North America Acetic Acid Market Size, Share, Trends & Growth Forecast Report By Derivatives (Vinyl Acetate Monomer (VAM), Purified Terephthalic Acid (PTA), Ethyl Acetate, Acetic Anhydride, and Other Derivatives), Application, and Country (The United States, Canada, and Rest of North America), Industry Analysis From 2025 to 2033

North America Acetic Acid Market Size

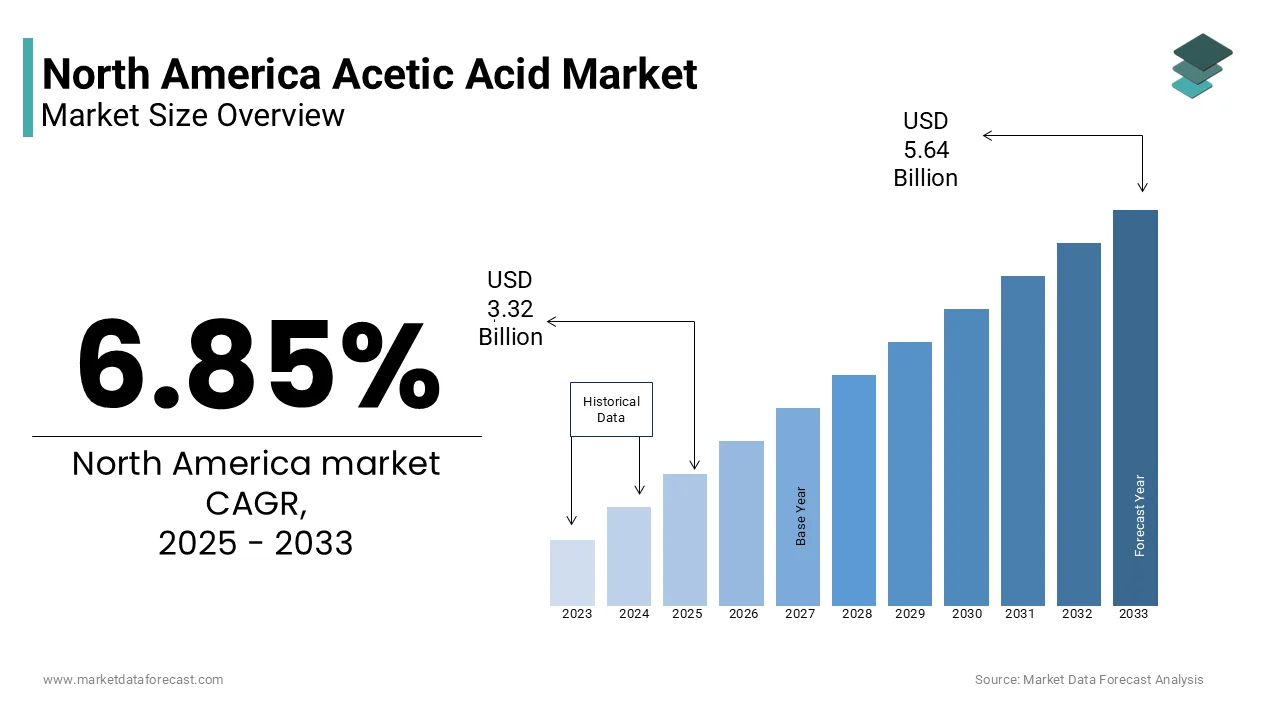

The Acetic acid market size in North America was valued at USD 3.11 billion in 2024 and is predicted to be worth USD 5.64 billion by 2033 from USD 3.32 billion in 2025 and grow at a CAGR of 6.85% from 2025 to 2033.

The North America acetic acid market covers the production, distribution, and consumption of acetic acid, a fundamental organic compound widely used in chemical synthesis across various industries. As a key building block for numerous industrial applications, acetic acid serves as an essential raw material in the manufacture of paints, coatings, adhesives, textiles, pharmaceuticals, food preservatives, and plasticizers. In industrial contexts, it is commonly derived from methanol carbonylation or through biological fermentation processes. The demand for acetic acid is closely tied to economic growth indicators, particularly in the United States, which remains one of the largest producers and consumers globally. Moreover, the growing emphasis on sustainable chemistry has led to increased research into bio-based acetic acid production methods.

