North America Biomedical Refrigerators And Freezers Market Size, Share, Trends & Growth Forecast Report By Product (Blood Bank Refrigerators, Shock Freezers, Plasma Freezers, Ultra Low Temperature Freezers), Application, And Country (US, Canada, And Rest Of North America), Industry Analysis From 2025 To 2033

North America Biomedical Refrigerators And Freezers Market Size

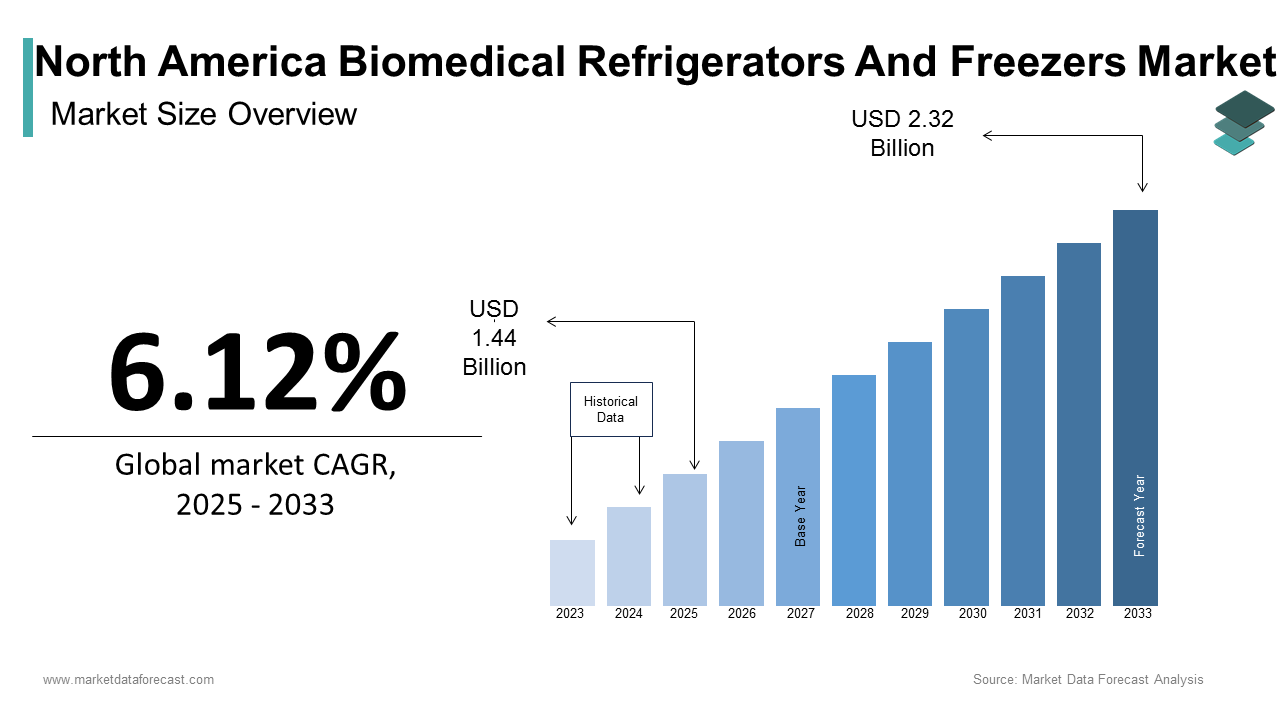

The size of the North America Biomedical Refrigerators And Freezers Market was calculated to be USD 1.36 billion in 2024 and is anticipated to be worth USD 2.32 billion by 2033, from USD 1.44 billion in 2025, growing at a CAGR of 6.12% during the forecast period.

Biomedical refrigerators and freezers are engineered to maintain precise temperature stability, often equipped with features such as digital monitoring systems, alarm mechanisms, and energy-efficient compressors to ensure sample integrity and regulatory compliance. The demand for these devices has surged due to their critical role in maintaining cold chain logistics for sensitive medical products, especially during large-scale immunization drives and clinical research activities.

