Global Military Radar Market Size, Share, Trends, & Growth Forecast Report – Segmented by Platform (Airborne Radar, Ground Radar, Naval Radar), Range (Long, Medium, Short, Very Short), Application (Weapon Guidance, Airspace Monitoring & Traffic Management, Airborne Mapping), Frequency (C-Band, S-Band, X-Band, L-Band, UHF/VHF), Component (Transmitter, Antenna, Receiver), & Region - Industry Forecast From 2024 to 2032

Global Military Radar Market Share Size (2024 to 2032)

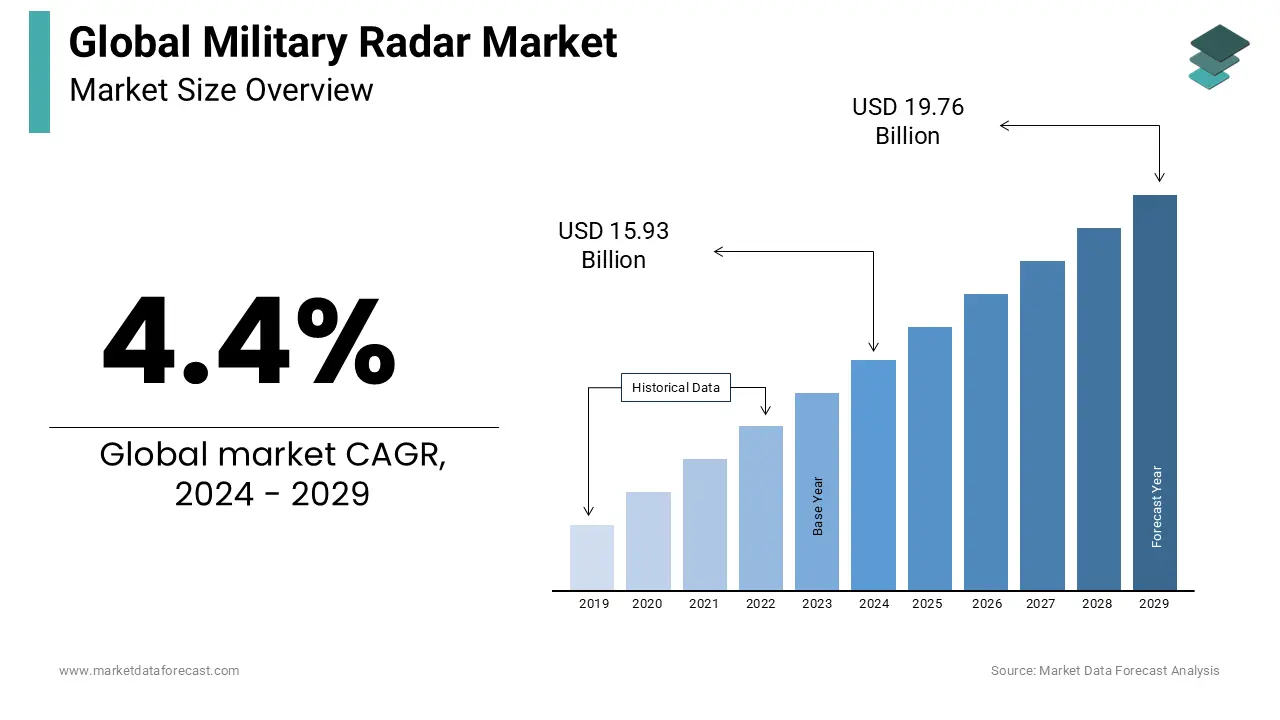

The global Military Radar Market was worth USD 15.26 billion in 2023. The global market is foreseen to expand from USD 15.93 billion in 2024 to USD 22.48 billion by 2032, and also register a CAGR of 4.4% during the foreseen period.

Radar systems in the military are extremely useful for early missile detection, air traffic control, air and land surveillance, navigation at sea, and many more. It is also used as a terrorist sweeping radar with a camera that uses ultrasonic frequency and the detection of various objects which uses image processing to provide greater security at national borders.

Advances in range, detection, identification and integration with other sensors, and adaptability to new missions, platforms, and environments are driving demand for new military radars worldwide. Growth in defense spending supports market growth. The increasing use of drones, advanced ballistic missiles, and electronic warfare systems has forced several countries to improve their radar capabilities.

MARKET TRENDS

Over the years, the number of airstrikes around the world has increased, leading to significant investments in aerial radars. The rise in the use of stealth aircraft and tactical drones is supposed to propel the growth of aerial radars over the envisioned period. The cost-effectiveness and ease of operations of unmanned platforms, compared to manned platforms, has contributed to the rapid adoption of these unmanned systems in defense applications (for surveillance and attack operations). Unmanned platforms are largely deployed by military organizations in conflict regions around the world. In addition, captive aerostat radar systems are used as low-level airborne ground surveillance systems in some countries. These large-scale investments in R&D and the acquisition of unmanned systems can continue to drive the market for military aerial radars in the coming years.

MARKET DRIVERS

The increasing purchase of radar and air defense systems due to increasing regional instability and transnational conflicts will boost the market for military radars. Likewise, the development of drones and UAVs will also drive the growth of the global military radar market during the outlook period.

