North America Vascular Graft Market Size, Share, Trends & Growth Forecast Report By Product (Hemodialysis Access Grafts, Endovascular Stent Grafts, Peripheral Vascular Graft), Application (Cardiac Aneurysm, Kidney Failure), Raw Material (Biosynthetic, Polyester, Polyurethane (PU), Polytetrafluoroethylene (PTFE)) and Country (United States, Canada, Mexico) Industry Analysis From 2025 to 2033.

North America Vascular Graft Market Size

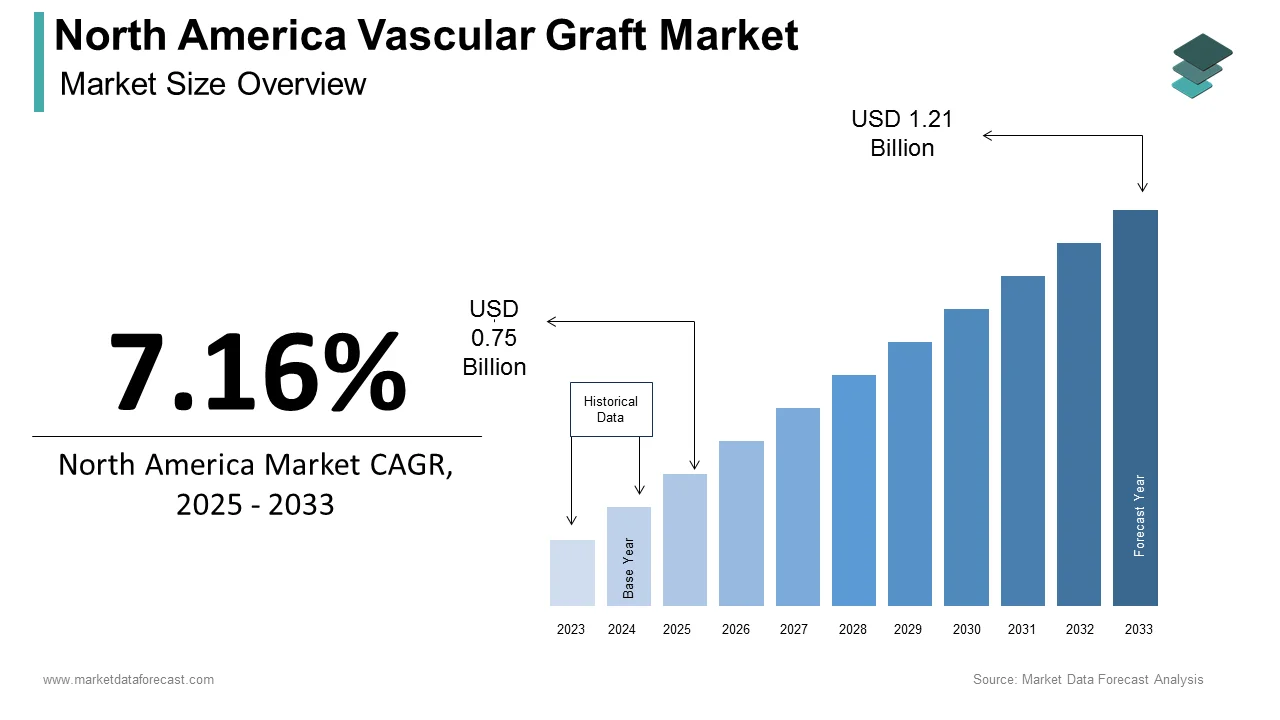

The size of the vascular graft market in North America was valued at USD 0.65 billion in 2024. This market is expected to grow at a CAGR of 7.16% from 2025 to 2033 and be worth USD 1.21 billion by 2033 from USD 0.75 billion in 2025.

The vascular graft market in North America is witnessing steady growth owing to the advancements in medical technology and an aging population prone to cardiovascular diseases. According to a study by the American Heart Association, nearly 121.5 million adults in the United States suffer from some form of cardiovascular disease, underscoring the growing demand for vascular grafts. The market is further buoyed by the rising prevalence of peripheral artery disease (PAD), which affects approximately 8.5 million people in the U.S. alone, as per the Centers for Disease Control and Prevention. Endovascular stent grafts have emerged as a dominant product category, accounting for over 40% of the market revenue in 2023. Canada, on the other hand, is experiencing a surge in hemodialysis access grafts due to increasing cases of chronic kidney disease. As per Statistics Canada, the incidence of end-stage renal disease has risen by 15% over the past decade, fueling demand for vascular grafts. The market is also supported by favorable reimbursement policies and government initiatives aimed at improving healthcare infrastructure, making vascular surgeries more accessible across the region.

