North America Data Center Power Market Size, Share, Trends & Growth Forecast Report By Components (Solution and Services), End-User Type, Data center sizes, Verticals, and Country (The United States, Canada, and Rest of North America), Industry Analysis From 2024 to 2033

North America Data Center Power Market Size

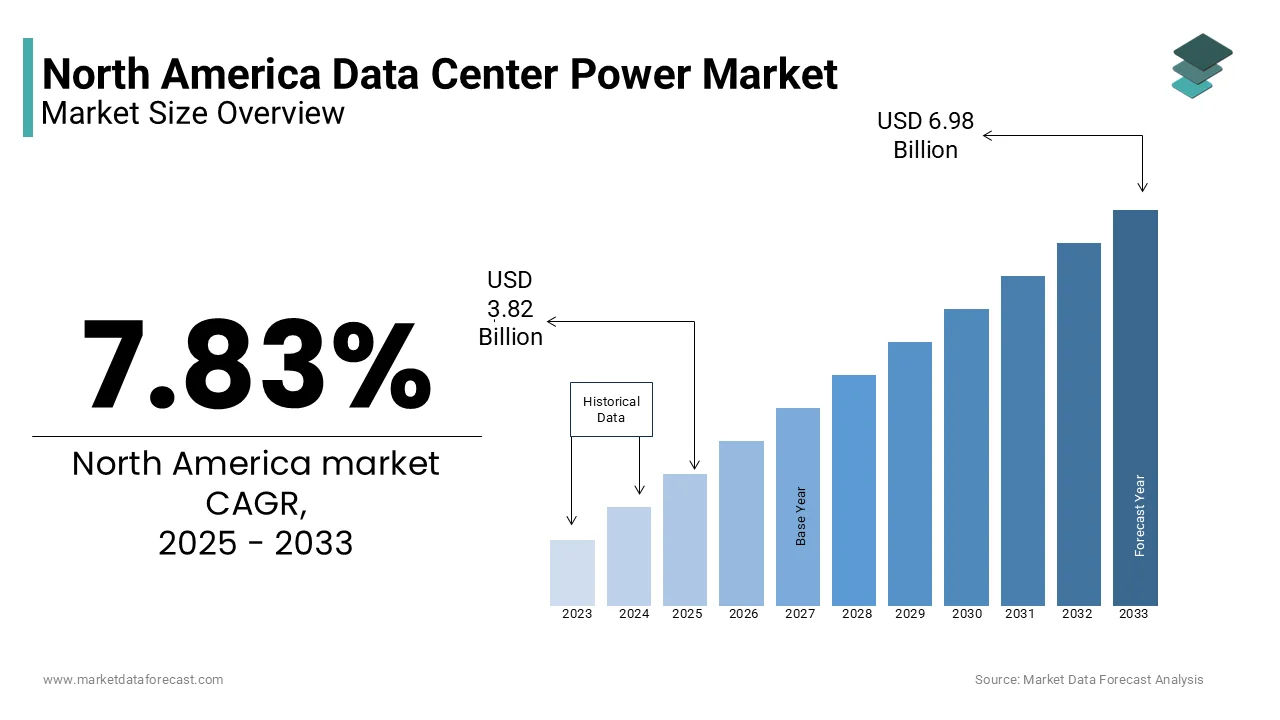

The North America data center power market was worth USD 3.54 billion in 2024. The North America market is projected to reach USD 6.98 billion by 2033 from USD 3.82 billion in 2025, rising at a CAGR of 7.83% from 2025 to 2033.

The North America data center power market refers to the infrastructure, technologies, and services involved in ensuring reliable, efficient, and uninterrupted power supply for data centers across the United States, Canada, and Mexico. These power systems include uninterruptible power supplies (UPS), generators, power distribution units (PDUs), transformers, and energy storage solutions tailored to support the continuous operation of mission-critical IT infrastructure.

