North America Clinical Trial Management System Market Research Report – Segmented By Product (Software, Services ) Delivery (Web-hosted,Cloud-based) Deployment (Enterprise ,On-site )End User (Pharma,CROs) and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Clinical Trial Management System Market Size

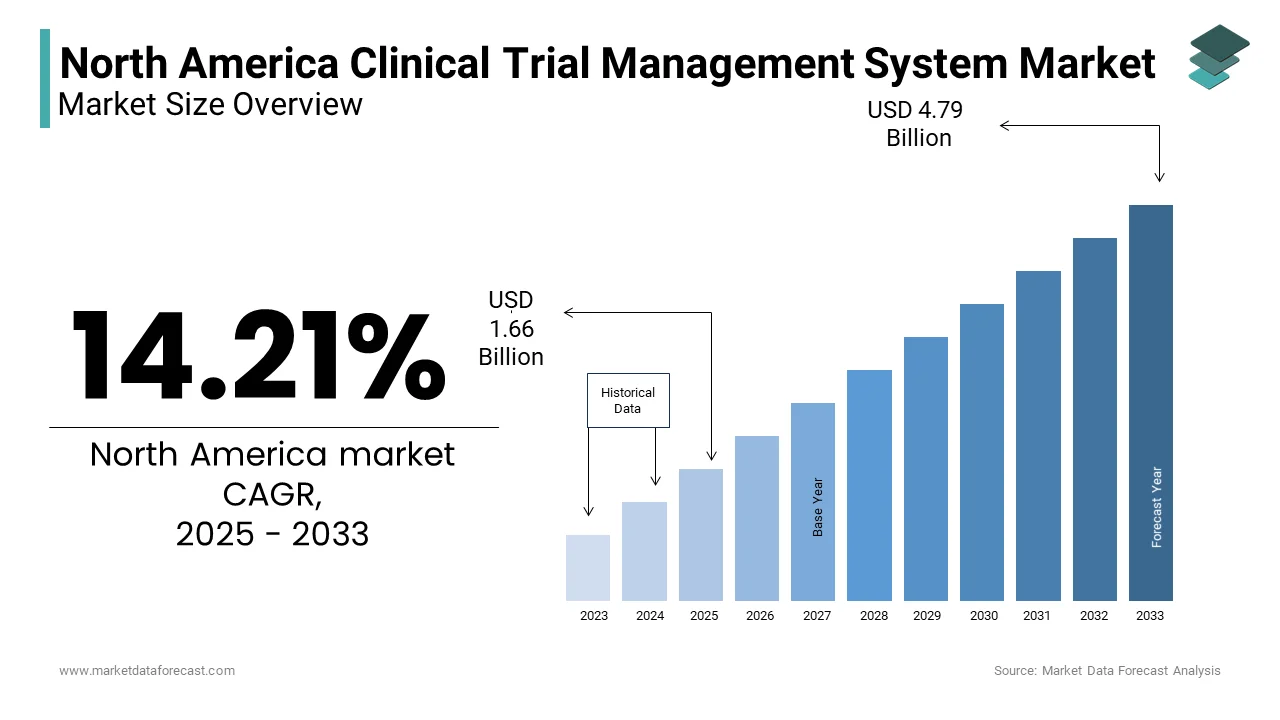

The North America Clinical Trial Management System Market Size was valued at USD 1.45 billion in 2024. The North America Clinical Trial Management System Market size is expected to have 14.21 % CAGR from 2025 to 2033 and be worth USD 4.79 billion by 2033 from USD 1.66 billion in 2025.

The North America clinical trial management system (CTMS) market is a robust and evolving sector, driven by advancements in technology and an increasing emphasis on data-driven decision-making in healthcare research. This is attributed to the high concentration of pharmaceutical companies, contract research organizations (CROs), and academic institutions conducting clinical trials. The United States alone contributes significantly to this figure, with regulatory frameworks like the FDA’s stringent compliance requirements further propelling the adoption of CTMS solutions.

Moreover, this surge has necessitated efficient systems for managing trial protocols, patient recruitment, and regulatory submissions. Additionally, the rise of decentralized clinical trials, accelerated by the COVID-19 pandemic, has created a favorable environment for cloud-based CTMS platforms. A report by the Tufts Center for the Study of Drug Development highlights that approximately 30% of trials now incorporate remote monitoring tools, further boosting demand. These factors collectively position North America as a pivotal hub for innovation and growth in the CTMS landscape.

