North America Bioreactors Market Research Report – Segmented By Material (Glass, Stainless-Steel, Single-use), Scale, Production Size , Control Type, End Users, Suppliers & By Country (US, Canada and Rest of North America)- Industry Analysis From 2025 to 2033

North America Bioreactors Market Size

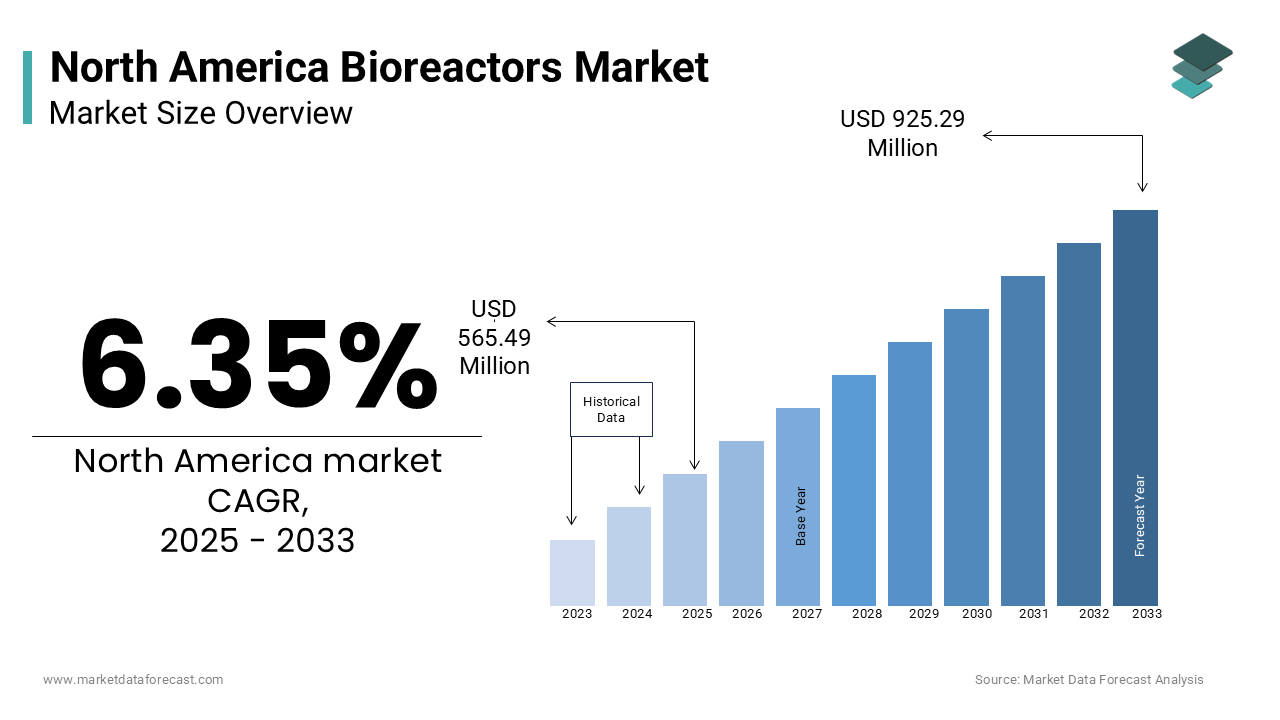

The North America bioreactors market size was valued at USD 531.73 million in 2024 and is estimated to reach USD 925.29 million by 2033 from USD 565.49 million in 2025, registering a CAGR of 6.35% from 2025 to 2033.

