North America Adult Diaper Market Size, Share, Trends & Growth Forecast Report By Type (Adult Pad Type Diaper, Adult Flat Type Diaper, Adult Pant Type Diaper), Distribution Channel and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Adult Diaper Market Size

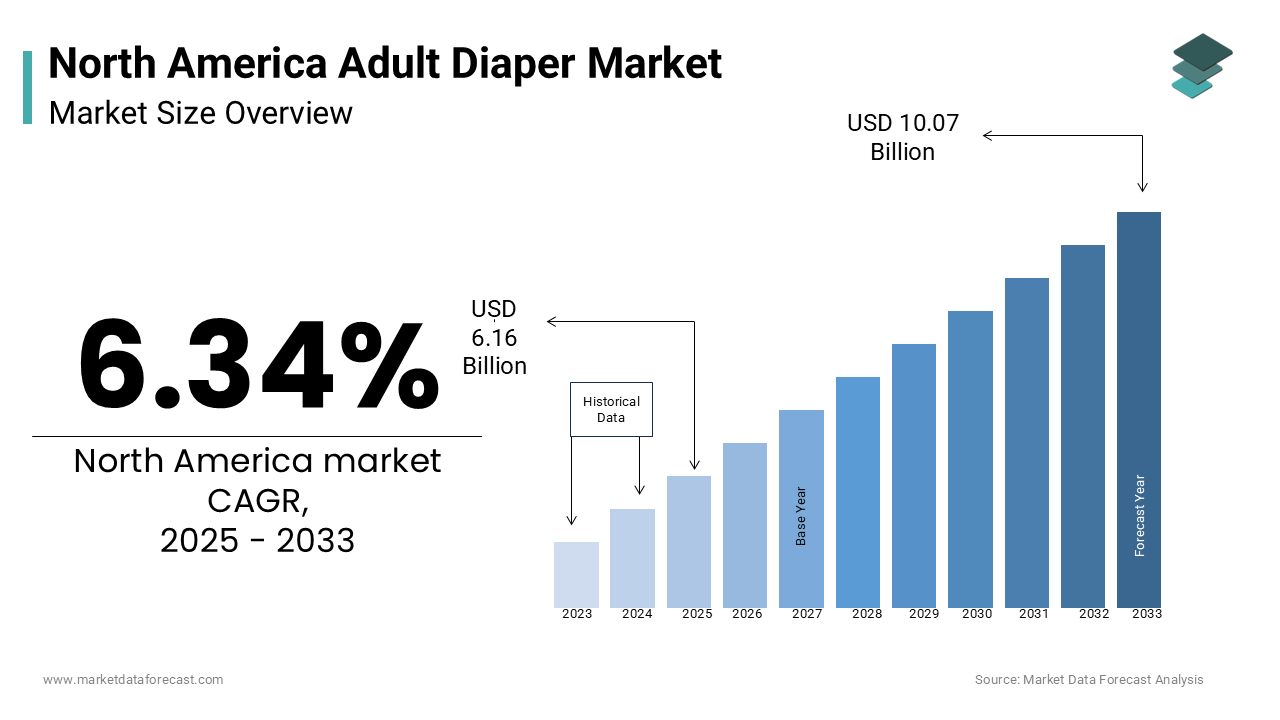

The North America adult diaper market was worth USD 5.79 billion in 2024. The North American market is estimated to grow at a CAGR of 6.34% from 2025 to 2033 and be valued at USD 10.07 billion by the end of 2033 from USD 6.16 billion in 2025.

The North American adult diaper market is catering to individuals with incontinence, mobility impairments, or age-related conditions requiring specialized hygiene solutions. Adult diapers, also known as incontinence products, are designed to provide comfort, dignity, and protection for adults who experience involuntary urine or bowel leakage due to medical conditions such as urinary incontinence, Alzheimer's disease, or post-surgical recovery needs. The demand for these products has grown significantly in recent years by an aging population and increasing awareness about incontinence management.

