North America Automotive Camera Market Size, Share, Trends & Growth Forecast Report By Type (Drive Cameras, Sensing Cameras), Application Type, And Country (US, Canada, And Rest Of North America), Industry Analysis From 2025 To 2033

North America Automotive Camera Market Size

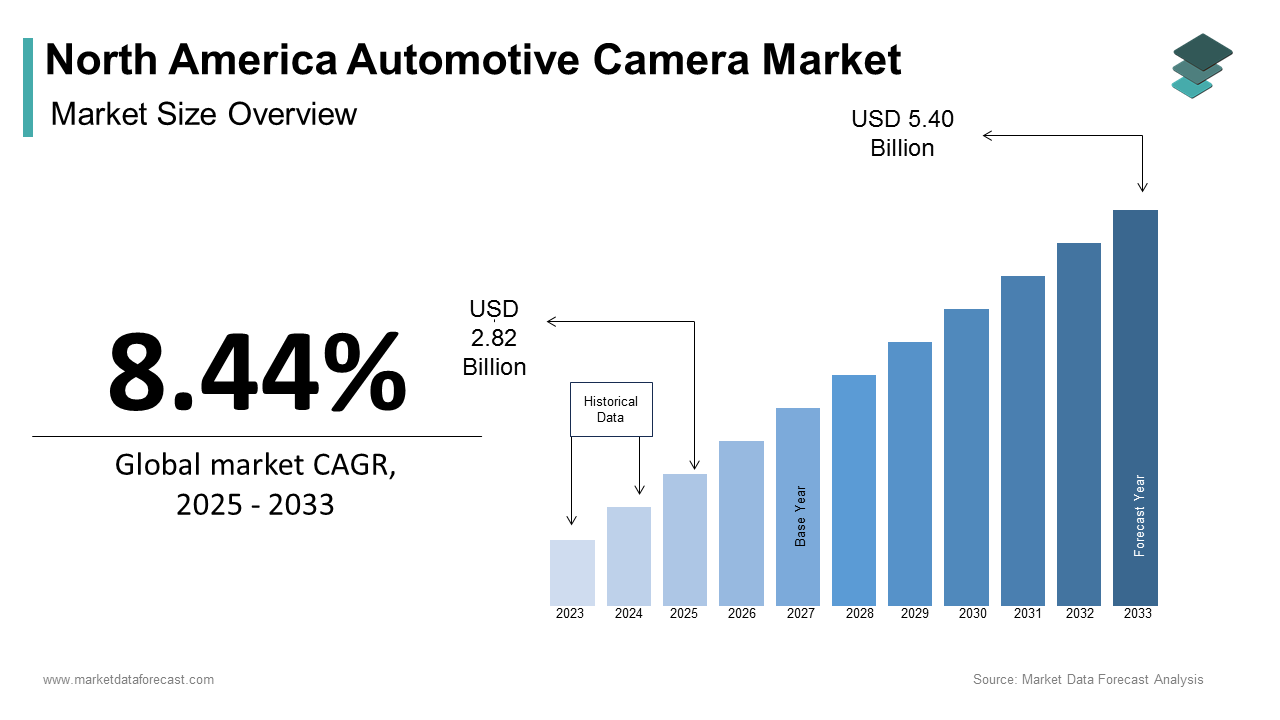

The size of the North America Automotive Camera Market was calculated to be USD 2.60 billion in 2024 and is anticipated to be worth USD 5.40 billion by 2033, from USD 2.82 billion in 2025, growing at a CAGR of 8.44% during the forecast period.

Automotive cameras—ranging from rearview, surround-view, and interior monitoring systems—are instrumental in enhancing road safety, enabling real-time navigation, and supporting semi-autonomous functionalities.

MARKET DRIVERS

Expansion of ADAS Adoption in Passenger Vehicles

The widespread integration of Advanced Driver Assistance Systems (ADAS) in passenger vehicles is one of the main drivers fueling the growth of the automotive camera market in North America. ADAS relies heavily on camera-based sensing technologies to enable features such as lane-keeping assistance, blind-spot detection, automatic emergency braking, and adaptive cruise control.

Also, rearview and surround-view cameras have become standard equipment across most vehicle classes. As per the U.S. Department of Transportation, the mandatory inclusion of rearview cameras in all new light vehicles under 10,000 pounds has been in effect since May 2018, contributing significantly to the proliferation of camera-based safety systems.