A bioreactor, in essence, is a vessel or system designed to support a biologically active environment, enabling the cultivation of microorganisms, mammalian cells, algae, or plant cells under controlled conditions. This technology has become indispensable in applications ranging from vaccine development and monoclonal antibody production to regenerative medicine and sustainable biofuel generation. The growing emphasis on precision medicine and personalized therapies, coupled with the increasing prevalence of chronic diseases such as cancer and diabetes influences the role of bioreactors in modern healthcare innovation. The North American bioreactors market growth is driven by its robust biotech infrastructure and substantial investments in research and development. According to the Biotechnology Innovation Organization, the U.S. biopharmaceutical sector accounts for over 5,000 medicines in development globally, many of which rely on advanced bioreactor systems. Furthermore, Canada’s commitment to green technologies has positioned it as a leader in algal bioreactors, particularly for carbon sequestration and bioenergy production. According to the Food and Drug Administration, biologics, which are heavily reliant on bioreactor technologies, constituted nearly 40% of new drug approvals in recent years. These factors collectively demonstrate the strategic importance of bioreactors in addressing both medical and environmental challenges across North America.

MARKET DRIVERS

Increasing Demand for Biopharmaceuticals

The escalating demand for biopharmaceuticals is a pivotal driver of the North American bioreactors market, fueled by an aging population and the rising incidence of chronic diseases. According to the Centers for Disease Control and Prevention, six in ten adults in the United States suffer from at least one chronic condition, such as diabetes or cardiovascular disease, which are often treated with biologics. Biopharmaceuticals, including monoclonal antibodies and recombinant proteins, require advanced bioreactor systems for their production. According to the National Institutes of Health, biologics account for over 30% of the global pharmaceutical market, with projections indicating continued growth due to their superior efficacy compared to traditional small-molecule drugs. This surge in demand has necessitated the adoption of scalable and efficient bioreactor technologies by fostering innovation and investment in single-use and continuous bioprocessing systems to meet regulatory standards and patient needs.

Government Initiatives and Funding for Biotechnology Research

Government initiatives and funding for biotechnology research significantly propel the bioreactors market forward in North America. According to the National Science Foundation, federal funding for life sciences research exceeded $45 billion in 2022, with substantial allocations directed toward biomanufacturing and bioengineering projects. These investments are instrumental in advancing bioreactor technologies for applications in regenerative medicine and vaccine development. For instance, the Biomedical Advanced Research and Development Authority has committed over $1 billion to support platforms for rapid vaccine production during public health emergencies. Additionally, Canada’s Strategic Innovation Fund’s commitment to sustainable bioprocessing by allocating $1.4 billion to clean technology projects where many of the incorporate algal and microbial bioreactors. Such robust governmental backing accelerates technological breakthroughs by ensuring the region remains at the forefront of bioreactor innovation while addressing global challenges like pandemics and climate change.

MARKET RESTRAINTS

High Initial Capital Investment and Operational Costs

The high initial capital investment and operational costs associated with bioreactor systems pose a significant restraint to the North American bioreactors market. According to the U.S. Department of Commerce is establishing a biomanufacturing facility equipped with advanced bioreactors can require an investment ranging from $200 million to $500 million by depending on the scale and complexity of operations. This financial burden often limits the adoption of cutting-edge bioreactor technologies, particularly for smaller biotech firms and academic institutions. The U.S. Food and Drug Administration emphasizes that maintaining compliance with Current Good Manufacturing Practices (CGMP) further escalates operational expenses, as these regulations mandate stringent quality control measures. Additionally, the cost of single-use bioreactors, which are gaining popularity due to their flexibility, can exceed $1 million per unit. These financial barriers hinder widespread accessibility and slow down the pace of innovation, particularly in resource-constrained settings.

Stringent Regulatory Frameworks and Approval Processes

Stringent regulatory frameworks and lengthy approval processes present another major challenge for the North American bioreactors market. The U.S. Food and Drug Administration mandates rigorous testing and validation of bioreactor systems used in drug production, which can extend development timelines by several years. A report by the Government Accountability Office have shown that it takes an average of 12 to 15 years and costs over $2 billion to bring a new biologic to market, largely due to these regulatory hurdles. According to the Health Canada, any modifications to existing bioreactor designs or processes require additional scrutiny by creating delays in scaling up production. Such complexities discourage innovation and increase the time-to-market for novel therapies for smaller companies with limited resources. These regulatory challenges not only impede technological advancements but also limit the ability to respond swiftly to emerging healthcare needs, such as pandemics or rare disease treatments.