MARKET DRIVERS

Expansion of the Vinyl Acetate Monomer (VAM) Industry

One of the primary drivers of the North America acetic acid market is the expanding use of acetic acid in the production of vinyl acetate monomer (VAM), a critical intermediate used in the formulation of adhesives, coatings, and synthetic fibers. VAM is synthesized using acetic acid and ethylene, making the availability and cost of acetic acid a major determinant of VAM production economics. A significant portion of this demand translates into increased consumption of VAM, thereby reinforcing the need for stable acetic acid supply chains. Moreover, rising infrastructure investment under federal programs such as the Bipartisan Infrastructure Law has spurred construction activity, further boosting the demand for paints and protective coatings that rely on VAM derivatives.

Growth in Bio-Based Chemical Production and Green Chemistry Initiatives

Growth in Bio-Based Chemical Production and Green Chemistry Initiatives

Another significant driver of the North America acetic acid market is the increasing focus on sustainable chemical production and the development of bio-based alternatives to traditional petrochemical inputs. Acetic acid derived from renewable sources—such as biomass fermentation—is gaining traction due to regulatory incentives and corporate sustainability commitments. Several chemical manufacturers are investing in new fermentation-based acetic acid facilities to meet the growing demand for eco-friendly raw materials. Additionally, companies like DuPont and Eastman Chemical have announced strategic initiatives to scale up their green chemistry operations, incorporating acetic acid into biodegradable polymers and solvent applications.

MARKET RESTRAINTS

Stringent Environmental Regulations and Emission Controls

A major restraint affecting the North America acetic acid market is the imposition of increasingly stringent environmental regulations governing industrial emissions and chemical handling procedures. Regulatory agencies such as the U.S. Environmental Protection Agency (EPA) and Environment and Climate Change Canada (ECCC) have implemented rigorous standards to limit volatile organic compound (VOC) emissions, hazardous air pollutants (HAPs), and wastewater discharges associated with chemical manufacturing. According to the EPA’s National Emissions Inventory (NEI), the chemical manufacturing sector contributes significantly to industrial VOC emissions, prompting tighter permitting requirements and pollution control mandates. Compliance with these regulations often necessitates costly upgrades to production facilities, including advanced scrubbers, catalytic oxidizers, and closed-loop systems designed to capture fugitive emissions. These regulatory pressures increase capital expenditures and operational costs for acetic acid producers, potentially slowing down capacity expansions and discouraging new entrants. In addition, public opposition to chemical plant emissions has led to delays in project approvals, further constraining market dynamics.

Volatility in Feedstock Prices and Supply Chain Disruptions

Another significant constraint impacting the North America acetic acid market is the volatility in feedstock prices, particularly for methanol and natural gas, which are integral to its production via carbonylation processes. Methanol prices are influenced by fluctuations in crude oil markets, geopolitical tensions, and trade policy changes, all of which can disrupt cost structures and profitability margins. In addition, global supply chain bottlenecks and logistical constraints have led to delays in raw material deliveries, equipment maintenance, and finished product distribution. These factors collectively create financial uncertainty and hinder long-term planning for acetic acid producers across North America.

MARKET OPPORTUNITIES

Rising Demand for Acetic Acid Derivatives in the Pharmaceutical Industry

A major opportunity emerging in the North America acetic acid market is the growing demand for acetic acid-derived compounds in the pharmaceutical sector. Acetic acid serves as a crucial precursor in the synthesis of active pharmaceutical ingredients (APIs), drug intermediates, and excipients used in pain relievers, antiseptics, and antibiotic formulations. According to the U.S. Food and Drug Administration (FDA), the domestic pharmaceutical industry saw a notable increase in API manufacturing activities in 2023, driven by efforts to strengthen supply chain resilience and reduce dependency on foreign imports. Companies such as Merck and Pfizer have expanded domestic production capabilities, incorporating acetic acid-based intermediates into their manufacturing pipelines. Furthermore, the rise in contract manufacturing organizations (CMOs) and specialty chemical suppliers offering custom synthesis services has increased the regional consumption of high-purity acetic acid.

Adoption of Acetic Acid in Biodegradable Polymer Manufacturing

An emerging opportunity in the North America acetic acid market lies in its application within the biodegradable polymer industry, which is gaining traction due to increasing environmental awareness and regulatory push for reducing plastic waste. Acetic acid derivatives, such as cellulose acetate and polyvinyl alcohol (PVA)-based resins, are being utilized in the production of compostable films, packaging materials, and textile fibers. This shift is being supported by state-level bans on single-use plastics and extended producer responsibility (EPR) laws mandating sustainable packaging solutions. Major chemical firms such as BASF and Celanese have invested in new production lines focused on green polymers derived from acetic acid, aligning with corporate sustainability goals and consumer demand for recyclable materials. The U.S. Department of Agriculture (USDA) also promotes the use of biobased polymers through its BioPreferred Program, further incentivizing industry players to expand their offerings in this segment.

