North America Cell Line Development Market Research Report – Segmented By Product & Service ( Reagents and Media , Services ) Source ( Mammalian Cell Line, Non-Mammalian Cell Line ) Type of Cell Lines ( Continuous Cell Lines ,Recombinant Cell Lines ) Application (Bioproduction,Tissue Engineering) and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Cell Line Development Market Size

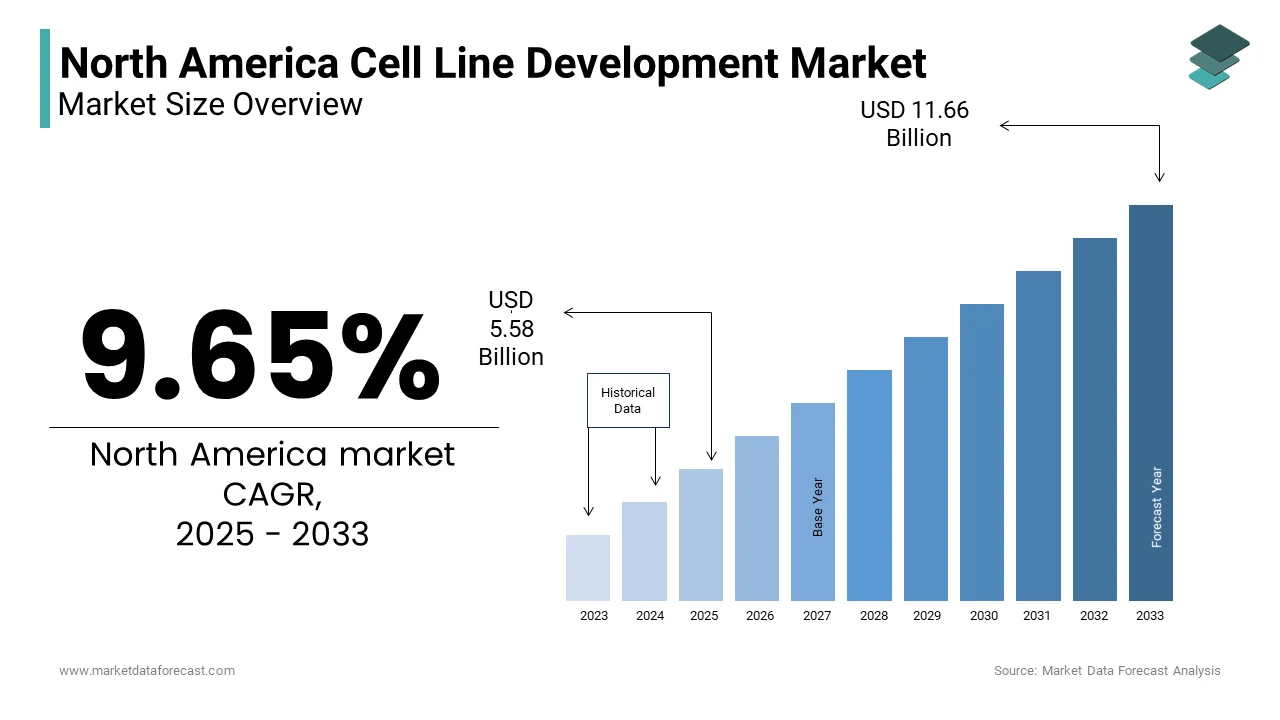

The North America Cell Line Development Market Size was valued at USD 5.09 billion in 2024. The North America Cell Line Development Market size is expected to have 9.65% CAGR from 2025 to 2033 and be worth USD 11.66 billion by 2033 from USD 5.58 billion in 2025.

The North America cell line development market is a pivotal segment within the global biotechnology industry, driven by advancements in biopharmaceuticals, drug discovery, and regenerative medicine. The region accounts for a significant share of the global market. This growth is fueled by the region's robust infrastructure for research and development, coupled with substantial investments in biotechnology. The United States dominates the regional market. Canada follows, leveraging its expertise in stem cell research and government-backed initiatives.