MARKET OPPORTUNITIES

Advancements in Personalized Medicine and Cell Therapy

The growing emphasis on personalized medicine and cell therapy presents a significant opportunity for the North American bioreactors market. The National Cancer Institute reports that immunotherapy treatments, such as CAR-T cell therapies, have shown remarkable success rates of over 80% in certain blood cancer cases by driving demand for advanced bioreactor systems tailored to cell expansion and culture. These therapies require highly controlled environments for large-scale production, where bioreactors play a critical role. According to the Centers for Medicare & Medicaid Services, spending on personalized medicine is projected to grow by 12% annually through 2030 by reflecting increased adoption of precision healthcare solutions. As per the U.S. Department of Health and Human Services, the FDA has approved over 30 cell and gene therapies since 2017 due to the need for scalable bioreactor technologies. This trend positions bioreactor manufacturers to capitalize on the burgeoning demand for innovative, patient-specific treatment modalities.

Expansion of Sustainable Bioprocessing Solutions

The increasing focus on sustainable bioprocessing offers another promising avenue for growth in the North American bioreactors market. The Environmental Protection Agency states that industrial biotechnology, including bio-based production methods, could reduce greenhouse gas emissions by up to 4 billion metric tons annually by 2050. Algal bioreactors, for instance, are gaining traction for their ability to capture carbon dioxide and produce biofuels, with the U.S. Department of Energy estimating that algae-based biofuels could replace up to 17% of U.S. oil imports if scaled effectively. According to the Canada’s Natural Resources Canada, investments in sustainable biomanufacturing technologies have surged by 30% over the past five years, driven by government incentives for green innovation. The bioreactors are poised to play a pivotal role in enabling eco-friendly solutions, from wastewater treatment to renewable energy generation by creating new revenue streams for manufacturers.

MARKET CHALLENGES

Limited Skilled Workforce in Bioprocessing Technologies

A significant challenge for the North American bioreactors market is the shortage of skilled professionals capable of operating and maintaining advanced bioprocessing systems. The U.S. Bureau of Labor Statistics projects that employment in life sciences and biotechnology sectors will grow by 10% annually through 2030 with the supply of qualified workers remains insufficient to meet industry demands. According to the National Science Board, only 17% of undergraduate students in STEM fields pursue specialized training in bioprocessing or bioengineering. This deficit is particularly pronounced in rural areas, where access to technical education programs is limited. The Department of Labor emphasizes that industries reliant on bioreactors face increased operational risks due to human error, which can compromise product quality and regulatory compliance. Addressing this challenge requires targeted workforce development initiatives and partnerships between academia and industry to cultivate expertise in cutting-edge bioreactor technologies.

Vulnerability to Supply Chain Disruptions

The North American bioreactors market faces significant challenges due to vulnerabilities in global supply chains, particularly for critical components like sensors, filters, and single-use bags. The U.S. Department of Commerce reports that over 60% of biomanufacturing materials are sourced internationally by making the industry susceptible to disruptions caused by geopolitical tensions, pandemics, or natural disasters. For instance, during the COVID-19 pandemic, the Food and Drug Administration identified shortages of single-use bioreactor components as a key bottleneck in vaccine production. According to the Canadian government’s Industry Sector Economic Analysis, lead times for certain bioreactor parts have increased by up to 50% since 2020 due to delays in scaling up operations. These supply chain uncertainties not only inflate costs but also hinder innovation and timely delivery of biologics with the need for regionalizing supply networks and investing in domestic manufacturing capabilities to ensure long-term resilience.

