North America Acrylamide Monomer Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By End-User And By Region (The USA, Canada & Mexico And Rest of North America), Industry Analysis From (2025 to 2033)

North America Acrylamide Monomer Market Size

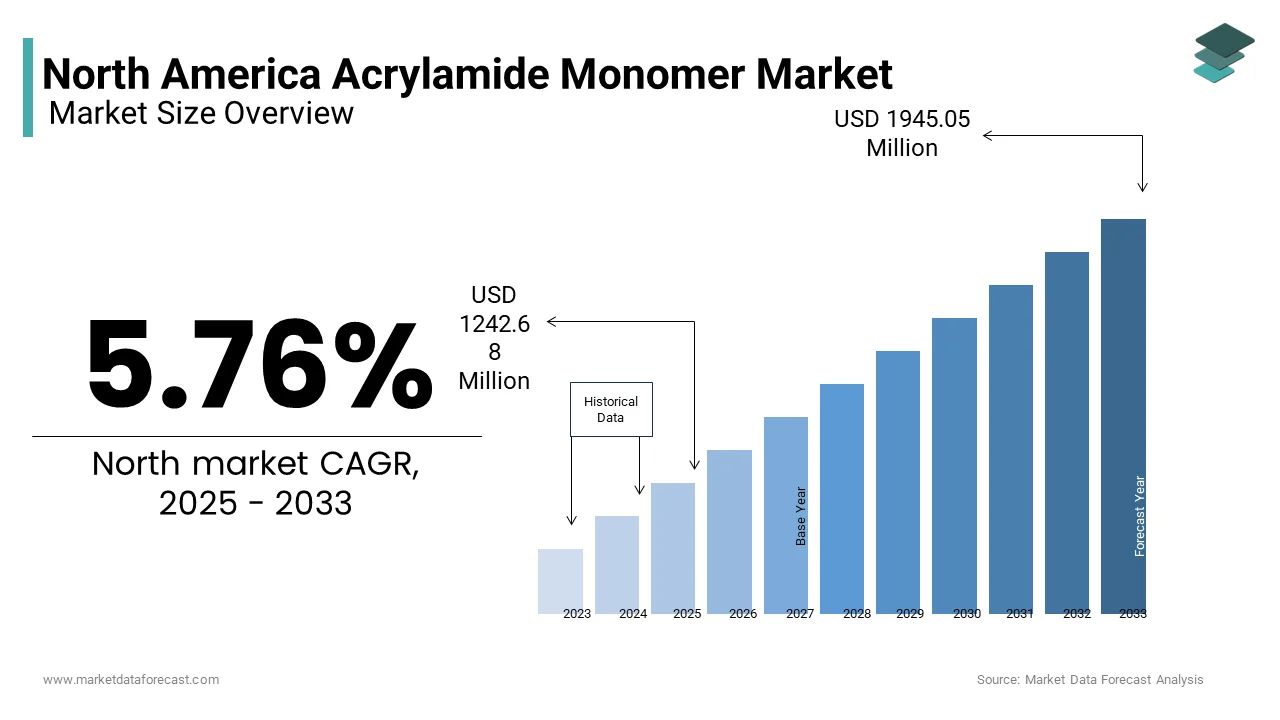

The North American acrylamide monomer market was valued at USD 1175 million in 2024 and is anticipated to reach USD 1242.68 million in 2025 from USD 1945.05 million by 2033, growing at a CAGR of 5.76% during the forecast period from 2025 to 2033.

The North American acrylamide monomer market growth is driven by its extensive application across industries such as water treatment, oil & gas, and pulp & paper. As per a report by the Environmental Protection Agency (EPA), wastewater management initiatives have increased the demand for flocculants containing acrylamide monomers. Furthermore, Canada’s growing shale gas exploration activities are expected to boost consumption in the next coming years, which will propel the growth of the market. The market growth is also driven by steady innovation, with manufacturers focusing on eco-friendly alternatives to address health concerns linked to acrylamide exposure.

MARKET DRIVERS

Rising Demand from Water & Wastewater Treatment Sector

Water scarcity and contamination issues have positioned water treatment as a critical driver for the acrylamide monomer market. Acrylamide-based polymers serve as effective flocculants, aiding in sedimentation and sludge dewatering processes. According to the United Nations World Water Development Report, nearly 2.2 billion people globally lack access to safe drinking water, intensifying efforts to enhance water infrastructure. In North America, the EPA mandates the use of advanced treatment technologies, propelling acrylamide demand. The U.S. alone spends over $100 billion annually on water infrastructure projects, which is creating lucrative opportunities for suppliers. As per a study by the American Water Works Association, polyacrylamide usage in municipal plants has surged by 15% since 2020.

