Global NLP In Healthcare and Life Sciences Market Size, Share, Trends & Growth Forecast Report By Technology (Speech Analytics Segment, Text Analytics Segment), End Use, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest Of Asia-Pacific), Industry Analysis From 2025 To 2033

Global NLP In Healthcare and Life Sciences Market Size

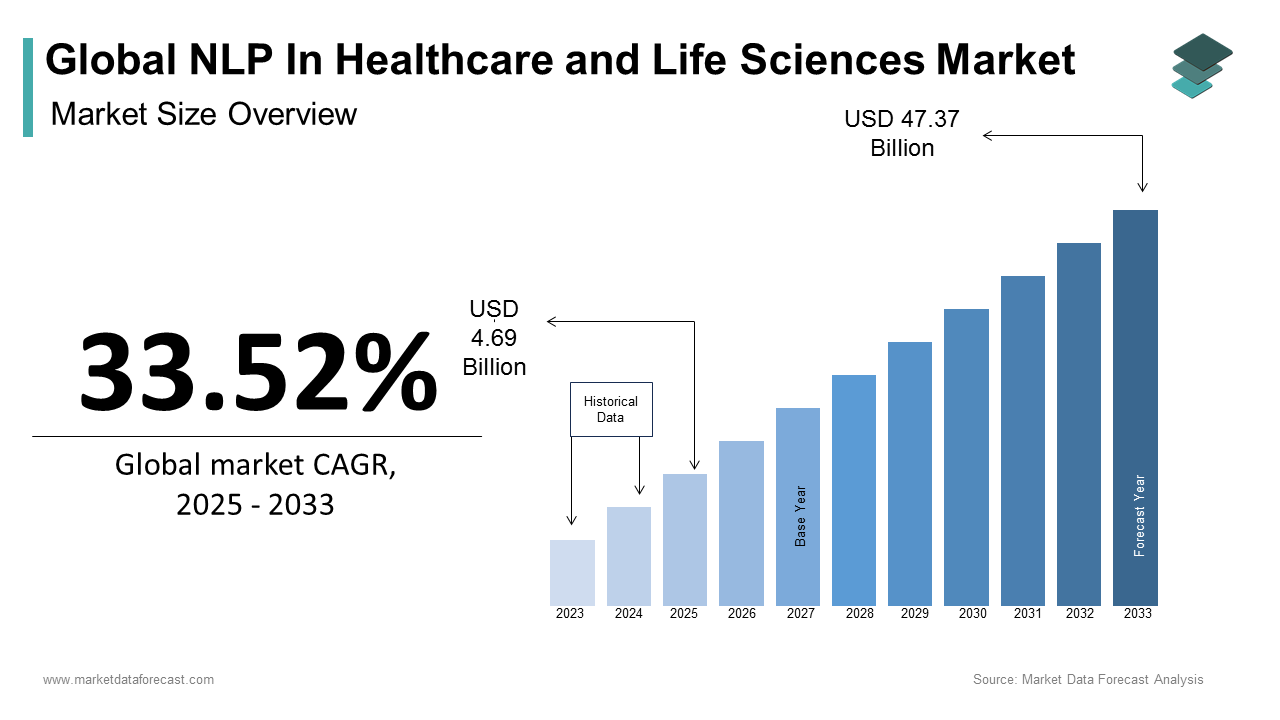

The global NLP in healthcare and life sciences market size was calculated to be USD 3.51 billion in 2024 and is anticipated to be worth USD 47.37 billion by 2033, from USD 4.69 billion in 2025, growing at a CAGR of 33.52% during the forecast period.

The application of Natural Language Processing (NLP) in healthcare and life sciences has gained significant traction across North America, particularly in the United States, where the market exhibits a mature and highly competitive landscape. The U.S. continues to dominate the market due to its advanced healthcare infrastructure, widespread adoption of electronic health records (EHRs), and increasing investments in AI-driven clinical solutions. As per the Office of the National Coordinator for Health Information Technology, over 96% of hospitals in the U.S. were using certified EHR systems by 2023, creating vast repositories of unstructured clinical data that NLP technologies are uniquely positioned to analyze. In addition, the rising demand for real-world evidence in drug development, coupled with regulatory support from agencies like the FDA, is accelerating the integration of NLP tools in pharmaceutical research and patient care workflows. Companies such as Nuance Communications and Innovaccer have reported increased deployment of NLP-based platforms to streamline documentation, enhance diagnostic accuracy, and improve clinical decision-making. With healthcare spending in the U.S. exceeding $4.9 trillion annually, as noted by the Centers for Medicare & Medicaid Services, the urgency to reduce administrative burden and operational inefficiencies further fuels the growth of NLP applications across both clinical and research domains.

