North America Automotive Collision Repair Market Size, Share, Trends & Growth Forecast Report By Product (Paint & Coatings, Consumables, Spare parts),Vehicle Type, Service Channel and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Automotive Collision Repair Market Size

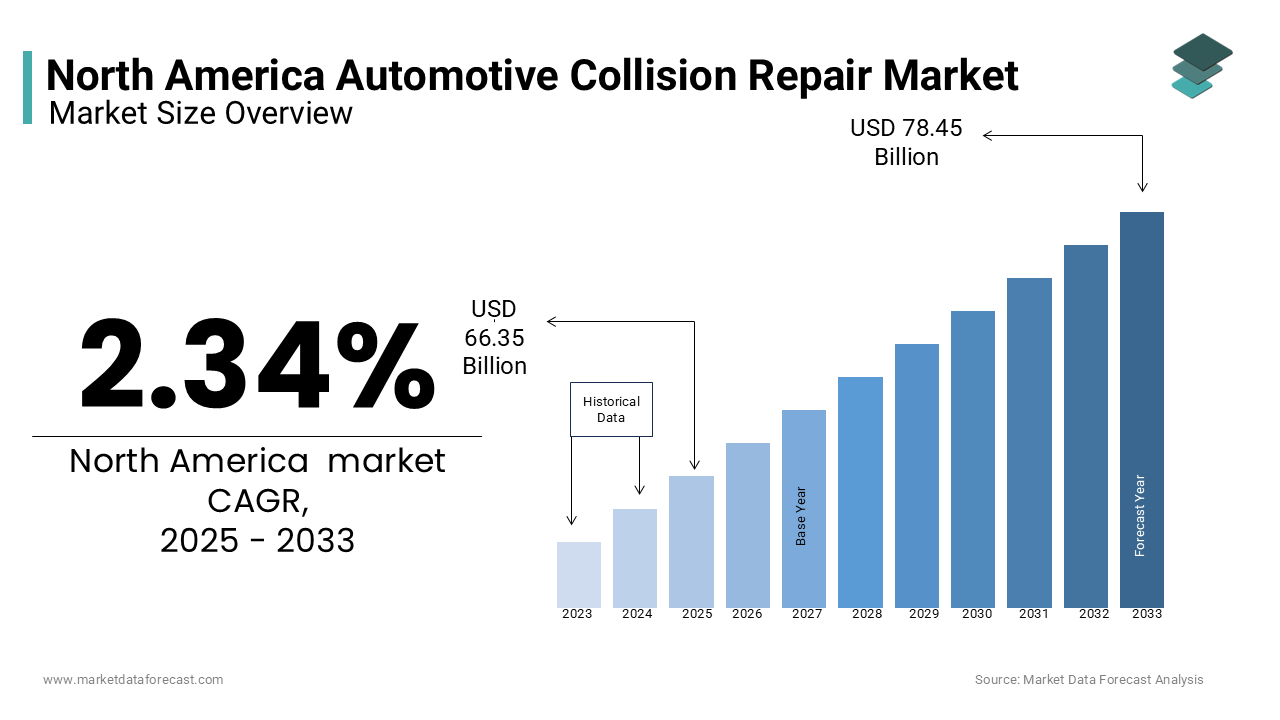

The North America Automotive Collision Repair Market was worth USD 64.97 billion in 2024. The North America market is expected to reach USD 78.45 billion by 2033 from USD 66.35 billion in 2025, rising at a CAGR of 2.34% from 2025 to 2033.

MARKET DRIVERS

Rising Road Accidents

Road accidents are a primary driver of the North America automotive collision repair market. Like, rear-end collisions alone account for a notable share of all crashes, leading to significant repair demand. The economic burden of these accidents exceeds a substantial amount annually, as per the NHTSA, exhibiting the critical role of collision repair services.

Urbanization and increased traffic congestion further exacerbate accident rates. For instance, cities like Los Angeles and New York report a substantial number of annual collisions. This consistent demand ensures steady revenue streams for repair shops, particularly those specializing in high-volume operations. Additionally, the growing complexity of modern vehicles, equipped with advanced driver-assistance systems (ADAS), necessitates specialized repair expertise, driving investments in training and technology.

Growth in Electric Vehicle Adoption

The surge in electric vehicle adoption is reshaping the collision repair landscape. Also, EV sales in North America grew significantly in recent years. These vehicles require unique repair solutions due to their battery systems and lightweight materials, such as aluminum and carbon fiber.

Repairing EVs often involves higher costs, with labor expenses increasing compared to traditional vehicles. This trend creates lucrative opportunities for collision repair businesses that invest in specialized tools and certifications. For example, Tesla-certified repair centers have seen an increase in service requests, reflecting the growing demand for EV-specific repairs.

MARKET RESTRAINTS

High Costs of Advanced Repairs

A primary restraint in the North America automotive collision repair market is the escalating cost of advanced repairs. Also, repairing vehicles equipped with ADAS can notably increase costs, primarily due to the need for recalibration and specialized equipment.