As digital transformation accelerates across industries, the demand for robust data processing and cloud computing capabilities has surged. Also, the proliferation of artificial intelligence, edge computing, and IoT-driven analytics is further intensifying the need for scalable and resilient power infrastructure.

Canada’s Innovation, Science and Economic Development department reported that the country added significant number of new hyperscale data centers between 2020 and 2023, reflecting growing investment in secure and high-capacity digital infrastructure. Meanwhile, Mexico is witnessing increased interest from global tech firms seeking nearshore data hosting options with stable power access.

MARKET DRIVERS

Expansion of Hyperscale Data Centers

One of the primary drivers of the North America data center power market is the rapid expansion of hyperscale data centers operated by major technology companies such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. As businesses migrate operations to the cloud, the demand for scalable and high-density computing environments has surged, necessitating advanced power infrastructure capable of supporting continuous uptime and performance. Each of these facilities requires extensive power provisioning, often exceeding tens of megawatts per site, driving demand for UPS systems, backup generators, and intelligent PDUs. Moreover, as artificial intelligence and machine learning applications become more compute-intensive, server racks are consuming more power, prompting upgrades to existing electrical infrastructure

Rising Demand for Edge Computing Infrastructure

Another significant driver of the North America data center power market is the growing deployment of edge computing infrastructure, which brings data processing closer to end-users to reduce latency and enhance performance. As industries such as manufacturing, healthcare, logistics, and retail increasingly adopt real-time analytics and automation, the need for localized data processing hubs is expanding rapidly. In response, telecom providers, colocation operators, and enterprise IT departments are investing heavily in edge data centers, all of which require compact yet highly reliable power systems to ensure operational continuity. Power solutions for edge computing must be modular, scalable, and capable of functioning in diverse environmental conditions.

MARKET RESTRAINTS

High Capital and Operational Expenditures

A key restraint affecting the North America data center power market is the substantial capital and operational costs associated with deploying and maintaining high-efficiency power infrastructure. Building and operating modern data centers require significant upfront investments in uninterruptible power supplies (UPS), switchgear, battery banks, and backup generators. In addition to initial setup costs, ongoing operational expenses—including maintenance, fuel for diesel generators, and grid electricity consumption—add financial pressure on data center operators. According to the U.S. Energy Information Administration (EIA), commercial electricity prices in the U.S. rose by 8.7% in 2023 , directly impacting the cost of powering and cooling data hall equipment. Furthermore, regulatory requirements for energy efficiency and emissions control are pushing operators to invest in newer, cleaner technologies such as lithium-ion batteries and natural gas-powered generators, which, while beneficial in the long run, add short-term financial burdens. For smaller enterprises or colocation providers without deep pockets, these escalating costs pose a challenge in scaling operations sustainably, limiting market accessibility and slowing adoption rates for advanced power solutions.

Grid Reliability and Power Supply Constraints

Another critical constraint on the North America data center power market is the aging electrical grid infrastructure and increasing instances of power outages due to extreme weather events and grid congestion. These reliability concerns compel data center operators to implement redundant power systems, including on-site generators, flywheels, and energy storage solutions, to mitigate downtime risks. However, securing long-term power contracts and managing peak load demands remain complex challenges. ISO New England and PJM Interconnection have reported tightening reserve margins during peak usage periods, raising concerns about future capacity constraints. Additionally, some regions, particularly California and Texas, face energy supply shortages due to increased electrification and population growth. As per the North American Electric Reliability Corporation (NERC), several parts of the U.S. are at risk of insufficient generation capacity through 2025, potentially delaying data center expansions unless alternative energy sources are secured.

