North America Companion Animal Drugs Market Size, Share, Trends & Growth Forecast Report By Animal Type (Dogs, Cats, Horses), Route of Administration, Indication, Distribution Channel, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2024 to 2033

North America Companion Animal Drugs Market Size

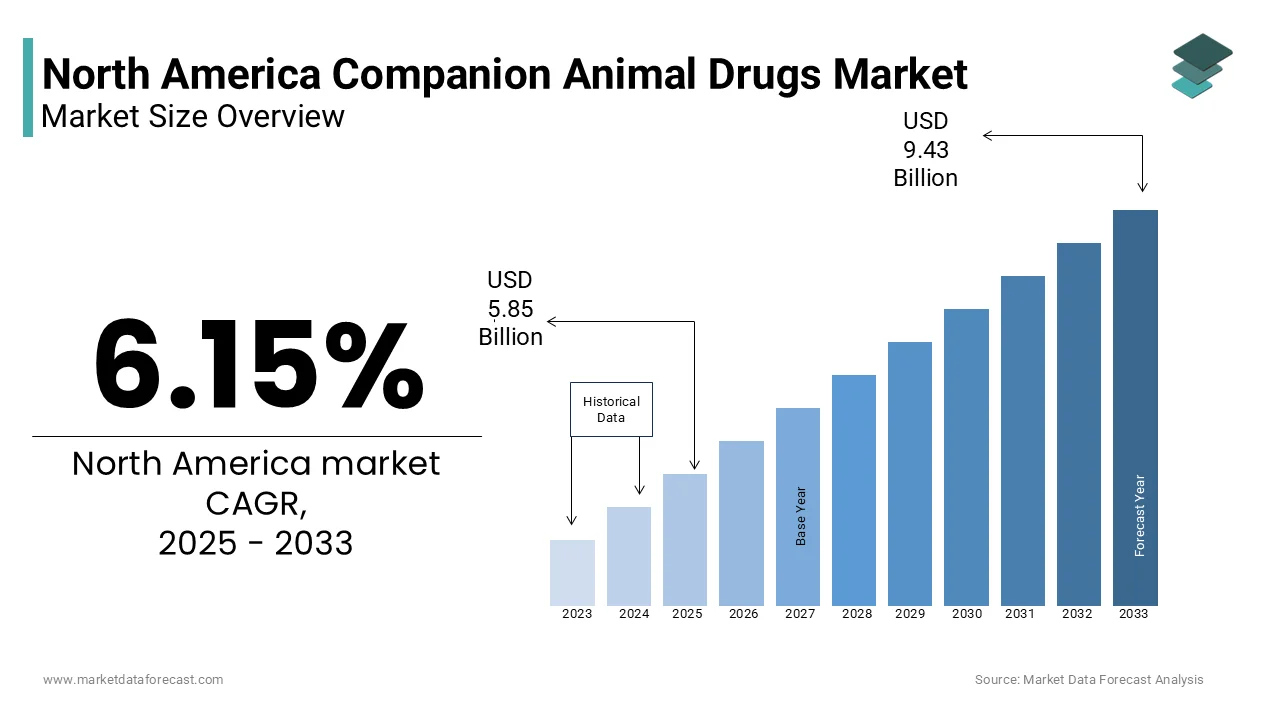

The North America Companion Animal Drugs market size was valued at USD 5.51 billion in 2024 and is predicted to be worth USD 9.43 billion by 2033 from USD 5.85 billion in 2025 and grow at a CAGR of 6.15% from 2025 to 2033.

The North America companion animal drugs market is a rapidly growing segment within the broader veterinary pharmaceuticals industry, driven by increasing pet ownership and advancements in animal healthcare. According to the American Pet Products Association, over 70% of U.S. households own a pet, with dogs and cats being the most popular companions. This surge in pet ownership has fueled demand for high-quality veterinary care and specialized medications. The market benefits from significant investments in research and development enabling the production of innovative treatments for chronic conditions such as arthritis, diabetes, and parasitic infections. Canada complements this growth with its robust veterinary infrastructure and rising awareness of animal welfare. Regulatory frameworks including those enforced by the U.S. Food and Drug Administration (FDA) ensure the safety and efficacy of companion animal drugs by fostering consumer trust. However, challenges such as high costs of veterinary care and limited access to advanced treatments in rural areas persist. As per data from the National Center for Biotechnology Information, approximately 30% of pet owners cite affordability as a barrier to accessing necessary medications. Despite these hurdles, the market remains buoyant, supported by technological advancements and growing emotional attachment to pets.

