North America Beer Market Size, Share, Trends & Growth Forecast Report By Product (Strong, Light), Production, Category, Packaging, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Beer Market Size

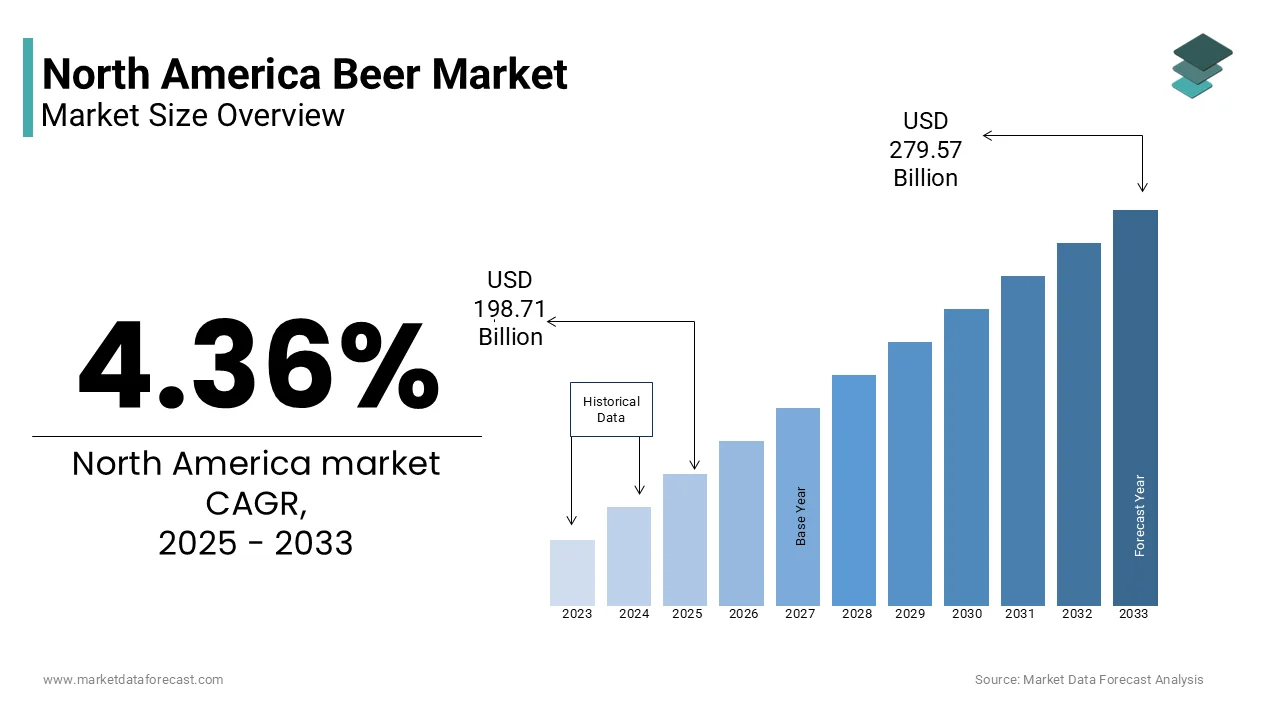

The Beer market size in North America size was valued at USD 190.41 billion in 2024 and is predicted to be worth USD 279.57 billion by 2033 from USD 198.71 billion in 2025 and grow at a CAGR of 4.36% from 2025 to 2033.

The beer reflects a blend of traditional brewing heritage and dynamic consumer preferences. The market has evolved significantly over the past two decades, driven by craft beer innovation, premiumization trends, and changing drinking habits among younger demographics.

In 2024, the U.S. alone accounted for over 90% of the regional beer volume sales, with approximately 235 million hectoliters consumed annually, as per data from Beverage Marketing Corporation. Meanwhile, Canada's beer consumption stood at around 8.6 billion liters, according to Statistics Canada, while Mexico reported domestic beer consumption of nearly 7.1 billion liters in the same period, based on INEGI figures. The region’s market is not only shaped by large multinational brewers but also bolstered by thousands of microbreweries that have transformed the landscape since the early 2010s.

