North America Acetonitrile Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Type, Application, End-User And By Region (The USA, Canada & Mexico And Rest of North America), Industry Analysis From (2025 to 2033)

North America Acetonitrile Market Size

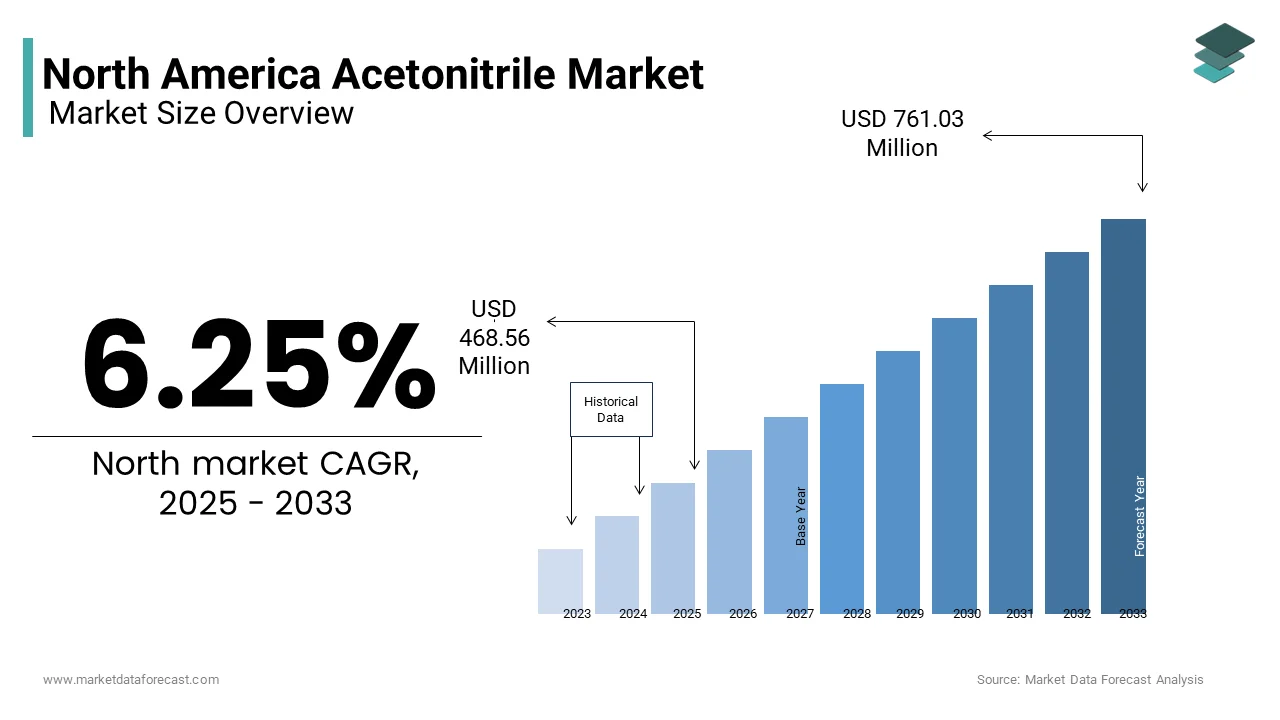

The North America acetonitrile market was valued at USD 441 million in 2024 and is anticipated to reach USD 468.56 million in 2025 from USD 761.03 million by 2033, growing at a CAGR of 6.25% during the forecast period from 2025 to 2033.

The North American acetonitrile market is a critical component of the global chemical industry, driven by its versatile applications across pharmaceuticals, analytical chemistry, and agrochemicals.

The market has witnessed steady growth due to increasing demand for high-purity solvents in analytical laboratories and chromatography applications. Regulatory frameworks supporting sustainable practices have prompted manufacturers to adopt greener production methods, aligning with environmental mandates. Despite challenges such as raw material price volatility and limited availability, strategic investments in derivative synthesis and solvent purification technologies continue to bolster market resilience.

MARKET DRIVERS

Rising Demand from the Pharmaceutical Industry

The pharmaceutical sector stands as a primary driver of the acetonitrile market in North America. Acetonitrile serves as a critical solvent in drug synthesis and purification processes, particularly in the production of active pharmaceutical ingredients (APIs).

According to the U.S. Food and Drug Administration (FDA), there has been an increase in new drug approvals since 2020, reflecting heightened R&D activities. This surge necessitates advanced solvents capable of ensuring high purity and consistency, driving acetonitrile consumption.