MARKET DRIVERS

Increasing Demand for Clinical Documentation Efficiency

The growing burden of administrative tasks in healthcare has led to an urgent need for automation, particularly in clinical documentation. Physicians in the U.S. spend nearly 49% of their workday on EHR documentation, according to a study published by the Annals of Internal Medicine. This excessive clerical load contributes significantly to physician burnout, which affects over 50% of practicing physicians. Natural Language Processing (NLP) is increasingly being adopted to streamline this process by converting unstructured clinical speech into structured electronic records in real-time. Leading health systems such as Cleveland Clinic and Kaiser Permanente have reported up to 30% reductions in physician documentation time after integrating NLP-based voice-to-text platforms like Nuance’s Dragon Medical One. The American Medical Association estimates that improved documentation efficiency could save the average physician one hour per day, translating to over $45,000 annually in productivity gains per provider.

Expansion of Real-World Evidence (RWE) in Drug Development

Pharmaceutical companies are increasingly relying on real-world data (RWD) to support regulatory submissions, post-market surveillance, and drug discovery. As per the U.S. Food and Drug Administration (FDA), over 60% of novel therapeutics approved between 2018 and 2022 incorporated some form of real-world evidence (RWE). However, much of this data exists in unstructured formats such as physician notes, patient-reported outcomes, and scientific literature where traditional analytics fall short. NLP bridges this gap by extracting meaningful insights from vast volumes of text-based clinical and research data. A 2023 report by IQVIA revealed that NLP-enhanced RWE platforms can reduce clinical trial recruitment times by up to 40% and accelerate drug development timelines by six to nine months. Additionally, companies like Roche and AstraZeneca have publicly endorsed the use of NLP-driven platforms to mine oncology data from pathology reports and radiology notes, enabling faster identification of eligible patients for targeted therapies.

MARKET RESTRAINTS

Data Privacy and Regulatory Compliance Challenges

Despite its transformative potential, the adoption of NLP in healthcare faces significant hurdles due to stringent data privacy regulations and compliance requirements. In the United States, the Health Insurance Portability and Accountability Act (HIPAA) imposes strict controls on how patient data is collected, stored, and processed. Similarly, the European Union’s General Data Protection Regulation (GDPR) mandates explicit consent for processing personal health information, adding complexity to NLP implementation in clinical settings. A 2023 survey by HIMSS revealed that over 65% of healthcare IT leaders cited compliance concerns as a major barrier to deploying AI and NLP tools. These concerns are further amplified when dealing with sensitive patient narratives, such as mental health assessments or genetic counseling notes, where anonymization remains a technical challenge. According to the Ponemon Institute, the average cost of a healthcare data breach reached USD 10.1 million per incident in 2023, making organizations reluctant to adopt technologies that involve parsing unstructured clinical text at scale. Additionally, interoperability standards like HL7 FHIR do not yet fully accommodate the nuances of natural language extraction, limiting seamless integration across EHR systems. Without standardized frameworks for secure NLP deployment, many institutions delay or limit their investment in these technologies.

High Implementation Costs and Technical Complexity

Implementing NLP solutions in healthcare and life sciences requires substantial financial and technical resources, posing a major constraint to the global NLP in healthcare and life sciences market growth. Customizing NLP models for domain-specific use cases such as identifying adverse drug reactions from social media or interpreting radiology reports demands extensive training on annotated medical datasets, which can be prohibitively expensive. Moreover, the scarcity of skilled professionals who understand both clinical workflows and machine learning architectures adds to the complexity. A workforce analysis by Burning Glass Technologies found that only 12% of job postings requiring NLP skills received qualified applicants with both healthcare and AI expertise. Even among large pharmaceutical firms, internal AI teams often rely on third-party vendors such as Verint or Linguamatics, increasing dependency and long-term costs. While cloud-based NLP platforms have reduced entry barriers, small and mid-sized providers still struggle to justify ROI without clear, measurable improvements in patient outcomes or operational efficiency.

