North America Aroma Chemicals Market Size, Share, Trends & Growth Forecast Report By Source (Synthetic Aroma Chemicals, Natural Aroma Chemicals), Chemicals, Application, And Country (Us, Canada, And Rest Of North America), Industry Analysis From 2025 To 2033

North America Aroma Chemicals Market Size

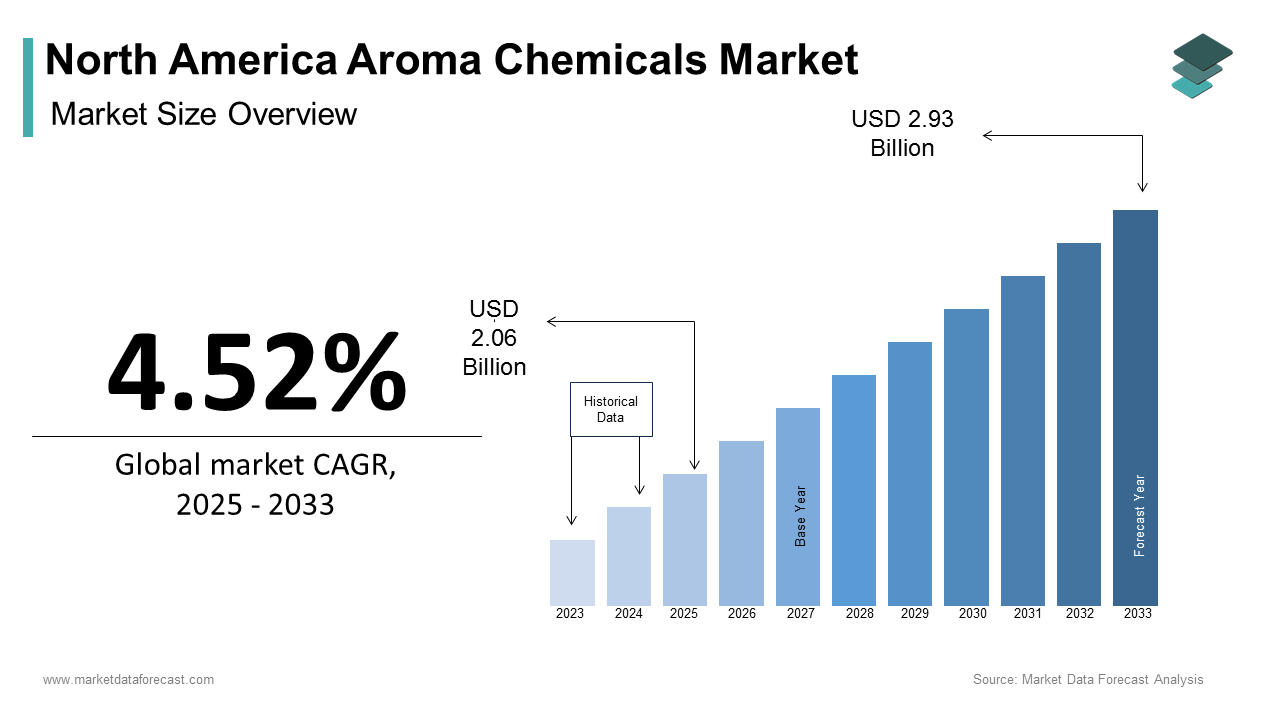

The North America aroma chemicals market size was calculated to be USD 1.97 billion in 2024 and is anticipated to be worth USD 2.93 billion by 2033, from USD 2.06 billion in 2025, growing at a CAGR of 4.52% during the forecast period.

The North America aroma chemicals market is a significant contributor to the global fragrance and flavor industry. Also, the United States dominates this regional landscape and is driven by its robust food and beverage, cosmetics, and household care industries. Canada follows closely, bolstered by increasing demand for natural and organic products.

Moreover, rising consumer awareness about product ingredients and sustainability has shifted preferences toward natural aroma chemicals, which now represent a notable portion of total sales in North America. Additionally, stringent regulations regarding synthetic chemicals have shaped the competitive dynamics.

MARKET DRIVERS

Growing Demand for Natural Aroma Chemicals

The surge in demand for natural aroma chemicals stems from shifting consumer preferences toward clean-label products. This trend is particularly evident in the food and beverage sector, where natural flavors account a notable share of the market. In 2022, the natural aroma chemicals segment witnessed a revenue increase of 8%, driven by innovations in extraction technologies like supercritical CO2 extraction. Furthermore, the rise of plant-based diets has amplified the need for natural aroma compounds such as terpenes.