MARKET OPPORTUNITIES

Integration of Renewable Energy Sources

An emerging opportunity in the North America data center power market is the increasing integration of renewable energy sources such as solar, wind, and hydroelectric power to meet sustainability goals and reduce reliance on fossil fuels. Major cloud service providers, including Apple, Google, and Microsoft, have committed to achieving net-zero carbon emissions, prompting them to procure clean energy for their data center operations. Companies are entering into power purchase agreements (PPAs) to source electricity directly from utility-scale solar and wind farms, ensuring both cost predictability and environmental compliance. Additionally, advancements in hybrid power architectures—combining renewables with battery storage and microgrid technologies—are enabling greater energy independence for data centers.

Adoption of AI-Driven Power Management Systems

Another transformative opportunity in the North America data center power market is the adoption of artificial intelligence (AI) and machine learning-based power management systems to optimize energy consumption, reduce downtime, and enhance operational efficiency. Traditional static power monitoring tools are being replaced by intelligent platforms that analyze real-time data from sensors, UPS systems, and PDUs to make predictive adjustments. Leading technology firms and software providers are developing AI-driven energy analytics tools that improve power utilization effectiveness (PUE) and detect anomalies before they lead to failures. These advanced systems enable dynamic load balancing, proactive maintenance scheduling, and real-time fault detection, enhancing both reliability and cost efficiency. Companies like Schneider Electric, Siemens, and Eaton are offering AI-integrated power management suites designed specifically for hyperscale and colocation environments.

MARKET CHALLENGES

Complexity in Power Distribution and Scalability

A pressing challenge facing the North America data center power market is the growing complexity in power distribution and scalability, particularly as data centers evolve to accommodate higher rack densities and modular deployment models. Modern servers, AI accelerators, and high-performance computing hardware consume significantly more power per rack compared to traditional IT equipment, necessitating redesigned electrical architectures and upgraded power delivery systems. This shift has placed immense strain on legacy power distribution units (PDUs), transformers, and cabling infrastructure, requiring comprehensive redesigns to prevent bottlenecks and thermal inefficiencies. Additionally, the trend toward modular and prefabricated data centers introduces new challenges in ensuring seamless power integration across multiple zones and phases of expansion. Addressing these complexities demands advanced engineering, simulation modeling, and coordination between IT, facilities, and energy teams to maintain optimal performance and scalability.

Regulatory Compliance and Environmental Pressures

Regulatory compliance and environmental pressures are increasingly shaping the dynamics of the North America data center power market. Governments and industry bodies are implementing stricter guidelines on energy efficiency, emissions, and water usage, compelling data center operators to rethink their power sourcing and cooling strategies. For example, the U.S. Environmental Protection Agency (EPA) has encouraged the adoption of ENERGY STAR-certified power equipment, while state-level mandates in California and New York require data centers to meet specific energy performance benchmarks. At the same time, public scrutiny surrounding the environmental impact of data centers is rising. Environmental advocacy groups and investors are pressuring tech firms to transition away from diesel-powered backup generators toward cleaner alternatives such as hydrogen fuel cells and battery energy storage systems.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.83% |

|

Segments Covered |

By Components, End-User Type, Data center sizes, Verticals, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Vertiv Group Corp., ABB Ltd, Schneider Electric, Tripp Lite (Eaton), Raritan Inc. (Legrand), Enlogic (nvent), Kohler Co., LayerZero Power Systems, Toshiba International Corporation, Siemens AG, Cummins Inc., and Legrand. |

SEGMENT ANALYSIS

By Components Insights

The solution segment dominated the North America data center power market by capturing a 68.5% of total market revenue in 2024. This dominance is primarily attributed to the increasing deployment of critical hardware components such as uninterruptible power supplies (UPS), generators, power distribution units (PDUs), and energy storage systems that ensure continuous and reliable operation of data centers. One key driver behind this segment’s leadership is the rising demand for high-efficiency UPS systems capable of managing fluctuating loads and supporting advanced server infrastructure. Additionally, the growing adoption of modular power solutions—particularly in edge and colocation facilities—has boosted demand for scalable and integrated power systems. Furthermore, the integration of lithium-ion batteries and flywheel-based energy storage technologies into power solutions has enhanced performance and sustainability, reinforcing their central role in modern data center design.

