North America Blow Molded Plastics Market Size Share, Trends & Growth Forecast Report By Technology (Extrusion Blow Molding, Injection Blow Molding, Stretch Blow Molding, Compound Blow Molding), Product, Application and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Blow Molded Plastics Market Size

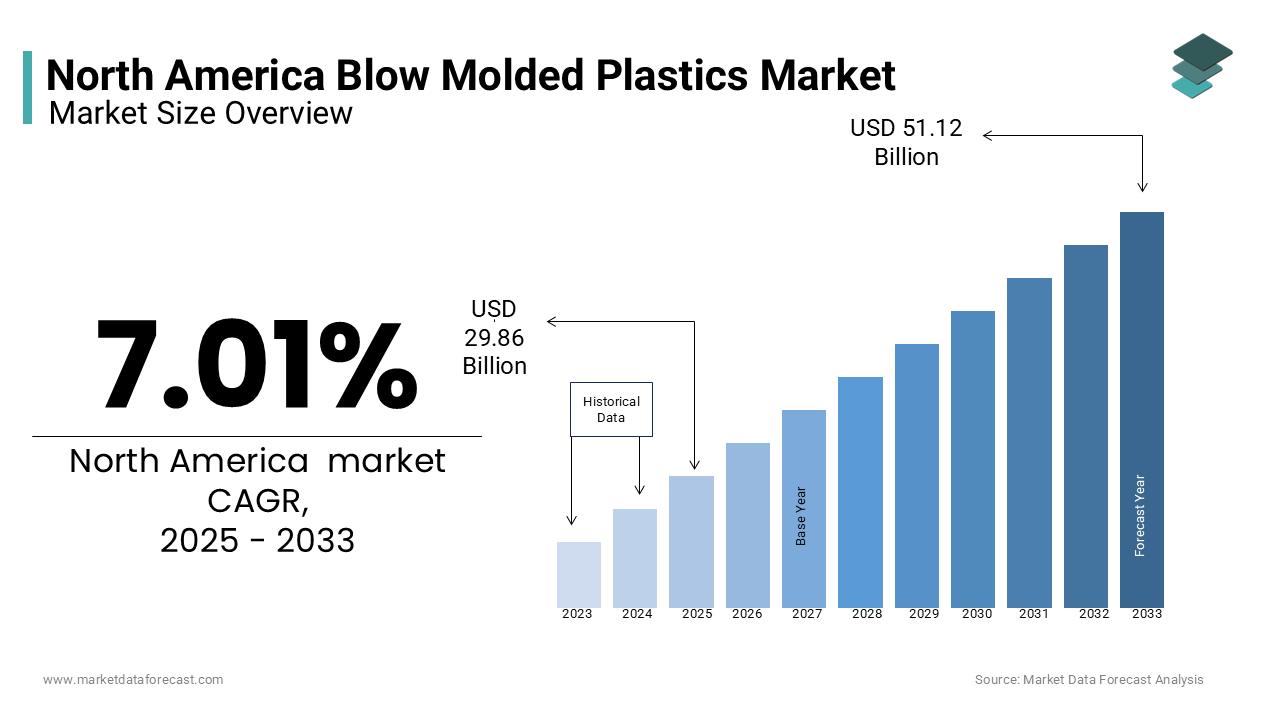

The North America blow molded plastics market was worth USD 27.82 billion in 2024. The North America market is expected to reach USD 51.12 billion by 2033 from USD 29.86 billion in 2025, rising at a CAGR of 7.01% from 2025 to 2033.

MARKET DRIVERS

Growth in the Packaging Industry

The packaging industry is a primary driver of the blow molded plastics market in North America, fueled by the increasing demand for lightweight and durable containers. Like, flexible and rigid plastic packaging accounted for a significant portion of all packaging materials used in the U.S. in 2022. These molded plastics and particularly polyethylene and polypropylene variants, are widely used in the production of bottles, jugs, and containers due to their superior strength-to-weight ratio and cost efficiency. Also, the rise of e-commerce has further amplified demand, which states that online retail sales in North America grew notably in recent years, necessitating robust packaging solutions. Additionally, advancements in material science have enabled the development of thinner yet stronger blow molded products, reducing material costs while maintaining performance. These innovations align perfectly with the needs of the packaging industry, making blow molded plastics indispensable in this sector.

