North America Embedded Software Market Size, Share, Trends & Growth Forecast Report By Operating System (General Purpose Operating System, Real-Time Operating System), Vertical, And Country (US, Canada, And Rest Of North America), Industry Analysis From 2025 To 2033

North America Embedded Software Market Size

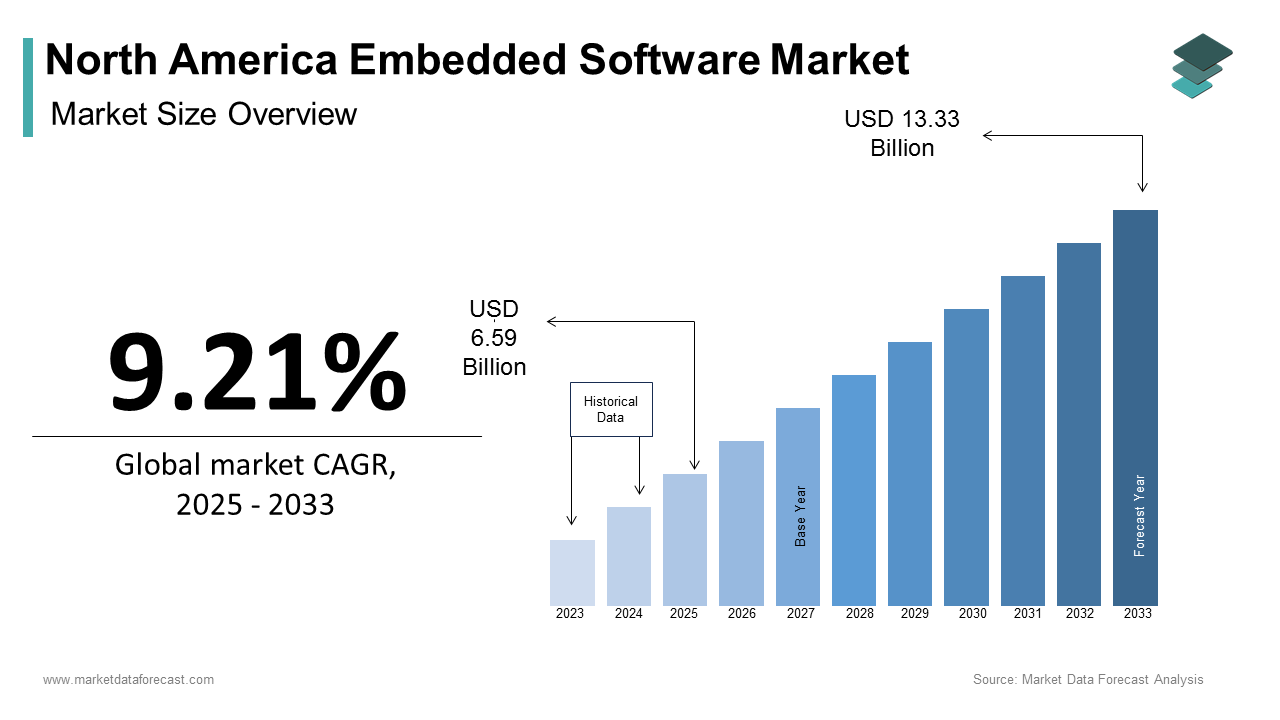

The size of the North American embedded software market was calculated to be USD 6.03 billion in 2024 and is anticipated to be worth USD 13.33 billion by 2033, from USD 6.59 billion in 2025, growing at a CAGR of 9.21% during the forecast period.

The North American embedded software market refers to the development and deployment of specialized software programs that operate within dedicated hardware systems across various industries such as automotive, healthcare, aerospace, industrial automation, consumer electronics, and telecommunications. Unlike general-purpose software, embedded software is designed to perform specific functions with high reliability and efficiency, often in real-time environments. The market encompasses both standalone devices and integrated systems where software plays a critical role in enabling device functionality and connectivity.