The services segment is emerging as the fastest-growing component of the North America data center power market, expanding at a CAGR of 9.4%. This rapid growth is driven by the increasing complexity of data center power systems and the need for specialized maintenance, monitoring, and optimization services to ensure operational efficiency and uptime. A major growth catalyst is the rise in managed power service contracts offered by companies like Schneider Electric, Eaton, and Vertiv. These services include predictive analytics, remote diagnostics, and real-time power usage tracking, all of which help operators reduce downtime risks and improve energy efficiency. Moreover, the expansion of edge computing environments has heightened the need for on-site support and rapid response teams to maintain uninterrupted power supply in decentralized locations.

By End-User Type Insights

Hyperscale data centers represented the largest end-user segment in the North America data center power market by accounting for 39% of total demand in 2024. This is due to the massive infrastructure investments made by global cloud providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, which require robust and redundant power systems to support their ever-expanding digital ecosystems. These facilities necessitate high-capacity UPS systems, multi-tier redundancy architectures, and advanced PDUs to manage the intense electrical loads generated by high-density server racks. Another key factor driving this segment’s leadership is the shift toward artificial intelligence, machine learning, and big data analytics, which significantly increase compute demands and power consumption.

Colocation providers are experiencing the highest growth rate in the North America data center power market, expanding at a CAGR of 10.2%. This growth is fueled by the increasing preference among enterprises to outsource IT infrastructure to third-party facilities that offer scalable, secure, and resilient power provisioning. One of the primary drivers is the growing demand from mid-sized businesses seeking cost-effective access to premium data center infrastructure without the burden of building and maintaining their own facilities. Additionally, colocation providers are investing heavily in next-generation power systems to meet customer requirements for high availability and green certifications. Furthermore, regulatory pressures and investor expectations around carbon neutrality are pushing colocation firms to adopt clean energy sourcing and hybrid power infrastructures.

By Data Center Size Insights

Large data centers commanded the North America data center power market by representing 62.3% of total demand in 2024. This segment's control is underpinned by the extensive capital investments made by hyperscalers, cloud providers, and major financial institutions in constructing expansive, high-density facilities to support digital transformation initiatives. A primary reason for this segment’s dominance is the sheer scale of power consumption associated with large facilities. Moreover, large data centers are increasingly integrating renewable energy sources and microgrid technologies to enhance reliability and reduce environmental impact. With the proliferation of AI-driven workloads and the expansion of digital economies, large data centers will continue to be the cornerstone of the North American data center power market.

Small and medium-sized data centers are witnessing the highest progress in the North America data center power market, expanding at a CAGR of 8.7%. This is primarily driven by the increasing adoption of edge computing and localized processing across industries such as healthcare, retail, and manufacturing. A key growth catalyst is the deployment of industrial IoT (IIoT) and real-time analytics applications that require low-latency data processing capabilities. Additionally, small and medium-sized enterprises (SMEs) are shifting away from centralized cloud-only strategies toward hybrid models that combine cloud with on-premises or co-located edge facilities. These facilities also benefit from advancements in modular and prefabricated power solutions that simplify deployment and scalability.

COUNTRY-LEVEL ANALYSIS

The United States holds the largest share in the North America data center power market, contributing 74% of regional demand in 2024. This lead position is supported by the country's vast digital infrastructure ecosystem, dominated by major cloud providers, financial institutions, and technology firms that rely on high-performance data centers for mission-critical operations. A key driver is the continued expansion of hyperscale facilities, particularly in states like Virginia, Texas, and California, where land availability, fiber connectivity, and proximity to urban centers make them attractive locations for data center development. Additionally, federal and state-level incentives aimed at promoting sustainable data center operations are shaping power procurement strategies. With ongoing investments in AI, edge computing, and digital transformation across industries, the U.S. remains at the forefront of the North America data center power market, setting the pace for innovation and capacity expansion.