Furthermore, the Insurance Institute for Highway Safety (IIHS) found that side-view cameras can reduce lane-change crashes, prompting automakers to include them even beyond regulatory requirements. With major OEMs like Ford, General Motors, and Tesla integrating multi-camera setups in their latest models, including electric vehicles, the North American market continues to experience sustained momentum in camera deployment, driven by both regulatory pressure and technological advancement.

Rise in Electric and Autonomous Vehicle Production

The surge in electric vehicle (EV) production and the development of autonomous driving platforms are key contributors to the growth of the automotive camera market in North America. EV manufacturers, particularly those based in the U.S., have increasingly embedded multiple high-definition cameras into vehicle architectures to support autonomous functions and improve driver situational awareness.

Tesla, a leading player in the EV space, utilizes an eight-camera system in its Full Self-Driving (FSD) hardware suite, underscoring the integral role of cameras in autonomous navigation. Similarly, traditional automakers such as General Motors and Rivian have announced plans to integrate enhanced camera-based perception systems into their upcoming EV lineups. The Society of Automotive Engineers (SAE) notes that Level 2+ and Level 3 autonomous vehicles rely extensively on visual data captured through cameras, often complemented by radar and lidar inputs.

Additionally, Waymo, operating extensively in Arizona and California, uses high-resolution front-facing cameras in its self-driving taxis to detect pedestrians, traffic signs, and lane markings in real time.

MARKET RESTRAINTS

Supply Chain Disruptions Affecting Component Availability

The ongoing volatility in global supply chains, particularly concerning semiconductor and sensor components essential for camera modules, is a significant restraint impeding the growth of the North American automotive camera market. The automotive industry has faced persistent shortages of microchips and image sensors since 2020, primarily due to geopolitical tensions, logistical bottlenecks, and manufacturing disruptions stemming from the pandemic.

According to the Center for Automotive Research (CAR), approximately 1.3 million fewer vehicles were produced in North America in 2022 compared to pre-pandemic projections, largely due to component unavailability.

Camera modules used in automotive applications require specialized CMOS image sensors (CIS), many of which are sourced from East Asian suppliers such as Sony, OmniVision, and Samsung. Delays in CIS shipments have led to production halts and reduced output at major OEM plants across Michigan, Ontario, and Tennessee.

For instance, Ford temporarily idled several assembly lines in early 2023 due to a shortage of camera-related components, directly affecting the availability of vehicles equipped with advanced visibility systems.

Moreover, trade restrictions imposed under the U.S.-China technology conflict have further complicated sourcing strategies, forcing companies to seek alternative but less mature supply channels.

Regulatory Complexity and Compliance Costs

Another notable challenge facing the North American automotive camera market is the complex regulatory landscape governing vehicle safety standards and electronic system certifications. Both the United States and Canada enforce stringent compliance protocols through agencies such as the National Highway Traffic Safety Administration (NHTSA) and Transport Canada. While these regulations ensure consumer safety and product reliability, they also impose substantial costs and delays on manufacturers seeking to introduce new camera-based systems into the market.

For example, NHTSA’s Federal Motor Vehicle Safety Standard (FMVSS) No. 111 mandates specific performance criteria for rearview visibility systems, requiring extensive testing and validation before approval. According to a report published by McKinsey & Company, compliance-related expenditures account for nearly 7% of total R&D budgets for Tier 1 automotive suppliers developing camera modules. This burden is especially pronounced for smaller firms and startups attempting to enter the market with innovative imaging solutions, such as thermal or ultra-wide-angle cameras.

Additionally, evolving cybersecurity and data privacy laws, including the California Consumer Privacy Act (CCPA) and proposed federal legislation on vehicle data governance, add another layer of complexity. Cameras capturing real-time footage may inadvertently collect personal data, necessitating additional safeguards and legal scrutiny. The International Organization for Standardization (ISO) has also introduced functional safety standards like ISO 26262, which require rigorous software validation for any camera-integrated system.

