North America Drip Irrigation Systems Market Size, Share, Trends & Growth Forecast Report, Segmented By Crop Type, Application, Components, & By Country (The U.S, Canada, Mexico and Rest of North America), Industry Analysis From 2025 to 2033

North America Drip Irrigation Systems Market Size

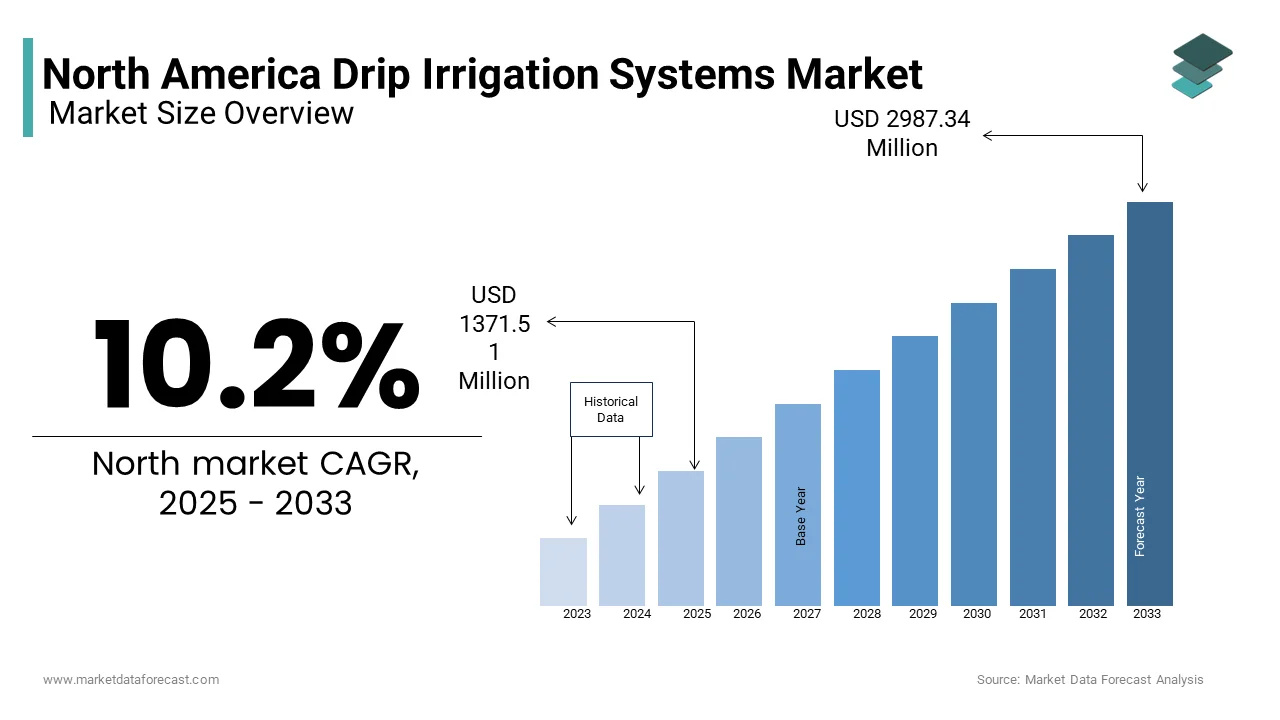

The North American drip irrigation systems market was valued at USD 1246.38 million in 2024 and is anticipated to reach USD 1373.51 million in 2025 from USD 2987.34 million in 2033, growing at a CAGR of 10.2% during the forecast period from 2025 to 2033.

MARKET DRIVERS

Water Scarcity Concerns

Water scarcity is a pressing issue in North America, particularly in western states like California and Texas, where prolonged droughts have become increasingly frequent. According to the National Oceanic and Atmospheric Administration (NOAA), the southwestern U.S. experienced a 20-year megadrought from 2000 to 2020, marking the driest period in over a millennium. This scenario has propelled the adoption of drip irrigation systems, which reduce water usage compared to traditional flood irrigation methods. Farmers are increasingly recognizing the economic benefits of conserving water, especially given that agriculture accounts for a notable share of freshwater withdrawals in the region. Furthermore, regulatory frameworks like the Sustainable Groundwater Management Act (SGMA) in California mandate efficient water use, incentivizing growers to adopt drip irrigation.