SEGMENTAL ANALYSIS

By Material Insights

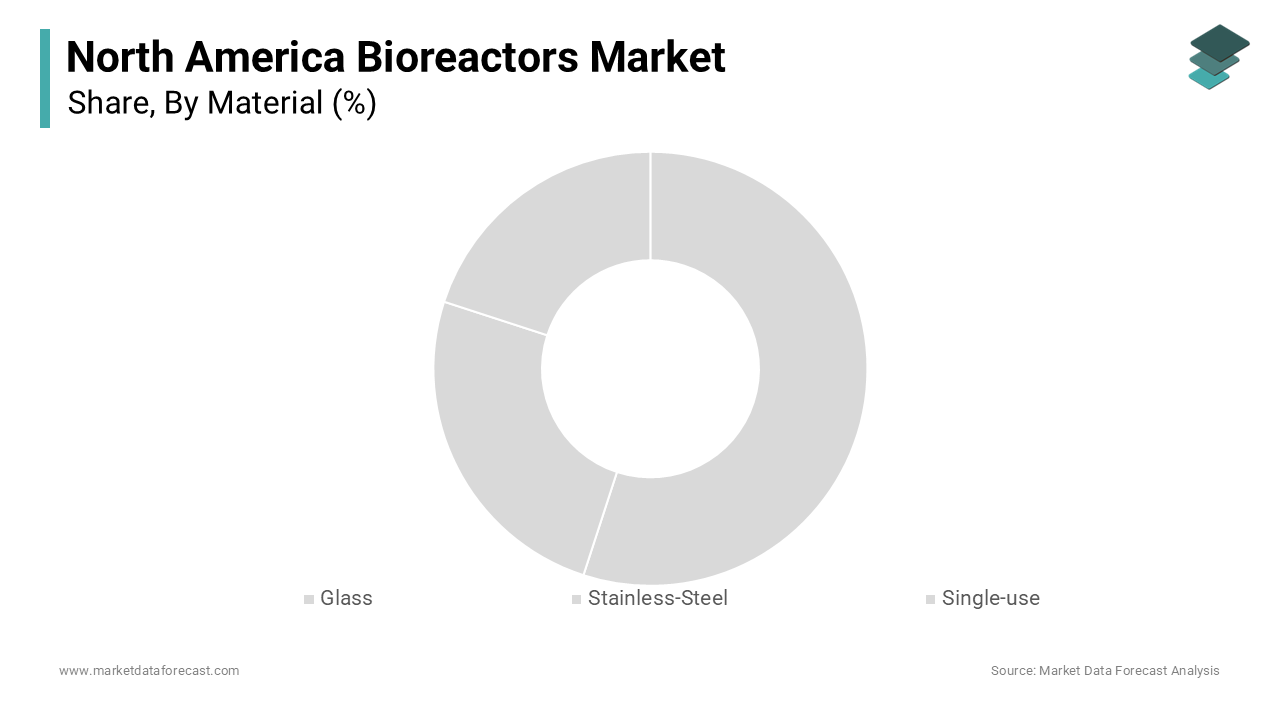

The stainless-steel segment was the largest and held 45.2% of the North American bioreactors market share in 2024. This dominance is attributed to their exceptional durability, reusability, and ability to support large-scale industrial applications by making them indispensable in pharmaceutical manufacturing. According to the National Institute for Occupational Safety and Health, stainless-steel systems are preferred for their compliance with stringent sterilization standards by ensuring consistent quality in biologics production. These bioreactors are particularly critical for producing high-volume therapies such as monoclonal antibodies, which account for over $150 billion in global sales annually, according to the Pharmaceutical Research and Manufacturers of America. Their robustness and cost-effectiveness in long-term operations make them a cornerstone in industries requiring rigorous cleaning and validation protocols. Furthermore, stainless-steel bioreactors are pivotal in addressing the growing demand for scalable solutions capable of supporting the mass production of vaccines and other biologics.

