North America Cardiac Arrhythmia Monitoring Devices Market Research Report – Segmented By Devices ( continuous rhythm monitoring devices, Mobile cardiac telemetry (MCT) service providers ) Service Providers ( Independent diagnostic testing facilities (IDTFs),Mobile cardiac telemetry (MCT) monitoring service providers ) and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Cardiac Arrhythmia Monitoring Devices Market Size

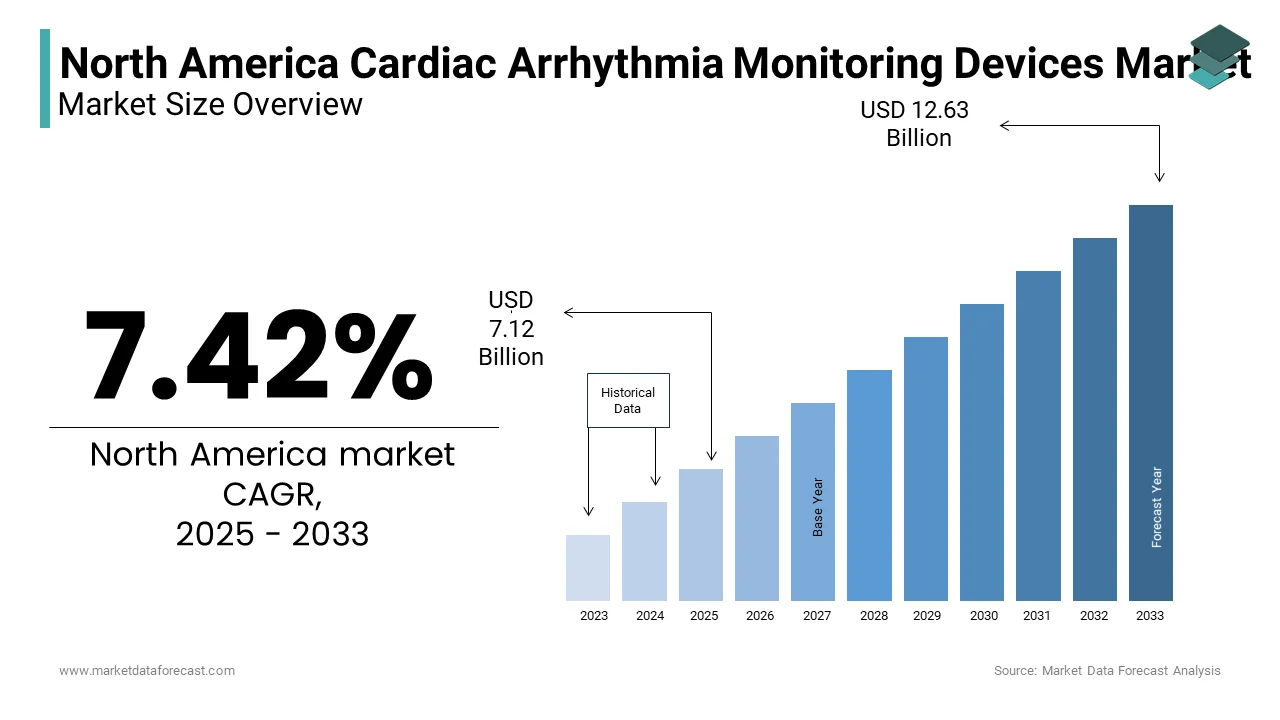

The North America Cardiac Arrhythmia Monitoring Devices Market Size was valued at USD 6.63 billion in 2024. The North America Cardiac Arrhythmia Monitoring Devices Market size is expected to have 7.42% CAGR from 2025 to 2033 and be worth USD 12.63 billion by 2033 from USD 7.12 billion in 2025.

