North America Carbonated Soft Drinks Market Size, Share, Trends & Growth Forecast Report By Type (Standard Carbonated Soft Drinks, Diet Carbonated Soft Drinks ), Packaging, Distribution Channel, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Carbonated Soft Drinks Market Size

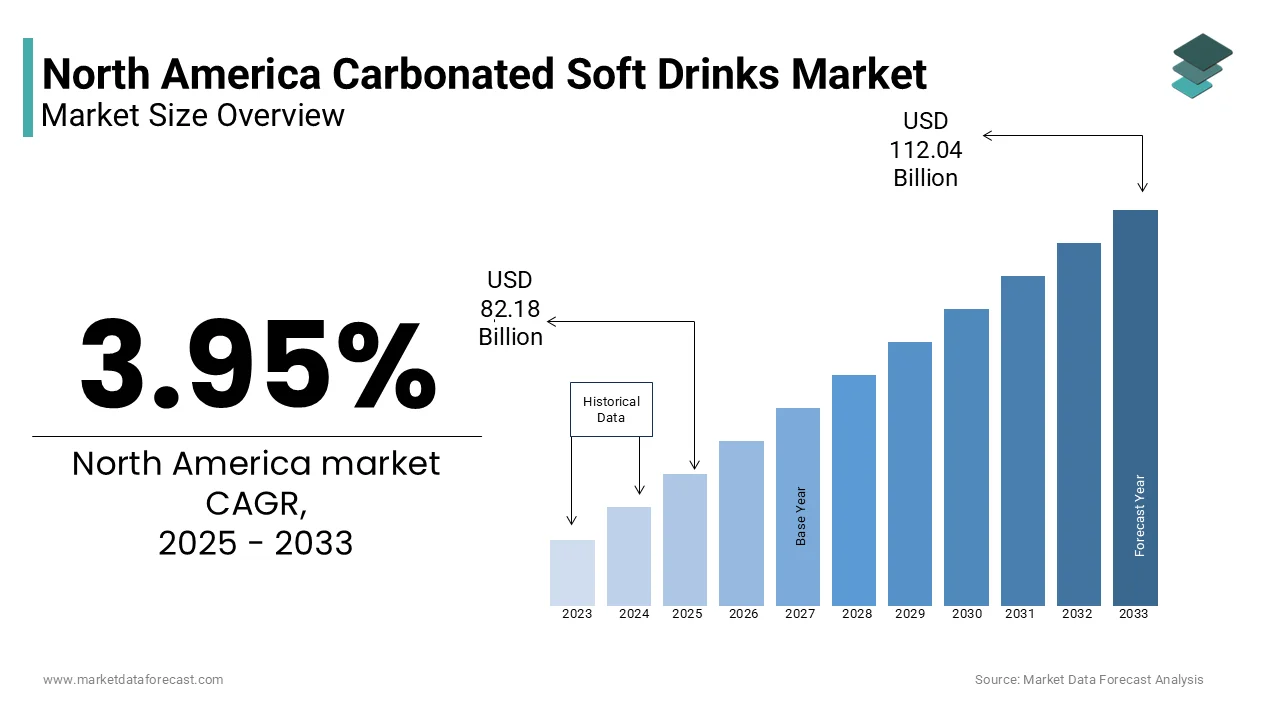

The Carbonated soft drinks market size in North America was valued at USD 79.06 billion in 2024 and is predicted to be worth USD 112.04 billion by 2033 from USD 82.18 billion in 2025 and grow at a CAGR of 3.95% from 2025 to 2033.

The North America carbonated soft drinks market encompasses a wide range of non-alcoholic beverages that contain dissolved carbon dioxide, giving them their characteristic fizz and effervescence. These beverages include colas, lemon-lime sodas, flavored sparkling drinks, and diet or zero-sugar variants. The market has long been a staple of the region’s beverage industry, driven by consumer preferences for refreshing, convenient, and flavorful drink options across both home and on-the-go consumption settings.

Despite evolving health trends, carbonated soft drinks continue to maintain a strong presence in North America due to extensive brand recognition, aggressive marketing strategies, and widespread availability through supermarkets, convenience stores, vending machines, and foodservice outlets.

Moreover, product innovation remains a key factor shaping the market, with manufacturers introducing new flavors, functional ingredients such as electrolytes or vitamins, and packaging formats tailored for convenience and sustainability.