MARKET DRIVERS

Increasing Adoption of Cloud-Based Solutions

Cloud-based clinical trial management systems are gaining traction due to their scalability, cost-effectiveness, and ability to streamline complex workflows. This growth is fueled by the rising need for real-time data access and collaboration among geographically dispersed teams. For instance, during the pandemic, decentralized trials became a necessity, and cloud-based CTMS facilitated remote monitoring and data collection. Also, as per a survey conducted by Applied Clinical Trials, nearly 65% of clinical trial sponsors reported improved efficiency after transitioning to cloud-based platforms. This shift is supported by robust cybersecurity measures, ensuring compliance with regulations like HIPAA and GDPR. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) into cloud-based systems enhances predictive analytics, enabling better resource allocation and risk management. These technological advancements underscore the critical role of cloud adoption as a primary driver of the CTMS market in North America.

Rising Complexity of Clinical Trials

The increasing complexity of clinical trials, characterized by multi-center studies and diverse patient populations, is another significant driver. According to the National Institutes of Health (NIH), the average cost of developing a new drug exceeds $2.6 billion, with clinical trials accounting for a substantial portion. To manage these costs and complexities, organizations are turning to advanced CTMS solutions. In addition, a study by Deloitte reveals that trials involving multiple sites experience a 30% reduction in timelines when utilizing CTMS platforms. These systems enable centralized oversight are ensuring standardized protocols and consistent data quality across sites. Moreover, the growing focus on personalized medicine has led to trials targeting niche patient groups, further amplifying the need for sophisticated management tools. As per BioMed Central, over 40% of ongoing trials now involve targeted therapies, necessitating precise patient recruitment and monitoring capabilities. This trend underscores the indispensable role of CTMS in addressing the escalating demands of modern clinical research.

MARKET RESTRAINTS

High Implementation Costs

One of the primary barriers to widespread CTMS adoption is the high upfront cost associated with implementation and customization. This financial burden is particularly challenging for small and medium-sized enterprises (SMEs) and academic research institutions with limited budgets. To add to this, ongoing maintenance and licensing fees add to the total cost of ownership. A study published in the Journal of Medical Internet Research indicates that 45% of organizations cite budget constraints as a significant obstacle to adopting advanced CTMS solutions. While cloud-based systems offer a more affordable alternative migration from legacy systems often requires additional investment in training and infrastructure upgrades. These financial considerations create a barrier to entry, especially for smaller players in the clinical research ecosystem.

Data Privacy and Security Concerns

Data privacy and security remain critical concerns in the adoption of CTMS solutions, particularly given the sensitive nature of clinical trial data. Regulatory frameworks such as HIPAA in the U.S. impose strict guidelines on data handling, which can complicate the implementation of CTMS platforms. Also, a survey by Healthcare IT News reveals that 60% of healthcare organizations are hesitant to adopt new technologies due to cybersecurity risks. Ensuring compliance with these regulations requires significant investment in encryption, access controls, and regular audits, which can deter some organizations from fully embracing CTMS solutions. In conjunction with, the integration of third-party applications and APIs increases vulnerability to cyberattacks, further exacerbating these concerns. These challenges underscore the need for robust security measures to build trust and drive broader adoption.

MARKET OPPORTUNITIES

Expansion of Decentralized Clinical Trials

The rapid expansion of decentralized clinical trials presents a significant opportunity for the CTMS market. As per the McKinsey & Company, decentralized trials are expected to account for 25% of all clinical trials by 2025 and is driven by advancements in telemedicine and wearable technologies. These trials rely heavily on CTMS platforms to manage remote patient interactions, data collection, and real-time monitoring. This shift creates a fertile ground for CTMS vendors to innovate and offer tailored solutions that address the unique challenges of remote trial management. By integrating features such as virtual patient consent, ePRO (electronic patient-reported outcomes), and IoT device connectivity, CTMS platforms can enhance operational efficiency and patient engagement. The growing acceptance of decentralized models by regulatory bodies like the FDA further amplifies this opportunity.