The North American cardiac arrhythmia monitoring devices market is a significant segment within the global healthcare industry, driven by rising cardiovascular disease prevalence and advancements in diagnostic technologies. As per the American Heart Association, heart disease remains the leading cause of death in the United States, accounting for approximately 697,000 deaths annually. This alarming statistic underscores the critical need for effective arrhythmia monitoring solutions. Continuous rhythm monitoring devices dominate the market due to their ability to provide real-time data, which has led to increased adoption in both clinical and home settings. The region's strong healthcare infrastructure further supports the market, with Canada investing over CAD 300 billion annually in its healthcare system as stated by the Canadian Institute for Health Information. Additionally, regulatory frameworks such as the FDA’s rigorous approval process ensure high-quality standards, fostering trust among end-users. The surge in telemedicine adoption, particularly post-pandemic, has also contributed to the market's growth, enabling remote patient monitoring and reducing hospital readmissions. According to Grand View Research, the North American market was valued at USD 1.2 billion in 2022, with projections indicating steady expansion due to technological innovations and an aging population. These factors collectively shape a robust and dynamic market landscape.

MARKET DRIVERS

Rising Prevalence of Cardiovascular Diseases

Cardiovascular diseases are a primary driver of demand for cardiac arrhythmia monitoring devices in North America. According to the Centers for Disease Control and Prevention (CDC), approximately 121.5 million adults in the U.S. suffer from hypertension, a key risk factor for arrhythmias. This widespread prevalence necessitates advanced diagnostic tools capable of early detection and continuous monitoring. Event monitoring devices, for instance, have witnessed increased adoption due to their ability to capture transient arrhythmias that may not occur during routine check-ups. Furthermore, the growing awareness of heart health, supported by public health campaigns, has led to more frequent screenings. A study published in the Journal of the American College of Cardiology revealed that nearly 2.7 million Americans live with atrial fibrillation, one of the most common arrhythmias. Such statistics emphasize the escalating need for reliable monitoring solutions. With the burden of cardiovascular diseases projected to rise further, the demand for innovative cardiac monitoring technologies is expected to grow exponentially.

Technological Advancements and Integration with Digital Platforms

Technological advancements represent another major driver shaping the market. Innovations such as AI-powered algorithms and cloud-based data storage have revolutionized how arrhythmias are detected and managed. For example, Abbott Laboratories introduced Confirm Rx, the world’s first smartphone-compatible insertable cardiac monitor, allowing patients to transmit data directly to physicians via a mobile app. According to Mordor Intelligence, the integration of IoT-enabled devices in healthcare is anticipated to grow at a CAGR of 20.2% from 2023 to 2030. These advancements not only enhance diagnostic accuracy but also improve patient compliance and convenience. Telehealth platforms, which gained traction during the pandemic, further amplify this trend by enabling remote monitoring. Data from McKinsey & Company suggests that telehealth utilization stabilized at levels 38 times higher than pre-pandemic rates. This convergence of technology and healthcare is reshaping the cardiac arrhythmia monitoring landscape, driving demand for cutting-edge devices that cater to modern medical needs.

MARKET RESTRAINTS

High Costs Associated with Advanced Monitoring Devices

One of the primary restraints hindering the adoption of cardiac arrhythmia monitoring devices is their high cost, which limits accessibility, especially for low-income populations. Devices like implantable loop recorders or mobile cardiac telemetry systems can cost thousands of dollars, making them unaffordable for uninsured or underinsured patients. According to Kaiser Family Foundation, nearly 28 million Americans remain uninsured, exacerbating disparities in access to advanced healthcare technologies. Even insured individuals face challenges due to varying coverage policies, with some insurers requiring prior authorization or imposing strict eligibility criteria. For example, a report by the National Center for Biotechnology Information highlights that only 40% of eligible patients receive reimbursement for long-term cardiac monitoring devices. These financial barriers impede widespread adoption, particularly in rural areas where healthcare resources are already limited. While manufacturers strive to reduce costs through economies of scale, the current pricing models continue to pose significant obstacles to market penetration.