A notable factor influencing the market dynamics is the increasing prevalence of chronic diseases such as cancer and diabetes, which has heightened the demand for advanced therapies. According to the American Cancer Society, there were an estimated 1.9 million new cancer cases in the U.S. in 2023 showcasing the critical role of cell line technologies in developing targeted treatments. Additionally, the presence of key players like Thermo Fisher Scientific and Merck KGaA has bolstered innovation and accessibility to cutting-edge tools and reagents. These factors collectively create a fertile environment for the expansion of the cell line development market in North America.

MARKET DRIVERS

Increasing Demand for Biologics and Biosimilars

The growing reliance on biologics and biosimilars represents a cornerstone of the North America cell line development market. Biologics, including monoclonal antibodies and recombinant proteins, are increasingly preferred due to their efficacy in treating complex diseases such as autoimmune disorders and cancer. As per the Pharmaceutical Research and Manufacturers of America (PhRMA), over 250 biologic medicines were in development in 2023 spotlighting the sector's momentum. The production of these therapies heavily relies on optimized cell lines, particularly mammalian cell lines, which account for nearly 70% of biopharmaceutical manufacturing, as stated by BioPlan Associates. Also, the FDA's approval of 10 new biosimilars in 2023 underscores the escalating demand for cost-effective alternatives to branded biologics. This trend propels investments in cell line engineering technologies, driving the market forward.

Advancements in Gene and Cell Therapy

The rapid evolution of gene and cell therapy has emerged as another significant driver for the market. As per the Alliance for Regenerative Medicine, over 1,300 clinical trials involving cell and gene therapies were underway globally in 2023, with North America leading in trial activity. The region's dominance is attributed to its advanced healthcare infrastructure and supportive regulatory frameworks. For instance, the FDA's expedited pathways for breakthrough therapies have accelerated the adoption of cell-based treatments. Such developments necessitate high-quality cell lines, fostering innovation and market growth.

MARKET RESTRAINTS

High Costs Associated with Cell Line Development

Among the primary barriers impeding the growth of the North America cell line development market is the substantial financial investment required for research, development, and commercialization. Developing a stable and efficient cell line involves intricate processes such as genetic modification, cloning, and scalability testing, which are both time-intensive and expensive. According to a study published by the Biotechnology Innovation Organization (BIO), the average cost of bringing a biologic drug to market exceeds 2.5 billion, with cell line optimization accounting for a significant portion of this expense. Additionally, the high costs of specialized equipment and reagents further exacerbate the financial burden. These financial challenges often deter smaller biotech firms from entering the market, limiting overall growth potential.

Regulatory Hurdles and Compliance Challenges

Stringent regulatory requirements pose another major restraint for the cell line development market in North America. Regulatory agencies such as the FDA mandate rigorous documentation and validation processes to ensure the safety and efficacy of cell-based products. Based on a report by Deloitte, the average timeline for gaining regulatory approval for a biologic product is approximately 12 years significantly longer than traditional pharmaceuticals. Furthermore, compliance with Good Manufacturing Practices (GMP) adds additional layers of complexity and cost. For example, maintaining GMP-compliant facilities requires continuous monitoring and adherence to strict quality control protocols, which can strain resources. A survey conducted by the Parenteral Drug Association revealed that over 60% of biotech companies cited regulatory compliance as a major challenge. These hurdles not only delay market entry but also increase operational burdens, thereby restraining market expansion.

MARKET OPPORTUNITIES

Expansion of Personalized Medicine

The burgeoning field of personalized medicine presents a transformative opportunity for the North America cell line development market. Personalized medicine tailors treatments to individual patients based on their genetic makeup, offering higher efficacy and reduced side effects. In line with the Personalized Medicine Coalition, personalized therapies accounted for 42% of all FDA-approved drugs in 2023 reflecting the growing emphasis on precision healthcare. This shift necessitates the development of customized cell lines capable of producing patient-specific biologics such as CAR-T cells for cancer treatment. By investing in advanced cell line technologies, companies can capitalize on this trend, fostering innovation and unlocking new revenue streams.

Emergence of CRISPR and Genome Editing Technologies

The advent of CRISPR and other genome editing tools has opened new avenues for the cell line development market. These technologies enable precise genetic modifications, enhancing the efficiency and functionality of cell lines used in drug discovery and therapeutic applications. A report by the Broad Institute states that CRISPR-based therapies have shown promising results in preclinical studies, with over 20 clinical trials initiated in 2023. Companies leveraging these technologies can develop superior cell lines with enhanced productivity and stability, meeting the rising demand for biologics and regenerative therapies. Moreover, collaborations between academia and industry are accelerating the adoption of genome editing, creating a fertile ground for market expansion.

