Global Motherboard Market Size, Share, Trends & Growth Forecast Report By Distribution Channel (Online ,Offline), Brand (ASUS,MSI), End-User(Gaming, Industrial) and Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 to 2033

Global Motherboard Market Size

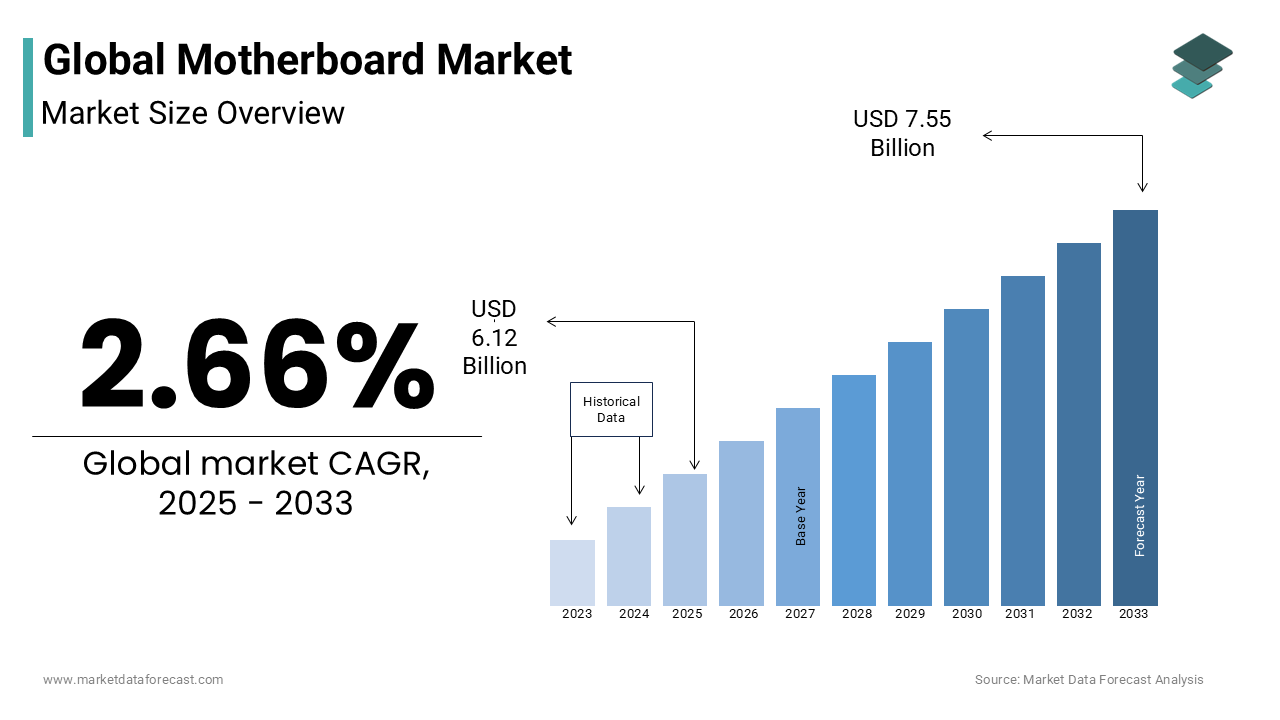

The motherboard market size was valued at USD 5.96 billion in 2024. The motherboard market size is expected to have 2.66% CAGR from 2025 to 2033 and be worth USD 7.55 billion by 2033 from USD 6.12 billion in 2025.

Motherboard serves as the central backbone of a computing system by integrating key components such as the processor, memory, storage, and expansion slots. It acts as a communication hub and is facilitating data flow between different hardware elements. With the increasing complexity of computing demands across consumer, enterprise, and industrial applications, motherboard technology has evolved significantly, incorporating high-speed connectivity options, improved thermal management, and enhanced power efficiency.