MARKET DRIVERS

Persistent Consumer Preference for Refreshing Beverage Options

One of the primary drivers fueling the North America carbonated soft drinks market is the continued consumer preference for refreshing and palatable beverages, particularly among younger demographics. Despite growing health consciousness, many consumers still seek out carbonated soft drinks for their taste, immediate refreshment, and association with lifestyle branding.

According to the International Food Information Council, over 65% of surveyed U.S. consumers in 2023 cited flavor as the top consideration when choosing a beverage , surpassing concerns about sugar content or nutritional value.

Besides, the presence of well-established brands such as Coca-Cola, PepsiCo, and Dr Pepper Snapple Group ensures sustained consumer engagement through targeted advertising, seasonal promotions, and strategic product placements. Moreover, the rise of premium and craft soda brands offering unique flavor profiles and natural ingredients has further broadened the appeal beyond traditional mass-market offerings.

Expansion of Distribution Channels and Retail Accessibility

Expansion of Distribution Channels and Retail Accessibility

Another significant driver contributing to the growth of the North America carbonated soft drinks market is the expansion of distribution channels and enhanced retail accessibility. The availability of carbonated beverages across a vast network of supermarkets, convenience stores, vending machines, and quick-service restaurants (QSRs) ensures constant consumer access, reinforcing regular consumption patterns.

Furthermore, e-commerce platforms have increasingly integrated beverage delivery services, allowing consumers to purchase soft drinks online and have them delivered directly to their homes. Apart from these, partnerships between beverage companies and restaurant chains have led to exclusive co-branded drink offerings, enhancing visibility and consumption. For instance, McDonald's and PepsiCo extended their exclusive beverage partnership to introduce limited-time carbonated soft drink flavors in select markets.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.95% |

|

Segments Covered |

By Type, Packaging, Distribution Channel, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Dr Pepper Snapple Group, Monster Beverage Corp., Kraft Foods, Dohler Group, Cott Corporation, the Coca-Cola Company, PepsiCo Inc., Parle Agro, and Britvic PLC, and others |

SEGMENTAL ANALYSIS

By Type Insights

The standard carbonated soft drinks segment held the largest share of the North America market, accounting for 54.6% of total volume sales in 2024. This dominance is primarily driven by the enduring popularity of classic cola and lemon-lime sodas among consumers across different age groups and geographic regions.

One key factor contributing to this segment’s leadership is the strong brand loyalty associated with major beverage companies such as The Coca-Cola Company and PepsiCo. Also, these brands continue to invest heavily in advertising, particularly during high-profile events like the Super Bowl, which reinforces consumer engagement. Moreover, standard carbonated drinks are often more affordable compared to newer premium or health-focused alternatives, making them accessible to a broad demographic base.

Another driver is their widespread availability through convenience stores, vending machines, and fast-food chains. These factors collectively ensure that standard carbonated soft drinks remain the dominant category in North America.

The diet carbonated soft drinks segment is predicted to rise at the fastest CAGR of around 4.7%. This growth is largely attributed to increasing health consciousness among consumers who seek low-calorie alternatives without compromising on taste or fizziness.

A major driving force behind this trend is the rising prevalence of lifestyle-related diseases such as obesity and diabetes, prompting consumers to opt for sugar-free beverages. Beverage manufacturers have responded by expanding their product lines with artificial sweeteners like aspartame and stevia-based formulations, offering improved taste profiles that appeal to a wider audience.

Additionally, younger generations—particularly millennials and Gen Z—are increasingly prioritizing wellness and fitness, influencing their beverage choices.

By Packaging Insights

The bottle packaging segment prevailed in the North America carbonated soft drinks market, representing 58.2% of total packaging volume in 2024. This is mainly due to the widespread use of plastic bottles (PET) and glass containers for both single-serve and multi-serve formats across retail and foodservice channels.

One of the primary drivers behind bottled beverages’ popularity is consumer preference for portability and resealability. Moreover, family-sized bottles remain a favored option for home consumption, especially in suburban and rural areas where refrigeration storage is readily available.

Another key factor is the extensive distribution network supporting bottled beverages, including vending machines, gas stations, and grocery retailers. Furthermore, beverage companies have introduced eco-friendly PET bottles made from recycled materials to align with sustainability goals, enhancing consumer perception.

The can packaging segment is anticipated to expand at the highest CAGR of nearly 5.2. This sudden growth is being fueled by shifting consumer preferences toward lightweight, portable, and recyclable packaging solutions, particularly in outdoor and on-the-go consumption scenarios.