MARKET DRIVERS

Growth of Craft and Specialty Beers

One of the key drivers of the North America beer market is the sustained expansion of the craft and specialty beer segment. Consumers across the U.S., Canada, and Mexico are increasingly gravitating toward unique, small-batch brews that offer distinct flavor profiles, local authenticity, and artisanal quality. In Canada, the number of craft breweries surpassed 1,200 in 2024, up from just over 500 in 2015, as reported by the Canadian Brewer’s Association. This rapid proliferation has been fueled by strong consumer interest in experiential consumption and a willingness to pay premium prices for differentiated products. Moreover, specialty beers such as IPAs, stouts, sour beers, and hard seltzers have gained traction, particularly among millennials and Gen Z drinkers.

Expansion of Direct-to-Consumer (DTC) Sales Channels

Another significant driver of the North America beer market is the growing adoption of direct-to-consumer (DTC) sales models by breweries, especially craft producers. Enabled by digital platforms, e-commerce growth, and evolving state regulations, DTC channels allow breweries to bypass traditional wholesalers and retailers, delivering products directly to consumers. This model enhances brand visibility, customer engagement, and profit margins. Similarly, in Canada, provinces such as Ontario and British Columbia introduced expanded online ordering systems for local breweries during the pandemic, leading to a 40% surge in online beer sales in 2022, according to Statista. These shifts indicate that DTC sales are no longer a niche channel but a strategic avenue for growth. Breweries leveraging digital marketing, subscription services, and home delivery are capitalizing on this opportunity, thereby reinforcing the resilience and adaptability of the North American beer market.

MARKET RESTRAINTS

Increasing Health Awareness and Alcohol Moderation Trends

A major restraint affecting the North America beer market is the growing consumer focus on health and wellness, which has led to a decline in overall alcohol consumption, particularly among younger demographics. Health-conscious lifestyles, increased awareness of alcohol-related risks, and the rise of sobriety movements have all contributed to this trend. Additionally, initiatives such as Dry January and Sober October have gained mainstream traction, influencing consumer behavior and prompting many to reduce or eliminate alcohol intake. This shift poses a challenge to beer producers, especially those reliant on volume-driven models. While some brands have responded by launching low-alcohol or non-alcoholic alternatives, the broader cultural movement toward moderation continues to exert downward pressure on overall beer consumption across North America.

Regulatory and Tax Burdens Across Jurisdictions

Another key restraint impacting the North America beer market is the complex and varying regulatory and tax environment across states and provinces. Unlike other consumer goods, beer is subject to multi-tiered taxation, licensing requirements, and distribution restrictions that differ significantly within and between countries. These disparities create operational inefficiencies and cost burdens, particularly for small and mid-sized breweries trying to scale their operations. Similarly, in Canada, provincial governments control alcohol distribution and pricing through liquor boards, leading to varied markups and availability challenges. Alberta, for instance, allows private retail sales, while Quebec maintains a government monopoly on distribution, complicating market access for independent brewers. Mexico also faces similar hurdles, with strict federal and local regulations governing alcohol advertising and sales hours. These regulatory complexities hinder market fluidity and pose ongoing constraints for beer producers seeking to expand efficiently across North America.

MARKET OPPORTUNITIES

Rise of Non-Alcoholic and Low-Alcohol Beer Variants

An emerging opportunity in the North America beer market is the increasing popularity of non-alcoholic and low-alcohol beer options. As consumer preferences evolve toward healthier lifestyles and responsible drinking, these variants offer a viable alternative without compromising on taste or experience. Brands such as Athletic Brewing Company and Heineken 0.0 have capitalized on this shift, reporting double-digit sales increases and expanding into new retail channels. Additionally, major breweries including Molson Coors and Anheuser-Busch have launched dedicated zero-proof lines, signaling a strategic pivot toward this growing market. Furthermore, in Mexico, where beer remains a staple of social culture, non-alcoholic variants have seen steady uptake, particularly among health-conscious professionals and urban dwellers. This shift presents a significant opportunity for beer producers to diversify their portfolios and capture a broader demographic base in North America.