MARKET DRIVERS

Rising Pet Humanization Trend

The humanization of pets is a pivotal driver of the North America companion animal drugs market, reflecting the deepening emotional bond between humans and their animals. Pets are increasingly regarded as family members, leading to heightened spending on their health and well-being. Based on findings by the American Veterinary Medical Association, annual expenditures on veterinary care in the U.S. reached a substantial mark in 2023, with a significant portion allocated to medications. This trend is particularly evident among millennials and Gen Z pet owners, who prioritize preventive care and premium treatments. The rise of pet insurance further supports this trend, with the North American Pet Health Insurance Association reporting a 20% year-over-year increase in policy subscriptions. These factors collectively drive demand for innovative and effective companion animal drugs, positioning the market for sustained growth.

Increasing Prevalence of Chronic Diseases in Pets

Another critical driver is the rising prevalence of chronic diseases among companion animals, necessitating long-term medication regimens. Conditions such as obesity, diabetes, and cancer are becoming more common due to factors like sedentary lifestyles and improper diets. As per the Banfield Pet Hospital’s State of Pet Health Report, cases of diabetes in dogs increased by 80% over the past decade, while feline obesity rates rose by 170%. This upward trend underscores the need for specialized treatments involving antibiotics, anti-inflammatory drugs, and insulin therapies. Beyond this, aging pets contribute to this demand; as per the American Kennel Club, the average lifespan of dogs has increased by 2 years over the last 20 years resulting in higher incidences of age-related ailments. Pharmaceutical companies are responding by developing targeted therapies such as monoclonal antibodies and enzyme replacement drugs. With chronic disease management becoming a priority for pet owners, the companion animal drugs market is poised for substantial expansion.

MARKET RESTRAINTS

High Costs of Veterinary Treatments

One of the primary restraints impacting the North America companion animal drugs market is the high cost of veterinary treatments, which limits accessibility for many pet owners. Advanced medications, such as biologics and specialty drugs, often come with steep price tags, making them unaffordable for low- and middle-income households. The Bureau of Labor Statistics notes that veterinary service costs have risen by 40% over the past decade, outpacing inflation. This financial burden is exacerbated by the lack of comprehensive pet insurance coverage, with only 3% of pets in the U.S. insured, as per the North American Pet Health Insurance Association. Consequently, many pet owners delay or forego necessary treatments, negatively impacting market growth. Addressing affordability concerns through subsidies or innovative pricing models remains a pressing challenge for industry stakeholders.

Stringent Regulatory Requirements

Stringent regulatory requirements pose another significant restraint for the North America companion animal drugs market. The approval process for veterinary drugs involves rigorous testing to ensure safety and efficacy, often taking several years and costing millions of dollars. According to the FDA, the average time to bring a new veterinary drug to market is 7-10 years, with clinical trials accounting for over 60% of total development costs. These hurdles discourage smaller companies from entering the market limiting innovation and competition. Furthermore, post-market surveillance mandates require manufacturers to monitor adverse effects adding to operational expenses. A study by PwC estimates that regulatory compliance costs can reduce profit margins by up to 15%. While these measures safeguard animal health, they also slow down product launches and increase prices, creating barriers for both manufacturers and consumers. Balancing regulatory rigor with market accessibility remains a persistent challenge.

MARKET OPPORTUNITIES

Expansion of Telemedicine Platforms

The integration of telemedicine platforms presents a significant opportunity for the North America companion animal drugs market, enhancing accessibility and convenience for pet owners. Virtual consultations enable veterinarians to diagnose conditions and prescribe medications remotely, addressing gaps in rural and underserved areas. According to the American Veterinary Medical Association, telehealth adoption in veterinary practices surged by 50% during the pandemic, with sustained growth expected. Companies like Chewy and Zoetis have launched digital platforms offering prescription refills and home delivery services, streamlining the purchasing process. Data from McKinsey & Company indicates that online sales of veterinary medications grew by 35% in 2023 reflecting consumer preference for digital solutions. By leveraging telemedicine, pharmaceutical companies can expand their reach, improve customer engagement, and foster loyalty. This trend aligns with the broader shift toward digital transformation, positioning telehealth as a key growth driver for the market.

