North America Fish Feed Market Size, Share, Trends & Growth Forecast Report, Segmented By Ingredient, Additive, End Users, And By Country (The U.S, Canada, Mexico and Rest of North America), Industry Analysis From 2025 to 2033

North America Fish Feed Market Size

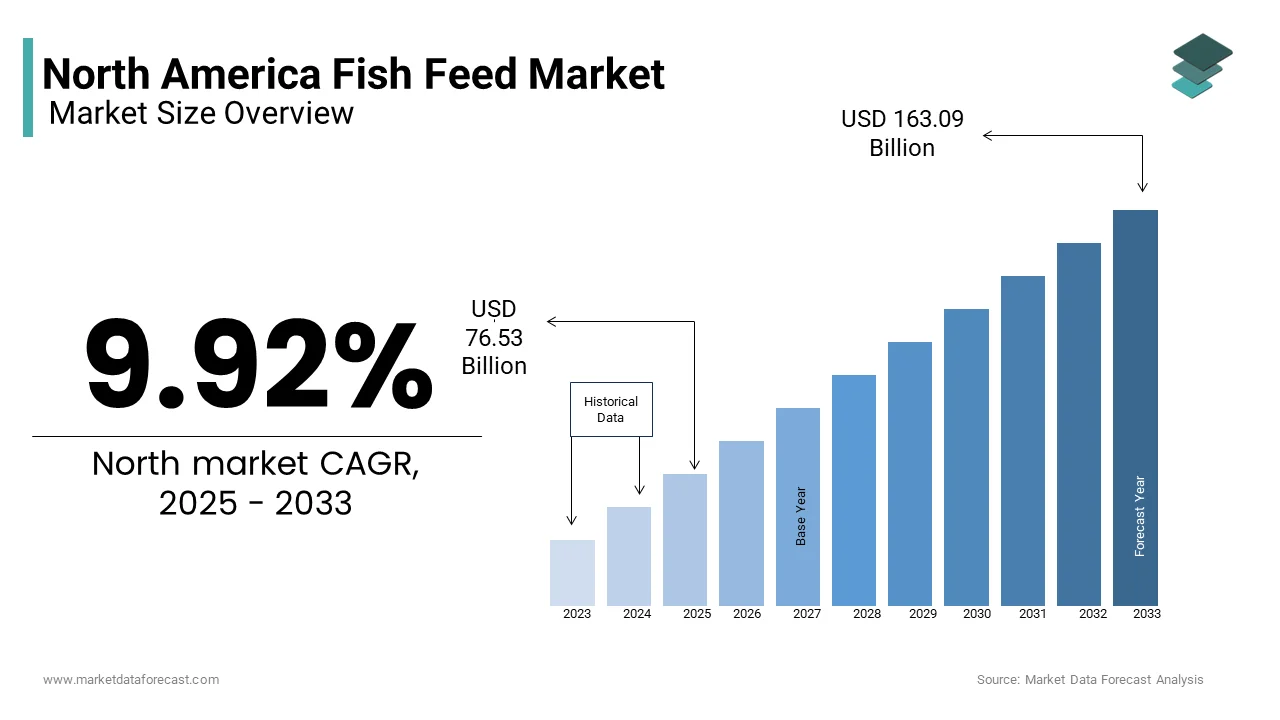

The North American fish feed market was valued at USD 69.62 billion in 2024 and is anticipated to reach USD 76.53 billion in 2025 from USD 163.09 billion by 2033, growing at a CAGR of 9.92% during the forecast period from 2025 to 2033.

MARKET DRIVERS

Increasing Demand for Sustainable Seafood

One of the primary drivers of the North American fish feed Market is the surging demand for sustainably sourced seafood. Consumers are increasingly prioritizing environmentally responsible food choices, which has propelled the aquaculture industry to adopt sustainable practices. These advancements not only cater to consumer expectations but also align with regulatory frameworks promoting sustainability.

Technological Advancements in Feed Formulations

Technological progress in fish feed formulations is another major driver shaping the North American Fish Feed Market. Precision feeding technologies, which optimize nutrient delivery and reduce waste, have revolutionized aquaculture operations. The U.S. Department of Agriculture notes that farms adopting precision feeding systems have reported a 20% reduction in feed wastage. Furthermore, the integration of artificial intelligence and machine learning in feed design allows for real-time adjustments based on fish health and environmental conditions. For instance, companies like Cargill have developed AI-driven platforms that analyze data from sensors to recommend ideal feed compositions.