Integration of AI and Predictive Analytics

The integration of artificial intelligence (AI) and predictive analytics into CTMS platforms represents another major growth avenue. The findings by PwC indicates that AI-driven solutions could contribute up to $150 billion annually to the U.S. healthcare economy by 2025. In clinical trials, AI-powered CTMS systems can optimize site selection, predict patient enrollment rates, and identify potential risks before they escalate. Apart from this, a study by Accenture reveals that organizations leveraging AI in clinical operations achieve a 20% reduction in trial timelines and a 15% increase in patient retention. For example, predictive analytics can analyze historical trial data to forecast recruitment bottlenecks enabling proactive interventions. Along with, AI enhances data integrity by automating repetitive tasks and minimizing human error. As pharmaceutical companies increasingly prioritize efficiency and innovation, the demand for AI-integrated CTMS solutions is poised to soar, creating lucrative opportunities for market players.

MARKET CHALLENGES

Resistance to Technological Change

Despite the clear benefits of CTMS solutions, resistance to technological change remains a significant challenge. According to a report by KPMG, 70% of organizations encounter internal pushback when implementing new digital tools primarily due to a lack of technical expertise and fear of disruption. This resistance is particularly pronounced among smaller CROs and academic institutions that rely on manual processes or legacy systems. A study by the Clinical Researcher journal indicates that only 40% of clinical trial professionals feel adequately trained to use advanced CTMS platforms. This skill gap often results in underutilization of system capabilities, limiting return on investment. Furthermore, cultural inertia within traditional research settings can hinder the adoption of innovative technologies. Overcoming these barriers requires comprehensive training programs and clear communication of the long-term benefits of CTMS adoption, which can be resource-intensive and time-consuming.

Interoperability Issues with Existing Systems

Interoperability challenges between CTMS platforms and existing healthcare IT systems pose another significant hurdle. Based on the data released by the HIMSS or the Healthcare Information and Management Systems Society, 60% of healthcare organizations struggle with integrating new software solutions due to incompatible data formats and fragmented infrastructures. In clinical trials, seamless data exchange between electronic health records (EHRs), laboratory information systems (LIS), and CTMS is crucial for maintaining data accuracy and compliance. Besides these, a report by the American Medical Informatics Association highlights that interoperability issues lead to a 25% increase in manual data reconciliation efforts, undermining the efficiency gains promised by CTMS adoption. On top of that, the absence of universal standards for data exchange exacerbates these challenges, forcing organizations to invest in custom integrations. These complexities not only inflate costs but also delay the deployment of CTMS solutions, impeding their widespread adoption across the industry.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.21 % |

|

Segments Covered |

By Product,Delivery,Deployment,End User and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Oracle Corporation (US), Medidata Solutions (US), Parexel International (US), Bioclinica (US) |

SEGMENTAL ANALYSIS

By Product Insights

The software segment segment dominated the North America clinical trial management system market by holding a market share of 60.6% in 2024. This control over the market is driven by the increasing need for comprehensive tools to manage trial protocols, patient data, and regulatory submissions. Moreover, the growing complexity of trials, coupled with the rise of decentralized models, has amplified demand for feature-rich software platforms. According to BioPharm Insight, over 70% of pharmaceutical companies prioritize software solutions that offer real-time analytics and customizable workflows. Beyond this, the integration of AI and ML capabilities enhances decision-making and operational efficiency, further solidifying the software segment’s authority. These factors collectively underscore the pivotal role of software in shaping the CTMS market landscape.

The services segment is projected to grow at the highest CAGR of 15.8% from 2025 to 2033. This growth is fueled by the increasing complexity of trial designs and the need for specialized expertise in system implementation and maintenance. A report by IQVIA highlights that outsourced services account for 40% of total CTMS-related spending, reflecting the reliance on external providers for technical support and training. Furthermore, the shift toward cloud-based solutions has created a demand for managed services including data migration, cybersecurity, and regulatory compliance. Based on a survey by Outsourcing Pharma, 55% of organizations prefer partnering with service providers to ensure seamless integration and ongoing system optimization. These trends show the critical role of services in supporting the adoption and sustainability of CTMS platforms.

