North America ATV and UTV Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Type Application, Fuel, And By Region (The USA, Canada, Mexico And Rest of North America), Industry Analysis, From (2025 to 2033)

North America ATV and UTV Market Size

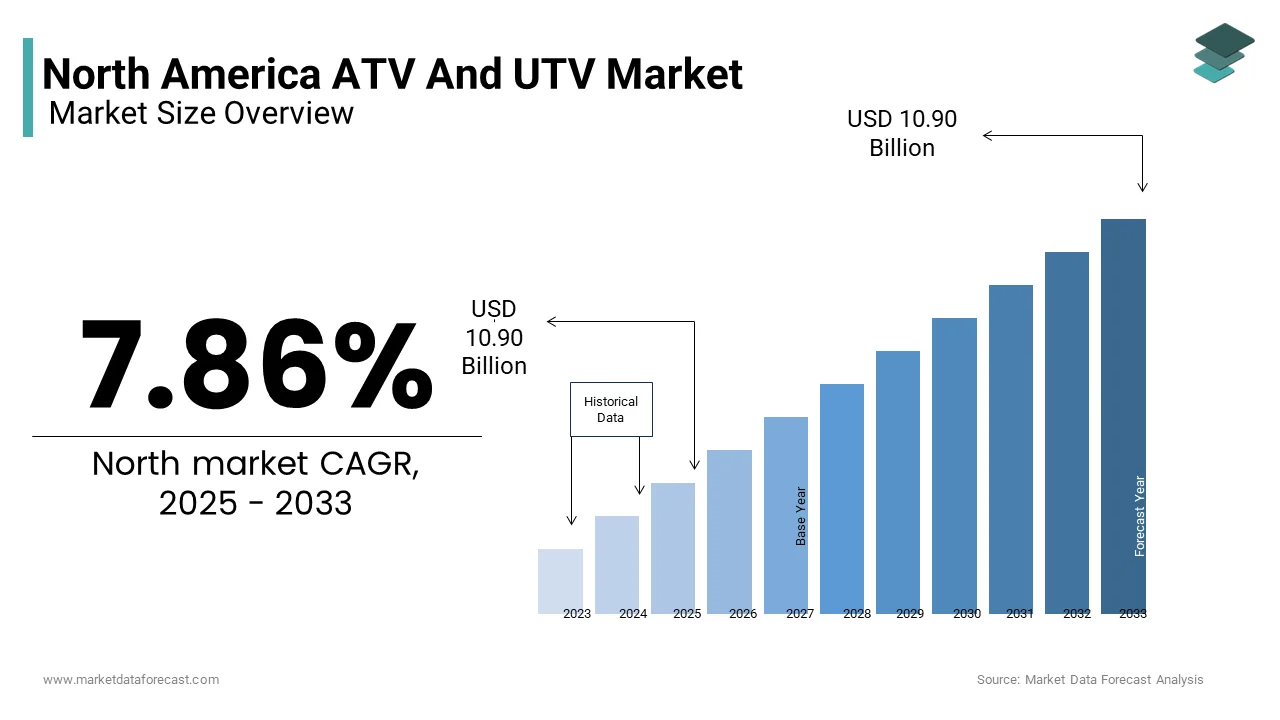

The North America ATV and UTV market size was valued at USD 10.11 billion in 2024 and is anticipated to reach USD 10.90 billion in 2025 from USD 19.98 billion by 2033, growing at a CAGR of 7.86% during the forecast period from 2025 to 2033.

MARKET DRIVERS

Rising Demand for Utility Applications

The increasing use of ATVs and UTVs in utility applications is a key driver of the North American market. These vehicles are indispensable in agriculture, construction, and land management due to their ability to navigate rugged terrains and carry heavy loads. Like, a significant portion of US farmers in rural areas rely on ATVs and UTVs for tasks such as crop monitoring and equipment transportation. Additionally, the construction sector has seen a surge in demand. Another factor is the growing popularity of side-by-side UTVs, which offer enhanced seating capacity and storage options.

Expansion of Recreational Activities

The expansion of recreational activities, particularly off-road adventures, significantly contributes to the growth of the ATV and UTV market. Similarly, a large portion American participated in off-road recreational activities in the past few years, creating a strong demand for ATVs and UTVs. These vehicles are favored for their durability and performance in challenging terrains, making them ideal for hunting, trail riding, and camping. Also, outdoor recreation majorly contributes annually to the U.S. economy, with ATVs and UTVs playing a vital role in this ecosystem. Furthermore, manufacturers have capitalized on this trend by introducing customizable models tailored for recreational use.