MARKET DRIVERS

Rising Prevalence of Cardiovascular Diseases

Cardiovascular diseases remain a leading cause of mortality in North America, with heart-related conditions accounting for one in every four deaths, according to the American Heart Association. This alarming statistic has significantly increased the demand for vascular grafts, particularly endovascular stent grafts used in treating aortic aneurysms. In 2023, approximately 15,000 abdominal aortic aneurysm repairs were performed in the U.S., reflecting a 5% annual increase over the past five years. The aging population, coupled with lifestyle factors such as smoking and obesity, further exacerbates the burden of these diseases. For instance, the National Institutes of Health estimates that 60% of individuals aged 65 and above are at risk of developing PAD, a condition often treated using vascular grafts. These trends underscore the critical role of cardiovascular disease prevalence as a primary driver of market growth.

Technological Advancements in Medical Devices

Technological innovations have revolutionized the vascular graft market that are making procedures safer and more effective. The development of bioengineered grafts, for example, has reduced complications such as infections and rejections, enhancing patient outcomes. As per a report by the Food and Drug Administration, bioengineered grafts now account for 25% of all vascular graft procedures in North America. Additionally, the integration of minimally invasive techniques has shortened recovery times, driving adoption rates. For instance, robotic-assisted vascular surgeries have grown by 12% annually since 2020, as per a study published in the Journal of Vascular Surgery. These advancements are supported by substantial investments in research and development, with companies allocating over $5 billion annually to innovate vascular solutions. Such progress not only meets the rising demand but also positions North America as a global leader in vascular graft technology.

MARKET RESTRAINTS

High Costs Associated with Vascular Procedures

The high cost of vascular graft procedures is one of the key factors hampering the growth of the North American vascular graft market. According to the Healthcare Cost and Utilization Project, the average cost of an endovascular stent graft procedure in the U.S. exceeds $50,000, making it inaccessible for uninsured or underinsured patients. Even with insurance coverage, out-of-pocket expenses can deter individuals from opting for surgery. This financial burden is further compounded by the rising costs of advanced medical technologies, which are often passed on to patients. For example, bioengineered grafts, while offering superior outcomes, are priced 30% higher than traditional synthetic grafts, limiting their adoption. Canada faces similar challenges, with provincial healthcare systems struggling to cover the expenses of complex vascular surgeries. As per the Canadian Institute for Health Information, wait times for vascular procedures have increased by 10% over the past three years due to budgetary constraints, hindering market growth.

Stringent Regulatory Approvals

Stringent regulatory requirements for medical devices are further hindering the expansion of the North American vascular graft market. The approval process for new graft technologies can take up to five years, delaying their commercial availability. According to the Food and Drug Administration, only 60% of vascular devices submitted for approval meet the required standards on the first attempt, necessitating costly revisions and additional testing. This lengthy process discourages smaller companies from entering the market, reducing competition and innovation. Furthermore, post-market surveillance mandates add to the compliance burden, increasing operational costs for manufacturers. A study by the Regulatory Affairs Professionals Society reveals that regulatory hurdles contribute to a 20% reduction in the number of new vascular graft products launched annually. These challenges highlight the need for streamlined approval processes to foster market growth.

MARKET OPPORTUNITIES

Growing Adoption of Minimally Invasive Procedures

The shift toward minimally invasive surgical techniques is one of the significant opportunities for the vascular graft market in North America. According to a report by the Society for Vascular Surgery, minimally invasive procedures now account for over 60% of all vascular surgeries performed in North America, driven by their shorter recovery times and reduced risk of complications. Endovascular stent grafts, in particular, have gained traction due to their ability to treat complex aneurysms without open surgery. In Canada, the adoption rate of these procedures has increased by 18% annually since 2020, as per data from the Canadian Cardiovascular Society. The integration of advanced imaging technologies, such as 3D angiography, has further enhanced the precision of these surgeries, making them more appealing to both surgeons and patients. Additionally, the growing preference for outpatient care models supports this trend, as minimally invasive procedures are often performed in ambulatory settings. This paradigm shift not only expands the patient pool but also positions vascular graft manufacturers to capitalize on the rising demand for innovative, less invasive solutions.

