North America Buckwheat Products Market Size, Share, Growth, Trends and Forecast Report - Segmented By Form (unhulled, Raw, Roasted), Application, Distribution Channel, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Buckwheat Products Market Size

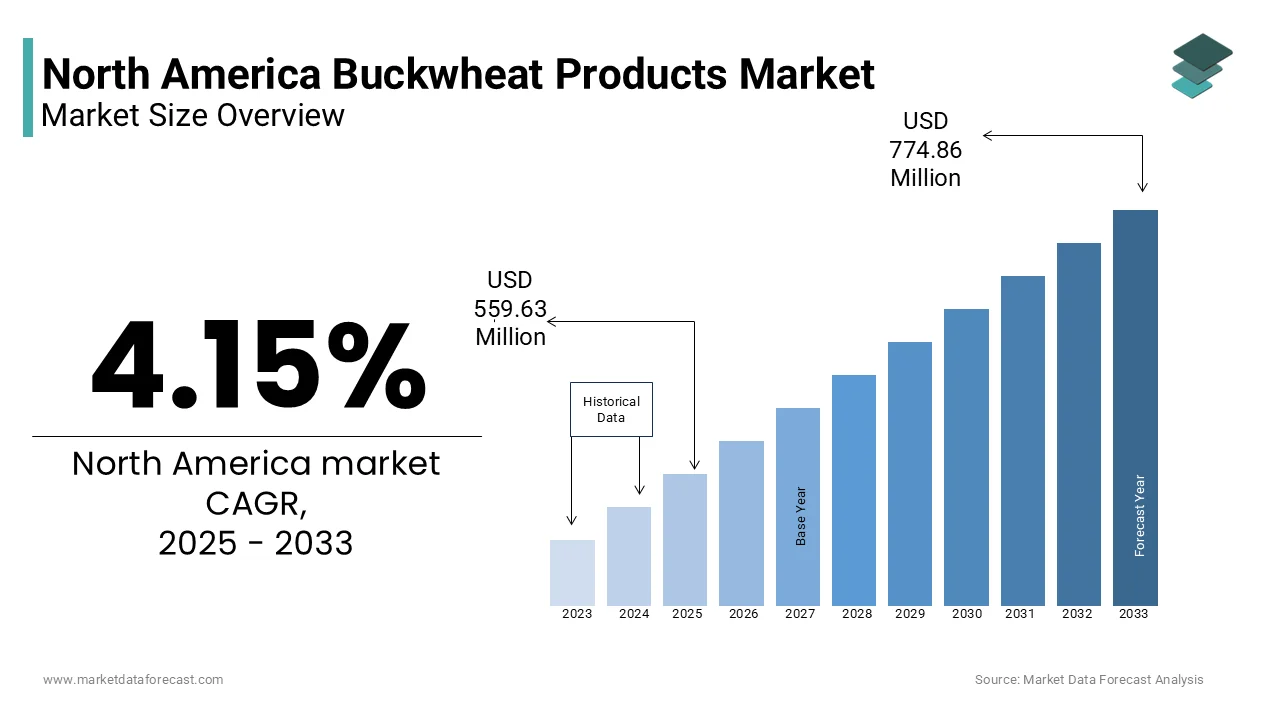

The North America buckwheat products market size was valued at USD 537.31 million in 2024, and the market size is expected to reach USD 774.86 million by 2033 from USD 559.63 million in 2025. The market is growing at a CAGR of 4.15% during the forecast period.

Buckwheat is a nutrient-rich pseudocereal widely consumed for its high protein content, gluten-free properties, and diverse culinary applications. The North America Buckwheat Products Market encompasses a range of food items derived from buckwheat, including flour, groats, noodles, pancakes, and ready-to-eat snacks. These products are increasingly being integrated into health-conscious diets, especially among consumers seeking alternatives to wheat-based foods.

The market has seen a resurgence in recent years due to rising awareness around dietary wellness and digestive health. In Canada and the United States, buckwheat cultivation remains relatively limited compared to other grains, but its value-added processing and niche demand have contributed to steady market growth.