MARKET RESTRAINTS

Stringent Safety Regulations

Stringent safety regulations pose a significant restraint to the North American ATV and UTV market. The Consumer Product Safety Commission (CPSC) mandates strict compliance with safety standards, including roll-over protection systems (ROPS) and speed limiters, to reduce accident risks. These regulations increase production costs, as manufacturers must invest in advanced safety technologies. Also, compliance costs account for a notable share of the total manufacturing expenses for ATVs and UTVs. Additionally, public awareness campaigns highlighting safety risks have led to increased scrutiny, deterring potential buyers.

Environmental Concerns and Emissions Standards

Environmental concerns and stringent emissions standards present another major restraint for the market. Traditional gas-powered ATVs and UTVs contribute to carbon emissions, drawing criticism from environmental groups and regulators. Also, off-road vehicles account for 5% of total transportation-related emissions in North America. This issue is compounded by regulations like California’s Advanced Clean Off-Road Regulation, which mandates a shift toward zero-emission vehicles by 2035. Compliance with these standards requires significant investments in electric powertrain technologies, which many companies find financially burdensome. Like, only a small number of ATVs and UTVs sold in the past few years were equipped with hybrid or electric engines, indicating slow adoption. These environmental pressures create obstacles for manufacturers, limiting the market’s expansion potential.

MARKET OPPORTUNITIES

Adoption of Electric and Hybrid Models

The adoption of electric and hybrid ATVs and UTVs presents a transformative opportunity for the North American market. With growing emphasis on sustainability, manufacturers are investing in eco-friendly alternatives to traditional gas-powered vehicles. Companies like Polaris and Can-Am have already introduced electric models, such as the Polaris Ranger EV, which offers zero emissions and reduced operating costs. Additionally, government incentives for electric vehicles further drive adoption. These advancements position electric and hybrid models as a key growth avenue in the market.

Growth in Rental and Tourism Services

The growing popularity of ATV and UTV rental services in the tourism sector offers significant opportunities for market expansion. Adventure tourism, particularly in regions like Colorado and Alaska, relies heavily on these vehicles for guided tours and recreational activities. Additionally, rental companies are capitalizing on this trend by offering customizable packages for tourists. These developments underscore the expanding role of ATVs and UTVs in supporting tourism and rental businesses, positioning them as a promising growth segment.

MARKET CHALLENGES

High Initial Costs and Maintenance Expenses

One of the primary challenges impacting the North American ATV and UTV market is the high initial cost and ongoing maintenance expenses associated with these vehicles. These costs are often prohibitive for recreational users and small-scale operators. Additionally, maintenance expenses, including parts replacement and servicing, can be expensive annually. A significant portion of potential buyers cite affordability as a barrier to purchasing ATVs and UTVs. These financial constraints not only deter first-time buyers but also limit market penetration, particularly in price-sensitive demographics.

Limited Charging Infrastructure for Electric Models

Limited charging infrastructure for electric ATVs and UTVs poses another critical challenge for the market. While the adoption of electric models is gaining traction, the lack of widespread charging stations in rural and off-road areas restricts their usability. Like, only a limited number of rural regions have access to reliable charging infrastructure, hindering the practicality of electric vehicles for utility and recreational purposes. This limitation is exacerbated by the long charging times required for current battery technologies, which can take up several hours for a full charge.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.86% |

|

Segments Covered |

By Vehicle, Application, Fuel, and Country |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country's Covered |

The United States, Canada, and the Rest of North America |

|

Market Leaders Profiled |

American Honda Motor Co. Inc., Yamaha Motor Co. Ltd, Arctic Cat Inc, Kwang Yang Motor Co. Ltd, Polaris Industries Inc, BRP Inc, Suzuki Motor of America Inc, Kawasaki Heavy Industries Ltd, DRR USA Inc, Daymak Inc, Kubota Corporation, Deere and Company. |

SEGMENTAL ANALYSIS

By Vehicle Type Insights

The UTV segment dominated the North American ATV and UTV market by holding 65.1% of the total share in 2024. This dominance is driven by the versatility of UTVs, which are widely used in both utility and recreational applications. One key factor is their ability to accommodate multiple passengers, making them ideal for family outings and group adventures. Another contributing factor is their utility in agricultural and construction sectors. A significant portion of construction site managers use UTVs for material transport and site inspections, underscoring their practicality. Additionally, advancements in customization options, such as enhanced seating and storage, have further strengthened UTVs' leadership position in the market.