Apart from these, the rise in biobanking initiatives across North America where human tissue and genetic material are stored for future research further underscores the growing reliance on high-performance biomedical refrigeration systems.

MARKET DRIVERS

The increasing demand for vaccine storage and distribution infrastructure, particularly in response to global health emergencies is one of the primary drivers of the North American biomedical refrigerators and freezers market. With the expansion of national immunization programs and the continuous development of new vaccines, including mRNA-based formulations requiring ultra-low temperature storage, there is an urgent need for advanced refrigeration systems. This has led to a significant rise in the procurement of ultra-low temperature (ULT) freezers by public health departments, hospitals, and pharmacies.

These developments have not only increased the adoption of specialized refrigeration units but also spurred innovation among manufacturers to develop more efficient, compliant, and remotely monitored storage solutions tailored to meet evolving healthcare needs.

The rapid growth of biobanking and personalized medicine research is another major driver fueling the North American biomedical refrigerators and freezers market. Biobanks play a crucial role in storing biospecimens such as blood, DNA, tissues, and cell lines, which are essential for advancing genomics, oncology, and regenerative medicine.

According to the International Society for Biological and Environmental Repositories (ISBER), North America hosts over 40% of the world’s active biobanks, many of which require highly controlled environments for long-term specimen preservation. This necessitates the use of specialized biomedical freezers capable of maintaining temperatures as low as -80°C to prevent degradation of sensitive biomaterials.

Furthermore, the rise in precision medicine initiatives, such as the All of Us Research Program funded by the National Institutes of Health (NIH), has significantly boosted the demand for secure and scalable cold storage solutions.

MARKET RESTRAINTS

A key restraint affecting the North America biomedical refrigerators and freezers market is the high cost of acquisition and maintenance , which limits adoption, especially among small- to medium-sized healthcare facilities. These refrigeration units are built with specialized components such as microprocessor controls, backup power systems, and alarm integration modules to ensure uninterrupted operation and sample safety.

Besides, ongoing operational costs—including energy consumption, calibration, and preventive maintenance—add financial pressure. Many independent laboratories and rural clinics face budgetary constraints that make it difficult to invest in or replace aging equipment. As a result, some facilities resort to using outdated or repurposed commercial refrigerators, which may not meet the stringent performance standards required for storing critical biological materials.

Another significant restraint influencing the North American biomedical refrigerators and freezers market is the stringent regulatory compliance requirements imposed by agencies such as the Food and Drug Administration (FDA) and the Centers for Medicare & Medicaid Services (CMS). These regulations mandate strict validation protocols for temperature-controlled storage equipment used in clinical and pharmaceutical settings to ensure product integrity and patient safety. Compliance involves extensive documentation, periodic audits, and adherence to Good Manufacturing Practices (GMP) and ISO standards, which can be cumbersome for manufacturers and end-users alike.

According to the FDA’s Bioresearch Monitoring Program, a significant number of inspected facilities between 2020 and 2023 received citations related to improper storage conditions for investigational drugs and biological specimens. Ensuring full compliance often requires additional investments in training, monitoring software, and certification processes, thereby increasing the complexity and cost of deploying biomedical refrigeration systems.

MARKET OPPORTUNITIES

The most promising opportunity in the NortAmericanca biomedical refrigerators and freezers market lies in the integration of Internet of Things (IoT) technology into cold storage systems. IoT-enabled refrigeration units allow for real-time remote monitoring of temperature, humidity, and door-opening events, ensuring optimal storage conditions and minimizing the risk of sample loss.

According to the Healthcare Information and Management Systems Society (HIMSS), a significant number of U.S. hospitals have adopted IoT-connected medical devices to improve operational efficiency and patient care. Manufacturers are increasingly embedding smart sensors and cloud-based analytics into biomedical refrigerators, enabling predictive maintenance and automated alerts in case of deviations.