Stringent Regulatory Approval Processes

Another restraint is the stringent regulatory approval processes governing medical devices, which delay product launches and increase development costs. In the U.S., the Food and Drug Administration (FDA) mandates rigorous clinical trials and safety evaluations before approving new devices. According to Deloitte Insights, it takes an average of five years and over USD 94 million to bring a Class III medical device to market. This lengthy and costly process often discourages smaller companies from entering the market, thereby limiting innovation. Moreover, post-market surveillance requirements add to the complexity, as manufacturers must continuously demonstrate device efficacy and safety. For instance, Medtronic faced delays in launching its LINQ II insertable cardiac monitor due to additional testing requests from regulators. Such regulatory hurdles create uncertainty and stifle market growth. Although these measures ensure patient safety, they inadvertently slow down the introduction of potentially life-saving technologies, impacting the pace of market expansion.

MARKET OPPORTUNITIES

Growing Adoption of Wearable Health Technologies

The increasing popularity of wearable health technologies presents a lucrative opportunity for the cardiac arrhythmia monitoring devices market. Wearables such as smartwatches equipped with ECG functionalities are gaining traction among consumers seeking proactive health management. According to Statista, the global wearable medical device market is projected to reach USD 23 billion by 2025, with North America accounting for a substantial share. Apple's Series 8 watch, for instance, features an FDA-cleared ECG app that detects irregular heart rhythms, appealing to tech-savvy users. The integration of wearables into mainstream healthcare offers immense potential for manufacturers to expand their product portfolios. Data from Accenture indicates that 33% of U.S. consumers use wearable devices for health tracking, reflecting a growing acceptance of non-invasive monitoring solutions. By leveraging partnerships with tech giants, traditional medical device companies can tap into this emerging trend, enhancing user engagement while addressing gaps in chronic disease management.

Expansion of Home Healthcare Services

The shift towards home healthcare services represents another promising avenue for market growth. With an aging population and rising healthcare costs, there is a growing emphasis on delivering care outside traditional hospital settings. As per the U.S. Census Bureau, the number of Americans aged 65 and above will exceed 73 million by 2030, creating a surge in demand for home-based monitoring solutions. Holter monitors and event recorders, which allow patients to track their heart activity remotely, align perfectly with this trend. A study by Allied Market Research estimates that the global home healthcare market will grow at a CAGR of 8.6% from 2022 to 2030. Manufacturers who develop user-friendly, portable devices tailored for home use stand to benefit significantly. Furthermore, government initiatives promoting home healthcare, such as Medicare’s expanded coverage for telehealth services, provide additional incentives for stakeholders to innovate in this space, ensuring better patient outcomes and reduced hospital readmissions.

MARKET CHALLENGES

Data Privacy Concerns Amid Increased Connectivity

As cardiac arrhythmia monitoring devices become increasingly connected to digital platforms, concerns about data privacy have emerged as a significant challenge. These devices collect sensitive health information, including heart rate patterns and ECG readings, which are transmitted to cloud servers or shared with healthcare providers. According to Pew Research Center, 81% of Americans express concern about how companies use their personal data, highlighting widespread apprehension regarding data security. Cyberattacks targeting healthcare systems are also on the rise; Verizon's Data Breach Investigations Report states that 79% of breaches involve external actors exploiting vulnerabilities in connected devices. For instance, in 2021, Philips Healthcare issued a recall for certain patient monitoring systems due to potential cybersecurity risks. Such incidents undermine consumer trust and deter adoption. Addressing these concerns requires robust encryption protocols, transparent data handling policies, and compliance with regulations like HIPAA, all of which add complexity and cost to device manufacturing.

Limited Awareness Among Underserved Populations

Another pressing challenge is the limited awareness of cardiac arrhythmia monitoring technologies among underserved populations, particularly in rural and economically disadvantaged areas. According to the Rural Health Information Hub, residents in rural regions experience higher rates of heart disease yet have lower access to advanced diagnostic tools. Cultural and linguistic barriers further compound this issue, preventing minority groups from fully benefiting from available resources. For example, a study by the Journal of General Internal Medicine found that Hispanic and African American communities are less likely to utilize wearable health devices compared to their white counterparts. Educational campaigns aimed at raising awareness about arrhythmia symptoms and treatment options often fail to reach these demographics effectively. Bridging this gap requires targeted outreach programs, culturally sensitive materials, and affordable pricing strategies. Without addressing these disparities, the market risks leaving behind large segments of the population, undermining efforts to achieve equitable healthcare access.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.42 % |

|

Segments Covered |

By Devices ,Service Providers and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Medtronic PLC,ACSDiangostics,GE Healthcare,Koninklijke Philips NV |