MARKET RESTRAINTS

High Costs of Raw Materials

A significant restraint affecting the North American fish Feed Market is the escalating cost of raw materials used in feed production. Fishmeal and fish oil, traditionally the primary protein sources in aquafeed, have become increasingly expensive due to dwindling marine resources. The United Nations Food and Agriculture Organization reports that global fishmeal prices surged between 2020 and 2022, impacting feed manufacturers across North America. This price volatility is exacerbated by geopolitical tensions and climate change, which disrupt supply chains. To mitigate these challenges, feed producers are exploring substitutes like soybean meal and poultry by-products, which, while cheaper, often lack the nutritional profile required for optimal fish growth.

Stringent Regulatory Standards

Another major restraint is the stringent regulatory environment governing aquaculture and feed production. Regulations aimed at ensuring environmental sustainability and animal welfare impose additional costs and operational complexities on manufacturers. The U.S. Environmental Protection Agency mandates that aquaculture facilities adhere to strict discharge limits, which necessitate advanced feed formulations that minimize nutrient runoff. Compliance with these regulations often requires significant investment in research and development. For example, the Global Aquaculture Alliance estimates that regulatory compliance adds approximately 15% to production costs for feed manufacturers. Moreover, varying state-level regulations within the U.S. create a fragmented landscape, complicating cross-border trade and increasing administrative burdens.

MARKET OPPORTUNITIES

Emergence of Plant-Based Proteins

A transformative opportunity in the North American fish Feed Market lies in the growing adoption of plant-based proteins as sustainable alternatives to traditional fishmeal. With marine resources under strain, researchers and manufacturers are turning to crops like peas, lentils, and canola to meet protein demands. Innovations in enzyme technology have enhanced the digestibility of these proteins, addressing earlier concerns about their efficacy. Companies such as Archer Daniels Midland are investing heavily in scaling up production capacities for plant-based ingredients, with projections indicating an annual growth in this segment. This shift not only reduces dependency on finite marine resources but also aligns with consumer demand for eco-friendly products, positioning plant-based proteins as a lucrative avenue for market expansion.

Expansion into Recirculating Aquaculture Systems (RAS)

Another promising opportunity is the integration of fish feed tailored for Recirculating Aquaculture Systems (RAS), which are gaining popularity due to their water-efficient and controlled environments. These systems require specialized feeds designed to minimize waste and maintain water quality. For instance, Skretting, a leading feed manufacturer, has developed RAS-specific feeds that reduce nitrogen and phosphorus excretion. This innovation not only enhances system efficiency but also lowers operational costs for farmers. Also, RAS facilities are increasingly being established in urban areas, reducing transportation emissions and enabling fresher product delivery.

MARKET CHALLENGES

Supply Chain Vulnerabilities

A critical challenge facing the North American Fish Feed Market is the vulnerability of its supply chain, particularly concerning imported raw materials. Many essential ingredients, such as fishmeal and certain plant-based proteins, are sourced internationally, exposing manufacturers to disruptions caused by geopolitical tensions and logistical bottlenecks. These disruptions not only inflate costs but also jeopardize production schedules, affecting overall market stability. Apart from these, reliance on foreign suppliers undermines efforts to achieve self-sufficiency, leaving the industry susceptible to price fluctuations and export restrictions. Efforts to localize supply chains have been initiated, but progress remains slow due to the high capital investment required for infrastructure development.