MARKET CHALLENGES

Ethical and Safety Concerns Surrounding Cell Line Use

Ethical and safety concerns represent a significant challenge for the North America cell line development market particularly regarding the use of human-derived cell lines. Public skepticism and regulatory scrutiny surrounding the sourcing and application of cell lines can hinder market progress. For instance, the use of embryonic stem cells remains controversial, with ethical debates often delaying research initiatives. Based on a survey by the Pew Research Center, 48% of Americans expressed moral concerns about the use of human embryos in scientific research. Together with, safety issues such as contamination risks during cell culture pose operational challenges. A study published in Nature Biotechnology revealed that over 15% of cell lines used in research are misidentified or contaminated, undermining experimental reliability. Addressing these concerns requires stringent quality control measures and transparent communication, which can be resource-intensive for stakeholders.

Scalability and Production Bottlenecks

Another pressing challenge is the difficulty in scaling up cell line production to meet industrial demands. While small-scale laboratory cultures suffice for research purposes, transitioning to large-scale biomanufacturing introduces complexities such as maintaining cell viability and consistency. The report by BioProcess International stresses that over 60% of biopharmaceutical companies face scalability issues during the transition from benchtop to commercial production. Factors such as nutrient depletion, oxygen limitations, and shear stress in bioreactors can compromise cell line performance. In extension to this, the lack of standardized protocols for scaling up non-mammalian cell lines exacerbates the problem. The National Institutes of Health states that only 30% of biologics successfully scale to commercial levels drawing attention to the need for innovative solutions. Overcoming these bottlenecks requires significant investment in process optimization and technology development posing a formidable challenge for market participants.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.65 % |

|

Segments Covered |

By Product & Service, Source, Type of Cell Lines,Application and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Thermo Fisher Scientific Inc.,Danaher,Sartorius AG,Merck KGaACorning Inc. |

SEGMENTAL ANALYSIS

By Product & Service Insights

The Reagents and media segment dominated the North America cell line development market by capturing 45.7% of the total market share in 2024. This market control is driven by the indispensable role of reagents and media in cell culture processes ensuring optimal growth conditions and productivity. Also, the increasing adoption of serum-free and chemically defined media has further propelled demand, as these formulations enhance reproducibility and reduce variability. This is reinforced by the rise in biopharmaceutical production has amplified the consumption of specialized reagents, such as growth factors and cytokines, which are critical for cell line optimization. These factors collectively reinforce the segment's leadership position.

The services segment is the fastest-growing category, with a projected CAGR of 14.2% from 2025 to 2033. This growth is fueled by the outsourcing trend among biopharmaceutical companies seeking to reduce operational costs and accelerate timelines. Contract research organizations (CROs) and contract development and manufacturing organizations (CDMOs) play a pivotal role in providing end-to-end solutions, from cell line engineering to scale-up and validation. According to BioPlan Associates, over 65% of biotech firms outsource at least one aspect of cell line development, displaying the segment's significance. Furthermore, the increasing complexity of cell-based therapies has heightened the demand for specialized services such as process optimization and regulatory support. These dynamics position the services segment as a key growth driver in the market.

By Source Insights

The mammalian cell lines constituted the largest segment by commanding a market share of 65.9% in 2024. This influence is linked to their ability to produce complex proteins with post-translational modifications making them ideal for biopharmaceutical applications. Also, the increasing prevalence of monoclonal antibody-based therapies has further amplified demand, with over 70% of approved biologics derived from mammalian cell lines, as stated by the Biotechnology Industry Organization (BIO). As an additional point, advancements in transfection technologies and gene editing tools have enhanced the efficiency and productivity of mammalian cell lines strengthening their position as the preferred choice for bioproduction. These factors collectively drive the segment's leadership in the market.