According to the U.S. Census Bureau, the number of Americans aged 65 and older is projected to reach over 94 million by 2060 is accounting for nearly one-quarter of the total population. Furthermore, data from the National Association for Continence reveals that approximately 25 million adults in the United States experience some form of urinary incontinence with the widespread prevalence of this condition. Additionally, the Centers for Disease Control and Prevention notes that chronic diseases, which often contribute to incontinence, affect six in ten adults in the United States that is amplifying the necessity for effective hygiene solutions.

MARKET DRIVERS

Aging Population and Increased Life Expectancy

The aging population is a significant driver of the North American adult diaper market. According to the U.S. Census Bureau, the number of individuals aged 85 and older, a group particularly prone to incontinence, is expected to triple from 6.5 million in 2020 to nearly 20 million by 2060. This demographic trend is compounded by increased life expectancy, with the Centers for Disease Control and Prevention reporting that life expectancy in the United States currently stands at 76 years, up from 70 years in 1960. As people live longer, they are more likely to experience age-related health conditions such as urinary incontinence, dementia, or mobility issues, all of which necessitate the use of adult diapers. The demand for adult incontinence products is set to surge by making this demographic shift a key growth catalyst for the market.

Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases is another major factor propelling the North American adult diaper market. According to the Centers for Disease Control and Prevention, chronic illnesses like diabetes, obesity, and cardiovascular diseases affect approximately 60% of adults in the United States. These conditions often lead to complications such as nerve damage or weakened pelvic muscles, which can result in incontinence. For instance, the National Institute of Diabetes and Digestive and Kidney Diseases estimates that over 37 million Americans have diabetes is a condition strongly associated with bladder dysfunction. Furthermore, the American Heart Association notes that heart failure, which affects nearly 6.2 million adults in the U.S., can also contribute to urinary incontinence.

MARKET RESTRAINTS

Limited Reimbursement and Insurance Coverage

The lack of widespread reimbursement and insurance coverage for adult diapers is a significant restraint in the North American market. The U.S. Department of Health and Human Services notes that most private health insurance plans, as well as Medicare, do not cover the cost of incontinence products is leaving consumers to bear the financial burden entirely. This exclusion disproportionately affects low-income individuals, particularly seniors and disabled populations, who rely heavily on these products. According to the National Council on Aging, approximately 25% of older adults struggle to afford basic healthcare necessities, with out-of-pocket expenses for incontinence supplies often exacerbating financial strain. The absence of standardized policies for reimbursement limits accessibility and discourages consistent usage, hindering market growth. Addressing this gap through policy changes or expanded coverage could significantly alleviate the financial barriers faced by millions of users.

Environmental Concerns Over Disposable Products

Environmental concerns associated with disposable adult diapers pose another major restraint for the market. The Environmental Protection Agency estimates that single-use hygiene products contribute significantly to landfill waste, with over 4 million tons of non-biodegradable materials discarded annually in the United States alone. Adult diapers, often made from plastic-based components, can take up to 500 years to decompose is raising alarms about their long-term ecological impact. According to the National Institutes of Health, growing consumer awareness about sustainability has led to increased scrutiny of such products by pressuring manufacturers to explore eco-friendly alternatives. However, the development of biodegradable or reusable options faces challenges by including higher production costs and limited scalability, which hinder their adoption.

MARKET OPPORTUNITIES

Technological Advancements in Product Design

The integration of advanced technologies into adult diaper design presents a significant opportunity for the North American market. According to the National Institute of Biomedical Imaging and Bioengineering, innovations such as moisture sensors and smart fabrics are transforming incontinence care by enabling real-time monitoring of hygiene needs. These technologies not only improve user comfort but also reduce the risk of skin irritation and infections, which affect nearly 15% of long-term incontinence product users, according to the Centers for Disease Control and Prevention. Additionally, advancements in biodegradable materials offer a solution to environmental concerns by aligning with growing consumer demand for sustainable products. These technological breakthroughs are expected to enhance product functionality and appeal is driving market expansion while addressing unmet needs in both healthcare and environmental sustainability.