Moreover, the U.S. has encouraged the adoption of connected medical equipment through its Smart and Connected Health initiative, promoting the use of digital tools to enhance biomedical logistics. Therefore, the demand for intelligent refrigeration systems is expected to rise, offering a substantial growth avenue for industry players looking to innovate beyond traditional hardware offerings.

Another potential opportunity emerging in the North American biomedical refrigerators and freezers market is the growing focus on sustainability and energy-efficient designs. With rising awareness about environmental impact and increasing pressure to reduce carbon footprints, healthcare providers are seeking refrigeration solutions that comply with green building standards such as ENERGY STAR and LEED certification.

According to the U.S. Environmental Protection Agency (EPA), the healthcare sector accounts for a notable share of the country's total energy consumption, making energy-efficient equipment a priority for cost reduction and sustainability goals. Leading manufacturers are responding by developing models with hydrocarbon-based refrigerants, vacuum insulation panels, and variable-speed compressors to minimize energy usage while maintaining precise temperature control. For instance, several companies have introduced freezers that consume less electricity compared to conventional models, as reported by the Global Green Growth Institute (GGGI).

Moreover, some academic and research institutions have begun incorporating eco-friendly cold storage units into their procurement policies, aligning with broader institutional commitments to sustainable operations.

MARKET CHALLENGES

The limited availability of skilled personnel for proper handling and maintenance of advanced refrigeration systems is a major challenge facing the North American biomedical refrigerators and freezers market. Modern biomedical refrigerators come equipped with complex digital interfaces, alarm systems, and remote monitoring capabilities, which require trained technicians and facility managers to operate effectively. However, according to the American Society for Clinical Laboratory Science (ASCLS), a significant share of laboratory staff in community hospitals and rural clinics lack formal training in managing sophisticated cold storage equipment. This gap leads to improper usage, frequent breakdowns, and compromised sample integrity.

Additionally, service and repair of these units often depend on manufacturer-certified technicians, whose availability can be limited in certain regions. As a result, healthcare facilities sometimes experience extended downtime when repairs are needed, risking the viability of stored biological materials.

Next pressing challenge impacting the North America biomedical refrigerators and freezers market is the increasing frequency of power outages and grid instability, which threatens the reliability of temperature-sensitive storage systems. Climate-related disruptions, aging electrical infrastructure, and rising energy demands have contributed to a surge in unplanned outages across various regions.

According to the U.S. Department of Energy (DOE), the number of weather-related power interruptions has increased significantly since the early 2000s. This poses a serious risk to biomedical storage units, especially those housing irreplaceable biological samples and time-sensitive vaccines. While some facilities have installed backup generators and uninterruptible power supply (UPS) systems, not all institutions—particularly smaller labs and clinics—can afford such redundancies. As reported by the Electric Power Research Institute (EPRI), nearly 25% of healthcare facilities in the U.S. do not have fully functional backup power solutions for their cold storage units. This vulnerability shows the need for resilient energy strategies and alternative cooling technologies that can sustain operations during power disruptions, presenting both a technical and logistical challenge for the market moving forward.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.12% |

|

Segments Covered |

By Product, End Use, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Us, Canada, and the Rest of North America |

|

Market Leaders Profiled |

Follett LLC, Panasonic Healthcare Corporation, Migali Scientific, Arctiko, B Medical Systems, Azbil Corporation, Thermo Fisher Scientific Inc., Helmer Scientific Inc., Aegis Scientific Inc., Eppendorf AG, Haier Biomedical, PHC Holdings Corporation, Philipp Kirsch GmbH, Vestfrost Solutions, Binder GmbH, Bionics Scientific Technologies (P) Ltd., So-Low Environmental Equipment Co., Stirling Ultracold, Powers Scientific Inc., NuAire Inc. |

SEGMENTAL ANALYSIS

By Product Insights

The Ultra Low Temperature Freezers held the largest market share, accounting for a 38.5% of the total market in 2024. The dominance of this segment is due to its critical role in preserving highly sensitive biological materials such as vaccines, stem cells, enzymes, and pharmaceutical compounds that require storage at temperatures as low as -80°C.