Adoption in the Automotive Sector

Another significant driver is the growing adoption of blow molded plastics in the automotive industry. It is driven by the need for lightweight components to enhance fuel efficiency and reduce emissions. Similarly, the average vehicle in North America contains higher pounds of plastic components, with blow molded parts accounting for a substantial portion. This plastic type is used in applications such as fuel tanks, air ducts, and structural components due to their durability, chemical resistance, and ability to meet stringent safety standards. Also, vehicles with lightweight plastic components can achieve notable improvement in fuel efficiency, exhibiting the material’s value in modern automotive design. Furthermore, the push toward electric vehicles (EVs), as outlined by the Biden administration’s goal to have EVs account for a major share of new car sales by 2030, has increased demand for blow molded plastics in battery housings and cooling systems.

MARKET RESTRAINTS

Environmental Concerns and Regulatory Pressure

Among the primary restraints impeding the growth of the blow molded plastics market is the increasing scrutiny of plastic waste and its environmental impact. Governments across North America have implemented stringent regulations aimed at reducing plastic usage and promoting recycling. For instance, Canada’s Single-Use Plastics Ban whish was introduced in 2022 and prohibits the manufacture and import of certain plastic products including bottles and containers made from non-recyclable materials. Similarly, California’s Plastic Pollution Prevention and Packaging Producer Responsibility Act mandates that all single-use packaging be recyclable or compostable by 2032. Like, only a small percentage of plastics produced globally are recycled, creating significant challenges for the industry. These regulatory pressures along with growing consumer demand for sustainable alternatives force manufacturers to invest heavily in research and development to create eco-friendly solutions and thereby increasing operational costs.

Volatility in Raw Material Prices

Another significant restraint is the volatility in raw material prices, particularly for petroleum-based resins like polyethylene and polypropylene. Similarly, raw material costs for blow molded plastics increased in 2022 due to geopolitical tensions and supply chain disruptions. The reliance on fossil fuels for resin production makes the industry vulnerable to fluctuations in crude oil prices, as noted by the U.S. Energy Information Administration. Besides, the limited availability of bio-based alternatives exacerbates the challenge, as these materials often come at a premium. Also, companies using traditional resins face profit margin reductions during periods of price volatility.

MARKET OPPORTUNITIES

Advancements in Bioplastics and Recyclable Materials

Advancements in bioplastics and recyclable materials represent a significant opportunity for the blow molded plastics market. Researchers are developing bio-based resins derived from renewable sources such as corn starch, sugarcane, and algae, offering a sustainable alternative to traditional petroleum-based plastics. Also, companies like NatureWorks and Braskem are pioneering the use of polylactic acid (PLA) and bio-polyethylene in blow molding applications enabling the production of fully recyclable and compostable products. Additionally, innovations in chemical recycling technologies allow manufacturers to break down complex plastics into their original monomers, facilitating closed-loop systems. These developments not only address environmental concerns but also open new revenue streams for companies willing to invest in sustainable solutions.

Expansion in the Medical Sector

The medical sector presents further promising opportunities for the blow molded plastics market which is propelled by the increasing demand for sterile and disposable medical devices. Blow molded plastics are widely used in the production of items such as IV bottles, inhalers, and diagnostic equipment due to their transparency, chemical resistance, and ability to meet stringent hygiene standards. Like, the adoption of single-use plastics in healthcare settings has increased greatly since the onset of the COVID-19 pandemic, exhibiting the material’s importance. Furthermore, the aging population in North America is driving demand for advanced medical devices creating opportunities for blow molded plastics to play a pivotal role in this expanding market.

MARKET CHALLENGES

Competition from Alternative Materials

One of the foremost challenges facing the blow molded plastics market is the growing competition from alternative materials such as glass, metal, and paper-based products. These materials are often perceived as more environmentally friendly, particularly in applications like beverage packaging and food containers. Similarly, glass containers accounted for a key share of the U.S. packaging market which is driven by consumer preferences for recyclable and reusable options. Likewise, the rise of paper-based packaging, supported by initiatives from companies like Amazon and Walmart, poses a threat to the dominance of plastics.

Technological Limitations in Customization

Another significant challenge is the technological limitations associated with customizing blow molded products for niche applications. While blow molding excels in producing large, hollow items like bottles and tanks, it faces challenges in achieving intricate designs or varying wall thicknesses required for specialized components. Also, achieving consistent quality in small-batch or highly customized products can increase production costs. This limitation restricts the material’s adoption in industries like electronics and aerospace, where precision and customization are critical. Additionally, the lack of widespread adoption of advanced technologies such as 3D printing for blow molding hinders innovation in this space.