MARKET DRIVERS

MARKET DRIVERS

Rising Demand for Gluten-Free and Functional Foods

One of the primary drivers of the North America Buckwheat Products Market is the increasing consumer preference for gluten-free and functional foods. With celiac disease affecting approximately 1 in 133 Americans , according to the University of Chicago Celiac Disease Center, and a growing number of individuals adopting gluten-free diets for perceived health benefits, buckwheat offers a natural, non-allergenic alternative to wheat-based products.

Buckwheat is rich in essential amino acids, fiber, and bioactive compounds such as rutin and quercetin, which contribute to improved metabolic and cardiovascular health. As per the American Journal of Clinical Nutrition, clinical trials have demonstrated that regular consumption of buckwheat can help regulate postprandial blood glucose levels, making it particularly beneficial for diabetic patients.

In response to this trend, major food manufacturers across North America, including Bob’s Red Mill and Arrowhead Mills, have expanded their buckwheat-based product lines to include flours, cereals, and baked goods. Retailers like Whole Foods and Sprouts Farmers Market have also increased shelf space for gluten-free options, further reinforcing consumer access and awareness.

Expansion of Organic and Sustainable Farming Practices

Expansion of Organic and Sustainable Farming Practices

Another significant driver influencing the North America Buckwheat Products Market is the expansion of organic and sustainable farming practices. Buckwheat is well-suited for regenerative agriculture due to its ability to suppress weeds, improve soil structure, and serve as a pollinator-friendly crop. According to the Rodale Institute, integrating buckwheat into crop rotations enhances biodiversity and reduces reliance on synthetic fertilizers and pesticides.

As per the U.S. Department of Agriculture's Economic Research Service, the number of certified organic farms in the United States increased between 2020 and 2024 , with many transitioning farmers turning to buckwheat as a low-input, high-value cover crop. In Canada, as per the Ontario Ministry of Agriculture, Food and Rural Affairs, buckwheat acreage under organic certification grew steadily, supported by premium pricing and strong export demand.

This shift toward sustainable agriculture aligns with consumer expectations for ethically sourced and environmentally responsible food products. Companies like Nature’s Path and Manitoba Harvest have capitalized on this movement by promoting organic buckwheat products that appeal to eco-conscious buyers.

MARKET RESTRAINTS

Limited Domestic Cultivation and Supply Chain Constraints

A major restraint facing the North America Buckwheat Products Market is the limited domestic cultivation and associated supply chain constraints. Despite its nutritional benefits and environmental advantages, buckwheat remains a minor crop in both the United States and Canada, with total acreage declining over the past two decades. According to the U.S. Department of Agriculture, only about 40,000 acres of buckwheat were harvested in 2024 , a fraction of the land dedicated to staple crops like corn or soybeans.

This limited production base results in inconsistent supply volumes, making it difficult for processors and food manufacturers to maintain stable sourcing.

Also, the lack of large-scale infrastructure for harvesting, cleaning, and milling buckwheat increases operational costs and limits economies of scale.

Moreover, the absence of government subsidies or price supports for buckwheat compared to other grains discourages widespread adoption by commercial farmers.

High Cost of Buckwheat-Based Products Compared to Conventional Grains

High Cost of Buckwheat-Based Products Compared to Conventional Grains

Another significant restraint limiting the growth of the North America Buckwheat Products Market is the relatively high cost of buckwheat-based products when compared to conventional grains like wheat, rice, and oats. Due to lower yields, limited mechanization, and higher labor inputs during harvesting and processing, buckwheat tends to be more expensive at both the farm gate and retail levels.

This price disparity is further exacerbated in processed food categories, where buckwheat flour and ready-to-eat products often carry a premium over standard gluten-free alternatives.

While health-conscious and specialty shoppers may accept these higher prices, mainstream consumers remain hesitant, especially in economically sensitive markets.

MARKET OPPORTUNITIES

Integration into Plant-Based and Alternative Protein Diets

One of the most promising opportunities for the North America Buckwheat Products Market lies in its integration into plant-based and alternative protein diets. As consumer interest in reducing meat consumption continues to rise, buckwheat has emerged as a valuable ingredient in plant-forward food formulations due to its high-quality protein profile and complete amino acid composition.