According to the National Institute of Standards and Technology (NIST), over 75% of biopharmaceutical research facilities in the U.S. rely on ULT freezers for long-term sample preservation.

In addition, the widespread deployment of mRNA-based vaccines during the pandemic, which necessitated ultra-cold storage infrastructure, significantly boosted demand.

Among all product segments, Shock Freezers are projected to grow at the fastest rate, with a CAGR of nearly 9.5% over the forecast period. This rapid growth is primarily driven by their increasing use in cryopreservation techniques within reproductive medicine and regenerative therapies. Shock Freezers enable rapid freezing of biological samples, minimizing ice crystal formation and preserving cellular integrity—a key requirement in applications such as in vitro fertilization (IVF) and stem cell banking.

Moreover, academic and clinical research centers are expanding their biobanking capabilities, further fueling adoption.

By End Use Insights

In terms of end-use segmentation, the Hospitals segment prevailed in the North American biomedical refrigerators and freezers market, commanding around 34% of the overall market in 2024. Hospitals represent a dominant end-user category due to their extensive reliance on temperature-controlled storage for vaccines, blood products, medications, and diagnostic specimens.

Additionally, the expansion of hospital networks, especially in suburban and rural areas, has contributed to higher procurement rates. The rise in outpatient services and surgical procedures—nearly 52 million surgeries were performed in U.S. hospitals in 2022, as per the Healthcare Cost and Utilization Project (HCUP)—has also intensified the need for reliable cold storage infrastructure.

The booming end-use segment is Research Laboratories, predicted to expand at a CAGR of around 9.2% through the coming years. This growth trajectory is fueled by the surge in life sciences research, particularly in genomics, oncology, and vaccine development.

According to the National Science Foundation (NSF), annual funding for biomedical research in the U.S. exceeded $50 billion in 2023, with Canada contributing an additional $4.3 billion toward similar initiatives. These investments have led to an increase in laboratory construction and modernization projects, many of which include state-of-the-art cold storage infrastructure.

Furthermore, the growing trend of personalized medicine and the proliferation of biotech startups—over 1,200 new biotech firms were established in North America in 2022, as reported by the Biotechnology Innovation Organization (BIO)—are amplifying demand for precision refrigeration equipment tailored to scientific workflows.

REGIONAL ANALYSIS

The United States occupied the leading position in the North American biomedical refrigerators and freezers market, holding a market share of 76.7% in 2024. Its dominance is underpinned by a robust healthcare infrastructure, high government expenditure on medical research, and a strong presence of leading manufacturers and research institutions.

Additionally, the country's aggressive vaccination programs, including those for influenza, HPV, and adult immunizations, necessitate large-scale deployment of biomedical freezers. With a well-established regulatory framework and continuous technological advancements, the U.S. remains the core driver of market expansion.

Canada is a major contributor to the North American biomedical refrigerators and freezers market. The country’s market is supported by its universal healthcare system, strong investment in life sciences research, and rising focus on vaccine manufacturing. Canadian provinces have also expanded their immunization programs, leading to increased procurement of biomedical refrigeration units.

In addition, the country’s growing participation in international clinical trials and its strategic collaboration with global pharmaceutical companies have further stimulated demand for temperature-controlled storage systems, positioning Canada as a key player in the regional market.

Mexico is smaller in scale but contributes significantly to the NortAmericanca biomedical refrigerators and freezers market. The country's market is being propelled by recent improvements in healthcare infrastructure, rising foreign investments in biopharmaceutical manufacturing, and increasing domestic vaccine production capacity. Apart from these, Mexico’s proximity to the U.S. makes it an attractive destination for contract manufacturing organizations (CMOs) setting up regional operations, thereby boosting demand for biomedical refrigeration.