MARKET OPPORTUNITIES

Integration with Precision Medicine Initiatives

Precision medicine relies heavily on analyzing complex patient data to tailor treatments based on individual genetic profiles, lifestyle, and environmental factors. A significant portion of this data including physician notes, pathology reports, and genomic summaries is unstructured, making it inaccessible to conventional analytics tools. NLP offers a powerful solution by transforming this textual data into actionable insights that support personalized treatment strategies. According to the National Institutes of Health (NIH), the All of Us Research Program, which aims to gather health data from one million participants in the U.S., utilizes NLP to extract phenotypic information from electronic health records. This enables researchers to identify subpopulations suitable for targeted therapies. Furthermore, a 2023 study published in Nature Genetics showed that NLP-powered analysis of clinical notes increased the accuracy of genotype-phenotype associations by over 35%, enhancing the predictive power of precision medicine models. With the growing demand for precision medicine, the integration of NLP in genomic interpretation, cancer profiling, and pharmacogenomics presents a substantial growth opportunity. Biotech firms such as Tempus and Foundation Medicine have already embedded NLP into their diagnostic workflows to match patients with appropriate clinical trials, demonstrating the scalability and impact of this technology in advancing personalized care.

Growth of Multilingual NLP Applications in Global Clinical Trials

As clinical trials become increasingly decentralized and global, the need for multilingual NLP capabilities has surged. Traditional translation services are slow and costly, while automated systems often fail to capture the nuance of medical terminology across languages. Advanced NLP engines trained on diverse linguistic datasets are now bridging this gap, allowing pharmaceutical companies to collect and analyze patient-reported outcomes, investigator notes, and adverse event logs from multiple geographies in real-time. According to the Tufts Center for the Study of Drug Development, nearly 70% of clinical trials conducted in 2023 involved sites across more than 10 countries, highlighting the logistical complexity of managing multilingual data. Companies like Saama Technologies and ArisGlobal have developed NLP platforms capable of processing clinical inputs in over 25 languages, reducing data reconciliation errors by up to 40% and accelerating trial timelines. In addition, the World Health Organization (WHO) has endorsed the use of AI-assisted translation tools in low-resource settings, where access to trained medical translators is limited. With the growing number of clinical trial activities, the ability of NLP to facilitate cross-border collaboration and improve data quality positions it as a critical enabler of international research initiatives.

MARKET CHALLENGES

Contextual Understanding and Domain-Specific Ambiguity

The difficulty in accurately interpreting context and resolving ambiguity in clinical language is one of the major challenges to the NLP within the healthcare and life sciences market. Unlike general-purpose NLP applications used in consumer tech, healthcare texts are laden with abbreviations, synonyms, negations, and highly specialized jargon. For instance, the phrase “no history of diabetes” must be correctly interpreted as the absence of a condition, rather than a positive diagnosis. For instance, even state-of-the-art NLP models misclassify up to 18% of clinical concepts due to contextual misunderstandings. This leads to downstream errors in coding, billing, and decision support systems. Moreover, variations in regional dialects, note-taking styles, and specialty-specific terminologies further complicate standardization efforts. To address this, leading vendors such as Epic Systems and Mayo Clinic have invested in building domain-specific NLP libraries, such as the Unified Medical Language System (UMLS), which maps over 3 million biomedical concepts. Despite these advancements, achieving high fidelity in clinical NLP remains an ongoing technical challenge. Without continuous refinement and feedback loops from clinicians, even well-trained models may produce misleading outputs, undermining trust and adoption in safety-critical environments.