MARKET DRIVERS

Growth of IoT and Smart Devices Across Industries

A primary driver fueling the North American embedded software market is the widespread adoption of Internet of Things (IoT) technologies and the proliferation of smart, interconnected devices across sectors such as automotive, healthcare, industrial automation, and consumer electronics. According to the Consumer Technology Association (CTA), over 6 billion IoT devices were deployed across the U.S. in 2023, each requiring embedded software to manage operations, process data, and ensure secure communication. These devices range from connected vehicles and wearable health monitors to smart home appliances and industrial sensors.

In the automotive sector, embedded software powers advanced driver-assistance systems (ADAS), infotainment units, and telematics modules, significantly enhancing vehicle performance and safety. In healthcare, embedded software enables remote patient monitoring and diagnostics through wearable devices, supporting the shift toward preventive and personalized medicine.

Increasing Demand for Autonomous and Real-Time Systems

Another significant factor driving the growth of the North American embedded software market is the rising need for autonomous and real-time processing capabilities in mission-critical applications. Embedded software plays a pivotal role in enabling self-regulating systems that require instantaneous decision-making, such as autonomous vehicles, robotics, drones, and industrial control systems.

In industrial settings, embedded software supports predictive maintenance, machine vision, and automated production lines, contributing to higher operational efficiency and reduced downtime. Moreover, aerospace and defense sectors utilize embedded software for flight control systems, radar management, and secure communication protocols. As these industries continue to adopt intelligent, self-governing systems, the demand for high-performance embedded software in North America is expected to rise substantially.

MARKET RESTRAINTS

Complexity in Development and Integration Challenges

A major restraint affecting the NortAmericanca embedded software market is the increasing complexity involved in developing and integrating embedded software with diverse hardware platforms and operating environments. Unlike traditional software applications, embedded systems must be tailored to function within strict constraints related to memory, power consumption, processing speed, and real-time responsiveness.

Besides, the lack of standardized development frameworks and cross-platform compatibility poses significant challenges for developers. As per a report by the Software Engineering Institute at Carnegie Mellon University, inconsistencies in firmware interfaces and communication protocols lead to prolonged testing cycles and increased maintenance costs. In the automotive industry, the migration from legacy architectures to software-defined vehicles has introduced complexities in ensuring seamless interoperability between different subsystems. The Aerospace Industries Association also notes that certification requirements for embedded software in avionics and medical devices add further layers of difficulty. These technical hurdles hinder the efficient scaling and deployment of embedded software solutions across North America’s rapidly evolving technology landscape.

Cybersecurity Vulnerabilities in Embedded Systems

A different and critical challenge impeding the growth of the North American embedded software market is the growing concern over cybersecurity vulnerabilities in embedded systems. Many embedded devices, especially those deployed in industrial control systems, medical equipment, and automotive applications, were historically designed without robust security measures, making them susceptible to cyber threats.

The increasing connectivity of embedded devices through IoT networks amplifies the risk of unauthorized access, data breaches, and system malfunctions. The Healthcare Information Trust Alliance (HITRUST) warns that outdated firmware in medical imaging devices and infusion pumps can expose hospital networks to cyberattacks. Despite growing awareness, many manufacturers struggle to implement end-to-end security protocols due to cost constraints and limited support for over-the-air updates. Addressing these vulnerabilities requires substantial investment in secure coding practices, threat modeling, and regulatory compliance, posing a major obstacle to the widespread adoption of embedded software solutions in North America.

MARKET OPPORTUNITIES

Expansion of Edge Computing and On-Device Intelligence

One of the most promising opportunities for the North American embedded software market lies in the expanding adoption of edge computing and on-device intelligence across industries. As businesses seek faster data processing and reduced latency, there is a growing shift from centralized cloud computing to localized decision-making powered by embedded systems.