Buckwheat’s versatility allows it to be incorporated into plant-based burgers, protein bars, and dairy-free yogurts, offering texture, nutrition, and functional benefits without compromising taste.

Food science researchers at Cornell University have explored buckwheat’s potential in extruded meat analogs, noting its ability to enhance moisture retention and binding properties. Companies such as Beyond Meat and Ripple Foods have begun experimenting with buckwheat as a partial substitute in protein blends, leveraging its neutral flavor and allergen-free status.

With continued innovation and strategic partnerships between buckwheat growers and plant-based food developers, the market is well-positioned to capture a growing share of the alternative protein landscape in North America.

Growing Popularity of Fermented and Gut-Health-Oriented Buckwheat Products

Another emerging opportunity for the North America Buckwheat Products Market is the growing popularity of fermented and gut-health-oriented food products. Consumers are increasingly prioritizing digestive wellness, driving demand for probiotic-rich and prebiotic-enhanced foods that support microbiome diversity.

Buckwheat serves as an excellent substrate for fermentation due to its high polyphenol and fiber content, which promote the growth of beneficial gut bacteria. As per the researchers at Tufts University, fermented buckwheat exhibited enhanced antioxidant activity and improved digestibility, making it an attractive option for functional food development.

In response to this trend, startups and established food brands alike are launching buckwheat-based kefir, sourdough bread, and cultured breakfast bowls aimed at health-conscious consumers. For instance, companies like Lifeway Foods and Wildbrine have introduced fermented buckwheat ingredients into their product portfolios, highlighting digestive and immune-boosting benefits.

Additionally, academic institutions such as the University of Saskatchewan have collaborated with food tech firms to develop enzyme-treated buckwheat powders suitable for use in probiotic beverages and dietary supplements.

MARKET CHALLENGES

Lack of Consumer Awareness and Culinary Familiarity

A major challenge confronting the North America Buckwheat Products Market is the lack of widespread consumer awareness and culinary familiarity with buckwheat as a dietary staple. Unlike traditional grains such as wheat, rice, and oats, buckwheat remains relatively unfamiliar to mainstream consumers outside of niche health and ethnic food circles.

According to a survey conducted by the International Food Information Council (IFIC), fewer than 30% of North American consumers could correctly identify buckwheat or describe its uses , indicating a significant knowledge gap. This limited awareness affects purchasing behavior and restricts buckwheat’s presence in everyday meals, despite its nutritional benefits and gluten-free nature.

Furthermore, the perception of buckwheat as an “alternative” or “exotic” ingredient hinders its adoption in routine cooking. While buckwheat is a staple in Japanese soba noodles and Eastern European kasha, these dishes do not dominate mainstream North American cuisine. As a result, many consumers lack exposure to common preparation methods and recipe ideas that could facilitate greater incorporation into daily diets.

Competition from Established Gluten-Free Alternatives

Another critical challenge for the North America Buckwheat Products Market is intense competition from established gluten-free alternatives such as quinoa, millet, sorghum, and rice flour. These ingredients have gained widespread acceptance due to aggressive marketing, brand recognition, and broader availability in mainstream retail outlets.

Quinoa, backed by global health trends and international trade agreements, has also become a preferred choice for consumers seeking protein-rich grains.

Buckwheat, while nutritionally superior in certain aspects—such as its balanced amino acid profile and higher rutin content—remains less prominent in consumer consciousness. The lack of consistent branding and promotional efforts from industry players further exacerbates this disadvantage.

Unless buckwheat producers and food manufacturers invest in targeted marketing, product differentiation, and retailer partnerships, the market risks being overshadowed by more commercially entrenched gluten-free grains.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.15% |

|

Segments Covered |

By Form, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Homestead Organics, Birkett Mills, Galinta IR Partneriai, Wels Ltd., Krishna India, Ningxia Newfield Foods Co. Ltd., Ladoga LLC, UA Global Inc., Sichuan Huantai Industrial Co., Ltd., Jinan Jinnuoankang Biotech Co., Ltd, and others |

SEGMENTAL ANALYSIS

By Form Insights

The raw & roasted buckwheat segment held the largest share of 52.3% in the North America Buckwheat Products Market in 2024, driven primarily by its widespread use in food processing and home cooking. This form is highly preferred for making traditional dishes such as kasha, buckwheat porridge, and gluten-free baked goods.