The Sport ATV segment is projected to grow at the highest CAGR of 9.5%. This rapid growth is fueled by its appeal among recreational enthusiasts seeking high-performance vehicles for racing and trail riding. One significant driver is the increasing participation in off-road racing events. Another factor is the growing trend of customization among younger consumers. These developments position Sport ATVs as a rapidly expanding segment within the market.

By Application Insights

The sports application segment led the North American ATV and UTV market by accounting for 50.3% of the total revenue in 2024. This control over the market is attributed to the widespread popularity of recreational activities like trail riding, hunting, and off-road racing. One key factor is the growing interest in outdoor adventures, particularly among urban dwellers. Another driver is the introduction of advanced features tailored for performance. Yamaha Motors reports that its YFZ450R sport ATV model saw an increase in sales in 2023, thanks to its lightweight frame and superior handling. Additionally, the rise of guided ATV tours in tourist destinations has further expanded the segment's reach, reinforcing its leadership position.

The agriculture application segment is poised to be the fastest-growing, with a projected CAGR of 10.2% from 2025 to 2033. This growth is driven by the increasing adoption of ATVs and UTVs for farm operations such as crop monitoring, equipment transportation, and livestock management. One significant factor is the rising demand for mechanized solutions in rural areas. Another driver is the expansion of precision agriculture technologies. These trends position agriculture as a key growth driver in the ATV and UTV market.

By Fuel Type Insights

The gasoline-powered segment prevailed in the North American ATV and UTV market by capturing a substantial portion of the total market share in 2024. This influence is driven by the widespread availability of gasoline infrastructure and the higher power output of gas engines, making them suitable for heavy-duty applications. One key factor is their affordability compared to electric alternatives. Generally, gasoline-powered ATVs and UTVs are priced lower than their electric counterparts, making them more accessible to rural users. Another contributing factor is their proven reliability in rugged terrains.

The electric-powered segment is predicted to advance at the highest CAGR of 12.8% from 2025 to 2033. This sudden rise is associated by the increasing emphasis on sustainability and government incentives for clean energy technologies. One significant driver is the rising demand for eco-friendly vehicles in urban and suburban areas. Another factor is the declining cost of battery technologies. Plus, the price of lithium-ion batteries dropped in the recent years, making electric ATVs and UTVs more affordable. These advancements position electric-powered vehicles as a transformative force in the market.

COUNTRY LEVEL ANALYSIS

The United States was at the forefront of the North American ATV and UTV market by contributing a 80.3% of the region’s total revenue in 2024. The country’s dominance stems from its robust recreational culture and extensive agricultural base. One key factor is the popularity of off-road tourism, particularly in states like Colorado and Alaska. Another driver is the widespread adoption of UTVs in agriculture. Like, a notable share of Midwestern farms rely on these vehicles for daily operations, ensuring steady demand. Additionally, investments in electric models and advanced safety features have positioned U.S.-based manufacturers as global leaders. These elements show the country’s pivotal role in shaping the regional market.

Canada is moving ahead in the North American ATV and UTV market. The country’s market growth is driven by its focus on outdoor recreation and natural resource management. One significant factor is the use of ATVs and UTVs in forestry and mining operations. Also, a significant share of logging companies utilize these vehicles for site preparation and residue removal, ensuring efficient operations. Another driver is the government’s commitment to reducing carbon emissions. Similarly, electric ATVs reduced emissions in the recent years. Additionally, Canada’s vast rural areas have increased demand for ATVs in hunting and snowmobiling, supported by provincial funding programs. These initiatives position Canada as a key contributor to the market.

The Rest of North America, comprising Mexico and other regions, represents a nascent yet promising segment. The segment’s growth is fueled by the increasing adoption of ATVs and UTVs in infrastructure development and disaster management. One key factor is Mexico’s investment in rural tourism projects, where ATVs are used for guided tours and adventure activities. Another driver is the region’s vulnerability to natural disasters, prompting the use of ATVs for emergency response.

KEY MARKET PLAYERS

American Honda Motor Co. Inc., Yamaha Motor Co. Ltd, Arctic Cat Inc, Kwang Yang Motor Co. Ltd, Polaris Industries Inc, BRP Inc, Suzuki Motor of America Inc, Kawasaki Heavy Industries Ltd, DRR USA Inc, Daymak Inc, Kubota Corporation, Deere and Company. are the market players that are dominating the north America ATV and UTV market.

Top Players in the Market

Polaris Inc.

