Global Mining Equipment Market Size, Share, Trends, & Growth Forecast Report By Type (Mineral Processing Equipment, Surface Mining Equipment, Underground Mining Equipment, Mining Drills & Breakers, Crushing, Pulverizing & Screening Equipment, and Others), Application (Metal Mining, Mineral Mining and Coal Mining) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Mining Equipment Market Size

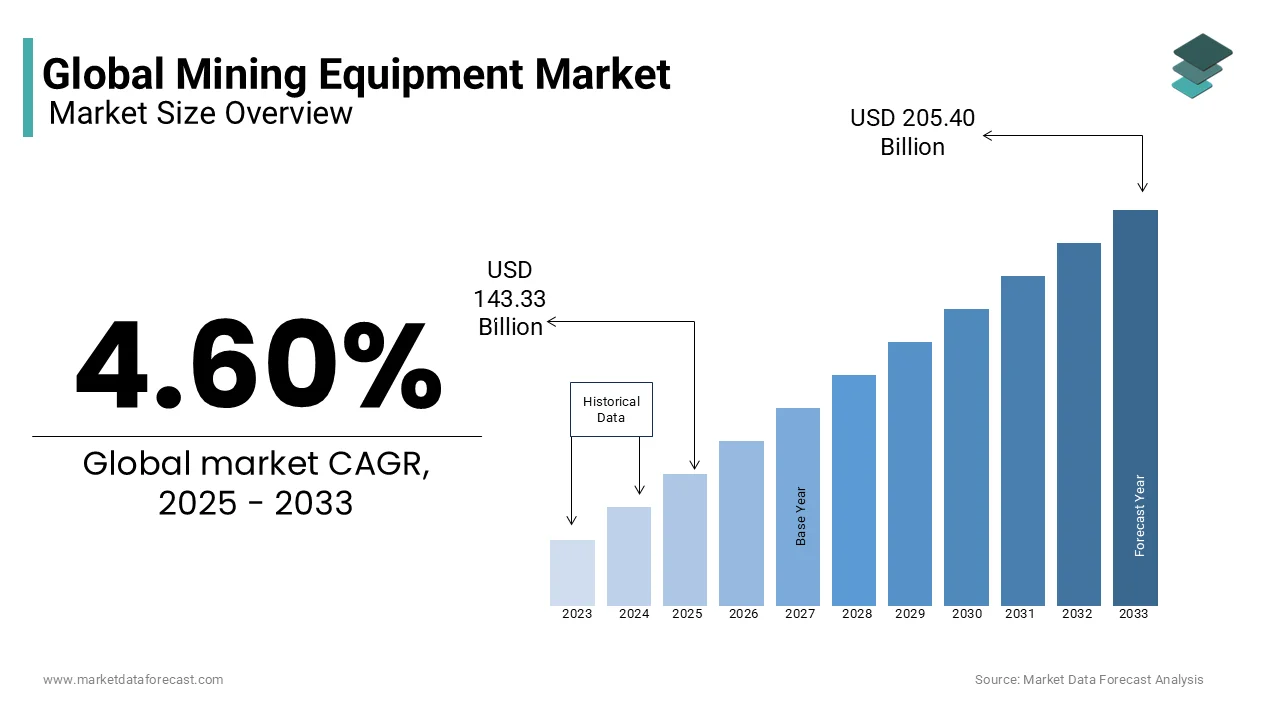

The global mining equipment market was worth USD 137.03 billion in 2024. The global market is estimated to grow at a CAGR of 4.60% from 2025 to 2033, and the global market size is projected to be valued at USD 205.40 billion by 2033 from USD 143.33 billion in 2025.

The mining equipment market is providing the essential machinery and tools required for the extraction and processing of geological resources. This sector encompasses a diverse range of equipment, including bulldozers, drilling rigs, excavators, haul trucks, and continuous miners, each designed to operate in some of the most challenging environments on Earth. Mining equipment plays a critical role in supporting industries such as energy production, construction, and manufacturing by ensuring a steady supply of raw materials like coal, iron ore, copper, and rare earth elements. According to the International Energy Agency, the demand for critical minerals such as lithium, cobalt, and nickel has surged by over 20% annually in recent years, driven by the global push toward electric vehicles and renewable energy systems.

