North America Soil Conditioners Market Size, Share, Trends, COVID-19 Impact And Growth Forecast Report, Segmented By Application, Type, Crop Type, Solubility, And By Region (US, Canada, Mexico and Rest of North America), Industry Analysis From (2025 to 2033)

North America Soil Conditioners Market Size

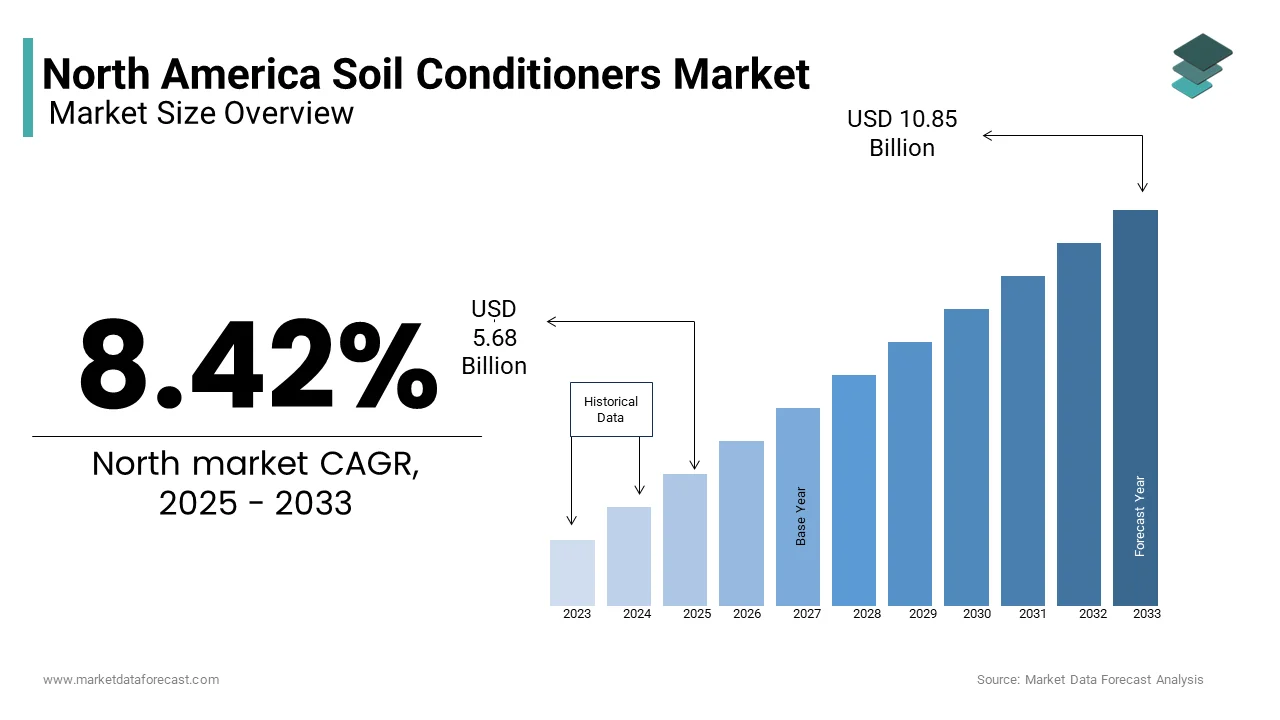

The North American soil conditioners market was valued at USD 5.24 billion in 2024 and is anticipated to reach USD 5.68 billion in 2025 from USD 10.85 billion by 2033, growing at a CAGR of 8.42% during the forecast period from 2025 to 2033.

Current Scenario Of The North America Soil Conditioners Market

The North American soil conditioners market represents a critical segment of the agricultural and horticultural industries, driven by the growing need to improve soil health, structure, and fertility. Soil conditioners are substances or materials added to soil to enhance its physical properties, such as water retention, aeration, drainage, and nutrient availability. These products play an indispensable role in combating soil degradation, a pervasive issue affecting over 50% of global agricultural land, according to the Food and Agriculture Organization (FAO). In North America, where intensive farming practices have led to widespread soil erosion and nutrient depletion, soil conditioners have emerged as a key solution for sustainable agriculture.