The motherboard market is experiencing robust growth due to the rising demand for personal computers, gaming systems, and enterprise IT infrastructure. According to IDC, global PC shipments reached 268 million units in 2023, underscoring sustained demand despite economic fluctuations. Additionally, the gaming industry has played a pivotal role in motherboard innovation, with high-performance chipsets and advanced cooling solutions becoming standard in gaming motherboards. Market players such as ASUS, MSI, and Gigabyte continue to introduce motherboards optimized for AI-driven workloads, overclocking capabilities, and DDR5 memory support. The server motherboard segment is also witnessing expansion due to the rapid adoption of cloud computing and data center services. Gartner reports that global spending on data center infrastructure is projected to surpass $230 billion by 2025 which is boosting demand for server-grade motherboards with enhanced scalability and reliability.

MARKET DRIVERS

Growth of Data Centers and Cloud Computing

The increasing reliance on cloud computing and hyperscale data centers is significantly driving the motherboard market. The enterprises transition towards cloud-based operations and consequently the demand for high-performance server motherboards capable of supporting advanced computing workloads has surged. According to the U.S. International Trade Administration, global cloud computing spending is projected to reach $1.3 trillion by 2025 indicating a sustained expansion of cloud infrastructure. Additionally, Statista reports that the number of hyperscale data centers worldwide exceeded 850 in 2023, a substantial increase from 300 in 2015. These data centers require specialized motherboards designed for scalability, energy efficiency, and AI-driven computing. As a result, key motherboard manufacturers are continuously innovating to meet the evolving needs of cloud service providers and enterprises.

Expansion of the Gaming and Esports Industry

The rapid growth of the gaming industry, particularly esports, is propelling demand for high-performance motherboards optimized for gaming PCs. The Entertainment Software Association (ESA) states that over 215 million Americans played video games in 2023, reflecting a thriving gaming ecosystem. This growth has intensified demand for motherboards with advanced chipsets, high-speed memory support, and overclocking capabilities. Additionally, gaming hardware innovations, such as DDR5 memory and PCIe 5.0 slots, are increasingly integrated into motherboards to enhance gaming performance. Leading motherboard brands, including ASUS and MSI, are leveraging these trends by launching gaming-centric motherboards with AI-powered tuning, enhanced cooling systems, and immersive connectivity features.

MARKET RESTRAINTS

Supply Chain Disruptions and Semiconductor Shortages

The motherboard market faces significant challenges due to supply chain disruptions and semiconductor shortages, impacting production timelines and pricing. The U.S. Department of Commerce highlights that the global chip shortage has led to an average lead time of over 26 weeks for semiconductor deliveries, affecting motherboard manufacturers dependent on high-performance chipsets and components. Additionally, the Semiconductor Industry Association (SIA) states that global semiconductor demand surged by 26% in 2022, straining supply chains. These disruptions have escalated motherboard production costs and resulted in price volatility, limiting market growth. While governments are investing in domestic semiconductor manufacturing, such as the U.S. CHIPS Act’s $52 billion funding, recovery remains slow, posing a persistent restraint on motherboard availability and affordability.

Declining Consumer PC Shipments

The motherboard market is facing a slowdown due to declining global PC shipments, reducing demand for consumer-grade motherboards. According to the International Data Corporation (IDC), global PC shipments declined by 16.6% in 2023, with total units dropping to approximately 268 million. This contraction is attributed to factors such as economic uncertainty, market saturation, and increased reliance on mobile devices. Additionally, the European Commission notes that inflationary pressures and weaker consumer purchasing power have led to lower discretionary spending on electronics. As PC sales decline, motherboard manufacturers catering to consumer desktops and laptops face reduced revenues, prompting a shift in focus towards server and gaming motherboards to mitigate losses.