Beyond market-specific figures, broader statistics highlight the significance of the mining equipment sector in shaping global resource utilization. For instance, the World Bank estimates that approximately 30% of the world’s energy consumption is linked to the extraction and processing of mineral resources, underscoring the industry's substantial energy footprint. Additionally, the United Nations Environment Programme reports that mining operations are responsible for nearly 10% of global deforestation, emphasizing the environmental challenges associated with this sector. As technological advancements continue to permeate the industry, automation and electrification are gaining traction, with PwC noting that over 60% of mining companies are investing in digital solutions to improve safety and operational efficiency. These developments reflect a growing emphasis on sustainability and innovation, positioning the mining equipment market at the forefront of efforts to balance resource extraction with ecological preservation.

MARKET DRIVERS

Growing Demand for Critical Minerals

The need for important minerals like lithium, cobalt, and nickel is driving the mining equipment market. These minerals are used in electric vehicles, renewable energy, and electronics. The International Energy Agency says global lithium demand could grow 40 times by 2040 as clean energy becomes more popular. Cobalt demand is also rising by 20-30% each year. This has led to more mining activities, which means more equipment is needed. Mining companies are buying advanced machines to meet production goals. The United States Geological Survey says global lithium production grew from 75,000 metric tons in 2020 to 100,000 metric tons in 2022. This shows how mining is expanding and increasing equipment demand.

Technological Advancements in Mining

New technologies are improving the mining equipment market by making operations safer and more efficient. Automation, IoT, and electrification are key trends. PwC says over 60% of mining companies are using digital tools to boost productivity and reduce risks. For example, autonomous haul trucks can cut fuel use by 10%, according to Deloitte. As per the estimates automation can make mining 25-30% more productive. These changes lower costs and solve labor shortages. Rio Tinto’s autonomous trucks moved over 1 billion tons of material in 2022, showing how effective technology can be. These advancements encourage mining firms to upgrade their equipment, boosting market growth.

MARKET RESTRAINTS

High Capital Investment Requirements

A big challenge for the mining equipment market is the high cost of buying and maintaining machinery. Advanced mining equipment is very expensive. Small and medium-sized mining companies often cannot afford these machines, making it hard to compete. The World Bank notes that maintenance costs can be 40% of total expenses. In poorer regions, lack of funding makes this worse. Many mining operations rely on old equipment, which lowers productivity and harms the environment. This financial barrier slows market growth.

Environmental Regulations and Sustainability Concerns

Strict environmental rules are a major challenge for the mining equipment market. Governments are enforcing rules to reduce mining’s impact on nature. The United Nations Environment Programme says mining causes 7% of global deforestation. Following these rules often requires costly upgrades or cleaner technologies. The International Council on Mining and Metals says meeting emissions standards can raise costs by 15-20%. Public opposition to mining projects due to environmental concerns has also delayed work. These factors create problems for equipment makers and mining companies, as they must balance profits with sustainability.

MARKET OPPORTUNITIES

Electrification of Mining Equipment

Switching to electric mining equipment is a big opportunity for the market. Electric machines help reduce carbon emissions and align with global green goals. BloombergNEF says electric equipment could cut mining emissions by 30% by 2030. Companies like BHP and Vale are investing in electric fleets. BHP aims to cut its carbon footprint by 30% by 2030. The International Renewable Energy Agency says electric equipment can lower fuel costs by 25% and maintenance by 20%. Governments are also offering incentives. For example, Canada’s Clean Technology Investment Tax Credit supports low-emission equipment.

Expansion into Emerging Markets

Emerging markets offer a big opportunity for the mining equipment market. Africa, Latin America, and Asia-Pacific have many untapped mineral resources, attracting investments. The African Development Bank states Africa holds 30% of the world’s minerals, including gold and platinum. The International Monetary Fund reports that Latin America produces 40% of global copper. As mining grows in these areas, equipment demand will rise. India’s Ministry of Mines predicts a 12% annual increase in mining output over the next five years. Companies that focus on these markets can benefit from rising equipment demand, creating long-term growth and strengthening their position globally.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain problems are a big challenge for the mining equipment market. The COVID-19 pandemic caused delays in manufacturing and shipping. The International Chamber of Shipping stresses global shipping costs rose by over 300%, delaying equipment delivery. The World Economic Forum reports that 70% of mining companies faced supply chain issues in 2022, causing delays and higher costs. Geopolitical tensions, like trade restrictions, also affect supply chains. For example, China controls 80% of rare earth processing, as per the United States Geological Survey, making the industry vulnerable. These disruptions make it hard to get equipment on time, affecting mining operations.

