North America Chlor Alkali Market Size, Share, Trends & Growth Forecast Report By Type (Alumina Industry Application, Chemicals Industry Application), Chlorine Application, Soda Ash Application, And Country (US, Canada, And Rest Of North America), Industry Analysis From 2025 To 2033

North America Chlor Alkali Market Size

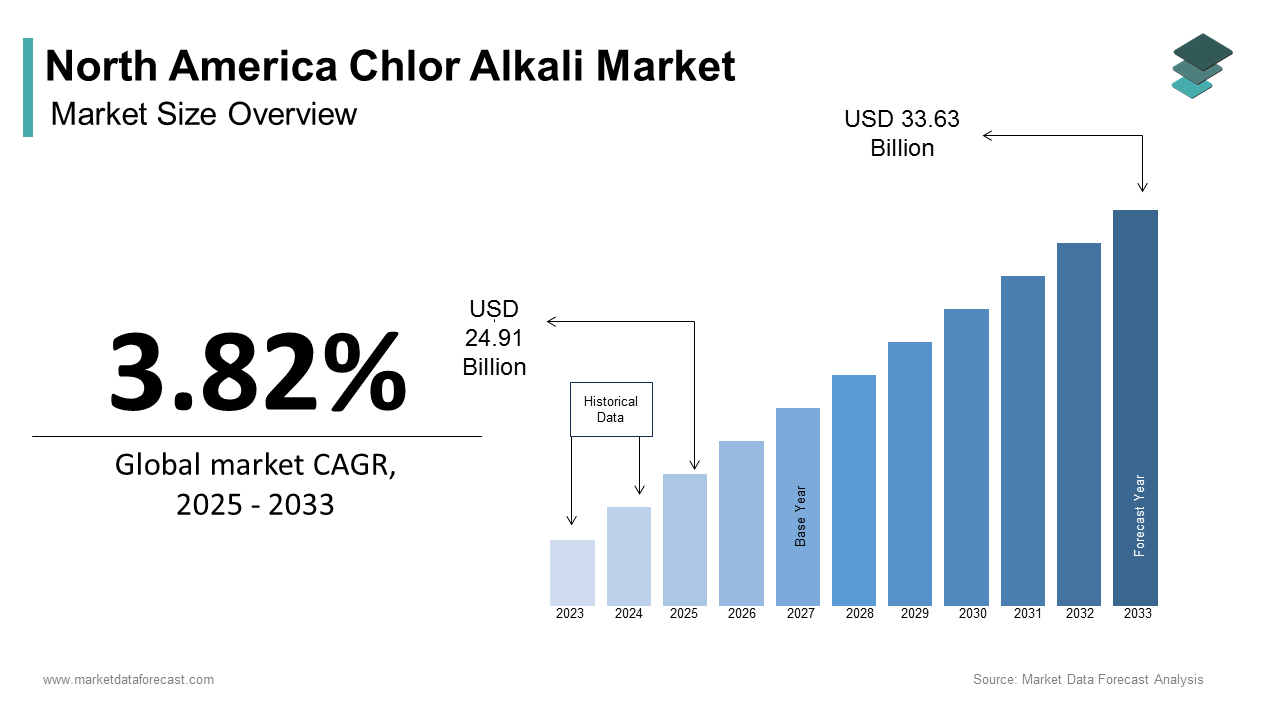

The North American Chlor Alkali Market size was calculated to be USD 23.99 billion in 2024 and is anticipated to be worth USD 33.63 billion by 2033, from USD 24.91 billion in 2025, growing at a CAGR of 3.82% during the forecast period.

The chlor alkali industry is a foundational segment of the chemical sector, centered on the production of chlorine and caustic soda (sodium hydroxide) through the electrolysis of sodium chloride brine. These chemicals serve as essential building blocks for numerous downstream applications including plastics, textiles, paper, water treatment, pharmaceuticals, and cleaning agents. In North America, the chlor alkali market has evolved into a strategically vital component of industrial infrastructure, with the United States accounting for most of the regional output.

The industry benefits from abundant natural resources, particularly salt and energy inputs, which are crucial to its cost structure. In addition, the shale gas boom in the U.S. has provided a reliable and affordable source of ethylene, further supporting chlorine demand via derivative products such as polyvinyl chloride (PVC).

In Canada, the chlor alkali sector is relatively smaller but remains integrated within broader chemical and pulp & paper industries. Environmental concerns and evolving regulatory frameworks have prompted industry players to adopt mercury-free technologies and invest in energy-efficient processes. Despite these challenges, the North American chlor alkali market continues to play a central role in supplying critical raw materials to diverse industrial sectors.