Expansion of the Cosmetics Industry

The cosmetics industry serves as another critical driver and is fueled by the growing popularity of personal care products. Synthetic aroma chemicals dominate this space and is contributing to a significant share of fragrance formulations due to their cost-effectiveness and versatility. Innovations in synthetic musk chemicals, which saw a notable annual growth, have further solidified their dominance. Additionally, the rise of e-commerce platforms has expanded access to niche fragrances, boosting demand.

MARKET RESTRAINTS

Stringent Regulatory Frameworks

Stringent regulatory frameworks pose a significant challenge to the aroma chemicals market. The U.S. Environmental Protection Agency (EPA) enforces strict guidelines under the Toxic Substances Control Act (TSCA), requiring manufacturers to conduct extensive safety assessments before commercializing new chemicals. Moreover, the European Union’s REACH regulation influences North American markets due to cross-border trade, limiting the use of certain synthetic compounds like phthalates. These regulatory hurdles have slowed innovation and increased time-to-market for novel aroma chemicals, impeding market growth.

Volatility in Raw Material Prices

Fluctuating raw material prices present another major restraint. Essential oils and plant extracts, critical for natural aroma chemicals, are subject to supply chain disruptions caused by climate change and geopolitical tensions. For instance, vanilla bean prices surged by 300% between 2019 and 2022 due to cyclones in Madagascar, a key supplier, according to the International Trade Centre. Similarly, petrochemical derivatives used in synthetic aroma chemicals face price volatility linked to crude oil fluctuations. Crude oil price swings can significantly impact synthetic aroma chemical production costs.

MARKET OPPORTUNITIES

Rising Adoption of Bio-Based Aroma Chemicals

The adoption of bio-based aroma chemicals presents a lucrative opportunity, driven by advancements in biotechnology. Companies leveraging microbial fermentation techniques have reduced production costs notably. Furthermore, partnerships between biotech firms and aroma chemical manufacturers have accelerated R&D investments, fostering innovation. This shift aligns with consumer demand for sustainable solutions, positioning bio-based chemicals as a high-growth segment.

Increasing Focus on Personalized Fragrances

Personalized fragrances represent an emerging opportunity, fueled by customization trends in luxury goods. Advances in encapsulation technologies have enabled the creation of bespoke scents tailored to individual preferences, driving demand for unique aroma chemicals. Brands collaborating with tech companies to develop AI-driven scent profiling tools have seen a notable increase in customer engagement.

MARKET CHALLENGES

Counterfeit Products and Intellectual Property Issues

Counterfeit products and intellectual property (IP) violations pose significant challenges to the aroma chemicals market. The Global Brand Counterfeiting Report highlights that counterfeit fragrances accounted for $12 billion in lost revenue globally in 2022, with North America being a primary target. Unauthorized replication of proprietary aroma formulations undermines brand equity and erodes profit margins. Additionally, counterfeit products often use substandard raw materials, posing health risks and damaging consumer trust.

Supply Chain Disruptions

Supply chain disruptions continue to hinder market stability, exacerbated by geopolitical tensions and natural disasters. China, a major supplier of intermediates, imposed export restrictions during the pandemic, causing shortages of key precursors like benzene derivatives, which impacted a considerable share of North American production. Furthermore, labor shortages in warehousing and transportation have increased delivery times. These disruptions not only escalate operational costs but also strain relationships with downstream industries reliant on consistent supply, creating long-term challenges for market participants.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.52% |

|

Segments Covered |

By Source, Chemicals, Application, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Us, Canada, And Rest Of North America |

|

Market Leaders Profiled |

Givaudan, International Flavors & Fragrances Inc. (IFF), Symrise AG, BASF SE, Takasago International Corporation, Sensient Technologies Corporation, Firmenich SA, Solvay, Agilex Fragrances, Eternis Fine Chemicals |

SEGMENTAL ANALYSIS

By Source Insights

The synthetic aroma chemicals segment dominated the North America market by holding a 55.6% share in 2024. This position of the segment is caused by their cost-effectiveness and versatility in applications across fragrances, cosmetics, and household care products. The synthetic segment is also driven by innovations in musk compounds and aldehydes, which are integral to modern perfumery. Additionally, advancements in green chemistry have enabled manufacturers to produce eco-friendly synthetic alternatives, addressing regulatory concerns. The U.S., being a hub for chemical manufacturing, contributes significantly to this segment’s growth, with synthetic aroma chemical exports rising significantly in the recent years, as reported by the U.S. Department of Commerce.

