North America Blood Glucose Monitoring Market Research Report – Segmented By Type ( test strips, lancets ) Glucose Monitoring (sensors ,durables) and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

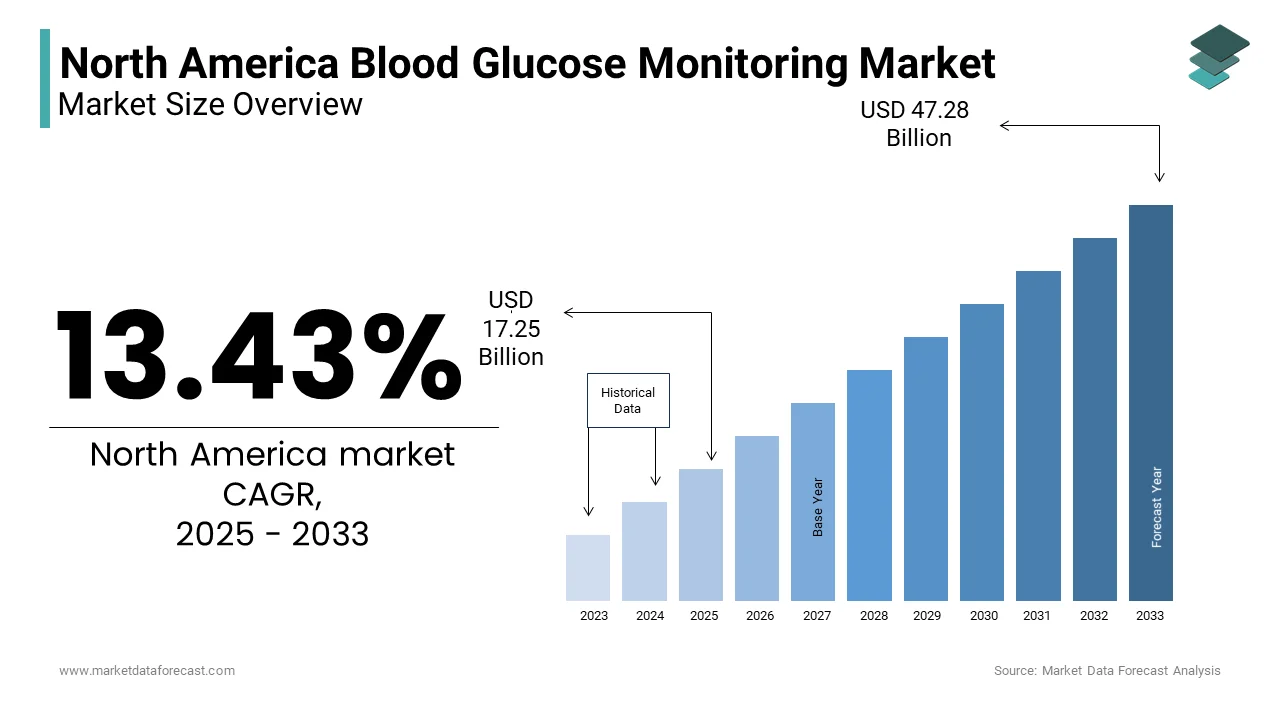

North America Blood Glucose Monitoring Market Size

The North America Blood Glucose Monitoring Market Size was valued at USD 15.21 billion in 2024. The North America Blood Glucose Monitoring Market size is expected to have 13.43% CAGR from 2025 to 2033 and be worth USD 47.28 billion by 2033 from USD 17.25 billion in 2025.

The North American blood glucose monitoring market is driven by escalating diabetes prevalence and technological advancements. As per the International Diabetes Federation, approximately 38 million adults in the United States alone were living with diabetes in 2021. The region's market thrives on its advanced healthcare infrastructure, high patient awareness, and strong adoption of digital health technologies. According to the Centers for Disease Control and Prevention, over 37% of adults aged 20 years or older show pre-diabetic conditions that is further expanding the target demographic. Additionally, government initiatives like the National Diabetes Prevention Program have bolstered awareness and accessibility, driving demand for self-monitoring tools. The U.S. dominates this market due to its extensive research and development ecosystem, while Canada showcases steady growth attributed to rising diabetic cases among aging populations.

