North America Adhesives And Sealants Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Adhesive Technology, Sealant Resin, And By Country (The USA, Canada, Mexico and Rest of North America), Industry Analysis (2025 to 2033)

North America Adhesives and Sealants Market

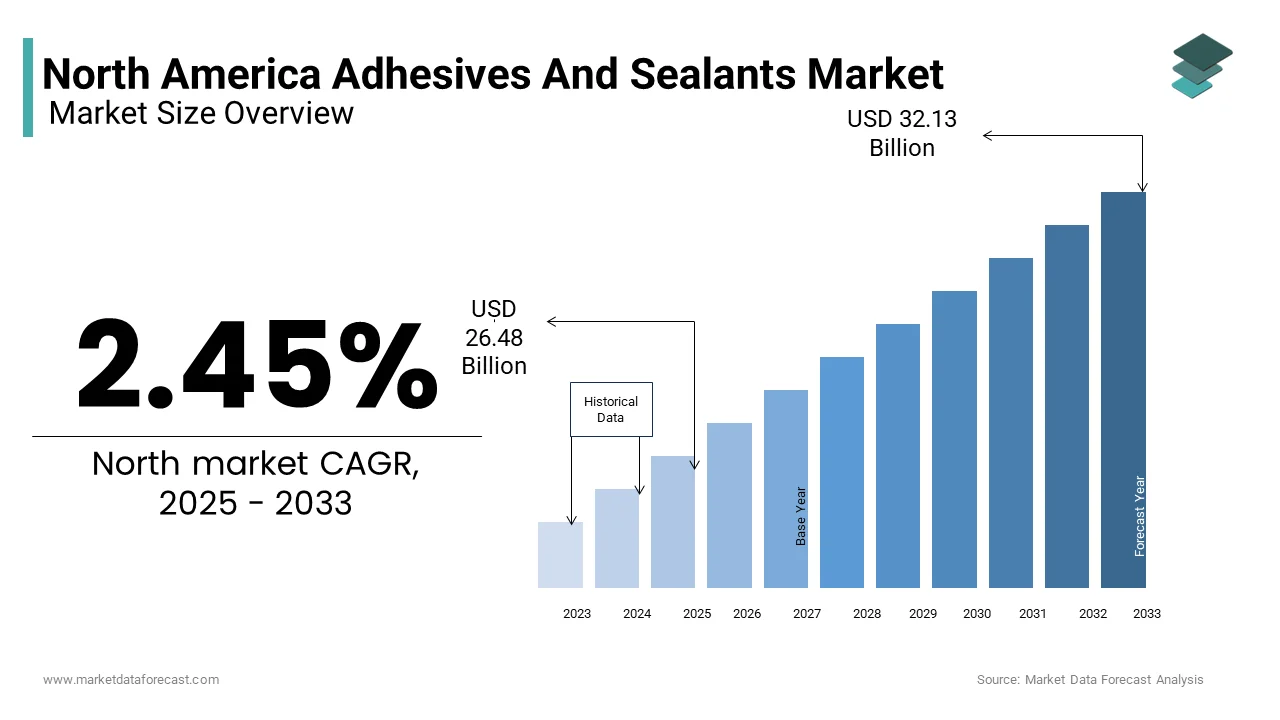

The North America adhesives and sealants market was valued at USD 25.85 billion in 2024 and is anticipated to reach USD 26.48 billion in 2025 from USD 32.13 billion by 2033, growing at a CAGR of 2.45% during the forecast period from 2025 to 2033.

The North American adhesives and sealants market incorporates a wide range of chemical formulations designed to bond, seal, or coat surfaces across various industrial and consumer applications. These products are integral to sectors such as construction, automotive, packaging, electronics, aerospace, and healthcare. Adhesives function by forming durable bonds between materials, while sealants provide flexibility, weather resistance, and structural integrity in joints and gaps. The industry has evolved significantly with advancements in polymer chemistry, enabling the development of high-performance, eco-friendly, and specialty-grade products.

MARKET DRIVERS

Growth in Automotive Manufacturing

The automotive industry is a critical driver of the North American adhesives and sealants market, primarily due to the increasing use of lightweight materials and advanced bonding solutions in vehicle assembly. As automakers strive to meet stringent fuel efficiency standards and reduce emissions, there has been a significant shift toward using aluminum, composites, and engineered plastics—materials that require robust adhesive systems for structural integrity. Adhesives are increasingly replacing traditional mechanical fasteners in body-in-white and interior assembly processes, offering better weight reduction, noise dampening, and corrosion resistance. For instance, structural adhesives now account for up to 15 kg per vehicle on average, as noted by Deloitte in their 2024 mobility report. In addition, electric vehicles (EVs) present new opportunities, requiring specialized thermal management adhesives for battery packs.