Development of Preventive Care Solutions

One more promising opportunity lies in the development of preventive care solutions, catering to the growing emphasis on proactive pet health management. Vaccines, parasiticides, and nutritional supplements are gaining traction as pet owners prioritize early intervention and wellness. As mentioned by the Merck Animal Health, preventive care accounts for nearly 40% of total veterinary expenditures, spotlighting its significance. Innovations such as extended-release formulations and combination therapies enhance convenience and compliance driving adoption. For instance, Zoetis’ ProHeart 12, a once-yearly heartworm preventive injection, saw a 25% increase in sales in 2023, as per company reports. Government initiatives promoting animal health awareness further bolster demand. As well as, partnerships between pharmaceutical companies and veterinary clinics facilitate education campaigns encouraging routine check-ups and timely interventions. By focusing on preventive care, the market can address unmet needs while fostering long-term relationships with pet owners.

MARKET CHALLENGES

Counterfeit and Substandard Medications

Counterfeit and substandard medications pose a significant challenge to the North America companion animal drugs market, threatening animal health and eroding consumer trust. Illegitimate products, often sold through unauthorized online channels, account for approximately 10% of global veterinary drug sales, as per the World Health Organization. These counterfeit drugs may lack active ingredients or contain harmful substances leading to treatment failures and adverse effects. The FDA in 2022 issued warnings about counterfeit flea and tick medications circulating in the U.S. prompting recalls and investigations. The prevalence of e-commerce exacerbates this issue, with online platforms often failing to verify seller credentials. In line with a report by the Alliance for Safe Online Pharmacies, over 95% of online pharmacies do not comply with legal standards. Combating this menace requires robust supply chain monitoring, stricter regulations, and public awareness campaigns. Without effective measures, counterfeit drugs could undermine market integrity and jeopardize animal welfare.

Limited Awareness in Rural Areas

Limited awareness of advanced veterinary treatments in rural areas represents another formidable challenge for the North America companion animal drugs market. Many pet owners in these regions lack access to specialized veterinary care and remain unaware of available medications. The U.S. Department of Agriculture reveals that over 20% of rural households own pets, yet veterinary service utilization rates are significantly lower compared to urban areas. Cultural perceptions and economic constraints further compound the issue, with many rural pet owners relying on traditional remedies rather than modern pharmaceuticals. A study by the Rural Health Information Hub highlights that veterinary shortages affect nearly 40% of rural counties limiting access to preventive care and chronic disease management. Outreach programs and mobile clinics have emerged as potential solutions, but funding and logistical challenges hinder scalability. Bridging this awareness gap is essential to ensuring equitable access to companion animal drugs and driving inclusive market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.15% |

|

Segments Covered |

By Animal Type, Route of Administration, Indication, Distribution Channel, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Zoetis Inc., Inc., Ceva Santé Animal, Merck & Co., Virbac Animal Health, Bayer AG, Eli Lily & Co, Sanofi (Merial), Boehringer Ingelheim GmbH, and others |

SEGMENTAL INSIGHTS

By Animal Type Insights

The most dominant segment is Dogs of the North America companion animal drugs market and captured 55.7% of the total share in 2024. This leading position in the market is associated to their extensive popularity as pets, with over 90 million dogs owned in the U.S. alone, according to the American Kennel Club. Also, the segment's growth is fueled by the rising incidence of chronic conditions, such as arthritis and obesity, which necessitate long-term medication. Moreover, advancements in veterinary diagnostics have enabled early detection of diseases, increasing demand for targeted therapies. The emotional bond between dogs and their owners further drives spending on premium treatments, with pet parents willing to invest in biologics and personalized medicine. Government initiatives promoting responsible pet ownership also contribute to market expansion. With dogs remaining the preferred companion animal, this segment is poised to maintain its dominance in the foreseeable future.