MARKET DRIVERS

Growth in PVC Production and Construction Demand

One of the key drivers of the North American chlor alkali market is the sustained growth in polyvinyl chloride (PVC) production, which accounts for nearly half of all chlorine consumption in the region. PVC is a dominant material in construction, used extensively for pipes, fittings, flooring, and window profiles due to its durability, affordability, and resistance to corrosion.

This resurgence directly boosted demand for PVC-based infrastructure components, reinforcing chlorine consumption. Moreover, government initiatives such as the Infrastructure Investment and Jobs Act allocated billions toward modernizing water systems, roads, and buildings—sectors that heavily rely on PVC piping and related materials.

Additionally, the shift toward sustainable construction practices has favored PVC due to its long lifespan and recyclability. With construction remaining a core economic driver and PVC maintaining its dominance in material selection, chlorine demand from this sector is expected to remain robust.

Expansion of Water Treatment and Disinfection Applications

Another significant driver of the NortAmericanca chlor alkali market is the growing reliance on chlorine-based compounds for water treatment and disinfection purposes. Chlorine plays a pivotal role in municipal water purification, wastewater management, and swimming pool sanitation, ensuring public health safety and environmental compliance.

Simultaneously, increasing awareness about hygiene and disease prevention has spurred investments in wastewater treatment infrastructure, particularly in densely populated urban centers.

Moreover, the healthcare and food processing sectors have intensified their use of chlorine-based sanitizers in response to heightened cleanliness standards.

With continued emphasis on clean water access and infection control, chlorine demand from water treatment applications is projected to sustain its upward trajectory across North America.

MARKET RESTRAINTS

Regulatory Pressures and Environmental Compliance Costs

A major restraint impacting the North American chlor alkali market is the increasing stringency of environmental regulations governing chlorine production and usage. Governments at both federal and state levels have imposed stricter emissions controls, waste disposal guidelines, and process efficiency mandates aimed at reducing the ecological footprint of chemical manufacturing.

Furthermore, legacy production methods, particularly those relying on mercury-cell technology, have come under intense scrutiny. Although most U.S. chlor alkali plants have transitioned to membrane or diaphragm cell technologies, some older facilities still require costly upgrades to meet new regulatory benchmarks.

These escalating regulatory burdens not only increase capital expenditure but also slow down plant expansions, limiting the overall flexibility of the chlor alkali industry in North America.

Volatility in Energy Prices and Supply Chain Disruptions

Energy price volatility poses a substantial challenge to the financial stability of the North American chlor alkali market, given that electricity constitutes one of the largest operating expenses in chlorine and caustic soda production. Electrolysis, the primary method of chlor alkali processing, is highly energy-intensive.

Supply chain disruptions have further exacerbated cost instability. Logistics bottlenecks, labor shortages, and fluctuating natural gas prices have affected the availability and pricing of critical raw materials such as salt and caustic soda derivatives.

Additionally, geopolitical tensions affecting global energy markets have introduced uncertainty into long-term procurement strategies.

This ongoing unpredictability in energy and logistics costs presents a persistent constraint on profitability and scalability within the NortAmericanca chlor alkali industry.

MARKET OPPORTUNITIES

Increasing Demand for Sustainable and Green Chemistry Applications

An emerging opportunity for the North American chlor alkali market lies in the expanding application of chlorine and caustic soda in sustainable and green chemistry initiatives. As industries increasingly prioritize eco-friendly alternatives and circular economy models, there is a growing shift toward using chlorine-based compounds in bio-based polymer synthesis, renewable fuel production, and advanced oxidation processes for water purification.

Chlorine is instrumental in the production of epichlorohydrin, a key precursor for bio-based epoxy resins used in wind turbine blades and electric vehicle components. Similarly, caustic soda is integral to biodiesel production, where it catalyzes transesterification reactions.

Moreover, chlorine-based disinfectants are gaining traction in agricultural and aquaculture settings as safer alternatives to conventional biocides. With sustainability becoming a core focus for regulators and consumers alike, the chlor alkali market stands to benefit significantly from its integration into next-generation green technologies.