MARKET DRIVERS

Rising Prevalence of Diabetes

The escalating incidence of diabetes serves as a cornerstone for the North American blood glucose monitoring market's growth. As per data from the American Diabetes Association, nearly 11.3% of the U.S. population had diabetes in 2019 is translating to over 34 million individuals requiring regular monitoring. This figure is projected to rise, with estimates suggesting that one in three Americans could develop diabetes by 2050 if current trends persist. Such alarming statistics create an urgent demand for accurate and accessible blood glucose monitoring devices. Moreover, type 2 diabetes, which accounts for about 90-95% of all diagnosed cases is disproportionately affects older adults with a demographic expected to grow significantly due to aging baby boomers. This demographic shift amplifies the need for continuous monitoring solutions. The increasing prevalence of obesity, a major risk factor for diabetes. According to the National Institute of Diabetes and Digestive and Kidney Diseases, more than 42% of U.S. adults are obese, directly contributing to higher diabetes rates.

Technological Advancements

Technological innovations are revolutionizing the blood glucose monitoring market is making devices smarter and more user-friendly. For instance, Abbott Laboratories introduced the FreeStyle Libre system, which eliminates the need for routine finger pricks by offering real-time glucose readings through wearable sensors. As per Abbott's reports, over 4 million users globally benefit from this technology, underscoring its widespread acceptance. Furthermore, the integration of artificial intelligence (AI) and cloud-based platforms enhances device functionality is enabling personalized insights and predictive analytics. Smart glucometers connected via Bluetooth or Wi-Fi allow seamless data sharing between patients and healthcare providers is improving disease management. These advancements appeal not only to tech-savvy younger generations but also to elderly patients seeking convenience. The rapid pace of innovation ensures consistent product upgrades, sustaining consumer interest and driving market growth.

MARKET RESTRAINTS

High Costs of Advanced Devices

One significant barrier hindering broader adoption of blood glucose monitoring devices is their prohibitive cost. Advanced systems, such as continuous glucose monitors (CGMs), often come with hefty price tags that deter many patients, particularly those without adequate insurance coverage. According to a study published in Diabetes Care , the annual cost of CGM usage can exceed $3,000, including sensor replacements and associated supplies. For low-income households, these expenses pose a substantial financial burden, limiting access despite the clinical benefits. Even traditional glucometers and test strips remain costly, discouraging frequent testing among uninsured or underinsured individuals. A report by the Commonwealth Fund indicates that nearly 28 million Americans lack sufficient health insurance, further exacerbating affordability issues. Additionally, reimbursement policies for diabetes management tools vary widely across states, creating disparities in accessibility. While some private insurers cover CGMs, Medicare restrictions often leave senior citizens struggling to afford these devices.

Regulatory Hurdles and Compliance Challenges

Stringent regulatory frameworks governing medical device approvals represent another obstacle for manufacturers operating in this space. The U.S. Food and Drug Administration (FDA) mandates rigorous clinical trials and post-market surveillance for glucose monitoring devices by ensuring safety and efficacy before commercialization. However, these processes are time-consuming and resource-intensive is delaying product launches and increasing R&D expenditures. According to the FDA’s Center for Devices and Radiological Health, obtaining premarket approval for novel devices can take up to two years or longer is depending on complexity. Smaller companies with limited budgets may struggle to navigate these requirements. Moreover, compliance with evolving standards, such as ISO 13485 for quality management systems, adds another layer of complexity. Non-compliance risks severe penalties, including recalls or bans, as seen in cases where defective products failed to meet regulatory benchmarks.

MARKET OPPORTUNITIES

Integration with Telemedicine Platforms

The convergence of telehealth services with blood glucose monitoring presents a lucrative opportunity for market expansion. Telemedicine has gained unprecedented traction during the COVID-19 pandemic, with McKinsey reporting a 38-fold increase in virtual care utilization. This trend extends to chronic disease management, where remote monitoring tools play a pivotal role. By integrating glucose monitoring devices with telehealth platforms, patients can seamlessly transmit their readings to healthcare providers by enabling timely interventions. For instance, Dexcom’s partnership with Livongo allows real-time data sharing is enhancing patient outcomes. Such collaborations foster greater adherence to treatment plans and improve glycemic control. Furthermore, the proliferation of smartphone apps designed for diabetes management creates an ecosystem conducive to innovation.

Expansion into Emerging Markets

Another promising avenue lies in tapping into emerging markets within North America. These regions exhibit rising diabetes prevalence coupled with increasing healthcare investments, creating fertile ground for market entrants. According to the World Health Organization, Mexico ranks sixth globally in terms of diabetes-related mortality with an urgent need for affordable monitoring solutions. Meanwhile, economic reforms and improved healthcare infrastructure in countries like Costa Rica and Panama present opportunities for strategic partnerships. Companies can adopt localized strategies, such as developing cost-effective devices tailored to regional preferences. Collaborations with local distributors and government agencies facilitate smoother market entry. Additionally, educational campaigns targeting underserved communities help raise awareness about diabetes management is boosting demand. Expanding footprints into these markets not only diversifies revenue streams but also strengthens brand presence across the continent.