The cats segment represented the fastest-growing category in the North America companion animal drugs market, with a projected CAGR of 7.8% through 2033. This growth is driven by increasing cat ownership, particularly among urban millennials, who value cats for their low-maintenance nature. The American Pet Products Association stresses that cat ownership has grown by 15% over the past five years, surpassing dogs in certain demographics. In further support of this, cats are prone to specific conditions such as urinary tract infections and hyperthyroidism creating demand for specialized medications. Innovations such as palatable oral formulations and transdermal gels cater to cats' unique physiological traits, enhancing compliance. The rise of indoor cats has also spurred demand for parasiticides and vaccines, as pet owners prioritize preventive care. With urbanization and lifestyle changes accelerating, the cat segment is set to outpace other categories, solidifying its status as a growth engine for the market.

By Route of Administration Insights

The oral administration segment has the maximum adoption rate in the North America companion animal drugs market by holding a share of 46.2% in 2024. This preference is because of the ease of use and non-invasive nature of oral medications making them suitable for home administration. Tablets, capsules, and liquid formulations are widely prescribed for treating chronic conditions such as arthritis and diabetes. The availability of flavored options enhances palatability ensuring better compliance among pets. Likewise, advancements in drug delivery systems such as extended-release formulations have improved therapeutic outcomes, driving adoption. The American Veterinary Medical Association notes that oral medications account for over 60% of prescriptions for chronic diseases. Their cost-effectiveness compared to injectables further bolsters demand. With innovations enhancing convenience and efficacy, oral administration remains the preferred route for companion animal drugs.

The topical administration of this market attained the swiftest growth rate with a calculated CAGR of 9.2% in the coming years. This upward trajectory is stimulated by the increasing demand for parasiticides such as flea and tick treatments which are predominantly administered topically. Spot-on formulations and sprays offer targeted action and ease of application, appealing to pet owners seeking hassle-free solutions. The rise of multi-parasite products, capable of combating fleas, ticks, and mites simultaneously, further propels growth. As well as, advancements in transdermal technology have expanded the scope of topical drugs, enabling systemic delivery of medications for chronic conditions. A study by Merck Animal Health found that topical treatments account for over 30% of parasite control sales. With growing awareness of preventive care and innovations enhancing efficacy, the topical segment is poised to lead market expansion.

By Indication Insights

The parasiticides segment gained the highest prominence under this category of the North America companion animal drugs market by commanding a business share of 35.9% in 2024. This recognition of the segment is propelled by the high prevalence of parasitic infections, such as fleas, ticks, and heartworms, which pose significant health risks to pets. The American Heartworm Society reports that over 1 million dogs are diagnosed with heartworm annually, showcasing the need for preventive treatments. Innovations such as long-lasting formulations and combination therapies enhance convenience and compliance, boosting adoption. Additionally, increasing awareness of zoonotic diseases has heightened demand for parasiticides, as pet owners prioritize both animal and human health. Government initiatives promoting parasite control further support market growth. With parasitic infections remaining a persistent threat, this segment continues to lead the market, ensuring steady demand for effective solutions.

Antibiotics are the fastest-growing indication segment, with a projected CAGR of 8.6% through 2033. This progression is caused by the rising incidence of bacterial infections, such as urinary tract infections and skin conditions, which necessitate antibiotic therapy. The American Veterinary Medical Association notes that antibiotic prescriptions have increased by 20% over the past five years reflecting growing demand. Innovations such as broad-spectrum formulations and targeted therapies enhance efficacy, addressing resistance concerns. To add to this, the rise of multidrug-resistant bacteria has spurred research into novel antibiotics, driving market expansion. Public awareness campaigns promoting responsible antibiotic use further bolster demand, ensuring sustainable growth. With bacterial infections posing a persistent challenge, antibiotics are set to emerge as a key focus area for pharmaceutical companies, fueling segmental growth.

By Distribution Channel Insights

The veterinary hospitals and clinics segment secured the top spot in the North America companion animal drugs market by contributing 60.3% of the overall share in 2024. This market control is supported by the trust and credibility associated with professional veterinary care. Hospitals and clinics serve as the primary point of contact for pet owners, facilitating diagnosis, treatment, and medication dispensing. Moreover, the American Veterinary Medical Association brings to attention that over 80% of pet owners prefer obtaining medications directly from veterinary facilities citing convenience and reliability. Additionally, the rise of specialized clinics such as oncology and cardiology centers has expanded access to advanced treatments, driving demand. Strategic partnerships between pharmaceutical companies and veterinary chains further enhance distribution efficiency. With pet owners prioritizing quality care, veterinary hospitals and clinics remain the cornerstone of the companion animal drugs market.