The single-use bioreactors segment is likely to experience as significant CAGR of 17.5% during the forecast period. This rapid expansion is driven by their unparalleled flexibility, reduced risk of cross-contamination, and significantly lower upfront costs compared to traditional stainless-steel systems. According to the Biomedical Advanced Research and Development Authority, single-use systems have revolutionized vaccine development timelines by accelerating production cycles by up to 30% during public health emergencies like the COVID-19 pandemic. According to the Canada’s National Research Council, over 60% of new biomanufacturing facilities now incorporate single-use technologies due to their scalability and ease of implementation. These systems are particularly advantageous for personalized medicine and smaller batch production, where rapid turnaround times and adaptability are paramount. The single-use bioreactors are becoming increasingly vital in enabling efficient, cost-effective, and scalable bioprocessing solutions as the demand for innovative therapies such as cell and gene therapies continues to rise.

By Scale Insights

The 200L-1500L segment dominated the North American bioreactors market with a share of 42.3% in 2024 owing to its suitability for large-scale production of biologics, including monoclonal antibodies and vaccines. According to the National Institutes of Health, over 60% of FDA-approved biologics are manufactured using mid-scale bioreactors due to their critical role in meeting industrial demands. These systems balance scalability and cost-efficiency, making them ideal for commercial-scale operations. Their widespread adoption is further driven by their compatibility with both single-use and stainless-steel configurations by ensuring flexibility in bioprocessing workflows.

The 5L-20L bioreactors segment is estimated to exhibit a prominent CGAR of 18.5% during the forecast period. This rapid growth is fueled by their extensive use in research and development in personalized medicine and cell therapy applications. The National Cancer Institute states that over 70% of preclinical studies utilize small-scale bioreactors for process optimization due to their precision and adaptability. Additionally, the rise in demand for rapid prototyping and small-batch production has amplified their adoption. The Centers for Medicare & Medicaid Services notes that spending on early-stage biotech research grew by 20% annually from 2020 to 2023 that is propelling this segment. These systems' compact design and affordability make them indispensable for innovation-driven sectors by positioning them as a cornerstone for future advancements in bioprocessing technologies.

By Production Size Insights

The full-scale production dominated the North American bioreactors market by accounting for 55.4% of the share in 2024 due to its critical role in large-scale biopharmaceutical manufacturing, including vaccines, monoclonal antibodies, and biotherapeutics. According to the Biotechnology Innovation Organization, over 70% of FDA-approved biologics are produced at full scale by necessitating robust bioreactor systems capable of handling high volumes. Full-scale bioreactors are indispensable for meeting global demand, particularly during public health crises like the COVID-19 pandemic, where rapid vaccine deployment was essential. Their dominance is due to their importance in ensuring cost-effective, high-volume production to address widespread healthcare needs.

The lab-scale production segment is swiftly growing with an estimated CGAR of 12.3% during the forecast period. This rapid expansion is driven by increasing investments in early-stage research and development, particularly in personalized medicine and gene therapy. The Centers for Disease Control and Prevention notes that over 40% of new drug candidates entering clinical trials require lab-scale bioreactors for initial testing and optimization. Additionally, the rise of academic-industry collaborations has fueled demand for compact, versatile systems that support innovative research. The U.S. Food and Drug Administration emphasizes that advancements in lab-scale bioreactors accelerate drug discovery timelines, reducing time-to-market for novel therapies. This segment’s growth reflects its pivotal role in fostering innovation and addressing unmet medical needs through cutting-edge biotechnological solutions.

By Control Type Insights

The automated bioreactors segment was the largest and dominated the North American market by capturing a significant share in 2024 due to their precision in controlling gas flow rates and maintaining optimal culture conditions, which are critical for high-yield bioprocessing. According to the National Institute of Standards and Technology, automated systems reduce human error by up to 40% by ensuring consistent quality in biologics production.