Workforce Safety and Labor Shortages

Safety and labor shortages are major challenges for the mining equipment market. Mining is dangerous, with the International Labour Organization reporting over 15,000 deaths annually. While better equipment can improve safety, there are not enough skilled workers. Deloitte pointing out that 74% of mining leaders see labor shortages as a top issue. Older workers are retiring, and fewer young people are joining the industry. This affects equipment use and productivity. Strict safety rules require extra training, raising costs. For example, the Mine Safety and Health Administration enforces detailed safety steps, which can delay projects. New solutions, like remote operation tools, are needed to attract workers and improve safety.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.60% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BelAZ, Komatsu Ltd., Liebherr Group, Guangxi LiuGong Machinery Co., Ltd, Metso Oyj, Sepro Mineral Systems Corp., Volvo Construction Equipment, Sandvik AB, Hitachi Construction Machinery Co. Ltd, and Terex Corporation. |

SEGMENT ANALYSIS

By Type Insights

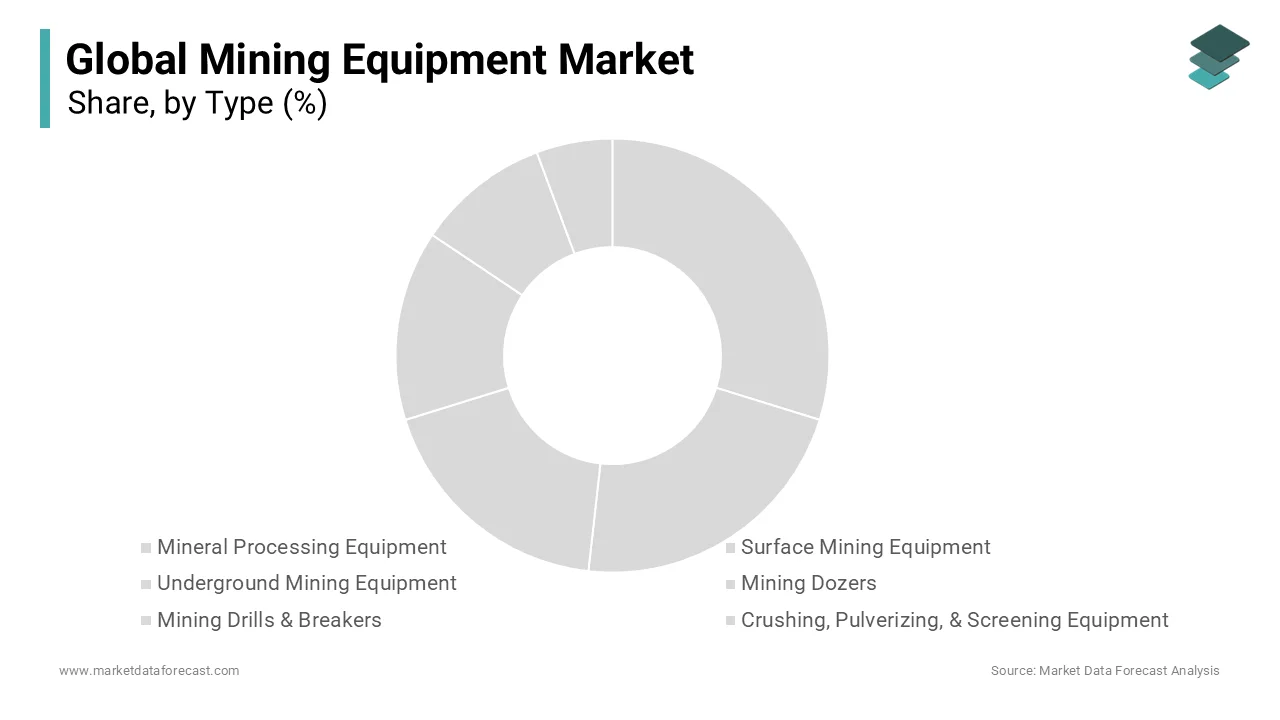

The Surface mining equipment segment was the biggest part of the market, with a 45.1% share in 2024. This type of equipment is used to dig up minerals like coal and iron ore that are near the surface. The United States Geological Survey emphasizes 60% of mining worldwide uses surface methods because it is cheaper and easier than underground mining. For example, open-pit mining needs fewer workers and simpler tools. This equipment is very important because coal mining, which provides 35% of global electricity, depends on it, according to the International Energy Agency.

The Crushing, pulverizing, and screening equipment segment is growing the fastest, with a CAGR of 7.2% from 2025 to 2033. This growth is due to the rising need for processed materials in construction and manufacturing. The U.S. Geological Survey reports that crushed stone production reached 1.3 billion metric tons in 2022, showing how important this equipment is. Stricter environmental rules also push companies to use better processing methods to reduce waste. India’s Ministry of Mines supports sustainable practices, which boosts demand. This segment helps industries like road building and cement production by improving how resources are used.

By Application Insights

The Metal mining segment was the largest application segment by holding 50.3% of the market in 2024. Metals like iron, copper, and aluminum are in high demand for construction, electronics, and renewable energy. The International Energy Agency shows that global copper demand could grow by 40% by 2030 because of electric vehicles and solar panels. Metal mining is also key to economies; for example, Chile’s copper exports made up 15% of its GDP in 2022. This segment is vital for supporting industries and building infrastructure around the world.

The Mineral mining segment is the rapidly expanding category, with a CAGR of 6.8% owing to the rising need for minerals like lithium, cobalt, and rare earth elements used in clean energy. The International Energy Agency predicts lithium demand will grow 40 times by 2040 due to electric vehicles. Countries like Australia and China are investing heavily in mineral mining, with Australia producing 55% of global lithium in 2022, according to the United States Geological Survey.