This trend is particularly evident in manufacturing, where embedded software enables real-time analytics in smart factories through programmable logic controllers (PLCs) and industrial IoT gateways. The Industrial Internet Consortium (IIC) highlights that edge-enabled embedded systems contribute to improved operational efficiency and predictive maintenance capabilities. In the healthcare sector, portable diagnostic devices equipped with embedded AI models allow clinicians to analyze patient data instantly without relying on external servers. Moreover, the transportation industry benefits from embedded software in autonomous vehicles that processes sensor data locally for immediate response.

Rising Adoption of Embedded Software in Renewable Energy Systems

Another significant opportunity emerging in the North American embedded software market is its increasing use in renewable energy systems such as solar inverters, wind turbines, battery storage units, and smart grid technologies. As the region transitions toward sustainable energy sources, embedded software plays a crucial role in optimizing energy generation, distribution, and consumption. According to the U.S. Department of Energy, over 30% of new electricity-generating capacity additions in 2023 came from solar and wind energy, all of which incorporate embedded systems for performance monitoring and control.

Embedded software enhances the efficiency of photovoltaic systems by managing maximum power point tracking and grid synchronization, while in wind farms, it supports turbine blade positioning and predictive maintenance.

Furthermore, microgrid implementations in industrial and residential settings rely on embedded controllers to manage hybrid power sources seamlessly.

MARKET CHALLENGES

Rapid Technological Obsolescence and Short Product Lifecycles

A major challenge facing the North American embedded software market is the rapid pace of technological obsolescence and the shrinking lifecycles of embedded products. Unlike traditional software applications, embedded systems are often developed for long-term use in industrial, medical, and automotive contexts, yet they must continuously adapt to evolving hardware standards, communication protocols, and security requirements.

This accelerated innovation cycle is particularly pronounced in the automotive industry, where new model introductions and software-defined features drive frequent upgrades. The Society of Automotive Engineers (SAE) notes that automakers are shifting toward over-the-air (OTA) updates to extend the usability of embedded systems post-deployment. However, maintaining backward compatibility and ensuring stable performance amid frequent changes remain difficult.

Talent Shortage and Skill Gaps in Embedded Software Development

Another pressing challenge confronting the North American embedded software market is the growing shortage of skilled professionals capable of designing, testing, and maintaining complex embedded systems. Unlike general software engineering, embedded development requires expertise in low-level programming, real-time operating systems, hardware-software co-design, and domain-specific knowledge in fields like automotive or aerospace engineering.

Universities and technical training centers have been slow to integrate embedded systems education into mainstream computer science and electrical engineering curricula. Meanwhile, industry leaders report difficulties in hiring engineers with hands-on experience in real-time kernel development, firmware optimization, and safety-critical system validation. Addressing this challenge requires stronger collaboration between academia, government, and industry stakeholders to cultivate a skilled workforce capable of sustaining the embedded software ecosystem in North America.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.21% |

|

Segments Covered |

By Operating System, Vertical, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Us, Canada, and the Rest of North America |

|

Market Leaders Profiled |

Intel Corporation, Microsoft Corporation, IBM Corporation, Green Hills Software LLC, Wind River Systems Inc., Mentor Graphics Corporation, STMicroelectronics N.V., NXP Semiconductors N.V., Texas Instruments Incorporated, ARM Holdings plc |

SEGMENTAL ANALYSIS

By Operating System Insights

The General Purpose Operating Systems (GPOS) held the largest market share, accounting for 58.6% of total revenue in 2024. This dominance is primarily attributed to their widespread use across consumer electronics, industrial automation, and computing devices where flexibility, user interface capabilities, and compatibility with a wide range of applications are essential.

Linux-based systems, Android, and Windows Embedded are commonly deployed in smart TVs, set-top boxes, and enterprise IoT gateways, offering developers extensive customization options and access to open-source ecosystems.

Additionally, as per the Consumer Technology Association (CTA), more than 400 million smart home devices were installed in U.S. households in 2023, each relying on GPOS-based embedded software for seamless connectivity and functionality. The scalability and broad industry adoption of general-purpose operating systems continue to reinforce their leading position in the North America embedded software landscape.