Integration of Sustainability Practices in Brewing Operations

Sustainability is becoming a powerful differentiator in the North America beer market, offering breweries a strategic opportunity to align with consumer values and regulatory expectations. With climate change concerns and resource conservation gaining prominence, both large and small brewers are adopting eco-friendly practices across sourcing, packaging, and energy use. Leading companies are responding by integrating renewable energy sources, reducing water usage, and adopting recyclable packaging materials. Moreover, Oshlag Systems, a Canadian startup, partnered with several microbreweries to implement AI-based water recycling technology, cutting water waste by up to 40%, according to Natural Resources Canada.

In Mexico, Grupo Modelo owned by AB InBev launched a comprehensive water stewardship initiative, restoring over 1.2 billion liters of water to communities near its breweries in 2024, as per Conagua (Mexico’s national water authority). These efforts not only enhance brand reputation but also position breweries favorably amid tightening environmental regulations.

MARKET CHALLENGES

Labor Shortages and Rising Operational Costs

One of the pressing challenges facing the North America beer market is the persistent labor shortage across brewing, packaging, and distribution sectors. The post-pandemic labor market has left many breweries struggling to find skilled workers, especially in roles such as brewing technicians, warehouse staff, and delivery drivers. In Mexico, inflationary pressures and labor reforms under President Andrés Manuel López Obrador have pushed up operational costs in regions like Jalisco and Nuevo León, where major breweries operate. These rising expenses place financial strain on smaller breweries, many of which lack the economies of scale to absorb such increases. Consequently, some have had to delay expansion plans or raise retail prices, potentially deterring price-sensitive consumers.

Supply Chain Disruptions and Raw Material Volatility

Supply chain instability and fluctuating raw material prices continue to challenge the North America beer market, disrupting production timelines and inflating costs. Key ingredients such as barley, hops, and aluminum have experienced significant price volatility in recent years due to climate disruptions, geopolitical tensions, and transportation bottlenecks. Aluminum, used extensively in cans and kegs, saw a 17% price increase in 2023, driven by global supply constraints and surging demand from other industries, as reported by Metal Prices. These cost escalations have placed pressure on breweries, especially small and independent ones, which often lack the purchasing power of larger competitors. In Canada, the Can Manufacturers Institute noted that aluminum can prices reached record highs in 2024, forcing some breweries to explore alternative packaging solutions or pass costs onto consumers. Logistical delays further compound these issues. Port congestion, trucking shortages, and rail service disruptions have extended lead times for ingredient deliveries and finished product distribution.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.36% |

|

Segments Covered |

By Product, Production, Category, Packaging, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Carlsberg Group, Anheuser-Busch InBev, Diageo PLC, Erdinger Brewery, Heineken N.V., Lasco Brewery, Radeberger Brewery, Oettinger Brewery, and BAVARIA N.V., and others |

SEGMENTAL ANALYSIS

By Product Insights

The light beer segment was the largest and held 58.6% of the North America beer market share in 2024. One key driver behind the continued strength of this segment is consumer preference for lower-calorie, lower-alcohol options that align with active lifestyles. NielsenIQ reported that in 2023, light beer accounted for nearly two-thirds of dollar sales in mainstream retail channels across the U.S., reflecting its entrenched position in daily consumption habits. Marketing efforts have also played a crucial role in sustaining this segment’s leadership. Major campaigns by brands such as Bud Light and Coors Light continue to resonate with broad audiences, especially during high-profile sporting events.