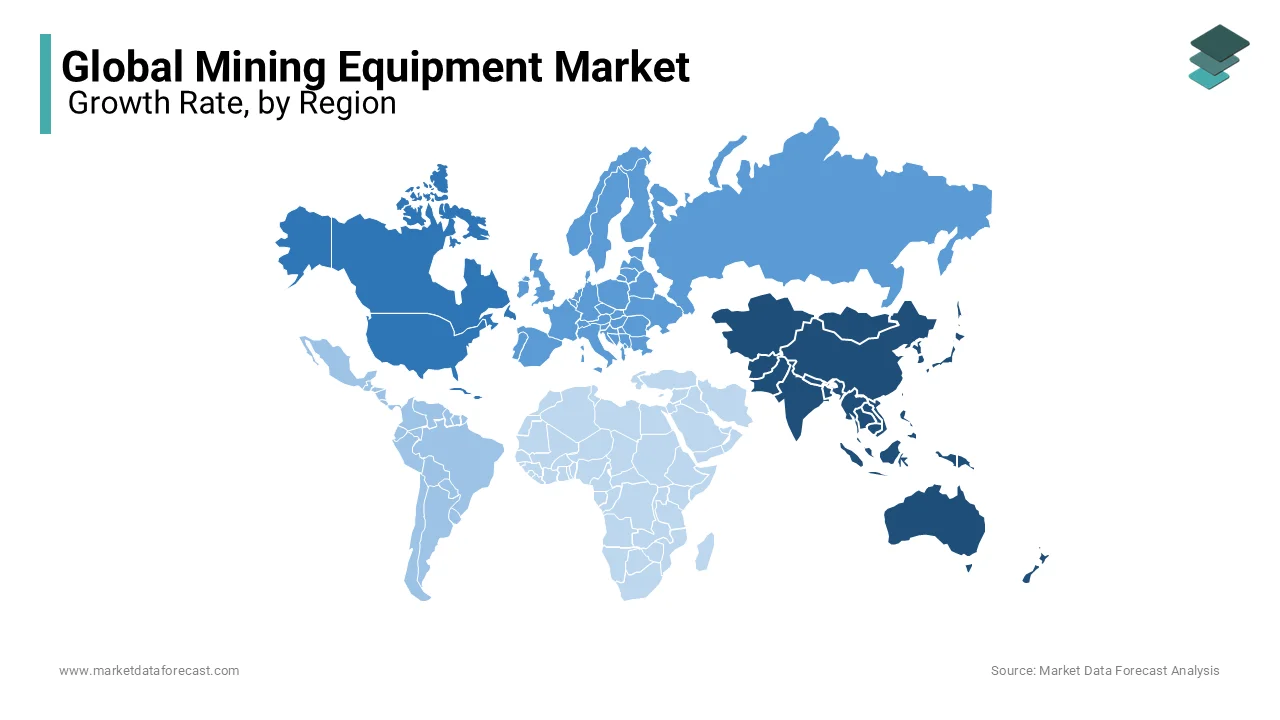

REGIONAL ANALYSIS

Asia Pacific led the mining equipment market by capturing 40.7% of the global share in 2024. This dominance is driven by China and India, which are among the largest producers of coal, iron ore, and rare earth elements. The United States Geological Survey reports that China accounts for 60% of global rare earth production, essential for electronics and clean energy technologies. Rapid urbanization and infrastructure development in the region further boost demand. For instance, India’s Ministry of Mines projects a 12% annual growth in domestic mining output through 2027. Asia Pacific’s leadership is critical as it supplies raw materials for global manufacturing hubs, ensuring economic stability and industrial growth.

North America held a significant position in the mining equipment market which is driven by advanced technology adoption and abundant mineral resources. The United States Geological Survey states that the U.S. produced 1.1 million metric tons of copper in 2022, ranking fourth globally. Canada is also a leader in gold and nickel mining, contributing to regional growth. According to PwC, over 60% of North American mining companies invest in automation and IoT, enhancing efficiency. Strict environmental regulations encourage sustainable practices, boosting demand for eco-friendly equipment. North America’s focus on innovation ensures its importance in global mining, supporting industries like renewable energy and automotive manufacturing.

Europe is a key player in the mining equipment market, driven by stringent environmental standards and technological advancements. The European Commission spotlighting that the EU imports 98% of its rare earth elements, prompting investments in domestic mining. Germany and Sweden lead in producing metals like copper and iron ore, essential for manufacturing. McKinsey reports that European mining companies spend 25% more on digital tools than the global average, improving productivity. Additionally, the push for green energy increases demand for lithium and cobalt. Europe’s emphasis on sustainability and innovation makes it vital for shaping eco-friendly mining practices and meeting global resource needs.