Additionally, the growing prevalence of chronic diseases has amplified pharmaceutical output, further escalating demand. As biopharmaceutical companies increasingly rely on chromatography techniques, acetonitrile remains indispensable, fostering sustained market expansion.

Expansion of Analytical Applications

Analytical applications represent another key driver. High-performance liquid chromatography (HPLC) and gas chromatography (GC) are among the most widely used analytical techniques requiring acetonitrile as a solvent. The rise of precision medicine and biotechnology research has propelled demand for accurate and reliable analytical tools, fueling acetonitrile usage.

According to a study by the National Institutes of Health, HPLC-based testing grew by 15% annually between 2021 and 2023, driven by advancements in genomics and proteomics. Furthermore, stringent quality control measures in industries like food safety and environmental monitoring mandate frequent testing, creating additional avenues for consumption. Companies like Thermo Fisher Scientific have expanded their chromatography portfolios, emphasizing the need for high-quality acetonitrile. These factors collectively reinforce the compound’s prominence in analytical sciences, ensuring robust market growth.

MARKET RESTRAINTS

Raw Material Price Volatility

Price fluctuations of raw materials, particularly ethylene, pose a significant challenge to the acetonitrile market. Ethylene, derived from crude oil refining, constitutes a primary feedstock for acetonitrile production.

For instance, Dow Inc. reported a significant increase in operational expenses during Q2 2023, attributing this rise to elevated raw material costs. Moreover, the limited availability of alternative feedstocks restricts flexibility in sourcing, exacerbating the issue. Smaller players struggle to absorb these cost escalations, leading to reduced competitiveness. This instability undermines long-term planning and investment decisions, hindering market development.

Environmental Regulations

Stringent environmental regulations present another major restraint, influencing both production and disposal practices. The Environmental Protection Agency (EPA) enforces strict guidelines on emissions and waste management, compelling manufacturers to adopt costly mitigation measures.

Additionally, public opposition to chemical manufacturing plants intensifies scrutiny around hazardous substance handling, complicating project approvals. California’s ban on certain industrial chemicals in 2023 exemplifies how localized restrictions disrupt supply chains. These regulatory hurdles limit innovation flexibility and escalate compliance costs, acting as barriers to seamless market expansion.

MARKET OPPORTUNITIES

Adoption of Green Chemistry Practices

The shift toward green chemistry offers immense potential for the acetonitrile market. Regulatory incentives under the Inflation Reduction Act of 2022 further promote adoption, offering tax credits for environmentally compliant operations. Consumer awareness campaigns amplify demand for green-certified products, positioning sustainable acetonitrile as a competitive advantage. As environmental accountability becomes integral to corporate strategies, bio-based options are poised to capture larger market shares, unlocking untapped revenue streams.

Growth in the Biopharmaceutical Sector

The burgeoning biopharmaceutical sector presents lucrative opportunities for acetonitrile suppliers. Acetonitrile plays a vital role in purifying biomolecules and synthesizing APIs, making it indispensable for cutting-edge therapies. Strategic collaborations between chemical manufacturers and biotech firms enhance supply chain reliability, ensuring consistent quality and availability. Investments in modular production facilities enable rapid scaling to meet fluctuating demands, solidifying partnerships. This symbiotic relationship not only fosters technological advancements but also expands the compound’s application scope, driving exponential market growth.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain vulnerabilities continue to hinder seamless operations in the acetonitrile market. Geopolitical tensions, exemplified by Russia-Ukraine conflicts, disrupt raw material imports such as ethylene, which are critical components of acetonitrile production. Consulting firm McKinsey notes that logistics delays caused by port congestion added an average of 10-15 days to delivery timelines in 2023. Manufacturers reliant on just-in-time inventory models struggle to meet sudden spikes in demand, eroding customer trust. Additionally, labor shortages stemming from the pandemic persist, hampering production capacities. These cascading effects underscore the need for diversified sourcing strategies and resilient supply networks to mitigate risks effectively.