The factor that may hold back market growth is the high expenses related to upgrading military radars, which is expected to hamper the market boom. However, the increasing demand for ground surveillance radars for border surveillance and the need for next-generation air and missile defense systems create new opportunities in the military radar market during the forecast period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

4.4% |

|

Segments Covered |

By Platform, Application, Range, Frequency, Component, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Raytheon Technologies Corporation (USA), Lockheed Martin Corporation (USA), Israel Aerospace Industries (Israel), Thales Group (France), and Leonardo SPA (Italy). |

SEGMENTAL ANALYSIS

Global Military Radar Market Analysis By Platform

The market is divided into airborne radar, ground radar, and naval radar. The ground radar/land radar segment is expected to dominate the market due to increased cross-border conflicts and geopolitical disputes between various countries. The airborne radar segment is supposed to grow at a higher CAGR during the forecast period due to increasing demand for UAV radars and increased fighter jet purchases in developing countries such as India.

Global Military Radar Market Analysis By Range

The market is classified as long, medium, short, and very short. The short-range segment is foreseen to dominate the market during the outlook period due to its wide range of use for surveillance, security, and border control applications. The long-range radar segment is expected to be the fastest-growing segment due to the increasing demand for long-range radars for naval surveillance and maritime operations.

Global Military Radar Market Analysis By Application

The market is segmented into airspace surveillance and traffic management, weapon guidance, aerial mapping, ground surveillance, and intrusion detection, navigation, and others. The ground surveillance and intrusion detection segment are likely to dominate the military radar systems market share owing to the increasing adoption of radar for border security. Growing cross-border disputes have resulted in a hike in the call for radar systems for both surveillance and threat detection.

Global Military Radar Market Analysis By Radar Frequency

The market is categorized into C-band, S-band, X-band, L-band, UHF / VHF, and Ku / K / Ka-band. The UHF / VHF frequency segment is estimated to be the fastest-growing segment due to its growing demand for Synthetic Aperture Radar (SAR). In addition, the growing demand for high-frequency radars for aviation and maritime applications is supposed to support the market growth.

Global Military Radar Market Analysis By Components

The market is categorized into the transmitter, antenna, receiver, duplexer, and others. The antenna segment is determined to become the largest and fastest-growing segment due to the increasing demand for advanced military surveillance radars and tracking systems. The increase in cross-border conflicts between countries like China and India has led to an increase in demand for advanced antennas that are reliable, efficient, and provide real-time communications.

REGIONAL ANALYSIS

The North American market dominated the military radar business and was foreseen to continue this trend in the projection period. The Middle East has long been a conflict-prone region due to border disputes and tensions in countries such as Saudi Arabia, Iraq, and Syria. The uncertainty of regional power and local conflicts have led to an increase in arms imports to the region. These concerns have led to increased defense spending and the purchase of these radars to detect threats, which is expected to drive market growth. Additionally, changing combat methods such as cyber and electronic warfare are expected to create opportunities for radar systems in this locale.

KEY MARKET PARTICIPANTS

The global military radar market is dominated by a few well-established players such as Raytheon Technologies Corporation (USA), Lockheed Martin Corporation (USA), Israel Aerospace Industries (Israel), Thales Group (France), and Leonardo SPA (Italy).

RECENT HAPPENINGS IN THE MARKET

June 2021 - The US Missile Defense Agency awarded Raytheon Technologies a $ 2.3 billion contract to produce and supply seven gallium nitride-based AN / TPY-2 radars for the Terminal High Altitude Area Defense (THAAD) system. These X-band radars are used to visualize ballistic missile threats.

March 2021: India received a US $ 40 million defense agreement for the delivery of four military radars built by Bharat Electronics Limited to Armenia. The deal is expected to boost India's defense sector and create opportunities for markets in Latin America, the Middle East, and Southeast Asia.

February 2021 - Northrop Grumman has been awarded a $ 262.3 million modification contract from the US Air Force to supply 90 active scanning electronically controlled radars (EASA) for the USAF's fleet of F-16 aircraft.

In October 2019, Turkish government officials announced the acquisition of S-400 air defense systems from Russia. Growing disputes in the South China Sea between China and its neighboring countries, such as Vietnam, Indonesia, Taiwan, Malaysia, and the Philippines, have led to an increase in the defense budget of these countries.

DETAILED SEGMENTATION OF THE GLOBAL MILITARY RADAR MARKET INCLUDED IN THIS REPORT

This research report on the global military radar market has been segmented and sub-segmented based on the platform, range, application, radar frequency, components, and region.

By Platform

- Airborne Radar

- Ground Radar

- Naval Radar

By Application

- Weapon Guidance

- Airspace Monitoring & Traffic Management

- Airborne Mapping

By Range

- Long

- Medium

- Short

- Very Short

By Frequency

- C-Band

- S-Band

- X-Band

- L-Band

- UHF/VHF

By Component

- Transmitter

- Antenna

- Receiver

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What are the key factors driving the growth of the military radar market?

Key factors driving the growth include increasing defense budgets worldwide, advancements in radar technology, growing geopolitical tensions, and the need for enhanced border security and surveillance.

What types of military radar systems are most commonly used?

Common types of military radar systems include ground-based radar, naval radar, airborne radar, and space-based radar. Among these, ground-based radar systems are the most widely used.

How are technological advancements influencing the military radar market?

Technological advancements such as the development of Active Electronically Scanned Array (AESA) radars, quantum radar technology, and enhanced signal processing capabilities are significantly improving the performance and capabilities of military radar systems.

What is the future outlook for the global military radar market?

The future outlook for the global military radar market is positive, with sustained growth expected due to ongoing technological advancements, increasing defense budgets, and the rising need for sophisticated surveillance and defense systems in response to evolving security threats.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com