One key driver behind the dominance of this segment is the rising demand for minimally processed, natural foods among health-conscious consumers. According to the Hartman Group, over 68% of U.S. consumers in 2024 preferred whole grain or minimally processed ingredients , aligning with the clean-label movement in the food industry. Raw and roasted buckwheat fits well into this trend due to its intact nutritional profile and versatility across multiple culinary applications.

In addition, major retailers like Whole Foods Market and Sprouts Farmers Market have expanded their shelf space for raw and roasted buckwheat products, recognizing a growing consumer base seeking plant-based and gluten-free alternative.

The unhulled buckwheat segment is projected to grow at the fastest CAGR of 9.7% during the forecast period, fueled by increasing interest in sprouting and fermenting whole grains for enhanced nutritional benefits. Unlike hulled varieties, unhulled buckwheat retains its outer husk, allowing for germination and improved bioavailability of nutrients such as polyphenols and minerals.

A major growth factor is the expanding adoption of fermented and gut-friendly food trends across North America. Startups and health-focused brands are incorporating unhulled buckwheat into probiotic beverages, cultured breakfast bowls, and enzyme-rich flours to cater to evolving consumer preferences.

Moreover, organic farmers are increasingly cultivating unhulled buckwheat due to its resilience against pests and minimal need for chemical inputs. These factors collectively contribute to the rapid expansion of this segment in the North American market.

By Application Insights

The food industry accounted for a 74% of the North America Buckwheat Products Market in 2024, serving as the primary application area due to the crop’s versatility and nutritional value. Buckwheat is widely used in baking, noodles, pancakes, cereals, and meat substitutes, particularly within gluten-free and plant-based dietary segments.

One of the major drivers of this segment is the rising prevalence of celiac disease and non-celiac gluten sensitivity, which has led to increased demand for wheat-free alternatives. According to the University of Chicago Celiac Disease Center, an estimated 3 million Americans suffer from celiac disease , while many more follow gluten-restricted diets for health reasons. Buckwheat flour, being naturally gluten-free and rich in protein, has become a staple in alternative baking and pasta production.

Another key factor is the integration of buckwheat into mainstream food formulations by leading manufacturers. Companies such as Bob’s Red Mill and General Mills have expanded their buckwheat-based offerings, capitalizing on its clean-label appeal and high fiber content.

The cosmetics industry is anticipated to exhibit the highest CAGR of 10.3% in the North America Buckwheat Products Market, driven by growing incorporation of buckwheat extracts in skincare and personal care formulations. Known for its antioxidant-rich properties, buckwheat is increasingly used in facial creams, serums, body lotions, and hair care products targeting anti-aging and skin protection benefits.

Scientific studies published in the Journal of Cosmetic Dermatology indicate that buckwheat-derived flavonoids such as rutin help strengthen capillaries, reduce inflammation, and improve skin elasticity. In response to these findings, beauty brands including Burt’s Bees and Alba Botanica have introduced buckwheat-infused product lines emphasizing natural ingredients and dermatological benefits.

Moreover, the rise of clean beauty movements has encouraged cosmetic companies to seek plant-based, hypoallergenic ingredients. With continued innovation and consumer preference shifts toward botanical skincare, this segment is poised for robust growth.

By Distribution Channel Insights

Supermarkets and hypermarkets grabbed a 56.1% of total distribution channel revenue in the North America Buckwheat Products Market in 2024, owing to their broad consumer reach and extensive shelf presence. Major chains such as Kroger, Walmart, and Costco have significantly expanded their offering of buckwheat-based products, ranging from flour and groats to ready-to-eat snacks.

One key reason for this segment’s dominance is the increasing availability of private label and branded buckwheat products in mainstream retail outlets.

Furthermore, promotional activities such as endcap displays, in-store tastings, and digital campaigns have boosted consumer awareness and trial rates. Retailers have also leveraged data analytics to identify regional demand patterns, enabling them to tailor product assortments accordingly.