Expansion of Specialty Chemicals and Derivatives Segment

The North American chlor alkali market is witnessing growing opportunities in the specialty chemicals and derivatives segment, particularly in the production of high-value intermediates used in pharmaceuticals, electronics, and agrochemicals. Chlorine serves as a fundamental feedstock for synthesizing organochlorines, solvents, refrigerants, and flame retardants, many of which are indispensable in advanced manufacturing and life sciences applications. This growth is fueled by rising demand from the semiconductor industry, where ultra-pure chlorine compounds are used in etching and cleaning processes. Pharmaceutical applications represent another promising avenue.

Simultaneously, the agriculture sector is leveraging chlorine-based herbicides and pesticides to enhance crop yield and pest control efficiency.

This diversification into high-margin, specialized applications positions the chlor alkali industry for sustained relevance in North America’s evolving chemical landscape.

MARKET CHALLENGES

Intensifying Competition from Alternative Materials and Processes

A significant challenge confronting the North American chlor alkali market is the intensifying competition from alternative materials and non-chlorine-based chemical processes. Industries traditionally reliant on chlorine and caustic soda are increasingly exploring substitutes such as hydrogen peroxide, ozone, and peracetic acid for disinfection and oxidation applications. According to the

In the pulp and paper industry, elemental chlorine-free (ECF) and chlorine-free (TCF) bleaching technologies have gained traction as more sustainable alternatives. Similarly, the textile industry has shifted toward enzymatic and oxygen-based bleaching methods, diminishing reliance on chlorine-based treatments.

Beyond industrial applications, consumer preferences are shifting toward chlorine-free household products, particularly in personal care and cleaning formulations.

This trend is further reinforced by corporate sustainability commitments, with major retailers and manufacturers pledging to phase out chlorine-containing ingredients from product lines.

Unless the chlor alkali industry adapts by promoting chlorine’s unique performance advantages and enhancing its environmental profile, substitution risks will continue to constrain market growth.

Aging Infrastructure and Limited Capital Expenditure

A critical challenge facing the North American chlor alkali market is the aging infrastructure across many production facilities, coupled with limited capital investment for modernization. Many chlor alkali plants in the U.S. and Canada were constructed in the 1970s and 1980s, and despite technological advancements, a significant portion of the asset base remains outdated.

Capital expenditure constraints have hindered the adoption of newer, more energy-efficient electrolysis technologies such as oxygen-depolarized cathode (ODC) and membrane cell optimization. Consequently, plant closures and consolidation have become common trends, particularly among smaller operators unable to justify large-scale upgrades.

Labor shortages in the chemical engineering and maintenance sectors have further delayed necessary infrastructure improvements.

In addition, investor reluctance to fund chemical manufacturing assets in favor of digital and service-oriented sectors has constrained financing options for facility expansions.

Without sufficient reinvestment in production capabilities, the North American chlor alkali market may face long-term competitiveness challenges in an era demanding greater efficiency and sustainability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.82% |

|

Segments Covered |

By Type, Chlorine Application, Soda Ash Application, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Us, Canada, and the Rest of North America |

|

Market Leaders Profiled |

Occidental Petroleum Corporation, Olin Corporation, Westlake Corporation, Formosa Plastics Corporation, Shin-Etsu Chemical Co. Ltd., Ercros S.A., Tata Chemicals North America Inc., Covestro LLC, Axiall Corporation, Tronox Holdings plc |

SEGMENTAL ANALYSIS

By Type Insights

The alumina industry represented the largest segment within the caustic soda application landscape in North America, accounting for 32.2% of total caustic soda consumption in 2024. This dominance is primarily attributed to the indispensable role caustic soda plays in the Bayer process, which is used to extract alumina from bauxite ore—a critical step in primary aluminum production.

The demand is concentrated in regions with active alumina refining capacity, such as Louisiana, Texas, and Quebec.

The continued reliance on caustic soda in alumina processing stems from its efficiency in dissolving aluminum-bearing minerals without degrading the final metal quality. Additionally, despite efforts to recycle process streams, the Bayer process inherently requires large volumes of sodium hydroxide due to chemical losses during the digestion and purification stages.

Furthermore, the resurgence of domestic aluminum production has reinforced caustic soda demand. This trend supports sustained consumption of caustic soda in the alumina sector, ensuring its position as the leading application segment.

The chemicals industry is emerging as the fastest-growing segment in the North American caustic soda market, projected to expand at a CAGR of 4.9%. This growth is primarily fueled by increasing demand for chlorine-based derivatives and specialty chemical intermediates used across pharmaceuticals, agrochemicals, and synthetic materials.

These compounds serve as essential building blocks for resins, solvents, and surfactants that are integral to various downstream industries.