Growth in Oil & Gas Exploration Activities

Acrylamide monomers play a pivotal role in enhanced oil recovery (EOR) techniques, where they act as viscosity modifiers. The surge in shale gas production in North America has significantly boosted EOR applications. According to the U.S. Energy Information Administration, shale gas accounted for 80% of natural gas production in 2022 by driving polymer demand. Additionally, Canada’s oil sands operations require high-performance chemicals for bitumen extraction, further fueling consumption. The acrylamide monomer market is poised for sustained growth bolstered by technological advancements in hydrocarbon extraction with energy security remaining a priority.

MARKET RESTRAINTS

Health and Safety Concerns Surrounding Acrylamide Exposure

One significant restraint in the acrylamide monomer market is its potential health hazards, which include neurotoxicity and carcinogenic risks. The International Agency for Research on Cancer (IARC) classifies acrylamide as a probable human carcinogen is prompting stricter occupational safety regulations. These concerns have led to increased scrutiny from regulatory bodies like OSHA, which is mandating rigorous handling protocols. For instance, workplace exposure limits in the U.S. were reduced to 0.03 mg/m³ in 2021, by escalating compliance costs for manufacturers. Such measures deter small-scale enterprises from entering the market are limiting competition. Moreover, consumer awareness campaigns emphasizing safer alternatives have curbed adoption rates, particularly in non-essential applications. This regulatory pressure poses a long-term challenge to market expansion despite rising industrial demand.

Volatility in Raw Material Prices

Another key restraint is the fluctuating cost of raw materials, primarily acrylonitrile, which constitutes over 80% of acrylamide production costs. As per data from the American Chemistry Council, acrylonitrile prices surged by 25% between 2021 and 2022 due to supply chain disruptions caused by geopolitical tensions and shipping delays. These price swings directly impact profit margins for acrylamide producers. Additionally, the reliance on petrochemical feedstocks exposes manufacturers to crude oil price volatility. This instability hampers investments in capacity expansions and R&D initiatives, thereby constraining overall market growth.

MARKET OPPORTUNITIES

Adoption of Green Chemistry Solutions

The shift toward sustainable practices presents immense opportunities for the acrylamide monomer market. Manufacturers are increasingly investing in bio-based or low-toxicity variants to align with environmental goals. According to the Green Chemistry & Commerce Council, eco-friendly chemical products could capture up to 30% of the specialty chemicals market by 2030. Innovations in enzymatic polymerization methods have enabled the development of biodegradable acrylamide derivatives by appealing to environmentally conscious consumers. In North America, government incentives under programs like the U.S. Department of Energy’s Bioenergy Technologies Office support green initiatives, fostering R&D collaborations.

Expansion into Emerging Applications

Emerging fields such as agriculture and biomedical engineering provide new avenues for acrylamide monomers. Superabsorbent polymers derived from acrylamide are gaining traction in soil conditioning and crop preservation, addressing food security challenges. The U.S. Department of Agriculture estimates that superabsorbents can reduce irrigation needs by 40%, which is making them indispensable in arid regions. Similarly, controlled-release drug delivery systems utilizing acrylamide-based hydrogels are witnessing rapid adoption, with the global pharmaceutical excipients market valued at $9 billion in 2023. North America’s dominance in life sciences research positions it as a fertile ground for these innovations. Strategic partnerships with academic institutions and startups can accelerate commercialization by unlocking transformative growth prospects for the acrylamide monomer market.

MARKET CHALLENGES

Stringent Environmental Regulations

Environmental regulations targeting industrial effluents pose significant hurdles for the acrylamide monomer market. The Clean Water Act in the U.S. imposes strict discharge limits is compelling manufacturers to adopt costly wastewater treatment technologies. Non-compliance penalties, which can reach $50,000 per day will exacerbate financial burdens. Additionally, bans on certain acrylamide formulations in Europe influence North American policies is given the interconnected nature of global trade. For example, the European Chemicals Agency’s REACH regulation restricts hazardous substances, that is indirectly pressuring U.S. exporters to reformulate products.