MARKET OPPORTUNITIES

Integration of AI-Powered Vision Systems in Commercial Fleets

Increasing adoption of AI-powered vision systems in commercial fleets, including delivery vans, logistics trucks, and public transit buses, is a key opportunity emerging within the NortAmericanca automotive camera market. Fleet operators are prioritizing safety, efficiency, and cost reduction, leading to a growing demand for intelligent camera solutions capable of detecting obstacles, monitoring driver behavior, and preventing accidents.

Companies such as Amazon, UPS, and FedEx have begun equipping their delivery vehicles with multi-camera setups integrated with artificial intelligence algorithms that analyze real-time visuals to identify potential hazards.

Moreover, municipal transit authorities in cities like Toronto and Los Angeles are deploying smart camera systems in public buses to monitor passenger activity and prevent vandalism. With rising concerns over road safety and liability management, the integration of intelligent camera systems into commercial transport presents a lucrative growth avenue for market players in North America.

Growth of Smart Parking Solutions in Urban Infrastructure

An emerging opportunity for the North American automotive camera market lies in the expansion of smart parking solutions integrated with vehicular camera systems. As urban centers grapple with congestion and limited parking availability, municipalities,s and private developers are investing in intelligent parking infrastructure that leverages real-time camera feeds from vehicles to optimize space utilization and reduce search times.

According to a report by the International Parking Institute, urban drivers in North America spend an average of 17 hours per month searching for parking spaces, contributing significantly to traffic congestion and emissions.

Automotive camera technology is playing a pivotal role in addressing this issue through vehicle-to-infrastructure (V2I) communication networks. Companies such as Bosch and Valeo are collaborating with city planners to develop camera-based systems that transmit occupancy data from vehicles to centralized parking management platforms.

Furthermore, automakers are embedding smart parking features into new vehicle models, allowing drivers to access real-time guidance based on camera inputs from both the vehicle and surrounding infrastructure. Cadillac and BMW have already introduced models with automated valet parking capabilities that rely on external camera feeds to navigate tight spaces without human intervention.

MARKET CHALLENGES

Data Security and Privacy Concerns Surrounding Onboard Cameras

A growing challenge confronting the North American automotive camera market is the increasing scrutiny around data security and privacy associated with onboard camera systems. As vehicles become more connected and equipped with multiple high-resolution cameras, concerns about unauthorized data collection, storage, and transmission have intensified. Consumers and regulators alike are demanding greater transparency regarding how vehicle-generated visual data is managed, particularly when it comes to driver and pedestrian privacy.

Also, the California Consumer Privacy Act (CCPA), for example, grants consumers the right to know what personal data is being collected and whether it is shared with third parties, including automakers and software providers.

Moreover, cybersecurity experts warn that automotive camera systems, if not properly encrypted and secured, could be exploited by hackers to gain unauthorized access to vehicle networks. As the regulatory environment evolves, automakers must invest heavily in secure data handling mechanisms, which could slow down the pace of innovation and increase development costs. Without clear industry-wide standards, privacy concerns will remain a formidable obstacle to widespread camera adoption in North America.a

High Calibration and Maintenance Requirements for Multi-Camera Systems

A significant technical and economic challenge facing the North American automotive camera market is the complexity involved in calibrating and maintaining multi-camera systems, especially in vehicles equipped with advanced autonomous features. Unlike traditional standalone cameras, modern vehicles utilize interconnected camera arrays that require precise alignment and synchronization to function effectively.

Like, misaligned or improperly calibrated cameras can lead to erroneous object detection, increasing the risk of collisions and compromising driver confidence.

The calibration process for automotive cameras is both labor-intensive and costly. Independent repair shops and dealerships must invest in specialized tools and training to recalibrate cameras after windshield replacements, body repairs, or software updates.

Additionally, environmental factors such as extreme temperatures, dust accumulation, and vibration can degrade camera performance over time, necessitating frequent inspections and cleaning. Automakers like Toyota and Volkswagen have acknowledged that maintenance challenges related to camera systems are among the top reasons for customer dissatisfaction with ADAS-equipped vehicles. As multi-camera configurations become more prevalent, ensuring reliable and cost-effective maintenance remains a critical hurdle for sustaining market growth in North America.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.44% |

|

Segments Covered |

By Type, Application Type, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Us, Canada, and the Rest of North America |

|

Market Leaders Profiled |

Robert Bosch GmbH, Continental AG, Panasonic Corporation, Garmin Ltd., Magna International Inc., ZF Friedrichshafen AG, Hella KGaA Hueck & Co., Valeo SA, Gentex Corporation, Delphi Automotive PLC, Denso Corporation, Aptiv PLC, Mobileye, OmniVision Technologies Inc. |

SEGMENTAL ANALYSIS

By Type Insights

The drive camera segment held the largest share of the North American automotive camera market, accounting for 58.2% of total revenue in 2024. This dominance is primarily attributed to the widespread integration of rearview and forward-facing cameras in vehicles to meet regulatory mandates and enhance driver visibility.