A key driver behind this growth is the expansion of the biopharmaceutical sector, where caustic soda is used in purification processes and active ingredient synthesis.

Additionally, environmental regulations have encouraged the adoption of caustic soda in carbon capture and scrubbing technologies.

With continuous innovation in green chemistry and advanced manufacturing, the chemicals segment is poised for robust and sustained growth in the North American caustic soda market.

By Chlorine Application Insights

Ethylene dichloride (EDC) and polyvinyl chloride (PVC) production represent the largest application segment for chlorine in North America, capturing 45.3% of total chlorine consumption in 2024. This dominance is primarily driven by the widespread use of PVC in construction, infrastructure development, and industrial applications.

PVC remains a preferred material for piping, flooring, window profiles, and wire insulation due to its durability, cost-effectiveness, and recyclability.

Moreover, government investments in water infrastructure modernization have further stimulated chlorine demand via EDC/PVC supply chains.

In addition, the energy-intensive nature of EDC cracking operations aligns well with North America’s abundant and relatively low-cost ethane feedstock derived from shale gas reserves. Given the entrenched role of PVC in major economic sectors, the EDC/PVC segment is expected to maintain its leadership in the regional chlorine market for the foreseeable future.

Propylene oxide production is the fastest-growing application segment for chlorine in the North America chlor alkali market, anticipated to grow at a CAGR of 5.6% through 2033. This surge is largely attributed to rising demand for polyurethanes used in automotive foams, insulation materials, and coatings—sectors experiencing strong growth due to evolving consumer preferences and regulatory mandates on energy efficiency.

One of the primary catalysts behind this growth is the increasing adoption of chlorohydrin-based propylene oxide (CHPO) technology, particularly among smaller-scale producers seeking flexibility and integration with existing chlorine assets. While newer non-chlorine methods such as HPPO (hydrogen peroxide to propylene oxide) are gaining traction, the CHPO route still accounts for a significant portion of regional production due to its established infrastructure and compatibility with existing chlor alkali facilities.

Moreover, the automotive industry’s shift toward lighter-weight vehicle components has spurred demand for polyurethane foam systems, many of which rely on propylene oxide as a core raw material. With ongoing advancements in mobility, construction, and packaging, the propylene oxide segment is positioned for rapid and sustained growth within the NortAmericanca chlorine market.

By Soda Ash Application Insights

Glass manufacturing stands as the largest application segment for soda ash in the North America chlor alkali market, commanding 48.2% of total soda ash consumption in 2024. This dominance is primarily driven by the extensive use of soda ash as a fluxing agent in flat glass, container glass, and fiber glass production, where it lowers the melting point of silica and enhances workability.

The United States, home to some of the world's largest natural soda ash reserves, remains the primary supplier and user of soda ash for glass applications, particularly in states like California, Ohio, and Pennsylvania.

The automotive and construction industries are key end-users of glass products, both of which experienced strong performance in 2023.

In addition, sustainability trends have favored glass recycling initiatives, which also require soda ash input to supplement recycled cullet in furnace formulations. With robust demand from both new and recycled glass production, the glass manufacturing segment continues to dominate the North American soda ash market.

Water treatment is the fastest-growing application segment for soda ash in the North American chlor alkali market, projected to expand at a CAGR of 4.1%. This upward trajectory is primarily driven by increasing municipal and industrial investments in water softening, pH adjustment, and contaminant removal processes.

Unlike caustic soda, which can increase corrosivity, soda ash effectively removes hardness ions such as calcium and magnesium without adversely affecting pipe integrity.

Industrial sectors, particularly food and beverage, power generation, and textile manufacturing, have also increased their reliance on soda ash-based water treatment solutions. Moreover, the growing emphasis on sustainable wastewater management has led to increased use of soda ash in flue gas desulfurization and heavy metal precipitation applications.

With heightened focus on clean water access, regulatory compliance, and industrial sustainability, the water treatment segment is set to outpace other soda ash applications in terms of growth rate over the coming decade.

REGIONAL ANALYSIS

United States Chlor Alkali Market Insights

The United States dominated the North American chlor alkali market, accounting for 80.1% of total regional production and consumption in 2024. As one of the largest chemical-producing nations globally, the U.S. maintains a well-established chlor alkali industry supported by abundant natural resources, mature industrial infrastructure, and strong downstream demand.

Domestic demand is primarily driven by the PVC, pulp and paper, textiles, and water treatment sectors. Meanwhile, the U.S. Environmental Protection Agency noted that municipal water treatment plants processed 38 billion gallons of drinking water daily, underscoring chlorine’s critical role in public health and sanitation.