By Delivery Insights

The web-hosted delivery model held the largest market share of 45.3% in 2024. This influence is credited to its balance of accessibility and control, making it ideal for organizations transitioning from legacy systems. A study by Gartner indicates that web-hosted solutions offer a 25% reduction in deployment time compared to on-premise alternatives. Besides, the flexibility of web-hosted platforms appeals to mid-sized organizations seeking cost-effective yet scalable options. According to a report by TechTarget, 60% of clinical trial sponsors prefer web-hosted systems for their ability to integrate with existing IT infrastructures while providing real-time data access. These factors underscore the enduring popularity of web-hosted delivery in the CTMS market.

The cloud-based segment is accelerating at a CAGR of 16.5%. This rapid progress is backed by the increasing adoption of decentralized trials and the need for remote collaboration. According to study, cloud-based systems reduce operational costs by 30% through automated updates and scalable storage. Apart from these, the integration of AI and IoT enhances data analytics and patient monitoring is making cloud-based solutions indispensable for modern trials. A study by Zebra Technologies reveals that 70% of organizations plan to migrate to cloud-based platforms within the next five years, spotlighting their transformative potential.

By Deployment Insights

The enterprise deployment model accounted for 55.2% of the market share in 2024. The dominance of segment is caused by its ability to support large-scale, multi-center trials with centralized oversight. As per a report by Beroe Inc., enterprise solutions improve trial efficiency by 40% through standardized protocols and real-time reporting. The growing emphasis on regulatory compliance further drives demand, as enterprise systems ensure data integrity across multiple sites. As per PharmaVOICE, 65% of pharmaceutical companies prioritize enterprise deployment for its scalability and robust security features.

The on-site deployment model is advancing at a CAGR of 14.2%. This development is influenced by the need for localized control in sensitive trials. A study by Clinical Leader indicates that on-site systems reduce data latency by 20% enhancing responsiveness. Also, smaller organizations favor on-site deployment for its cost-effectiveness and ease of implementation making it a rapidly emerging segment.

By End User Insights

The pharmaceutical sector captured a 51.1% market share in 2024. This authority is driven by the high volume of trials conducted by pharma companies. According to EvaluatePharma, pharma-sponsored trials account for 60% of global clinical research activity. The increasing focus on personalized medicine further amplifies demand, as per Nature Reviews Drug Discovery. These factors cement pharma’s position as the leading end user.

CROs are moving ahead quickly at a CAGR of 17.3% . This growth is driven by the outsourcing trend, with 45% of trials managed by CROs, according to Contract Pharma. Their agility and expertise make them a key growth driver.

COUNTRY LEVEL ANALYSIS

The United States is the dominant force in North America’s companion animal drugs market, holding an estimated 79.2% share in 2024. This authority over the market is backed by the presence of leading pharmaceutical companies, CROs, and a robust regulatory framework established by the FDA. As per a report by the Pharmaceutical Research and Manufacturers of America (PhRMA), the U.S. conducts over 40% of global clinical trials, creating a fertile ground for CTMS adoption. Also, a key aspect is the increasing focus on decentralized trials, with the FDA endorsing remote monitoring tools during the pandemic. As per Deloitte, decentralized trials reduce patient dropout rates by 30%, further boosting demand for advanced CTMS platforms. To reinforce this point, the integration of AI and predictive analytics into U.S.-based systems enhances operational efficiency. A study by Accenture reveals that organizations leveraging AI in trials achieve a 20% reduction in timelines. These factors solidify the U.S.'s leadership in the CTMS landscape.

Canada represents a stable and moderately growing market. The country’s growth is credited to its strong research infrastructure and collaboration between academia and industry. As indicated by the Innovation, Science and Economic Development Canada, the nation invests over CAD 4 billion annually in health research, fostering a conducive environment for CTMS adoption. The Canadian government’s push for digital transformation in healthcare, including initiatives like the Digital Health Strategy, has accelerated the uptake of cloud-based CTMS solutions. A report by Statistics Canada notes that 70% of clinical trials in the country now utilize digital tools for data management. Together with, Canada’s emphasis on personalized medicine aligns with the capabilities of modern CTMS platforms driving their adoption. These trends underscore Canada’s growing role in the CTMS ecosystem.