MARKET CHALLENGES

Data Privacy Concerns

The integration of digital technologies in blood glucose monitoring raises concerns about data privacy and cybersecurity. With devices transmitting sensitive health information to cloud servers or mobile apps, there is heightened vulnerability to hacking and unauthorized access. According to Verizon’s 2021 Data Breach Investigations Report, healthcare remains one of the most targeted sectors, accounting for nearly 79% of all ransomware attacks. Such breaches compromise patient confidentiality and erode trust in digital solutions. For example, a cyberattack on Medtronic in 2020 disrupted insulin pump operations with the risks posed by interconnected systems. Addressing these vulnerabilities requires robust encryption protocols and stringent compliance with regulations like HIPAA. However, implementing these measures increases operational costs, straining smaller companies. Balancing innovation with security remains a persistent challenge is potentially slowing down technological adoption.

Limited Awareness Among Underserved Populations

Despite advancements, awareness about modern blood glucose monitoring tools remains low among certain underserved communities. Ethnic minorities, rural residents, and economically disadvantaged groups often lack access to updated information is leading to suboptimal diabetes management. According to the National Institutes of Health, Hispanic and African American populations face disproportionately higher diabetes prevalence yet lower utilization rates of advanced monitoring devices. Cultural barriers, language gaps, and mistrust in healthcare systems further compound the issue. Educational outreach programs are essential to bridge this knowledge gap, but they require substantial investment and coordination. Without targeted efforts, these populations may continue relying on outdated methods. Bridging this divide necessitates innovative approaches, such as community workshops and culturally tailored resources, to ensure equitable access.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

13.43 % |

|

Segments Covered |

By Type,Glucose Monitoring and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Dexcom, Johnson & Johnson,Medtronics, F. Hoffmann-La Roche AG,Abbott Diabetes Care |

SEGMENTAL ANALYSIS

By Type Insights

The test strips segment dominated the North America blood glucose monitoring market and held 60.1% of share in 2024. The growth of the segment is likely to be driven by the indispensability in daily glucose monitoring routines. Each test strip provides precise readings when paired with glucometers by ensuring reliable tracking of blood sugar levels. Factors driving this dominance include affordability compared to CGMs and widespread availability across pharmacies and online retailers. Additionally, the simplicity of use appeals to elderly patients who prioritize ease of operation. Ongoing innovations, such as enhanced accuracy and compatibility with multiple devices, sustain consumer loyalty.

The lancets segment is swiftly emerging with a CAGR of 7.5% from 2025 to 2033. Their rapid growth is fueled by the rising adoption of home-based monitoring practices. Miniaturized lancets designed for painless pricking attract tech-savvy consumers seeking comfort and convenience. Innovations like adjustable depth settings cater to diverse skin types, broadening applicability. Furthermore, disposable lancets address hygiene concerns is aligning with post-pandemic preferences for single-use products. Partnerships between manufacturers and e-commerce platforms enhance accessibility, driving sales volumes. For instance, Amazon’s exclusive deals on branded lancets boost visibility and affordability.

By Glucose Monitoring Insights

The sensors segment held the dominant share of the North America blood glucose monitoring market in 2024. The growth of the segment is from their critical role in providing real-time glucose data by empowering users to make informed decisions. Key drivers include superior accuracy, reduced reliance on manual testing, and compatibility with smart devices. Leading brands like Dexcom and Abbott continuously refine sensor technology, incorporating features like extended wear durations and factory calibration. According to a study in Diabetes Technology & Therapeutics , patients using CGM sensors experience a 1% reduction in HbA1c levels, validating their clinical efficacy. Favorable insurance coverage policies also bolster adoption, particularly among type 1 diabetics.

The durables segment is lucratively growing with a significant CAGR of 9.2% during the orecast period. This surge is attributable to the growing emphasis on durable, reusable components that reduce long-term costs. Transmitters equipped with Bluetooth connectivity enable seamless data synchronization, enhancing user experience. Manufacturers focus on durability and battery life improvements, addressing key consumer pain points. For example, Medtronic’s Guardian Connect system boasts a transmitter lifespan of six months, appealing to value-conscious buyers. Additionally, regulatory approvals for next-generation durables accelerate market entry. The shift towards subscription-based models further supports growth, ensuring recurring revenue streams.