Urbanization and industrialization have further exacerbated soil quality challenges, with the United States Environmental Protection Agency (EPA) estimating that urban sprawl has resulted in the loss of over 31 million acres of farmland since 1982. To address these issues, farmers, landscapers, and gardeners are increasingly adopting organic and synthetic soil conditioners to restore soil vitality. Additionally, government initiatives promoting regenerative agriculture, such as Canada’s Agricultural Climate Solutions program, have bolstered demand for soil conditioners. By enhancing soil resilience and productivity, these products not only support food security but also align with broader environmental goals, making them a cornerstone of modern agricultural practices in North America.

MARKET DRIVERS

Increasing Soil Degradation and Erosion

Soil degradation and erosion are significant drivers propelling the adoption of soil conditioners across North America. As per the USDA, soil erosion affects approximately 60% of U.S. cropland, leading to a loss of topsoil and reduced agricultural productivity. This issue is particularly pronounced in regions like the Midwest, where intensive monoculture farming has depleted soil nutrients and compromised its structural integrity.

A key factor is the growing awareness of the economic and environmental impacts of soil degradation. According to the University of Nebraska-Lincoln, soil erosion costs the U.S. agricultural sector over $44 billion annually due to reduced crop yields and increased input costs. Soil conditioners, such as compost, gypsum, and biochar, play a pivotal role in mitigating these challenges by improving soil aggregation, water retention, and nutrient availability. For instance, studies conducted by Texas A&M University demonstrate that incorporating organic soil conditioners can increase crop yields by up to 25% while reducing erosion rates by 30%. Government programs, such as EQIP, further incentivize the use of soil conditioners, reinforcing their importance in sustainable farming practices.

Rising Adoption of Organic Farming Practices

The increasing adoption of organic farming practices is another major driver fueling the expansion of the North American soil conditioners market. According to the Organic Trade Association, sales of organic products in the U.S. reached $61.9 billion in 2022, reflecting a cultural shift towards chemical-free and environmentally friendly farming methods. Organic soil conditioners, derived from natural sources like compost, manure, and plant residues, are essential for maintaining soil fertility and structure without relying on synthetic inputs.

For example, as per research by Cornell University, organic soil conditioners enhance microbial activity, which improves nutrient cycling and reduces dependency on chemical fertilizers. Additionally, federal and state-level initiatives promoting organic agriculture, such as California’s Healthy Soils Program, provide financial incentives for farmers to adopt organic soil management practices. The alignment of consumer preferences, regulatory support, and environmental benefits positions soil conditioners as a critical tool in advancing organic farming and addressing the growing demand for sustainably produced food.

MARKET RESTRAINTS

High Costs of Premium Soil Conditioners

One of the primary restraints hindering the widespread adoption of soil conditioners in North America is the high cost associated with premium products, particularly those derived from organic sources. According to the American Society of Agronomy, organic soil conditioners such as biochar and humic acid can be significantly more expensive than synthetic alternatives, making them less accessible to small-scale farmers and budget-conscious consumers. This financial barrier limits the adoption of advanced soil conditioning solutions, particularly in regions with lower agricultural profitability.

Moreover, the transportation and application costs of soil conditioners add to the overall expense. For instance, as per a study by Purdue University, the logistics of transporting bulky organic materials like compost can increase costs by up to 20%, particularly in remote or rural areas. While some government programs offer subsidies for sustainable farming practices, these initiatives are not universally available. This financial challenge restricts the accessibility of soil conditioners, impeding their broader market penetration.

Limited Awareness and Education

Another significant restraint is the limited awareness and education surrounding the benefits and proper usage of soil conditioners. Despite their potential to improve soil health, many farmers and gardeners remain unfamiliar with how to effectively integrate these products into their operations. According to a survey conducted by the National Sustainable Agriculture Coalition, over 60% of small-scale farmers in the U.S. lack adequate knowledge about the long-term advantages of soil conditioners, creating skepticism and hesitation among potential users.

Additionally, the complexity of selecting and applying the appropriate soil conditioner for specific soil types requires technical expertise, which many users lack. As per research by the University of Wisconsin-Madison, improper application of soil conditioners can lead to inefficiencies, negating their intended benefits. Educational gaps and insufficient outreach programs further exacerbate this issue, particularly among rural communities. Without clear guidelines and increased advocacy, overcoming skepticism and fostering widespread acceptance of soil conditioners remains a formidable challenge in North America.