The natural aroma chemicals are the fastest-growing segment, expanding at a CAGR of 7.3% from 2025 to 2033. This growth is fueled by consumer demand for clean-label and organic products, particularly in the food and beverage sector. Innovations in extraction technologies such as supercritical CO2, have enhanced yield efficiency and is reducing production costs. Canada’s emphasis on sustainable agriculture has also bolstered regional supply chains, making natural aroma chemicals a pivotal growth driver.

By Chemicals Insights

The musk chemicals segment represented the largest category by commanding a 38.8% share in 2024. This category is indispensable in fragrance formulations due to its long-lasting scent properties. According to the International Fragrance Association (IFRA), synthetic musks dominate this segment, accounting for 70% of total musk chemical usage. Technological advancements in nitro-musk and polycyclic musk production have improved odor stability, driving adoption in luxury fragrances. The U.S. leads global production, with musk chemicals contributing 25% to the domestic aroma chemicals market, as per the American Chemistry Council (ACC). Rising consumer spending on premium perfumes, which grew notably each yaer in North America, further strengthen musk chemicals’ leadership position.

The terpenes and terpenoids segment the quickest expanding category, projected to grow at a CAGR of 8.5% through 2033. This progress is caused by their widespread use in cannabis-derived products and aromatherapy. Advances in steam distillation and cold pressing have increased extraction yields, reducing costs. Moreover, the wellness industry’s expansion, with aromatherapy sales growing annually, has boosted demand for natural terpenes. Canada’s legalization of cannabis has further accelerated regional adoption, positioning terpenes as a high-growth category in the aroma chemicals market.

By Application Insights

The fragrance application segment commanded the North America aroma chemicals market by capturing a 60.8% share in 2024. This segment benefits from the booming cosmetics industry. Synthetic musks and aldehydes are critical components, contributing a significant portion of fragrance formulations. The rise of e-commerce platforms has expanded access to niche perfumes, boosting demand for premium aroma chemicals. Additionally, partnerships between fragrance houses and fashion brands have driven innovation, reinforcing the segment’s leadership in the aroma chemicals market.

The flavors application segment is emerging swiftly in the market, expanding at a CAGR of 6.8% in the coming years. This is caused by the food and beverage industry’s shift toward natural and organic ingredients. The natural flavor market has been growing and is a significant portion of the overall flavoring agents. Innovations in encapsulation technologies have enhanced flavor stability, driving adoption in functional foods and beverages. Canada’s focus on health-conscious products has further propelled regional growth, making flavors a key growth driver in the aroma chemicals market.

REGIONAL ANALYSIS

The United States was the largest contributor to the North America aroma chemicals market by holding a 75.1% share in 2024. Also, the U.S. market benefits from its robust cosmetics, food, and beverage industries. The country’s advanced chemical manufacturing infrastructure supports synthetic aroma chemical production, which accounts for a notable share of domestic output, per the ACC. Rising consumer awareness about sustainability has also driven demand for natural aroma chemicals. The U.S.’s strategic investments in R&D and trade agreements further solidify its leadership in the regional market.

Canada is expected to witness considerable expansion in this market. This market is driven by its focus on sustainability and organic products. Additionally, government incentives for green chemistry have encouraged innovation, positioning Canada as a leader in eco-friendly aroma chemical solutions.

The Rest of North America, including Mexico and other smaller markets, holds a smaller share in the aroma chemicals market as per Allied Market Research. This region is characterized by its growing industrial base and increasing consumer awareness about premium fragrances and flavors. Mexico’s chemical sector grew notable growth in recent years, driven by rising exports to the U.S. and Europe. The demand for synthetic aroma chemicals dominates this segment, accounting for a substantial portion of total consumption due to their affordability and scalability in household care products. Additionally, Mexico’s burgeoning food and beverage industry, which expanded, has fueled demand for flavoring agents like esters and aldehydes. Government initiatives promoting sustainable agriculture have also bolstered the supply chain for natural aroma chemicals, positioning the region as a promising growth hub within North America.

LEADING PLAYERS IN THE NORTH AMERICA AROMA CHEMICALS MARKET

International Flavors & Fragrances (IFF)

International Flavors & Fragrances (IFF) is a global leader in the aroma chemicals market. Headquartered in New York, IFF specializes in developing innovative fragrance and flavor solutions, leveraging advanced biotechnology and green chemistry. The company’s focus on sustainability is evident in its Naturals Together program, which promotes ethical sourcing of raw materials. IFF’s strategic acquisitions, such as that of DuPont’s Nutrition & Biosciences division, have strengthened its product portfolio and solidified its leadership position.