Interoperability and Standardization Gaps Across Systems

Despite the rapid evolution of NLP technologies, their effectiveness is often constrained by the lack of interoperability between disparate healthcare systems and data formats. Electronic health records (EHRs) from different vendors store clinical narratives in inconsistent structures, making it difficult for NLP tools to extract and normalize data across institutions. As reported by KLAS Research in 2024, only 30% of healthcare providers rated their EHR system's interoperability as satisfactory, highlighting the fragmentation in data exchange. This lack of standardization hampers the scalability of NLP solutions, especially in multi-institutional research collaborations and population health analytics. For example, a study by the Office of the National Coordinator for Health Information Technology (ONC) found that less than 20% of patient-generated notes were successfully integrated into structured databases due to format mismatches and semantic inconsistencies. Efforts such as the Fast Healthcare Interoperability Resources (FHIR) framework aim to bridge these gaps, but full adoption remains slow. Without uniform data standards and open APIs that support natural language input, NLP tools will continue to operate in siloed environments, limiting their potential to deliver comprehensive insights across the care continuum.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

33.52% |

|

Segments Covered |

By Technology, End Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

IBM Corporation, Microsoft Corporation, Amazon Web Services, Google LLC, 3M Company, Cerner Corporation, SAS Institute Inc., Health Fidelity Inc., Linguamatics, Dolbey Systems Inc. |

SEGMENTAL ANALYSIS

By Technology Insights

The text analytics segment accounted for the leading share of 31.3% of the global market in 2024. The growth of the text analytics segment in the global market is driven by its widespread application across clinical documentation, research data extraction, and real-world evidence generation. The ability of text analytics to convert vast volumes of unstructured clinical notes, discharge summaries, and scientific literature into structured, analyzable formats has made it indispensable for both providers and pharmaceutical firms. According to a 2023 report by Frost & Sullivan, over 65% of leading biopharmaceutical companies use text analytics platforms to accelerate drug discovery and post-market surveillance. Additionally, academic medical centers such as Mayo Clinic and Stanford Medicine have integrated NLP-based text analytics tools into their electronic health record systems to support clinical decision-making and population health management. A study published in JAMA Network Open found that hospitals using NLP-driven text mining tools saw a 27% improvement in diagnostic accuracy for rare diseases, demonstrating the tangible impact of this technology. Furthermore, regulatory agencies like the FDA are increasingly relying on insights derived from text analytics for pharmacovigilance, with more than 50% of novel therapeutics approved between 2018 and 2023 incorporating real-world data analyzed via NLP, as per an agency white paper. These factors collectively underline why text analytics remains the most substantial and widely adopted NLP technology in the healthcare and life sciences domain.

The speech analytics segment is emerging as the fastest-growing segment and is projected to register a CAGR of 16.8% over the forecast period owing to the increasing deployment of voice-enabled clinical documentation tools, ambient listening systems, and virtual scribes that help reduce physician burnout and improve patient-clinician interactions. According to the American Medical Association, physicians in the U.S. spend nearly 49% of their workday on EHR documentation, contributing significantly to job dissatisfaction and turnover. The adoption of speech analytics solutions such as Nuance’s Dragon Ambient eXperience (DAX) and Google Cloud’s Speech-to-Text API is enabling automated capture and structuring of clinical conversations directly into EHRs. According to studies, implementing ambient listening tools led to a 30% reduction in after-hours charting time and improved clinician satisfaction scores by 22%. Moreover, speech analytics is playing a critical role in behavioral health diagnostics. Startups like Sonde Health and Winterlight Labs are leveraging vocal biomarkers to detect early signs of depression, Alzheimer’s, and Parkinson’s disease. For instance, over 40% of health tech investors prioritized speech AI startups in 2024, signaling strong future momentum. With advancements in natural language understanding and the growing demand for contactless care delivery models, speech analytics is poised to outpace other NLP technologies in terms of growth velocity.

By End-Use Insights

The life science companies segment captured the major share of 36.9% of the global market in 2024. The leading position of the life sciences segment in the global market is primarily attributed to the increasing reliance on unstructured clinical and research data in drug discovery and development processes. For instance, nearly 60% of pharmaceutical firms now use NLP to extract insights from scientific literature, pathology reports, and patient narratives to support real-world evidence generation. This has significantly enhanced the speed and accuracy of target identification and clinical trial design. Moreover, regulatory agencies like the FDA are encouraging the use of NLP-powered analytics for pharmacovigilance and adverse event detection. A 2023 report by IQVIA revealed that NLP applications reduced clinical trial recruitment times by up to 40% and improved signal detection in safety monitoring. With major biopharma players such as Roche, Novartis, and Merck investing heavily in AI-driven R&D platforms, the demand for advanced NLP tools continues to grow rapidly within this sector.