The strong beer segment is swiftly emerging with a CAGR of 6.7% in the next coming years. A significant factor driving this expansion is the rise of premiumization trends, particularly in the U.S. and Canada. As per the Brewers Association, in 2023, strong beer accounted for nearly 19% of craft brewery revenue despite representing only 11% of production volume, indicating higher average selling prices and profitability. Craft breweries are leveraging this shift by producing limited-edition, barrel-aged, and experimental brews that command premium pricing. Additionally, state-level regulatory changes have enabled greater availability of high-strength beers in off-premise retail outlets. For instance, in Texas and Florida, legal thresholds for alcohol-by-volume (ABV) were raised in 2022, allowing local breweries to distribute stronger variants more freely. This legislative flexibility has unlocked new distribution avenues, which is contributing to the segment’s rapid ascent in the North American beer market.

By Production Insights

The macro breweries segment was the largest with prominent share of the North America beer market in 2024. One of the primary drivers of macro breweries’ dominance is their ability to meet mass-market demand through efficient large-scale production and cost-effective packaging solutions. As per the U.S. Census Bureau, in 2023, macro breweries accounted for 72% of all beer shipped in the U.S., with leading brands like Bud Light, Coors Light, and Corona dominating supermarket and convenience store shelves. Their strong presence in national retail chains ensures widespread accessibility, reinforcing consumer familiarity and repeat purchases. Another critical factor is aggressive marketing and sponsorship initiatives.

The microbreweries segment is likely to grow with a CAGR of 8.2% in the next coming years. One of the key factors fueling this growth is the rising consumer preference for artisanal, locally sourced products. According to NielsenIQ, microbrewery beer sales increased by 11% in 2023 compared to the previous year, outpacing overall beer market growth. Consumers, particularly millennials and Gen Z, are increasingly prioritizing authenticity and community engagement, which microbreweries effectively leverage through taproom experiences and regional collaborations. Moreover, evolving regulatory frameworks have facilitated easier access to wholesale and direct-to-consumer (DTC) markets. In Canada, provinces like British Columbia and Ontario introduced relaxed licensing rules in 2022, allowing microbreweries to sell directly to consumers online.

By Category Insights

The normal beer segment was accounted in holding prominent share of the North America beer market in 2024. One of the key drivers behind the sustained dominance of normal beer is its appeal to price-sensitive consumers who prioritize value over premium attributes. This affordability makes it the go-to choice for everyday drinking occasions among older demographics and rural populations. Additionally, extensive distribution networks maintained by macro breweries ensure that normal beer remains highly accessible across various retail formats. As per the Beer Institute, in 2024, 92% of U.S. convenience stores carried at least one flagship brand from the top three brewing companies, reinforcing product availability and consumer habituation. This combination of cost-effectiveness and ubiquity sustains the normal beer category as the cornerstone of the North American beer market.

The super premium beer segment is likely to grow with a CAGR of 9.1% from 2020 to 2024, according to Grand View Research. A major driver of this segment’s growth is the increasing willingness among affluent consumers to spend on experiential and differentiated products. This trend is further supported by the rise of beer tourism and branded tasting rooms, where consumers can engage directly with premium brewing processes. Additionally, the premiumization movement within the hospitality sector has amplified demand for high-quality beer selections.

By Packaging Insights

The canned beer was the largest by accounting for 57.6% of the North America beer market share in 2024. One of the key drivers behind the prevalence of canned beer is its growing acceptance among craft breweries that previously relied heavily on bottled formats. Additionally, environmental considerations have reinforced the popularity of aluminum cans, which are among the most recycled beverage containers. As per the Aluminum Association, in 2024, the U.S. achieved a 53% aluminum can recycling rate, surpassing both glass bottles and PET plastic.

The draught segment is swiftly emerging with a CAGR of 6.8% during the forecast period. A key factor driving draught beer’s growth is the recovery of the hospitality sector, particularly in urban centers where craft beer culture thrives. Taprooms and brewpubs have played a pivotal role in this rebound, offering immersive tasting experiences that enhance consumer engagement.