The non-mammalian cell lines segment is moving forward at a rapid pace with a calculated CAGR of 13.8% in the future. This upward trend is caused by their cost-effectiveness and scalability, particularly for applications such as vaccine production and industrial enzymes. For instance, yeast-based cell lines are widely used in the production of recombinant insulin, accounting for over 30% of global insulin supply, according to the World Health Organization. In support of this, the development of novel platforms such as insect cell lines for viral vector production has expanded their utility in gene therapy. These innovations position non-mammalian cell lines as a rapidly emerging segment in the market.

By Type of Cell Lines Insights

The continuous cell lines category held the biggest share i.e. 50.3% of the North America cell line development market in 2024. The pre-eminence is due to their ability to divide indefinitely enabling long-term use in research and production. These cell lines are extensively utilized in drug screening and toxicity testing, with over 60% of preclinical studies relying on continuous cell lines, as stated by the National Institutes of Health. To augment this, their adaptability to various culture conditions and resistance to contamination make them a preferred choice for industrial applications. These attributes reinforce their leadership position in the market.

The recombinant cell lines segment is the swiftly expanding in the market, with an estimated CAGR of 15.4% during the forecast period. This development is supported by their ability to produce high-value proteins, such as monoclonal antibodies and growth factors, with high specificity and yield. According to BioPlan Associates, over 80% of biologics in development utilize recombinant cell lines, underscoring their critical role in biopharmaceutical manufacturing. Furthermore, advancements in gene editing technologies, such as CRISPR, have enhanced the efficiency of recombinant cell line development, fueling their rapid adoption. These factors position recombinant cell lines as a key growth driver in the market.

By Application Insights

The bioproduction represented the best performing application segment by capturing 40.4% of the North America cell line development market in 2024. This performance is stimulated by the increasing demand for biologics, including monoclonal antibodies, vaccines, and recombinant proteins. As well as, the shift toward continuous bioprocessing has amplified the reliance on optimized cell lines enhancing productivity and reducing costs. These factors collectively reinforce bioproduction's leadership position in the market.

Tissue engineering is the fastest-growing application segment, with a projected CAGR of 16.7% in the future. This growth is fueled by the rising demand for regenerative therapies and organ transplantation. According to the Tissue Engineering and Regenerative Medicine International Society, over 200 tissue-engineered products were in development in 2023, showcasing the sector's momentum. Additionally, advancements in 3D bioprinting and scaffold technologies have expanded the utility of cell lines in creating functional tissues further accelerating market growth. These innovations position tissue engineering as a transformative application in the market.

COUNTRY LEVEL ANALYSIS

In 2024, the United States accounted for 81.4% of the North American cell line development market. This influence is hold up by the country’s robust biotechnology ecosystem supported by substantial federal funding and private investments. For instance, the National Institutes of Health (NIH) allocated $47.4 billion to biomedical research in 2023 fostering innovation in cell line technologies. The U.S. is home to over 1,300 biotech companies many of which specialize in biologics production driving demand for advanced cell lines. Also, the FDA's proactive stance on approving novel therapies has accelerated market growth. The agency in 2023 alone approved 10 new biosimilars exhibiting the importance of optimized cell lines in drug manufacturing. As well as, partnerships between academia and industry have propelled advancements in gene editing, reinforcing the U.S.'s dominance in the global market.

Canada presents a steadily evolving landscape for cell line development by leveraging its expertise in stem cell research and regenerative medicine. It is driven by government initiatives such as the Stem Cell Network, which has invested over 100 million in research since 2001. The Canadian biotechnology sector benefits from a collaborative environment that fosters innovation. For example, the University of Toronto's contributions to CRISPR technology have enhanced the efficiency of cell line engineering. Beyond this, Canada's participation in global clinical trials has increased demand for high-quality cell lines, further bolstering the market. These factors position Canada as a key contributor to regional growth.