Growing Demand for Home Healthcare Solutions

The increasing preference for home healthcare services is creating substantial opportunities for the adult diaper market in North America. The U.S. Department of Health and Human Services projects that home healthcare expenditures will exceed $200 billion by 2030, driven by an aging population seeking cost-effective and convenient care options. This shift is further supported by the Centers for Medicare & Medicaid Services, which notes that over 80% of older adults prefer aging in place rather than moving to institutional settings. The high-quality incontinence products is rising as home-based care becomes more prevalent. Adult diapers play a critical role in enabling independent living for seniors and individuals with chronic conditions by making them indispensable in home healthcare settings. Manufacturers can capitalize on this trend by tailoring products to meet the specific needs of home care environments is fostering growth in this expanding segment.

MARKET CHALLENGES

Stigma and Social Barriers Surrounding Incontinence

Social stigma surrounding incontinence remains a significant challenge for the North American adult diaper market is deterring many individuals from seeking or using these products. According to the National Institutes of Health, nearly 50% of adults with urinary incontinence avoid discussing their condition with healthcare providers due to embarrassment or fear of judgment. This reluctance often leads to underreporting and delayed adoption of effective hygiene solutions. Additionally, the Centers for Disease Control and Prevention notes that untreated incontinence can result in social isolation, with affected individuals withdrawing from public activities to avoid potential embarrassment.

Unequal Access Across Demographic Groups

Unequal access to adult diapers across different demographic groups presents another challenge for the market. The U.S. Census Bureau reports that approximately 11% of Americans live below the poverty line is making it difficult for low-income families to afford incontinence products, which are often excluded from government assistance programs like Medicaid. Furthermore, the National Center for Health Statistics reveals that rural populations face additional hurdles, such as limited availability of specialized healthcare services and incontinence products when compared to urban areas. These disparities exacerbate the burden on vulnerable groups, including the elderly and disabled, who rely heavily on these products for daily living. Bridging this gap requires targeted efforts to improve affordability and accessibility is ensuring equitable access to adult diapers for all segments of the population.