Expansion of the Construction Sector

The construction industry remains a dominant consumer of adhesives and sealants in North America, driven by both residential and non-residential building activities. Sealants are extensively used in windows, doors, roofing, and flooring, while adhesives play a crucial role in laminating panels, tile setting, and insulation applications. This surge was fueled by infrastructure investments under the Infrastructure Investment and Jobs Act. In Canada, the value of building permits issued in 2023 rose by 9.5% compared to the previous year, according to Statistics Canada, signaling strong future construction activity. Similarly, Mexico’s National Institute of Statistics and Geography (INEGI) reported a 6.1% rise in construction output during the same period. These figures illustrate the sustained momentum in building projects across the continent. Moreover, green building certifications like LEED have encouraged the adoption of low-VOC (volatile organic compound) sealants and adhesives, aligning with environmental regulations.

MARKET RESTRAINT

Regulatory Constraints on VOC Emissions

One of the primary restraints affecting the North American adhesives and sealants market is the tightening regulatory framework around volatile organic compound (VOC) emissions. Many conventional solvent-based adhesives and sealants release VOCs that contribute to air pollution and pose health risks. The U.S. Environmental Protection Agency (EPA) has established strict limits on VOC content under the National Volatile Organic Compound Emission Standards for Consumer and Commercial Products. These regulations compel manufacturers to reformulate products using water-based, reactive, or hot-melt technologies, which often entail higher production costs and extended R&D cycles. Additionally, the California Air Resources Board (CARB) enforces some of the most stringent VOC limits in the world, influencing product availability and pricing across the U.S. market. While this has spurred innovation in sustainable chemistry, it also poses challenges for smaller players lacking the resources for extensive reformulation efforts.

Supply Chain Disruptions and Raw Material Price Volatility

Supply chain instability and fluctuating raw material prices have emerged as persistent constraints for the North American adhesives and sealants industry. The market relies heavily on petrochemical derivatives such as acrylics, polyurethanes, and epoxies, whose prices are closely tied to crude oil and natural gas markets. Moreover, logistical bottlenecks have persisted due to labor shortages, port congestion, and geopolitical tensions. Key feedstock suppliers, including Dow and BASF, reported delays in resin and monomer deliveries, forcing some adhesive producers to implement price surcharges. Additionally, tariffs imposed on imported chemicals from Asia and Europe have further strained procurement strategies. These combined factors have led to margin compression and delayed project rollouts for many North American manufacturers.

MARKET OPPORTUNITY

Rising Demand for Sustainable and Bio-Based Adhesives

A significant opportunity emerging in the North American adhesives and sealants market is the growing preference for sustainable and bio-based formulations. Consumers, regulators, and corporate sustainability initiatives are driving the transition away from petroleum-derived products toward greener alternatives. Several leading manufacturers, including Henkel and 3M, have introduced plant-based adhesive lines that offer performance parity with conventional products. For example, soy-based adhesives are gaining traction in wood bonding applications, while starch and cellulose derivatives are being used in packaging and labeling. The U.S. Department of Agriculture’s BioPreferred Program certifies thousands of biobased products, encouraging federal and private procurement. Additionally, investor interest in circular economy models is fostering innovation in recyclable and compostable adhesive solutions. Companies receiving funding from organizations like the Biotechnology Innovation Organization (BIO) are developing enzymatically degradable polymers suitable for temporary bonding applications.

Integration of Smart Adhesives in High-Tech Applications

The emergence of smart adhesives—formulations capable of responding to external stimuli such as temperature, pressure, or electrical current—is opening new avenues for growth in the North American adhesives and sealants market. These advanced materials are increasingly being adopted in high-tech sectors such as electronics, aerospace, robotics, and medical devices, where precision, adaptability, and reliability are paramount. In the electronics industry, conductive adhesives are replacing soldering techniques in flexible printed circuits and semiconductor packaging. Companies like LORD Corporation and Master Bond have launched thermally and electrically conductive adhesives tailored for miniaturized electronic components. Meanwhile, in aerospace, NASA and Boeing have collaborated on shape-memory adhesives that enable self-repairing structures, enhancing aircraft durability and safety. Medical device manufacturers are also leveraging UV-curable and bioresorbable adhesives for wound closure and implantable devices, minimizing surgical complications. Furthermore, academic institutions such as MIT and Stanford are advancing research into electroactive polymers that could revolutionize robotic grippers and wearable sensors.