Government Subsidies and Incentives

Government initiatives play a pivotal role in driving the adoption of drip irrigation systems across North America. The U.S. Department of Agriculture’s Environmental Quality Incentives Program (EQIP) offers financial assistance to farmers who implement water-saving technologies, with allocations reaching $1.5 billion in 2023 alone. This funding has significantly lowered the barrier to entry for small and medium-sized farms, enabling them to invest in advanced irrigation systems. According to a report by the Canadian Federation of Agriculture, these incentives have led to a 25% increase in the adoption of precision irrigation technologies in the Prairie provinces over the past three years.

MARKET RESTRAINTS

High Initial Investment Costs

One of the most significant barriers to the widespread adoption of drip irrigation systems in North America is the high upfront cost associated with installation. This cost includes components such as pipes, emitters, filters, and pumps, as well as labor expenses for installation. For small-scale farmers, who constitute a significant share of the agricultural workforce in the U.S., these expenses can be prohibitive despite long-term savings on water and labor. Moreover, the need for periodic maintenance and replacement of parts adds to the financial burden. While government subsidies aim to offset these costs, their coverage is often insufficient, leaving many farmers hesitant to transition from conventional irrigation methods.

Limited Awareness Among Farmers

Another key restraint is the lack of awareness and technical knowledge about drip irrigation systems, especially among smallholder and traditional farmers. This knowledge gap is exacerbated by insufficient outreach programs and training initiatives tailored to the needs of local farming communities. In Canada, a survey by the Canadian Agricultural Human Resource Council found that only 30% of farmers in Atlantic provinces had received formal training on modern irrigation techniques. Without adequate education and demonstration of the system's benefits, farmers remain reluctant to adopt new technologies. This challenge is compounded by misconceptions about the compatibility of drip irrigation with certain crops, leading to missed opportunities for improving water efficiency and crop yields.

MARKET OPPORTUNITIES

Integration with Smart Agriculture Technologies

The convergence of drip irrigation systems with smart agriculture technologies presents a transformative opportunity for the North American market. IoT-enabled sensors, coupled with drip irrigation, allow real-time monitoring of soil moisture, nutrient levels, and weather conditions, optimizing water and fertilizer usage. Such innovations appeal to tech-savvy farmers seeking to maximize yields while minimizing resource waste. Furthermore, the increasing affordability of IoT devices, with prices dropping over the past five years, makes these solutions accessible to a broader audience.

Expansion into Non-Agricultural Applications

Beyond traditional farming, drip irrigation systems hold immense potential in non-agricultural sectors such as landscaping, sports turf management, and urban gardening. As per the National Gardening Association, the U.S. residential lawn and garden business is valued at $50 billion, with homeowners increasingly prioritizing sustainable water management practices. Municipalities and commercial establishments are also adopting drip irrigation for public parks and golf courses, reducing water usage. Similarly, rooftop gardens and vertical farming ventures in urban centers like New York and Toronto are utilizing drip systems to cultivate crops in confined spaces. With urbanization accelerating across North America, the demand for efficient water management solutions in non-agricultural settings is poised to create lucrative opportunities for market players.

MARKET CHALLENGES

Technical Complexity and Maintenance Issues

A significant challenge facing the North American drip irrigation systems market is the technical complexity involved in installation and ongoing maintenance. Clogging, caused by sediment, algae, or mineral deposits, requires regular cleaning and filtration, which can be labor-intensive and costly. Apart from these, the design of these systems must account for variations in terrain, soil type, and crop requirements, making customization a complex process. These technical hurdles are particularly pronounced for small-scale farmers who lack access to expert guidance or specialized equipment.