The Real-Time Operating System (RTOS) segment is emerging as the fastest-growing category in the North American embedded software market, projected to expand at a CAGR of 10.6% through 2033. RTOS is designed to deliver deterministic responses within strict time constraints, making it indispensable in mission-critical applications such as aerospace control systems, medical devices, autonomous vehicles, and industrial automation.

One key driver behind this growth is the increasing deployment of RTOS in automotive systems, particularly in advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communication modules. As industries prioritize safety, reliability, and low-latency performance, the demand for RTOS continues to surge across North America.

By Vertical Insights

The automotive sector was the most popular in the market, contributing 34.4% of total revenue in 2024. This lead position is due to the rapid digital transformation occurring in vehicle design, with modern automobiles incorporating extensive embedded software for infotainment, telematics, driver assistance, and powertrain management.

Furthermore, as per the Society of Automotive Engineers (SAE), more than 15 automakers in North America are actively developing Level 3 and Level 4 autonomous driving technologies, which rely heavily on real-time embedded software for perception, localization, and control functions. The shift toward electrification and connected mobility solutions has also intensified software integration into battery management systems and vehicle diagnostics.

The manufacturing vertical is experiencing the highest growth rate in embedded software adoption, projected to grow at a CAGR of 11.2%. This acceleration is fueled by the expansion of Industry 4.0 initiatives, which emphasize smart factories, predictive maintenance, and real-time process optimization using embedded systems.

Embedded software plays a critical role in programmable logic controllers (PLCs), industrial robots, and sensor networks that enable automation and machine-to-machine communication.

Moreover, the National Institute of Standards and Technology (NIST) notes that the adoption of digital twins—virtual replicas of physical assets—relies extensively on embedded software for simulation and performance monitoring.

The consumer electronics had the biggest share of the North America embedded software market, capturing a 37% of total revenue in 2024. This superiority is driven by the widespread integration of embedded software into smartphones, wearables, smart home appliances, and entertainment systems, reflecting the region's high consumer demand for intelligent and interconnected devices.

Each of these products relies on embedded software for real-time responsiveness, voice recognition, and cloud synchronization. The proliferation of embedded Linux and Android-based systems in consumer gadgets further supports market expansion. With continuous innovation in edge computing and AI-powered personal assistants, consumer electronics remains the largest contributor to embedded software demand in North America.

The industrial automation segment is witnessing the fastest growth in embedded software adoption, projected to expand at a CAGR of 11.5%. This surge is largely attributed to the increasing deployment of smart manufacturing technologies, including robotics, programmable logic controllers (PLCs), and industrial IoT gateways that require embedded software for real-time data processing and control.

The National Institute of Standards and Technology (NIST) highlights that embedded intelligence in sensors and actuators enables predictive maintenance, reducing unplanned equipment downtime. Additionally, the rise of cyber-physical systems and digital twin technology is accelerating the need for deterministic, low-latency embedded software frameworks. With government incentives promoting smart manufacturing and workforce reskilling programs, the industrial automation segment is positioned for continued rapid growth in the North American embedded software market.

REGIONAL ANALYSIS

The United States had the dominant position in the North American embedded software market, capturing 85.2% of regional revenue in 2024. This is underpinned by the country’s robust technology infrastructure, extensive R&D investments, and presence of major semiconductor and software firms.

The automotive and aerospace industries are increasingly adopting embedded software for autonomous functions, while healthcare providers integrate it into diagnostic imaging and patient monitoring systems. With Silicon Valley, Boston, and Austin serving as innovation hubs, the U.S. continues to drive advancements in embedded software technologies across both commercial and defense applications.

Canada holds a moderate but steadily expanding share of the North America embedded software market in 2024. The country’s embedded software growth is primarily driven by its emphasis on smart manufacturing, automotive innovation, and AI-integrated industrial systems.

Moreover, Canada has emerged as a key player in the development of embedded systems for autonomous and electric vehicles. In addition, academic institutions such as the University of Waterloo and École Polytechnique de Montréal are advancing embedded AI and robotics research. With supportive government policies and strategic partnerships between tech firms and auto manufacturers, Canada is strengthening its embedded software footprint within North America.