Furthermore, technological advancements in kegging and dispensing systems have improved efficiency and reduced waste, making draught beer more viable for smaller breweries. These developments indicate that draught beer is not only recovering but also evolving as a dynamic and high-potential segment in the North American beer market.

REGIONAL ANALYSIS

The United States was the top performer in the North America beer market by accounting for 84.3% of share in 2024. One of the key factors supporting the U.S. market’s leadership position is the sheer scale of its brewing industry. In 2023, there were over 9,500 operating breweries nationwide, including major players like Anheuser-Busch InBev and a rapidly expanding network of independent craft breweries, as reported by the Brewers Association. This density fosters both competition and diversity in product offerings, catering to a wide range of consumer preferences.

Canada was the positioned second with 12.1% of the North America beer market share in 2024. A key driver of Canada’s beer market growth is the proliferation of independent craft breweries, which now number over 1,200 across the country, according to the Canadian Brewer’s Association. These smaller producers have capitalized on shifting consumer preferences toward locally made, high-quality, and innovative beer styles in provinces like British Columbia, Ontario, and Quebec.

Additionally, favorable government policies and trade agreements have enhanced Canada’s beer export potential. According to Global Affairs Canada, in 2023, beer exports reached $450 million, with the U.S. being the primary destination. The Canada-U.S.-Mexico Agreement (CUSMA) has facilitated smoother cross-border trade, enabling Canadian breweries to expand beyond domestic markets.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major players in the North America beer market are Carlsberg Group, Anheuser-Busch InBev, Diageo PLC, Erdinger Brewery, Heineken N.V., Lasco Brewery, Radeberger Brewery, Oettinger Brewery, and BAVARIA N.V.

The competition in the North America beer market is characterized by a dynamic interplay between global giants and a rapidly growing number of independent craft breweries. While major players maintain a dominant presence through scale, brand recognition, and widespread distribution, the rise of microbreweries and regional craft brands has introduced a high degree of fragmentation and diversity in the marketplace. These smaller breweries leverage localized branding, niche flavor profiles, and direct-to-consumer models to carve out dedicated consumer bases. At the same time, larger brewers are countering this shift by acquiring craft labels, introducing limited edition releases, and investing in sustainability and digital engagement initiatives. The regulatory environment also influences competitive dynamics, with varying state and provincial laws affecting production, pricing, and distribution flexibility.

TOP PLAYERS IN THE MARKET

Anheuser-Busch InBev (AB InBev)

AB InBev is the leading player in the North America beer market, known for its extensive portfolio of iconic brands such as Budweiser, Bud Light, Michelob Ultra, and Stella Artois. The company’s dominance stems from its deep-rooted brand equity, expansive distribution network, and strategic acquisitions that have promoted its presence across all consumer segments. AB InBev plays a crucial role in shaping global brewing trends through innovation, sustainability initiatives, and digital marketing strategies that resonate with modern consumers.

Molson Coors Beverage Company

Molson Coors is a major force in the North American beer landscape, offering a diverse lineup of domestic and imported beers including Coors Light, Miller Lite, Blue Moon, and Carling. With strong footholds in both the U.S. and Canada, the company has successfully balanced mainstream appeal with craft-inspired offerings to cater to evolving consumer preferences. Molson Coors contributes significantly to the global beer industry through product diversification, responsible drinking campaigns, and investments in alternative beverage formats like hard seltzers and non-alcoholic beers.

Constellation Brands

Constellation Brands has carved out a unique position in the North America beer market by focusing on premium imports such as Corona and Modelo, which have become household names in the U.S. Leveraging its strong import strategy, Constellation has capitalized on shifting consumer tastes toward lighter, flavorful lagers. Beyond beer, the company’s strategic foresight in diversifying into wine and cannabis has enhanced its overall beverage portfolio. Its influence extends globally through partnerships and supply chain optimization that reinforce brand loyalty and international growth.