This financial burden disproportionately affects smaller repair shops, which struggle to afford the necessary upgrades. Like, only a small portion of independent repair facilities are fully equipped to handle ADAS-related repairs. Besides, insurance companies are increasingly scrutinizing repair costs, leading to longer approval times and reduced profitability for service providers.

Shortage of Skilled Technicians

A shortage of skilled technicians poses another significant challenge. According to the Bureau of Labor Statistics, the automotive repair industry faces a major workforce deficit, with an enormous number of unfilled positions. This shortage is exacerbated by the rapid adoption of new technologies, which require continuous training and certification. For instance, repairing EVs demands expertise in high-voltage systems, a skill set possessed by a small percentage of technicians. The lack of qualified professionals limits the industry’s capacity to meet growing demand, particularly for complex repairs.

MARKET OPPORTUNITIES

Expansion into Tier-II and Tier-III Cities

The North American automotive collision repair market has significant growth potential in tier-II and tier-III cities. Smaller cities often lack adequate repair infrastructure, creating opportunities for established players to expand their networks. For example, Caliber Collision recently opened a notable number of new centers in suburban areas, reporting an increase in service requests within six months. Additionally, government initiatives to improve road safety, such as the Safe Streets and Roads for All program, provide funding for local repair facilities, further boosting market penetration.

Adoption of Digital Tools and AI

The integration of digital tools and artificial intelligence presents another promising opportunity. AI-powered diagnostic tools can reduce repair times considerably enhancing operational efficiency. These innovations not only improve service quality but also attract tech-savvy consumers, positioning early adopters as industry leaders.

MARKET CHALLENGES

Regulatory Compliance

Navigating regulatory compliance is a significant challenge for the North American automotive collision repair market. According to the Environmental Protection Agency (EPA), repair facilities must adhere to stringent emission standards, particularly for paint booths and solvent usage. Non-compliance can result in hefty fines. Additionally, state-level regulations, such as California’s CARB standards, create inconsistencies across regions.

Competition from Unauthorized Repair Shops

Unauthorized repair shops pose a growing threat to legitimate businesses. Similarly, these unregulated entities account for a notable portion of the market, offering lower prices but compromising on quality and safety. Consumers opting for cheaper alternatives risk substandard repairs, leading to warranty voidance and increased liability for manufacturers. For instance, a significant portion of vehicles repaired at unauthorized shops experienced recurring issues, damaging brand reputation and consumer trust.

SEGMENTAL ANALYSIS

By Product Insights

The segment of paint & coatings dominated the North America automotive collision repair market by holding a 60.5% share in 2024. This dominance is segment is propelled by the frequent need for refinishing after collisions, with a substantial number of vehicles requiring paint jobs annually. Key factors include advancements in eco-friendly formulations, such as water-based paints, which reduce VOC emissions. Plus, these coatings now account for a notable percentage of the market, aligning with regulatory mandates. Apart from these, consumer demand for high-gloss finishes has fueled innovation, with metallic and pearlescent options commanding premium pricing.

The consumables segment is the quickest expanding, with a CAGR of 8.5%. This growth is fueled by the increasing complexity of modern vehicles, which require specialized adhesives, sealants, and abrasives. Like, consumable sales have increased annually, driven by the rise in EV repairs and ADAS recalibrations.

By Vehicle Type Insights

Light-duty vehicles account for a major share of the market in 2024. This dominance is due to their widespread use, with significant numbers of registered vehicles in North America. Key drivers include urbanization and increased traffic congestion, leading to higher accident rates. Similarly, light-duty vehicles are involved in a notable share of all collisions, ensuring consistent demand for repair services. Additionally, the growing adoption of ADAS has created niche opportunities, with specialized repair shops gaining a competitive edge.

The Heavy-duty vehicles segment is emerging at the highest rate the fastest-growing segment, with a CAGR of 9.2%. This progress is attributed to the booming e-commerce sector, with online retail sales considerably rising in recent years. Delivery fleets require durable repairs to withstand harsh conditions, driving demand for corrosion-resistant coatings and reinforced components. Plus, commercial vehicle registrations increased significantly in the past few years, showing the segment’s potential. Investments in logistics infrastructure further support this upward trajectory.

REGIONAL ANALYSIS

The United States was the largest contributor to the North America automotive collision repair market by commanding a 75.1% share in 2024. This dominance is supported by its robust automotive sector, with substantial registered vehicles and annual accidents. Urbanization and traffic congestion exacerbate accident rates, particularly in cities like Los Angeles, New York, and Chicago, where rear-end collisions account for a significant portion of all incidents. The rise in electric vehicle (EV) adoption has introduced new dynamics, with EVs requiring specialized repair techniques and components. This shift has driven demand for high-voltage system repairs and recalibration of advanced driver-assistance systems (ADAS), creating lucrative opportunities for certified repair centers. Additionally, regulatory mandates, such as California’s CARB standards, have pushed repair facilities to adopt eco-friendly practices. Government initiatives, such as the Safe Streets and Roads for All program, provide funding for road safety improvements, indirectly boosting repair demand. Furthermore, partnerships between repair centers and automakers, like Tesla-certified shops, have strengthened the supply chain and ensured consistent quality.