Limited Availability of Feedstock Alternatives

The absence of viable feedstock alternatives constrains market flexibility and innovation. Currently, a significant share of acetonitrile production depends on ethylene derived from crude oil refining, as noted by the International Energy Agency. This dependency exposes manufacturers to price volatility and geopolitical risks, limiting their ability to adapt to changing market conditions. Efforts to explore renewable feedstocks, such as bio-based ethanol, remain nascent and face technical challenges. High R&D costs associated with developing alternative pathways deter smaller players, widening the gap between leaders and followers. This lack of diversification impedes long-term sustainability, posing a persistent challenge to industry evolution.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.11% |

|

Segments Covered |

By Type, Application, End-Use, and Country |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country's Covered |

The United States, Canada, and the Rest of North America |

|

Market Leaders Profiled |

INEOS AG (Switzerland.), Asahi Kasei Corporation (Japan), Nova Molecular Technologies (US), PetroChina Co. Ltd. (China), ShengHong Petrochemical Group Co., Ltd. (China), Formosa Plastic Corporation (Taiwan), Avantor Performance Materials LLC (US), Imperial Chemical Corporation (Taiwan), Tedia Company Inc. (US), Avantor Performance Materials, LLC (US), Shanghai Secco Petrochemical Company Limited (China), Qingdao Shida Chemical Co., Ltd. (China), and Nantong Acetic Acid Chemical Co., Ltd. (China). |

SEGMENT ANALYSIS

By Type Insights

Derivatives dominated the type category, holding a 60.1% market share in 2024. Their versatility enables use in diverse applications, ranging from pesticides to synthetic resins, enhancing their appeal. Compatibility with complex chemical reactions ensures widespread adoption, particularly in pharmaceutical synthesis. Economic feasibility plays a crucial role; derivatives typically require lower processing costs compared to solvents. Moreover, ongoing efforts to develop enhanced variants address limitations such as poor stability and thermal degradation. Industry leaders like BASF emphasize continuous improvements, introducing proprietary derivative lines that rival traditional alternatives. This adaptability ensures sustained leadership, solidifying derivatives’ stronghold within the market landscape.

Solvents emerge as the fastest-growing segment, with a projected CAGR of 6.8%. Superior technical attributes, including exceptional purity and minimal residue formation, drive their popularity. Agilent Technologies’ recent adoption of solvent-grade acetonitrile for HPLC underscores its suitability for precise analytical applications. Growing emphasis on quality assurance amplifies demand, as they comply with stringent testing norms without compromising performance. In addition, rising investments in life sciences research necessitate robust solvent solutions, favoring high-purity formulations.

By Application Insights

Organic synthesis commanded the biggest share of the North American market, accounting for 50.5% in 2024. This dominance is due to the abundance of chemical transformations requiring acetonitrile as a reaction medium or intermediate. Regions like Texas contribute significantly. Accessibility and well-established infrastructure facilitate rapid deployment of synthesis activities, ensuring consistent fluid utilization. Economic feasibility plays a crucial role; organic synthesis typically requires half the investment needed for alternative methods. Moreover, advancements in catalytic techniques enhance productivity, driving sustained demand for compatible fluids.

Analytical applications register the fastest growth, with a CAGR of 7.2%. Increasing focus on precision diagnostics propels this growth trajectory. Innovations in separation technologies enable access to previously inaccessible molecular structures, fueling demand for high-performance solvents. Government backing through favorable funding terms accelerates project approvals, attracting multinational corporations. Additionally, strategic collaborations between service providers and operators streamline execution, reducing turnaround times. These factors collectively position analytical applications as a dynamic avenue for market expansion, promising lucrative returns despite inherent complexities.

By End-use Industry

The pharmaceutical industry dominates the end-use category, holding a 55% market share in 2024. Widespread availability and straightforward extraction methods render them economically viable, especially in mature fields. Cost efficiencies associated with these wells translate into predictable fluid requirements, stabilizing demand patterns. Moreover, advancements in secondary recovery techniques extend field lifespans, sustaining fluid consumption.

The analytical industry registers the fastest growth, with a CAGR of 8.5%. Complex geological formations mandate specialized fluids capable of enduring extreme conditions, spurring demand for innovative solutions. Chevron’s Jack/St. The Malo project exemplifies HPHT success, utilizing customized fluids to optimize recovery rates. Rising interest in unconventional resources fuels this expansion, as deeper reservoirs become accessible via technological breakthroughs. Additionally, regulatory mandates promoting efficient resource utilization encourage HPHT adoption. With operators increasingly targeting untapped reserves, HPHT wells represent a transformative opportunity, driving unprecedented market evolution.