MARKET OPPORTUNITIES

Expansion of AI and Edge Computing

The increasing adoption of artificial intelligence (AI) and edge computing presents a significant opportunity for the motherboard market. As businesses integrate AI-driven applications across sectors such as healthcare, finance, and autonomous systems, demand for motherboards with advanced processing capabilities is rising. According to the U.S. National Institute of Standards and Technology (NIST), AI-driven computing is expected to contribute over $15.7 trillion to the global economy by 2030, necessitating high-performance hardware solutions. Additionally, the International Energy Agency (IEA) reports that edge computing data traffic is expected to grow at a 35% annual rate, requiring specialized motherboards with low-latency processing and energy efficiency. Manufacturers are capitalizing on this by developing AI-optimized motherboards with dedicated neural processing units and enhanced connectivity features.

Growth in Automotive and Embedded Systems

The rapid expansion of automotive electronics and embedded computing is creating new opportunities for motherboard manufacturers. With the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), automakers require high-performance motherboards to support in-vehicle computing and real-time data processing. The U.S. Department of Transportation states that over 60% of new vehicles in 2023 incorporated ADAS technology, a significant increase from 40% in 2020. Furthermore, the International Energy Agency (IEA) projects that global EV sales will surpass 45 million units annually by 2030, driving demand for automotive-grade motherboards. Additionally, embedded motherboards are gaining traction in industrial automation and healthcare applications, supporting smart manufacturing and connected medical devices, further expanding growth potential in this segment.

MARKET CHALLENGES

Rising Raw Material Costs and Inflationary Pressures

The motherboard market faces a significant challenge due to the rising costs of raw materials, impacting production and profitability. The U.S. Bureau of Labor Statistics (BLS) reports that the prices of essential materials such as copper, aluminum, and silicon have increased by over 30% in the past three years, driven by supply chain constraints and geopolitical tensions. Additionally, global inflation has exacerbated cost pressures, leading to higher manufacturing expenses. The World Bank states that global inflation remained elevated at 6.6% in 2023, affecting consumer purchasing power and reducing demand for electronics. As a result, motherboard manufacturers are forced to either absorb higher costs or pass them on to consumers, potentially limiting market growth and competitiveness.

Cybersecurity Risks and Hardware Vulnerabilities

As motherboards become more sophisticated, incorporating AI and IoT-enabled functionalities, the risk of cybersecurity threats and hardware vulnerabilities has increased. The U.S. Cybersecurity and Infrastructure Security Agency (CISA) warns that firmware-level attacks targeting motherboard components, such as BIOS and chipsets, have risen by 300% since 2020. Additionally, the National Institute of Standards and Technology (NIST) highlights that supply chain cyberattacks have affected major hardware manufacturers, leading to potential data breaches and system failures. These security concerns necessitate continuous investments in secure hardware design, firmware updates, and regulatory compliance, increasing operational complexities for motherboard manufacturers. Ensuring robust security frameworks while maintaining performance efficiency remains a critical challenge for the industry.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.66% |

|

Segments Covered |

By Distribution Channel, Brand, End-User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

ASUS MSI, Gigabyte Technology, AS Rock, Intel, Biostar,EVGA ,Acer Inc.,HP,Del. |

SEGMENT ANALYSIS

By Distribution Channel Insights

The offline segment led the market and accounted for 61.8% of the global market share in 2024. This preference is driven by consumers seeking immediate product availability and personalized assistance. According to the U.S. Census Bureau, in 2023, 90% of retail sales still occurred in physical stores, underscoring the enduring importance of brick-and-mortar establishments in consumer purchasing behavior.

Conversely, the online segment is on the rise and is expected to be the fastest growing segment by registering a CAGR of 14.27% over the forecast period. This surge is attributed to the convenience of online shopping, wider product selections, and the increasing penetration of e-commerce platforms. The U.S. Department of Commerce noted that e-commerce sales increased by 32.4% in 2020, reflecting a significant shift towards online purchasing. This trend is expected to continue, driven by advancements in technology and changing consumer preferences.

By Brand Insights

The ASUS segment had the leading share of 38.4% in the global market in 2024 due to its innovative product lines, particularly the ROG series, which caters to gamers and enthusiasts seeking high-performance components. ASUS is projected to deliver approximately 15 million units in 2024, reaffirming its strong market position. The brand's commitment to quality and cutting-edge technology has solidified its reputation, making it a preferred choice among consumers and contributing significantly to its market leadership.