The remaining North American countries, including Mexico and select Caribbean territories, collectively account for a small share of the embedded software market in 2024. While relatively small compared to the U.S. and Canada, this segment shows potential due to increasing industrialization, automotive investment, and government-backed digitization initiatives.

Mexico has been strengthening its embedded software ecosystem through its well-established automotive manufacturing base. The country’s proximity to the U.S. makes it an attractive location for nearshoring embedded software development services. Meanwhile, Caribbean nations such as Jamaica and the Bahamas are gradually adopting embedded technologies in telecommunications and energy infrastructure.

LEADING PLAYERS IN THE NORTH AMERICAN EMBEDDED SOFTWARE MARKET

Siemens Digital Industries Software

Siemens is a leading global provider of embedded software solutions, particularly in industrial automation, automotive systems, and IoT-enabled devices. The company offers a comprehensive portfolio of tools for embedded development, simulation, and system verification, enabling manufacturers to design complex software-driven products with high reliability. Its contributions extend beyond traditional engineering applications into digital twin technology, which enhances embedded system testing and validation. Siemens plays a crucial role in shaping industry standards and advancing model-based embedded software development across North America.

Mentor Graphics (a Siemens Business)

Mentor Graphics, now fully integrated under Siemens, specializes in embedded software tools and solutions for semiconductor design, automotive electronics, and real-time operating systems. The company provides industry-leading platforms such as Nucleus RTOS and Sourcery CodeBench, widely used in safety-critical and performance-driven applications. Its expertise in embedded code optimization, debugging, and verification has made it a trusted partner for automotive, aerospace, and consumer electronics firms. By offering scalable tools that support both general-purpose and real-time embedded development, Mentor continues to influence the evolution of embedded software ecosystems in North America.

BlackBerry QNX

BlackBerry QNX is renowned for its secure and reliable real-time operating system (RTOS) tailored for automotive, medical, and industrial applications. With a strong focus on cybersecurity and functional safety, QNX powers infotainment systems, advanced driver-assistance systems (ADAS), and autonomous driving technologies. Its software platform is certified to the highest industry standards, making it a preferred choice for Tier 1 automotive suppliers and OEMs. As vehicle architectures become increasingly software-defined, BlackBerry QNX plays a vital role in ensuring deterministic performance, secure communication, and seamless integration of embedded components across North American transportation and healthcare sectors.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One major strategy employed by key players in the North American embedded software market is deep vertical integration with hardware manufacturers and system-on-chip (SoC) providers. Companies are forging strategic alliances with semiconductor firms to ensure seamless compatibility between embedded software and next-generation processors, enhancing performance and reducing time-to-market for end users.

Another critical approach is expanding into domain-specific embedded software platforms tailored for industries such as automotive, healthcare, and aerospace. By developing specialized toolchains, operating systems, and middleware optimized for particular use cases, vendors can offer higher levels of reliability, security, and real-time responsiveness—key requirements for mission-critical applications.

Lastly, companies are investing heavily in AI-driven development environments and cloud-connected embedded systems, allowing for over-the-air updates, predictive maintenance, and remote diagnostics. This shift toward intelligent, connected embedded platforms is redefining how software is designed, deployed, and maintained across North America’s evolving technology landscape.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the North American embedded software market include Intel Corporation, Microsoft Corporation, IBM Corporation, Green Hills Software LLC, Wind River Systems Inc., Mentor Graphics Corporation, STMicroelectronics N.V., NXP Semiconductors N.V., Texas Instruments Incorporated, ARM Holdings plc

The competition in the North American embedded software market is highly dynamic, characterized by continuous innovation, strategic partnerships, and an increasing emphasis on functional safety and cybersecurity. Major players compete not only on technological capabilities but also on ecosystem integration, developer support, and long-term sustainability of their software platforms. The market sees a mix of established enterprise software firms, semiconductor-integrated solution providers, and emerging startups specializing in niche areas like real-time systems and AI-powered firmware.