Canada holds a key market share that is supported by its harsh winters and icy roads, which contribute to weather-related accidents. Like, adverse weather conditions make up an eye-catching share of all collisions, ensuring steady demand for collision repair services. Cities like Toronto and Vancouver report a great number of annual accidents, primarily due to snow and ice.

The Canadian government has prioritized road safety through initiatives like Vision Zero, aiming to eliminate traffic fatalities by 2030. These efforts have increased funding for local repair facilities, enabling them to upgrade equipment and adopt eco-friendly practices.

Mexico is driven by its growing automotive manufacturing base and strategic position as a trade hub. The USMCA trade agreement has facilitated access to North American markets, driving repair demand, particularly for commercial vehicles. Delivery fleets transporting goods across borders require durable repairs to withstand harsh conditions, fueling demand for corrosion-resistant coatings and reinforced components. Furthermore, investments in logistics infrastructure, such as new highways and ports, have created opportunities for collision repair businesses. For instance, companies like Caliber Collision have expanded their presence in northern Mexico, catering to cross-border traffic and boosting service accessibility.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Caliber Collision, Gerber Collision & Glass, Service King Collision Repair Centers, Maaco, Classic Collision, 3M, Magna International Inc., Tenneco Inc., Robert Bosch LLC, DENSO Corporation, Continental AG, Federal-Mogul LLC, Faurecia (FORVIA), Honeywell International Inc., Martinrea International Inc., MANN+HUMMEL Group, Snap-on Incorporated, Safelite Group, Inc., and Monro, Inc. are some of the key market players in the north America automotive collison repair market.

The North America automotive collision repair market is highly competitive, characterized by intense rivalry among established players and emerging innovators. Key competitors include Caliber Collision, Gerber Collision & Glass, and ABRA Auto Body & Glass.

Companies differentiate themselves through technological advancements, such as AI-driven diagnostics and eco-friendly practices. Similarly, ABRA’s adoption of bio-based consumables has aligned with regulatory mandates, gaining a competitive edge.

Strategic partnerships and acquisitions further intensify competition. Additionally, the rise in electric vehicle adoption has created niche opportunities, with certified repair centers gaining a competitive advantage.

However, challenges such as high repair costs, regulatory compliance, and a shortage of skilled technicians persist.

Despite these challenges, the market remains resilient, driven by urbanization, rising accident rates, and technological innovation. Companies that adapt to evolving consumer preferences and regulatory requirements are well-positioned to thrive in this dynamic landscape.

Top Players in the North America Automotive Collision Repair Market

Caliber Collision

Caliber Collision leads the North America automotive collision repair market. The company’s dominance is attributed to its customer-centric approach and focus on technological innovation. Caliber’s partnership with Tesla has positioned it as a leader in EV repairs. The company’s investment in AI-driven diagnostics and eco-friendly practices further differentiates it from competitors.

Gerber Collision & Glass

Gerber Collision & Glass is leveraging its extensive network of locations across North America. Gerber’s implementation of AI-driven damage assessment software has reduced repair times by 30%, enhancing operational efficiency. Additionally, the company’s focus on sustainability has led to the adoption of water-based paints, reducing VOC emissions. Gerber’s collaboration with automakers like Ford and General Motors ensures consistent demand and technological alignment, further solidifying its market position.

ABRA Auto Body & Glass

ABRA Auto Body & Glass is focusing on sustainability and eco-friendly practices. ABRA’s partnership with BASF has enabled it to introduce innovative products, such as recyclable adhesives and sealants. Additionally, the company’s investment in technician training programs has addressed the skills shortage, ensuring high-quality repairs.

Top Strategies Used by Key Players

Market leaders employ strategies like mergers, acquisitions, and technological innovation to maintain their edge. Similarly, Gerber Collision & Glass implemented AI-driven diagnostics, reducing repair times and improving customer satisfaction.

Investments in eco-friendly practices and sustainability are another key strategy. Additionally, companies like Fix Auto have launched mobile repair services, targeting suburban areas and increasing accessibility.

Strategic collaborations with automakers, such as Tesla and Ford, ensure consistent demand and technological alignment. These strategies not only bolster market share but also address emerging challenges, ensuring long-term growth.

MARKET SEGMENTATION

This research report on the North America automotive collision repair market is segmented and sub-segmented into the following categories.

By Product

- Paint & Coatings

- Consumables

- Spare parts

By Vehicle Type

- Light-duty Vehicles

- Heavy-duty vehicles

By Service channel

- DIY

- DIFM

- OE

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What factors are driving the growth of the automotive collision repair market in North America?

Factors include increasing vehicle ownership, rising accident rates, higher demand for advanced collision repair technologies, and the growing use of insurance services for vehicle repairs.

What trends are emerging in the North America automotive collision repair market?

Trends include the adoption of advanced diagnostic tools, digital claims processing, eco-friendly paints and materials, and the consolidation of independent repair shops into larger chains.

What is the future outlook for the North America automotive collision repair market?

The market is expected to grow steadily, driven by advancements in vehicle technologies, rising accident rates, and the increasing need for specialized repair services.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com