The payers segment is projected to exhibit the highest CAGR of 18.2% over the forecast period due to the rising need for cost containment and fraud detection in insurance claims. As per the National Health Expenditure Data published by the Centers for Medicare & Medicaid Services, U.S. healthcare spending surpassed $4.9 trillion in 2023, with payer organizations seeking efficient ways to manage risk-based contracts and detect anomalies in billing patterns. NLP enables automated review of claim narratives, medical records, and provider notes to flag potential discrepancies or fraudulent activities. For instance, NLP-assisted claims processing led to a reduction of up to 25% in manual review time across leading health insurers. Additionally, payers are leveraging NLP to enhance member engagement through chatbots and virtual assistants that interpret patient inquiries and provide personalized responses. With health plans increasingly adopting value-based reimbursement models, the integration of NLP into decision-making workflows is expected to accelerate further.

REGIONAL ANALYSIS

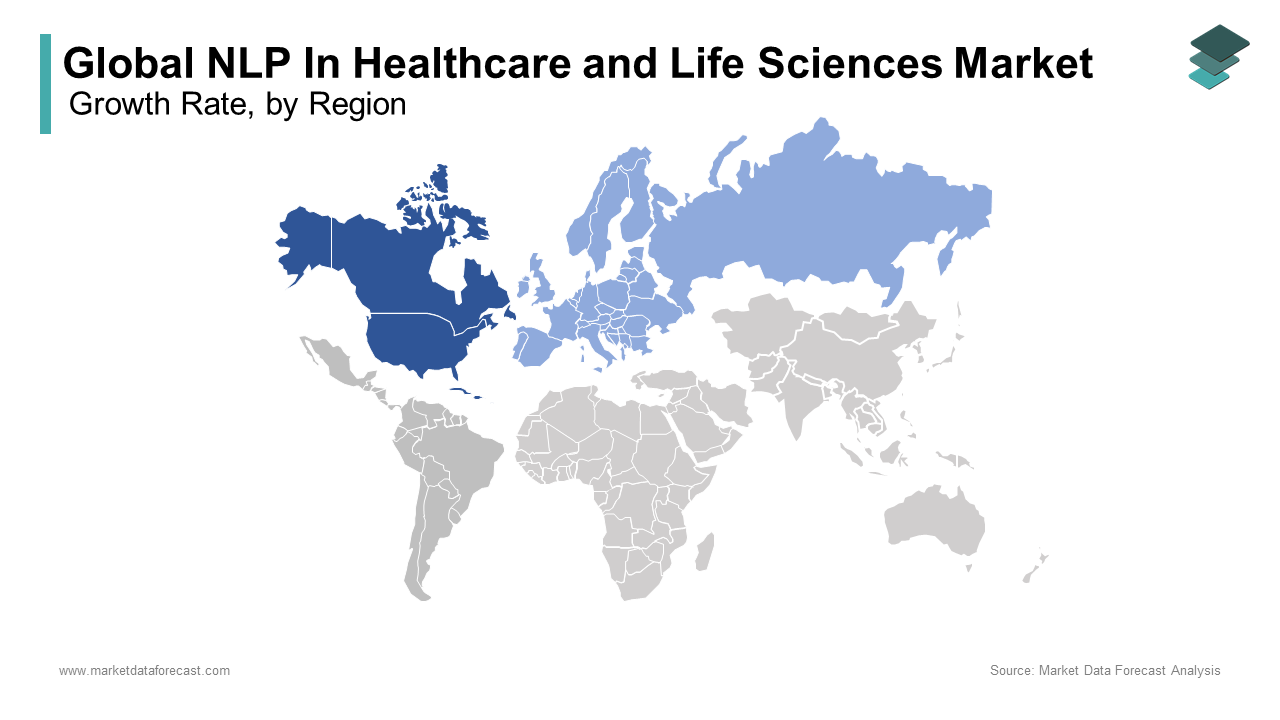

North America dominated the market in 2024 by holding 41.7% of the global market share in 2024. The dominance of North America in the global market is driven by its mature healthcare IT infrastructure and early adoption of AI technologies. The United States, in particular, benefits from widespread EHR implementation, with over 96% of hospitals using certified systems as reported by the Office of the National Coordinator for Health Information Technology. The country's robust investment in digital transformation initiatives, coupled with the strong presence of leading NLP vendors such as Nuance Communications and Verint, supports continued growth. Additionally, the U.S. Food and Drug Administration’s endorsement of real-world evidence in regulatory decisions has increased demand for NLP tools capable of analyzing clinical notes and research publications. According to the Mayo Clinic, physicians spend nearly 49% of their workday on documentation, highlighting the urgency for automation solutions. These factors collectively reinforce North America’s leadership position in the global NLP healthcare landscape.