MARKET CHALLENGES

Technological Complexity and High Capital Investment in Production Facilities

One of the most pressing challenges facing the North America acetic acid market is the technological complexity involved in large-scale production, coupled with the substantial capital investment required to establish and maintain processing facilities. The dominant production method, methanol carbonylation, requires advanced reactor systems, high-efficiency catalysts, and precise temperature and pressure controls to ensure optimal yield and safety. These financial barriers limit the ability of smaller players to enter the market and constrain expansion opportunities for existing producers. Moreover, the integration of newer technologies—such as bio-based fermentation or electrochemical synthesis—requires extensive R&D investment and pilot testing before commercial deployment. The International Energy Agency (IEA) notes that despite growing interest in sustainable production routes, only a few projects have reached commercial viability due to technical and economic hurdles.

Competition from Substitute Chemicals and Alternative Feedstocks

Another significant challenge confronting the North America acetic acid market is the increasing competition from substitute chemicals and alternative feedstocks that offer comparable performance at lower costs or with fewer regulatory constraints. Industries traditionally reliant on acetic acid are exploring options such as glycolic acid, formic acid, and propionic acid, which can serve similar functions in solvents, preservatives, and polymer synthesis. Some of these substitutes are derived from more readily available or renewable sources, making them attractive from both an economic and sustainability perspective. Additionally, the emergence of direct ethanol-to-ethylene routes in polymer manufacturing has reduced reliance on acetic acid-based intermediates in certain applications. The U.S. Department of Energy (DOE) highlights that advancements in catalytic conversion technologies are enabling more efficient use of alternative feedstocks, further reshaping raw material demand patterns.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.85% |

|

Segments Covered |

By Derivatives, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Celanese Corporation, INEOS, Eastman Chemical Company, LyondellBasell Industries Holdings BV, SABIC, and others. |

SEGMENTAL ANALYSIS

By Derivatives Insights

The Vinyl Acetate Monomer (VAM) segment had the largest share of the North America acetic acid market in 2024. VAM is a major derivative of acetic acid, primarily used in the production of emulsion polymers, adhesives, coatings, and synthetic fibers. One key driver behind this dominance is the widespread use of VAM in the adhesives and coatings industry, which has seen steady growth due to rising demand from construction, automotive, and packaging sectors. Additionally, the expansion of woodworking and furniture manufacturing in North America has further boosted adhesive consumption.

The Acetic Anhydride segment is emerging as the fastest-growing within the North America acetic acid market, projected to expand at a CAGR of 6.8%. This rapid growth is primarily driven by its extensive use in the pharmaceutical and cellulose derivatives industries. One major application of acetic anhydride is in the synthesis of acetylsalicylic acid (ASA), commonly known as aspirin, which remains one of the most widely consumed pain relievers globally. According to the U.S. Food and Drug Administration (FDA), domestic pharmaceutical production saw increased activity in 2023, particularly in generic drug manufacturing, leading to higher demand for acetic anhydride as a key intermediate. Moreover, the growing use of cellulose acetate in cigarette filters and biodegradable films is contributing to market expansion.

By Application Insights

The polymers segment represented the biggest application area in the North America acetic acid market by capturing a 32.3% of total usage in 2024. This is because of acetic acid’s role in producing intermediates such as vinyl acetate monomer (VAM) and terephthalic acid, both of which are essential in polymer synthesis. A primary driver of this segment's leadership is the expansion of the polyethylene terephthalate (PET) industry , which relies heavily on purified terephthalic acid (PTA)—a major derivative of acetic acid. Furthermore, the rise in construction and infrastructure development under federal funding programs like the Bipartisan Infrastructure Law has increased the need for polymer-modified bitumen, sealants, and insulation foams—products that utilize VAM-based polymers.

The medical application segment is the fastest-growing within the North America acetic acid market, expanding at a CAGR of 7.1%. This growth is mainly attributed to the compound’s use in synthesizing active pharmaceutical ingredients (APIs), antiseptics, and medical-grade solvents. One major factor driving this segment is the resurgence of domestic API manufacturing following supply chain disruptions caused by global events. Additionally, the growing adoption of biopharmaceuticals and contract development and manufacturing organizations (CDMOs) has led to higher demand for high-purity acetic acid in controlled environments. With ongoing advancements in drug delivery systems and the expansion of personalized medicine, the medical application of acetic acid is expected to gain even greater momentum in the coming years.