Canada is maintaining a steady growth trajectory driven by increasing investments in cloud computing, digital banking, and government digitization initiatives. The country’s stable political environment, favorable data sovereignty laws, and growing adoption of green energy make it an attractive location for both domestic and international data center operators. A key growth area lies in the deployment of hyperscale and colocation facilities in cities like Toronto, Montreal, and Vancouver. Canadian provinces are offering tax incentives and streamlined permitting processes to attract global players such as Google and Microsoft, who are expanding their presence in the region. Besides, Canada’s commitment to reducing greenhouse gas emissions has led to greater integration of hydroelectric and wind-powered data centers, necessitating advanced power conditioning and energy storage systems.

Mexico is positioning it as an emerging player due to rising demand for nearshore data hosting and growing investments in digital infrastructure. While traditionally less developed than the U.S. and Canada in terms of data center density, Mexico is increasingly becoming a preferred location for multinational corporations looking to establish regional hubs with lower latency and improved compliance with North American data regulations. A key growth driver is the expansion of manufacturing and logistics industries adopting Industry 4.0 technologies, which require real-time data processing and local data storage. Additionally, telecom operators and cloud service providers are investing in regional data centers to support 5G rollouts and content delivery networks (CDNs).

KEY MARKET PLAYERS

The major players in the North America data center power market include Vertiv Group Corp., ABB Ltd, Schneider Electric, Tripp Lite (Eaton), Raritan Inc. (Legrand), Enlogic (nvent), Kohler Co., LayerZero Power Systems, Toshiba International Corporation, Siemens AG, Cummins Inc., and Legrand.

TOP LEADING PLAYERS IN THE MARKET

Schneider Electric

Schneider Electric is a global leader in energy management and automation, with a dominant presence in the North America data center power market. The company offers a comprehensive portfolio of uninterruptible power supplies (UPS), power distribution units (PDUs), switchgear, and energy-efficient data center solutions. Schneider’s EcoStruxure platform integrates IoT-enabled technologies to provide real-time monitoring and predictive maintenance for mission-critical infrastructure. Its strategic focus on sustainability, digital transformation, and edge computing has positioned it as a preferred partner for hyperscale cloud providers and enterprise clients seeking resilient and intelligent power systems.

Eaton Corporation

Eaton plays a pivotal role in shaping the North America data center power landscape through its advanced UPS systems, electrical safety controls, and modular power solutions tailored for both large-scale and edge environments. The company emphasizes innovation in energy efficiency, offering hybrid and lithium-ion battery technologies that align with corporate sustainability goals. Eaton's strong R&D capabilities and long-standing partnerships with major IT and cloud infrastructure providers have enabled it to deliver customized power protection and management systems across diverse data center applications, reinforcing its leadership position in the region.

Vertiv Co.

Vertiv is a key player specializing in critical digital infrastructure, particularly in power, cooling, and monitoring solutions for data centers. The company provides end-to-end power systems including high-efficiency UPS, precision cooling, and DCIM software platforms that support continuous uptime and optimized performance. Vertiv’s expertise in modular and scalable designs makes it a preferred choice for colocation providers and hyperscalers expanding their footprint across North America. With a strong regional service network and focus on AI-driven analytics, Vertiv continues to drive advancements in data center power resilience and efficiency.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One of the primary strategies employed by leading players in the North America data center power market is product innovation and technology differentiation , focusing on developing high-efficiency, modular, and intelligent power systems. Companies are integrating AI-driven analytics, remote monitoring, and predictive maintenance features into their offerings to enhance reliability and reduce downtime risks.

Another crucial approach is strategic partnerships and ecosystem collaborations , where manufacturers team up with cloud providers, system integrators, and renewable energy firms to create integrated, future-ready power infrastructures. These alliances enable companies to offer holistic solutions that meet evolving customer demands for scalability, energy efficiency, and environmental compliance.