Balancing Nutritional Needs with Cost Efficiency

Another significant challenge is the difficulty of balancing the nutritional requirements of farmed fish with the economic constraints of feed production. Fish species like salmon and trout demand high-protein diets rich in omega-3 fatty acids, which are costly to produce. While substituting expensive ingredients with cheaper alternatives can lower costs, it often compromises fish health and growth rates. For example, excessive use of soybean meal has been linked to reduced growth performance in some species, as brought to attention by Oregon State University studies. This trade-off creates a complex dilemma for feed manufacturers striving to deliver affordable yet nutritionally adequate products.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.92% |

|

Segments Covered |

Ingredient, Additive, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

United States, Canada, Mexico |

|

Market Leaders Profiled |

Ridley Corporation Limited, Archer Daniels Midland Company, Nutreco N.V., Cargill, Avanti Feeds Limited, Purina Animal Nutrition, Biostadt India Limited, Alltech, Nutriad, and Biomar, among others. |

SEGMENTAL ANALYSIS

By Ingredient Insights

The fish meal segment dominated the North American fish Feed Market by holding a market share of 35.5% in 2024. This dominance is driven by its high protein content, which is critical for the growth and development of farmed fish species like salmon, trout, and tilapia. Fish meal’s ability to provide essential amino acids and omega-3 fatty acids makes it indispensable in aquafeed formulations. According to the U.S. Department of Agriculture, fish meal contributes to a large portion of the total protein requirements in intensive aquaculture systems.

One of the primary factors driving its prominence is the increasing demand for premium seafood. Besides, advancements in processing technologies have improved the quality and digestibility of fish meal, enhancing its appeal among feed manufacturers.

The segment of soybean is the quickly advancing ingredient in the North American Fish Feed Market, with a projected CAGR of 8.5%. This rapid rise is fueled by the rising cost of traditional marine-based ingredients like fishmeal, prompting manufacturers to adopt cost-effective plant-based alternatives. Soybean meal offers a viable solution, providing a balanced amino acid profile at a fraction of the price. Environmental sustainability is another key factor driving soybean adoption. The World Wildlife Fund notes that replacing fishmeal with soybean reduces reliance on wild-caught fish, thereby alleviating pressure on marine ecosystems. Furthermore, genetic advancements in soybean cultivation have enhanced nutritional profiles, with certain varieties now containing a significant percentage of crude protein.

By Additive Insights

The vitamins segment represented the largest additive category in the North America Fish Feed Market by commanding a market share of 30.5% in 2024. This leading position is due to their critical role in ensuring optimal fish health and growth. Vitamins like A, D3, and E are essential for immune function, bone development, and stress resistance, making them indispensable in aquafeed formulations. The U.S. Food and Drug Administration mandates that feed formulations meet specific vitamin thresholds to ensure compliance with animal welfare standards, further solidifying their importance.

The dominance of vitamins is also driven by rising awareness about disease prevention in aquaculture. In addition, advancements in microencapsulation technology have improved the stability and bioavailability of vitamins, reducing wastage and enhancing efficacy.

The feed enzymes segment is the rapidly expanding additive segment, with a CAGR of 9.2%. This development is fueled by their ability to enhance nutrient absorption and reduce waste production, addressing both economic and environmental concerns. Enzymes such as phytase and protease break down complex compounds into simpler forms, improving digestibility and minimizing nutrient runoff.

The push for sustainable aquaculture practices is a significant driver of enzyme adoption. The Environmental Protection Agency highlights that farms using enzyme-supplemented feeds have reduced phosphorus discharge by 20%, contributing to cleaner water systems. Furthermore, the rising prevalence of Recirculating Aquaculture Systems (RAS) has amplified demand for enzyme-rich feeds, as these systems require precise nutrient management to maintain water quality. Data from the Aquaculture Engineering Society indicates that enzyme use in RAS operations has grown by 40% since 2020. Innovations in enzyme formulation, such as thermostable variants, have also expanded their application scope, enabling broader adoption across diverse aquaculture environments.

By End-User Insights

The fish segment constituted the biggest end-user in the North American Fish Feed Market by capturing a 60.4% share in 2024. This influence is attributed to the region's extensive focus on finfish aquaculture, particularly salmon and trout, which are among the most cultivated species. Salmon farming alone accounts for a notable portion of the total fish feed consumption and is driven by its popularity as a premium seafood product. The growth of this segment is propelled by rising consumer demand for high-quality protein sources. Besides, advancements in selective breeding and feed optimization have enhanced production efficiency, with feed conversion ratios improving over the past decade.

The crustaceans, including shrimp and prawns, represent the fastest-growing end-user segment, with a CAGR of 7.8% during the forecast period. This progress is caused by the expanding global appetite for crustacean-based seafood, particularly in urbanized areas where consumers prioritize exotic and high-value options. Shrimp farming, in particular, has seen a surge in demand, with production volumes increasing.