Puerto Rico, while not a sovereign nation, plays a strategic role in the NorAmericanica biomedical refrigerators and freezers market. Its significance stems from its status as a major hub for pharmaceutical and biotechnology manufacturing, attracting numerous multinational corporations. According to the Puerto Rico Industrial Development Company (PRIDCO), the island hosts over 170 life sciences companies, including several top-tier pharmaceutical firms that rely heavily on temperature-controlled storage for drug development and quality assurance. The U.S. Food and Drug Administration (FDA) has consistently ranked Puerto Rico among the top global producers of FDA-approved drugs, reinforcing the need for high-performance biomedical refrigeration units. Besides, the island’s participation in federal health programs and its integration with U.S. supply chains enhance its relevance in the regional cold storage landscape, making it a key secondary market within North America.

The rest of North America, comprising territories like Greenland, Bermuda, and other Caribbean dependencies, collectively contributed a smaller share of the market share in 2024. While these regions do not exhibit high-volume demand, they are increasingly adopting biomedical refrigeration systems due to improving healthcare access and expanding vaccine distribution programs. According to the Pan American Health Organization (PAHO), these smaller jurisdictions have received targeted support for strengthening cold chain infrastructure, particularly in response to climate-related disruptions affecting traditional supply routes.

LEADING PLAYERS IN THE NORTH AMERICA BIOMEDICAL REFRIGERATORS AND FREEZERS MARKET

Thermo Fisher Scientific Inc.

Thermo Fisher Scientific is a global leader in laboratory equipment and biomedical storage solutions. In the North American market, it plays a pivotal role by offering a comprehensive range of high-performance refrigerators and freezers tailored for healthcare, research, and biopharma applications. The company's contribution extends beyond product innovation to include integrated service support, digital monitoring tools, and compliance-focused designs. Its emphasis on reliability, energy efficiency, and regulatory alignment has made its products a standard in hospitals, blood banks, and research labs across the region.

Eppendorf AG

Eppendorf is renowned for its precision-engineered biomedical storage systems that cater to both clinical and research environments. In North America, the company is recognized for delivering compact yet highly efficient refrigeration units suitable for small-scale laboratories and large-scale biobanking facilities alike. Eppendorf’s commitment to maintaining sample integrity through advanced temperature control mechanisms has strengthened its presence in academic institutions and life sciences research centers. Its focus on user-centric design and integration with lab automation enhances its value proposition in the regional market.

Panasonic Healthcare Co., Ltd.

Panasonic Healthcare has established a strong foothold in the North American biomedical refrigeration space by offering technologically advanced, energy-efficient cold storage systems. The company is known for its ultra-low temperature freezers that are widely used in vaccine storage, pharmaceutical R&D, and clinical diagnostics. With an emphasis on durability, smart connectivity, and environmental sustainability, Panasonic continues to be a preferred choice among healthcare providers and contract manufacturing organizations operating in North America.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the North American biomedical refrigerators and freezers market deploy strategic initiatives to solidify their competitive edge. One major approach is product innovation and customization, where companies design next-generation refrigeration units with enhanced features such as remote monitoring, real-time alerts, and improved energy efficiency to meet evolving customer needs. Another crucial strategy is expanding service networks and technical support, ensuring end-users receive timely maintenance, calibration, and compliance assistance, which is vital for uninterrupted operations. Lastly, strategic collaborations with healthcare institutions and research bodies play a significant role in strengthening market position, allowing manufacturers to align product development with clinical and scientific demands while fostering long-term trust and brand loyalty across the industry.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the North American biomedical Refrigerators and freezers market include Follett LLC, Panasonic Healthcare Corporation, Migali Scientific, Arctiko, B Medical Systems, Azbil Corporation, Thermo Fisher Scientific Inc., Helmer Scientific Inc., Aegis Scientific Inc., Eppendorf AG, Haier Biomedical, PHC Holdings Corporation, Philipp Kirsch GmbH, Vestfrost Solutions, Binder GmbH, Bionics Scientific Technologies (P) Ltd., So-Low Environmental Equipment Co., Stirling Ultracold, Powers Scientific Inc., NuAire Inc.