Polaris Inc. is a leading innovator in the North American ATV and UTV market, renowned for its versatile product lineup catering to both recreational and utility users. The company’s RANGER and Sportsman series are widely adopted for their durability and advanced features. Additionally, the company partnered with outdoor tourism operators to promote guided ATV tours, enhancing brand visibility.

Yamaha Motor Corporation

Yamaha Motor Corporation is a key player in the ATV and UTV market, offering high-performance vehicles like the Grizzly ATV and Wolverine UTV series. Known for their rugged designs, Yamaha vehicles are favored by hunters and off-road enthusiasts. The company also invested in training programs for dealerships to ensure superior customer service. Furthermore, Yamaha expanded its manufacturing facilities in Georgia to meet rising demand, reinforcing its commitment to the North American market.

Can-Am (BRP Inc.)

Can-Am, a division of BRP Inc., specializes in innovative ATV and UTV models tailored for sports and utility applications. Its Defender and Maverick series have gained popularity for their versatility and performance. The company also collaborated with agricultural associations to promote UTVs for farming use, broadening its application base.

Top Strategies Used by Key Market Participants

Key players in the North American ATV and UTV market employ strategies such as product innovation, sustainability initiatives, and partnerships to strengthen their positions. Companies like Polaris and Yamaha focus on developing electric and hybrid models to align with environmental regulations and consumer preferences. Strategic alliances with tourism operators and agricultural organizations help expand their reach across diverse sectors. Can-Am emphasizes customization, offering tailored solutions for sports and utility applications. Another common strategy is investing in dealer training programs to enhance customer satisfaction. These approaches collectively drive growth and competitiveness in the ATV and UTV market.

COMPETITION OVERVIEW

The North American ATV and UTV market is highly competitive, driven by innovation, regulatory compliance, and diverse applications across industries. Leading players like Polaris, Yamaha, and Can-Am dominate the landscape, each targeting specific niches such as recreational sports, agriculture, and utility tasks. The competitive environment is further intensified by the entry of new startups and the adoption of disruptive technologies like electric powertrains and GPS navigation systems. Regulatory frameworks also play a pivotal role, with companies striving to comply with emissions standards while innovating within constraints. Collaborations with research institutions and government bodies provide a competitive edge, fostering innovation. Additionally, price differentiation and feature customization are common tactics to capture market share. This dynamic ecosystem ensures continuous evolution, making the North American ATV and UTV market a hub for technological breakthroughs and strategic maneuvers.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Polaris Inc. launched its Ranger EV model, introducing an electric-powered UTV to align with sustainability trends and attract eco-conscious consumers.

- In June 2023, Yamaha Motor Corporation expanded its Georgia-based manufacturing facility to increase production capacity for its Grizzly ATV series, meeting rising demand from rural users.

- In August 2023, Can-Am unveiled its hybrid-powered UTV prototype at an industry expo, showcasing its commitment to developing eco-friendly alternatives for utility applications.

- In October 2023, Polaris partnered with outdoor tourism operators to promote guided ATV tours, enhancing brand visibility and tapping into the growing adventure tourism sector.

- In December 2023, Yamaha introduced GPS-enabled navigation systems in its Wolverine UTV series, improving user experience and solidifying its reputation for technological innovation.

MARKET SEGMENTATION

This research report on the North America ATV and UTV market is segmented and sub-segmented into the following categories.

By Vehicle Type

- Sport ATVs

- Utility Terrain Vehicle (UTVs)

By Application

- Sports

- Agriculture

- Other Applications

By Fuel Type

- Gasoline Powered

- Electric Powered

By Country

- The United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

What are ATVs and UTVs, and how are they used in North America?

ATVs are single-rider, off-road vehicles designed for recreation and light-duty tasks, while UTVs are larger, multi-passenger vehicles built for hauling, farming, construction, and outdoor sports across rugged terrains.

What factors are driving growth in the North America ATV and UTV market?

Growth is fueled by expanding recreational off-road activities, increased use in agriculture and forestry, rising rural development, and the introduction of electric and hybrid off-road models.

What technological innovations are shaping the future of ATVs and UTVs?

Innovations include electric and hybrid powertrains, smart navigation systems, enhanced suspension for rough terrains, and integration of GPS and telematics for fleet management and recreational tracking.

What are the main challenges facing the ATV and UTV market in North America?

Key challenges include environmental regulations on emissions, concerns about off-road vehicle accidents, high ownership costs, and the need for better charging infrastructure for electric models.

Which North American regions are seeing the highest ATV and UTV adoption?

The United States, particularly states like Texas, California, and Utah, leads the market, while Canada is seeing rising usage in rural provinces for farming, hunting, and recreational tourism activities.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com