MARKET OPPORTUNITIES

Integration with Urban Agriculture Initiatives

The rise of urban agriculture presents a transformative opportunity for the North American soil conditioner market. As per the Urban Land Institute, over 80% of North Americans reside in urban areas, driving demand for localized food production systems such as rooftop gardens, vertical farms, and community plots. Soil conditioners play a pivotal role in these initiatives by improving soil fertility and structure in constrained urban environments, where traditional soil may be compacted or contaminated.

For instance, cities like New York and Los Angeles are investing heavily in urban gardening projects to combat food insecurity and reduce urban heat islands. According to research by Texas Tech University, incorporating organic soil conditioners into urban soils can enhance water retention by up to 40%, ensuring optimal plant growth in challenging conditions. Partnerships with local governments and private stakeholders further facilitate large-scale adoption, unlocking new revenue streams for manufacturers. By leveraging this untapped potential, the soil conditioners market can position itself as a cornerstone of North America’s sustainable urban development efforts.

Expansion into Regenerative Agriculture Programs

The growing emphasis on regenerative agriculture offers another significant opportunity for the North American soil conditioners market. As per the Rodale Institute, regenerative farming practices could sequester over 1 billion tons of carbon annually if implemented globally, with soil conditioners playing a crucial role in restoring soil health and enhancing carbon storage. Federal and state-level programs, such as EQIP and Canada’s Agricultural Climate Solutions, provide financial incentives for farmers to adopt regenerative practices, including the use of soil conditioners.

For example, studies conducted by Iowa State University reveal that integrating soil conditioners with cover cropping and reduced tillage can increase soil organic matter by up to 15%, significantly improving soil resilience and productivity. Additionally, the rising consumer demand for sustainably produced food further accelerates the adoption of regenerative practices. By capitalizing on these opportunities, the soil conditioners market can solidify its role in advancing sustainable agricultural practices across the region.

MARKET CHALLENGES

Dependence on Weather and Climatic Conditions

A significant challenge facing the North American soil conditioners market is the dependence on favorable weather and climatic conditions for optimal effectiveness. As per the National Oceanic and Atmospheric Administration (NOAA), unpredictable weather patterns caused by climate change have led to prolonged droughts, excessive rainfall, and temperature fluctuations, impacting soil health and the performance of soil conditioners. For instance, extreme dry spells can render water-retentive conditioners ineffective, while heavy rains may wash away applied products before they integrate into the soil.

According to research by the University of California-Davis, climatic variability can reduce the efficacy of soil conditioners by up to 25%, necessitating repeated applications and increasing costs for farmers. While advancements in weather forecasting and adaptive technologies aim to mitigate these risks, their availability and affordability remain inconsistent. Addressing this challenge requires significant investment in resilient soil management strategies, posing a persistent obstacle to market growth.

Competition from Traditional Farming Practices

Competition from traditional farming practices represents another major challenge for the soil conditioner market in North America. Conventional methods, such as the use of chemical fertilizers and manual soil amendments, dominate the market due to their lower upfront costs and ease of implementation. As per the USDA, traditional farming practices account for over 70% of all agricultural operations, making them a formidable competitor for soil conditioners.

Additionally, misconceptions about the complexity of soil conditioners deter adoption. According to a survey by the National Farmers Union, nearly 50% of farmers perceive soil conditioners as difficult to integrate into existing workflows, despite their long-term benefits. This perception gap, combined with the entrenched market presence of conventional methods, creates a challenging environment for soil conditioner providers. Bridging this gap requires targeted education campaigns and demonstrations of cumulative advantages, which remain an uphill battle in the current competitive landscape.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.42% |

|

Segments Covered |

By Application, Type, Crop Type, and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The U.S, Mexico, Brazil, Rest of North America |

|

Market Leaders Profiled |

BASF SE (Germany), The Dow Chemical Company (U.S.), Evonik Industries AG (Germany), Akzo Nobel N.V. (Netherlands), and Solvay S.A. (Belgium), Croda International Plc (U.K.), Clariant International AG (Switzerland), Lambent Corp. (U.S.), Adeka Corporation (Japan), and Eastman Chemical Company (U.S.). |

SEGMENT ANALYSIS

By Application Insights

The agricultural segment dominates the North America soil conditioners market, accounting for approximately 70% of the total market share, as per the USDA. This leadership is driven by the critical role soil conditioners play in enhancing soil health and productivity, particularly in regions with intensive farming practices. For instance, according to Iowa State University, over 60% of U.S. cropland requires soil amendments to combat nutrient depletion and structural degradation caused by monoculture farming.