The competition in the North American biomedical refrigerators and freezers market is marked by a blend of technological sophistication, regulatory expertise, and customer-centric innovation. A mix of global leaders and emerging regional players actively contend for dominance, each striving to offer superior performance, reliability, and compliance with stringent healthcare standards. Market participants differentiate themselves through advancements in temperature control technologies, integration of digital monitoring systems, and energy-efficient designs tailored for diverse applications—from vaccine storage to stem cell preservation. The presence of well-established distribution networks and after-sales service infrastructure further intensifies rivalry, as companies seek to enhance customer retention and operational uptime. Additionally, rising demand from research institutions and biopharmaceutical firms fuels continuous product development and strategic partnerships, shaping a dynamic and highly responsive competitive landscape.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Thermo Fisher Scientific launched a new line of smart-connected ultra-low temperature freezers equipped with AI-based predictive analytics, aimed at enhancing sample protection and reducing downtime in critical healthcare settings.

- In June 2024, Eppendorf expanded its North American footprint by opening a dedicated biomedical refrigeration training and service center in Boston, focusing on equipping lab personnel with best practices in cold storage management and system optimization.

- In September 2024, Panasonic Healthcare partnered with a leading U.S.-based vaccine manufacturer to co-develop customized freezer units optimized for mRNA vaccine storage, reinforcing its role in supporting immunization supply chains.

- In November 2024, BINDER GmbH introduced a new series of plasma storage refrigerators featuring adaptive cooling technology designed to maintain precise temperature stability, catering to growing demand from blood banks and transfusion centers across North America.

- In January 2024, Helmer Scientific announced the launch of its cloud-based remote monitoring platform for biomedical freezers, enabling healthcare providers to manage multiple units from a centralized dashboard, improving operational efficiency and compliance adherence.

DETAILED SEGMENTATION OF THE NORTH AMERICA BIOMEDICAL REFRIGERATORS AND FREEZERS MARKET INCLUDED IN THIS REPORT

This research report on the North America Biomedical Refrigerators And Freezers Market has been segmented and sub-segmented based on product, end use & region.

By Product

- Blood Bank Refrigerators

- Shock Freezers

- Plasma Freezers

- Ultra Low-Temperature Freezers

By End Use

- Hospitals

- Research Laboratories

- Pharmacies

- Diagnostic Centers

- Blood Banks

- Others

By Region

- US

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is driving the growth of this market?

Growth is driven by the rising demand for safe storage of temperature-sensitive biomedical products, increased healthcare spending, and the expansion of biotechnology and pharmaceutical industries.

2. Which types of products are included in this market?

The market includes blood bank refrigerators, plasma freezers, ultra-low temperature freezers, laboratory refrigerators, and vaccine refrigerators.

3. Who are the key players in the North America Biomedical Refrigerators and Freezers Market?

Follett LLC, Panasonic Healthcare Corporation, Thermo Fisher Scientific Inc., Haier Biomedical, Helmer Scientific Inc., B Medical Systems, Eppendorf AG, PHC Holdings Corporation, Arctiko, and Vestfrost Solutions.

4. Which end-user segments dominate this market?

Hospitals, blood banks, diagnostic laboratories, research institutions, and pharmaceutical companies are the primary end-users.

5. What technological advancements are impacting the market?

Smart monitoring systems, energy-efficient compressors, eco-friendly refrigerants, and IoT-enabled temperature tracking are key innovations.

6. What are the major challenges in this market?

High equipment costs, maintenance requirements, and regulatory compliance challenges are major obstacles to market growth.

7. What is the market size and growth outlook?

The market is expected to grow steadily, driven by increasing vaccine storage needs and medical research activity, with a strong CAGR over the forecast period.

8. How do regulations affect this market?

Regulatory bodies like the CDC, FDA, and WHO enforce strict guidelines for biomedical storage, which drives the demand for compliant refrigeration equipment.

9. Which countries lead the North American market?

The United States dominates due to its advanced healthcare infrastructure, followed by Canada with growing investment in biotech and life sciences.

10. How is the market segmented?

Segmentation is typically by product type, end-user, and country (U.S., Canada, Mexico), with further division by storage volume and temperature range.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com