Givaudan

Givaudan, a Swiss-based company with a strong presence in North America. Also, Givaudan leads in fragrance innovation, particularly in synthetic musks and terpenes. The company’s emphasis on digitalization and AI-driven scent profiling tools has enabled it to capture niche markets like personalized fragrances. Givaudan’s collaboration with biotech firms to develop bio-based aroma chemicals aligns with consumer demand for sustainable solutions, reinforcing its competitive edge in North America.

Firmenich

Firmenich, now part of DSM-Firmenich following a merger. The company with a significant focus on natural and organic compounds. Firmenich’s proprietary extraction technologies, such as green fractionation, have enhanced the efficiency of producing high-quality aroma chemicals. Its partnerships with local suppliers in Canada and the U.S. ensure a robust supply chain, enabling it to meet growing demand for clean-label products across cosmetics, food, and household care industries.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the North America aroma chemicals market employ diverse strategies to maintain competitiveness. Collaborations and partnerships are prevalent, with companies like IFF and Givaudan teaming up with biotech firms to develop bio-based aroma chemicals, addressing sustainability demands. Acquisitions play a pivotal role; for instance, IFF’s acquisition of DuPont’s Nutrition & Biosciences division expanded its product portfolio and geographic reach. Investment in R&D is another core strategy, with Firmenich allocating a notable portion of its annual revenue to innovation in natural and synthetic compounds. Additionally, companies are leveraging digital platforms to enhance customer engagement, offering AI-driven tools for personalized fragrance creation. These strategies collectively drive growth and differentiation in the competitive landscape.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the North America Aroma Chemicals market include Givaudan, International Flavors & Fragrances Inc. (IFF), Symrise AG, BASF SE, Takasago International Corporation, Sensient Technologies Corporation, Firmenich SA, Solvay, Agilex Fragrances, Eternis Fine Chemicals

The North America aroma chemicals market is highly competitive, characterized by the dominance of multinational corporations like IFF, Givaudan, and Firmenich. These players leverage economies of scale, advanced R&D capabilities, and strategic partnerships to maintain leadership. The market also witnesses intense competition from regional manufacturers specializing in cost-effective synthetic chemicals. Innovation remains a key differentiator, with companies investing heavily in sustainable practices and bio-based solutions to meet regulatory standards and consumer preferences. Smaller players, however, face challenges such as limited access to capital and stringent compliance requirements, creating a fragmented yet dynamic competitive environment.

RECENT HAPPENINGS IN THE MAREKT

- In April 2023, IFF acquired a biotech startup specializing in microbial fermentation, enhancing its bio-based aroma chemical production capabilities.

- In June 2023, Givaudan launched an AI-powered scent profiling platform, enabling customization of fragrances for niche consumer segments.

- In August 2023, Firmenich partnered with Canadian agricultural suppliers to source sustainably grown raw materials for natural aroma chemicals.

- In October 2023, Symrise invested $50 million in expanding its Texas manufacturing facility to meet rising demand for synthetic musks.

- In December 2023, Takasago introduced a new line of eco-friendly terpenes, targeting the growing cannabis-derived products market in North America.

MARKET SEGMENTATION

This research report on the North America aroma chemicals market has been segmented and sub-segmented based on source, chemicals, application, and region.

By Source

- Synthetic Aroma Chemicals

- Natural Aroma Chemicals

By Chemicals

- Musk Chemicals

- Terpenes & Terpenoids

By Application

- Fragrance

- Flavors

By Region

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. How is the North America aroma chemicals market expected to grow?

The market is projected to grow steadily due to increasing demand in personal care, cosmetics, household products, and food & beverage industries, alongside rising consumer preference for scented and natural products.

2. Who are the leading players in the North America aroma chemicals market?

Key market players include Givaudan, International Flavors & Fragrances Inc. (IFF), Symrise AG, BASF SE, and Firmenich SA.

3. Which factors are driving the growth of the aroma chemicals market in North America?

Growth is driven by increasing demand for personal care and home care products, rising consumer preference for natural and customized scents, and advancements in synthetic fragrance technologies.

4. What are aroma chemicals, and how are they classified?

Aroma chemicals are synthetic or natural compounds that provide fragrances and flavors. They are typically classified into terpenes, benzenoids, musk chemicals, and aliphatic compounds.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com