A key driving factor is the growing emphasis on sustainable agriculture. As per the Rodale Institute, regenerative farming practices, which heavily rely on soil conditioners, can sequester up to 1 billion tons of carbon annually, making them indispensable for addressing climate change. Additionally, government programs like EQIP provide subsidies for farmers adopting soil conditioning technologies, further accelerating adoption. The convergence of sustainability goals and policy support reinforces the dominance of the agricultural segment in the soil conditioners market.

The industrial segment is the fastest-growing application area in the North America soil conditioners market, with a projected CAGR of 8.5% through 2030, according to the Environmental Protection Agency (EPA). This growth is fueled by the increasing use of soil conditioners in land reclamation projects, construction sites, and urban development initiatives.

A significant driver is the rising focus on environmental restoration. According to the EPA, soil conditioners are being widely used to rehabilitate degraded lands caused by mining, deforestation, and industrial activities. For example, studies conducted by the University of Arizona reveal that incorporating soil conditioners into reclaimed mine sites can restore vegetation cover by up to 40%, significantly improving ecological balance. Additionally, urbanization trends have spurred demand for soil conditioners in landscaping and green infrastructure projects, creating new opportunities for growth in this segment.

By Type Insights

Natural soil conditioners dominate the North American market, capturing approximately 60% of the total market share, as stated by the American Society of Agronomy. These products, derived from organic materials such as compost, manure, and biochar, are preferred for their ability to enhance soil fertility and microbial activity without introducing synthetic chemicals. For instance, according to Cornell University, natural soil conditioners can increase soil organic matter by up to 15%, improving water retention and nutrient availability.

A primary driving factor is the growing consumer preference for eco-friendly solutions. As per the Organic Trade Association, sales of organic products in the U.S. reached $61.9 billion in 2022, reflecting a cultural shift towards chemical-free farming practices. Government initiatives promoting organic agriculture, such as Canada’s Healthy Soils Program, further bolster the adoption of natural soil conditioners. The alignment of consumer demand, regulatory support, and environmental benefits positions natural soil conditioners as the dominant type in the market.

Synthetic soil conditioners are the fastest-growing segment in the North American soil conditioners market, with a CAGR of 9.2%, according to the USDA Foreign Agricultural Service. This growth is propelled by their cost-effectiveness and ability to deliver immediate results, particularly in large-scale agricultural operations.

A key driver is the increasing need for rapid soil improvement in commercial farming. According to Purdue University, synthetic conditioners such as gypsum and polymers can enhance soil structure and drainage within weeks, making them ideal for time-sensitive applications. Additionally, advancements in polymer technology have improved the durability and performance of synthetic products, expanding their use in industrial applications like land reclamation and construction. The convergence of innovation and efficiency positions synthetic soil conditioners as a critical growth driver in the market.

By Crop Type Insights

Cereals and grains dominate the North American soil conditioners market, accounting for approximately 40% of the total market share, as per the USDA. This prominence stems from the widespread cultivation of crops like corn, wheat, and barley, which require optimal soil conditions to achieve high yields. For instance, according to Texas A&M University, cereals and grains account for over 50% of total U.S. farmland, underscoring their importance in the agricultural landscape.

A major driving factor is the increasing global demand for staple crops. As per the Food and Agriculture Organization (FAO), global cereal production must increase by 50% by 2050 to meet the needs of a growing population. Soil conditioners play a pivotal role in meeting this demand by improving soil fertility and reducing erosion. Additionally, government programs promoting sustainable farming practices incentivize the use of soil conditioners in cereal and grain cultivation, further reinforcing their dominance in the market.

Fruits and vegetables are the fastest-growing crop type segment in the North America soil conditioners market, with a CAGR of 10.3%, according to the National Sustainable Agriculture Coalition. This growth is driven by the rising consumer demand for fresh, organic produce, particularly among health-conscious individuals.