Retail stores, particularly independent health food shops and specialty grocers, are expected to grow at the fastest CAGR of 9.1% in the North America Buckwheat Products Market, driven by rising consumer engagement with niche wellness products and locally sourced ingredients.

Unlike mass-market supermarkets, independent retail stores often emphasize organic, ethically sourced, and artisanal food items, aligning closely with the values of health-conscious shoppers.

These stores frequently offer educational resources, recipe ideas, and personalized customer service, fostering stronger brand loyalty among buckwheat consumers. Additionally, partnerships between local producers and small retailers have facilitated direct-to-consumer sales models, reducing reliance on centralized supply chains.

REGIONAL ANALYSIS

United States

The United States held the largest share of the North America Buckwheat Products Market, accounting for a 63.1% of total regional consumption in 2024, driven by strong domestic demand for gluten-free and functional foods. The country's expanding health-conscious population, coupled with a thriving alternative grain sector, has positioned buckwheat as a key player in the broader superfood movement.

Also, buckwheat acreage remained relatively stable, with key production zones in New York, Minnesota, and North Dakota supplying both domestic processors and export markets. Meanwhile, academic institutions like Cornell University and the University of Vermont have conducted extensive research on buckwheat’s role in managing metabolic disorders, enhancing consumer trust in its health benefits.

Major food companies, including General Mills and Nature’s Path, have incorporated buckwheat into various product lines, from cereals to snack bars.

Canada

Canada is distinguished by its focus on organic farming and niche product development. The country has witnessed a resurgence in buckwheat cultivation, particularly in Ontario and Manitoba, where regenerative agriculture initiatives have encouraged its use as a cover crop and rotational grain.

Canadian food processors have capitalized on this trend by launching premium buckwheat flours, cereals, and bakery goods tailored to eco-conscious consumers.

Moreover, as per the Canadian Food Inspection Agency, rise in buckwheat exports to the U.S. and Europe, signaling growing international demand for high-quality buckwheat ingredients. Domestic brands such as Purity Foods and Nature’s Path have played a pivotal role in introducing buckwheat-based snacks and infant nutrition products, further diversifying its market applications within the region.

Rest of North America

The Rest of North America is representing an emerging but dynamic segment with growing potential. While buckwheat remains a niche crop in these regions, increasing interest in gluten-free and plant-based diets has begun influencing local food industries.

In Mexico, health-focused startups and boutique bakeries have started incorporating buckwheat flour into gluten-free breads, pastries, and tortillas, catering to a small but expanding consumer base.

Meanwhile, in the Caribbean, efforts to introduce climate-resilient crops have included buckwheat as part of diversified agricultural programs aimed at improving food security and nutrition. Universities in Puerto Rico and Jamaica have initiated pilot projects assessing buckwheat’s adaptability under tropical conditions, suggesting future opportunities for localized cultivation and product development across the region.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Homestead Organics, Birkett Mills, Galinta IR Partneriai, Wels Ltd., Krishna India, Ningxia Newfield Foods Co. Ltd., Ladoga LLC, UA Global Inc., Sichuan Huantai Industrial Co., Ltd., Jinan Jinnuoankang Biotech Co., Ltd are the key players in the North America buckwheat products market.

The competition in the North America Buckwheat Products Market is marked by a mix of established natural food brands, emerging specialty producers, and conventional food manufacturers adapting to shifting consumer preferences. While dominant players leverage strong brand recognition and widespread distribution networks, smaller niche companies are carving out unique positions through innovative formulations and localized sourcing strategies. The market remains fragmented, allowing new entrants to gain traction by focusing on specific consumer segments such as gluten-free, plant-based, or organic diets. Competitive differentiation increasingly hinges on transparency in sourcing, product functionality, and alignment with broader wellness trends. As demand for alternative grains continues to grow, companies are intensifying efforts in marketing, product development, and supply chain optimization to capture greater market share. Additionally, the rising influence of e-commerce and direct-to-consumer models is reshaping how buckwheat products reach end users, further intensifying the competitive landscape. With ongoing innovation and strategic positioning, the market is poised for continued expansion, though success will depend on a brand's ability to resonate with evolving consumer values and dietary priorities.