SEGMENTAL ANALYSIS

By Devices Insights

Continuous rhythm monitoring devices dominate the North American market, holding a substantial share of approximately 45%, as per Allied Market Research. Their prominence stems from their ability to provide uninterrupted, real-time data, which is crucial for diagnosing conditions like atrial fibrillation. The aging population plays a pivotal role in driving this segment’s dominance, with the U.S. Census Bureau projecting that seniors will account for 21% of the population by 2030. Additionally, hospitals and clinics prefer these devices due to their reliability and compatibility with electronic health records (EHRs).

According to HIMSS Analytics, over 90% of U.S. hospitals now use EHR systems, facilitating seamless integration of monitoring data. Another contributing factor is the growing emphasis on preventive care, encouraged by insurance providers offering incentives for early diagnosis. For instance, Blue Cross Blue Shield covers continuous monitoring for high-risk patients, boosting adoption rates. These elements collectively solidify the segment’s leadership position.

By Service Providers Insights

Mobile cardiac telemetry (MCT) service providers are experiencing rapid growth, with a projected CAGR of 15.3% from 2023 to 2030, according to Fortune Business Insights. This surge is fueled by the increasing demand for remote patient monitoring, particularly post-pandemic. MCT devices excel in capturing detailed arrhythmia data over extended periods, surpassing traditional Holter monitors in functionality. A report by Frost & Sullivan highlights that MCT services reduce hospital readmissions by 30%, appealing to healthcare providers aiming to optimize resource allocation. Technological advancements, such as AI-driven analytics, further enhance diagnostic accuracy, making MCT a preferred choice for clinicians. Moreover, favorable reimbursement policies, including Medicare’s expanded coverage for remote monitoring, incentivize adoption. With telehealth consultations becoming mainstream, MCT providers are well-positioned to capitalize on this trend, ensuring sustained growth in the foreseeable future.

Independent diagnostic testing facilities (IDTFs) and clinics represent the largest segment within the North American cardiac arrhythmia monitoring devices market, commanding a market share of approximately 55%, as per Grand View Research. This dominance is attributed to their widespread presence and specialized focus on diagnostic services, which ensures accurate and timely arrhythmia detection. IDTFs are particularly favored for their cost-effectiveness compared to hospital-based diagnostics, with Healthcare Financial Management Association reporting that outpatient diagnostic services can reduce costs by up to 30%. Furthermore, these facilities cater to underserved populations, bridging gaps in healthcare access. For instance, rural areas with limited hospital infrastructure rely heavily on IDTFs for advanced cardiac monitoring. The proliferation of partnerships between IDTFs and device manufacturers has also strengthened this segment’s position. Companies like BioTelemetry have established extensive networks with IDTFs, enabling seamless service delivery. Additionally, regulatory support, such as CMS’s reimbursement policies for diagnostic tests conducted at IDTFs, further bolsters adoption, solidifying their leadership in the market.

Mobile cardiac telemetry (MCT) monitoring service providers are the fastest-growing segment, with a CAGR of 16.8% from 2023 to 2030, according to MarketsandMarkets. This growth is driven by the increasing demand for real-time, remote monitoring solutions that enhance patient convenience and clinical outcomes. MCT devices offer superior diagnostic capabilities, capturing intermittent arrhythmias missed by traditional Holter monitors. A study published in the Journal of Cardiovascular Electrophysiology revealed that MCT detected clinically significant arrhythmias in 62% of patients, compared to 43% for Holter monitors. The integration of AI-powered analytics further enhances accuracy, enabling predictive insights into potential cardiac events. Moreover, the post-pandemic surge in telehealth adoption has accelerated MCT adoption, as patients increasingly prefer home-based monitoring. Favorable reimbursement policies, including expanded Medicare coverage for remote cardiac monitoring, have also fueled growth. With technological advancements and rising chronic disease prevalence, MCT service providers are poised to maintain their rapid expansion trajectory.