Automotive and industrial automation sectors are intensifying the demand for robust, deterministic embedded software, pushing vendors to differentiate through industry-specific solutions and certification-ready frameworks. Meanwhile, open-source platforms and modular development tools are reshaping competitive dynamics by lowering entry barriers for smaller firms. As embedded software becomes more central to product differentiation across hardware domains, companies are focusing on building scalable, interoperable, and secure software stacks to maintain leadership positions in this rapidly evolving landscape.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Siemens Digital Industries Software announced a new collaboration with a leading U.S. semiconductor firm to optimize embedded development tools for next-generation automotive microcontrollers, aiming to streamline software-hardware integration for automakers and Tier 1 suppliers.

- In April 2024, BlackBerry QNX launched an expanded suite of cybersecurity-focused embedded software solutions targeting medical device manufacturers, addressing growing concerns around data integrity and regulatory compliance in healthcare applications across North America.

- In July 2024, Wind River introduced a cloud-native version of its Simics virtual lab platform, allowing developers to test and validate embedded software remotely, significantly improving agility and scalability for enterprises adopting DevOps-driven workflows.

- In September 2024, Mentor Graphics (a Siemens Business) unveiled an enhanced version of its Nucleus Real-Time Operating System (RTOS) with built-in AI acceleration features, specifically designed for edge computing applications in industrial automation and smart manufacturing.

- In November 2024, ETAS, a leading embedded software solutions provider, opened a dedicated innovation center in Detroit focused on automotive embedded systems, strengthening its presence in North America and supporting the region’s transition toward software-defined vehicles.

DETAILED SEGMENTATION OF THE NORTH AMERICA EMBEDDED SOFTWARE MARKET INCLUDED IN THIS REPORT

This research report on the North America embedded software market has been segmented and sub-segmented based on operating system, vertical, & region.

By Operating System

- General Purpose Operating System

- Real-Time Operating System

By Vertical

- Automotive

- Manufacturing

- Consumer Electronics

- Industrial Automation

By Region

- US

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is embedded software and how is it used in North America?

Embedded software refers to computer programs designed to perform specific tasks within embedded systems. In North America, it is widely used in automotive, industrial automation, consumer electronics, and healthcare devices.

2. Which industries are the major adopters of embedded software in North America?

Key industries include automotive, aerospace & defense, industrial automation, consumer electronics, healthcare, and telecommunications.

3. Who are the leading players in the North America embedded software market?

Major players include Intel Corporation, Microsoft Corporation, IBM Corporation, Green Hills Software LLC, Wind River Systems Inc., and ARM Holdings plc.

4. What are the primary drivers of growth in the North America embedded software market?

Growth is driven by the rising demand for IoT devices, connected cars, smart consumer electronics, and advancements in AI and machine learning.

5. How is embedded software impacting the automotive industry in North America?

It powers critical functions such as Advanced Driver Assistance Systems (ADAS), infotainment, and autonomous driving technologies.

6. What challenges are faced by the embedded software market in North America?

Challenges include software complexity, cybersecurity threats, integration with legacy systems, and real-time performance requirements.

7. What role does embedded software play in the development of IoT solutions?

Embedded software enables connectivity, data processing, and control functions in IoT devices, making it essential for smart infrastructure and automation.

8. How is the market for embedded software regulated or standardized in North America?

The market adheres to industry standards such as ISO 26262 (automotive safety), DO-178C (aviation), and IEC 62304 (medical software).

9. What is the future outlook for the North America embedded software market?

The market is expected to grow steadily, fueled by advancements in 5G, AI, and edge computing, along with increasing demand for smart and connected devices.

10. How are companies in North America addressing the cybersecurity concerns related to embedded software?

Firms are adopting secure coding practices, regular software updates, hardware-based security modules, and compliance with cybersecurity standards like NIST and ISO/IEC 27001.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com