North America Conveyor Belt Market Size, Share, Trends & Growth Forecast Report By Type (Medium-Weight Conveyor Belt, Light-Weight Conveyor Belt, and Heavy-Weight Conveyor Belt), End-Use, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2024 to 2033

North America Conveyor Belt Market Size

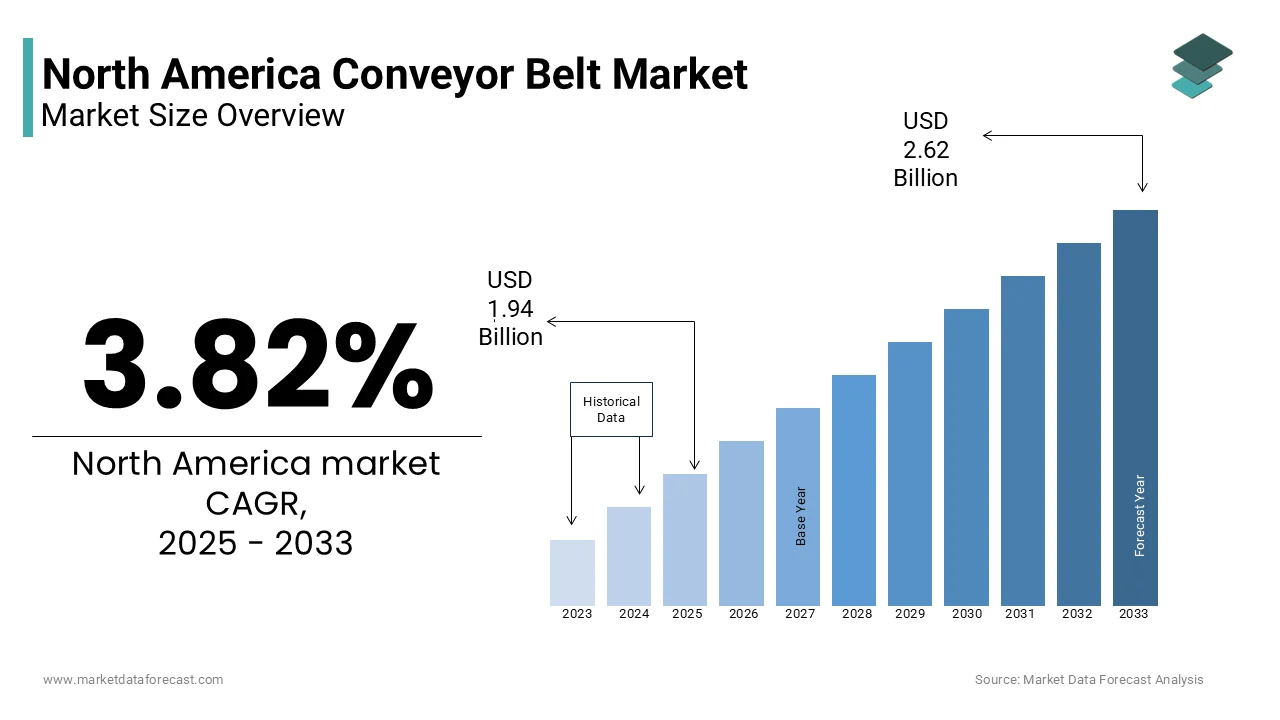

The Conveyor Belt market size in North America was valued at USD 1.87 billion in 2024 and is predicted to be worth USD 2.62 billion by 2033 from USD 1.94 billion in 2025 and grow at a CAGR of 3.82% from 2025 to 2033.

The North American conveyor belt market is witnessing steady growth due to industrialization and urbanization. The conveyor belts are integral to mining operations with material handling equipment used in the sector. Additionally, the rise of e-commerce has amplified demand for conveyor systems in warehousing and distribution centers, as per the Material Handling Institute. These factors collectively position North America as a dynamic hub for conveyor belt innovation and adoption.

MARKET DRIVERS

Growth in E-Commerce and Logistics

The rapid expansion of e-commerce and logistics operations is a primary driver of the conveyor belt market in North America. This surge has created an unprecedented demand for efficient material handling solutions, with conveyor belts playing a pivotal role in automating warehouse operations. A study by Prologis reveals that the average warehouse size in North America increased by 20% in 2022, necessitating advanced conveyor systems to handle higher volumes of goods. Conveyor belts enhance operational efficiency by reducing manual labor and minimizing errors by making them indispensable for large-scale fulfillment centers operated by companies like Amazon and Walmart. Furthermore, advancements in smart conveyor technology, such as IoT-enabled systems, have improved real-time tracking and optimization by aligning with the needs of modern supply chains.