The Rest of North America is primarily led by Mexico and is witnessing the fastest CAGR of approximately 9.3% from 2025 to 2033. While smaller in scale, this section of the market is gaining traction due to increasing investments in healthcare infrastructure and biopharmaceutical manufacturing. Mexico in particular has emerged as a hub for contract manufacturing organizations (CMOs), with over 30 facilities specializing in biologics production. The Mexican government's focus on fostering innovation, exemplified by the National Council of Science and Technology (CONACYT), has spurred advancements in cell line technologies. Furthermore, collaborations with U.S.-based firms have facilitated knowledge transfer, enhancing local capabilities. These dynamics underscore the potential for growth in this segment.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America cell line development market are Thermo Fisher Scientific Inc.,Danaher,Sartorius AG,Merck KGaACorning Inc.,Lonza,Creative BioLabs.,WuXi PharmaTech,Advanced Instruments,Berkeley Lights

The North America cell line development market is characterized by intense competition, with key players vying for technological superiority and market dominance. Companies like Thermo Fisher Scientific, Merck KGaA, and Lonza Group lead the charge, leveraging their expertise in biologics production and genome editing. The competitive landscape is shaped by rapid advancements in cell culture technologies and increasing demand for personalized medicine. Strategic collaborations and investments in R&D further intensify rivalry, driving innovation and market expansion.

Top Players in the Market

Thermo Fisher Scientific

Thermo Fisher Scientific occupies a leading position in the North America cell line development market, renowned for its comprehensive portfolio of reagents, media, and bioprocessing solutions. The company's strength lies in its ability to provide end-to-end services, from cell line optimization to large-scale bioproduction. Its acquisition of Patheon in 2017 significantly expanded its biologics manufacturing capabilities, enabling it to cater to a diverse client base. With a strong emphasis on innovation, Thermo Fisher consistently introduces cutting-edge tools such as its Gibco media formulations which are widely adopted in biopharmaceutical applications.

Merck KGaA

Merck KGaA is a prominent player known for its expertise in mammalian cell line development, particularly through its CHOZN platform. The company's strengths include its proprietary technologies, which enhance productivity and scalability. Merck's focus on sustainability and quality has earned it a reputation as a trusted partner for biopharmaceutical companies. Its collaboration with academic institutions and industry leaders has fostered advancements in genome editing, further solidifying its market position.

Lonza Group

Lonza Group excels in providing customized cell line solutions, catering to the growing demand for personalized medicine and gene therapies. The company's strengths lie in its state-of-the-art facilities and extensive experience in regulatory compliance. Lonza's investment in digitalization and automation has streamlined bioprocessing workflows, enhancing efficiency. Its global presence and commitment to innovation make it a key contributor to the market.

Top strategies used by the key market participants

Key players in the North America cell line development market employ strategic initiatives such as mergers and acquisitions, product launches, and collaborations to strengthen their foothold. For instance, Thermo Fisher Scientific acquired PPD in 2021, expanding its clinical research capabilities. Similarly, Merck KGaA partnered with Pfizer in 2023 to co-develop innovative therapies. These strategies enable companies to diversify their offerings and tap into emerging opportunities, ensuring sustained growth.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Thermo Fisher Scientific launched a new line of chemically defined media, enhancing cell line productivity.

- In June 2023, Merck KGaA introduced CRISPR-based tools for cell line engineering, boosting precision and efficiency.

- In August 2023, Lonza Group expanded its biologics facility in Texas, increasing production capacity.

- In October 2023, Catalent acquired a gene therapy company, strengthening its cell line capabilities.

- In December 2023, Sartorius AG partnered with a biotech firm to co-develop scalable cell culture solutions.

MARKET SEGMENTATION

This research report on the north america cell line development market has been segmented and sub-segmented into the following.

By Product & Service

- Reagents and Media

- Services

By Source

- Mammalian Cell Line

- Non-Mammalian Cell Line

By Type of Cell Lines

- Continuous Cell Lines

- Recombinant Cell Lines

By Application

- Bioproduction

- Tissue Engineering

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What are the major applications of cell line development in north america cell line development market?

Cell line development is used in drug discovery, biologics production (such as vaccines and therapeutic proteins), gene therapy, and regenerative medicine.

Which types of cell lines are commonly developed at north america cell line development market?

Common cell lines include mammalian (CHO, HEK293, NS0), bacterial (E. coli), insect (Sf9), and plant-based cell lines. Mammalian cell lines dominate due to their ability to produce complex proteins.

What role does regulatory compliance play in north america cell line development market growth?

Compliance with FDA, EMA, and other health authorities is crucial for approval of biologics and therapeutics, making quality assurance and adherence to guidelines essential for success.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com