The automated segment is likely to gain a CAGR of 12.8% during the forecast period. This rapid growth is fueled by the increasing adoption of Industry 4.0 technologies, such as AI and IoT, which enhance bioreactor efficiency. The National Institutes of Health notes that automated systems can improve production timelines by up to 30%, addressing the urgent need for faster vaccine and therapeutic development. According to Canada’s Innovation, Science and Economic Development agency, investments in digital biomanufacturing have surged by over 25% annually with rising sustainability goals. These advancements are promoting the segment’s role in meeting regulatory standards while reducing operational costs by making it indispensable for future bioprocessing innovations.

By End Users Insights

The biopharmaceutical companies dominated the North American bioreactors market by holding a market share of 45.4% in 2024 due to their pivotal role in producing biologics, which account for over $200 billion in annual revenue in the U.S. alone. The National Institutes of Health reports that biopharmaceuticals represent more than 30% of the global drug pipeline by necessitating advanced bioreactor systems for large-scale production. These companies prioritize scalability, precision, and compliance with stringent regulatory standards by making bioreactors indispensable.

The Contract Manufacturing Organizations (CMOs) segment is anticipated to rule the North America bioreactors market with a CAGR of 15.8% from 2025 to 2033. This growth is driven by the increasing outsourcing of biologics manufacturing by biopharmaceutical companies seeking cost efficiency and operational flexibility. According to the Food and Drug Administration (FDA), over 30% of biologics are now produced by CMOs by reflecting their rising importance. As per Health Canada, investments in single-use bioreactors by CMOs have surged by 25% annually by enabling rapid scalability for diverse therapeutic needs. The demand for CMOs is further fueled by the rise in personalized medicine and biosimilars by positioning them as key enablers of innovation and capacity expansion in the biopharmaceutical industry.

By Suppliers Insights

The Original Equipment Manufacturers (OEMs) segment dominated the North American bioreactors market by occupying a share of 60.2% in 2024. Their ability to provide innovative, high-quality bioreactor systems tailored to diverse applications, from pharmaceuticals to biofuels is likely to propel the growth of the market. According to the National Institutes of Health, OEMs are pivotal in addressing the growing demand for single-use bioreactors, which account for over 35% of bioprocessing equipment sales. Their direct relationships with end-users ensure seamless integration and after-sales support. OEMs' focus on R&D enables them to meet stringent regulatory standards by ensuring reliability and scalability for complex biologics production.

The system integrators segment is likely to pose a CAGR of 14.5% in the next coming years. This rapid growth is driven by the increasing complexity of bioprocessing systems by requiring specialized expertise to integrate bioreactors with automation and monitoring technologies. The Food and Drug Administration emphasizes that integrated systems enhance process efficiency and compliance with CGMP regulations by reducing production timelines by up to 20%. Additionally, Canada’s National Research Council reports that investments in digitalization and Industry 4.0 solutions have surged by 25% annually that further propel the demand for system integrators. Their role in optimizing workflows and enabling real-time data analytics makes them indispensable for scaling biologics production and addressing the rising need for cost-effective and sustainable bioprocessing solutions.

REGIONAL ANALYSIS

The United States dominated the North American bioreactors market with a prominent share of 85.3% in 2024, owing to the robust biotechnology infrastructure, with over 1,800 biotech firms operating nationwide, supported by federal funding exceeding $45 billion annually for life sciences research, according to the National Institutes of Health. The U.S. remains a global hub for biopharmaceutical innovation by producing nearly half of all FDA-approved biologics. Its emphasis on advanced manufacturing technologies, including single-use and continuous bioprocessing systems that ensures scalability and compliance with stringent regulatory standards.