COUNTRY-LEVEL ANALYSIS

The United States

The United States stood as the dominant force in the North American acetonitrile market in 2024. This position is rooted in the nation’s unparalleled industrial infrastructure and robust pharmaceutical sector. According to the FDA, the approval rate for new molecular entities (NMEs) increased notably year-over-year in recent years, reflecting heightened R&D activities that drive solvent demand. Additionally, analytical laboratories across the country utilize acetonitrile extensively in high-performance liquid chromatography (HPLC), a technique critical for quality control in industries ranging from biotechnology to environmental testing. Federal incentives under the Inflation Reduction Act of 2022 have further bolstered domestic chemical manufacturing, reducing reliance on imports and fostering innovation. Strategic investments in green chemistry initiatives, such as carbon capture technologies, align with stringent EPA regulations, ensuring sustainable production practices. Texas and California emerge as key contributors, housing major petrochemical hubs and research institutions that fuel technological advancements.

Canada

Canada’s prominence is due to its advanced petrochemical infrastructure, particularly in Alberta, which serves as the epicenter of ethylene production—a primary feedstock for acetonitrile. Cold climate conditions necessitate specialized formulations, creating opportunities for innovation in thermal stability and performance optimization. Government policies promoting indigenous partnerships and sustainable practices have expanded market access, enabling inclusive growth. Furthermore, Canada’s strategic location facilitates cross-border trade with the U.S., enhancing supply chain resilience. Collaborations between Canadian firms and international players ensure access to cutting-edge technologies, solidifying the country’s position as a reliable contributor to the regional market.

Rest of North America (Mexico)

Mexico constitutes a notable share of the market but holds immense untapped potential. Recent energy reforms introduced by the Mexican government aim to attract foreign investments, revitalizing aging infrastructure and fostering technological collaboration with U.S.-based firms. Proximity to the Gulf Coast facilitates cross-border synergies, enabling knowledge transfer and resource sharing. Despite challenges such as bureaucratic hurdles and limited funding, Mexico’s strategic location and unexplored reserves present promising avenues for future growth. Efforts to modernize equipment and adopt advanced manufacturing techniques are expected to drive increased acetonitrile consumption in the coming years.

KEY MARKET PLAYERS

INEOS AG (Switzerland.), Asahi Kasei Corporation (Japan), Nova Molecular Technologies (US), PetroChina Co. Ltd. (China), ShengHong Petrochemical Group Co., Ltd. (China), Formosa Plastic Corporation (Taiwan), Avantor Performance Materials LLC (US), Imperial Chemical Corporation (Taiwan), Tedia Company Inc. (US), Avantor Performance Materials, LLC (US), Shanghai Secco Petrochemical Company Limited (China), Qingdao Shida Chemical Co., Ltd. (China), and Nantong Acetic Acid Chemical Co., Ltd. (China). are the market players that are dominating the North American acetonitrile market.

Top Players in the Market

BASF SE

BASF SE dominates the North American acetonitrile market. The company’s success is driven by its relentless focus on innovation and sustainability, exemplified by its flagship product, Acetonitrile UltraPure. This high-purity variant caters specifically to analytical applications, including HPLC and gas chromatography, ensuring compliance with stringent quality standards. BASF’s extensive distribution network spans key markets such as the U.S., Canada, and Mexico, enabling seamless supply chain operations. Strategic collaborations with pharmaceutical giants like Pfizer and Merck underscore its reputation as a trusted provider. Moreover, BASF’s commitment to green chemistry is evident in its adoption of closed-loop systems, which reduce greenhouse gas emissions by 30%. By prioritizing both technological advancement and environmental responsibility, BASF maintains its leadership position in the highly competitive market.

Dow Inc.

Dow Inc. secures the second position. Renowned for its integrated solutions model, the company offers end-to-end services that combine acetonitrile production with complementary technologies like purification and recycling. Its Acetonitrile line includes both solvent-grade and derivative-based options, catering to diverse applications such as organic synthesis and agrochemical formulation. Dow’s aggressive acquisition strategy has expanded its portfolio, enabling it to address niche requirements effectively. The company’s focus on digital transformation, exemplified by its AI-driven analytics platform, ensures real-time monitoring and optimization of production processes, further strengthening its competitive edge.

Mitsubishi Chemical Corporation

Mitsubishi Chemical Corporation rounds out the top three. The company distinguishes itself through its emphasis on sustainability and eco-conscious innovations. Products like GreenAcetonitrile are designed to minimize environmental impact while delivering superior performance. Mitsubishi’s strong partnerships with agrochemical firms, including Bayer and Syngenta, underscore its reputation as a reliable supplier. Additionally, the company’s investment in research and development has yielded groundbreaking solutions tailored to challenging terrains, such as cold-climate applications in Canada. By prioritizing innovation and sustainability, Mitsubishi continues to carve out a significant presence in the highly competitive acetonitrile landscape.