MARKET CHALLENGES

Technological Complexity in Formulating High-Performance Sealants

Developing high-performance sealants that meet diverse application requirements presents a significant challenge for manufacturers in the North American adhesives and sealants market. Sealants must simultaneously deliver properties such as elasticity, UV resistance, chemical stability, and long-term durability—often under extreme environmental conditions. For example, silicone-based sealants used in aerospace applications must withstand temperatures ranging from -65°F to 400°F, as specified by ASTM standards. Meeting these demands involves precise control over polymer crosslinking, filler dispersion, and curing kinetics—processes that require advanced analytical tools and skilled personnel. Moreover, the integration of nanomaterials and hybrid resins to enhance performance adds complexity to manufacturing workflows and increases quality assurance requirements. Another issue lies in adapting formulations for specific substrates, such as glass, metal, or composite materials, each of which interacts differently with sealant chemistries. This necessitates extensive testing protocols and customization capabilities, especially in regulated industries like healthcare and defense.

Intensifying Competitive Pressure and Margin Compression

The North American adhesives and sealants market is experiencing heightened competitive intensity, resulting in downward pressure on profit margins and increased pressure to innovate rapidly. A fragmented landscape featuring multinational corporations, regional players, and specialty niche firms has led to aggressive pricing strategies and frequent product launches. This environment is exacerbated by customer demands for customized solutions, shorter lead times, and improved service offerings. Large OEMs in the automotive and electronics sectors often dictate terms, leveraging bulk purchasing power to negotiate lower prices. Additionally, the influx of imported adhesives from Asian producers, many benefiting from lower production costs and export subsidies, has intensified domestic competition. To counteract these pressures, companies must invest in automation, digital supply chain tools, and vertical integration strategies, all of which require capital outlays.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.90% |

|

Segments Covered |

By Adhesive Technology, Sealant Resin, and By Country |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

United States, Canada, Mexico, and Country |

|

Market Leaders Profiled |

Henkel Ag & Co. Kgaa, H.B. Fuller Company, Sika Ag, Arkema (Bostik), 3m, Huntsman Corporation, Illinois Tool Works Inc., Dow, Wacker Chemie Ag. |

SEGMENTAL ANALYSIS

By Adhesive Technology Insights

Water-based adhesives dominated the North American adhesives and sealants market by accounting for 38.5% of total consumption in 2024. This segment’s dominance is primarily driven by its environmental advantages over solvent-based alternatives, aligning with tightening VOC regulations across the region. The adoption of water-based adhesives is particularly strong in the packaging, paper, and wood industries, where safety, ease of handling, and regulatory compliance are critical. For example, Additionally, growing investments in green building certifications such as LEED have reinforced the preference for low-emission materials.

Reactive adhesives are emerging as the fastest-growing segment in the North American adhesives and sealants market, registering a CAGR of 7.9%. This rapid expansion is attributed to their superior performance characteristics, including high bond strength, chemical resistance, and durability under extreme conditions. A key driver behind this growth is the increasing use of reactive adhesives in automotive assembly, especially for lightweight composite and aluminum bonding. As automakers transition to reduce vehicle weight and improve fuel efficiency, structural adhesives have replaced traditional mechanical fasteners. Moreover, the electronics industry is leveraging reactive adhesives for encapsulation and die attach applications in miniaturized components. In the construction sector, reactive polyurethane sealants are gaining traction for window glazing and façade sealing due to their long-term flexibility and weather resistance.

By Sealant Resin Insights

Silicone sealants had the largest share in the North America sealants market by representing 34.5% of total resin-type consumption in 2024. Their widespread adoption stems from their exceptional durability, temperature resistance, and compatibility with diverse substrates such as glass, metal, and concrete. One of the primary drivers of silicone dominance is its extensive use in architectural and construction applications. Silicone-based products are extensively used in curtain walling, window installation, and bathroom waterproofing due to their ability to maintain elasticity over decades. Another key factor is their role in the automotive industry, particularly in electric vehicle (EV) manufacturing. Silicone sealants are crucial in battery enclosures and sensor housing, offering thermal stability and electrical insulation. Additionally, the healthcare sector utilizes medical-grade silicones for device assembly and sterilization-resistant seals.