Latin America is a top performer in the mining equipment market due to its rich mineral reserves. The United States Geological Survey states that Chile produces 28% of the world’s copper, while Brazil ranks second in iron ore production. These resources attract significant foreign investments, boosting equipment demand. The International Monetary Fund highlights that mining contributes over 10% to the GDP of countries like Peru and Chile. Latin America’s focus on expanding mining operations supports global supply chains, especially for clean energy technologies. The region’s growth underscores its role in supplying critical minerals, ensuring its importance in global industrial and energy sectors.

The Middle East & Africa region is a major contributor to the mining equipment market and Africa accounts for 30% of global mineral reserves, according to the African Development Bank. South Africa leads in platinum and gold mining, while Morocco dominates phosphate production. The World Bank notes that mining accounts for 10% of Africa’s GDP, driving economic growth. Rising investments in infrastructure and urbanization increase equipment demand. The Middle East focuses on diversifying its economy through mining, as seen in Saudi Arabia’s Vision 2030 plan. This region’s vast untapped resources and growing mining activities make it crucial for meeting global mineral demands and fostering economic development.

KEY MARKET PLAYERS

The major players in the global mining equipment market include BelAZ, Komatsu Ltd., Liebherr Group, Guangxi LiuGong Machinery Co., Ltd, Metso Oyj, Sepro Mineral Systems Corp., Volvo Construction Equipment, Sandvik AB, Hitachi Construction Machinery Co. Ltd, and Terex Corporation.