TOP STRATEGIES USED BY KEY PLAYERS

Brand Diversification and Portfolio Expansion

Leading players in the North America beer market are continuously expanding their product portfolios to include a mix of mainstream, craft, flavored, and non-alcoholic beers. This strategy allows them to capture a broader consumer base and adapt to changing drinking habits. By acquiring or launching new sub-brands and specialty lines, companies ensure they remain relevant across different demographic segments.

Strategic Mergers and Acquisitions

Consolidation remains a key tactic among top beer producers, enabling them to strengthen market share, enhance distribution capabilities, and gain access to innovative brewing techniques. Companies frequently acquire regional or craft breweries to tap into local consumer bases while maintaining brand authenticity and fostering innovation within their existing structures.

Digital Transformation and Direct-to-Consumer Engagement

Breweries are investing heavily in digital platforms to improve customer engagement, streamline sales, and gather consumer insights. From e-commerce integration to data-driven marketing, these efforts help companies build stronger relationships with consumers and respond more effectively to emerging trends and preferences.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Anheuser-Busch launched a new line of sustainably brewed lagers under its core brand portfolio, emphasizing reduced carbon footprint and water conservation in the brewing process. This initiative aligns with the company’s broader environmental goals and enhances brand positioning among eco-conscious consumers.

- In May 2024, Molson Coors expanded its direct-to-consumer delivery service across additional U.S. states, which is leveraging third-party logistics partnerships to increase online accessibility and strengthen its omnichannel retail strategy.

- In July 2024, Constellation Brands announced a partnership with a Mexican craft brewery to co-develop exclusive regional variants of its imported beer lines by aiming to deepen cultural relevance and expand its reach among Hispanic consumers in the U.S.

- In September 2024, Sierra Nevada Brewing Co., a leading independent craft brewer, introduced a national subscription-based beer club, which is offering members curated seasonal releases and exclusive merchandise to foster brand loyalty and community engagement.

- In November 2024, Heineken USA expanded its zero-alcohol beer distribution to major grocery chains and convenience stores across North America, which is capitalizing on the rising demand for non-alcoholic alternatives without compromising on taste or brand identity.

MARKET SEGMENTATION

This research report on the North America beer market has been segmented and sub-segmented based on the following categories.

By Product

- Strong

- Light

By Production

- Micro

- Macro

By Category

- Normal

- Super premium

- Premium

By Packaging

- Draught

- Bottled

- Canned

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

1. What was the size of the North America beer market in 2024?

The North America beer market was valued at USD 190.41 billion in 2024.

2. What is the projected size of the North America beer market by 2033?

The North America beer market is expected to reach USD 279.57 billion by 2033.

3. What is the expected growth rate of the North America beer market from 2025 to 2033?

The North America beer market is projected to grow at a CAGR of 4.36% between 2025 and 2033.

4. What are the major trends driving the North America beer market?

The North America beer market is influenced by trends like craft beer demand, low-alcohol options, and premiumization.

5. How is changing consumer behavior impacting the North America beer market?

Shifting preferences toward healthier and innovative beverage choices are shaping the North America beer market.

6. What are the key growth drivers of the North America beer market?

Factors such as rising disposable incomes, urbanization, and brand diversification are fueling market growth.

7. What challenges are faced by the North America beer market?

The North America beer market faces challenges like regulatory restrictions, health concerns, and shifting alcohol consumption patterns.

8. How is the craft beer segment impacting the North America beer market?

The craft segment adds diversity, supports local economies, and appeals to consumers seeking unique beer experiences.

9. What is the role of innovation in the North America beer market?

Product innovation in flavors, packaging, and brewing methods is a key factor in market competitiveness.

10. What future opportunities exist in the North America beer market?

Opportunities lie in non-alcoholic beers, eco-friendly packaging, digital marketing, and expanding distribution networks.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com