TOP PLAYERS IN THE MARKET

Bob’s Red Mill Natural Foods

Bob’s Red Mill is a leading brand in the alternative grains and natural food products space, playing a pivotal role in making buckwheat accessible to mainstream consumers across North America. The company offers a wide range of buckwheat-based products including flour, groats, pancake mixes, and hot cereals, emphasizing quality, nutrition, and ease of use. By focusing on clean-label ingredients and consumer education, Bob’s Red Mill has significantly contributed to the increased awareness and acceptance of buckwheat in everyday diets.

Nature’s Path Foods

Nature’s Path is a prominent player known for its commitment to organic and sustainable food production. The company incorporates buckwheat into various product lines such as breakfast cereals, granolas, and frozen waffles, catering to health-conscious consumers seeking gluten-free and plant-based options. Its emphasis on environmental responsibility and regenerative agriculture aligns with growing consumer demand for ethically sourced and nutritious food choices, reinforcing buckwheat’s presence in the market.

Purity Foods

Purity Foods specializes in producing high-quality organic grains and flours, with buckwheat being a key ingredient in several of its offerings. The company supports small-scale farmers and promotes organic farming practices that enhance soil health and biodiversity. Through consistent innovation and strategic retail partnerships, Purity Foods has helped position buckwheat as a premium, functional grain in both specialty and mass-market grocery channels across North America.

TOP STRATEGIES USED BY KEY MARKET PLAYERS

One major strategy employed by key players in the North America Buckwheat Products Market is product diversification and formulation innovation . Companies are continuously expanding their portfolios to include ready-to-eat snacks, baked goods, and plant-based alternatives that feature buckwheat as a core ingredient. This approach allows them to cater to evolving dietary preferences while enhancing the versatility and appeal of buckwheat in mainstream cuisine.

Another critical strategy involves consumer education and brand storytelling . Leading brands are investing in digital marketing, recipe development, and social media engagement to raise awareness about buckwheat’s nutritional benefits and culinary applications. By highlighting its gluten-free nature, protein content, and sustainability profile, companies aim to build stronger emotional connections with health-oriented shoppers.

Lastly, strategic partnerships with organic farmers and regional suppliers are helping key players secure reliable raw material sources while supporting local agricultural ecosystems. These collaborations not only ensure product quality but also reinforce corporate commitments to ethical sourcing and environmental stewardship, strengthening market credibility and long-term growth potential.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Bob’s Red Mill launched an educational campaign titled “Buckwheat Beyond Breakfast,” featuring digital content, influencer collaborations, and in-store demonstrations aimed at showcasing the versatility of buckwheat in savory dishes, smoothies, and baking, thereby broadening consumer perception beyond traditional uses.

- In March 2024, Nature’s Path partnered with organic farmer cooperatives in Manitoba and Ontario to expand contract farming initiatives for buckwheat, ensuring a stable supply of certified organic grain while supporting regenerative agricultural practices that enhance long-term sustainability and product integrity.

- In June 2024, Purity Foods introduced a line of sprouted buckwheat-based instant porridge cups, targeting convenience-driven consumers who seek nutrient-dense, easy-to-prepare meals, marking a strategic move into the ready-to-eat segment and appealing to urban professionals and health-focused families.

- In August 2024, a group of independent buckwheat millers and regional distributors formed the North American Buckwheat Alliance to promote industry collaboration, improve supply chain efficiency, and advocate for policy support that encourages domestic cultivation and processing of buckwheat.

- In November 2024, General Mills incorporated buckwheat into select varieties of its Annie’s Homegrown cereal line, leveraging the grain’s clean-label appeal and gluten-free status to attract parents seeking healthier breakfast options for children, signaling broader mainstream adoption of buckwheat in packaged food products.

MARKET SEGMENTATION

This research report on the North America buckwheat products market has been segmented and sub-segmented based on the following categories.

By Form

-

Unhulled

-

Raw

-

Roasted

By Application

-

Food Industry

-

Beverage Industry

-

Cosmetics Industry

-

Textile Industry

-

Others

By Distribution Channel

-

Retail Stores

-

Supermarkets

-

Hypermarkets

By Country

- The United States

- Canada

- Rest of North America

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com