Europe is another major region in the global NLP healthcare life sciences market and is anticipated to account for a substantial share of the global market over the forecast period. Factors such as strong government backing for digital health initiatives and stringent data governance frameworks are propelling the growth of the European NLP in the healthcare and life sciences market. Countries such as the UK, Germany, and France have been proactive in integrating AI into public health systems, with the European Commission allocating EUR 1.3 billion under the Digital Europe Programme to support AI innovation until 2027. The emphasis of Europe on interoperability standards, particularly through the adoption of HL7 FHIR and SNOMED CT, facilitates seamless integration of NLP into electronic health records. A 2024 report by Deloitte highlighted that more than 50% of NHS trusts in England had deployed NLP-based tools for patient triage and administrative efficiency. However, the complexity of GDPR compliance and multilingual data handling presents unique challenges that require tailored NLP training models. Despite these hurdles, Europe remains a key growth hub for NLP applications in both clinical and pharmaceutical domains.

Asia Pacific is emerging as a high-growth region with a projected CAGR of 16.4% over the forecast period owing to the expanding telemedicine networks, increasing digitization of health records, and growing investments in AI-driven diagnostics. In India, for example, the Ministry of Health launched the Ayushman Bharat Digital Mission to create a unified health ecosystem, which includes support for NLP-enabled medical transcription services. China is also witnessing rapid deployment of NLP in hospital information systems, with Baidu and Alibaba Cloud developing language models specifically trained on Mandarin medical texts. According to Frost & Sullivan, over 70% of Chinese hospitals plan to adopt AI-based clinical decision-support tools by 2026. Japan and South Korea are also leveraging NLP for geriatric care management, given their aging populations. With governments promoting cross-sector collaboration between tech firms and healthcare providers, Asia Pacific is poised for sustained expansion in NLP adoption.

Latin America represents a modest but growing segment in the global market and experiencing a steady uptake of NLP solutions due to improving healthcare access and rising private sector participation. Brazil leads the region in digital health investments, with the Ministry of Health supporting pilot programs for AI-assisted diagnosis in rural areas. For instance, Brazilian health tech startups raised over USD 300 million in funding, much of which went toward natural language understanding tools for telehealth platforms. Mexico is also advancing in EHR adoption, with over 60% of urban clinics digitizing patient records, creating opportunities for NLP-based coding and billing automation. However, limited technical expertise and inconsistent internet connectivity pose barriers to large-scale implementation. Despite these constraints, the region is showing promise, especially in Spanish-language NLP applications for chronic disease management and remote consultations.

Middle East and Africa account for a considerable share of the global NLP in the healthcare and life sciences market, with notable progress in countries such as Saudi Arabia, UAE, and South Africa. The Gulf Cooperation Council (GCC) nations are actively investing in smart healthcare infrastructure, with Vision 2030 in Saudi Arabia emphasizing AI integration in national health systems. According to Frost & Sullivan, UAE hospitals are deploying NLP-powered voice scribes to reduce physician workload and improve patient interactions. In Africa, mobile health innovations are gaining traction, particularly in low-resource settings where NLP can assist in interpreting community health worker notes and patient feedback forms. However, linguistic diversity and limited digital literacy remain persistent challenges. Nonetheless, initiatives like the African Union’s Digital Transformation Strategy are laying the groundwork for broader AI adoption, making the MEA region an area of future interest for NLP solution providers.

LEADING PLAYERS IN THE MARKET

Nuance Communications (a Microsoft Company)

Nuance is a leader in conversational AI and speech recognition, offering Dragon Medical One, one of the most widely used clinical documentation platforms globally. Its NLP capabilities enable real-time dictation, ambient listening, and EHR integration, helping clinicians streamline workflows and reduce burnout.