Increasing Focus on Personalized Medicine

Personalized medicine is emerging as a significant force in the North American vascular graft market, offering tailored solutions that improve patient outcomes. As per the National Institutes of Health, personalized grafts designed using patient-specific anatomical data have demonstrated a 25% reduction in postoperative complications compared to traditional options. Biodegradable and bioengineered grafts, which adapt to the patient’s biological environment, are gaining popularity, with the U.S. market for these products projected to grow at a CAGR of 14% through 2030. Advances in 3D printing technology have further accelerated this trend, enabling the creation of custom grafts within days. For instance, a study published in the Journal of Biomedical Materials Research highlights that 3D-printed vascular grafts now account for 10% of all grafts used in experimental trials. This focus on personalization aligns with broader healthcare trends, creating new avenues for innovation and market expansion in North America.

MARKET CHALLENGES

Limited Availability of Skilled Surgeons

The shortage of skilled vascular surgeons is one of the notable challenges to the growth of the North American vascular graft market. According to the American College of Surgeons, there are fewer than 4,000 certified vascular surgeons in the United States, a number that falls short of meeting the growing demand for complex vascular procedures. This scarcity is particularly pronounced in rural areas, where access to specialized healthcare services remains limited. For example, a study by the Rural Health Information Hub reveals that only 20% of rural hospitals in the U.S. offer advanced vascular surgeries, leaving millions of patients underserved. Canada faces similar challenges, with the Canadian Medical Association reporting a 12% increase in wait times for vascular procedures due to a lack of qualified professionals. Training programs for vascular surgeons are also limited, exacerbating the workforce gap. Without addressing this issue, the market risks stagnation, as even the most advanced graft technologies cannot be utilized effectively without skilled practitioners.

Ethical Concerns Surrounding Bioengineered Grafts

Ethical concerns surrounding the use of bioengineered grafts are further challenging the expansion of the North American vascular graft market. While these grafts offer superior biocompatibility and reduce rejection rates, their development often involves the use of animal-derived materials or stem cells, raising ethical questions. According to a survey conducted by the Ethics Committee of the American Society for Bioethics, 35% of patients express hesitation about using bioengineered grafts due to moral objections. This sentiment is particularly pronounced among religious communities, where the use of animal tissues is viewed unfavorably. Additionally, regulatory bodies like the Food and Drug Administration have imposed strict guidelines on the sourcing and processing of biological materials, increasing compliance costs for manufacturers. A report by the Biotechnology Innovation Organization notes that these ethical and regulatory hurdles have slowed the adoption of bioengineered grafts, limiting their market penetration despite their potential benefits.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Application, Raw Material, and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico and Rest of North America |

|

Market Leader Profiled |

Medtronic, Terumo Corporation, LeMaitre Vascular, Inc., Getinge AB; BD (Becton Dickinson), Abbott, B. Braun Melsungen AG., W. L. Gore and Associates, Inc., MicroPort Scientific Corporation, Endologix, and Others. |

SEGMENTAL ANALYSIS

By Product Insights

The endovascular stent grafts segment had 54.9% of the North America vascular graft market share in 2024. The dominating position of endovascular stent grafts segment in the North American market is driven by their widespread use in treating abdominal aortic aneurysms (AAA) that account for nearly 75% of all aortic aneurysm cases in the region, as per the Society for Vascular Surgery. The minimally invasive nature of these procedures has significantly boosted their adoption, with over 15,000 AAA repairs performed annually in the U.S. alone. Additionally, advancements in stent graft design, such as fenestrated and branched systems, have expanded their applicability to complex anatomical conditions, further solidifying their position as the largest segment. The aging population also plays a pivotal role, as individuals aged 65 and above are five times more likely to require endovascular interventions. According to the National Institutes of Health, this demographic is projected to grow by 20% over the next decade, ensuring sustained demand for stent grafts. Furthermore, favorable reimbursement policies for minimally invasive procedures have made them more accessible, contributing to their market leadership.