One significant driver is the increasing adoption of aluminum cans due to their environmental benefits. Beverage manufacturers have also embraced can packaging for new product launches, especially in the craft soda and functional beverage categories.

Another key contributor is the rise in outdoor recreational activities and events where cans are preferred over breakable glass or bulky plastic bottles. Moreover, major beverage companies like Coca-Cola and PepsiCo have expanded their canned carbonated offerings in response to changing retail trends, further accelerating this segment’s growth trajectory.

By Distribution Channel Insights

The store-based distribution channel had the largest share of the North America carbonated soft drinks market, capturing a 76.3% of total sales in 2024. This is credited to the extensive retail infrastructure across supermarkets, hypermarkets, convenience stores, and independent grocers, which provide easy consumer access to a wide range of carbonated beverage products.

One of the key factors driving this segment’s leadership is the strategic placement of carbonated soft drinks in high-traffic retail locations. Retailers frequently offer promotional deals and bundled packages, encouraging bulk purchases of bottled and canned beverages.

Additionally, convenience stores play a crucial role in sustaining store-based sales, particularly in urban and highway corridor locations where consumers seek quick refreshment options.

The non-store-based distribution segment is expected to advance at the fastest CAGR of approximately 6.1%. This accelerated expansion is primarily driven by the rising adoption of e-commerce platforms and direct-to-consumer delivery services for beverage purchases.

One major catalyst for this growth is the increasing popularity of online grocery shopping, particularly among urban consumers seeking convenience and time-saving solutions.

Another key driver is the integration of digital ordering systems by quick-service restaurants (QSRs) and food delivery apps, allowing customers to customize their meal bundles with carbonated soft drinks. With continued advancements in logistics and digital commerce, this segment is poised for sustained growth in the coming years.

REGIONAL ANALYSIS

The United States held the dominant position in the North America carbonated soft drinks market, commanding more than 82% of regional market share in 2024. As one of the world’s largest consumers of carbonated beverages, the U.S. benefits from a deeply embedded beverage culture, strong brand presence, and an extensive distribution network that spans supermarkets, convenience stores, vending machines, and foodservice outlets.

One of the key drivers behind this dominance is the enduring popularity of major brands such as Coca-Cola, PepsiCo, and Keurig Dr Pepper, which continue to invest heavily in product innovation and marketing. Additionally, seasonal promotions and large-scale advertising campaigns during events like the Super Bowl significantly influence purchasing behavior.

Another contributing factor is the widespread availability of both standard and diet variants across multiple packaging formats.

Canada's market is distinguished by its growing emphasis on premium and functional beverages, particularly among urban and health-conscious consumers.

A major growth catalyst is the increasing availability of low-sugar and zero-calorie alternatives tailored to changing dietary preferences. Major beverage companies have responded by expanding their diet and flavored sparkling water portfolios in Canadian markets.

In addition, the rise of convenience retailing and digital ordering platforms has boosted accessibility. With continued investment in sustainable packaging and localized marketing, Canada is emerging as a key contributor to the region’s carbonated soft drinks landscape.

Mexico is positioned as a rapidly developing market, Mexico has seen rising consumption levels, particularly in urban centers where beverage availability through modern trade channels has expanded significantly.

One of the key growth drivers is the country’s strong presence of global beverage manufacturers, including FEMSA (Coca-Cola FEMSA) and PepsiCo, which maintain extensive production and distribution networks. These companies have capitalized on local consumer preferences for fizzy, flavorful drinks, ensuring broad reach through convenience stores, kiosks, and informal retail outlets.

Another contributing factor is the continued popularity of traditional soda flavors, particularly among older generations who remain loyal to classic cola and citrus variants. Moreover, the expansion of vending infrastructure in public transportation hubs and commercial districts has reinforced regular consumption habits.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Dr Pepper Snapple Group, Monster Beverage Corp., Kraft Foods, Dohler Group, Cott Corporation, the Coca-Cola Company, PepsiCo Inc., Parle Agro, and Britvic PLC are playing dominating role in the North America carbonated soft drinks market.

The competition in the North America carbonated soft drinks market is characterized by intense brand rivalry, evolving consumer preferences, and a dynamic regulatory environment. Dominated by a few global giants, the market sees continuous innovation in product development, packaging formats, and marketing strategies aimed at capturing and retaining consumer interest. While traditional players maintain a strong foothold through established distribution networks and brand equity, emerging challenger brands are gaining traction by introducing craft sodas, functional carbonates, and health-focused alternatives.