Expansion in Mining and Metallurgy

Another significant driver is the increasing activity in the mining and metallurgy sector, which relies heavily on conveyor belts for material handling. According to the National Mining Association, the U.S. mining industry generated over $900 billion in economic output in 2022, with conveyor systems being integral to operations in coal, copper, and iron ore extraction. Heavy-weight conveyor belts, capable of transporting bulk materials over long distances and rugged terrains. As per a report by the U.S. Geological Survey, coal production in the Appalachian region alone exceeded 200 million tons in 2022 with the need for durable and high-capacity conveyor solutions.

MARKET RESTRAINTS

High Maintenance and Operational Costs

One of the primary restraints impeding the growth of the conveyor belt market is the high maintenance and operational costs associated with these systems. Conveyor belts require regular upkeep to ensure optimal performance, including lubrication, alignment adjustments, and replacement of worn components. According to the Material Handling Industry, maintenance costs can account for up to 25% of the total lifecycle expenses of a conveyor system. Additionally, unexpected breakdowns can lead to costly downtime in industries like e-commerce and manufacturing where efficiency is paramount. According to a study by the American Society of Mechanical Engineers, over 30% of conveyor-related operational issues stem from inadequate maintenance practices. These financial burdens often deter small and medium-sized enterprises from adopting advanced conveyor systems are limiting market expansion.

Environmental Regulations and Sustainability Concerns

Another significant restraint is the increasing scrutiny of environmental regulations and sustainability concerns surrounding conveyor belt materials and operations. Governments across North America have implemented stringent policies aimed at reducing carbon emissions and promoting eco-friendly practices. For instance, California’s Air Resources Board mandates reductions in greenhouse gas emissions from industrial equipment, including conveyor systems. According to the Environmental Protection Agency, the use of non-recyclable rubber and synthetic materials in conveyor belts contributes significantly to industrial waste. Additionally, the energy consumption of conveyor systems, particularly in heavy-duty applications like mining, has drawn criticism from environmental groups. According to a report by the Ellen MacArthur Foundation, only 10% of industrial plastics used in conveyor belts are recycled by creating challenges for manufacturers seeking to align with sustainability goals.

MARKET OPPORTUNITIES

Adoption of Smart Conveyor Technologies

The integration of smart technologies, such as IoT sensors and AI-driven analytics, represents a significant opportunity for the conveyor belt market. These innovations enable real-time monitoring, predictive maintenance, and operational optimization, addressing key challenges like downtime and inefficiency. In industries like e-commerce and manufacturing, where precision and speed are critical, these capabilities offer a competitive edge. Companies investing in smart conveyor solutions, such as IoT-enabled belts and automated sorting systems, are well-positioned to capitalize on this trend.

Expansion in Renewable Energy Projects

Another promising opportunity lies in the growing adoption of conveyor belts in renewable energy projects in solar and wind farms. According to the U.S. Department of Energy, renewable energy capacity in North America is projected to grow by 25% annually through 2030 by creating demand for efficient material handling solutions. Conveyor belts are used extensively in the construction and maintenance of solar panels and wind turbines by facilitating the transportation of raw materials and components. According to a study by BloombergNEF, solar panel installations in the U.S. exceeded 20 gigawatts in 2022 with the need for scalable conveyor systems. Additionally, the push toward hydrogen production, supported by government initiatives like the Hydrogen Energy Earthshot program, is driving demand for conveyor belts in electrolyzer manufacturing.

MARKET CHALLENGES

Intense Competition from Alternative Material Handling Solutions

One of the foremost challenges facing the conveyor belt market is the growing competition from alternative material handling solutions, such as robotic systems and automated guided vehicles (AGVs). These technologies are increasingly being adopted in industries like e-commerce and manufacturing, where flexibility and scalability are prioritized. According to the Robotics Industries Association, shipments of industrial robots in North America increased by 10% in 2022, with many companies opting for robotic arms and AGVs over traditional conveyor systems. While conveyor belts excel in high-volume, linear operations, they face limitations in dynamic environments requiring frequent reconfiguration. Additionally, the high initial costs of robotics are declining are making them more accessible to smaller players.