Canadian bioreactors market is esteemed to have a CAGR of 12.3% during the forecast period. This growth is fueled by the nation’s focus on green technologies and renewable energy solutions, with investments in algal bioreactors for carbon capture increasing by 30% annually. Natural Resources Canada reports that bio-based industries contribute over $59 billion to the national GDP, supported by government initiatives like the Strategic Innovation Fund, which allocates $1.4 billion to clean tech projects. Canada’s commitment to reducing greenhouse gas emissions by 40-45% by 2030 drives demand for sustainable bioprocessing systems. Its growing expertise in algal bioreactors and biofuels positions it as a leader in eco-friendly biomanufacturing by addressing global climate challenges while fostering economic growth.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Key Market Participants Leading the North America Bioreactors Market Profiled in the Report are Sartorius AG, Thermo Fisher Scientific, Merck KGaA, GE Healthcare, Danaher Corporation, Eppendorf AG, and significant Engineering, Procurement and Construction (EPC) players included in this report are Amec Foster Wheeler plc., Fluor Corporation, Jacobs Engineering Group Inc., M+W Group, PM Group, and Technip S.A.

The North American bioreactors market is characterized by intense competition, driven by the presence of established global players and emerging regional firms striving to capitalize on the growing demand for bioprocessing solutions. The market is highly consolidated, with key players such as Sartorius AG, Thermo Fisher Scientific, Merck KGaA, and GE Healthcare dominating the landscape through their innovative product portfolios and extensive distribution networks. These companies leverage advanced technologies like single-use bioreactors, continuous processing systems, and integrated automation platforms to maintain their competitive edge. Strategic initiatives such as mergers, acquisitions, and partnerships are frequently employed to expand market share and enhance technological capabilities. For instance, Danaher Corporation has strengthened its position through targeted acquisitions, while Merck KGaA has collaborated with biotech firms to develop customized solutions.

Emerging players and engineering, procurement, and construction (EPC) firms like Fluor Corporation and Jacobs Engineering Group Inc. are also contributing to the competitive dynamics by focusing on large-scale biomanufacturing facilities and infrastructure development. The emphasis on sustainability and regulatory compliance further intensifies competition, as companies vie to offer eco-friendly and CGMP-compliant systems. Additionally, the rise of personalized medicine and cell therapies has created niche opportunities, prompting firms to differentiate themselves through specialized offerings. Overall, the competitive environment in the North American bioreactors market is shaped by innovation, strategic collaborations, and a relentless focus on meeting the evolving needs of the biopharmaceutical and biotechnology industries.

Top 3 Players in the Market

Sartorius AG

Sartorius AG is a leading player in the North American bioreactors market, renowned for its cutting-edge single-use bioreactor technologies and comprehensive bioprocessing solutions. The company has established itself as a key enabler of innovation in the biopharmaceutical sector, offering scalable systems that cater to both small-scale research and large-scale commercial production. Sartorius’s strong emphasis on automation and digital integration has positioned it as a pioneer in Industry 4.0 applications for bioprocessing. Its contributions extend beyond equipment supply, as the company actively collaborates with pharmaceutical firms to optimize workflows and enhance process efficiency, ensuring compliance with stringent regulatory standards.

Thermo Fisher Scientific

Thermo Fisher Scientific is another dominant force in the North American bioreactors market, leveraging its extensive portfolio of bioprocessing equipment and consumables to address the growing demand for biologics and cell therapies. The company’s expertise lies in providing end-to-end solutions, from upstream bioreactor systems to downstream purification processes. Thermo Fisher’s commitment to sustainability is evident in its development of energy-efficient bioreactor designs and single-use technologies that minimize environmental impact. By fostering strategic partnerships with biotech companies and research institutions, Thermo Fisher plays a pivotal role in advancing personalized medicine and accelerating drug discovery pipelines across the region.

Merck KGaA

Merck KGaA has cemented its position as a major contributor to the North American bioreactors market through its innovative bioprocessing technologies and focus on customization. The company’s Mobius® line of single-use bioreactors is widely recognized for its flexibility and reliability, making it a preferred choice for biologics production. Merck KGaA’s dedication to addressing unmet needs in the industry is reflected in its continuous investment in R&D, enabling the development of advanced bioreactor systems tailored to emerging applications such as cell and gene therapies.