Online pharmacies is the quickest expanding distribution channel, with a calculated CAGR of 10.5% owing to the increasing adoption of e-commerce and the convenience it offers to pet owners. Platforms such as Chewy and 1-800-PetMeds provide a wide range of medications, often at discounted prices, appealing to cost-conscious consumers. The rise of telemedicine has further accelerated this trend, enabling remote consultations and prescription refills. According to McKinsey & Company, online sales of veterinary medications grew by 40% in 2023 reflecting shifting consumer preferences. Innovations such as subscription models and home delivery services enhance customer retention, driving repeat purchases. With digital transformation reshaping the veterinary landscape, online pharmacies are poised to emerge as a dominant force in the distribution ecosystem.

REGIONAL ANALYSIS

The United States continues to dominate the North American companion animal drugs market by accounting for an estimated 79.2% of the regional share in 2024. Its hegemony is backed by the country's robust veterinary infrastructure, high pet ownership rates, and significant investments in animal healthcare innovation. According to the American Pet Products Association, over 90 million households in the U.S. own pets, with annual spending on veterinary care exceeding $34 billion in 2023. This surge in demand is driven by the humanization of pets, with millennials and Gen Z leading the trend. Additionally, advancements in biologics and personalized medicine have positioned the U.S. as a global leader in cutting-edge treatments. Government initiatives, such as the FDA’s Center for Veterinary Medicine programs, ensure the safety and efficacy of drugs, fostering consumer trust. Strategic partnerships between pharmaceutical companies and veterinary chains further enhance accessibility. With urbanization and lifestyle changes accelerating, the U.S. remains a cornerstone of the regional market, driving innovation and growth.

Canada’s companion animal pharmaceutical sector presents a mature yet evolving landscape. The country’s growth trajectory is due to its strong emphasis on animal welfare and rising awareness of preventive care. As per the Statistics Canada, pet ownership rates have increased by 20% over the past decade, with dogs and cats being the most popular companions. Also, the Canadian government’s support for veterinary research, exemplified by funding initiatives through the Natural Sciences and Engineering Research Council, bolsters innovation. Additionally, the rise of telemedicine platforms has improved access to veterinary care, particularly in rural areas. A report by the Canadian Veterinary Medical Association highlights those online consultations surged by 40% during the pandemic reflecting shifting consumer preferences. With increasing disposable incomes and a growing focus on pet health, Canada’s market is poised for steady expansion, reinforcing its regional significance.

Countries in the Rest of North America, particularly Mexico, are emerging as high-growth zones for companion animal pharmaceuticals, with a projected CAGR of 8.7% between 2025 and 2033. Mexico’s companion animal drugs market benefits from its expanding middle class and rising pet ownership rates, as per data from the Mexican Veterinary Association. The country’s strategic proximity to the U.S. facilitates seamless trade, with cross-border collaborations enhancing product availability. However, challenges such as limited access to advanced veterinary care and affordability issues persist. According to the National Institute of Statistics and Geography, over 60% of pet owners cite cost as a barrier to accessing medications. Despite these hurdles, government initiatives promoting animal health awareness and partnerships with international pharmaceutical companies are driving growth. Innovations such as affordable generics and localized distribution networks further bolster accessibility. With increasing urbanization and economic development, Mexico’s market is set to gain momentum contributing to regional growth.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Zoetis Inc., Inc., Ceva Santé Animal, Merck & Co., Virbac Animal Health, Bayer AG, Eli Lily & Co, Sanofi (Merial), Boehringer Ingelheim GmbH are playing dominating role in North America companion animal drugs market.

The North America companion animal drugs market is characterized by intense competition, driven by the presence of multinational corporations and regional players. Companies strive to differentiate themselves through innovation, cost efficiency, and sustainability. Strategic collaborations, such as joint ventures and licensing agreements, are common to leverage complementary strengths. The market’s fragmented nature necessitates continuous investments in R&D and process optimization. Regulatory compliance and shifting consumer demand further intensify competition, compelling players to adopt agile strategies.