The MSI segment is recognized as the fastest-growing segment in the global motherboard market and is estimated to grow at a CAGR of 6.25% over the forecast period. This growth is driven by the increasing demand for gaming and high-performance motherboards, as well as advancements in technology that enhance user experience. MSI's focus on developing motherboards with superior cooling solutions and gamer-centric features has positioned it favorably in a competitive landscape. MSI is expected to ship around 9.3 million motherboards in 2024, highlighting its significant presence in the market.

By End-User Insights

The industrial segment accounted for 44.3% of the global market share in 2024 and emerged as the most dominating segment in the global market. The growth of the industrial segment in the global market is primarily driven by the increasing integration of advanced computing solutions in industrial applications, such as automation, robotics, and process control systems. The demand for reliable and high-performance motherboards in these settings has led to significant market share for this segment. The deployment of industrial robots has been a key factor, with the International Federation of Robotics reporting approximately 4.28 million operational industrial robots worldwide by the end of 2023. This surge in automation underscores the critical role of high-performance motherboards in supporting complex industrial processes.

Conversely, the gaming segment is estimated to register rapid expansion and is likely to grow at a CAGR of 11.2% over the forecast period. The growth of the gaming segment is driven by the increasing popularity of both casual and competitive gaming. This surge has led to heightened demand for high-performance gaming laptops and desktops, which require advanced motherboards supporting enhanced device compatibility, CPU overclocking, and a range of gaming features. According to Statista, the number of PC gamers worldwide increased from 1.5 billion in 2019 to 1.75 billion in 2020, reflecting a significant rise in the gaming population. Additionally, Logitech International reported a nearly 7% increase in sales, reaching $1.34 billion, in the pre-holiday quarter of 2025, attributing high gaming sales to several launches ahead of the holidays. These trends underscore the growing sales of gaming hardware, which are contributing significantly to the motherboard market's expansion.