REGIONAL ANALYSIS

The United States maintained the dominant position in the North America acetic acid market by accounting for 82% of total regional consumption in 2024. This is attributed to the country’s well-established chemical industry, large-scale manufacturing base, and high demand from downstream sectors such as polymers, pharmaceuticals, and coatings. The country also hosts several world-scale production facilities operated by companies like Celanese, Eastman Chemical, and BP, ensuring a stable domestic supply for various end-use industries. In addition, federal investments in infrastructure and clean energy have spurred demand for PET-based materials and waterborne coatings, both of which rely on acetic acid derivatives.

Canada’s market is steadily growing due to increasing demand from the coatings, textile, and pharmaceutical industries. According to Natural Resources Canada, the country’s chemical manufacturing sector plays a vital role in national industrial output, with acetic acid being a key input in the production of solvents, dyes, and specialty chemicals. Additionally, the Canadian Paint and Coatings Association (CPCA) reports that the country’s coatings industry experienced a slight uptick in production volumes , largely due to infrastructure upgrades and eco-friendly product development. With environmental regulations encouraging the shift toward low-VOC formulations, acetic acid-based intermediates have found renewed relevance in sustainable paint technologies.

The "Rest of North America" segment, basically comprising Mexico and select Central American territories, accounts for smaller share of total regional consumption in 2024. Though relatively modest in volume, this segment is showing promising growth potential due to expanding manufacturing activities and increasing foreign direct investment in chemical processing. Moreover, the region’s growing pharmaceutical and textile sectors have further stimulated demand for acetic acid-based inputs. The Pan American Health Organization (PAHO) notes that Mexico has been strengthening its domestic pharmaceutical manufacturing capacity, aligning with broader regional health security strategies.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Celanese Corporation, INEOS, Eastman Chemical Company, LyondellBasell Industries Holdings BV, and SABIC are the key players in the North America acetic acid market.

The competition in the North America acetic acid market is characterized by a concentrated structure dominated by a few multinational chemical manufacturers that control the majority of production and distribution channels. These established players leverage economies of scale, advanced production technologies, and long-standing relationships with downstream industries to maintain their market positions. However, increasing pressure from environmental regulations, fluctuating feedstock prices, and rising demand for sustainable alternatives have prompted firms to re-evaluate their operational models and invest in cleaner production methods.

Mid-sized and regional chemical producers are attempting to carve out niche roles by offering specialized acetic acid derivatives tailored to specific industrial applications. These companies often focus on custom formulations, solvent blends, and smaller-scale production runs that cater to specialized markets such as pharmaceuticals and food processing. Meanwhile, growing interest in bio-based acetic acid and alternative synthesis routes has introduced new entrants focused on green chemistry and circular economy principles.

Despite these developments, entry barriers remain high due to the capital-intensive nature of acetic acid manufacturing and stringent compliance requirements. As a result, the market remains largely consolidated, with competition centered around innovation, sustainability, and strategic alliances rather than pure price competition.

TOP PLAYERS IN THE MARKET

Celanese Corporation

Celanese is a leading global producer of acetic acid and its derivatives, with a strong presence in North America. The company supplies high-purity acetic acid to a wide range of industries, including polymers, pharmaceuticals, coatings, and chemical intermediates. Known for its technological expertise and vertically integrated production capabilities, Celanese plays a pivotal role in shaping market dynamics through innovation, sustainability initiatives, and strategic customer partnerships across the industrial value chain.

Eastman Chemical Company

Eastman Chemical is a major player in the North American acetic acid market, leveraging its extensive chemical manufacturing infrastructure to produce and distribute acetic acid-based solvents, esters, and specialty chemicals. The company serves diverse end-use sectors such as adhesives, textiles, and packaging, emphasizing product performance and environmental responsibility. Its focus on process efficiency and application-driven solutions has strengthened its position in both domestic and international markets.

BP p.l.c. (BP Chemicals)

BP Chemicals, a subsidiary of BP, is a key supplier of acetic acid in North America, operating large-scale production facilities that support downstream applications in vinyl acetate monomer (VAM), purified terephthalic acid (PTA), and other critical derivatives. With a legacy of technical excellence and supply chain reliability, BP continues to influence industry standards through continuous investment in plant optimization, safety protocols, and sustainable chemical production practices tailored to evolving market needs.