Competition from Alternative Irrigation Methods

Another pressing challenge is the competition from alternative irrigation methods, such as center pivot and sprinkler systems, which dominate the market due to their lower upfront costs and perceived ease of use. Sprinkler systems, on the other hand, are favored for their versatility in handling diverse crops and terrains. While drip irrigation offers superior water efficiency, its higher initial investment and maintenance requirements deter some farmers from switching. For example, a report by Kansas State University indicates that only 10% of corn growers in the Midwest have adopted drip systems, despite their proven benefits. This competitive landscape underscores the need for targeted marketing strategies and educational campaigns to highlight the long-term advantages of drip irrigation, particularly in regions dominated by traditional methods.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.2% |

|

Segments Covered |

By Crop Type, Application, Components, and Country |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

The US, Canada, Rest of North America |

|

Market Leaders Profiled |

Netafim Limited, Jain Irrigation System Limited, Lindsay Corporation, The Toro Company, Eurodrip SS.A., EPC Industries Limited, Rain Bird Corporation, Rivulus Irrigation, Driptech Incorporated. |

SEGMENT ANALYSIS

By Crop Type Insights

The fruits and vegetables segment dominated the North America drip irrigation systems market by commanding a share of 42.3% in 2024. This dominance is driven by the region's growing demand for fresh produce, which has surged over the past decade due to rising health consciousness among consumers. Like, fruits and vegetables account for nearly 30% of the total agricultural output in the U.S., making them a critical focus for water-efficient farming practices. The adoption of drip irrigation in this segment is further fueled by its ability to enhance crop yields. Apart from these, the increasing popularity of high-value crops like avocados and almonds, which require precise irrigation, has bolstered demand.

The vineyard segment is projected to grow at the highest CAGR of 9.5% through 2033. This rapid expansion is attributed to the burgeoning wine industry in North America, particularly in regions like California’s Napa Valley and British Columbia’s Okanagan Valley. As per the Wine Institute, California alone produces 81% of U.S. wine. Vineyards are increasingly adopting drip irrigation to maintain consistent soil moisture levels, which are critical for grape quality and flavor profiles. A study by Oregon State University reveals that drip irrigation can reduce water consumption by up to 60% compared to traditional methods, while improving grape sugar content by 10%. Furthermore, climate change-induced droughts have compelled winemakers to adopt sustainable practices.

By Application Insights

The agriculture segment prevailed in the market by holding a share of 68.9%. This control over the market is due to the region's reliance on agriculture as a cornerstone of its economy, with the sector contributing majoly to the U.S. GDP. Drip irrigation's ability to conserve water while boosting crop yields has made it indispensable for large-scale farming operations. For example, corn and soybean growers in the Midwest have adopted drip systems to combat erratic rainfall patterns, achieving water savings. Moreover, government programs like the Environmental Quality Incentives Program (EQIP) provide subsidies for water-efficient technologies, encouraging widespread adoption.

The greenhouse application segment is experiencing the swiftest growth, with a CAGR of 11.2%. This expansion is supported by the increasing popularity of controlled-environment agriculture (CEA), particularly in urban areas where space is limited. Drip irrigation systems are integral to greenhouse operations, enabling precise nutrient delivery and water management for crops like tomatoes, cucumbers, and leafy greens. Like, drip irrigation in greenhouses reduces water usage while increasing yields. Also, the rising demand for locally sourced produce has incentivized farmers to invest in greenhouse technologies.

By Components Insights

The segment of emitters represented the largest component in the North America drip irrigation systems market by accounting for 35.5% of the total share in 2024. This dominance is propelled by their critical role in ensuring uniform water distribution across fields. The increasing adoption of pressure-compensating emitters, which maintain consistent flow rates regardless of terrain, has further solidified their market position. For instance, almond growers in California have reported a 25% improvement in water efficiency after switching to advanced emitter technologies, as highlighted by the Almond Board of California. Apart from these, the growing integration of IoT-enabled emitters, capable of real-time monitoring and adjustments, has enhanced their appeal among tech-savvy farmers.