Polyurethane sealants are witnessing the highest growth in the North American sealants market, expanding at a CAGR of 8.3%. This surge is primarily fueled by their versatility, cost-effectiveness, and adaptability to both industrial and consumer applications. A major growth catalyst is the booming infrastructure modernization efforts across the U.S., supported by the Infrastructure Investment and Jobs Act. Polyurethane sealants are widely used in bridge deck joints, road paving, and tunnel linings due to their excellent elongation properties and resistance to dynamic loads. Furthermore, the automotive repair and refinish market is driving demand for polyurethane-based sealants. In the construction sector, polyurethane foams and sealants are being adopted for energy-efficient building retrofits. These trends collectively propel polyurethane sealants to the forefront of market innovation.

COUNTRY-LEVEL ANALYSIS

The United States stood as the dominant force in the North American adhesives and sealants market by commanding 68.5% of regional revenue in 2024. This lead position is underpinned by a robust industrial base, high R&D expenditure, and the presence of global adhesive manufacturers such as 3M, Henkel, and Dow. A key driver is the country's sustained growth in automotive and aerospace manufacturing. Similarly, Boeing and Lockheed Martin continue to integrate advanced bonding technologies in aircraft assembly, reinforcing demand for high-performance sealants. This includes residential, commercial, and infrastructure developments, all of which rely heavily on adhesives for flooring, insulation, and façade applications. Moreover, the U.S. leads in sustainability-driven product innovation, supported by programs like the USDA BioPreferred initiative.

Canada saw steady growth and is driven by a combination of industrial expansion, government-backed infrastructure investments, and a rising emphasis on eco-friendly formulations. A key growth area lies in the construction industry, signaling strong future activity. Sealants and adhesives are integral to roofing, window installation, and insulation, making them essential inputs for both residential and commercial developments. Additionally, the automotive sector remains a significant consumer. Advanced adhesives are increasingly used in vehicle manufacturing for weight reduction and improved crash performance. Canada’s commitment to environmental standards is also shaping market trends. Environment and Climate Change Canada has mandated stricter VOC limits, prompting formulators to shift toward water-based and bio-adhesive solutions.

Mexico is positioning itself as a rapidly evolving player in the region. The country's proximity to the U.S., coupled with competitive labor costs and favorable trade agreements, has spurred foreign direct investment in manufacturing sectors that heavily utilize adhesives and sealants. The automotive industry serves as a cornerstone for this growth. As automakers expand operations in Guanajuato, Nuevo León, and San Luis Potosí, demand for bonding agents in interior assembly and exterior paneling is rising sharply. Construction activity is another key driver. Sealants and adhesives are increasingly used in tile setting, window installations, and HVAC system integration. Moreover, Mexico’s participation in USMCA has strengthened cross-border supply chains, allowing adhesive suppliers to serve both domestic and export-oriented industries efficiently.

KEY MARKET PLAYERS

Henkel AG & Co. KGaA, H.B. Fuller Company, Sika AG, Arkema (Bostik), 3 M, Huntsman Corporation, Illinois Tool Works Inc., Dow, Wacker Chemie AG are the market players that are dominating the North America adhesives and sealants market.

Top Players in the Market

Henkel AG & Co. KGaA

Henkel is a global leader in adhesives, sealants, and functional coatings, with a strong presence in North America through its Loctite brand. The company offers a broad portfolio catering to the automotive, electronics, construction, and consumer goods sectors. Henkel’s innovation-driven approach, coupled with its extensive distribution network, enables it to maintain a competitive edge. Its focus on sustainable product development and digital solutions has reinforced its leadership position in the region.

3M Company

3M is a diversified technology company with a significant footprint in the North American adhesives and sealants market. Known for its wide range of high-performance adhesive tapes, bonding systems, and specialty sealants, 3M serves key industries such as transportation, healthcare, and electronics. The company's strength lies in its robust R&D capabilities and continuous product innovation that addresses evolving industry needs.

Dow Inc.

Dow plays a pivotal role in supplying raw materials and formulated products to the adhesives and sealants industry across North America. With a focus on silicone-based and polyurethane technologies, Dow supports applications in construction, packaging, and automotive sectors. Its strategic partnerships and commitment to sustainability have strengthened its position in the regional market.

Top Strategies Used by Key Market Participants

One of the primary strategies employed by leading players is product innovation and differentiation, focusing on developing advanced formulations that offer superior performance, durability, and environmental compliance. Companies are investing heavily in R&D to create bio-based, low-VOC, and smart adhesive solutions tailored to specific industrial applications.

Another key strategy is strategic mergers, acquisitions, and partnerships, allowing companies to expand their geographic reach, enhance technical capabilities, and integrate into new market segments. These collaborations help firms strengthen supply chains and gain access to emerging technologies and customer bases.

Lastly, sustainability-driven initiatives have become central to business growth strategies. Major players are aligning with green certification programs, adopting circular economy principles, and reformulating products to meet stringent regulatory standards while appealing to environmentally conscious consumers and industries.