TOP STRATEGIES USED BY KEY PLAYERS

One major strategy employed by leading players in the North America acetic acid market is vertical integration and backward linkage optimization . Companies are consolidating their supply chains by acquiring or developing upstream feedstock sources, ensuring stable raw material availability and cost control. This approach enhances production efficiency and mitigates risks associated with price volatility in methanol and natural gas.

Another key tactic is product portfolio diversification and application-specific innovation . Manufacturers are investing in research and development to expand their offerings into high-value derivatives and niche applications such as biodegradable polymers, pharmaceutical excipients, and green solvents. By aligning with sustainability trends and regulatory requirements, firms aim to capture emerging demand segments and differentiate themselves from competitors.

Lastly, companies are focusing on strategic partnerships, joint ventures, and capacity expansions to strengthen their regional foothold. These collaborations allow firms to access new technologies, enhance distribution networks, and respond swiftly to shifting market conditions, reinforcing their competitive edge in the dynamic acetic acid landscape.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Celanese announced a multi-million-dollar expansion of its acetic acid production complex in Texas, aimed at enhancing output capacity and improving supply chain resilience for key derivatives used in polymer and pharmaceutical applications. This initiative was designed to meet rising demand while reinforcing the company’s leadership in industrial chemical supply chains.

- In August 2023, Eastman Chemical launched a new line of high-purity acetic acid-based solvents specifically formulated for use in biopharmaceutical manufacturing processes. This product rollout was intended to capitalize on growing demand for clean and efficient chemical inputs in drug formulation and sterile medical device production.

- In January 2024, BP entered into a strategic partnership with a U.S.-based biotech firm to explore next-generation fermentation-based acetic acid production methods that reduce carbon emissions and reliance on fossil feedstocks. This collaboration aligned with broader corporate sustainability goals and positioned BP as an innovator in low-carbon chemical pathways.

- In October 2023, BASF expanded its North American distribution network for acetic acid and related esters by establishing new logistics hubs in the Midwest and Southeastern United States. This move was aimed at improving delivery times and supporting industrial customers engaged in adhesive, coating, and textile manufacturing.

- In May 2024, LyondellBasell introduced a proprietary catalyst system for acetic acid synthesis, designed to improve process efficiency and reduce energy consumption in large-scale production facilities. This technological advancement was expected to enhance cost competitiveness and support long-term growth in derivative markets such as PET resin and vinyl acetate monomer (VAM).

MARKET SEGMENTATION

This research report on the North America acetic acid market has been segmented and sub-segmented based on the following categories.

By Derivatives

- Vinyl Acetate Monomer (VAM)

- Purified Terephthalic Acid (PTA)

- Ethyl Acetate

- Acetic Anhydride

- Other Derivatives

By Application

- Plastics and Polymers

- Food and Beverage

- Adhesives, Paints, and Coatings

- Textile

- Medical

- Other Applications

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

1. What is acetic acid used for in North America?

Acetic acid is widely used in producing vinyl acetate monomer, acetic anhydride, and as a chemical reagent in food, textiles, plastics, and pharmaceuticals.

2. Which industries drive the demand for acetic acid in North America?

Key industries include plastics & polymers, food & beverage, paints & coatings, textiles, adhesives, and pharmaceuticals.

3. What are the major derivatives of acetic acid in North America?

Major derivatives include vinyl acetate monomer (VAM), purified terephthalic acid (PTA), ethyl acetate, and acetic anhydride.

4. Why is the demand for vinyl acetate monomer (VAM) increasing?

VAM demand is rising due to its application in adhesives, paints, coatings, films, and packaging materials across various sectors.

5. Which countries contribute the most to acetic acid consumption in North America?

The United States and Canada are the top consumers, driven by industrial expansion and demand for processed goods.

6. Are there any environmental concerns related to acetic acid production?

Yes, acetic acid production may generate emissions and wastewater, so manufacturers are investing in cleaner technologies.

7. What are the key trends in the North America acetic acid market?

Trends include increased bio-based acetic acid production, adoption of green chemistry, and rising demand from end-use sectors.

8. How is acetic acid transported and stored?

Acetic acid is typically transported in stainless steel tanks and stored in cool, ventilated, and corrosion-resistant containers.

9. Who are the major players in the North America acetic acid market?

Key companies include Celanese Corporation, Eastman Chemical Company, LyondellBasell, and Dow Chemical Company.

10. Is acetic acid used in food products in North America?

Yes, food-grade acetic acid is used as a preservative and flavoring agent in sauces, pickles, and vinegar-based products.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com