COUNTRY LEVEL ANALYSIS

The United States holds the largest share of the North American cardiac arrhythmia monitoring devices market, accounting for approximately 78% of the regional revenue, as per Allied Market Research. This leadership stems from its robust healthcare infrastructure, high prevalence of cardiovascular diseases, and strong adoption of advanced medical technologies. According to the CDC, heart disease remains the leading cause of death in the U.S., driving demand for innovative monitoring solutions. The country’s emphasis on preventive care, supported by favorable insurance policies, further accelerates adoption. For example, private insurers like UnitedHealthcare cover long-term cardiac monitoring for high-risk patients, reducing barriers to access. Additionally, the U.S. government’s investment in digital health initiatives, such as the FDA’s Digital Health Innovation Action Plan, fosters innovation. The presence of major market players like Medtronic and Abbott Laboratories also strengthens the domestic ecosystem, ensuring cutting-edge product availability and continuous market growth.

Canada represents a significant contributor to the North American cardiac arrhythmia monitoring devices market, holding a market share of approximately 15%, as stated by Mordor Intelligence. The country’s universal healthcare system, funded through the Canada Health Act, ensures equitable access to advanced diagnostic tools, including arrhythmia monitoring devices. According to Statistics Canada, cardiovascular diseases account for 23% of all deaths, highlighting the critical need for effective monitoring solutions. The Canadian government’s focus on telehealth expansion, particularly post-pandemic, has bolstered remote monitoring adoption. For instance, Ontario’s Digital First for Health strategy aims to integrate digital tools into routine care, benefiting patients requiring continuous rhythm monitoring. Furthermore, collaborations between local manufacturers and international firms have enhanced product accessibility. These factors collectively position Canada as a key player in the regional market, with steady growth anticipated in the coming years.

The Rest of North America, comprising Mexico and other smaller nations, accounts for approximately 7% of the regional market, as per Data Bridge Market Research. While this segment is smaller compared to the U.S. and Canada, it exhibits significant untapped potential due to rising cardiovascular disease prevalence and improving healthcare infrastructure. According to the World Health Organization, cardiovascular diseases are the leading cause of mortality in Mexico, accounting for 31% of total deaths. Efforts to modernize healthcare systems, supported by government initiatives like Mexico’s National Development Plan, are driving demand for advanced monitoring technologies. Additionally, partnerships with multinational corporations have improved device affordability and accessibility. For example, collaborations between Mexican healthcare providers and global leaders like Philips have facilitated the introduction of affordable, high-quality devices. Though challenges like limited awareness persist, strategic investments and policy reforms are expected to unlock growth opportunities in this region.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America Cardiac Arrhythmia Monitoring Devices Market are Medtronic PLC,ACSDiangostics,GE Healthcare,Koninklijke Philips NV.

The North American cardiac arrhythmia monitoring devices market is characterized by intense competition, driven by technological advancements and growing demand for innovative solutions. Key players like Medtronic, Abbott Laboratories, and Boston Scientific dominate the market, leveraging their extensive R&D capabilities and global presence. Smaller firms, however, are gaining traction by focusing on niche segments and cost-effective solutions. The competitive landscape is further shaped by collaborations with tech companies, enabling the integration of AI and IoT technologies. Regulatory compliance and quality standards remain critical differentiators, with companies striving to meet stringent requirements. As the market evolves, competition is expected to intensify, fostering innovation and expanding access to advanced monitoring technologies across the region.

Top Players in the Market

Medtronic plc

Medtronic stands as a global leader in the cardiac arrhythmia monitoring devices market, renowned for its innovative product portfolio and commitment to advancing patient care. The company offers cutting-edge solutions like the LINQ family of insertable cardiac monitors, which combine miniaturization with advanced data analytics. Medtronic’s strengths lie in its extensive R&D capabilities and strategic collaborations with healthcare providers, enabling it to address unmet clinical needs effectively. Its robust distribution network ensures widespread availability, while its focus on training healthcare professionals enhances user adoption. Medtronic’s leadership is further reinforced by its proactive approach to integrating AI and cloud technologies, positioning it at the forefront of the industry.