SEGMENTAL ANALYSIS

By Type Insights

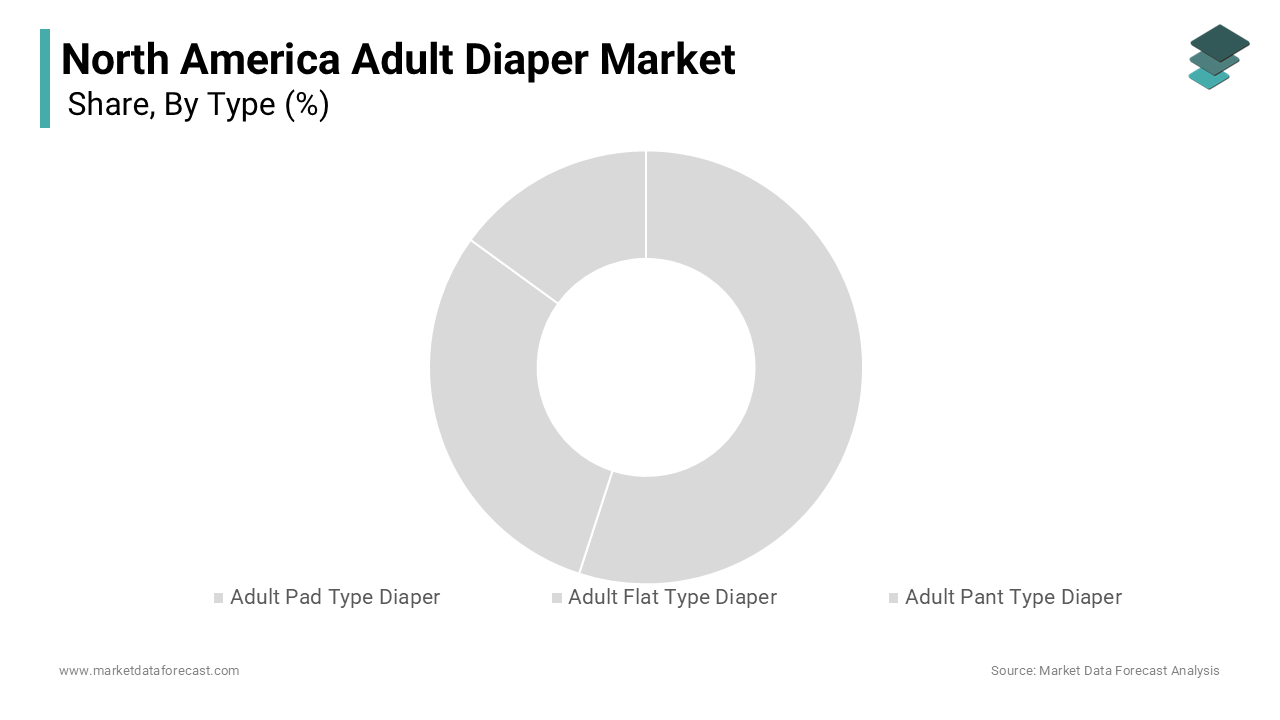

The adult pant-type diapers segment dominated the North American market and held 45.3% of the share in 2024. The growth of the segment is attributed with from their ease of use, comfort, and discreet design by making them ideal for active adults with incontinence. According to the Centers for Disease Control and Prevention, over 70% of users prefer pant-type designs due to their resemblance to regular underwear, which enhances user dignity and confidence.

The adult pad-type diaper segment is likely to grow with a CAGR of 8.5% during the forecast period by increasing demand among elderly individuals living independently, who require cost-effective and lightweight solutions. The National Institute on Aging reports that over 60% of seniors aged 75 and above experience mild incontinence, favoring pads for their affordability and convenience. Additionally, the rising adoption of reusable cloth pads aligns with sustainability trends.

By Distribution Channel Insights

The pharmacies segment was the largest and held 40.3% of the North American adult diaper market share in 2024 owing to their widespread availability, trusted reputation, and direct access to healthcare professionals who recommend these products. Pharmacies also cater to elderly populations, who frequently visit for prescriptions and other medical supplies, making them a convenient one-stop solution. According to the Centers for Disease Control and Prevention, over 60% of adults aged 65 and older manage chronic conditions is increasing their reliance on pharmacies for incontinence care.

The online stores segment is likely to grow with a CAGR of 12.5% during the forecast period. This rapid expansion is fueled by the increasing penetration of e-commerce platforms among tech-savvy seniors and caregivers seeking convenience and privacy. The National Institutes of Health notes that over 70% of consumers prefer online purchasing for sensitive products like adult diapers due to discreet delivery options. Additionally, the rise of subscription-based models and competitive pricing has further boosted demand. The COVID-19 pandemic accelerated this trend, with the U.S. Census Bureau reporting a 32% surge in online retail sales in 2020 alone.

REGIONAL ANALYSIS

The United States was the largest contributor for the North American adult diaper market with a share of 86,1% in 2024 due to its large aging population, with over 54 million adults aged 65 and older, a number projected to double by 2060. According to the Centers for Disease Control and Prevention, chronic conditions like diabetes and obesity, which often lead to incontinence, affect nearly 60% of Americans. Additionally, the widespread availability of pharmacies and online retail platforms ensures accessibility.

Canada is estimated to hit a fastest CAGR of 9.2% during the forecast period. The growth of the market in this country is fueled by an aging population, with seniors expected to account for 25% of the population by 2030. The Public Health Agency of Canada notes that increasing awareness of incontinence solutions and rising investments in home healthcare services are key drivers. Additionally, the proliferation of e-commerce platforms has made products more accessible, particularly in rural areas. Canada’s focus on sustainability, including government-backed initiatives for eco-friendly products, further accelerates adoption. This rapid expansion will enhance the Canada’s potential to become a significant contributor to regional market dynamics.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Nippon Paper Industries Co Ltd, Drylock Technologies NV, Ontex BV, Health Care Products Inc, First Quality Enterprises Inc, Kimberly-Clark Corp, Principle Business Enterprises, Essity AB, AB Abena, Others.