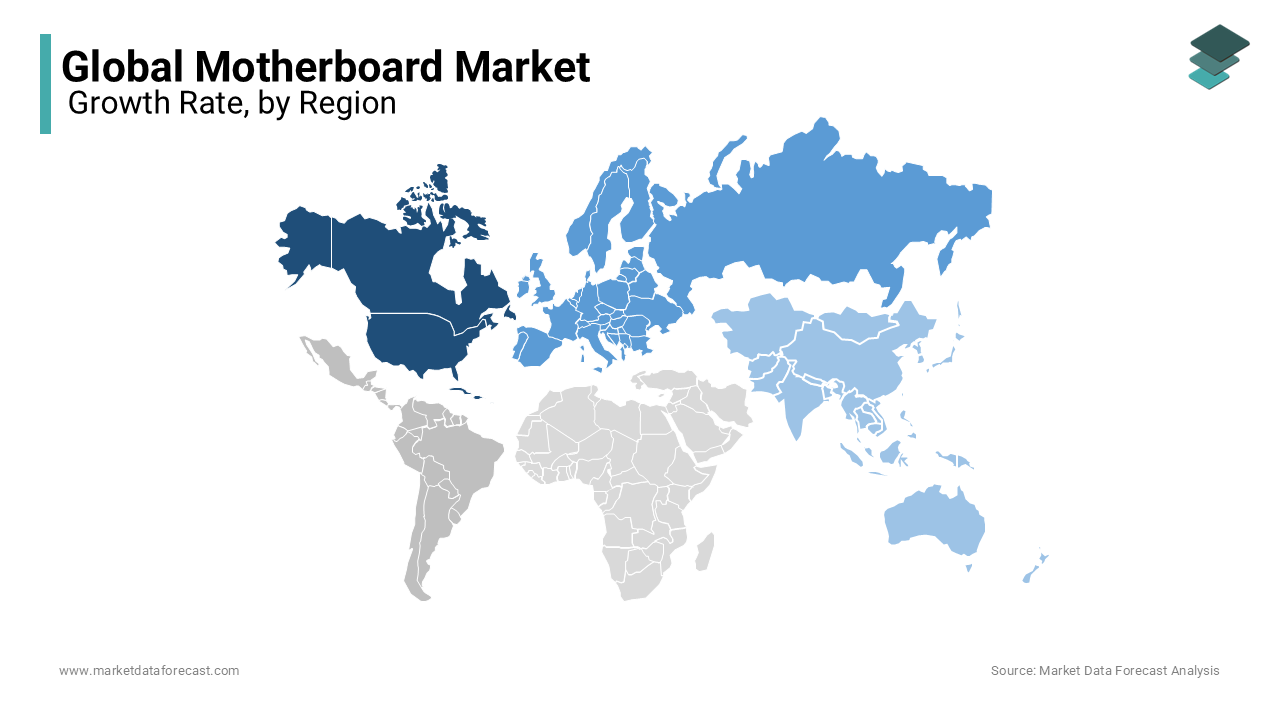

REGIONAL ANALYSIS

North America accounted for 38.4% of the global market share in 2024 owing to the presence of robust manufacturing sector, widespread adoption of automation and Internet of Things (IoT) technologies across various industries, and advanced technological infrastructure. In 2023, the United States' computer hardware market was valued at approximately $160.1 billion, reflecting the country's significant role in the global technology sector. The region is at the forefront of innovation, integrating cutting-edge technologies in sectors such as aerospace, defense, and automotive. This leadership in technological advancement underscores North America's prominence in the global motherboard market.

The Asia-Pacific region is experiencing the fastest growth in the global motherboard market and is estimated to expand at a CAGR of 16.7% from 2025 to 2033. This rapid expansion is attributed to the region's strong emphasis on manufacturing, significant investments in automation, and the adoption of smart technologies. China holds the largest market share within the region, while India's motherboard market is noted as the fastest-growing. The region's focus on technological advancement and manufacturing excellence positions it as a key driver of global market growth. Furthermore, India's electronics production reached USD 115 billion in 2024, driven by global firms like Apple and Samsung, as reported by Reuters.

Europe accounts for the second-largest market share in the motherboard market. The mature industrial landscape of Europe and stringent regulatory frameworks drive the demand for modern and reliable computing solutions. Initiatives toward digital transformation and Industry 4.0 further bolster the need for advanced motherboards in industrial applications. Germany leads the market share in Europe, with the United Kingdom experiencing the fastest growth within the region.

In Latin America, the motherboard market is anticipated to grow steadily, supported by increasing industrialization and the adoption of digital technologies. The Middle East and Africa are also expected to witness growth, driven by investments in technological infrastructure and the rising adoption of computing solutions across various sectors. While these regions currently hold smaller market shares compared to North America and Asia-Pacific, ongoing developments in technology and infrastructure are likely to enhance their positions in the global motherboard market in the coming years.

Top 3 Players in the market

ASUSTeK Computer Inc. (ASUS)

ASUS, a Taiwanese multinational company, is recognized as the largest motherboard manufacturer globally, accounting for over 13% of the market share. In 2024, ASUS is projected to ship approximately 15 million motherboards, reflecting its strong market presence. The company's commitment to quality and innovation has solidified its leadership position in the industry.

Gigabyte Technology Co. Ltd

Also based in Taiwan, Gigabyte is a prominent player in the motherboard market. In 2024, the company is expected to ship around 10.3 million motherboards, underscoring its significant role in the industry. Gigabyte's focus on high-performance and durable products has earned it a substantial share of the global market.

Micro-Star International Co., Ltd (MSI)

MSI, another Taiwanese multinational corporation, is a key contributor to the motherboard market. In 2024, MSI is anticipated to ship approximately 9.3 million motherboards, highlighting its strong market position. The company's emphasis on gaming and high-performance computing solutions has driven its success in the global market.