Country Level Analysis

The U.S. led the North American blood glucose monitoring market by holding 85.6% of share in 2024. Its dominance is underpinned by a highly developed healthcare ecosystem and a large diabetic population. Government initiatives, such as the Affordable Care Act are to enhance accessibility to monitoring tools by fostering widespread adoption. Technological hubs like Silicon Valley drive innovation, with startups pioneering AI-driven solutions. A report by the Centers for Disease Control and Prevention have shown that over 10% of the U.S. population lives with diabetes that is ensuring sustained demand. Investments in R&D and favorable reimbursement policies further boost the growth of the market in this country.

Canada is esteemed to achieve a highest CAGR of 12.3% during the forecast period owing to the increasing diabetes prevalence among seniors. Statistics Canada reports that over 3 million Canadians live with diabetes by necessitating robust monitoring solutions. Publicly funded healthcare ensures affordability is encouraging device usage. Provincial programs promoting diabetes prevention bolster awareness. Collaboration between academia and industry spurs technological breakthroughs by positioning Canada as a key player.

Top 3 Players in the Market

Abbott Laboratories

Abbott Laboratories stands at the forefront of the blood glucose monitoring market, renowned for its groundbreaking FreeStyle Libre system. The company leverages its expertise in biosensors to deliver non-invasive solutions by setting industry benchmarks. Its strengths include a vast distribution network and relentless focus on R&D, enabling frequent product updates. Abbott’s collaborations with tech giants amplify its reach is ensuring global prominence.

Dexcom Inc.

Dexcom specializes in continuous glucose monitoring, offering advanced systems like the G6 and G7. Known for superior accuracy and real-time data transmission, Dexcom caters to tech-savvy consumers. Its strategic alliances with telehealth platforms enhance usability is reinforcing its market position.

Roche Diagnostics

Roche Diagnostics excels in producing high-quality self-monitoring devices, including Accu-Chek glucometers. With decades of experience, Roche combines precision engineering with user-friendly designs. Its commitment to sustainability and ethical practices earns trust worldwide. Extensive clinical validation supports its reputation for reliability.

Top strategies used by the key market participants

Key players employ diverse strategies to consolidate their foothold. Product innovation remains paramount, with firms investing heavily in R&D to launch cutting-edge devices. Strategic partnerships with tech companies and healthcare providers expand market reach. Geographic expansion into untapped regions diversifies revenue streams. Pricing strategies, such as tiered models, cater to varied demographics. The educational campaigns raise awareness by fostering long-term growth.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North American blood glucose monitoring market are Dexcom, Johnson & Johnson,Medtronics, F. Hoffmann-La Roche AG,Abbott Diabetes Care

The North American blood glucose monitoring market is fiercely competitive, characterized by intense rivalry among established giants and emerging startups. Dominant players like Abbott and Dexcom leverage technological prowess to maintain its dominance, while smaller firms focus on niche segments. The influx of AI-driven solutions intensifies competition, compelling companies to innovate continuously. Mergers and acquisitions streamline operations, enhancing scalability.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Abbott acquired a startup specializing in AI-driven glucose analytics, enhancing predictive capabilities.

- In June 2023, Dexcom partnered with Fitbit to integrate CGM data with fitness trackers.

- In February 2023, Roche launched an eco-friendly glucometer line targeting environmentally conscious consumers.

- In September 2022, Medtronic unveiled a next-gen CGM sensor with extended wear duration.

- In January 2022, Lifescan collaborated with CVS Pharmacy to offer discounted monitoring kits nationwide.

MARKET SEGMENTATION

This research report on the North American Blood Glucose Monitoring Market has been segmented and sub-segmented into the following categories.

By Type

- test strips

- lancets

By Glucose Monitoring

- sensors

- durables

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What is the current size of the North American blood glucose monitoring market?

The market size varies based on reports, but it is projected to grow significantly due to rising diabetes prevalence and technological advancements.

What are the major types of blood glucose monitoring devices available?

The main types include Self-Monitoring Blood Glucose (SMBG) devices (glucometers, test strips, lancets) and Continuous Glucose Monitoring (CGM) systems.

How is technology evolving in the blood glucose monitoring market?

The market is seeing innovations like non-invasive glucose monitors, AI-based predictive analytics, smartphone integration, and implantable CGMs.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com