Competition from Substitute Materials

The proliferation of alternative materials threatens the dominance of acrylamide monomers in traditional applications. Polyaluminum chloride (PAC) and ferric sulfate are increasingly preferred in water treatment due to lower toxicity profiles. Similarly, bio-based flocculants derived from chitosan and starch offer comparable performance while meeting sustainability benchmarks. This competitive landscape forces acrylamide producers to differentiate their offerings, often at higher costs, challenging profitability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.76% |

|

Segments Covered |

By End-Use, and Country |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country's Covered |

The United States, Canada, and the Rest of North America |

|

Market Leaders Profiled |

BASF SE (Germany), Black Rose Industries Ltd. (India), Jiangxi Changjiu Agrochemical Co. Ltd (China), Kemira Oyj (Finland), Mitsubishi Chemicals (Japan), Mitsui Chemicals, Inc. (Japan), NUOER GROUP (China), SNF Group (France), Solenis (U.S.), Zhejiang Xinyong Biochemical Co., Ltd. (China). |

SEGMENTAL ANALYSIS

By End-User Insights

The water & wastewater treatment segment held the largest share of the North American acrylamide monomer market with 45.4% in 2024 due to the widespread use of polyacrylamides as flocculants in municipal and industrial water purification systems. Regulatory mandates, such as the Safe Drinking Water Act, mandate the removal of contaminants by amplifying flocculant requirements. Urbanization trends further amplify demand; cities like Los Angeles and New York invest heavily in upgrading aging infrastructure.

The oil & gas segment is likely to register a CAGR of 6.5% in the next coming years within the North American acrylamide monomer market, driven by enhanced oil recovery (EOR) applications. Technological advancements in hydraulic fracturing and horizontal drilling have revitalized shale plays, increasing polymer demand. Canada’s oil sands operations also benefit from acrylamide-based viscosity modifiers, with Suncor Energy reporting a 10% efficiency gain post-implementation. Investments in carbon capture and storage (CCS) projects further propel growth, as acrylamide aids in CO2 sequestration processes.

COUNTRY LEVEL ANALYSIS

The United States was the largest contributor for the North American acrylamide monomer market with an estimated share of 76.5% in 2024 due to its highly diversified industrial landscape and stringent environmental regulations that mandate advanced water treatment solutions. The shale gas revolution has further bolstered demand, particularly in states like Texas, Pennsylvania, and North Dakota, where hydraulic fracturing relies heavily on acrylamide-based viscosity modifiers. Additionally, California’s ambitious water recycling initiatives, such as the 3.4 billion investments in desalination plants, have created new avenues for growth. The presence of key manufacturers like Dow Inc. and BASF SE ensures a steady supply chain, while innovation hubs like Silicon Valley drive advancements in bio-based acrylamide derivatives.

Canada held the second position by holding 15.4% of the North American acrylamide monomer market share in 2024. The country’s prominence is primarily driven by its oil sands operations, which require significant quantities of acrylamide polymers for bitumen extraction and enhanced oil recovery (EOR) techniques. Alberta’s oil sands account for nearly 96% of Canada’s crude oil reserves, making it a critical consumer of acrylamide-based chemicals. Companies like Suncor Energy and Syncrude invest heavily in cutting-edge technologies, with Syncrude reportedly allocating $1.5 billion annually to improve extraction efficiency using acrylamide-based solutions. Furthermore, Canada’s commitment to sustainable mining practices under the Green Mining Initiative amplifies demand for eco-friendly flocculants. Provincial policies promoting water conservation also contribute to market growth in regions like British Columbia, where freshwater management is a priority.

KEY MARKET PLAYERS

BASF SE (Germany), Black Rose Industries Ltd. (India), Jiangxi Changjiu Agrochemical Co. Ltd (China), Kemira Oyj (Finland), Mitsubishi Chemicals (Japan), Mitsui Chemicals, Inc. (Japan), NUOER GROUP (China), SNF Group (France), Solenis (U.S.), Zhejiang Xinyong Biochemical Co., Ltd. (China). are the market players that are dominating the North American acrylamide monomer market.