Top strategies used by the key market participants

Technological Innovation and Product Diversification

Key players such as ASUSTeK Computer Inc. (ASUS), Gigabyte Technology Co. Ltd., and Micro-Star International Co., Ltd. (MSI) focus on continuous technological advancements to meet evolving consumer demands. They invest heavily in research and development to introduce motherboards that support the latest processors, high-speed memory modules, and advanced connectivity options. For instance, these companies have developed motherboards compatible with DDR5 memory and PCIe 4.0/5.0 interfaces, catering to gamers and professionals seeking high-performance computing solutions. This commitment to innovation ensures they remain competitive in a rapidly evolving market.

Strategic Partnerships and Alliances

Forming strategic partnerships is another approach utilized by these companies to enhance their market presence. Collaborations with chipset manufacturers, gaming hardware firms, and technology providers enable them to integrate cutting-edge features into their products. For example, partnerships with companies like Intel and AMD allow for early access to new processor technologies, facilitating the timely release of compatible motherboards. Such alliances not only expand their product offerings but also strengthen their positions in various market segments.

Brand Positioning and Marketing Initiatives

Establishing a strong brand presence through targeted marketing campaigns and sponsorships is crucial for market leaders. Companies like MSI and ASUS sponsor esports events and professional gaming teams, enhancing brand visibility among gaming enthusiasts. Additionally, they leverage social media platforms and online communities to engage with customers, gather feedback, and promote new product launches. This focus on brand building fosters customer loyalty and attracts new users in a competitive market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the global laptop market include are ASUS MSI, Gigabyte Technology, AS Rock, Intel, Biostar,EVGA ,Acer Inc.,HP,Del.

The global motherboard market is characterized by intense competition among key players striving for technological innovation and market share. Leading companies such as ASUSTeK Computer Inc. (ASUS), Gigabyte Technology Co. Ltd., and Micro-Star International Co., Ltd. (MSI) dominate the landscape, each contributing significantly to market dynamics. ASUS, for instance, is recognized as the largest motherboard manufacturer globally, accounting for over 13% of the market share. In 2024, ASUS is projected to ship approximately 15 million motherboards, reflecting its strong market presence.

These industry leaders focus on continuous innovation, developing motherboards that support the latest processors, high-speed memory modules, and advanced connectivity options to meet diverse consumer and industrial needs. The competition is further intensified by the rapid growth of the gaming industry and the increasing adoption of artificial intelligence and edge computing, which drive demand for high-performance motherboards. Additionally, regional dynamics play a crucial role, with North America holding the largest market share due to its robust manufacturing sector and technological infrastructure, while the Asia-Pacific region is experiencing the fastest growth, propelled by significant investments in automation and smart technologies.

Overall, the motherboard market's competitive environment fosters continuous advancements, benefiting consumers with a wide array of high-quality and innovative products.

RECENT HAPPENINGS IN THE MARKET

- In October 2024, GIGABYTE launched the Z890 motherboard series, featuring advancements in artificial intelligence integration and enhanced performance capabilities. This launch aims to support the next generation of computing needs with improved processing power and efficiency.

- In June 2024, ASUS unveiled prototype motherboards at Computex 2024, designed for compatibility with upcoming Intel Arrow Lake processors. These motherboards incorporate BTF (Back to the Future) layouts to enhance cable management and system aesthetics, improving user experience and build efficiency.

MARKET SEGMENTATION

This research report on the Motherboard Market is segmented and sub-segmented into the following categories.

By Distribution Channel

- Online

- Offline

By Brand

- ASUS

- MSI

- Gigabyte

By End-User

- Gaming

- Industrial

- Consumer Electronics

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the key factors driving the motherboard market?

Increasing demand for gaming PCs, AI, cloud computing, and advancements in processor technology.

What is the expected growth rate of the motherboard market?

The motherboard market is projected to grow at a Compound Annual Growth Rate (CAGR) of 2.66 % to 4.33 % between 2023 and 2033.

What industries primarily use motherboards?

Motherboards are widely used in gaming, data centers, industrial automation, and consumer electronics.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]