COMPETITION OVERVIEW

The competition in the North American adhesives and sealants market is characterized by a mix of global giants, regional manufacturers, and niche specialty players, all striving to capture market share through innovation, strategic alliances, and operational efficiency. While multinational corporations dominate due to their extensive R&D capabilities and well-established distribution networks, mid-sized and local companies are increasingly leveraging agility and customization to compete effectively. The market is highly fragmented, with players differentiating themselves through technological advancements, sustainability efforts, and application-specific product development. Customer loyalty is influenced by technical support, reliability, and formulation expertise, making service excellence a critical battleground. Additionally, rising demand for eco-friendly alternatives and regulatory pressures are reshaping competitive dynamics, pushing companies to continuously evolve their offerings. As end-user industries adopt more complex manufacturing processes, the need for high-performance, durable, and adaptable adhesive and sealant solutions is intensifying competition further, encouraging both consolidation and innovation within the sector.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Henkel announced the expansion of its North America innovation center in Rocky Hill, Connecticut, aimed at accelerating the development of sustainable adhesive solutions tailored for the packaging and electronics industries.

- In May 2024, 3M introduced a new line of structural adhesives designed specifically for electric vehicle assembly, reinforcing its position in the rapidly growing automotive segment.

- In July 2024, Dow launched a collaborative initiative with leading automotive OEMs to develop next-generation bonding technologies that improve lightweighting and battery integration in electric vehicles.

- In September 2024, H.B. Fuller acquired a specialty adhesive manufacturer based in Texas to enhance its presence in the flexible packaging and construction markets across North America.

- In November 2024, Arkema opened a new R&D facility in Arizona focused on advancing UV-curable and reactive adhesive technologies for high-tech applications in aerospace and electronics.

MARKET SEGMENTATION

This research report on the North American adhesives and sealants market is segmented and sub-segmented into the following categories.

By Adhesive Technology

- Water-based

- Solvent-based

- Hot-melt

- Reactive

By Sealant Resin

- Silicone

- Polyurethane

- Plastisol

- Emulsion

- Polysulfide

- Butyl

By Country

- US

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

What is the projected growth rate of the North America adhesives and sealants market from 2025 to 2033?

The market is expected to grow at a CAGR of 2.45% from 2025 to 2033, driven by rising demand from construction, automotive, and packaging sectors, particularly in the U.S. and Mexico.

Which country leads in bio-based adhesive adoption in North America?

Canada leads in bio-based adhesive use , with over 18% of adhesive manufacturers incorporating renewable feedstocks like soybean oil and starch-based polymers into formulations, supported by federal green chemistry incentives.

How much revenue does the U.S. construction sector contribute to the sealants market annually?

The U.S. construction segment accounts for nearly $3.2 billion in annual sealant sales , fueled by residential remodeling and infrastructure projects requiring silicone, polyurethane, and acrylic-based products.

Which type of adhesive dominates the North American automotive assembly process?

Structural adhesives, especially epoxy- and polyurethane-based systems, account for over 60% of adhesive use in vehicle manufacturing, replacing traditional mechanical fasteners for lighter, more durable builds.

What percentage of packaging adhesives in North America are water-based?

Approximately 72% of adhesives used in food and beverage packaging are water-based due to their low VOC emissions and compliance with FDA safety standards for indirect food contact.

How has the Inflation Reduction Act (IRA) impacted adhesive formulation strategies in 2024?

Under the IRA, over 25 adhesive and sealant companies have reformulated products to qualify for green tax credits, focusing on reducing carbon footprint and increasing recyclability.

Which application segment is driving fastest growth in industrial sealant usage?

The renewable energy sector , particularly wind turbine manufacturing, is driving sealant demand at a CAGR of 9.4% , due to the need for high-performance bonding in blade assembly and nacelle sealing

How many new adhesive product registrations were filed with EPA under TSCA in 2023?

In 2023, the EPA received over 140 new adhesive-related chemical notifications under the Toxic Substances Control Act (TSCA), reflecting increased innovation in low-emission and reactive formulations.

What role do robotics play in adhesive dispensing in North American factories?

Over 40% of Tier 1 automotive suppliers now use robotic adhesive dispensing systems, improving precision, reducing waste by up to 20% , and enhancing production line efficiency.

How much has e-commerce contributed to DIY adhesive sales growth in North America?

Online retail channels accounted for a 28% increase in consumer-grade adhesive sales in 2023, with platforms like Amazon and Home Depot seeing higher demand for multipurpose and craft-use glues.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com