On the other hand, the filters segment is the fastest-growing component, with a CAGR of 10.8%. This development is caused by the increasing complexity of water sources used in irrigation, including recycled and treated wastewater. The EPA estimates that a notable share of irrigated farmland in the U.S. relies on non-traditional water sources, necessitating advanced filtration systems to prevent clogging. For example, a study by the University of Arizona found that sand media filters reduced clogging incidents by 40% in farms using reclaimed water. Furthermore, the rising adoption of micro-irrigation systems, which are highly sensitive to sediment and debris, has amplified the demand for high-efficiency filters.

KEY MARKET PLAYERS

Netafim Limited, Jain Irrigation System Limited, Lindsay Corporation, The Toro Company, Eurodrip S.A., EPC Industries Limited, Rain Bird Corporation, Rivulus Irrigation, Driptech Incorporated. Some of the market players dominate the North American drip irrigation system market.

REGIONAL ANALYSIS

Top Countries In the Market

The United States led the North American drip irrigation systems market by capturing 78.4% of the regional share in 2024. The country's vast agricultural landscape, coupled with its focus on sustainable farming practices, has propelled the adoption of drip irrigation. California, the nation's largest agricultural producer, accounts for a major share of all irrigated farmland and has embraced drip systems to combat severe drought conditions. Besides, federal initiatives like the Farm Bill allocate $1.2 billion annually for water conservation projects, further boosting adoption.

Canada continues to go ahead in the North American drip irrigation market. The country’s diverse agricultural sector, spanning prairies and coastal regions, has driven the adoption of drip irrigation. Alberta and Saskatchewan, known for their wheat and canola production, have seen a considerable annual increase in drip system installations. The Canadian government’s Agricultural Climate Solutions program provides grants for sustainable farming practices, incentivizing farmers to adopt efficient irrigation technologies.

Mexico captured a notable share of the North American drip irrigation market, with growth driven by its expanding horticultural sector. Regions like Sinaloa and Michoacán, major producers of fruits and vegetables, have adopted drip systems to meet export demands. Government subsidies and international trade agreements further support this growth.

The remaining markets, including smaller countries and territories, collectively hold a small share. These regions are witnessing gradual adoption, particularly in niche applications like vineyards and orchards. Local governments and NGOs are promoting drip irrigation to address water scarcity, ensuring steady growth in these underrepresented areas.

Top Players In the Market

Netafim

Netafim, a global leader in drip irrigation systems, has played a pivotal role in revolutionizing water-efficient agriculture. The company’s innovative solutions cater to a wide range of applications, from large-scale farming to greenhouse operations. Netafim’s emphasis on precision agriculture and smart irrigation technologies has positioned it as a key contributor to sustainable farming practices worldwide. By addressing challenges such as water scarcity and crop yield optimization, Netafim continues to shape the future of drip irrigation globally.

Lindsay Corporation

Lindsay Corporation is renowned for its cutting-edge irrigation technologies, including its Zimmatic brand of center pivot systems and FieldNET remote management solutions. The company’s focus on integrating IoT and data analytics into drip irrigation systems has set new standards for efficiency and ease of use. Lindsay’s solutions are designed to help farmers maximize productivity while minimizing resource consumption.

Rain Bird Corporation

Rain Bird Corporation is a prominent player known for its comprehensive range of irrigation products, including drip systems tailored for agriculture, landscaping, and greenhouses. The company’s dedication to sustainability and water conservation aligns with the growing demand for eco-friendly farming practices. Rain Bird’s expertise in designing durable and efficient irrigation components has earned it a loyal customer base. By emphasizing education and outreach programs, the company empowers farmers and landscapers to adopt modern irrigation techniques, further solidifying its influence in the global market.

Top Strategies Used By Key Players In The Market

Strategic Partnerships and Collaborations

Key players in the North American drip irrigation systems market have increasingly engaged in partnerships to expand their reach and enhance product offerings. Collaborations with local agricultural organizations, government bodies, and technology providers enable companies to tailor solutions to regional needs.