A significant driver is the increasing prevalence of urban gardening and small-scale farming. According to the Urban Land Institute, over 550 community gardens across North America are adopting organic soil conditioners to grow fruits and vegetables sustainably. Additionally, federal initiatives like California’s Healthy Soils Program provide funding for organic farming, encouraging the use of soil conditioners in fruit and vegetable cultivation. The convergence of consumer preferences and policy support positions this segment as a critical growth driver in the market.

COUNTRY ANALYSIS

Top Leading Countries in the Market

The U.S. leads the North American soil conditioners market, holding a 65% market share, as per the USDA. Its dominance is driven by its vast agricultural infrastructure and robust adoption of advanced soil management technologies. For instance, states like Iowa and Illinois are pioneers in implementing soil conditioners to combat nutrient depletion and erosion. According to the USDA Foreign Agricultural Service, the U.S. accounts for over 70% of global soil conditioner exports, reinforcing its leadership in the sector.

Canada ranks second, with a 15% market share, according to Agriculture and Agri-Food Canada. The country’s leadership is fueled by its focus on sustainable farming practices, particularly in regions like Saskatchewan and Alberta. Programs like the Agricultural Climate Solutions initiative provide funding for soil conditioners, enhancing the competitiveness of Canadian farmers in both domestic and international markets.

Mexico holds a 10% market share, as per the Mexican Ministry of Agriculture. The country’s growth is driven by its expanding adoption of organic farming practices, particularly in regions like Jalisco and Chihuahua. Government initiatives promoting sustainable agriculture have spurred investments in soil conditioners, supporting both local consumption and regional trade.

Brazil accounts for 5% of the market, according to the Brazilian Agricultural Research Corporation. The nation’s tropical climate and extensive pasturelands make it a key player in soil conditioners for agricultural and industrial applications. Initiatives like the ABC Plan, which promotes low-carbon agriculture, further bolster the adoption of soil conditioners.

The remaining countries hold a 5% market share, as per regional trade associations. These nations leverage soil conditioners to address localized challenges, such as soil degradation and urban heat islands. For instance, Caribbean islands are increasingly adopting soil conditioners to sustain agriculture during dry seasons, supported by international partnerships and funding.

KEY MARKET PLAYERS

Some of the major players in the market include BASF SE (Germany), The Dow Chemical Company (U.S.), Evonik Industries AG (Germany), Akzo Nobel N.V. (Netherlands), and Solvay S.A. (Belgium), Croda International Plc (U.K.), Clariant International AG (Switzerland), Lambent Corp. (U.S.), Adeka Corporation (Japan), and Eastman Chemical Company (U.S.).

Top Players in the Market

BASF SE

BASF SE is a global leader in the soil conditioners market, renowned for its innovative solutions that enhance soil fertility and structure. The company’s contribution to the global market lies in its ability to develop advanced synthetic and bio-based products tailored to diverse agricultural needs. BASF actively collaborates with farmers and governments to promote sustainable farming practices, particularly in regions facing soil degradation. Its focus on research and development has positioned it as a pioneer in creating eco-friendly soil conditioners that align with environmental goals, reinforcing its reputation as a trusted partner for modern agriculture.

Novozymes A/S

Novozymes A/S specializes in producing bio-based soil conditioners derived from natural enzymes and microorganisms, making it a key player in promoting organic farming. The company’s commitment to sustainability is evident in its development of microbial solutions that improve soil health by enhancing nutrient availability and microbial activity. Novozymes actively invests in expanding its product portfolio to include biodegradable and non-toxic options, appealing to environmentally conscious consumers. By emphasizing education and advocacy, the company has strengthened its global presence, positioning itself as a driving force behind regenerative agriculture practices worldwide.

Yara International ASA

Yara International ASA focuses on delivering high-quality soil conditioners designed to optimize crop yields while conserving resources. The company’s innovative approach addresses both agricultural and industrial applications, making it a preferred choice for large-scale farming operations and land reclamation projects. Yara actively supports initiatives aimed at reducing carbon footprints and improving soil resilience through precision farming technologies. Its contributions to the global market include fostering sustainable practices and supporting green infrastructure projects, solidifying its role as a leader in advancing soil health solutions.