Moreover, consumer demand for enhanced safety features such as blind-spot monitoring and lane departure warnings has further fueled the deployment of drive cameras across both luxury and economy vehicle segments. Moreover, major automakers including Ford, General Motors, and Tesla have increasingly embedded multi-camera setups into their vehicle architectures to support semi-autonomous driving functions.

The sensing camera segment is projected to register the highest compound annual growth rate (CAGR) of 13.7% in the coming years. Also, these cameras are integral components of advanced driver-assistance systems (ADAS) and autonomous driving technologies, capturing high-resolution visual data for real-time object detection, classification, and environmental mapping.

One of the primary factors propelling this rapid growth is the increasing deployment of Level 2+ and Level 3 autonomous vehicles in North America. Companies such as Waymo, Cruise, and Aurora are leveraging high-performance sensing cameras to enable features like lane-keeping assist, adaptive cruise control, and automated parking.

Additionally, government incentives promoting road safety and emissions reduction are accelerating the uptake of sensing-enabled ADAS solutions. With evolving software algorithms improving image processing accuracy, sensing cameras are poised to outpace other segments in terms of technological adoption and market expansion.

By Application Type Insights

Advanced Driver-Assistance Systems (ADAS) constitute the strongest application segment within the North American automotive camera market, representing 65.1% of total market value in 2024. This overwhelming dominance stems from the growing reliance on camera-based perception systems to power functionalities such as lane departure warning, automatic emergency braking, and adaptive cruise control.

One of the key drivers of ADAS adoption is the increasing regulatory pressure to enhance road safety. The National Highway Traffic Safety Administration (NHTSA) has mandated that all new vehicles include forward collision warning and lane departure alert systems, many of which depend on front-facing and side-mounted cameras.

Moreover, consumer awareness regarding vehicle safety has surged in recent years. Automakers such as General Motors, Toyota, and Hyundai have responded by offering ADAS packages with integrated camera modules as standard or optional equipment across multiple vehicle classes.

Among application types, the parking segment is experiencing the highest growth rate, recording a CAGR of 14.3%. This rapid expansion is driven by the rising integration of surround-view and rearview camera systems designed to enhance maneuverability and reduce parking-related incidents.

A key catalyst for this growth is the increasing complexity of urban environments, particularly in densely populated cities like New York, Toronto, and Los Angeles, where parallel parking and tight spaces pose significant challenges.

Automakers have responded by embedding 360-degree camera systems in mid-range and premium models, allowing drivers to view obstacles in real-time through digital dashboards. Tesla, BMW, and Cadillac have introduced fully automated parking features that rely heavily on camera inputs to detect curbs, pedestrians, and adjacent vehicles.

Furthermore, municipal governments are supporting smart parking initiatives that integrate vehicle cameras with infrastructure sensors to optimize space utilization.

REGIONAL ANALYSIS

The United States dominated the North American automotive camera market, commanding 80% of the regional market share in 2024. This lead position is underpinned by robust automotive manufacturing, high penetration of connected and electric vehicles, and stringent federal regulations mandating camera-based safety systems.

Beyond regulatory enforcement, the U.S. is home to leading automakers and technology firms actively developing advanced camera-based ADAS and autonomous driving solutions. Companies such as Tesla, General Motors, and Waymo have deployed sophisticated camera arrays in their latest models, further boosting market growth. Moreover, the rise of ride-hailing and delivery fleets has led to increased adoption of AI-enhanced surveillance systems.

The Canadian market is characterized by consistent growth driven by increasing vehicle electrification and government-backed road safety initiatives.

A key growth driver is the Canadian government’s push toward safer and smarter transportation infrastructure. Transport Canada has aligned its vehicle safety standards with those of the U.S., mandating rearview cameras in all new passenger vehicles.

