Global Modular Trailer Market Size, Share, Trends & Growth Forecasts Report By Type (Multi-Axle, Telescopic/Extendable, Lowboy), Application (Construction & Infrastructure, Mining, Wind & Energy, Heavy Engineering), Number of Axles (2 Axles, >2 Axles) and Region (North America, Latin America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis (2025 to 2033)

Global Modular Trailer Market Size

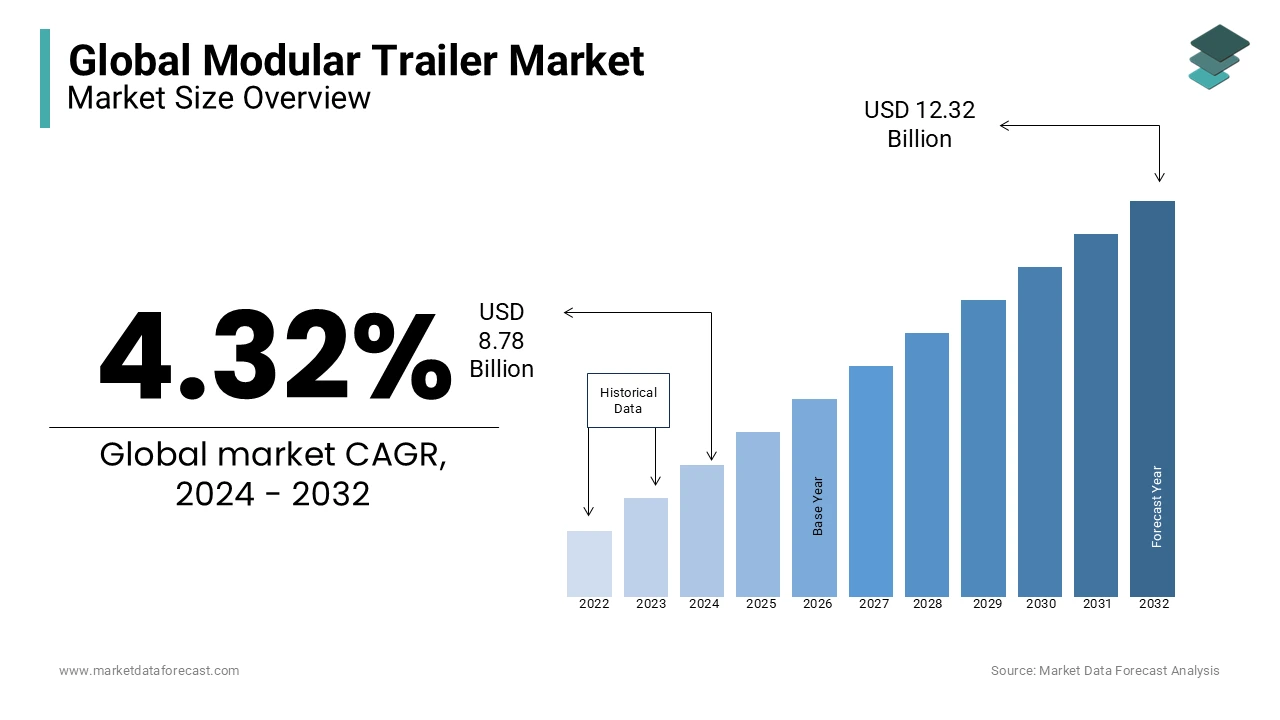

The global modular trailer market size was valued at USD 8.78 billion in 2024. The global market is further expected to reach USD 9.16 billion in 2025 and USD 12.85 billion by 2033, growing at a CAGR of 4.32% during the forecast period from 2025 to 2033.

Modular trailers contain a series of specialized vehicles that are utilized in various industries for the transportation of heavy and enormous cargo. A number of the main applications of those trailers include power stations, iron & steel, chemical, and construction industries. These trailers are available in various configurations of two, three, four, five, and above axle models to satisfy the precise industry requirements. The upcoming infrastructure activities in developing countries are anticipated to fuel the expansion of the global modular trailer market over the foreseen period.

The growth of the global modular trailer market size is driven by expanding end-user industries like construction & infrastructure, wind & energy, mining, and heavy engineering. However, high prices of modular trailers and a lack of skilled labor could affect the expansion of the modular trailer market during the foreseen period of 2020 to 2027.