TOP PLAYERS IN THE MARKET

Zoetis Inc.

Zoetis Inc. is a global leader in the companion animal drugs market, renowned for its innovative solutions and extensive product portfolio. Headquartered in New Jersey, the company specializes in vaccines, parasiticides, and dermatology products, catering to diverse therapeutic needs. Zoetis’ strengths lie in its cutting-edge R&D capabilities and commitment to sustainability, exemplified by its goal to achieve carbon neutrality by 2030. The company’s integration across the value chain, from research to distribution, ensures operational efficiency and customer satisfaction. Zoetis’ focus on digital transformation, including telemedicine platforms, enhances accessibility and engagement, solidifying its leadership position globally.

Merck Animal Health

Merck Animal Health, a subsidiary of Merck & Co., is a dominant player in the North America companion animal drugs market. The company excels in producing high-performance medications, including antibiotics, vaccines, and parasiticides. Its market position is bolstered by strategic investments in biologics and personalized medicine. Merck’s collaborative approach with veterinarians and researchers fosters innovation, enabling it to deliver tailored solutions that meet evolving market demands. The company’s emphasis on preventive care aligns with global health trends, reinforcing its reputation as a trusted partner in animal healthcare.

Elanco Animal Health

Elanco Animal Health is a key contributor to the North America companion animal drugs landscape, specializing in parasiticides, vaccines, and nutritional supplements. The company’s state-of-the-art manufacturing facilities and focus on operational excellence drive its success. Elanco’s leadership in developing sustainable products, such as eco-friendly packaging and recyclable materials, aligns with environmental goals. Its strong distribution network and customer-centric strategies further enhance its market presence, positioning it as a vital player in the global veterinary pharmaceuticals industry.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the North America companion animal drugs market employ strategies such as mergers and acquisitions, R&D investments, and sustainability initiatives to strengthen their positions. Mergers and acquisitions enable companies to expand their product portfolios and geographic reach. For instance, Elanco acquired Bayer’s animal health division to enhance its offerings in parasiticides and vaccines. R&D investments focus on developing innovative solutions, such as Zoetis’ advancements in monoclonal antibodies for allergic dermatitis. Sustainability initiatives, including Merck’s circular economy programs, address regulatory requirements and consumer preferences. Partnerships with technology firms also drive digital transformation, optimizing supply chains and production processes.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Zoetis launched Solensia, a novel monoclonal antibody treatment for feline osteoarthritis, marking a breakthrough in chronic pain management for cats.

- In June 2023, Merck Animal Health partnered with PetDesk to integrate telemedicine services, enhancing accessibility to companion animal drugs.

- In March 2023, Elanco acquired Kindred Biosciences, expanding its pipeline of biologics and specialty therapeutics for pets.

- In January 2023, Boehringer Ingelheim introduced NexGard Spectra Combo, a multi-parasite treatment for dogs, addressing unmet needs in parasite control.

- In November 2022, Virbac initiated a nationwide campaign to promote preventive care, distributing educational materials to over 10,000 veterinary clinics across North America.

MARKET SEGMENTATION

This research report on the North America companion animal drugs market has been segmented and sub-segmented based on the following categories.

By Animal Type

- Dogs

- Cats

- Horses

- Other Companion Animals

By Route of Administration

- Oral

- Injectable

- Topical

By Indication

- Infectious Diseases

- Dermatologic Diseases (Skin Diseases)

- Pain

- Orthopedic Diseases

- Behavioral Disorders

- Others (Dental, Cardio, Pregnancy, Cancer)

By Distribution Channel

- Veterinary Hospitals

- Veterinary Clinics

- Retail Pharmacies

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

1. What is the projected size of the North America companion animal drugs market by 2033?

The market is expected to grow from USD 5.85 billion in 2025 to USD 9.43 billion by 2033, at a CAGR of 6.15%.

2. What factors are driving growth in the companion animal drugs market?

Key drivers include increasing pet ownership, rising awareness of animal health, advancements in veterinary medicine, and growing demand for preventive care products.

3. What is the future outlook for the North America companion animal drugs market?

The market is poised for steady growth due to increasing pet humanization, advancements in veterinary medicine, and expanding access to healthcare services for animals.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com