Technological Limitations in Customization

Another significant challenge is the technological limitations associated with customizing conveyor belts for niche applications. While standard conveyor systems are widely available, industries like pharmaceuticals and electronics require specialized solutions tailored to their unique needs. According to the Society of Plastics Engineers, achieving consistent quality in custom-designed conveyor belts can increase production costs by up to 35%. This limitation restricts the material’s adoption in sectors where precision and adaptability are critical. Additionally, the lack of widespread adoption of advanced materials, such as lightweight composites and bio-based polymers, hinders innovation in this space.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.82% |

|

Segments Covered |

By Type, End-Use, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Fenner Dunlop Conveyor Belting, Bridgestone Corporation, Continental AG, Intralox L.L.C., Dorner Mfg. Corp., Hytrol Conveyor Company, Beltservice Corporation, Ashworth Bros. Inc., Honeywell Intelligrated Inc, and others |

SEGMENTAL ANALYSIS

By Type Insights

The medium-weight conveyor belts segment was the largest and held 45.3% of the North American market share in 2024. Their versatility and cost-effectiveness make them ideal for a wide range of applications, from manufacturing to logistics. According to the Material Handling Industry, medium-weight belts are preferred in industries requiring moderate load capacities, such as food processing and packaging. The segment’s growth is further driven by advancements in material science by enabling the development of durable yet flexible belts capable of withstanding harsh operating conditions.

The light-weight conveyor belts segment is anticipated to register a fastest CAGR of 5.8% throughout the forecast period. This growth is fueled by their increasing adoption in industries like e-commerce and aviation, where efficiency and speed are critical. According to the International Air Transport Association, light-weight belts accounted for over 30% of all conveyor systems used in airports in 2022 by reflecting their importance in baggage handling operations.

By End-Use Insights

The mining and metallurgy segment was the largest by capturing 35.4% of the North America conveyor belt market share in 2024. The growth of the segment is driven by the extensive use of conveyor belts in material handling operations in coal and metal extraction.

REGIONAL ANALYSIS

The United States dominated the North American conveyor belt market with 75.8% of the regional share in 2024 with the underpinned by the country’s robust industrial infrastructure, extensive mining operations, and booming e-commerce sector. The U.S. mining industry generated high economic output in 2022, with conveyor belts being integral to material handling in coal, copper, and iron ore extraction. Additionally, the rise of e-commerce has amplified demand for conveyor systems in warehousing and distribution centers. As per a report by Prologis, the average warehouse size in the U.S. increased by 20% in 2022 with the advanced conveyor solutions to handle higher volumes of goods. The U.S. government’s emphasis on sustainability, through initiatives like the Inflation Reduction Act, has also spurred innovation in eco-friendly conveyor materials and technologies.

Canada held 15.4% of the North American conveyor belt market share in 2024. The country’s rich mineral resources and growing investments in oil sands have created a favorable environment for heavy-duty conveyor systems. Additionally, Canada’s focus on renewable energy projects, such as wind farms and hydrogen production, has opened new avenues for conveyor belt adoption. Furthermore, the country’s commitment to reducing carbon emissions, as outlined in its Net-Zero Emissions by 2050 plan, has encouraged the development of lightweight and recyclable conveyor materials.

KEY MARKET PLAYERS

Key players in the North America conveyor belt market are Fenner Dunlop Conveyor Belting, Bridgestone Corporation, Continental AG, Intralox L.L.C., Dorner Mfg. Corp., Hytrol Conveyor Company, Beltservice Corporation, Ashworth Bros. Inc., Honeywell Intelligrated Inc., and Daifuku Co. Ltd.

The North American conveyor belt market is characterized by intense competition, with key players vying for dominance through innovation, quality, and strategic initiatives. Companies like Continental AG, Fenner PLC, and Bridgestone Corporation dominate the landscape, each leveraging unique strengths to capture market share. Continental AG leads the pack with its cutting-edge smart conveyor solutions and global presence by allowing it to cater to large-scale projects in sectors like e-commerce and mining. Fenner PLC differentiates itself through its focus on lightweight and durable conveyor belts, appealing to customers in aviation and logistics. Bridgestone Corporation excels in providing heavy-duty solutions for the mining and metallurgy industries by targeting customers seeking robust and reliable options. Despite their individual strengths, all players face challenges such as environmental regulations, raw material price volatility, and competition from alternative material handling solutions.