Furthermore, urbanization and the expansion of smart city projects in provinces like Ontario and British Columbia are fostering demand for intelligent parking and traffic monitoring solutions. The City of Toronto’s Intelligent Transportation Systems (ITS) program incorporates vehicle-to-infrastructure (V2I) communication, where onboard cameras transmit real-time data to centralized traffic management platforms.

The remaining North American region, which includes Mexico and select Caribbean territories, accounts for a notable share of the regional automotive camera market. Although relatively small compared to the U.S. and Canada, this segment exhibits emerging potential due to gradual improvements in automotive manufacturing and infrastructure development.

Mexico plays a pivotal role in this sub-region as a major automotive production hub. However, domestic penetration of automotive cameras remains lower due to economic constraints and less stringent regulatory enforcement.

Despite these limitations, foreign automakers such as Volkswagen, Nissan, and Ford have begun equipping locally assembled models with basic camera systems to align with global export requirements.

In the Caribbean, countries like Puerto Rico and the Bahamas are exploring the use of automotive cameras in tourism-driven transport fleets. However, limited vehicle ownership and infrastructure investment constrain broader market growth.

LEADING PLAYERS IN THE NORTH AMERICA AUTOMOTIVE CAMERA MARKET

Magna International Inc.

Magna International is a leading global automotive supplier with a strong foothold in the North American automotive camera market. The company offers advanced vision-based driver assistance systems, including rearview, surround-view, and forward-facing cameras integrated into ADAS platforms. With extensive R&D capabilities and partnerships with major automakers, Magna plays a pivotal role in shaping next-generation vehicle safety technologies. Its expertise in system integration enables seamless incorporation of camera modules with autonomous driving functions, contributing significantly to both regional and global market advancements.

Robert Bosch GmbH (Bosch)

Bosch is a key player in the automotive electronics sector, offering high-performance automotive camera solutions tailored for North American OEMs. The company specializes in developing monocular and stereo-vision cameras that support lane-keeping, traffic sign recognition, and automated parking features. Bosch's commitment to innovation and functional safety has made its camera systems a preferred choice among automakers aiming to meet evolving regulatory and consumer demands. Its presence in North America is reinforced by localized production and technical collaboration with major vehicle manufacturers.

Continental AG

Continental AG is a major contributor to the North American automotive camera market through its comprehensive range of camera-based sensing and monitoring solutions. The company develops intelligent camera systems designed for real-time object detection, driver assistance, and autonomous applications. By integrating software-driven image processing capabilities, Continental enhances the reliability and performance of automotive vision systems. In North America, it collaborates closely with tier-one suppliers and original equipment manufacturers to advance mobility solutions, positioning itself as a critical player in the region’s automotive technology ecosystem.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One of the primary strategies employed by key players in the North American automotive camera market is deepening partnerships with automakers and tech firms. Companies are forging long-term collaborations with OEMs and software developers to integrate camera systems into next-generation vehicles, particularly those equipped with Level 2+ autonomous features. These alliances allow for the co-development of customized solutions that align with evolving vehicle architectures and consumer expectations.

Another crucial approach is investing heavily in research and development. Market leaders are focusing on enhancing camera resolution, improving night vision capabilities, and incorporating artificial intelligence to refine object detection accuracy. By strengthening their R&D pipelines, companies aim to stay ahead of technological shifts and regulatory changes while addressing emerging challenges such as data privacy and cybersecurity.

Lastly, expanding manufacturing and service capabilities within North America is a key growth strategy. Major players are establishing localized production units and service centers to reduce lead times, ensure compliance with regional standards, and provide efficient post-installation calibration and maintenance services. This localized presence also supports faster deployment of new technologies across the supply chain.

KEY MARKET PLAYERS AND COMPETITIVE OVERVIEW

Major Players in the North American automotive camera market include Robert Bosch GmbH, Continental AG, Panasonic Corporation, Garmin Ltd., Magna International Inc., ZF Friedrichshafen AG, Hella KGaA Hueck & Co., Valeo SA, Gentex Corporation, Delphi Automotive PLC, Denso Corporation, Aptiv PLC, Mobileye, OmniVision Technologies Inc.