The North American adult diaper market is characterized by intense competition, driven by the presence of established multinational corporations and regional players striving to capture significant market share. Leading companies such as Kimberly-Clark Corp, Essity AB, and Ontex BV dominate the landscape, leveraging their strong brand recognition, extensive distribution networks, and commitment to innovation. These key players focus on developing high-quality, user-friendly products that cater to diverse consumer needs, including affordability, sustainability, and advanced functionality. The competitive environment is further intensified by the growing emphasis on technological advancements, with manufacturers incorporating features like smart sensors and biodegradable materials to differentiate their offerings.

In addition to product innovation, strategic initiatives such as mergers, acquisitions, and partnerships play a pivotal role in shaping the competitive dynamics. Companies are expanding their reach by collaborating with healthcare providers, pharmacies, and e-commerce platforms to enhance accessibility and tap into underserved markets. Furthermore, marketing campaigns aimed at reducing the stigma associated with incontinence have become a critical battleground for competitors, as brands strive to build trust and foster brand loyalty.

Despite the dominance of major players, smaller firms and emerging entrants are gaining traction by targeting niche segments and offering cost-effective solutions. This has created a dynamic and fragmented market where innovation, affordability, and consumer-centric strategies are paramount. As demand continues to rise due to an aging population and increased awareness, competition is expected to intensify further, driving continuous improvements in product quality and service delivery

Top Key players in the Market

Kimberly-Clark Corp

Kimberly-Clark Corp is a leading player in the North American adult diaper market, renowned for its innovative product lines under globally recognized brands such as Depend and Poise. The company has established itself as a pioneer in addressing the needs of individuals with incontinence by focusing on comfort, discretion, and skin health. Kimberly-Clark leverages advanced technologies to develop products that cater to diverse consumer preferences, including eco-friendly options that align with growing sustainability trends. Its strong distribution network, spanning pharmacies, retail outlets, and online platforms, ensures widespread accessibility.

Essity AB

Essity AB is another dominant force in the North American adult diaper market, known for its commitment to improving hygiene and health through its TENA brand. Essity distinguishes itself by prioritizing both consumer needs and environmental responsibility, incorporating sustainable materials into its product designs. The company actively collaborates with healthcare professionals and caregivers to enhance awareness about incontinence management, thereby reducing stigma and promoting proactive care. Through strategic partnerships and acquisitions, Essity has expanded its reach by ensuring its products are accessible to a broad demographic while maintaining high standards of quality and reliability.

Ontex BV

Ontex BV has emerged as a key competitor in the North American adult diaper market, driven by its customer-centric approach and cost-effective product offerings. The company specializes in developing high-quality, affordable incontinence solutions that cater to both institutional and individual users. Ontex’s emphasis on innovation is evident in its adoption of breathable materials and ergonomic designs, which enhance user comfort and reduce the risk of skin irritation. Furthermore, Ontex has successfully tapped into the growing demand for home healthcare solutions by providing reliable products that support independent living.

Top strategies by the market players in the market

Product Innovation and Technological Advancements

Key players in the North American adult diaper market have consistently prioritized product innovation to maintain a competitive edge. Companies are investing in research and development to introduce advanced features such as moisture-wicking fabrics, odor control technologies, and smart sensors that monitor hygiene levels in real-time. These innovations not only enhance user comfort and convenience but also address concerns like skin irritation and environmental impact. For instance, manufacturers are increasingly incorporating biodegradable materials into their designs to align with growing consumer demand for sustainable products.

Strategic Partnerships and Expansions

Strategic partnerships and geographic expansions are critical strategies adopted by key players to strengthen their foothold in the North American adult diaper market. Collaborations with healthcare providers, pharmacies, and online retailers enable companies to improve product accessibility and reach underserved regions, particularly rural areas. Additionally, partnerships with home healthcare organizations help cater to the rising demand for incontinence solutions in non-institutional settings. Some companies are also expanding their manufacturing capabilities or acquiring smaller firms to consolidate their market presence.