Strategic mergers, acquisitions, and co-branding initiatives are frequently employed to consolidate market positions and expand into new consumer segments. Additionally, sustainability and health consciousness are reshaping competitive dynamics, compelling companies to reformulate products, reduce sugar content, and adopt eco-friendly packaging. The rise of digital commerce and personalized marketing further intensifies competition, allowing brands to engage directly with consumers and tailor offerings based on real-time feedback. As the market matures, differentiation through innovation, ethical sourcing, and experiential branding will play a pivotal role in sustaining long-term growth and relevance.

TOP PLAYERS IN THE MARKET

The Coca-Cola Company

The Coca-Cola Company remains the leading force in the North America carbonated soft drinks market, with a vast portfolio spanning iconic brands like Coca-Cola, Diet Coke, Sprite, and Fanta. Its dominance is rooted in decades of brand building, strategic acquisitions, and continuous product innovation. The company plays a crucial role in defining industry trends, particularly in beverage formulation, sustainability initiatives, and omnichannel distribution strategies.

PepsiCo, Inc.

PepsiCo is a major competitor in the North American carbonated soft drinks sector, offering a diverse lineup that includes Pepsi, Mountain Dew, 7UP, and Sierra Mist. The company has successfully leveraged its snack and beverage synergy to enhance cross-promotion and retail placement. PepsiCo continues to invest in reformulated products, health-conscious alternatives, and digital engagement strategies to retain consumer loyalty and expand market reach.

Keurig Dr Pepper (KDP)

Keurig Dr Pepper is a key player in the North American market, known for its extensive regional bottling network and popular brands such as Dr Pepper, 7UP, A&W, and Snapple. The company has strategically positioned itself by focusing on niche flavor profiles and direct-to-consumer innovations. KDP also contributes to the evolution of beverage dispensing technology through partnerships with restaurant chains and office beverage systems.

TOP STRATEGIES USED BY KEY PLAYERS

Product Diversification and Reformulation Initiatives

Leading players are continuously expanding their product portfolios to include low-sugar, no-calorie, and naturally sweetened carbonated beverages in response to shifting consumer preferences. This strategy not only addresses health concerns but also captures new customer segments looking for indulgence without excessive sugar intake.

Sustainable Packaging Innovations

Beverage companies are investing heavily in eco-friendly packaging solutions, including recyclable aluminum cans, plant-based PET bottles, and reduced plastic usage. These efforts align with corporate sustainability goals while responding to regulatory pressures and consumer demand for environmentally responsible products.

Digital Integration and Direct-to-Consumer Channels

Major players are leveraging e-commerce platforms, mobile apps, and subscription services to strengthen their market presence. By integrating digital ordering with logistics networks, they enhance convenience for consumers while gaining valuable data insights to refine marketing and distribution strategies.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, The Coca-Cola Company launched a limited-edition line of fruit-infused carbonated beverages under its Powerade brand, targeting fitness-conscious consumers and expanding its footprint in the flavored carbonate category.

- In May 2024, PepsiCo announced a partnership with Amazon Fresh to offer exclusive canned soft drink bundles through the online platform, aiming to boost non-store-based sales and leverage digital consumer engagement.

- In August 2024, Keurig Dr Pepper introduced a new line of 100% recycled aluminum cans for its Dr Pepper and 7UP products, reinforcing its commitment to sustainability while enhancing brand appeal among environmentally aware consumers.

- In November 2024, Coca-Cola expanded its Freestyle self-serve fountain technology to over 5,000 additional locations across the U.S. and Canada, allowing customers to customize carbonated drink flavors and driving impulse purchases.

- In March 2025, PepsiCo acquired a minority stake in a California-based functional beverage startup specializing in electrolyte-enhanced carbonates, signaling its intent to diversify into the wellness-oriented beverage segment.

MARKET SEGMENTATION

This research report on the North America carbonated soft drinks market has been segmented and sub-segmented based on the following categories.

By Type

- Standard Carbonated Soft Drinks

- Diet Carbonated Soft Drinks

By Packaging

- Bottles

- Cans

By Distribution Channel

- Store-based Distribution

- Non-store-based Distribution

By Country

- The United States

- Canada

- Rest of North America

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com