Egypt

- Sudan

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]