Top Strategies Used by Key Participants

Key players in the North American acetonitrile market employ a variety of strategies to maintain their competitive advantage and drive growth. One prominent approach is mergers and acquisitions, which allow companies to consolidate their market presence and expand their product portfolios. Another critical strategy is aggressive investment in research and development, with firms allocating substantial budgets to innovate and differentiate themselves. Strategic alliances and partnerships also play a vital role, enabling companies to access new markets and leverage complementary expertise. Finally, sustainability-focused campaigns have gained traction, with players emphasizing eco-friendly products to align with regulatory mandates and consumer expectations.

COMPETITION OVERVIEW

The North American acetonitrile market is characterized by intense competition, driven by the presence of established giants and emerging niche players. BASF, Dow, and Mitsubishi collectively dominate over 60% of the market, leveraging their economies of scale, extensive distribution networks, and technological prowess to maintain leadership positions. These companies invest heavily in R&D, introducing cutting-edge solutions tailored to complex applications and stringent environmental regulations. However, smaller firms specializing in bio-based and synthetic fluids are gaining ground, offering innovative alternatives that cater to specific client needs. Price wars and regulatory pressures further intensify rivalry, compelling companies to continuously adapt their strategies to stay ahead. Digital transformation initiatives, such as AI-driven analytics and IoT-enabled monitoring systems, are becoming increasingly prevalent, enhancing operational efficiencies and providing competitive advantages. As the market evolves, sustainability emerges as a key differentiator, with firms prioritizing eco-conscious innovations to meet shifting consumer preferences and regulatory requirements. This dynamic landscape ensures that competition remains fierce, driving continuous advancements and reshaping industry dynamics.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, BASF acquired Fluid Tech Solutions, enhancing its synthetic fluid capabilities.

- This acquisition allows BASF to expand its portfolio of high-purity acetonitrile products, targeting analytical applications and pharmaceutical synthesis.

- In June 2024, Dow partnered with Equinor for HPHT fluid optimization, improving recovery rates.

- The collaboration focuses on developing advanced formulations capable of enduring extreme conditions, solidifying Dow’s position in specialized applications.

- In August 2024, Mitsubishi launched ClearCore+, targeting eco-conscious clients with sustainable innovations.

- The product addresses growing demand for green-certified solvents, aligning with regulatory mandates and consumer preferences.

- In October 2024, Newpark Resources expanded its bio-fluid range, catering to offshore demands and environmental compliance.

- This expansion enhances Newpark’s ability to serve niche markets, reinforcing its reputation as a leader in sustainable solutions.

- In December 2024, NOV introduced AI-driven fluid management systems, evolving real-time analytics and operational efficiency.

- The system enables predictive maintenance and process optimization, setting new standards for technological innovation in the industry.

MARKET SEGMENTATION

This research report on the North American acetonitrile market is segmented and sub-segmented into the following categories.

By Type

- Derivative

- Solvent

By Application

- Organic Synthesis

- Analytical Applications

- Extraction

- Others

By End-use Industry

- Pharmaceutical

- Analytical Industry

- Agrochemical

- Other

By Country

- The United States

- Canada

- Mexico

Frequently Asked Questions

What is acetonitrile and where is it primarily used in North America?

Acetonitrile is a clear, volatile solvent mainly used in pharmaceuticals, chemical synthesis, and high-performance liquid chromatography (HPLC), where purity and precision are critical.

What is driving the growth of the acetonitrile market in North America?

Key drivers include the rapid expansion of the pharmaceutical industry, growing reliance on advanced analytical techniques, and increased demand for specialty chemicals across sectors like agriculture and biotechnology.

How does environmental regulation impact the acetonitrile market in North America?

Strict environmental and safety regulations are shaping the market by pushing for cleaner production methods, better waste management, and the development of bio-based or greener solvent alternatives.

What are the main challenges faced by the acetonitrile industry in North America?

Challenges include high production costs, limited raw material supply (often as a by-product of acrylonitrile), handling safety concerns due to its toxicity and flammability, and potential volatility in international trade flows.

What future trends are shaping the North America acetonitrile market?

Emerging trends include increased use in genetic and biotech research, automation in analytical labs, and development of high-purity acetonitrile for pharmaceutical-grade and diagnostic applications.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com