Technological advancements in feed formulations tailored for crustaceans are also driving this growth. For instance, feeds enriched with astaxanthin and other carotenoids enhance coloration and nutritional value, appealing to health-conscious consumers. Moreover, the rise of inland shrimp farming systems has created new opportunities for feed manufacturers, as these systems require highly optimized diets to thrive in controlled environments.

COUNTRY ANALYSIS

Top Leading Countries In The Market

The U.S. dominated the North American fish feed market by accounting for 65.5% of the regional share as of 2024. This leading position is due to the country's advanced aquaculture sector, which supplies over 50% of domestic seafood demand. The U.S. is a global innovator in sustainable fish farming practices, with states like Louisiana and Mississippi leading production. A key driver is the growing consumer preference for high-protein diets, with per capita seafood consumption reaching 16 pounds annually as per NOAA statistics. Apart from these, government initiatives such as the USDA’s grants for aquaculture research have spurred innovation. Rising imports of premium fish species like salmon further fuel demand for specialized feeds.

Canada holds a significant share of the North American fish feed market and i driven by its robust aquaculture industry concentrated in provinces like British Columbia and Nova Scotia. The country benefits from cold-water ecosystems ideal for salmonid farming, contributing to steady growth in feed demand. Government regulations emphasizing environmental sustainability, such as the Canadian Aquaculture Industry Alliance standards, ensure responsible feed usage. Moreover, Canada’s proximity to the U.S. allows seamless export opportunities, amplifying its regional influence. Investments in R&D for plant-based and alternative protein feeds are also reshaping the market landscape.

Mexico commands a smaller share of the North American fish feed market, which is leveraging its strategic geographic location and thriving aquaculture hubs like Sinaloa and Sonora. According to CONAPESCA (National Commission of Aquaculture and Fisheries), shrimp farming alone contributes a major share of national aquaculture output and is creating substantial demand for nutrient-rich feeds. Rising urbanization and increasing disposable incomes have fueled seafood consumption, particularly tilapia and shrimp, driving feed manufacturers to innovate. Mexico’s trade agreements with the U.S. and Canada under USMCA enhance cross-border supply chains, boosting local feed producers. Environmental challenges, however, necessitate efficient feed formulations to minimize waste.

The "Rest of North America" segment encompasses smaller markets like Cuba, Jamaica, and the Bahamas. While individually small, these nations play vital roles in niche markets such as lobster and conch farming, which require tailored feed solutions. Climate change impacts, including rising ocean temperatures, are prompting investments in resilient feed technologies. Regional collaborations, such as partnerships with international NGOs, aim to improve feed efficiency and reduce dependency on imported feeds. Although limited by scale, this sub-region benefits from tourism-driven seafood demand, ensuring steady market expansion.

KEY MARKET PLAYERS

Some of the major players in the market are Ridley Corporation Limited, Archer Daniels Midland Company, Nutreco N.V., Cargill, Avanti Feeds Limited, Purina Animal Nutrition, Biostadt India Limited, Alltech, Nutriad, and Bioma,r mong others.

TOP PLAYERS IN THE MARKET

Cargill, Inc.

Cargill is a global leader in the North American fish feed Market, renowned for its innovative feed formulations and commitment to sustainability. The company leverages cutting-edge research to develop nutritionally balanced feeds tailored to specific species and life stages. Cargill’s focus on precision feeding technologies has enabled it to cater to both small-scale farmers and large aquaculture operations.

Skretting

Skretting, a subsidiary of Nutreco, is a key player known for its high-quality fish feed solutions. The company emphasizes innovation, particularly in developing feeds for Recirculating Aquaculture Systems (RAS). Skretting’s dedication to sustainability is evident in its efforts to incorporate alternative protein sources and reduce carbon footprints. By collaborating with local farmers and research institutions, Skretting ensures its products meet regional needs while adhering to global standards. Its proactive approach to addressing challenges like disease prevention and nutrient optimization has solidified its reputation as an industry pioneer.

Alltech

Alltech stands out for its focus on natural and sustainable feed additives. The company specializes in enhancing feed efficiency through probiotics, enzymes, and other bioactive compounds. Alltech’s commitment to improving animal health and performance aligns with growing consumer demand for responsibly sourced seafood. Its emphasis on education and training programs empowers farmers to adopt best practices, fostering long-term relationships.