Product Innovation and Customization

Continuous investment in research and development has allowed leading companies to introduce advanced drip irrigation systems equipped with IoT integration and automation capabilities. By focusing on customization, these firms address specific challenges faced by farmers, such as uneven terrain or diverse crop types.

Geographic Expansion and Market Penetration

To strengthen their position, key players are expanding their footprint in underserved regions within North America. By establishing distribution networks and service centers in rural areas, companies can better serve small-scale farmers and promote the adoption of drip irrigation systems.

COMPETITION OVERVIEW

The North American drip irrigation systems market is characterized by intense competition, driven by the presence of both established multinational corporations and emerging regional players. Leading companies leverage their technological expertise and extensive distribution networks to maintain dominance, while smaller firms focus on niche markets and innovative solutions to carve out their share. The market’s competitive landscape is shaped by the need to address pressing issues such as water scarcity, climate change, and the rising demand for sustainable agriculture. Companies are increasingly investing in digital transformation, integrating IoT, AI, and data analytics into their offerings to enhance efficiency and user experience. Additionally, partnerships with governments and agricultural organizations play a crucial role in shaping market dynamics.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Netafim launched a new line of IoT-enabled drip irrigation controllers designed to optimize water usage in vineyards and orchards. This move is anticipated to strengthen its leadership in precision agriculture and expand its customer base among premium crop growers.

-

In June 2023, Lindsay Corporation partnered with a Canadian agtech startup to integrate AI-driven soil moisture sensors into its FieldNET platform. This collaboration aims to enhance real-time monitoring capabilities and improve irrigation efficiency for farmers in North America.

-

In September 2022, Rain Bird Corporation acquired a Texas-based manufacturer specializing in high-efficiency filtration systems. This acquisition is expected to bolster Rain Bird’s product portfolio and address the growing demand for advanced filtration solutions in drip irrigation.

- In February 2023, Netafim initiated a training program for small-scale farmers in the Midwest, focusing on the benefits of drip irrigation and offering subsidies for system installation. This initiative seeks to increase adoption rates in underserved agricultural communities.

-

In November 2023, Lindsay Corporation expanded its manufacturing facility in Arizona to meet the rising demand for drip irrigation systems in arid regions. This expansion is anticipated to reduce lead times and enhance customer satisfaction in the southwestern U.S.

MARKET SEGMENTATION

This research report on the North American drip irrigation system market is segmented and sub-segmented into the following categories.

By Crop Type

- Fruits and Vegetables

- Field crops

- Orchard Crops

- Turf and ornamental

- Vineyard

- Others

- Y-o-Y Growth Analysis

- Market Attractiveness Analysis

- Market Share Analysis

By Application

- Agriculture

- Landscape

- Greenhouse

- Others

- Y-o-Y Growth Analysis

- Market Attractiveness Analysis

- Market Share Analysis

By Components

- Pressure Gauges

- Filters

- Valves

- Emitters,

- Drip Tubes,

- Others

- Y-o-Y Growth Analysis

- Market Attractiveness Analysis

- Market Share Analysis

By Country

- US

- Canada

- Rest of North America

Frequently Asked Questions

What is driving the growth of the drip irrigation market in North America?

The growth is driven by water conservation needs, rising adoption of precision farming, and government incentives promoting efficient irrigation technologies.

Which crops are most commonly irrigated using drip systems in North America?

Drip irrigation is widely used for high-value crops like vegetables, fruits, nuts, and vineyards.

What are the major challenges faced by the drip irrigation market in North America?

High initial setup costs, system maintenance, and limited awareness among small-scale farmers are key challenges.

Who are the leading players in the North American drip irrigation market?

Top companies include Netafim, Jain Irrigation, Toro Company, Rain Bird, and Lindsay Corporation.

How is technology innovation impacting drip irrigation systems?

Smart irrigation controllers, IoT sensors, and automation are enhancing system efficiency, saving water and improving crop yields.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com