TOP PLAYERS IN THE MARKET

Continental AG

Continental AG is a global leader in the conveyor belt market due to its expertise in developing high-performance conveyor belts tailored to industries like mining, manufacturing, and logistics. In 2023, Continental AG launched a line of IoT-enabled conveyor belts equipped with sensors to enable real-time monitoring and predictive maintenance. This innovation aligns with the growing demand for smart material handling solutions in e-commerce and manufacturing. Additionally, the company’s acquisition of a Canadian tech firm specializing in conveyor automation in early 2023 strengthened its ability to supply cutting-edge solutions across North America.

Fenner PLC

Fenner PLC is another prominent player in the North American market share. The company specializes in innovative conveyor solutions for the e-commerce and aviation sectors by leveraging its expertise in lightweight and durable materials. In 2023, Fenner PLC partnered with a major e-commerce giant to develop automated conveyor systems capable of handling high volumes of goods in fulfillment centers. The company’s focus on precision engineering and material science has enabled it to produce high-performance conveyor belts that meet stringent operational requirements.

Bridgestone Corporation

Bridgestone Corporation rounds out the list of top players. The company excels in providing conveyor belts for the mining and metallurgy industries by offering heavy-duty solutions capable of withstanding extreme conditions. In 2023, Bridgestone invested $150 million to expand its production facilities in Canada by targeting the growing demand for conveyor belts in the country’s mining and oil sands sectors. The company’s commitment to quality and durability has earned it long-term partnerships with leading mining companies such as Rio Tinto and BHP. Additionally, Bridgestone’s focus on sustainability has led to the development of eco-friendly conveyor materials, by aligning with global trends toward environmental responsibility.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the North American conveyor belt market employ a variety of strategies to maintain their competitive edge and drive growth. One prevalent strategy is product innovation, with companies investing heavily in research and development to create smarter, more efficient conveyor solutions. Another widely adopted strategy is forming strategic partnerships with end-users, technology providers, and government agencies to enhance market penetration. Fenner PLC’s collaboration with e-commerce giants exemplifies this approach by enabling it to develop tailored solutions for high-volume operations. Geographic expansion is also a critical focus, with companies like Bridgestone Corporation investing in new facilities and production lines to tap into emerging markets across North America.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Continental AG launched a line of IoT-enabled conveyor belts equipped with sensors for real-time monitoring and predictive maintenance, addressing the growing demand for smart material handling solutions.

- In June 2023, Fenner PLC partnered with a major e-commerce firm to develop automated conveyor systems for large-scale fulfilment centres by enhancing its market presence in the logistics sector.

- In March 2023, Bridgestone Corporation invested $150 million to expand its production facilities in Canada by targeting the growing demand for conveyor belts in the mining and oil sands industries.

- In January 2023, Continental AG acquired a Canadian tech firm specializing in conveyor automation to bolster its capabilities in smart material handling technologies.

- In October 2022, Fenner PLC completed the development of a lightweight conveyor belt tailored for aviation baggage handling systems by positioning itself as a leader in niche applications.

MARKET SEGMENTATION

This research report on the North America conveyor belt market has been segmented and sub-segmented based on the following categories.

By Type

- Medium-Weight Conveyor Belt

- Light-Weight Conveyor Belt

- Heavy-Weight Conveyor Belt

By End-Use

- Mining and Metallurgy

- Manufacturing

- Chemicals, Oils and Gases

- Aviation

- Others

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

1. What are the key opportunities in the North America Conveyor Belt Market?

Growth opportunities are driven by the expansion of e-commerce and logistics, increased automation in manufacturing, and rising demand for energy-efficient and durable conveyor systems in industries such as mining, food processing, and automotive.

2. Who are the major players in the North America Conveyor Belt Market?

Key players include Continental AG, Bridgestone Corporation, Fenner Dunlop, Habasit, and Intralox, recognized for their advanced conveyor technologies, strong distribution networks, and customized industry solutions.

3. What are the major challenges facing the North America Conveyor Belt Market?

Challenges include high initial installation and maintenance costs, supply chain disruptions affecting raw material availability, and the need for frequent technological upgrades to meet evolving industrial demands.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com