Top Strategies Used by Key Players in the Market

Strategic Collaborations and Partnerships

Key players in the North American fish Feed Market have increasingly focused on forming strategic collaborations to enhance their product offerings and expand their reach. By partnering with research institutions, universities, and technology firms, companies can leverage external expertise to innovate and address emerging challenges. These alliances also enable players to co-develop customized solutions that cater to specific regional needs, ensuring higher adoption rates among farmers.

Sustainability Initiatives

Another major strategy is the emphasis on sustainability to align with evolving consumer preferences and regulatory requirements. Leading companies are investing in eco-friendly feed ingredients, such as plant-based proteins and microalgae, to reduce environmental impact. Additionally, they are adopting circular economy principles, utilizing by-products from other industries to create value-added feed components.

Technological Advancements

The integration of advanced technologies, such as artificial intelligence and machine learning, is a key strategy used to optimize feed formulations and improve operational efficiency. Companies are leveraging data analytics to monitor fish health, predict nutritional needs, and minimize waste. This tech-driven approach allows for real-time adjustments in feed composition, ensuring optimal growth and productivity.

COMPETITION OVERVIEW

The North American Fish Feed Market is characterized by intense competition, driven by the presence of established players and emerging innovators. Companies are vying for market share by focusing on product differentiation, sustainability, and technological advancements. The market is highly fragmented, with multinational corporations and regional players coexisting. Multinationals like Cargill and Skretting dominate due to their extensive resources and global reach, while smaller firms compete by offering niche solutions tailored to local needs. Sustainability has emerged as a critical battleground, with firms striving to reduce reliance on finite marine resources and adopt eco-friendly practices. Innovation in feed formulations, such as the inclusion of alternative proteins and functional additives, is another key competitive factor. Strategic acquisitions and partnerships are frequently employed to consolidate market positions and expand capabilities. Furthermore, regulatory compliance and consumer awareness about responsible sourcing have intensified competition, pushing companies to adopt transparent and ethical practices.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Cargill announced the launch of a new line of plant-based fish feed formulations designed to reduce dependency on marine-based ingredients. This initiative aims to enhance sustainability while maintaining high nutritional standards.

- In June 2023, Skretting partnered with a leading biotechnology firm to develop enzyme-rich feeds tailored for Recirculating Aquaculture Systems (RAS). This collaboration seeks to improve water quality and operational efficiency in RAS facilities.

- In February 2023, Alltech acquired a startup specializing in insect-based protein production. This acquisition enables Alltech to integrate innovative protein sources into its feed formulations, addressing the growing demand for sustainable alternatives.

- In September 2022, Cargill expanded its research and development center in Minnesota to focus on precision nutrition technologies. This expansion supports the company’s efforts to deliver customized feed solutions for diverse aquaculture species.

- In November 2021, Skretting launched a global campaign promoting the use of microalgae in fish feed. This initiative highlights the company’s commitment to reducing environmental impact and advancing sustainable aquaculture practices.

MARKET SEGMENTATION

This research report on the North American aquarium fish feed market is segmented and sub-segmented into the following categories.

By Ingredient

- Corn

- Soybean

- Fish oil

- Fish meal

- Additives

- Others

By Additives

- Vitamins

- Antibiotics

- Amino acids

- Antioxidants

- Feed acidifiers

- Feed enzymes

- Other additives

By End-User

- Fish

- Molluscs

- Crustaceans

- Others

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

What is driving the growth of the North America fish feed market?

Increased demand for seafood, rising aquaculture activities, and a focus on high-protein diets are the key drivers.

Which types of fish feed are most commonly used in North America?

Pellets, flakes, and granules are the most commonly used, with pellets dominating due to ease of use and nutrition.

What are the major ingredients in fish feed production?

Fishmeal, fish oil, soybean meal, corn gluten, and wheat are primary ingredients, often mixed with vitamins and minerals.

Who are the major players in the North America fish feed industry?

Key players include Cargill, Skretting, Alltech, BioMar Group, and Archer Daniels Midland Company.

What challenges does the market face?

Challenges include high raw material costs, environmental concerns, and regulatory pressures on sustainable practices.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com