Top Strategies Used By Key Market Participants

Strategic Partnerships with Agricultural Stakeholders

Key players in the North American soil conditioners market frequently collaborate with farmers, agricultural cooperatives, and research institutions to promote the adoption of their products. These partnerships enable companies to demonstrate the tangible benefits of soil conditioners through field trials and pilot programs, fostering grassroots adoption. For instance, joint initiatives with universities allow firms to validate the efficacy of their products scientifically, building credibility and trust among end-users. Such collaborations not only enhance brand loyalty but also create a network of advocates who drive demand across various segments.

Investment in R&D for Technological Advancements

Innovation remains a cornerstone for maintaining competitiveness in the soil conditioners market. Leading companies are investing heavily in research and development to improve product performance and user experience. By focusing on advancements such as bio-based polymers, nanotechnology, and enzyme formulations, these firms can differentiate themselves while addressing emerging trends like carbon sequestration and water conservation. This emphasis on technological leadership ensures they stay ahead of regulatory requirements and consumer expectations, reinforcing their position as industry pioneers.

Expansion into Emerging Applications

To diversify their revenue streams, key players are exploring new applications for soil conditioners beyond traditional agriculture. For example, soil conditioners are increasingly being used in urban gardening, vertical farming, and land reclamation projects. By targeting these emerging markets, companies can tap into untapped opportunities and reduce reliance on conventional sectors. This strategy not only broadens their customer base but also positions them as innovators in the evolving agricultural and environmental landscape.

COMPETITION OVERVIEW

The NorthAmericana soil conditioners market is characterized by intense competition, driven by the presence of established players and emerging startups striving to capture market share. Leading companies leverage their expertise in technology and innovation to offer superior products that comply with stringent environmental standards. The competitive landscape is further shaped by the increasing demand for sustainable solutions, prompting firms to adopt strategies such as mergers, acquisitions, and partnerships. Smaller players, on the other hand, focus on niche markets, targeting specific applications like urban farming or industrial land reclamation. This dynamic interplay between innovation, sustainability, and strategic initiatives underscores the complexity of the market, ensuring robust growth and continuous evolution.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, BASF SE launched a partnership with a major U.S. agricultural cooperative to promote regenerative farming practices using bio-based soil conditioners. This collaboration aims to educate farmers about the long-term benefits of sustainable soil management while facilitating access to carbon credit programs.

- In June 2023, Novozymes A/S introduced a new line of microbial soil conditioners specifically designed for organic farming. This move aligns with the growing demand for chemical-free agricultural inputs and strengthens the company’s position in the organic market.

- In February 2024, Yara International ASA acquired a regional waste management firm specializing in organic compost production. This acquisition enhances the company’s supply chain resilience and supports its goal of scaling natural soil conditioner production.

- In September 2023, a Canada-based producer signed a memorandum of understanding with the government to promote sustainable soil management practices. This collaboration aims to improve soil health and increase production efficiency, boosting the company’s domestic and regional market presence.

- In November 2023, a U.S. cooperative launched a pilot program in California to demonstrate the use of soil conditioners in urban gardening projects. The initiative targets environmentally conscious consumers and highlights soil conditioners’ role in sustainable urban ecosystems.

MARKET SEGMENTATION

This research report on the North American soil conditioners market is segmented and sub-segmented into the following categories.

By Application Insights

- Agricultural

- Industrial segments

By Type Insights

- Natural

- Synthetic segments

By Crop Type Insights

- Oilseeds

- Pulses

- Cereals

- Grains

- Fruits and vegetables

- Solubility

- Water-soluble

- Hydrogels

By Country

- United States

- Canada

- Mexico

Frequently Asked Questions

What are soil conditioners and why are they important in North America?

Soil conditioners are materials added to soil to improve its physical qualities, especially for agricultural productivity. In North America, they help address soil erosion, nutrient loss, and compaction, supporting sustainable farming.

What factors are driving the growth of the soil conditioners market in North America?

Key drivers include the demand for high crop yields, adoption of organic farming, and concerns over soil degradation due to intensive agriculture.

Which types of soil conditioners are most commonly used in North America?

Organic conditioners like compost, manure, and biochar are popular, along with inorganic options such as gypsum and lime for pH and structure improvement.

Who are the major end-users of soil conditioners in the region?

The primary end-users include commercial farmers, horticulturists, and turf managers (like golf courses and sports fields).

What are the emerging trends in the North American soil conditioners market?

Trends include increased use of sustainable and eco-friendly products, precision agriculture technologies, and partnerships between agritech companies and farms.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com