The hemodialysis access grafts segment is predicted to witness the fastest CAGR of 9.8% over the forecast period owing to the rising incidence of chronic kidney disease (CKD) and end-stage renal disease (ESRD), which require reliable vascular access for dialysis. As per the Centers for Disease Control and Prevention, CKD affects over 37 million Americans, with ESRD cases increasing by 4% annually. Synthetic hemodialysis grafts, known for their durability and ease of use, are increasingly preferred over autologous fistulas, particularly in elderly patients with compromised veins. Technological innovations, such as heparin-coated grafts, have further enhanced their appeal by reducing thrombosis rates by 30%, according to a study published in the Journal of Vascular Access. Canada’s growing focus on improving dialysis infrastructure has also contributed to this trend, with provincial healthcare programs investing heavily in vascular access solutions.

By Application Insights

The cardiac aneurysm segment held 59.7% of the North American market share in 2024. The leading position of cardiac aneurysm segment in North America is attributed to the high prevalence of cardiovascular diseases, which affect over 121.5 million adults in the U.S., as reported by the American Heart Association. Abdominal aortic aneurysms, a subset of cardiac aneurysms, represent the majority of cases, driving demand for endovascular stent grafts. The increasing adoption of minimally invasive techniques has further bolstered this segment, with over 60% of AAA repairs now performed using stent grafts. Aging populations and lifestyle-related risk factors, such as smoking and hypertension, exacerbate the burden of cardiac aneurysms. According to the National Institutes of Health, individuals with untreated hypertension are three times more likely to develop aneurysms, underscoring the critical need for effective vascular solutions. Government initiatives promoting early diagnosis and treatment have also played a key role in sustaining the segment’s dominance.

The kidney failure segment is projected to register a prominent CAGR of 10.2% over the forecast period owing to the rising prevalence of chronic kidney disease (CKD), which affects over 15% of the U.S. population, as per the Centers for Disease Control and Prevention. Hemodialysis access grafts are integral to managing kidney failure, with synthetic grafts accounting for 40% of all vascular access procedures. Innovations in graft materials, such as biocompatible polymers, have improved patency rates and reduced complications, making them more appealing to clinicians. Canada’s emphasis on enhancing dialysis services has further accelerated this trend, with provincial healthcare systems allocating significant resources to vascular access infrastructure. According to Statistics Canada, the number of dialysis patients has increased by 15% over the past decade, reflecting the growing demand for vascular grafts in this application.

REGIONAL ANALYSIS

The United States held the largest share of 81.4% of the North America vascular graft market share in 2024. The dominating position of the U.S. in the North American market is attributed to the country’s advanced healthcare infrastructure, high prevalence of cardiovascular diseases, and significant investments in medical research. According to the American Heart Association, cardiovascular diseases affect over 40% of the U.S. population, creating a robust demand for vascular grafts. The aging demographic further amplifies this need, as individuals aged 65 and above are disproportionately affected by conditions such as abdominal aortic aneurysms (AAA) and peripheral artery disease (PAD). Additionally, the widespread adoption of minimally invasive procedures has propelled the market forward, with endovascular stent grafts accounting for over 50% of all vascular surgeries performed. Favorable reimbursement policies and government initiatives, such as the Centers for Medicare & Medicaid Services’ coverage for advanced vascular treatments, have also contributed to market growth. Furthermore, the presence of leading manufacturers and research institutions ensures continuous innovation, solidifying the U.S.’s dominance in the regional market.

Canada is anticipated to account for a prominent share of the North American vascular graft market over the forecast period. The rising cases of chronic kidney disease (CKD) and end-stage renal disease (ESRD) that necessitate hemodialysis access grafts are driving the Canadian market growth. According to Statistics Canada, the incidence of ESRD has increased by 20% over the past decade, reflecting the growing demand for vascular solutions. Provincial healthcare systems play a pivotal role in shaping the market landscape, with significant investments in dialysis infrastructure and vascular care services. Technological advancements, such as bioengineered grafts and heparin-coated materials, are gaining traction, supported by Canada’s focus on improving patient outcomes. Additionally, the country’s collaborative research ecosystem fosters innovation, with partnerships between academia and industry driving the development of next-generation grafts. While smaller in scale compared to the U.S., Canada’s strategic emphasis on accessibility and quality healthcare positions it as a key player in the regional market.