The Rest of North America which includes Mexico and several smaller economies in the region are emerging as the fastest-growing segment, with a projected compound annual growth rate of 8.7% from 2025 to 2033. While smaller in scale, this segment is witnessing steady growth due to increasing investments in healthcare infrastructure. The Mexican Association of Pharmaceutical Research Industries (AMIIF) stresses that Mexico’s clinical trial activity grew by 15% in 2022 driven by collaborations with international sponsors. Moreover, government initiatives, such as the National Health Information System in Mexico are promoting the adoption of digital tools like CTMS. A study by the Pan American Health Organization indicates that decentralized trials are gaining traction in these regions supported by advancements in telemedicine. These developments exhibit the potential for growth in the Rest of North America.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America Clinical Trial Management System Market are Oracle Corporation (US), Medidata Solutions (US), Parexel International (US), Bioclinica (US), and IBM (US), Bio-Optronics (US), Datatrak (US), Veeva Systems (US), DSG (US), MasterControl (US), ERT (US), Advarra Technology Solutions (US), MedNet Solutions (US), ArisGlobal (US), DZS Clinical Services (US).

The North America CTMS market is characterized by intense competition, with major players vying for technological supremacy. The market is fragmented, with both established giants and niche players offering specialized solutions. Innovations in cloud-based platforms and AI integration are key differentiators. Regulatory compliance and customer-centric features further intensify rivalry. This competitive landscape fosters rapid advancements, benefiting end users.

Top Players in the Market

Oracle Corporation

Oracle Corporation occupies a prominent position in the CTMS market, offering a comprehensive suite of solutions tailored to the needs of pharmaceutical companies and CROs. Its strengths lie in its robust cloud infrastructure and seamless integration capabilities with existing IT systems. The company’s focus on enhancing user experience through AI-driven analytics has positioned it as a leader in managing complex multi-center trials.

Medidata Solutions

Medidata Solutions is renowned for its innovative approach to clinical trial management, particularly in decentralized and hybrid trial models. Its platform leverages real-time data analytics and IoT integration to optimize patient recruitment and monitoring. Medidata’s commitment to advancing precision medicine has strengthened its reputation as a pioneer in the CTMS space.

Veeva Systems

Veeva Systems excels in providing enterprise-grade CTMS solutions that cater to large-scale pharmaceutical operations. Its strengths include scalability, regulatory compliance, and a strong emphasis on data security. Veeva’s ability to address the evolving needs of global clinical trials has cemented its status as a trusted partner for organizations seeking efficient trial management.

Top strategies used by the key market participants

Key players in the North America CTMS market employ strategies such as product innovation, strategic partnerships, and geographic expansion to strengthen their positions. Product innovation focuses on integrating AI and ML to enhance predictive analytics. Strategic partnerships with healthcare IT firms ensure interoperability, while geographic expansion targets emerging markets. These strategies collectively drive market growth.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Oracle Corporation launched a new AI-powered module for its CTMS platform, enabling real-time risk assessment and predictive analytics for clinical trials.

- In June 2023, Medidata Solutions partnered with a leading telehealth provider to integrate virtual patient monitoring tools into its decentralized trial offerings.

- In August 2023, Veeva Systems expanded its operations in Canada, targeting academic institutions conducting clinical research with its scalable CTMS solutions.

- In October 2023, IBM Watson Health introduced an enhanced version of its CTMS software, focusing on improving data security and regulatory compliance for multi-center trials.

- In December 2023, Parexel International acquired a niche CTMS provider specializing in medical device trials, strengthening its portfolio for device manufacturers.

MARKET SEGMENTATION

This research report on the north america clinical trial management system market has been segmented and sub-segmented into the following.

By Product

- Software

- Services

By Delivery

- Web-hosted

- Cloud-based

By Deployment

- Enterprise

- On-site

By End User

- Pharma

- CROs

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

Which industries primarily use Clinical Trial Management Systems in North America Clinical Trial Management System Market?

CTMS is primarily used in pharmaceuticals, biotechnology, CROs, medical device companies, and academic research institutions.

Which countries lead the North America clinical trial management system market?

The United States and Canada are the major players due to their robust pharmaceutical industry, high R&D spending, and favorable government regulations.

What role does regulatory compliance play in the North America clinical trial management system market ?

CTMS solutions must comply with FDA (21 CFR Part 11), HIPAA, ICH-GCP, and other regulations to ensure data integrity, patient safety, and adherence to clinical trial protocols.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com