Verint Systems Inc.

Verint delivers enterprise-wide customer engagement and back-office automation solutions, including healthcare-specific NLP tools that help payers and providers analyze unstructured data from call centers, medical records, and claims. Its AI-driven platform enhances operational efficiency and improves patient experiences across healthcare delivery systems.

Linguamatics (an IQVIA Company)

Linguamatics specializes in clinical and life sciences NLP solutions, enabling researchers and pharmaceutical companies to extract insights from vast volumes of unstructured data. Its I2E platform is extensively used in drug discovery, pharmacovigilance, and real-world evidence generation, supporting faster and more informed decision-making in biopharma.

KEY MARKET PLAYERS AND COMPETITIVE OVERVIEW

Major Players of the NLP in healthcare and life sciences market include IBM Corporation, Microsoft Corporation, Amazon Web Services, Google LLC, 3M Company, Cerner Corporation, SAS Institute Inc., Health Fidelity Inc., Linguamatics, Dolbey Systems Inc.

The NLP in the healthcare and life sciences market is characterized by a dynamic and evolving competitive environment, featuring a mix of established tech giants, specialized NLP vendors, and emerging AI startups. While large enterprises dominate through strategic acquisitions and integrated platforms, niche players are carving out space by focusing on domain-specific applications such as genomics, radiology, and pharmacovigilance. Collaboration between technology firms and healthcare institutions is becoming increasingly common, with partnerships aimed at enhancing model accuracy, expanding language capabilities, and ensuring compliance with regulatory standards. As demand for real-time clinical insights and automated documentation grows, competition intensifies not only on product performance but also on scalability, interoperability, and ease of integration within existing healthcare ecosystems. The market remains highly fragmented, with room for innovation across underserved segments and geographies.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Nuance Communications announced the launch of Dragon Ambient eXperience (DAX) Express, a cloud-native ambient clinical intelligence solution designed to automate patient visit documentation directly within EHRs, enhancing clinician productivity and reducing after-hours charting.

- In March 2024, Verint Systems entered into a strategic partnership with Change Healthcare, now part of UnitedHealth Group, to integrate NLP-powered claims analytics into their payment integrity solutions, aiming to reduce fraud and improve claims adjudication efficiency across payer networks.

- In May 2024, Linguamatics introduced an updated version of its I2E platform , featuring enhanced multilingual NLP capabilities to support global clinical trials and pharmacovigilance efforts, enabling pharmaceutical clients to process non-English medical literature and patient-reported outcomes more effectively.

- In July 2024, Amazon Web Services expanded its Amazon Comprehend Medical service to include real-time processing of unstructured clinical notes for population health analytics, partnering with several U.S. health systems to deploy scalable NLP tools across hospital networks.

- In September 2024, Google Health collaborated with Mayo Clinic to develop a custom NLP model trained on de-identified clinical data to improve diagnostic accuracy and support clinical decision-making tools, marking a significant step toward embedding AI deeply into patient care workflows.

MARKET SEGMENTATION

This research report on the global NLP In Healthcare and Life Sciences Market has been segmented and sub-segmented based on technology, end use, and region.

By Technology

- Speech Analytics Segment

- Text Analytics Segment

By End Use

- Healthcare Providers

- Healthcare Payers

- Life Sciences Companies

- Others (clinical research organizations, academic institutions)

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. What challenges are faced in implementing NLP in healthcare?

Key challenges include data privacy concerns, lack of standardized medical terminologies, integration with legacy systems, and the complexity of processing multilingual and context-specific medical language.

2. How is NLP transforming the healthcare industry?

NLP helps streamline clinical documentation, improves diagnostic accuracy, supports predictive analytics, automates coding, and enhances patient engagement by enabling more efficient data processing and decision-making.

3. Which deployment mode is preferred by healthcare institutions for NLP solutions?

Cloud-based deployment is increasingly preferred due to scalability, cost-effectiveness, and ease of integration.

4. Who are the leading vendors in the global NLP in healthcare and life sciences market?

Leading vendors include IBM Corporation, Microsoft Corporation, Google LLC, Amazon Web Services, and 3M Company.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com