MARKET DRIVERS

- Expanding the construction and mining industries will accelerate market growth.

- The increasing prevalence of freight transportation is another factor that drives the expansion of the market.

- Diversification of the wind energy industry to put in more power-generating equipment will enhance the market growth.

MARKET RESTRAINTS

- Increased availability of local or regional players is going to be obstructing the expansion of the market.

- A lack of skilled and qualified drivers also can restrict the expansion of this market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.32% |

|

Segments Covered |

By Type, Application, Number of Axles, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Goldhofer (Germany), Nooteboom Trailers (Netherlands), Faymonville Group (Italy), TII Group (Germany), and VMT Industries (India), K-Line Trailers (Canada), Tratec Engineers (India), Anster (China), Doll Fahrzeugbau AG (Germany), and Demarko Trailers (Poland), and Others. |

SEGMENT ANALYSIS

By Type Insights

The major driving factor for multi-axle trailers is the demand from end-user industries. The need for resource exploration and mining activities in developing countries is hiking. The good economic outlook and growth of the wind & energy and construction industries are expanding opportunities for modular trailer makers. Multi-axle trailers are likely to account for the most critical market share during the foreseen period. It can load dimension cargo with the addition of axle lines as per requirement. Because the axle lines are often attached and detached, a multi-axle trailer is commonly used for different applications. The payload capacity per axle line is initiated at 15 tons. Moreover, it offers maximum agility, perfect stability, maneuverability, and safety.

By Application Insights

Construction companies usually have projects located in several areas. Modular trailers help with the transportation of the already built sections to places where they're going to be installed and, at an equivalent time, shift material and equipment from one project to a different one. These trailers are wont to transport large bridge segments, large girders, concrete beans, and construction machinery, among others. Spending on capital-intensive projects and infrastructure is predicted to grow significantly within the next decade, thereby driving the necessity for the transportation of construction equipment and materials.

By Number of Axles Insights

The 2-axle line trailers are available in a wide selection of sizes and weight-carrying capacities. The per-axle line load-carrying capacity starts at 10 tons and goes up to 1000 tons. 2-axle line trailers are quite famous for the transportation of large equipment. The Asia Pacific and North America together account for a better number of 2-axle line trailers. Consistent with the Indian Construction Equipment Manufacturer Association (ICEMA), the growth for earthmoving and mining equipment during FY 2017–18 was significant, recording a rise of 23%. The rising demand for such material creates the necessity for freight transportation for supply chain operations. In turn, it will create a positive outlook for the global modular trailer business.

KEY MARKET PLAYERS

Companies playing a notable role in the global modular trailer market include Goldhofer (Germany), Nooteboom Trailers (Netherlands), Faymonville Group (Italy), TII Group (Germany), and VMT Industries (India), K-Line Trailers (Canada), Tratec Engineers (India), Anster (China), Doll Fahrzeugbau AG (Germany), and Demarko Trailers (Poland).

RECENT MARKET HAPPENINGS

- Heavy-haul trailer maker Talbert Manufacturing shows its 65SA modular trailer that comes with multiple axle configurations and is supported by customer requirements for optimum versatility and regulatory compliance.

- BPW subsidiary Idem has introduced a replacement, modular trailer telematics system known as Cargofleet Trailer Gateway. Consistent with the German component supplier, the system is predicated on a kind of onboard computer that processes data from so-called hubs called the TC Gateway.

- The Faymonville Group is well-known across Europe for the development of towed equipment for specialist haulage equipment, also because of the transportation of glass and concrete elements. This year, the group announced that they'd reached an agreement to accumulate 100% shares of Italian company Industrie Cometto S.p.A.

- French transport and repair provider AltéAd has taken ownership of the newest modular platform trailer from transportation specialist the Tii Group to help it with the transportation of wind turbines.

MARKET SEGMENTATION

This research report on the global modular trailer market is segmented and sub-segmented into the following categories.

By Type

- Multi-axle

- Telescopic/Extendable

- Lowboy

By Application

- Construction & Infrastructure

- Mining

- Wind & Energy

- Heavy Engineering

By Number of Axles

- 2 axles

- >2 axles

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]