KEY MARKET PLAYERS

A few of the notable companies operating in the North America vascular graft market profiled in this report are Medtronic, Terumo Corporation, LeMaitre Vascular, Inc., Getinge AB; BD (Becton Dickinson), Abbott, B. Braun Melsungen AG., W. L. Gore and Associates, Inc., MicroPort Scientific Corporation, Endologix, and Others.

TOP PLAYERS IN THE MARKET

W.L. Gore & Associates leads with its innovative endovascular stent grafts, which are widely used for treating abdominal aortic aneurysms. Medtronic follows closely, offering a range of bioengineered grafts and minimally invasive solutions that cater to diverse clinical needs. Terumo Corporation rounds out the top three, with a strong presence in hemodialysis access grafts. Its commitment to research and development has enabled the launch of advanced biocompatible materials, reinforcing its global standing.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the North America vascular graft market employ a variety of strategies to strengthen their positions. Collaborations and partnerships are a primary focus, enabling companies to leverage complementary expertise and expand their product offerings. For instance, W.L. Gore & Associates has partnered with leading research institutions to develop next-generation bioengineered grafts. Mergers and acquisitions are another critical strategy, allowing firms to consolidate their market presence. Medtronic, for example, acquired a startup specializing in robotic-assisted vascular surgeries, enhancing its technological capabilities. Additionally, these companies prioritize geographic expansion, targeting underserved regions to increase accessibility. Terumo Corporation has invested heavily in establishing distribution networks across Canada, ensuring broader market penetration. Product innovation remains central to their strategies, with substantial R&D investments driving the development of advanced solutions tailored to evolving patient needs.

COMPETITION OVERVIEW

The North America vascular graft market is characterized by intense competition, driven by the presence of established players and emerging innovators. The market is moderately consolidated, with W.L. Gore & Associates, Medtronic, and Terumo Corporation dominating the landscape. These companies compete on the basis of product innovation, technological superiority, and strategic collaborations. Smaller firms, however, are gaining ground by focusing on niche segments, such as bioengineered and personalized grafts. The competitive dynamics are further shaped by regulatory requirements, which mandate rigorous testing and compliance, creating barriers to entry for new entrants. Pricing pressures also influence competition, as companies strive to offer cost-effective solutions without compromising quality. Despite these challenges, the market’s growth potential remains robust, fueled by increasing demand for minimally invasive procedures and advancements in medical technology.

TOP 5 MAJOR ACTIONS TAKEN BY COMPANIES

- In March 2024, W.L. Gore & Associates launched a new line of fenestrated stent grafts designed for complex aortic aneurysms. This initiative aimed to address unmet clinical needs and expand its product portfolio.

- In May 2024, Medtronic acquired a robotics firm specializing in vascular surgeries. This acquisition was anticipated to enhance its capabilities in minimally invasive procedures.

- In June 2024, Terumo Corporation partnered with a Canadian healthcare provider to improve access to hemodialysis grafts in rural areas. This collaboration sought to address regional disparities in vascular care.

- In July 2024, Bard Peripheral Vascular introduced a biodegradable graft for pediatric patients. This innovation aimed to reduce long-term complications associated with traditional synthetic grafts.

- In August 2024, Cook Medical expanded its manufacturing facilities in the U.S. to meet the growing demand for endovascular stent grafts. This investment was intended to enhance production capacity and reduce lead times.

MARKET SEGMENTATION

This research report on the North America vascular graft market is segmented and sub-segmented into the following categories.

By Product

- Hemodialysis Access Grafts

- Endovascular Stent Grafts

- Peripheral Vascular Graft

By Application

- Cardiac Aneurysm,

- Kidney Failure

By Raw Material

- Biosynthetic

- Polyester

- Polyurethane (PU)

- Polytetrafluoroethylene (PTFE)

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is the expected growth rate of the North America vascular graft market?

The North America vascular graft market is expected to grow at a CAGR of 7.16% from 2025 to 2033.

2. What factors are driving the growth of the North America vascular graft market?

The North America vascular graft market is driven by the increasing prevalence of cardiovascular diseases, advancements in graft materials, and rising demand for minimally invasive procedures.

3. What are the key challenges in the North America vascular graft market?

The North America vascular graft market faces challenges such as high procedure costs and strict regulatory approvals.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com