The competition in the North American automotive camera market is intensifying as established automotive suppliers and emerging technology firms vie for dominance in an increasingly sophisticated mobility ecosystem. With rising demand for advanced driver-assistance systems and autonomous driving capabilities, market participants are under pressure to innovate rapidly while ensuring compliance with stringent safety and performance standards. Traditional Tier 1 automotive suppliers maintain a strong presence due to their deep-rooted relationships with original equipment manufacturers and their ability to offer integrated vision solutions. However, newer entrants specializing in AI-powered imaging and sensor fusion are gaining traction by delivering cutting-edge perception technologies tailored for next-generation vehicles. Strategic acquisitions have become a common tactic to expand product portfolios and enhance software capabilities. Additionally, companies are investing in localized manufacturing and engineering hubs to accelerate time-to-market and improve after-sales service efficiency. As automakers continue to prioritize camera-based sensing over alternative technologies due to cost-effectiveness and scalability, competition is expected to further consolidate around firms capable of delivering robust, secure, and adaptable camera solutions for evolving transportation needs.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Magna International expanded its partnership with General Motors to co-develop an enhanced surround-view camera system for upcoming electric vehicle models. This initiative aims to improve vehicle autonomy and driver safety, reinforcing Magna’s position as a leading Tier 1 supplier in North America.

- In May 2024, Bosch launched a new software update for its mono-vision camera platform, enabling improved pedestrian detection and dynamic lane guidance. The update was rolled out across multiple OEM fleets in the U.S., enhancing the functionality of existing ADAS-equipped vehicles without requiring hardware modifications.

- In July 2024, Continental AG announced the opening of a dedicated camera system testing facility in Michigan. The center focuses on validating the performance of high-resolution automotive cameras under diverse lighting and weather conditions, supporting faster deployment of reliable vision systems in North American markets.

- In October 2024, Valeo introduced a new line of infrared-enhanced night vision cameras specifically designed for pickup trucks and SUVs popular in North America. This strategic product launch targets the growing demand for enhanced visibility in rural and low-light environments.

- In January 2025, Aptiv acquired a minority stake in a Silicon Valley-based AI vision startup to bolster its camera-processing algorithms. This move strengthens Aptiv’s capabilities in real-time image analysis and reinforces its competitive edge in supplying smart camera solutions for autonomous and semi-autonomous vehicles in North America.

DETAILED SEGMENTATION OF THE NORTH AMERICA AUTOMOTIVE CAMERA MARKET INCLUDED IN THIS REPORT

This research report on the North America Automotive Camera Market has been segmented and sub-segmented based on type, application type, & region.

By Type

- Drive Cameras

- Sensing Cameras

By Application Type

- ADAS Applications

- Parking Applications

By Region

- US

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What are the main drivers of market growth?

Key drivers include growing demand for ADAS (Advanced Driver-Assistance Systems), government safety regulations, and rising consumer preference for high-tech and safer vehicles.

2. Which types of automotive cameras are most in demand?

Rear-view and front-view cameras are currently most in demand, but surround-view and in-cabin monitoring cameras are seeing fast adoption due to autonomous vehicle development.

3. What technologies are commonly used in automotive cameras?

Common technologies include CMOS sensors, night vision, thermal imaging, wide-angle lenses, and AI-based image processing.

4. Who are the key market players in North America?

Robert Bosch GmbH, Continental AG, Panasonic Corporation, Garmin Ltd., Magna International Inc., ZF Friedrichshafen AG, Hella KGaA, Valeo SA, Gentex Corporation, and Aptiv PLC.

5. Which vehicle segment dominates the market?

Passenger vehicles lead the market due to increased integration of camera-based safety systems. However, commercial vehicles are catching up.

6. What role does government regulation play?

Mandatory installation of rear-view cameras in the U.S. (from 2018) and increasing focus on accident reduction through ADAS have boosted market growth.

7. What are the major challenges in the market?

High installation costs, data privacy concerns, and technological complexity are key challenges hindering mass adoption.

8. How does the market outlook appear for the next 5 years?

The market is expected to grow steadily, driven by electrification, autonomous driving trends, and more stringent safety norms.

9. Which countries in North America are leading this market?

The United States holds the largest share due to its advanced automotive industry and strict safety regulations. Canada and Mexico are emerging markets.

10. What is the market size and growth rate?

The market is projected to grow steadily, driven by safety mandates and autonomous driving innovations, with a CAGR of over 10% in upcoming years.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com