TOP 3 PLAYERS IN THE MARKET

Caterpillar Inc.

Caterpillar Inc. is the largest player in the global mining equipment market, holding approximately 25% of the market share. The company’s dominance stems from its wide range of advanced machinery, including haul trucks, excavators, and dozers, designed for both surface and underground mining. Caterpillar’s focus on innovation has led to the development of autonomous mining equipment, which improves safety and productivity. According to PwC, over 60% of mining companies globally prefer Caterpillar’s solutions due to their reliability and efficiency. In 2022, Caterpillar reported a 15% revenue growth in its mining division, driven by rising demand for coal and metals. Its commitment to sustainability, such as offering electric and hybrid equipment, ensures its leadership in shaping the future of mining.

Komatsu Ltd.

Komatsu Ltd. ranks second in the global mining equipment market, with an estimated 18% market share. Known for its cutting-edge technologies, Komatsu has pioneered autonomous haulage systems (AHS), which have transported over 4 billion tons of material worldwide. The company’s Smart Construction initiative integrates IoT and AI to enhance operational efficiency, reducing fuel consumption by up to 10%, as highlighted by Deloitte. Komatsu’s strong presence in Asia-Pacific, particularly in China and Australia, contributes significantly to its growth. In 2022, Komatsu invested heavily in electrification, aligning with global decarbonization goals. Its contributions to sustainable mining practices and technological advancements solidify its position as a key market leader.

Hitachi Construction Machinery Co., Ltd.

Hitachi Construction Machinery holds the third-largest position in the global mining equipment market, with a 12% market share. The company specializes in ultra-large hydraulic excavators and dump trucks, widely used in coal and iron ore mining. Hitachi’s EX-7000 series excavator is one of the largest in the world, enhancing productivity for large-scale operations. The company emphasizes digital transformation, with its ConSite platform enabling predictive maintenance and reducing downtime by 20%, according to McKinsey. Hitachi’s collaboration with major mining firms in North America and Europe has driven its revenue growth by 10% annually. By focusing on energy-efficient equipment and expanding its global footprint, Hitachi continues to play a pivotal role in advancing the mining industry.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Technological Innovation and Automation

Key players in the mining equipment market, such as Caterpillar and Komatsu, are heavily investing in technological advancements to strengthen their positions. Automation is a major focus, with autonomous haulage systems (AHS) and IoT-enabled machinery becoming central to their strategies. For instance, Komatsu’s AHS has transported over 4 billion tons of material globally, improving efficiency and safety, as highlighted by Deloitte. Similarly, Caterpillar’s autonomous mining trucks have reduced operational costs by 15%, according to PwC. These innovations help companies meet the growing demand for smarter, safer, and more efficient mining solutions. By adopting cutting-edge technologies, these firms not only enhance productivity but also differentiate themselves in a competitive market.

Sustainability and Electrification Initiatives

Sustainability is a key strategy adopted by leaders like Hitachi and Caterpillar to align with global decarbonization goals. Caterpillar has introduced hybrid and electric equipment, reducing emissions and fuel consumption by up to 25%. Hitachi focuses on energy-efficient machinery, integrating eco-friendly designs into its product lineup. Additionally, Komatsu has committed to achieving carbon neutrality by 2050, investing in electric vehicles and hydrogen-powered equipment. According to McKinsey, over 70% of mining companies prioritize sustainable equipment, making this strategy crucial for maintaining market relevance. By addressing environmental concerns, these companies attract environmentally conscious customers and comply with stricter regulations.

Strategic Partnerships and Collaborations

Collaborations and partnerships are vital strategies used by key players to expand their reach and capabilities. For example, Caterpillar collaborates with major mining firms like BHP and Rio Tinto to develop customized solutions tailored to specific operational needs. Similarly, Komatsu partners with tech companies like NVIDIA to integrate AI and machine learning into its equipment, enhancing predictive maintenance capabilities. Hitachi works closely with governments in emerging markets, such as India and Africa, to support infrastructure development. The World Economic Forum shows that such partnerships can increase operational efficiency by 30%. By leveraging external expertise and resources, these companies strengthen their global presence and market share.