SEGMENTAL ANALYSIS

By Technology Insights

The extrusion blow molding segment spearheaded the North American market by capturing 55.1% of the total share in 2024. Their popularity is credited to their cost-effectiveness and ability to produce large as well as hollow items such as bottles and containers. According to the Plastics Industry Association, extrusion blow molding is the preferred technology for over 60% of packaging applications due to its versatility and scalability. The segment’s growth is further driven by advancements in automation and process optimization, enabling faster production cycles and higher output.

The stretch blow molding segment is the fastest-growing, with a projected CAGR of 6.2% through 2033. This growth is fueled by the increasing demand for lightweight and transparent containers in the beverage and personal care industries. According to Beverage Marketing Corporation, PET bottles produced using stretch blow molding accounted for a substantial portion of all bottled water containers sold in North America in 2022. Additionally, advancements in material science have enabled the development of thinner yet stronger PET bottles, reducing material costs while maintaining performance.

By Product Insights

The polyethylene segment dominated the North American blow molded plastics market by holding 45.6% of the total share in 2024. Moreover, the dominance of this segment is attributed to its versatility, durability, and cost-effectiveness, making it ideal for applications like bottles, jugs, and containers. Like, high-density polyethylene (HDPE) accounts for major share of all polyethylene used in blow molding due to its excellent chemical resistance and impact strength. The segment’s growth is further driven by the increasing adoption of HDPE in the packaging and automotive industries.

The category of polystyrene is the fastest expanding segment, with a projected CAGR of 5.8% in the coming years. This rise is associated with its expanding use in medical and pharmaceutical applications, where clarity and sterility are critical. Similarly, polystyrene-based containers make up a considerable portion of all medical packaging in North America. Additionally, advancements in recycling technologies have improved the material’s sustainability profile, enhancing its appeal in eco-conscious markets.

By Application Insights

The packaging segment represented the largest application by capturing 40.8% of the market share in 2024. Also, the leading position is driven by the increasing demand for lightweight and durable containers in industries like food and beverage, personal care, and household chemicals. In addition, blow molded plastics accounted for a significant share of all rigid packaging materials used in this region.

The medical segment is the fastest-growing application, with a projected CAGR of 6.5% in the future. This growth is fueled by the increasing demand for sterile and disposable medical devices, particularly in light of the aging population and rising healthcare expenditures.

REGIONAL ANALYSIS

The United States was at the forefront of the North American blow molded plastics market by commanding 75.7% of the regional share in 2024. This leading position is backed by the country’s robust manufacturing base, strong industrial infrastructure, and significant investments in sectors like packaging, automotive, and healthcare. Like, the U.S. consumes a considerable percentage of all blow molded plastics globally, driven by its dominance in industries such as e-commerce, food and beverage, and pharmaceuticals. The rise of online retail, highlighted by a major growth in e-commerce sales in recent years, has amplified demand for durable and lightweight packaging solutions. Additionally, government initiatives promoting recycling and sustainability, such as California’s Plastic Waste Reduction Roadmap, have spurred innovation in eco-friendly blow molded products. Investments in advanced manufacturing technologies, including automation and smart systems, further strengthen the U.S.’s position as a leader in this industry.

Canada is moving ahead in the North American blow molded plastics market. The country’s focus on sustainability and environmental stewardship has created a favorable environment for the adoption of bioplastics and recyclable materials. Also, the packaging industry hold a significant share of the Canadian market. Additionally, the country’s growing automotive sector, particularly in Ontario, leverages blow molded plastics for lightweight components to enhance fuel efficiency and reduce emissions.

The Rest of North America, encompassing Mexico and other smaller economies. Mexico, in particular, plays a crucial role due to its rapidly expanding industrialization and urbanization, which are driving demand for blow molded plastics in sectors like automotive, construction, and consumer goods. Blow molded plastics are widely used in this sector for components such as fluid reservoirs and structural parts, owing to their durability and cost-effectiveness. Furthermore, the rise of e-commerce logistics hubs in Mexico has increased demand for packaging solutions, creating new opportunities for blow molded containers and bottles.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Berry Global Inc., Amcor plc, Graham Packaging Company, Plastipak Holdings, Inc., and Dow Inc., Reynolds Group Holdings, Apex Plastics, Comar LLC, Pretium Packaging, and Alpha Packaging are some of the key market players in the North American blow molded plastics market.