Additionally, the Inflation Reduction Act and Infrastructure Investment and Jobs Act have spurred investments in chemical manufacturing, water infrastructure, and clean energy projects, all of which support sustained chlor alkali consumption.

Canada Chlor Alkali Market Insights

Canada is maintaining a stable but smaller presence compared to the United States. Despite its modest scale, Canada sustains a fully integrated chlor alkali industry, serving key domestic markets such as pulp and paper, aluminum smelting, and chemical manufacturing.

The province of Quebec benefits from hydroelectric-powered chlor alkali facilities, which offer lower energy costs and reduced carbon emissions compared to fossil-fuel-based alternatives.

The Canadian pulp and paper industry remains a major consumer of caustic soda, utilizing it extensively in kraft pulping and bleaching processes.

Additionally, Canada’s aluminum sector, one of the largest in the world, drives steady demand for caustic soda in alumina refining. Although constrained by stricter environmental regulations and limited plant expansions, Canada’s chlor alkali industry remains strategically positioned within the broader North American framework, leveraging sustainable practices and regional trade linkages.

The Rest of North America is gradually expanding due to growing industrial activity, foreign direct investment, and cross-border trade dynamics.

Mexico Chlor Alkali Market Insights

Mexico serves as the primary contributor within this sub-region, benefiting from its integration into the U.S. supply chain under the U.S.-Mexico-Canada Agreement (USMCA).

The automotive and electronics sectors, which have seen substantial investment in recent years, have also contributed to increased chlor alkali demand.

Furthermore, the Mexican government has intensified efforts to modernize urban water infrastructure, leading to higher procurement of disinfectants and water purification chemicals.

While still developing, the chlor alkali market in the Rest of North America presents emerging opportunities for expansion, particularly as regional economies continue to integrate with North American supply chains and adopt more stringent hygiene and industrial standards.

LEADING PLAYERS IN THE NORTH AMERICAN CHLOR ALKALI MARKET

Olin Corporation

Olin Corporation is a leading player in the North American chlor alkali market, with a long-standing presence in chlorine and caustic soda production. The company operates integrated facilities that support both upstream chemical manufacturing and downstream applications. Olin’s strategic focus on operational efficiency, product diversification, and sustainable production methods has solidified its position as a key contributor to the global chlor alkali industry. Its products serve critical sectors such as water treatment, plastics, and industrial chemicals, reinforcing its influence beyond regional boundaries.

Westlake Chemical Corporation

Westlake Chemical is a major participant in the North American chlor alkali sector, leveraging vertical integration to optimize production and enhance supply chain resilience. The company produces chlorine and caustic soda primarily for internal use in downstream PVC and vinyl-based products, though it also supplies external markets. Westlake’s emphasis on innovation, capital investments in modern electrolysis technologies, and commitment to environmental stewardship have positioned it as a forward-thinking force in the global chlor alkali landscape.

Formosa Plastics Corporation, USA

Formosa Plastics is a dominant entity in the U.S. chlor alkali market, operating large-scale facilities that integrate chlorine and caustic soda into broader petrochemical and polymer manufacturing. The company's extensive infrastructure and process optimization strategies ensure stable output for both domestic and international markets. By aligning its chlor alkali operations with PVC and epoxy derivatives production, Formosa supports diverse industries globally while maintaining a strong foothold in North America through continuous investment and technological upgrades.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One of the primary strategies employed by key players in the North American chlor alkali market is vertical integration, wherein companies consolidate upstream and downstream operations to enhance cost efficiency and supply chain control. This approach allows firms to utilize chlorine and caustic soda internally for producing PVC, epoxies, and other derivatives while also supplying external customers, ensuring steady demand and improved margins.

Another crucial strategy is an investment in advanced production technologies, particularly membrane cell and oxygen-depolarized cathode (ODC) systems, which improve energy efficiency and reduce environmental impact. Companies are upgrading legacy facilities to meet evolving sustainability standards and regulatory requirements, thereby securing long-term operational viability and competitiveness.