Top strategies used by the key market participants

Innovation and Product Development

Key players in the North American bioreactors market prioritize innovation and product development to maintain their competitive edge. Companies like Sartorius AG and Thermo Fisher Scientific consistently invest in research and development to introduce cutting-edge technologies, such as single-use bioreactors and continuous bioprocessing systems. These advancements cater to the evolving needs of the biopharmaceutical industry, particularly for applications in personalized medicine and cell therapies. Additionally, customization of bioreactor systems to address specific client requirements has become a hallmark of their strategies, enabling them to serve diverse industries ranging from pharmaceuticals to biofuels.

Strategic Collaborations and Partnerships

Strategic collaborations and partnerships are another cornerstone of growth strategies adopted by key players. For instance, Merck KGaA and GE Healthcare have forged alliances with academic institutions, biotech startups, and pharmaceutical giants to co-develop innovative solutions and streamline bioprocessing workflows. These partnerships facilitate knowledge sharing and accelerate the commercialization of novel therapies, reinforcing their leadership in the market. Furthermore, companies engage in joint ventures with regional players to expand their geographic footprint and tap into underserved markets. Such collaborations not only enhance their technological capabilities but also strengthen their brand presence and customer loyalty.

Mergers, Acquisitions, and Expansions

Mergers, acquisitions, and facility expansions are pivotal strategies employed by leading firms to consolidate their market position. Danaher Corporation and Thermo Fisher Scientific have actively pursued acquisitions to broaden their product portfolios and integrate complementary technologies. These moves enable them to offer end-to-end solutions, from upstream bioreactor systems to downstream purification processes. Simultaneously, companies like Eppendorf AG focus on expanding their manufacturing capacities and service networks to meet rising demand and reduce lead times.

RECENT MARKET DEVELOPMENTS

- In February 2025, Thermo Fisher Scientific announced its acquisition of Solventum’s purification and filtration business for approximately $4.1 billion. This acquisition aims to enhance Thermo Fisher’s bioprocessing capabilities in North America by expanding its filtration solutions.

- In January 2025, Sartorius AG announced significant investments in expanding its single-use technologies for biopharmaceuticals. This initiative focuses on increasing production capacities and developing new products to support bioprocessing in North America.

- In January 2025, Thermo Fisher Scientific reported increased demand for its bioprocessing products and services used in drug development. This growth reflects the company’s strengthened position in North America’s bioprocessing market.

- In March 2024, Thermo Fisher Scientific announced investments to expand its bioprocessing infrastructure in North America. This initiative focuses on increasing manufacturing capacities for single-use technologies and improving service offerings.

- In June 2023, Eppendorf AG introduced a new line of advanced bioreactor systems tailored for the North American market. These systems feature enhanced automation and scalability, addressing the evolving needs of biopharmaceutical companies.

- In August 2024, Jacobs Engineering Group announced collaborations with leading biotech firms to design and construct state-of-the-art bioprocessing facilities in North America. These partnerships leverage Jacobs’ engineering expertise to support the growing bioreactor market.

- In April 2023, Fluor Corporation expanded its biopharmaceutical project portfolio, focusing on designing and constructing bioreactor facilities. This strategic diversification positions Fluor to capitalize on the increasing demand for bioprocessing infrastructure in North America.

MARKET SEGMENTATION

This research report on the North America Bioreactors Market has been segmented and sub-segmented the North America Bioreactors Market into the following categories:

By Material

- Glass

- Stainless-Steel

- Single-use

By Scale

- 5L-20L

- 20L-200L

- 200L-1500L

- Over 1500L

By Production Size

- Lab-Scale Production

- Pilot-Scale Production

- Full-Scale Production

By Control Type

- Manual

- Automated (MFCs)

By End Users

- R&D Departments

- R&D Institutes

- CRO’s

- Biopharmaceutical Companies

- Biopharmaceutical Manufacturers

- CMO’s

By Suppliers

- OEMs

- System Integrators

- EPCs

By Country

- The United States

- Canada

- Rest of North America

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com