The North American blow molded plastics market is characterized by intense competition, with key players vying for dominance through innovation, quality, and strategic initiatives. Companies like Berry Global Group, AptarGroup, and Silgan Holdings dominate the landscape, each leveraging unique strengths to capture market share. Berry Global leads the pack with its cutting-edge sustainable packaging solutions and global presence, allowing it to cater to large-scale projects in sectors like e-commerce and healthcare. AptarGroup differentiates itself through its focus on medical and pharmaceutical applications, offering high-precision products that meet stringent regulatory requirements. Silgan Holdings excels in providing cost-effective solutions for the food and beverage industry, appealing to customers seeking reliable and scalable options. Despite their individual strengths, all players face challenges such as environmental regulations, raw material price volatility, and competition from alternative materials. To mitigate these challenges, companies are increasingly adopting advanced technologies and automation to enhance operational efficiency and product performance. This competitive dynamic not only drives innovation but also ensures that customers benefit from cutting-edge solutions that meet their specific needs.

Top Players in the North America Blow Molded Plastics Market

Berry Global Group

Berry Global Group is the undisputed leader in the North American blow molded plastics market. The company’s dominance stems from its extensive portfolio of sustainable packaging solutions, catering to industries such as food and beverage, healthcare, and personal care. The company’s strategic investments in advanced manufacturing technologies, including automation and process optimization, have enabled it to maintain a competitive edge.

AptarGroup, Inc.

AptarGroup, Inc. is another prominent player. The company specializes in developing blow molded solutions for the medical and pharmaceutical industries, leveraging its expertise in sterile and disposable products. The company’s focus on precision engineering and material science has enabled it to produce high-performance blow molded products that meet stringent regulatory standards. By prioritizing innovation and sustainability, AptarGroup has positioned itself as a key player in the competitive blow molded plastics market.

Silgan Holdings

Silgan Holdings rounds out the list of top players. The company excels in providing blow molded solutions for the food and beverage industry, offering lightweight and durable containers that enhance shelf appeal and functionality. Also, the company’s commitment to quality and customer satisfaction has earned it long-term partnerships with leading brands. Additionally, Silgan’s focus on cost efficiency and scalability has enabled it to cater to both large-scale and niche markets effectively.

Top Strategies Used by Key Market Participants

Key players in the North American blow molded plastics market employ a variety of strategies to maintain their competitive edge and drive growth. One prevalent strategy is product innovation, with companies investing heavily in research and development to create sustainable and high-performance solutions. Another widely adopted strategy is forming strategic partnerships with end-users, technology providers, and government agencies to enhance market penetration. Geographic expansion is also a critical focus, with companies like Silgan Holdings investing in new facilities and production lines to tap into emerging markets across North America. Lastly, companies emphasize sustainability and compliance with regulatory frameworks, leveraging incentives and certifications to differentiate themselves in a crowded marketplace.

RECENT MARKET DEVELOPMENTS

- In April 2024, Berry Global launched a line of biodegradable blow molded containers made from bio-based resins, aligning with global trends toward environmental sustainability and addressing regulatory pressures.

- In June 2023, AptarGroup partnered with a major healthcare provider to develop recyclable medical containers, enhancing its market presence in the medical and pharmaceutical sectors.

- In March 2023, Silgan Holdings invested $200 million to expand its production capacity in Mexico, targeting the growing demand for packaging solutions in the region’s e-commerce and automotive sectors.

- In January 2023, Berry Global acquired a Canadian bioplastics firm to bolster its sustainability portfolio and expand its geographic reach across North America.

- In October 2022, AptarGroup completed the development of a recyclable medical container, positioning itself as a leader in sustainable healthcare packaging solutions.

MARKET DEVELOPMENTS

By Technology

- Extrusion Blow Molding

- Injection Blow Molding

- Stretch Blow Molding

- Compound Blow Molding

By Product

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyethylene (PE)

- Polystyrene (PS)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyamide (PA)

- Polyamide 6

- Polyamide 66

- Others

By Application

-

- Packaging

- Consumables & Electronics

- Automotive & Transport

- Building & Construction

- Medical

- Others

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What factors are driving the growth of the blow molded plastics market in North America?

Rising demand for lightweight, cost-effective, and durable plastic products is a major driver. Additionally, growth in consumer goods and automotive industries fuels market expansion.

What are the latest trends in this market?

There is growing use of bio-based and recycled plastics and automation in manufacturing processes. Customization and lightweight design are also trending.

What is the future outlook of the North America Blow Molded Plastics Market?

The market is expected to grow steadily due to rising demand and innovations in material technology. Focus on eco-friendly production will shape its future trajectory.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]