Lastly, strategic expansion and asset consolidation play a vital role in strengthening market positions. Leading firms are acquiring underutilized plants, forming joint ventures, or expanding production capacities in favorable locations to capitalize on growing downstream demand and secure a stronger foothold in the regional chlor alkali market.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the North American chlor alkali market include Occidental Petroleum Corporation, Olin Corporation, Westlake Corporation, Formosa Plastics Corporation, Shin-Etsu Chemical Co. Ltd., Ercros S.A., Tata Chemicals North America Inc., Covestro LLC, Axiall Corporation, Tronox Holdings pl.c

The competition within the NortAmericanca chlor alkali market is shaped by a combination of established industry leaders, vertically integrated producers, and niche manufacturers striving to maintain relevance amid evolving economic and regulatory conditions. While a few dominant players control the majority of production capacity, smaller regional firms continue to operate by focusing on specialized applications and localized supply chains. This dynamic fosters both collaboration and rivalry, particularly as companies seek to optimize costs, comply with environmental regulations, and invest in next-generation technologies.

Market participants face challenges related to energy-intensive operations, aging infrastructure, and fluctuating raw material prices, all of which necessitate strategic planning and innovation. Some firms differentiate themselves through product diversification, while others emphasize sustainability initiatives and process optimization to enhance their competitive edge. Additionally, trade dynamics, particularly between the U.S., Canada, and Mexico, influence market positioning and distribution networks.

With increasing emphasis on clean chemistry, circular economy models, and resource efficiency, the chlor alkali industry must continuously adapt to remain resilient. As a result, the competitive landscape remains fluid, driven by technological advancements, regulatory pressures, and shifting end-user demands across key industrial sectors.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Olin Corporation announced the modernization of its chlorine and caustic soda production facility in Freeport, Texas, incorporating advanced membrane cell technology to improve energy efficiency and reduce carbon emissions.

- In March 2024, Westlake Chemical expanded its Lake Charles, Louisiana complex with a new chlorine derivatives unit aimed at supporting increased PVC and epoxy resin output, reinforcing its integrated manufacturing capabilities.

- In June 2024, Formosa Plastics Corporation, USA initiated a multi-phase upgrade at its Point Comfort, Texas site to enhance process automation and increase production reliability for both chlorine and caustic soda.

- In August 2024, Occidental Petroleum entered into a strategic partnership with a European chemical firm to explore joint ventures in sustainable chlor-alkali processing technologies and alternative feedstock utilization.

- In October 2024, Shintech, a subsidiary of Shin-Etsu Chemical, announced plans to expand its Plaquemine, Louisiana chlor alkali plant to better serve growing downstream demand in the Gulf Coast region.

DETAILED SEGMENTATION OF THE NORTH AMERICAN CHLOR ALKALI MARKET INCLUDED IN THIS REPORT

This research report on the North America Chlor Alkali Market has been segmented and sub-segmented based on type, chlorine application, soda ash application, & region.

By Type

- Alumina Industry Application

- Chemicals Industry Application

By Chlorine Application

- EDC/PVC Production

- Propylene Oxide Production

By Soda Ash Application

- Glass Manufacturing

- Water Treatment

By Region

- US

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What are the key products in the chlor alkali market?

The major products include chlorine, caustic soda, soda ash, hydrogen, and hydrochloric acid.

2. Which industries are the primary end-users of chlor alkali products?

Key end-user industries include paper and pulp, water treatment, textiles, chemicals, pharmaceuticals, and construction.

3. What is driving the growth of the North America chlor alkali market?

Growth is driven by rising demand for water treatment, increased industrialization, and demand from downstream sectors like PVC manufacturing.

4. What challenges does the chlor alkali market face in North America?

Environmental regulations, energy-intensive production processes, and fluctuations in raw material costs are significant challenges.

5. Which countries dominate the North America chlor alkali market?

The United States is the dominant player, followed by Canada and Mexico.

6. Who are the key players in the North America chlor alkali market?

Major players include Occidental Petroleum Corporation, Olin Corporation, Westlake Corporation, Formosa Plastics Corporation, and Shin-Etsu Chemical Co. Ltd.

7. How is the chlor alkali market segmented?

It is segmented by product type (chlorine, caustic soda, etc.), production process (membrane cell, diaphragm cell, mercury cell), application, and country.

8. What are the main applications of chlor alkali products?

These products are used in water treatment, pulp and paper, textiles, plastics, pharmaceuticals, detergents, and chemical manufacturing.

9. What trends are shaping the future of the chlor alkali market in North America?

Trends include the adoption of sustainable production methods, increased demand for PVC, and advancements in green chemistry technologies.

10. What are the future growth opportunities in the North America chlor alkali market?

Growth opportunities lie in green production technologies, expansion in downstream industries, and rising demand in Latin American export markets.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com