Top Players in the Market

Dow Inc. leads the North American acrylamide monomer market by leveraging its extensive R&D capabilities and global distribution network. The company’s focus on sustainability has resulted in groundbreaking developments, such as bio-based acrylamide variants introduced in April 2024. These innovations align with the growing demand for eco-friendly solutions in water treatment and agriculture. Dow’s strategic partnerships with municipal authorities across the U.S. ensure consistent demand, while its state-of-the-art manufacturing facilities in Texas and Louisiana maintain supply chain resilience.

BASF SE is expertise in polymer chemistry. In March 2024, the company expanded its production facility in Alabama by doubling its acrylamide capacity to meet rising demand from the oil & gas sector. BASF’s emphasis on digital transformation is evident in its development of predictive analytics tools that optimize polymer dosages in industrial applications. Its collaboration with European research institutions positions it at the forefront of green chemistry initiatives by enhancing its competitive edge.

SNF Group’s acquisition of a Canadian startup in May 2024 amplifies its commitment to biodegradable alternatives by catering to environmentally conscious consumers. SNF’s robust presence in both the U.S. and Canada enables it to capitalize on regional opportunities in wastewater treatment and mining. Its customer-centric approach and localized manufacturing units ensure timely delivery and superior service quality.

Top Strategies Used By Key Market Participants

Key players in the North America acrylamide monomer market employ diverse strategies to maintain their dominance and explore new growth avenues. Expansion of production capacities remains a cornerstone strategy, exemplified by BASF’s Alabama facility upgrade in March 2024. Investments in R&D are equally critical, with Dow launching bio-based acrylamide variants in April 2024 to address sustainability concerns. Strategic acquisitions also play a vital role; SNF Group’s purchase of a Canadian startup in May 2024, focus on innovation and market diversification. Collaborations with academic institutions and government bodies further enhance competitiveness by enabling companies to stay ahead of regulatory trends and technological advancements.

COMPETITION OVERVIEW

The North American acrylamide monomer market exhibits moderate consolidation, characterized by intense rivalry among tier-one players like Dow Inc., BASF SE, and SNF Group. These companies leverage their scale, technological prowess, and distribution networks to capture significant market shares. However, smaller firms struggle to compete due to high entry barriers, including capital-intensive manufacturing processes and stringent safety regulations. Despite this, niche players carve out specialized segments by offering tailored solutions, such as low-toxicity formulations or biodegradable alternatives. The competitive landscape is further shaped by evolving consumer preferences, with sustainability emerging as a key differentiator. Innovations in green chemistry and digital tools for process optimization are redefining market dynamics by ensuring continuous evolution and adaptation among participants.

RECENT HAPPENINGS IN THIS MARKET

- In March 2024, BASF expanded its Alabama facility to double acrylamide production capacity.

- In April 2024, Dow launched a bio-based acrylamide variant targeting sustainable markets.

- In May 2024, SNF acquired a Canadian startup specializing in biodegradable polymers.

- In June 2024, Dow partnered with a U.S. university to develop enzyme-based acrylamide synthesis.

- In August 2024, Kemira launched a digital platform optimizing polymer dosages in water treatment.

MARKET SEGMENTATION

This research report on the North American acrylamide monomer market is segmented and sub-segmented into the following categories.

By End-User

- Water & Wastewater Treatment

- Pulp & Paper

- Oil & Gas

- Mining

- Others

By Country

- The United States

- Canada

- Mexico

Frequently Asked Questions

What is acrylamide monomer, and where is it used in North America?

Acrylamide monomer is a water-soluble compound primarily used to produce polyacrylamide, which is widely applied in water treatment, paper manufacturing, mining, and enhanced oil recovery across North America.

What is driving the growth of the acrylamide monomer market in North America?

The market is being driven by the rising need for clean water infrastructure, stricter wastewater regulations, and the growing demand for oil recovery solutions and sustainable paper production processes.

Which industries in North America are the major end-users of acrylamide monomer?

Key consumers include the municipal and industrial water treatment sector, the oil & gas industry, the pulp and paper sector, and increasingly, the agriculture industry through its use in soil conditioning agents.

What are the key challenges facing the acrylamide monomer market?

Health and environmental concerns due to acrylamide’s potential toxicity, strict regulatory scrutiny, and the push for bio-based alternatives are significant challenges facing manufacturers and users.

What future trends are shaping the North American acrylamide monomer market?

Future growth is expected to come from advancements in eco-friendly polymer technologies, increasing investment in water recycling infrastructure, and R&D into safer, more biodegradable acrylamide derivatives.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com