COMPETITIVE LANDSCAPE

The mining equipment market is very competitive with many big companies working hard to stay ahead. Key players like Caterpillar Komatsu and Hitachi are leading the market because they make advanced machines that are used all over the world. These companies focus on innovation and use new technologies to make mining safer and more efficient. For example Caterpillar makes autonomous trucks that can work without drivers while Komatsu uses smart systems to track equipment performance. This helps miners save time and money.

Smaller companies also compete by offering cheaper equipment or focusing on specific regions. Some firms target emerging markets like Africa and Asia where mining is growing fast. To stand out companies often provide extra services like training and maintenance support. This helps them build trust with customers and keep their business for a long time.

Competition is also driven by the need for sustainable solutions. Governments and mining companies want equipment that is eco-friendly and uses less energy. Companies that offer electric or hybrid machines have an advantage in this area. Overall the competition in the mining equipment market is strong and dynamic. It pushes companies to improve their products and services which benefits both the industry and the environment.

RECENT MARKET DEVELOPMENTS

- In May 2024, the European Union and Australia signed a partnership agreement focusing on sustainable critical and strategic minerals. This collaboration aims to secure the supply chain of essential minerals, impacting mining equipment markets by fostering joint ventures and technological exchanges between companies in both regions.

- In May 2024, the European Council adopted reforms to the electricity market design, including packages on decarbonized gases and hydrogen. These reforms are expected to influence the mining equipment sector by promoting the integration of cleaner energy sources in mining operations, thereby driving demand for equipment compatible with alternative fuels.

- In March 2025, Caterpillar Inc., a leading American manufacturer of construction and mining equipment, launched its next-generation hydraulic mining shovel. This model features enhanced fuel efficiency, increased payload capacity, and advanced safety features, aiming to improve operational productivity for mining companies.

- In February 2025, Komatsu Ltd., a Japanese multinational corporation, introduced its new electric dump truck in Asian markets. Designed to reduce carbon emissions and operational costs, this vehicle aligns with the industry's shift towards sustainable mining practices.

- In January 2025, Sandvik AB, a Swedish engineering group, completed the acquisition of DSI Underground, a global leader in ground support and reinforcement products for the mining industry. This strategic move aims to strengthen Sandvik’s position in the mining equipment sector by expanding its product portfolio and global reach.

- In December 2024, the Government of India implemented new standards for mining equipment to enhance safety and efficiency in mining operations. These regulations mandate the use of advanced technologies and stricter safety protocols, impacting both domestic and international equipment manufacturers supplying to the Indian market.

- In November 2024, the Australian Government approved the use of autonomous mining trucks in specific mining regions. This decision is expected to revolutionize mining operations by increasing efficiency and reducing human intervention in hazardous environments, prompting mining equipment manufacturers to accelerate the development of autonomous technologies.

MARKET SEGMENTATION

This research report on the global mining equipment market is segmented and sub-segmented into the following categories.

By Type

- Mineral Processing Equipment

- Surface Mining Equipment

- Underground Mining Equipment

- Mining Dozers

- Mining Drills & Breakers

- Crushing, Pulverizing, & Screening Equipment

- Others

By Application

- Metal Mining

- Mineral Mining

- Coal Mining

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the major factors driving the growth of the mining equipment market?

The growth of the mining equipment market is driven by increasing demand for minerals and metals, advancements in technology, expansion of mining activities in emerging economies, and the need for efficient mining operations.

How is technology impacting the mining equipment market?

Technology is significantly impacting the mining equipment market by enabling automation, improving operational efficiency, enhancing safety measures, and reducing environmental impact. Innovations such as IoT, AI, and robotics are transforming mining operations.

What role do government regulations play in the mining equipment market?

Government regulations play a crucial role in the mining equipment market by setting standards for environmental protection, safety, and operational efficiency. Compliance with these regulations can drive innovation and influence market dynamics.

How is the demand for sustainable mining equipment shaping the market?

The demand for sustainable mining equipment is shaping the market by encouraging the development of energy-efficient machinery, reducing carbon emissions, and promoting eco-friendly mining practices. Companies are increasingly investing in green technologies to meet regulatory requirements and consumer expectations.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com