Marketing and Awareness Campaigns

To combat stigma and drive adoption, major players in the adult diaper market are investing heavily in marketing and awareness campaigns. These initiatives focus on educating consumers about incontinence management, emphasizing that adult diapers are essential tools for maintaining dignity and independence. Companies are leveraging digital platforms, social media, and collaborations with advocacy groups to normalize conversations around incontinence and promote the benefits of their products. By highlighting testimonials from caregivers and users, these campaigns build trust and encourage individuals to seek solutions without hesitation. Furthermore, brands are tailoring their messaging to resonate with specific demographics, such as seniors or working adults by ensuring their products are perceived as reliable and indispensable for improving quality of life.

RECENT MARKET DEVELOPMENTS

- In March 2024, First Quality Enterprises announced a major capacity expansion, increasing baby diaper and training pant production by 50% and adult care product capacity by 25%. This initiative is expected to strengthen their manufacturing capabilities and reinforce their position in the North American adult diaper market.

- In March 2024, Drylock Technologies opened a new 430,000-square-foot diaper manufacturing facility in Reidsville, North Carolina. The site, which created 300 jobs, is expected to enhance their U.S. production footprint and support growth in the adult diaper market.

- In March 2024, Kimberly-Clark Corporation unveiled a strategic reorganization, segmenting its business into North America, International Personal Care, and International Family Care & Professional. This move is designed to streamline operations and enhance market responsiveness in North America.

- In May 2024, Principle Business Enterprises invested in the development and expansion of plus-size adult incontinence products. This initiative commemorates the 20th anniversary of its bariatric line and aims to meet growing demand for inclusive product offerings.

- In February 2024, Principle Business Enterprises’ Tranquility brand was recognized by Forbes Health in three categories of its “Best Adult Diapers of 2024” list. This recognition strengthens the brand’s reputation and visibility in the North American market.

- In March 2025, Ontex published its 2024 annual report, highlighting financial growth, environmental efforts, and governance initiatives. The report supports their commitment to transparency and long-term positioning in the marketplace.

- In February 2025, First Quality Enterprises signed a definitive agreement to acquire Henkel’s North American Retailer Brands business. The acquisition is expected to enhance their private label portfolio, indirectly benefiting their adult diaper distribution channels.

- In December 2024, Essity AB reported a strong financial position with high EBITDA coverage and solid debt ratios. This financial health underpins the company’s ability to invest in growth initiatives to expand their product portfolio.

- In December 2024, Drylock Technologies released a year-end summary showcasing advancements in innovation, sustainability, and production capacity. These efforts support its competitive position in the adult hygiene sector across North America.

- In January 2025, Kimberly-Clark reported strong results from its transformation program, including an operating profit of $3.2 billion. This initiative, which included divestitures and cost optimization, is aimed at improving operational efficiency and reinforcing market presence in North America.

MARKET SEGMENTATION

This research report on the north america adult diaper market is segmented and sub-segmented based on categories.

By Type

- Adult Pad Type Diaper

- Adult Flat Type Diaper

- Adult Pant Type Diaper

By Distribution Channel

- Pharmacies

- Convenience Stores

- Online Stores

- Others

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What factors are driving the growth of this market?

The aging population, increasing cases of incontinence, and growing awareness around hygiene and elder care are major drivers. The rise of home healthcare and improved product technology also contribute to market expansion.

Is there a rising trend in adult diaper use in North America?

Yes, there's a significant increase in demand due to the aging population and growing awareness of incontinence care. Social stigma around usage is also decreasing, leading to more open acceptance.

What factors are driving the future growth of the adult diaper market?

Key drivers include an aging population, increased prevalence of incontinence-related conditions, and heightened awareness of personal hygiene. Additionally, product innovations and the expansion of online retail channels contribute to market growth.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com