Abbott Laboratories

Abbott Laboratories is another dominant player, leveraging its expertise in diagnostic and monitoring technologies to drive market innovation. The company’s Confirm Rx device exemplifies its commitment to patient-centric design, offering smartphone compatibility for seamless data transmission. Abbott’s strengths include its diversified product portfolio, spanning wearable devices and implantable monitors, catering to varied patient needs. Its emphasis on research and development has resulted in groundbreaking innovations, while partnerships with tech giants enhance its competitive edge. Abbott’s ability to adapt to evolving healthcare trends, such as telemedicine and remote monitoring, underscores its pivotal role in shaping the future of cardiac arrhythmia management.

Boston Scientific Corporation

Boston Scientific Corporation is a key contributor to the market, distinguished by its focus on minimally invasive technologies and patient-friendly solutions. The company’s offerings, such as the ZOOM LatITUDE Communication System, enable efficient remote monitoring and data management. Boston Scientific’s strengths lie in its collaborative approach, working closely with clinicians to develop tailored solutions. Its commitment to sustainability and ethical practices further enhances its reputation. By investing in next-generation technologies, including AI-driven analytics, Boston Scientific continues to expand its footprint, addressing complex challenges in cardiac care while maintaining its leadership position.

Top Strategies Used by Key Players

Leading companies in the North American cardiac arrhythmia monitoring devices market employ diverse strategies to strengthen their positions and drive growth. Strategic partnerships and collaborations are a cornerstone, enabling firms to leverage complementary expertise and expand their reach. For instance, Medtronic partnered with IBM Watson Health to integrate AI-driven insights into its monitoring devices, enhancing diagnostic accuracy. Another prominent strategy is mergers and acquisitions, allowing companies to consolidate resources and enter new markets. Abbott Laboratories’ acquisition of St. Jude Medical exemplifies this approach, broadening its product portfolio and technological capabilities. Additionally, firms prioritize R&D investments to innovate and stay ahead of competitors. Boston Scientific allocates over 10% of its annual revenue to R&D, ensuring continuous product evolution. These strategies collectively position companies for sustained success in a competitive landscape.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Medtronic launched its next-generation LINQ III insertable cardiac monitor, featuring enhanced battery life and AI-driven analytics, reinforcing its leadership in remote monitoring.

- In June 2023, Abbott introduced an upgraded version of its Confirm Rx device, incorporating advanced ECG algorithms to improve arrhythmia detection accuracy.

- In February 2023, Boston Scientific acquired Preventice Solutions, expanding its portfolio of ambulatory cardiac monitoring technologies.

- In October 2022, Philips Healthcare partnered with Amazon Web Services to enhance cloud-based data storage for its cardiac telemetry systems, boosting scalability.

- In August 2022, BioTelemetry collaborated with Mayo Clinic to develop AI-powered predictive models for early arrhythmia detection, setting a new benchmark for innovation.

MARKET SEGMENTATION

This research report on the north america cardiac arrhythmia monitoring devices market has been segmented and sub-segmented into the following.

By Devices

- continuous rhythm monitoring devices

- Mobile cardiac telemetry (MCT) service providers

By Service Providers

- Independent diagnostic testing facilities (IDTFs)

- Mobile cardiac telemetry (MCT) monitoring service providers

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What is the size and growth rate of the North America Cardiac Arrhythmia Monitoring Devices Market?

The market size and growth rate depend on various factors, including technological advancements, increasing prevalence of cardiac disorders, and rising awareness about early diagnosis.

What role does artificial intelligence (AI) play in cardiac arrhythmia monitoring?

AI-powered algorithms help in early detection and diagnosis of arrhythmias by analyzing large volumes of ECG data, improving accuracy, and reducing false alarms.

Which types of cardiac arrhythmia monitoring devices are most commonly used?

Key devices include Holter Monitors, Event Monitors , Mobile Cardiac Telemetry (MCT) Devices, Implantable Loop Recorders Wearable ECG Devices.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]