Lastly, expansion into edge computing and hybrid deployment models is gaining prominence. As decentralized data processing grows, vendors are tailoring compact and resilient power solutions for micro data centers, enabling seamless integration with existing enterprise and cloud architectures while strengthening their competitive positioning in the regional market.

COMPETITION OVERVIEW

The competition in the North America data center power market is characterized by a dynamic mix of global industry leaders, established engineering firms, and emerging solution providers striving to capture market share amid rising demand for resilient and sustainable infrastructure. The market is highly fragmented, with major players competing not only on product performance but also on service capabilities, technological innovation, and customization for different data center typologies—ranging from hyperscale facilities to edge deployments.

A defining feature of this competitive environment is the increasing convergence of power, cooling, and IT infrastructure, prompting vendors to offer more integrated and intelligent systems. Companies are differentiating themselves through smart grid compatibility, modular design, and enhanced energy efficiency to cater to the growing emphasis on sustainability and cost optimization. Additionally, the shift toward AI-driven power management platforms is redefining how operators monitor and optimize energy consumption, further intensifying competition among technology providers.

Moreover, regulatory pressures and investor expectations around carbon neutrality are compelling vendors to incorporate green technologies such as hydrogen fuel cells, lithium-ion batteries, and microgrid-based energy systems into their offerings. As enterprises and governments prioritize digital infrastructure resilience and decarbonization, the competition is shifting from standalone products to comprehensive, eco-conscious power ecosystems that ensure reliability, scalability, and environmental responsibility across the data center value chain.

RECENT MARKET DEVELOPMENTS

- In January 2024, Schneider Electric launched a new line of modular uninterruptible power supply (UPS) systems designed specifically for edge data centers, aiming to enhance deployment speed and energy efficiency for distributed IT environments.

- In March 2024, Vertiv entered into a strategic partnership with a leading U.S.-based AI infrastructure provider to deliver turnkey power and cooling solutions for next-generation AI training facilities, reinforcing its position in high-density computing environments.

- In June 2024, Eaton acquired a software firm specializing in real-time power analytics for data centers, enhancing its portfolio of smart energy management tools and strengthening its ability to provide predictive maintenance solutions.

- In August 2024, Caterpillar introduced a next-generation natural gas-fueled backup generator platform tailored for data centers seeking to reduce carbon emissions while maintaining grid independence during peak load conditions.

- In November 2024, Siemens expanded its microgrid-as-a-service offering to include data center clients, enabling facility operators to integrate renewable energy sources, battery storage, and intelligent load balancing for improved energy resilience and sustainability.

MARKET SEGMENTATION

This research report on the North America data center power market is segmented and sub-segmented into the following categories.

By Components

- Solution

- Power distribution

- Power monitoring

- Power backup

- Cabling infrastructure

- Services

- Design and consulting

- Integration and deployment

- Support and maintenance

By End-User Type

- Enterprises

- Colocation providers

- Cloud providers

- Hyperscale data centers

By Data center sizes

- Small and Medium-sized data center

- Large data center

By Verticals

- BFSI

- IT and Telecommunication

- Media and Entertainment

- Healthcare

- Government and Defense

- Retail

- Manufacturing

- Others (Energy, research and academia, and transport and logistics)

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What is driving the growth of the North America data center power market?

The market is growing due to increasing cloud computing adoption, rising data consumption, and the expansion of hyperscale data centers.

Which industries are major contributors to data center power demand?

The IT & telecom, banking & financial services, healthcare, and government sectors are the largest consumers of data center power.

What are the latest innovations in data center power management?

Innovations include AI-driven power optimization, lithium-ion battery adoption, and advanced energy monitoring systems.

What is the future outlook for the North America data center power market?

The market is expected to grow due to increased investments in hyperscale and sustainable data centers, alongside advancements in energy efficiency technologies.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com